Key Insights

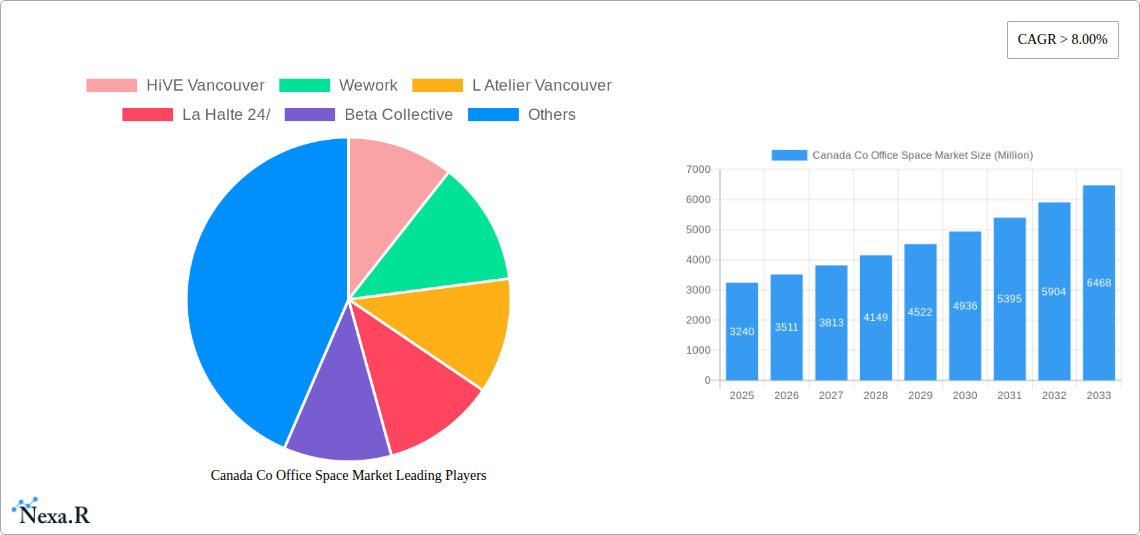

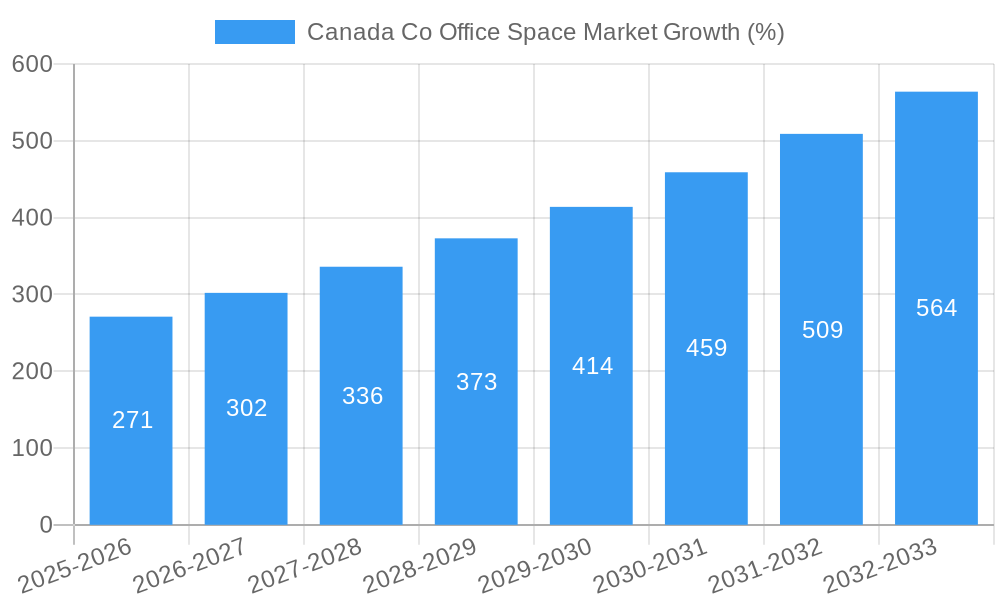

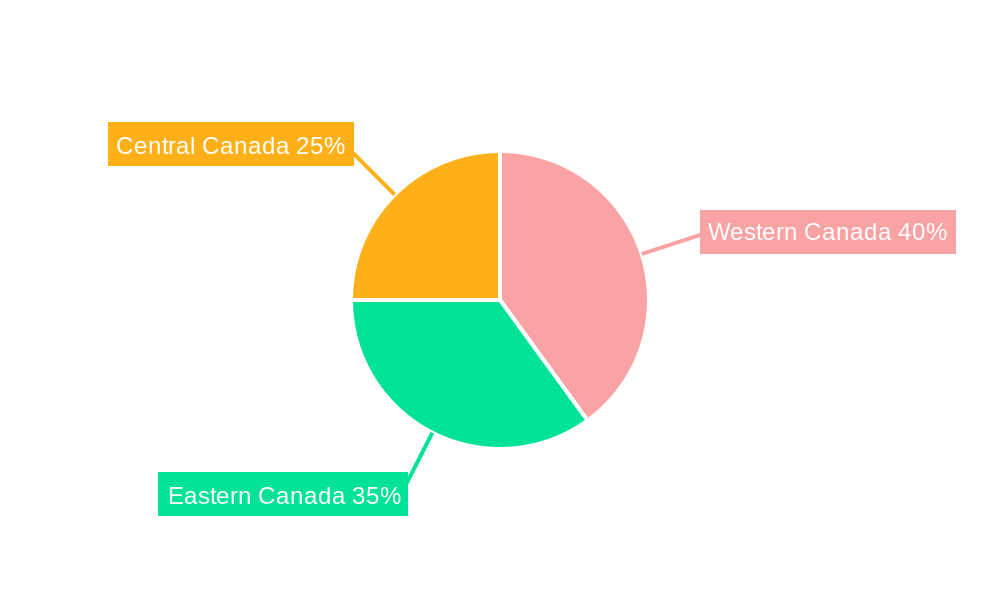

The Canadian co-working office space market, valued at $3.24 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 8% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing prevalence of remote work and hybrid work models necessitates flexible office solutions, boosting demand for co-working spaces. Furthermore, the rise of startups and small-to-medium-sized enterprises (SMEs) seeking cost-effective and scalable office options significantly contributes to market growth. The diverse range of industries utilizing co-working spaces, including IT, legal services, BFSI, and consulting, further broadens the market's appeal. Technological advancements, such as improved booking systems and virtual office features, are also enhancing user experience and driving market adoption. Regional variations exist, with Western Canada potentially exhibiting higher growth due to the presence of thriving tech hubs like Vancouver, while Eastern Canada might show steadier, consistent growth. However, factors like economic fluctuations and competition from traditional office spaces could act as restraints, impacting the overall growth trajectory. Segmentation by end-user (personal, small-scale, large-scale companies) and by type (flexible managed, serviced offices) provides a granular view of market dynamics, enabling targeted strategies for different player segments.

The market's competitive landscape is dynamic, with both established international players like Regus and WeWork, and local providers like HiVE Vancouver and Beta Collective vying for market share. The success of individual operators hinges on factors such as location strategy, service offerings (including amenities and technological integration), pricing models, and brand reputation. Future growth will likely depend on adapting to evolving user needs, incorporating sustainable practices, and leveraging technology to enhance the overall co-working experience. The continued expansion of the Canadian economy and the sustained popularity of flexible work arrangements will remain significant catalysts for future growth in this market. Analyzing the regional distribution (Eastern, Western, and Central Canada) reveals further insights into growth potential and informs strategic investment decisions. The forecast period of 2025-2033 offers a clear view of the market’s potential for significant expansion.

Canada Co-working Office Space Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Canadian co-working office space market, offering invaluable insights for investors, industry professionals, and strategic planners. We examine market dynamics, growth trends, dominant segments, and key players, projecting market evolution from 2019 to 2033. The report utilizes a robust methodology incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. Market values are presented in millions.

Canada Co-working Office Space Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the Canadian co-working office space market. We examine market concentration, identifying key players and their market share, along with the impact of mergers and acquisitions (M&A). Technological innovation, including smart office solutions and flexible workspace technologies, are assessed for their influence on market growth. Regulatory frameworks governing commercial real estate and co-working spaces are examined, while competitive substitutes, such as traditional office rentals and remote work options, are considered. Finally, the evolving demographics of end-users, from individual freelancers to large corporations, are analyzed to understand shifting demands.

- Market Concentration: The Canadian co-working market exhibits moderate concentration, with a few major players holding significant shares, while numerous smaller operators compete for market share. The top 5 players account for approximately xx% of the market (2024).

- M&A Activity: The past five years witnessed xx M&A deals, largely driven by consolidation efforts among smaller players seeking scale and increased market share.

- Technological Innovation: Smart building technologies, booking systems, and virtual office solutions are driving market innovation, enhancing operational efficiency, and improving the user experience.

- Regulatory Framework: Provincial and municipal regulations concerning building codes, zoning, and licensing influence market expansion, particularly in major urban centers.

- End-User Demographics: A shift towards flexible work arrangements fuels demand across various sectors, particularly among IT and ITES companies, and small and medium-sized enterprises (SMEs).

Canada Co-working Office Space Market Growth Trends & Insights

This section details the evolution of the Canadian co-working market, examining market size, adoption rates, technological disruptions, and consumer behavior changes. We analyze the historical growth trajectory (2019-2024) and project future expansion (2025-2033), utilizing both qualitative and quantitative data. The impact of technological advancements on market dynamics is explored, as is the influence of evolving workplace preferences and economic factors. Specific metrics such as Compound Annual Growth Rate (CAGR) and market penetration are provided for a deeper understanding of market trends. The market size is projected to reach xx Million by 2033, growing at a CAGR of xx%. Factors influencing this growth include increased demand for flexible workspaces, expanding tech hubs, and rising urbanization.

Dominant Regions, Countries, or Segments in Canada Co-working Office Space Market

This section identifies the key regions, countries, and segments driving growth within the Canadian co-working market. We analyze the market share and growth potential of various segments, including:

By End-User:

- Large Scale Company: This segment exhibits the highest growth potential, driven by the increasing adoption of flexible work models by large corporations.

- Small Scale Company: This segment remains a significant contributor, representing a substantial portion of the market.

- Personal User: This segment is experiencing moderate growth, reflecting the increasing number of freelancers and independent workers.

By Type:

- Flexible Managed Office: This segment dominates due to its flexibility and cost-effectiveness.

- Serviced Office: This segment shows steady growth, providing more comprehensive services and amenities.

By Application:

- Information Technology (IT and ITES): This segment exhibits the strongest growth due to the industry's preference for flexible workspaces.

Key Drivers:

- Rapid urbanization and population growth in major cities like Toronto and Vancouver.

- Growing adoption of flexible work arrangements by businesses of all sizes.

- Increasing demand for collaborative workspaces and networking opportunities.

Canada Co-working Office Space Market Product Landscape

The Canadian co-working market offers a diverse range of products, from basic shared workspaces to fully serviced offices with premium amenities. Innovation is focused on enhancing user experience and productivity, incorporating smart technologies, flexible lease terms, and customized workspace solutions. Many providers offer virtual office packages, combining the benefits of a physical address with access to co-working spaces and networking events. The key differentiators include location, amenities (meeting rooms, high-speed internet, etc.), and the level of service provided.

Key Drivers, Barriers & Challenges in Canada Co-working Office Space Market

Key Drivers:

The rise of remote and hybrid work models, the need for flexible workspace solutions, and technological advancements are driving market expansion. Government incentives promoting entrepreneurship and small business growth also positively influence the sector. Growing urbanization and an increasing concentration of businesses in major cities contribute to a high demand for co-working spaces.

Key Challenges and Restraints:

High real estate costs in prime urban locations, intense competition among co-working space providers, and economic downturns present significant challenges. Fluctuations in demand due to economic cycles can impact occupancy rates. Supply chain disruptions, impacting the availability of building materials and furniture, could also restrain growth.

Emerging Opportunities in Canada Co-working Office Space Market

Emerging opportunities lie in underserved markets beyond major urban centers, specialized co-working spaces catering to specific industries, and integrating technology to improve efficiency and user experience. The growth of the gig economy and the increasing number of freelancers create a sustained demand for flexible workspaces. Expanding into smaller cities and offering specialized services tailored to particular industries present substantial growth opportunities.

Growth Accelerators in the Canada Co-working Office Space Market Industry

Long-term growth is fueled by technological advancements in workspace management, the continued rise of the gig economy, and strategic partnerships between co-working operators and corporations seeking flexible solutions for their employees. Expansion into secondary markets and the development of specialized co-working spaces catering to niche industries will further accelerate growth.

Key Players Shaping the Canada Co-working Office Space Market Market

- HiVE Vancouver

- WeWork (WeWork)

- L Atelier Vancouver

- La Halte 24/

- Beta Collective

- Acme Works

- Regus (Regus)

- District

- BNKR

- Lab T O

- Workhaus

- Coworker

Notable Milestones in Canada Co-working Office Space Market Sector

- January 2023: Captivate partners with WeWork to transform digital screens in WeWork locations into advertising spaces, enhancing revenue streams for WeWork and expanding Captivate's reach.

- January 2022: IWG expands its presence in Vancouver's Broadway Corridor and King George Hub, adding significant co-working space in rapidly growing tech hubs.

In-Depth Canada Co-working Office Space Market Outlook

The Canadian co-working office space market is poised for continued growth, driven by evolving work preferences, technological advancements, and increasing urbanization. Strategic partnerships, expansion into new markets, and the development of specialized co-working spaces catering to specific industry needs present significant opportunities for market players. The market’s future trajectory is bright, with substantial potential for innovation and expansion in the coming years.

Canada Co Office Space Market Segmentation

-

1. End-User

- 1.1. Personal User

- 1.2. Small Scale Company

- 1.3. Large Scale Company

- 1.4. Other End-Users

-

2. Type

- 2.1. Flexible Managed Office

- 2.2. Serviced Office

-

3. Application

- 3.1. Information Technology (IT and ITES)

- 3.2. Legal Services

- 3.3. BFSI (Banking, Financial Services, and Insurance)

- 3.4. Consulting

- 3.5. Other Services

-

4. Geography

- 4.1. Vancouver

- 4.2. Calgary

- 4.3. Ottawa

- 4.4. Toronto

- 4.5. Rest of Canada

Canada Co Office Space Market Segmentation By Geography

- 1. Vancouver

- 2. Calgary

- 3. Ottawa

- 4. Toronto

- 5. Rest of Canada

Canada Co Office Space Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives; Demand for office and retail space

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor; Supply chain issues and rising material costs

- 3.4. Market Trends

- 3.4.1. Toronto Region is Providing Ample of Opportunities to Tech Giants and Promoting the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Co Office Space Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Personal User

- 5.1.2. Small Scale Company

- 5.1.3. Large Scale Company

- 5.1.4. Other End-Users

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Flexible Managed Office

- 5.2.2. Serviced Office

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Information Technology (IT and ITES)

- 5.3.2. Legal Services

- 5.3.3. BFSI (Banking, Financial Services, and Insurance)

- 5.3.4. Consulting

- 5.3.5. Other Services

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Vancouver

- 5.4.2. Calgary

- 5.4.3. Ottawa

- 5.4.4. Toronto

- 5.4.5. Rest of Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Vancouver

- 5.5.2. Calgary

- 5.5.3. Ottawa

- 5.5.4. Toronto

- 5.5.5. Rest of Canada

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Vancouver Canada Co Office Space Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Personal User

- 6.1.2. Small Scale Company

- 6.1.3. Large Scale Company

- 6.1.4. Other End-Users

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Flexible Managed Office

- 6.2.2. Serviced Office

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Information Technology (IT and ITES)

- 6.3.2. Legal Services

- 6.3.3. BFSI (Banking, Financial Services, and Insurance)

- 6.3.4. Consulting

- 6.3.5. Other Services

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Vancouver

- 6.4.2. Calgary

- 6.4.3. Ottawa

- 6.4.4. Toronto

- 6.4.5. Rest of Canada

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. Calgary Canada Co Office Space Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Personal User

- 7.1.2. Small Scale Company

- 7.1.3. Large Scale Company

- 7.1.4. Other End-Users

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Flexible Managed Office

- 7.2.2. Serviced Office

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Information Technology (IT and ITES)

- 7.3.2. Legal Services

- 7.3.3. BFSI (Banking, Financial Services, and Insurance)

- 7.3.4. Consulting

- 7.3.5. Other Services

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Vancouver

- 7.4.2. Calgary

- 7.4.3. Ottawa

- 7.4.4. Toronto

- 7.4.5. Rest of Canada

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Ottawa Canada Co Office Space Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Personal User

- 8.1.2. Small Scale Company

- 8.1.3. Large Scale Company

- 8.1.4. Other End-Users

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Flexible Managed Office

- 8.2.2. Serviced Office

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Information Technology (IT and ITES)

- 8.3.2. Legal Services

- 8.3.3. BFSI (Banking, Financial Services, and Insurance)

- 8.3.4. Consulting

- 8.3.5. Other Services

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Vancouver

- 8.4.2. Calgary

- 8.4.3. Ottawa

- 8.4.4. Toronto

- 8.4.5. Rest of Canada

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. Toronto Canada Co Office Space Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Personal User

- 9.1.2. Small Scale Company

- 9.1.3. Large Scale Company

- 9.1.4. Other End-Users

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Flexible Managed Office

- 9.2.2. Serviced Office

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Information Technology (IT and ITES)

- 9.3.2. Legal Services

- 9.3.3. BFSI (Banking, Financial Services, and Insurance)

- 9.3.4. Consulting

- 9.3.5. Other Services

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Vancouver

- 9.4.2. Calgary

- 9.4.3. Ottawa

- 9.4.4. Toronto

- 9.4.5. Rest of Canada

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. Rest of Canada Canada Co Office Space Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 10.1.1. Personal User

- 10.1.2. Small Scale Company

- 10.1.3. Large Scale Company

- 10.1.4. Other End-Users

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Flexible Managed Office

- 10.2.2. Serviced Office

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Information Technology (IT and ITES)

- 10.3.2. Legal Services

- 10.3.3. BFSI (Banking, Financial Services, and Insurance)

- 10.3.4. Consulting

- 10.3.5. Other Services

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Vancouver

- 10.4.2. Calgary

- 10.4.3. Ottawa

- 10.4.4. Toronto

- 10.4.5. Rest of Canada

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 11. Eastern Canada Canada Co Office Space Market Analysis, Insights and Forecast, 2019-2031

- 12. Western Canada Canada Co Office Space Market Analysis, Insights and Forecast, 2019-2031

- 13. Central Canada Canada Co Office Space Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 HiVE Vancouver

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Wework

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 L Atelier Vancouver

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 La Halte 24/

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Beta Collective

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Acme Works**List Not Exhaustive

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Regus

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 District

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 BNKR

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Lab T O

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Workhaus

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Coworker

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.1 HiVE Vancouver

List of Figures

- Figure 1: Canada Co Office Space Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Co Office Space Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Co Office Space Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Co Office Space Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 3: Canada Co Office Space Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Canada Co Office Space Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Canada Co Office Space Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Canada Co Office Space Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Canada Co Office Space Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Eastern Canada Canada Co Office Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Western Canada Canada Co Office Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Central Canada Canada Co Office Space Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Canada Co Office Space Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 12: Canada Co Office Space Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Canada Co Office Space Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Canada Co Office Space Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Canada Co Office Space Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Canada Co Office Space Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 17: Canada Co Office Space Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Canada Co Office Space Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Canada Co Office Space Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Canada Co Office Space Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Canada Co Office Space Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 22: Canada Co Office Space Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Canada Co Office Space Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Canada Co Office Space Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Canada Co Office Space Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Canada Co Office Space Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 27: Canada Co Office Space Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Canada Co Office Space Market Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Canada Co Office Space Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: Canada Co Office Space Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Canada Co Office Space Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 32: Canada Co Office Space Market Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Canada Co Office Space Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Canada Co Office Space Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 35: Canada Co Office Space Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Co Office Space Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the Canada Co Office Space Market?

Key companies in the market include HiVE Vancouver, Wework, L Atelier Vancouver, La Halte 24/, Beta Collective, Acme Works**List Not Exhaustive, Regus, District, BNKR, Lab T O, Workhaus, Coworker.

3. What are the main segments of the Canada Co Office Space Market?

The market segments include End-User, Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives; Demand for office and retail space.

6. What are the notable trends driving market growth?

Toronto Region is Providing Ample of Opportunities to Tech Giants and Promoting the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor; Supply chain issues and rising material costs.

8. Can you provide examples of recent developments in the market?

January 2023: Captivate, a leading digital out-of-home video network, announced its strategic partnership with WeWork, a leading global flexible space provider, to transform existing digital screens in WeWork lobbies, elevator banks, and communal workspaces to display the Captivate on-screen content experience. This partnership makes Captivate WeWork's exclusive ad sales representation for the U.S. and Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Co Office Space Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Co Office Space Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Co Office Space Market?

To stay informed about further developments, trends, and reports in the Canada Co Office Space Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence