Key Insights

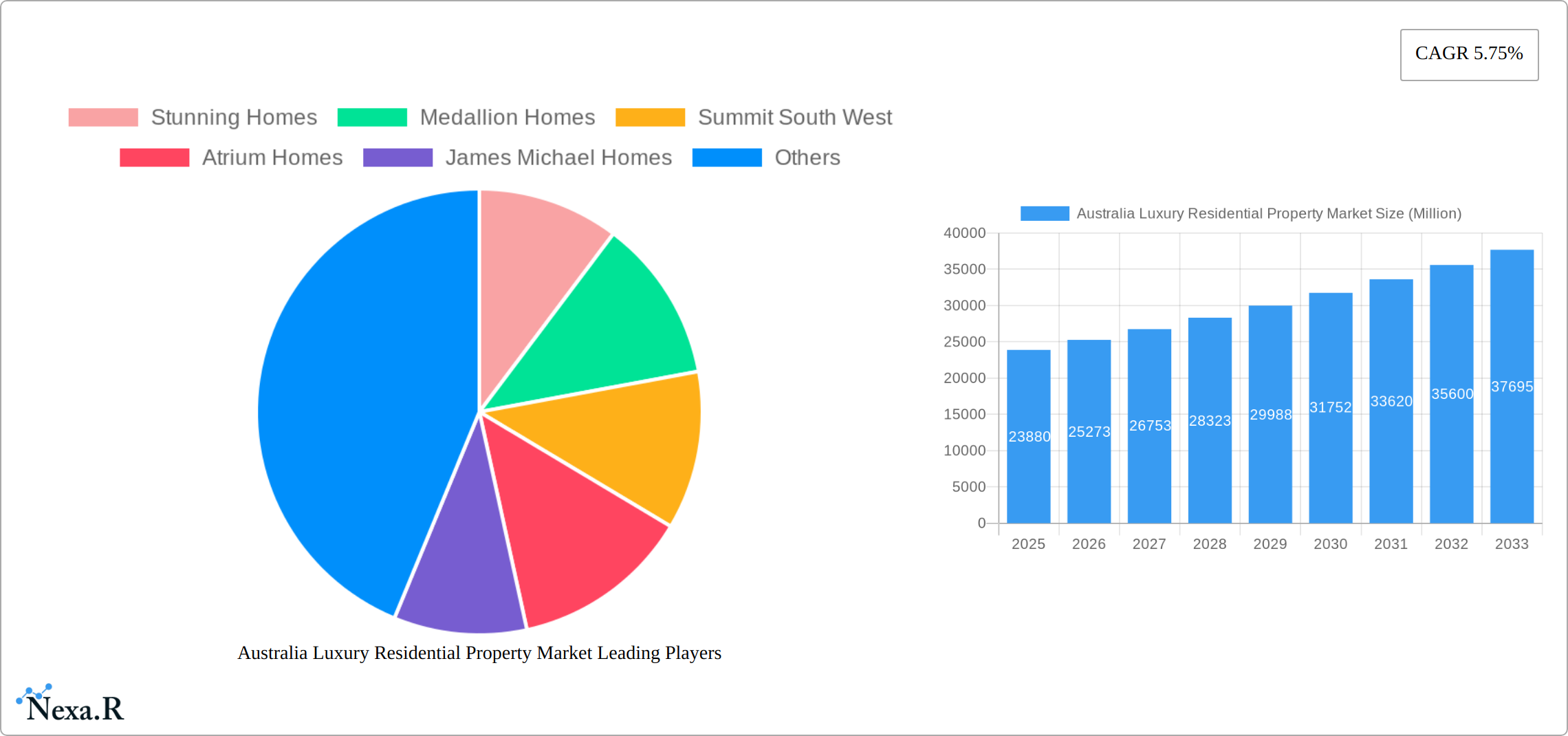

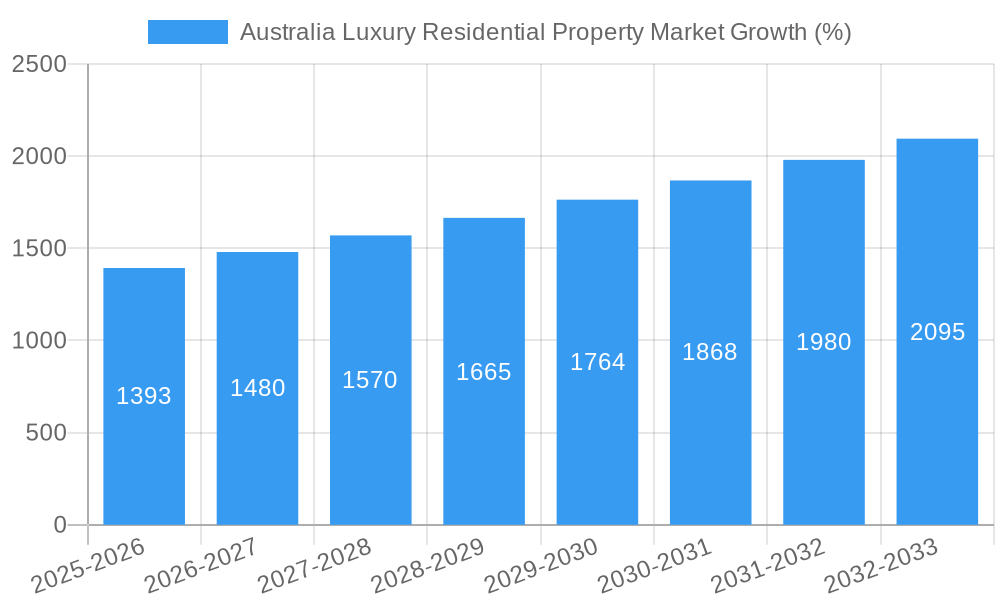

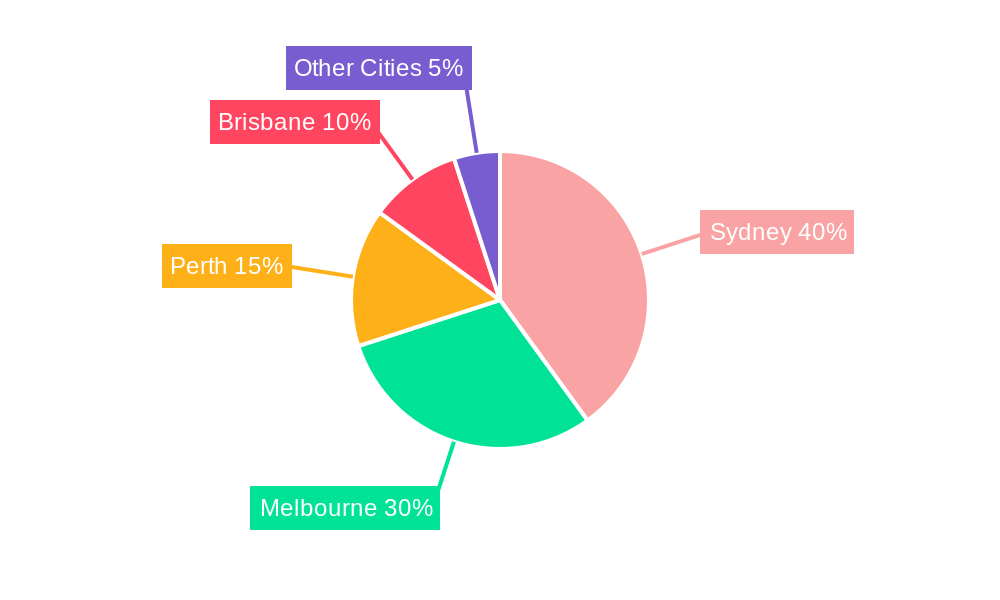

The Australian luxury residential property market, valued at $23.88 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.75% from 2025 to 2033. This expansion is driven by several factors. Firstly, a sustained increase in high-net-worth individuals (HNWIs) residing in Australia fuels demand for premium properties. Secondly, low interest rates in previous years have incentivized investment in luxury real estate. Thirdly, a limited supply of luxury properties in prime locations, particularly in major cities like Sydney, Melbourne, and Perth, contributes to escalating prices. The market is segmented by property type (apartments and condominiums, villas and landed houses) and city (Sydney, Perth, Melbourne, Brisbane, and other cities). Key players include established developers such as Stunning Homes, Medallion Homes, and Metricon Homes, along with a number of boutique builders catering to niche markets. While the market faces potential restraints such as economic downturns and government regulations impacting property investment, the strong underlying demand from HNWIs and a relatively stable Australian economy suggest continued positive growth in the forecast period.

The market's strong performance is expected to continue, although at a potentially moderated pace in the later years of the forecast period. Factors influencing this include potential interest rate adjustments and the evolving preferences of luxury buyers toward sustainable and technologically advanced properties. The continued appeal of prime locations, coupled with ongoing infrastructural developments in major cities, will likely support the growth trajectory. Competition among developers is keen, driving innovation in design, amenities, and services offered to attract discerning buyers. The segments exhibiting the most significant growth are likely to be villas and landed houses in prime locations within Sydney and Melbourne, given the strong demand and limited supply in these areas. The "Other Cities" segment will also show growth, driven by increasing affluence across Australia and development of luxury projects in regional areas.

Australia Luxury Residential Property Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Australian luxury residential property market, covering the period from 2019 to 2033. With a focus on key segments, dominant players, and emerging trends, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this dynamic market. The report leverages extensive data analysis to provide actionable insights and forecasts, enabling informed decision-making.

Keywords: Australia luxury real estate, luxury residential property market Australia, Sydney luxury apartments, Melbourne luxury homes, Brisbane luxury villas, Perth luxury property, Australian luxury property market forecast, luxury property investment Australia, high-end residential development Australia, Australian luxury housing market trends.

Australia Luxury Residential Property Market Dynamics & Structure

The Australian luxury residential property market is characterized by high concentration among a few established players and emerging boutique developers. Technological innovations, such as smart home technology and sustainable building practices, are increasingly influencing the market. Regulatory frameworks, including zoning regulations and environmental approvals, significantly impact development timelines and costs. Competitive substitutes, such as luxury rentals and high-end serviced apartments, cater to specific market niches. End-user demographics show a preference towards larger, more sustainable properties in prime locations with affluent, high-net-worth individuals and families as the primary buyers. M&A activity has been relatively moderate in recent years, with xx million in deal volume recorded in 2024.

- Market Concentration: High, with top 5 builders holding approximately xx% market share in 2024.

- Technological Drivers: Smart home integration, sustainable building materials, and virtual reality property tours are gaining traction.

- Regulatory Framework: Complex zoning and environmental regulations create development challenges.

- Competitive Substitutes: Luxury rental markets and serviced apartments pose a competitive threat.

- End-User Demographics: High-net-worth individuals and families, aged 45-65, dominate the market.

- M&A Trends: Relatively low volume in recent years; xx deals recorded in 2024, projected to increase to xx in 2025.

Australia Luxury Residential Property Market Growth Trends & Insights

The Australian luxury residential property market experienced strong growth between 2019 and 2024, with a Compound Annual Growth Rate (CAGR) of xx% driven by robust economic conditions, low interest rates and high demand from both domestic and international buyers. However, market growth slowed in 2024 due to increased interest rates and economic uncertainty. Despite this, the market remains resilient, exhibiting strong demand for prime properties in key cities. Technological disruptions, such as the adoption of PropTech solutions, are streamlining processes and enhancing the customer experience. Consumer behaviour is shifting towards sustainable and technologically advanced homes, leading to an increased demand for energy-efficient and smart home features. Market penetration of luxury apartments in key cities is around xx% in 2024, with Villas and Landed Houses accounting for xx%. The forecast period, 2025–2033, projects a steady CAGR of xx%, fueled by ongoing urbanization, economic recovery, and increased foreign investment.

Dominant Regions, Countries, or Segments in Australia Luxury Residential Property Market

Sydney, Melbourne, and Brisbane consistently dominate the Australian luxury residential property market, driven by strong economic activity, infrastructure development, and a high concentration of high-net-worth individuals. Within these cities, the demand for apartments and condominiums remains high, particularly in coastal and inner-city areas with proximity to amenities and employment hubs. The Villas and Landed Houses segment also demonstrates strong performance, catering to buyers seeking larger properties and greater privacy. Other cities like Perth show considerable potential but experience slower growth due to economic factors.

- Sydney: Strong demand for waterfront properties and apartments in the inner city. Market share in 2024: xx%

- Melbourne: High demand for luxury apartments and houses in established suburbs. Market share in 2024: xx%

- Brisbane: Growing demand driven by infrastructure projects and population growth. Market share in 2024: xx%

- Perth: Slower growth compared to other cities but potential for future expansion. Market share in 2024: xx%

- Apartments and Condominiums: High demand in metropolitan areas, driven by convenience and lifestyle preferences. Market share in 2024: xx%

- Villas and Landed Houses: Strong demand among affluent buyers seeking larger properties and privacy. Market share in 2024: xx%

Australia Luxury Residential Property Market Product Landscape

The Australian luxury residential property market features a diverse range of products, including bespoke, architecturally designed homes, ultra-modern apartments with state-of-the-art amenities, and luxurious villas with expansive gardens. Unique selling propositions include prime locations, high-end finishes, advanced security systems, sustainable design features, and access to exclusive amenities such as private pools, gyms, and concierge services. Recent advancements in smart home technologies have become increasingly integrated into new developments, offering enhanced convenience and lifestyle benefits.

Key Drivers, Barriers & Challenges in Australia Luxury Residential Property Market

Key Drivers:

- Strong economic growth in key cities.

- Increasing disposable incomes among high-net-worth individuals.

- Demand for luxury properties in premium locations.

- Investment in infrastructure and urban renewal projects.

Key Challenges:

- Rising construction costs impacting affordability.

- Regulatory complexities delaying project approvals.

- Limited land availability in prime locations.

- Competition from luxury rentals and alternative accommodation options. Increased interest rates impacting buyer affordability.

Emerging Opportunities in Australia Luxury Residential Property Market

- Growing demand for sustainable and eco-friendly luxury homes.

- Increased adoption of smart home technologies.

- Expansion into regional areas with high tourism potential.

- Development of luxury retirement communities targeting aging populations.

Growth Accelerators in the Australia Luxury Residential Property Market Industry

The long-term growth of the Australian luxury residential property market will be significantly influenced by sustained economic growth, advancements in sustainable building practices, technological integration within properties, and strategic partnerships between developers and luxury brands. Government incentives for sustainable development and foreign investment could further accelerate market growth.

Key Players Shaping the Australia Luxury Residential Property Market Market

- Stunning Homes

- Medallion Homes

- Summit South West

- Atrium Homes

- James Michael Homes

- Metricon Homes

- High End Nicheliving

- Broadway Homes

- Lomma Homes

- Rossadale Homes

Notable Milestones in Australia Luxury Residential Property Market Sector

- August 2023: Made Property announces the Corsa Mortlake development, a 20-apartment project on Sydney Harbour.

- September 2023: Launch of Burly Residences, a luxury apartment development in North Burleigh, Queensland.

In-Depth Australia Luxury Residential Property Market Market Outlook

The Australian luxury residential property market is poised for continued growth, albeit at a more moderate pace than previously observed. Strategic opportunities exist for developers focusing on sustainable development, technological integration, and unique design features. The focus on premium locations and exclusive amenities will remain crucial, while catering to the evolving needs and preferences of a discerning buyer base. The market is expected to experience steady growth through 2033, driven by the factors mentioned above.

Australia Luxury Residential Property Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. City

- 2.1. Sydney

- 2.2. Perth

- 2.3. Melbourne

- 2.4. Brisbane

- 2.5. Other Cities

Australia Luxury Residential Property Market Segmentation By Geography

- 1. Australia

Australia Luxury Residential Property Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.75% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of High Net-Worth Individuals (HNWIs)

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Interest Rates

- 3.4. Market Trends

- 3.4.1. Ultra High Net Worth Population Driving the Demand for Prime Properties

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Luxury Residential Property Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Sydney

- 5.2.2. Perth

- 5.2.3. Melbourne

- 5.2.4. Brisbane

- 5.2.5. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Stunning Homes

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Medallion Homes

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Summit South West

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Atrium Homes

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 James Michael Homes

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Metricon Homes

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 High End Nicheliving

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Broadway Homes**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lomma Homes

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rossadale Homes

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Stunning Homes

List of Figures

- Figure 1: Australia Luxury Residential Property Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Luxury Residential Property Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Luxury Residential Property Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Luxury Residential Property Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Australia Luxury Residential Property Market Revenue Million Forecast, by City 2019 & 2032

- Table 4: Australia Luxury Residential Property Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia Luxury Residential Property Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia Luxury Residential Property Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Australia Luxury Residential Property Market Revenue Million Forecast, by City 2019 & 2032

- Table 8: Australia Luxury Residential Property Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Luxury Residential Property Market?

The projected CAGR is approximately 5.75%.

2. Which companies are prominent players in the Australia Luxury Residential Property Market?

Key companies in the market include Stunning Homes, Medallion Homes, Summit South West, Atrium Homes, James Michael Homes, Metricon Homes, High End Nicheliving, Broadway Homes**List Not Exhaustive, Lomma Homes, Rossadale Homes.

3. What are the main segments of the Australia Luxury Residential Property Market?

The market segments include Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.88 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of High Net-Worth Individuals (HNWIs).

6. What are the notable trends driving market growth?

Ultra High Net Worth Population Driving the Demand for Prime Properties.

7. Are there any restraints impacting market growth?

4.; Rising Interest Rates.

8. Can you provide examples of recent developments in the market?

August 2023: Sydney-based boutique developer Made Property laid plans for a new apartment project along Sydney Harbour amid sustained demand for luxury waterfront properties. The Corsa Mortlake development, positioned on Majors Bay in the harbor city’s inner west, will deliver 20 three-bedroom apartments offering house-sized living spaces and ready access to a 23-berth marina accommodating yachts up to 20 meters. With development approval secured for the project, the company is moving quickly to construction. Made Property expects construction to be completed in late 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Luxury Residential Property Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Luxury Residential Property Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Luxury Residential Property Market?

To stay informed about further developments, trends, and reports in the Australia Luxury Residential Property Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence