Key Insights

Sweden's luxury real estate market, including apartments, condominiums, landed houses, and villas, demonstrates significant growth potential. Valued at approximately 34.7 billion in 2025, the sector is projected to expand at a Compound Annual Growth Rate (CAGR) of 2.6% through 2033. Key growth drivers include a robust economy, a rising number of high-net-worth individuals, and limited luxury property supply in prime locations such as Stockholm and Malmö. Emerging trends emphasize sustainable and eco-friendly luxury residences, complemented by advancements in property technology and marketing. Potential market restraints involve foreign investment regulations and global economic volatility. The market is segmented by property type (apartments/condominiums vs. landed houses/villas) and key cities (Stockholm, Malmö, and other cities), influencing pricing and demand dynamics. Leading players like Sotheby's International Realty, Luxury Abode, and Fantastic Frank are influential through their specialized services and extensive networks.

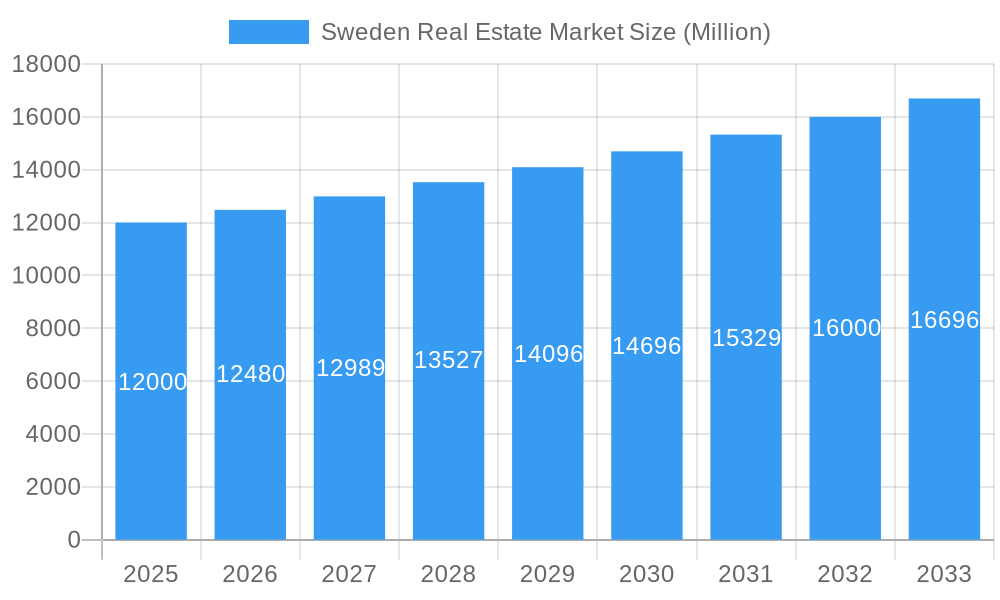

Sweden Real Estate Market Market Size (In Billion)

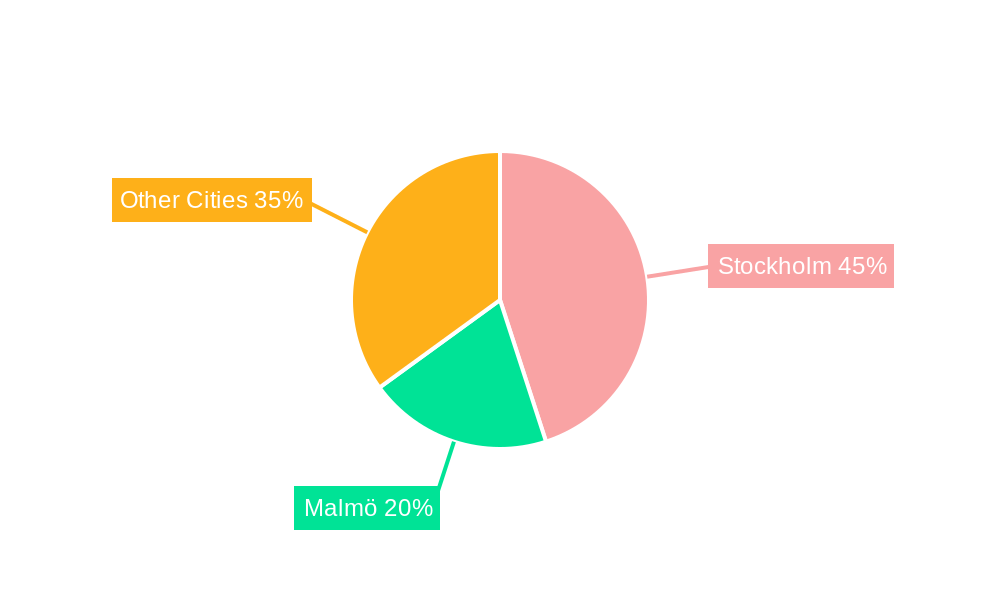

The forecast anticipates continued market expansion, with economic downturns posing a moderating factor. Demand for sustainable luxury properties is expected to rise due to increasing consumer preference for eco-friendly living. Intensifying competition among luxury real estate agencies is fostering innovative marketing and superior customer service. Stockholm and Malmö will remain central to market growth. Market analysis indicates that the "Other Cities" segment will experience proportionate growth, though potentially at a slower rate than major metropolitan hubs. This detailed segmentation supports refined marketing strategies and investment decisions.

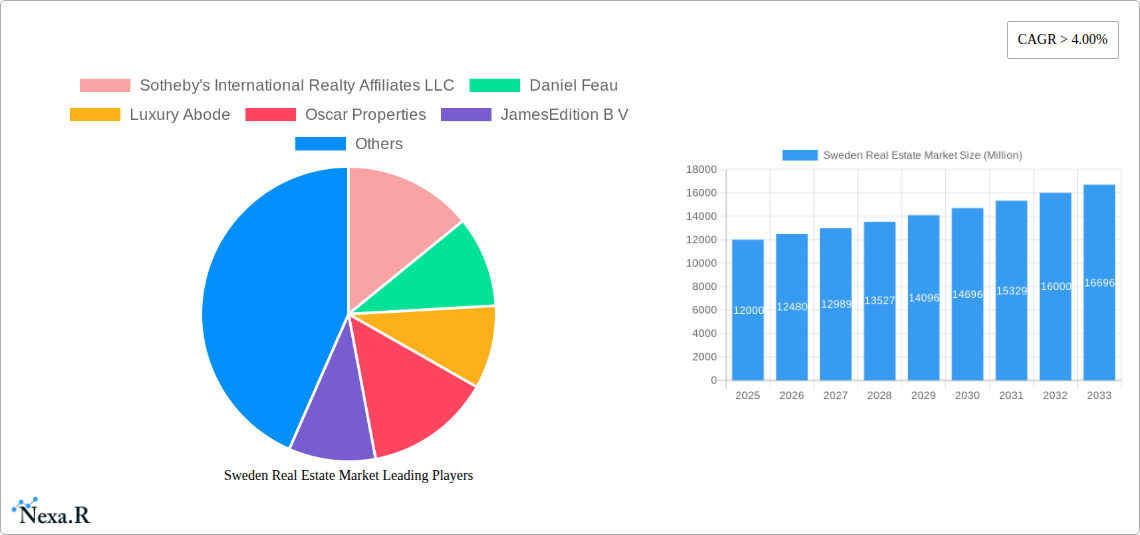

Sweden Real Estate Market Company Market Share

Sweden Real Estate Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Sweden real estate market, encompassing historical data (2019-2024), current estimations (2025), and future projections (2025-2033). It delves into market dynamics, growth trends, key players, and emerging opportunities across various segments, including apartments & condominiums, landed houses & villas, and key cities like Stockholm and Malmö. This report is an essential resource for real estate investors, developers, analysts, and industry professionals seeking to navigate the complexities of the Swedish real estate landscape.

Sweden Real Estate Market Dynamics & Structure

The Swedish real estate market, valued at xx Million in 2024, exhibits a moderately concentrated structure with a few dominant players alongside numerous smaller firms. Technological innovation, particularly in proptech, is gradually transforming the sector, impacting marketing, transaction processes, and property management. Stringent regulatory frameworks, including environmental regulations and building codes, influence development and investment decisions. The market witnesses competition from alternative investment options, but strong demand driven by population growth and urbanization remains a primary driver. Mergers and acquisitions (M&A) activity, while not exceptionally high, shows a steady trend, particularly amongst smaller firms seeking scale and expertise.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- Technological Innovation: Adoption of VR/AR for property viewings, online platforms for transactions, and smart home integration are increasing.

- Regulatory Framework: Strict environmental standards and building permits are key factors affecting development costs.

- M&A Activity: An estimated xx M&A deals were concluded in the historical period (2019-2024).

- End-User Demographics: Growing urban populations and changing household structures are major demand drivers.

Sweden Real Estate Market Growth Trends & Insights

The Swedish real estate market demonstrates consistent growth throughout the study period (2019-2033). Driven by strong domestic demand and foreign investment, the market experienced a CAGR of xx% during the historical period (2019-2024). This growth is expected to moderate slightly in the forecast period (2025-2033), with a projected CAGR of xx%, reaching a market value of xx Million by 2033. Technological disruptions, including the rise of proptech platforms and the increasing use of data analytics in market valuation, are influencing consumer behavior and driving efficiency. The market penetration rate of online property portals stands at xx% in 2025. Consumer preference shifts toward sustainable and energy-efficient properties are gaining traction.

Dominant Regions, Countries, or Segments in Sweden Real Estate Market

Stockholm dominates the Swedish real estate market, accounting for xx% of the total market value in 2025. Its strong economy, high population density, and well-developed infrastructure attract significant investment and contribute to premium pricing. The Apartments and Condominiums segment represents the largest share of the market, driven by high demand in urban centers. Malmö, although smaller, also presents strong growth potential, boosted by investments in urban renewal projects and a relatively young population.

- Stockholm: High demand, strong economy, and excellent infrastructure drive market leadership.

- Malmö: Urban renewal projects and a young population fuel significant growth potential.

- Apartments & Condominiums: High demand in urban areas and affordability considerations fuel segment dominance.

- Landed Houses & Villas: Strong demand in suburban areas and a desire for more space drives growth.

Sweden Real Estate Market Product Landscape

The Swedish real estate product landscape is characterized by a diverse range of properties, from compact apartments in city centers to spacious villas in suburban areas. Increasingly, developers are focusing on sustainable design, incorporating green building materials and energy-efficient technologies to meet evolving consumer preferences. Smart home features, such as integrated security systems and energy management systems, are becoming more common in new constructions. Unique selling propositions include proximity to nature, excellent public transportation, and high-quality construction.

Key Drivers, Barriers & Challenges in Sweden Real Estate Market

Key Drivers: Strong economic growth, rising household incomes, increasing urbanization, and government incentives for sustainable development are key drivers. Furthermore, the influx of foreign investment also plays a significant role.

Challenges: High property prices, particularly in major cities, present a barrier to entry for many potential buyers. Strict environmental regulations increase development costs and can slow down project timelines. The current interest rate also impacts the affordability of purchasing properties. Competition among developers is intense, impacting profitability.

Emerging Opportunities in Sweden Real Estate Market

The growing demand for sustainable and energy-efficient housing presents a significant opportunity for developers to focus on green building practices. The expansion of digital platforms offers prospects for innovative marketing and transaction services. Furthermore, the development of affordable housing options in suburban areas holds vast potential, addressing the rising demand for spacious living arrangements.

Growth Accelerators in the Sweden Real Estate Market Industry

Technological advancements in construction techniques and materials, strategic partnerships between developers and technology firms, and the expansion into new markets, such as sustainable and green real estate, will accelerate growth. Government incentives for green housing and supportive policies will further enhance market development.

Key Players Shaping the Sweden Real Estate Market Market

- Sotheby's International Realty Affiliates LLC

- Daniel Feau

- Luxury Abode

- Oscar Properties

- JamesEdition B V

- Bolaget Fastighetsformedling

- Per Jansson Fastighetsformedling AB

- MANSION GLOBAL

- Fantastic Frank

- Christies International Real Estate

- LuxuryEstate

Notable Milestones in Sweden Real Estate Market Sector

- 2021: Introduction of new green building standards impacting construction practices.

- 2022: Launch of a major new proptech platform significantly impacting transactions.

- 2023: Several smaller firms acquired by larger corporations. (Specific details xx)

- 2024: Launch of a large scale sustainable housing project in Stockholm.

In-Depth Sweden Real Estate Market Market Outlook

The Swedish real estate market is poised for continued growth driven by the aforementioned factors. Strategic opportunities lie in sustainable developments, technological integration, and catering to evolving consumer preferences for energy-efficient housing. Focus on underserved markets and innovative financing models will unlock further potential. The market's resilience and capacity for adaptation ensure its position as a dynamic and attractive investment destination in the long term.

Sweden Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Key Cities

- 2.1. Stockholm

- 2.2. Malmo

- 2.3. Other Cities

Sweden Real Estate Market Segmentation By Geography

- 1. Sweden

Sweden Real Estate Market Regional Market Share

Geographic Coverage of Sweden Real Estate Market

Sweden Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Urbanization and population growth; Government policies and Foreign Investnents

- 3.3. Market Restrains

- 3.3.1. Skilled Labor Shortage; Material Price Fluctuations

- 3.4. Market Trends

- 3.4.1. Rise in Construction of New Dwellings Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Stockholm

- 5.2.2. Malmo

- 5.2.3. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sotheby's International Realty Affiliates LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Daniel Feau

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Luxury Abode

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oscar Properties

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JamesEdition B V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bolaget Fastighetsformedling

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Per Jansson Fastighetsformedling AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MANSION GLOBAL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fantastic Frank*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Christies International Real Estate

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LuxuryEstate

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Sotheby's International Realty Affiliates LLC

List of Figures

- Figure 1: Sweden Real Estate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Sweden Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Sweden Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Sweden Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 3: Sweden Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Sweden Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Sweden Real Estate Market Revenue billion Forecast, by Key Cities 2020 & 2033

- Table 6: Sweden Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Real Estate Market?

The projected CAGR is approximately 2.6%.

2. Which companies are prominent players in the Sweden Real Estate Market?

Key companies in the market include Sotheby's International Realty Affiliates LLC, Daniel Feau, Luxury Abode, Oscar Properties, JamesEdition B V, Bolaget Fastighetsformedling, Per Jansson Fastighetsformedling AB, MANSION GLOBAL, Fantastic Frank*List Not Exhaustive, Christies International Real Estate, LuxuryEstate.

3. What are the main segments of the Sweden Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Urbanization and population growth; Government policies and Foreign Investnents.

6. What are the notable trends driving market growth?

Rise in Construction of New Dwellings Driving the Market.

7. Are there any restraints impacting market growth?

Skilled Labor Shortage; Material Price Fluctuations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Real Estate Market?

To stay informed about further developments, trends, and reports in the Sweden Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence