Key Insights

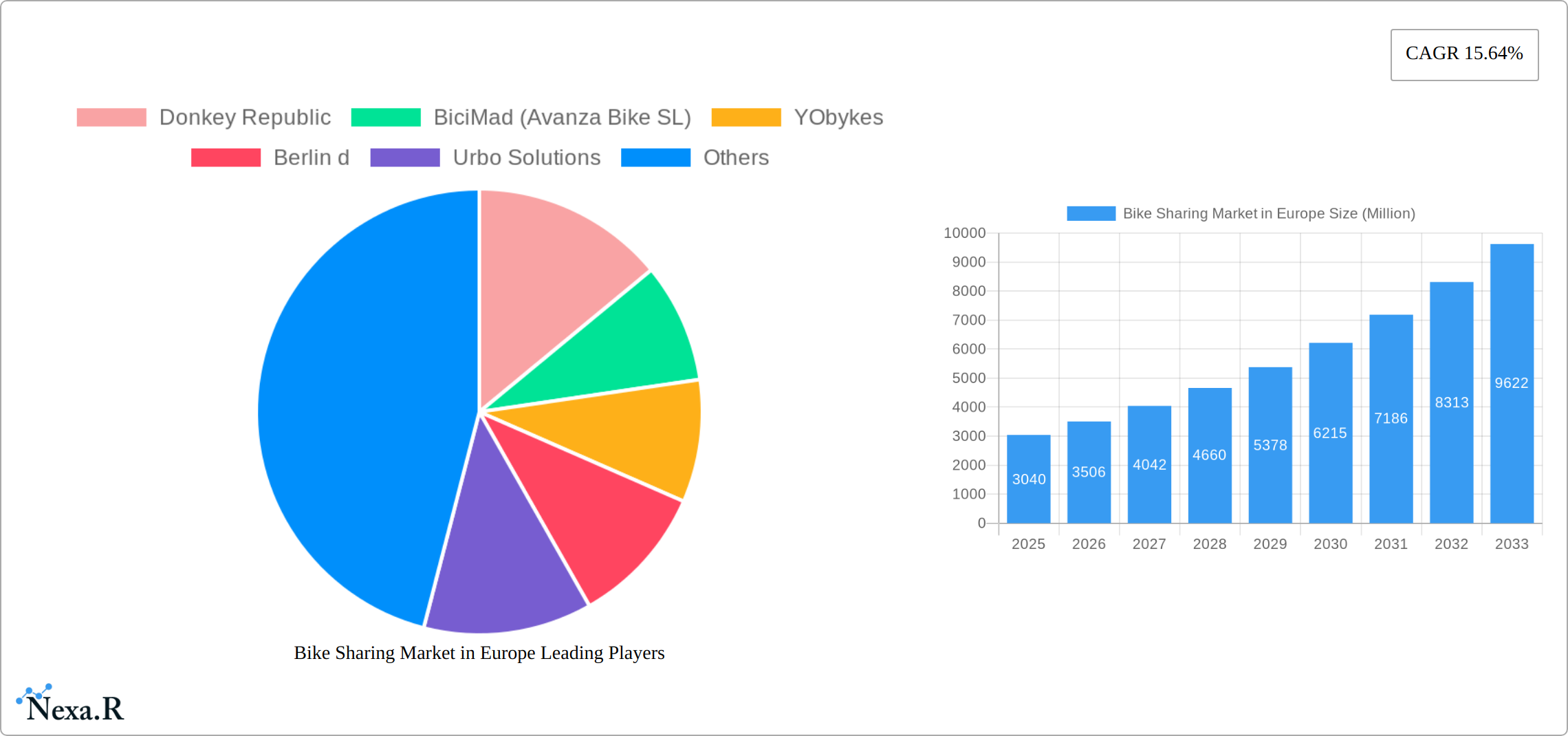

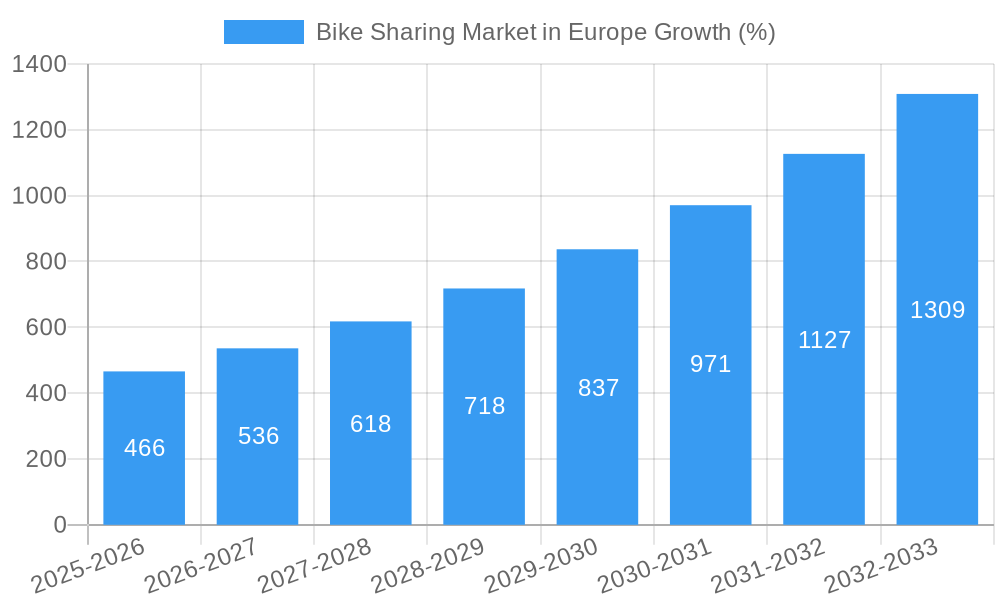

The European bike-sharing market, valued at €3.04 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 15.64% from 2025 to 2033. This surge is driven by several factors. Increasing urbanization and concerns about traffic congestion and air pollution are prompting cities across Europe to invest heavily in sustainable transportation alternatives. The rising popularity of e-bikes and the integration of bike-sharing systems with public transportation networks further fuel this growth. Government initiatives promoting cycling and providing subsidies for bike-sharing infrastructure also play a significant role. The market is segmented by duration (long-term and short-term rentals) and application (tourism and commuting), with commuting currently dominating the market share, though tourism is showing significant growth potential, especially in popular tourist destinations across Europe. Key players like Donkey Republic, BiciMad, and YObykes are strategically expanding their operations and technological offerings to cater to the evolving demands of the market. Germany, France, the United Kingdom, and Italy represent the largest national markets within Europe, showcasing significant opportunities for growth due to their large populations and substantial urban areas. However, challenges remain, including the need for robust infrastructure maintenance, efficient operational models to counter vandalism and theft, and addressing concerns about the environmental impact of e-bike battery disposal. Overcoming these challenges will be crucial for sustained market growth and long-term sustainability.

The forecast period (2025-2033) anticipates continued expansion driven by technological advancements, such as improved GPS tracking and smart locking systems that enhance user experience and operational efficiency. The integration of bike-sharing with other mobility solutions, such as ride-hailing apps, is another trend expected to fuel market growth. Furthermore, the emergence of subscription-based models and innovative pricing strategies are anticipated to attract a wider range of users. The ongoing expansion of bike-sharing programs into smaller cities and towns, and the increasing adoption of dockless systems, will further contribute to market growth during this period. However, potential economic downturns and fluctuations in fuel prices could present challenges to the market's continued trajectory.

Bike Sharing Market in Europe: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European bike-sharing market, encompassing market dynamics, growth trends, dominant segments, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report analyzes the market across various segments including duration type (long and short-term rentals) and application type (tourism and commuting), providing a granular view of this dynamic market estimated at xx Million units in 2025.

Bike Sharing Market in Europe Market Dynamics & Structure

The European bike-sharing market is characterized by a moderately fragmented landscape, with several regional and national players competing alongside established international brands. Market concentration is low, with no single dominant player controlling a significant majority of the market share. Technological innovation, primarily in e-bike technology and smart-locking systems, is a key driver of market growth. However, regulatory frameworks, varying across different European countries, pose significant challenges and opportunities. The rise of micromobility solutions presents a competitive threat, yet also offers synergistic opportunities for collaboration. End-user demographics are expanding, moving beyond traditional urban commuters to include tourists and recreational users.

- Market Concentration: Low, with xx% market share held by the top 5 players in 2025.

- Technological Innovation: Focus on e-bikes, smart locking, and integrated mobile apps.

- Regulatory Framework: Varied across EU countries, creating both opportunities and hurdles.

- Competitive Substitutes: Micromobility solutions (e-scooters, etc.) pose competitive pressure.

- End-User Demographics: Expanding to include tourists and recreational users alongside commuters.

- M&A Trends: xx M&A deals recorded between 2019-2024, with an increasing trend towards consolidation.

Bike Sharing Market in Europe Growth Trends & Insights

The European bike-sharing market has witnessed robust growth during the historical period (2019-2024), fueled by increasing urbanization, environmental concerns, and government initiatives promoting sustainable transportation. The market size has expanded significantly, reaching xx Million units in 2024, registering a CAGR of xx% during the period. This growth is expected to continue throughout the forecast period (2025-2033), driven by technological advancements, improving infrastructure, and evolving consumer preferences for eco-friendly mobility solutions. Market penetration is expected to reach xx% by 2033 in major European cities. Technological disruptions, such as the integration of AI and IoT in bike-sharing systems, are enhancing efficiency and improving the user experience, further accelerating adoption rates. Consumer behavior is shifting toward a preference for convenient, on-demand, and sustainable transportation options.

Dominant Regions, Countries, or Segments in Bike Sharing Market in Europe

Western European countries, particularly Germany, France, the Netherlands, and the UK, currently dominate the European bike-sharing market. These countries have a well-established infrastructure, supportive government policies, and a higher adoption rate of bike-sharing services. Within the segment breakdown, the Commuting application type holds the largest market share, driven by the increasing demand for efficient and sustainable commuting solutions in urban areas. Short-term rentals also showcase significant growth potential, fuelled by tourism and recreational use.

- Key Drivers for Western Europe:

- Well-developed urban infrastructure.

- Supportive government policies and investments in cycling infrastructure.

- High awareness of environmental sustainability.

- Higher disposable income among the population.

- Market Share: Western Europe holds approximately xx% of the total European market in 2025.

- Growth Potential: Eastern European countries present significant untapped potential for future expansion.

Bike Sharing Market in Europe Product Landscape

The bike-sharing market offers a diverse product landscape, encompassing traditional bicycles, e-bikes, and cargo bikes. Product innovation focuses on enhancing durability, safety, user-friendliness, and integration with smart city technologies. E-bikes, in particular, are gaining significant traction, driven by their ability to overcome geographical barriers and increase the appeal of bike-sharing to a wider demographic. Key performance metrics include bike availability, user satisfaction, and operational efficiency. Unique selling propositions often involve advanced features such as integrated GPS tracking, smart locks, and mobile app-based booking systems.

Key Drivers, Barriers & Challenges in Bike Sharing Market in Europe

Key Drivers:

- Growing urban populations and traffic congestion.

- Increasing environmental awareness and government initiatives for sustainable transport.

- Technological advancements in e-bikes and smart city integration.

- Convenient and cost-effective alternative to public transport.

Challenges and Restraints:

- Vandalism and theft, leading to high operational costs (xx% of total operational costs in 2024).

- Uneven infrastructure development across different regions.

- Stringent regulations and licensing requirements in some countries.

- Competition from other micromobility solutions.

Emerging Opportunities in Bike Sharing Market in Europe

- Expansion into smaller cities and towns.

- Integration with public transportation systems for seamless travel.

- Development of specialized bike-sharing programs targeting specific user segments (e.g., tourists, delivery services).

- Rise of subscription models and bundled services.

Growth Accelerators in the Bike Sharing Market in Europe Industry

The long-term growth of the European bike-sharing market will be significantly driven by the continued integration of smart city technologies, fostering the creation of more efficient and user-friendly systems. Strategic partnerships between bike-sharing operators and public transportation providers will further unlock growth potential. Expansion into underserved markets and the development of innovative business models will further contribute to long-term growth.

Key Players Shaping the Bike Sharing Market in Europe Market

- Donkey Republic

- BiciMad (Avanza Bike SL)

- YObykes

- Berlin d

- Urbo Solutions

- Pony Bikes

- Cloudbike

- Rekola Bikesharing s r o

- Bleeper Active

Notable Milestones in Bike Sharing Market in Europe Sector

- February 2023: nextbike by Tier launched four bike-sharing systems in Spain within eight weeks, significantly expanding its market presence.

- March 2023: PBSC Urban Solutions launched Madrid's new bicimad system, introducing an advanced, integrated bike-sharing solution.

In-Depth Bike Sharing Market in Europe Market Outlook

The European bike-sharing market is poised for continued expansion throughout the forecast period. Growth will be driven by increasing urbanization, rising environmental consciousness, and advancements in technology. Strategic partnerships, expansion into new markets, and the development of innovative service offerings will play a crucial role in shaping the future of the industry. The potential for integrating bike-sharing with other modes of transportation, creating seamless and efficient multimodal solutions, represents a significant opportunity for growth.

Bike Sharing Market in Europe Segmentation

-

1. Duration Type

- 1.1. Long

- 1.2. Short

-

2. Application Type

- 2.1. Tourism

- 2.2. Commuting

Bike Sharing Market in Europe Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. France

- 5. Rest of Europe

Bike Sharing Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.64% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of E-bikes

- 3.3. Market Restrains

- 3.3.1. Availability of Alternative Transport Options

- 3.4. Market Trends

- 3.4.1. Commuting Holds the Highest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bike Sharing Market in Europe Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Duration Type

- 5.1.1. Long

- 5.1.2. Short

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Tourism

- 5.2.2. Commuting

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. Italy

- 5.3.4. France

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Duration Type

- 6. Germany Bike Sharing Market in Europe Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Duration Type

- 6.1.1. Long

- 6.1.2. Short

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Tourism

- 6.2.2. Commuting

- 6.1. Market Analysis, Insights and Forecast - by Duration Type

- 7. United Kingdom Bike Sharing Market in Europe Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Duration Type

- 7.1.1. Long

- 7.1.2. Short

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Tourism

- 7.2.2. Commuting

- 7.1. Market Analysis, Insights and Forecast - by Duration Type

- 8. Italy Bike Sharing Market in Europe Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Duration Type

- 8.1.1. Long

- 8.1.2. Short

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Tourism

- 8.2.2. Commuting

- 8.1. Market Analysis, Insights and Forecast - by Duration Type

- 9. France Bike Sharing Market in Europe Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Duration Type

- 9.1.1. Long

- 9.1.2. Short

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Tourism

- 9.2.2. Commuting

- 9.1. Market Analysis, Insights and Forecast - by Duration Type

- 10. Rest of Europe Bike Sharing Market in Europe Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Duration Type

- 10.1.1. Long

- 10.1.2. Short

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Tourism

- 10.2.2. Commuting

- 10.1. Market Analysis, Insights and Forecast - by Duration Type

- 11. Germany Bike Sharing Market in Europe Analysis, Insights and Forecast, 2019-2031

- 12. France Bike Sharing Market in Europe Analysis, Insights and Forecast, 2019-2031

- 13. Italy Bike Sharing Market in Europe Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Bike Sharing Market in Europe Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Bike Sharing Market in Europe Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Bike Sharing Market in Europe Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Bike Sharing Market in Europe Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Donkey Republic

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 BiciMad (Avanza Bike SL)

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 YObykes

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Berlin d

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Urbo Solutions

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Pony Bikes

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Cloudbike

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Rekola Bikesharing s r o

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Bleeper Active

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.1 Donkey Republic

List of Figures

- Figure 1: Bike Sharing Market in Europe Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bike Sharing Market in Europe Share (%) by Company 2024

List of Tables

- Table 1: Bike Sharing Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bike Sharing Market in Europe Revenue Million Forecast, by Duration Type 2019 & 2032

- Table 3: Bike Sharing Market in Europe Revenue Million Forecast, by Application Type 2019 & 2032

- Table 4: Bike Sharing Market in Europe Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Bike Sharing Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Bike Sharing Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Bike Sharing Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Bike Sharing Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Bike Sharing Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Bike Sharing Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Bike Sharing Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Bike Sharing Market in Europe Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Bike Sharing Market in Europe Revenue Million Forecast, by Duration Type 2019 & 2032

- Table 14: Bike Sharing Market in Europe Revenue Million Forecast, by Application Type 2019 & 2032

- Table 15: Bike Sharing Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Bike Sharing Market in Europe Revenue Million Forecast, by Duration Type 2019 & 2032

- Table 17: Bike Sharing Market in Europe Revenue Million Forecast, by Application Type 2019 & 2032

- Table 18: Bike Sharing Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Bike Sharing Market in Europe Revenue Million Forecast, by Duration Type 2019 & 2032

- Table 20: Bike Sharing Market in Europe Revenue Million Forecast, by Application Type 2019 & 2032

- Table 21: Bike Sharing Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Bike Sharing Market in Europe Revenue Million Forecast, by Duration Type 2019 & 2032

- Table 23: Bike Sharing Market in Europe Revenue Million Forecast, by Application Type 2019 & 2032

- Table 24: Bike Sharing Market in Europe Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Bike Sharing Market in Europe Revenue Million Forecast, by Duration Type 2019 & 2032

- Table 26: Bike Sharing Market in Europe Revenue Million Forecast, by Application Type 2019 & 2032

- Table 27: Bike Sharing Market in Europe Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bike Sharing Market in Europe?

The projected CAGR is approximately 15.64%.

2. Which companies are prominent players in the Bike Sharing Market in Europe?

Key companies in the market include Donkey Republic, BiciMad (Avanza Bike SL), YObykes, Berlin d, Urbo Solutions, Pony Bikes, Cloudbike, Rekola Bikesharing s r o, Bleeper Active.

3. What are the main segments of the Bike Sharing Market in Europe?

The market segments include Duration Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of E-bikes.

6. What are the notable trends driving market growth?

Commuting Holds the Highest Share.

7. Are there any restraints impacting market growth?

Availability of Alternative Transport Options.

8. Can you provide examples of recent developments in the market?

February 2023: The German company nextbike by Tier introduced four shared push bike and e-bike systems in Spain in eight weeks. Moreover, the new services in Getxo, Mislata, and Palma de Mallorca added to the firm’s win of a large-scale tender in Barcelona.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bike Sharing Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bike Sharing Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bike Sharing Market in Europe?

To stay informed about further developments, trends, and reports in the Bike Sharing Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence