Key Insights

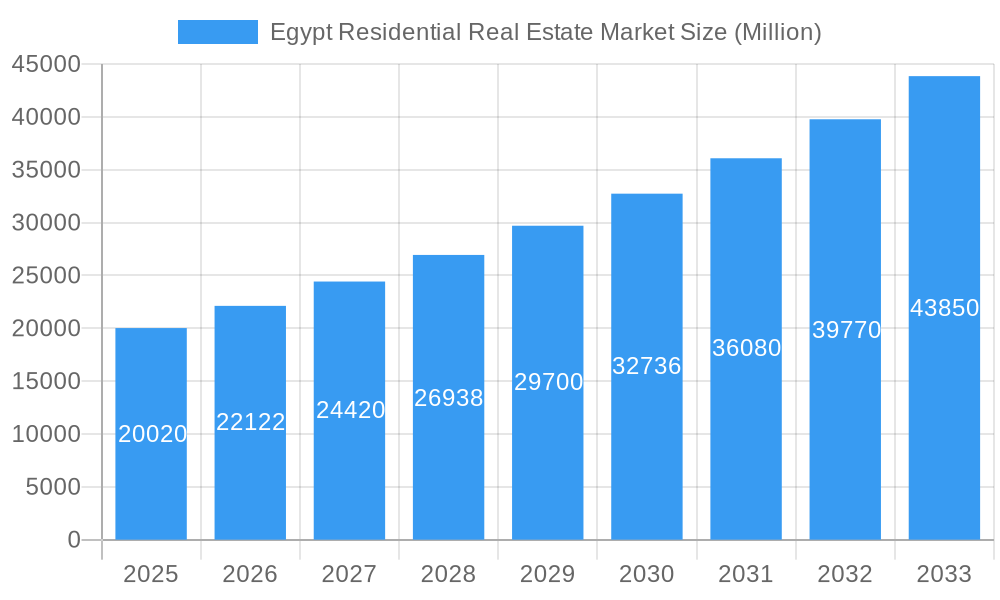

The Egypt residential real estate market is experiencing robust growth, projected to reach $20.02 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 10.96% from 2025 to 2033. This expansion is driven by several key factors. A burgeoning population, particularly a growing middle class with increasing disposable incomes, fuels the demand for housing. Furthermore, government initiatives aimed at infrastructure development and affordable housing schemes are stimulating market activity. Tourism's resurgence also contributes significantly, impacting demand for luxury properties and holiday homes. The market is segmented primarily into apartments and condominiums, which tend to dominate due to affordability and location advantages within urban centers, and villas and landed houses, catering to the higher end of the market and those seeking more space and privacy. Key players like Iwan Developments, Emaar Misr, and Ora Developers are shaping the market landscape through innovative projects and strategic investments. However, challenges remain, including fluctuating economic conditions, potential inflation impacting construction costs, and land availability constraints within popular urban areas. These factors necessitate a balanced approach to development, focusing on sustainable practices and catering to the diverse needs of the Egyptian population across various income levels.

Egypt Residential Real Estate Market Market Size (In Billion)

Despite these challenges, the long-term outlook for the Egyptian residential real estate market remains positive. The continued growth of the economy and population, coupled with ongoing infrastructure improvements and sustained investment from both domestic and international players, are expected to drive market expansion over the forecast period. The diversification of the market across segments, ranging from affordable apartments to luxurious villas, will ensure that a range of consumer needs are met. A focus on sustainable development and energy-efficient housing solutions will further enhance the sector’s appeal and long-term viability, strengthening its position as a key driver of economic growth in Egypt. Effective regulation and transparent market practices will also be crucial to sustaining this positive trajectory.

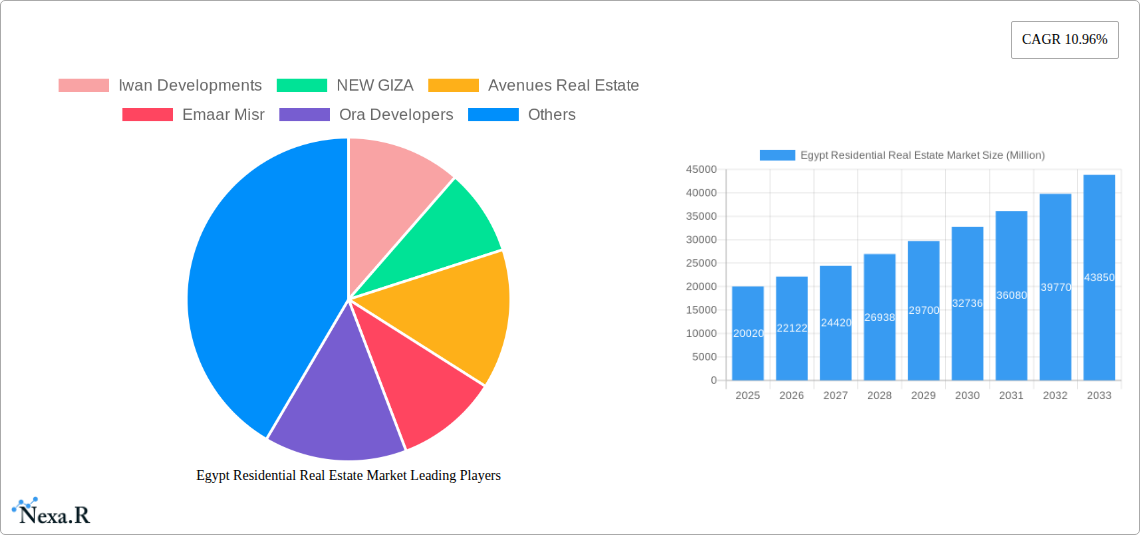

Egypt Residential Real Estate Market Company Market Share

Egypt Residential Real Estate Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Egypt residential real estate market, covering the period 2019-2033, with a focus on the year 2025. It delves into market dynamics, growth trends, key players, and emerging opportunities, offering invaluable insights for industry professionals, investors, and stakeholders. The report segments the market by type (Apartments & Condominiums, Villas & Landed Houses) providing a granular view of the parent and child markets. This data-driven analysis incorporates both quantitative and qualitative data to provide a holistic understanding of this dynamic sector.

Keywords: Egypt real estate, residential real estate Egypt, Egypt property market, Cairo real estate, apartments Egypt, villas Egypt, real estate investment Egypt, Egyptian real estate market analysis, Emaar Misr, Ora Developers, SODIC, Orascom Development Egypt, Wadi Degla Developments, Hassan Allam Properties, Iwan Developments, Avenues Real Estate, Coldwell Banker Egypt, La Vista, New Giza.

Egypt Residential Real Estate Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends impacting the Egyptian residential real estate market. The analysis incorporates data from the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033).

Market Concentration: The Egyptian residential real estate market exhibits a moderately concentrated structure, with a few large players like Emaar Misr and Orascom Development Egypt holding significant market share, while numerous smaller players cater to niche segments. xx% of the market is controlled by the top 5 players in 2025, indicating a potential for consolidation.

Technological Innovation: Adoption of PropTech solutions like online property portals and virtual tours is steadily increasing, however, digital literacy and infrastructure limitations pose challenges to widespread adoption.

Regulatory Framework: Government policies related to land ownership, construction permits, and foreign investment significantly influence market activity. Recent changes in regulations aimed at streamlining the approval process have shown xx% improvement in project completion timelines.

Competitive Product Substitutes: The primary substitute for traditional housing is rental accommodation, a factor impacted by the availability and affordability of rental properties.

End-User Demographics: The market is primarily driven by a growing middle class, increasing urbanization, and a preference for modern, amenity-rich housing. Millennials are increasingly shaping demand for sustainable and technologically advanced properties.

M&A Trends: The acquisition of Orascom Real Estate by SODIC in 2022 illustrates the growing consolidation trend, driven by the need for economies of scale and access to capital. A total of xx M&A deals were recorded between 2019 and 2024, indicating a robust activity level.

Egypt Residential Real Estate Market Growth Trends & Insights

The Egyptian residential real estate market has witnessed significant growth in recent years, driven by urbanization, population growth, and government initiatives to improve infrastructure. The market size, estimated at xx million units in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% between 2025 and 2033, reaching xx million units by 2033. This growth is further fueled by the rising demand for high-quality, affordable housing, a trend accelerated by favorable macroeconomic conditions and increased foreign investment. The market penetration of new construction is expected to increase from xx% in 2025 to xx% in 2033 due to the government's infrastructure development programs and affordable housing schemes. The technological disruptions, such as PropTech adoption and sustainable building materials, are also expected to contribute to overall market growth. Consumer behavior, demonstrating a shift towards modern designs, enhanced security features, and sustainable living practices, will influence the construction and design of upcoming projects.

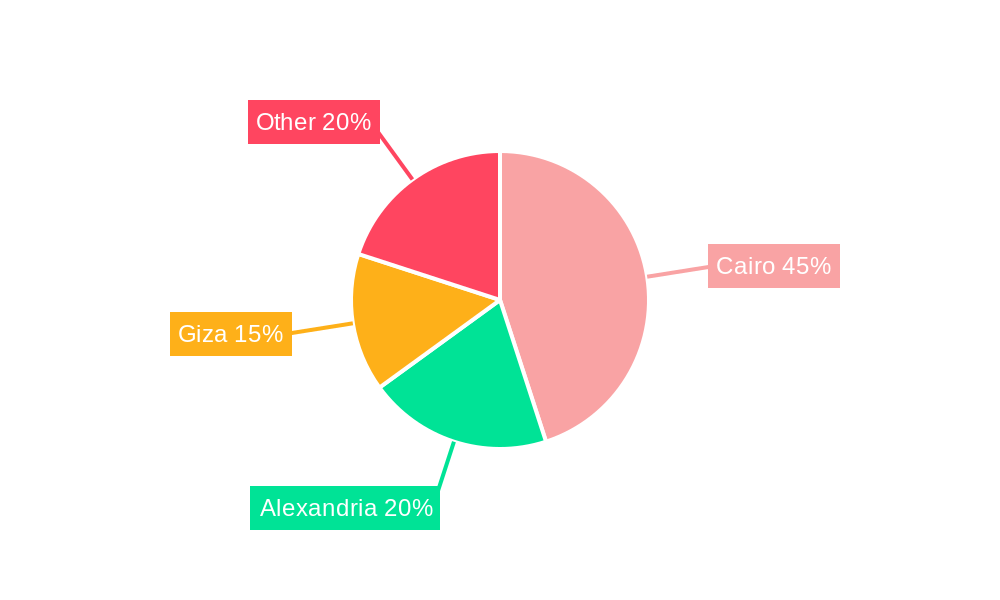

Dominant Regions, Countries, or Segments in Egypt Residential Real Estate Market

The Greater Cairo area remains the dominant region for residential real estate in Egypt, accounting for approximately xx% of the market in 2025, followed by Alexandria and other coastal cities. This dominance is driven by factors including higher employment opportunities, better infrastructure, and a more established social fabric.

Key Drivers of Growth in Apartments and Condominiums:

- High population density and urbanization.

- Affordability compared to villas.

- Availability of various sizes and price ranges.

- Growing preference for modern amenities and community living.

Key Drivers of Growth in Villas and Landed Houses:

- Increasing disposable incomes and preference for spacious living.

- Growing demand in suburban areas with access to nature and tranquility.

- Government initiatives to develop new residential communities.

The growth potential of Villas and Landed Houses segment is significant, particularly in newly developed areas outside the main cities. However, Apartments and Condominiums will continue to dominate in terms of market share due to factors like higher population concentration and affordability.

Egypt Residential Real Estate Market Product Landscape

The Egyptian residential real estate market offers a diverse range of products, from affordable apartments to luxury villas. Recent innovations include the incorporation of smart home technologies, sustainable building materials, and energy-efficient designs to enhance the quality and appeal of residential units. This reflects increasing consumer demand for environmentally friendly and technologically advanced housing. Key performance metrics for developers include unit sales, occupancy rates, and rental yields. Unique selling propositions are increasingly focused on community amenities and lifestyle-driven features to attract discerning buyers.

Key Drivers, Barriers & Challenges in Egypt Residential Real Estate Market

Key Drivers:

- Population Growth & Urbanization: Rapid population growth and urbanization are driving the demand for housing across Egypt.

- Economic Growth & Rising Incomes: Improved economic conditions and increased disposable incomes enable more people to purchase property.

- Government Initiatives: Government-led housing projects and infrastructure improvements are boosting the market.

Key Challenges:

- Financing Constraints: Access to mortgages and construction financing remains limited, impacting affordability. The xx% interest rate on mortgages has contributed to the decline in market activity.

- Land Availability & Regulations: Land acquisition and regulatory approvals are often slow and cumbersome, creating delays in project delivery. A xx% reduction in land availability has increased costs and competition.

- Infrastructure Gaps: Inadequate infrastructure, particularly in newly developed areas, can hinder residential development.

Emerging Opportunities in Egypt Residential Real Estate Market

- Affordable Housing: Significant unmet demand for affordable housing presents opportunities for developers who focus on cost-effective solutions.

- Green Building & Sustainability: Growing consumer interest in sustainable living creates opportunities for developers to adopt green building practices.

- Smart Home Technology: Integrating smart home technology into residential properties can enhance their appeal and command higher prices.

Growth Accelerators in the Egypt Residential Real Estate Market Industry

The Egyptian residential real estate market is poised for sustained growth. Technological advancements, particularly in construction techniques and materials, are enabling cost-effective and sustainable development. Strategic partnerships between developers, investors, and technology companies are also driving growth. Moreover, the government’s continuous focus on infrastructure development and easing regulations further fuels long-term expansion of the market.

Key Players Shaping the Egypt Residential Real Estate Market Market

- Iwan Developments

- NEW GIZA

- Avenues Real Estate

- Emaar Misr

- Ora Developers

- Coldwell Banker Egypt

- La Vista

- Wadi Degla Developments

- Orascom Development Egypt

- Hassan Allam Properties

Notable Milestones in Egypt Residential Real Estate Market Sector

- November 2022: Wadi Degla Developments launched the Club Town project (USD 61 million investment), adding 550 residential units to the market.

- October 2022: SODIC's acquisition offer for Orascom Real Estate (USD 125 million) signifies market consolidation.

In-Depth Egypt Residential Real Estate Market Market Outlook

The Egyptian residential real estate market is expected to experience robust growth in the coming years. This is driven by continued population growth, urbanization, and rising disposable incomes. Strategic investments in infrastructure, coupled with supportive government policies, will create substantial opportunities for developers and investors. The focus on sustainable and technologically advanced housing solutions will further shape the market's future, with significant potential for both local and international players.

Egypt Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

Egypt Residential Real Estate Market Segmentation By Geography

- 1. Egypt

Egypt Residential Real Estate Market Regional Market Share

Geographic Coverage of Egypt Residential Real Estate Market

Egypt Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Private Investment in Real Estate Sector; Growth in the Luxury Housing Market

- 3.3. Market Restrains

- 3.3.1. Increase in primary and secondary rents in the market

- 3.4. Market Trends

- 3.4.1. Increasing Private Investment in Real Estate Sector Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Iwan Developments

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NEW GIZA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Avenues Real Estate

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emaar Misr

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ora Developers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coldwell Banker Egypt

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 La Vista**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wadi Degla Developments

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Orascom Development Egypt

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hassan Allam Properties

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Iwan Developments

List of Figures

- Figure 1: Egypt Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Egypt Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Egypt Residential Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Egypt Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Egypt Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Residential Real Estate Market?

The projected CAGR is approximately 10.96%.

2. Which companies are prominent players in the Egypt Residential Real Estate Market?

Key companies in the market include Iwan Developments, NEW GIZA, Avenues Real Estate, Emaar Misr, Ora Developers, Coldwell Banker Egypt, La Vista**List Not Exhaustive, Wadi Degla Developments, Orascom Development Egypt, Hassan Allam Properties.

3. What are the main segments of the Egypt Residential Real Estate Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Private Investment in Real Estate Sector; Growth in the Luxury Housing Market.

6. What are the notable trends driving market growth?

Increasing Private Investment in Real Estate Sector Driving the Market.

7. Are there any restraints impacting market growth?

Increase in primary and secondary rents in the market.

8. Can you provide examples of recent developments in the market?

November 2022: Wadi Degla Developments, an Egyptian developer, launched the Club Town new residential project in New Degla, Maadi, South Cairo, for EGP 1.5 billion (USD 61 million). The three-phase project spans 70 acres and includes 550 residential units and a commercial area. Breeze, part of Club Town's Phase I, is expected to be delivered between 2024 and 2026, according to the statement. Between 2022 and 2023, the developer intended to complete more than 1,500 units.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Egypt Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence