Key Insights

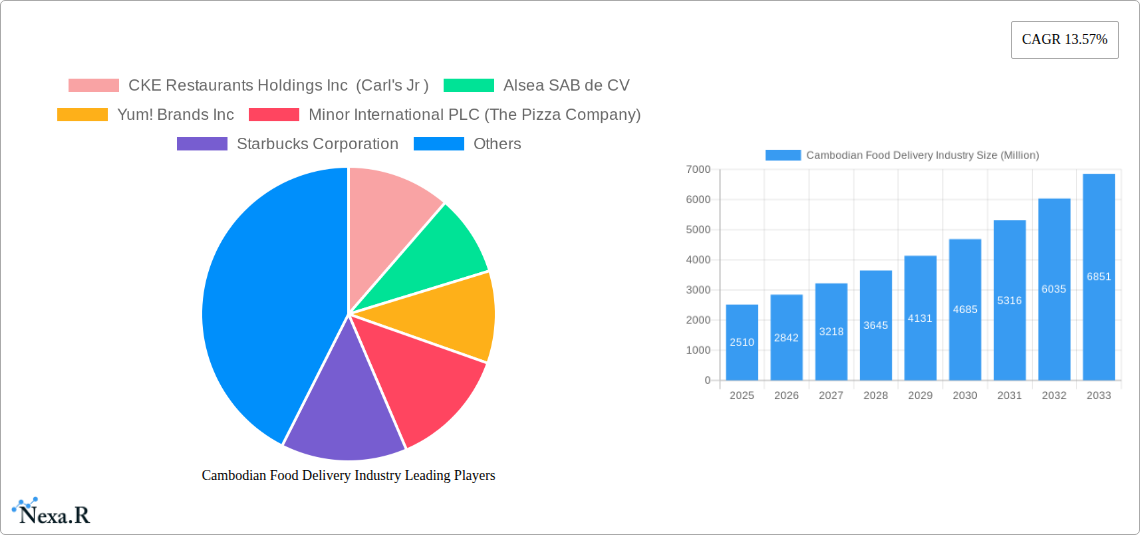

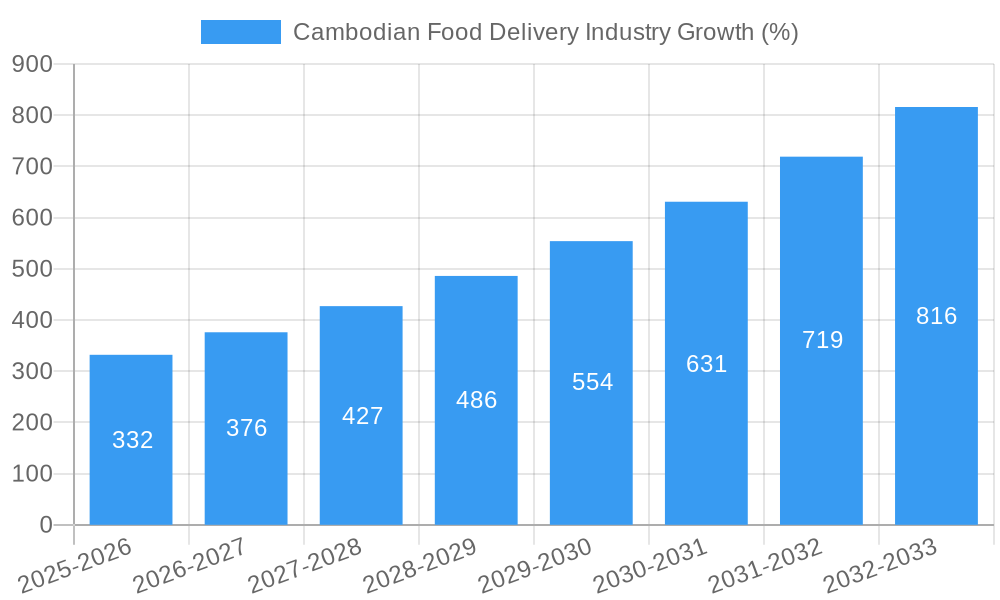

The Cambodian food delivery market, valued at $2.51 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 13.57% from 2025 to 2033. This surge is driven by several factors. The increasing penetration of smartphones and affordable internet access has broadened the reach of online food delivery platforms, making them accessible to a larger segment of the population. Changing lifestyles, particularly among young urban professionals, coupled with a growing preference for convenience, are key drivers. The rise of e-commerce and digital payment systems further facilitates the market's expansion. Furthermore, a diverse range of food options, catering to various budgets and preferences, including full-service restaurants, fast food, cafes, and street food vendors leveraging delivery services, contribute to market vibrancy. The emergence of both independent and chained outlets provides a competitive landscape stimulating innovation and service improvement.

However, challenges remain. Infrastructure limitations in certain regions of Cambodia may hinder efficient delivery operations. Concerns around food safety and hygiene, along with the potential for inconsistent service quality from independent outlets, need to be addressed to ensure sustained growth. Furthermore, competition among established players and the entry of new market participants will necessitate strategic adaptation for companies to maintain market share. Addressing these factors, through enhanced logistics, stricter regulatory oversight on hygiene, and improved customer service practices, is crucial for achieving the projected growth trajectory and maintaining consumer confidence in the Cambodian food delivery sector. The market segmentation highlights a diverse range of players, indicating opportunities for specialized services focusing on particular customer segments.

Cambodian Food Delivery Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the Cambodian food delivery industry, covering market dynamics, growth trends, key players, and future outlook from 2019 to 2033. The report is invaluable for industry professionals, investors, and anyone seeking to understand this rapidly evolving sector. We delve into the parent market (Restaurant Industry) and the child market (Food Delivery) for a holistic view.

Cambodian Food Delivery Industry Market Dynamics & Structure

This section analyzes the Cambodian food delivery market's structure, concentration, technological advancements, regulatory environment, competitive landscape, and M&A activity. The Cambodian food delivery market is experiencing significant growth, driven by factors such as increasing smartphone penetration, rising urbanization, and changing consumer preferences.

- Market Concentration: The market is characterized by a mix of large international chains and numerous smaller, independent players. The market share of the top 5 players is estimated at xx% in 2025.

- Technological Innovation: The adoption of online ordering platforms, mobile payment systems, and delivery optimization technologies is transforming the industry. However, barriers to innovation exist, including limited digital literacy in certain demographics and inconsistent internet connectivity.

- Regulatory Framework: Government regulations concerning food safety, hygiene, and licensing impact market operations. Specific regulations regarding delivery services are currently xx (describe current state, lacking or developing).

- Competitive Product Substitutes: Traditional dine-in restaurants and street food vendors remain significant competitors, especially in lower-income segments. The rise of cloud kitchens is also impacting the market.

- End-User Demographics: Young adults and working professionals represent the primary target demographic. Growing disposable incomes and busy lifestyles fuel demand for convenience.

- M&A Trends: Recent acquisitions like Domino's Pizza's sale (USD 214 million in August 2022) indicate consolidation and strategic investment in the sector. The estimated volume of M&A deals in the period 2019-2024 was xx Million USD.

Cambodian Food Delivery Industry Growth Trends & Insights

This section analyzes the historical, current, and projected growth of the Cambodian food delivery market using detailed data and insights, factoring in technological disruptions and shifts in consumer preferences. The market size, based on total revenue, is projected to reach xx Million USD in 2025, with a CAGR of xx% during the forecast period (2025-2033). The market penetration rate is currently estimated at xx% and is expected to reach xx% by 2033. Technological disruptions like the rise of super-apps and the increasing popularity of contactless delivery are key drivers of this growth. Changes in consumer behavior, such as a preference for healthier options and personalized experiences, are also shaping the market’s evolution. Data from XXX (replace XXX with data source) supports these observations.

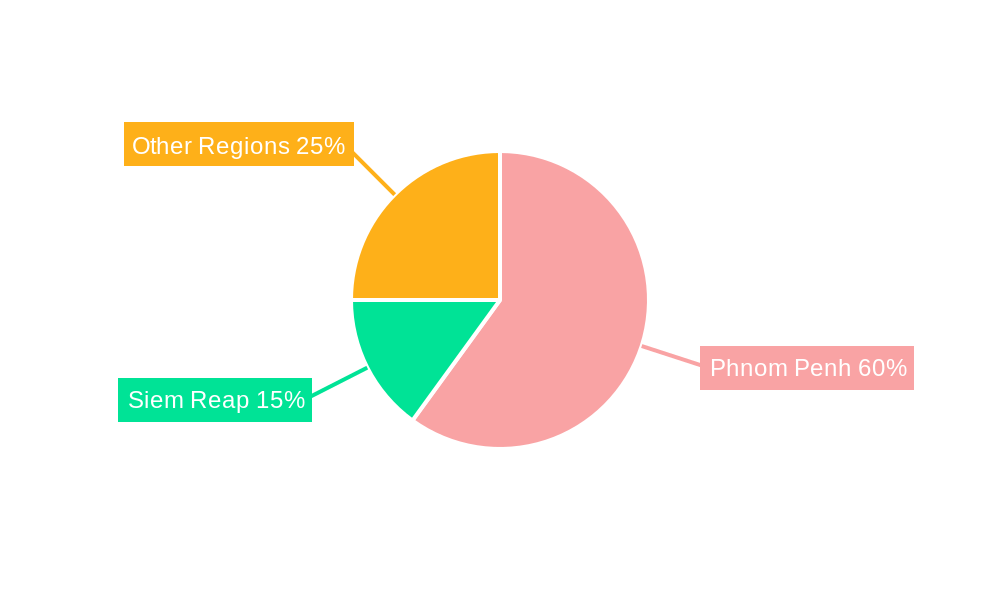

Dominant Regions, Countries, or Segments in Cambodian Food Delivery Industry

This section identifies the leading segments and regions driving growth within the Cambodian food delivery industry. The fastest-growing segment is anticipated to be xx (either Type or Structure), driven by factors such as xx (specific drivers).

- Type: The Fast Food segment exhibits the highest growth potential, fueled by affordability and convenience. Street Stalls/Kiosks maintain a significant market share due to their wide reach and lower costs. However, the Full Service Restaurants segment is gradually incorporating delivery services to expand their customer base.

- Structure: Chained outlets are gaining traction due to brand recognition and efficient operations, though independent outlets still represent a substantial part of the market.

- Key Drivers: Factors driving growth include increasing smartphone penetration, rising urbanization, improving infrastructure, and supportive government policies aimed at promoting digitalization.

Cambodian Food Delivery Industry Product Landscape

The Cambodian food delivery market is witnessing innovative product offerings, encompassing diverse cuisines, customizable meal options, and value-added services like loyalty programs. Technological advancements in order management systems, delivery route optimization, and digital payment integration are enhancing operational efficiency. The unique selling propositions focus on speed, convenience, and variety, catering to evolving customer needs.

Key Drivers, Barriers & Challenges in Cambodian Food Delivery Industry

Key Drivers: Rising disposable incomes, increased smartphone penetration, urbanization, and the growing preference for convenience are propelling the market's growth. Government initiatives promoting digitalization further stimulate the sector.

Key Challenges & Restraints: Infrastructure limitations, especially in rural areas, hinder efficient delivery operations. Food safety and hygiene regulations present ongoing challenges, impacting operational costs and market participation. Intense competition and rising delivery costs affect profit margins.

Emerging Opportunities in Cambodian Food Delivery Industry

Untapped markets in rural areas present considerable potential. Expanding service offerings to include grocery delivery, meal kits, and specialized dietary needs will attract new customer segments. The adoption of advanced technologies such as AI-powered recommendation systems and drone deliveries could revolutionize operations.

Growth Accelerators in the Cambodian Food Delivery Industry Industry

Technological advancements in delivery optimization, digital payment systems, and marketing strategies are key growth accelerators. Strategic partnerships between food businesses and delivery platforms create synergistic growth opportunities. Expansion into new geographic areas and service offerings broadens market reach.

Key Players Shaping the Cambodian Food Delivery Industry Market

- CKE Restaurants Holdings Inc (Carl's Jr)

- Alsea SAB de CV

- Yum! Brands Inc

- Minor International PLC (The Pizza Company)

- Starbucks Corporation

- Papa John's International Inc

- Restaurant Brands International Inc

- Thalias Co Ltd

- Domino's Pizza Inc.

- Berkshire Hathaway Inc (Dairy Queen)

Notable Milestones in Cambodian Food Delivery Industry Sector

- August 2021: Pizza Hut enters the Cambodian market via United Food Group.

- August 2022: Starbucks launches online sales via Wingmall.

- August 2022: DPE acquires Domino's Pizza businesses in Cambodia, Malaysia, and Singapore for USD 214 million.

In-Depth Cambodian Food Delivery Industry Market Outlook

The Cambodian food delivery market exhibits significant growth potential, driven by ongoing technological advancements, expanding infrastructure, and rising consumer demand. Strategic investments in technology, partnerships, and market expansion will further propel the sector's growth and create new opportunities for market participants. The sector is poised for continued expansion, particularly in untapped markets and with innovative service offerings.

Cambodian Food Delivery Industry Segmentation

-

1. Type

- 1.1. Full Service Restaurants

- 1.2. Self-service Restaurants

- 1.3. Fast Food

- 1.4. Street Stalls/Kiosks

- 1.5. Cafes/Bars

- 1.6. 100% Home Delivery/Takeaway

-

2. Structure

- 2.1. Chained Outlets

- 2.2. Independent Outlets

Cambodian Food Delivery Industry Segmentation By Geography

- 1. Cambodia

Cambodian Food Delivery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Application of Collagen in End-User Industry; Implementation of Business Strategies by Market Players

- 3.3. Market Restrains

- 3.3.1. Growing Inclination Toward Clean Label Products

- 3.4. Market Trends

- 3.4.1. Growing Influence of Online Food Delivery Apps

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cambodian Food Delivery Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Full Service Restaurants

- 5.1.2. Self-service Restaurants

- 5.1.3. Fast Food

- 5.1.4. Street Stalls/Kiosks

- 5.1.5. Cafes/Bars

- 5.1.6. 100% Home Delivery/Takeaway

- 5.2. Market Analysis, Insights and Forecast - by Structure

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Cambodia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 CKE Restaurants Holdings Inc (Carl's Jr )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alsea SAB de CV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yum! Brands Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Minor International PLC (The Pizza Company)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Starbucks Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Papa John's International Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Restaurant Brands International Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thalias Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Domino's Pizza Inc.

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Berkshire Hathaway Inc (Dairy Queen)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CKE Restaurants Holdings Inc (Carl's Jr )

List of Figures

- Figure 1: Cambodian Food Delivery Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Cambodian Food Delivery Industry Share (%) by Company 2024

List of Tables

- Table 1: Cambodian Food Delivery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Cambodian Food Delivery Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Cambodian Food Delivery Industry Revenue Million Forecast, by Structure 2019 & 2032

- Table 4: Cambodian Food Delivery Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Cambodian Food Delivery Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Cambodian Food Delivery Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Cambodian Food Delivery Industry Revenue Million Forecast, by Structure 2019 & 2032

- Table 8: Cambodian Food Delivery Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cambodian Food Delivery Industry?

The projected CAGR is approximately 13.57%.

2. Which companies are prominent players in the Cambodian Food Delivery Industry?

Key companies in the market include CKE Restaurants Holdings Inc (Carl's Jr ), Alsea SAB de CV, Yum! Brands Inc, Minor International PLC (The Pizza Company), Starbucks Corporation, Papa John's International Inc, Restaurant Brands International Inc, Thalias Co Ltd, Domino's Pizza Inc., Berkshire Hathaway Inc (Dairy Queen).

3. What are the main segments of the Cambodian Food Delivery Industry?

The market segments include Type, Structure.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Application of Collagen in End-User Industry; Implementation of Business Strategies by Market Players.

6. What are the notable trends driving market growth?

Growing Influence of Online Food Delivery Apps.

7. Are there any restraints impacting market growth?

Growing Inclination Toward Clean Label Products.

8. Can you provide examples of recent developments in the market?

In August 2022, DPE announced the purchase of Domino's Pizza businesses in Cambodia, Malaysia, and Singapore for USD 214 million. A binding agreement has been entered into between DPE and Impress Foods Pte Ltd, which owns Domino's Pizza Singapore and Domino's Pizza Cambodia at 100%; Mikenwill (M) Sdn Bhd, which holds 100% of Dommal Food Services Sdn Bhd, the Malaysian franchise holder; and with minority Cambodian shareholders for the remaining 35%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cambodian Food Delivery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cambodian Food Delivery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cambodian Food Delivery Industry?

To stay informed about further developments, trends, and reports in the Cambodian Food Delivery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence