Key Insights

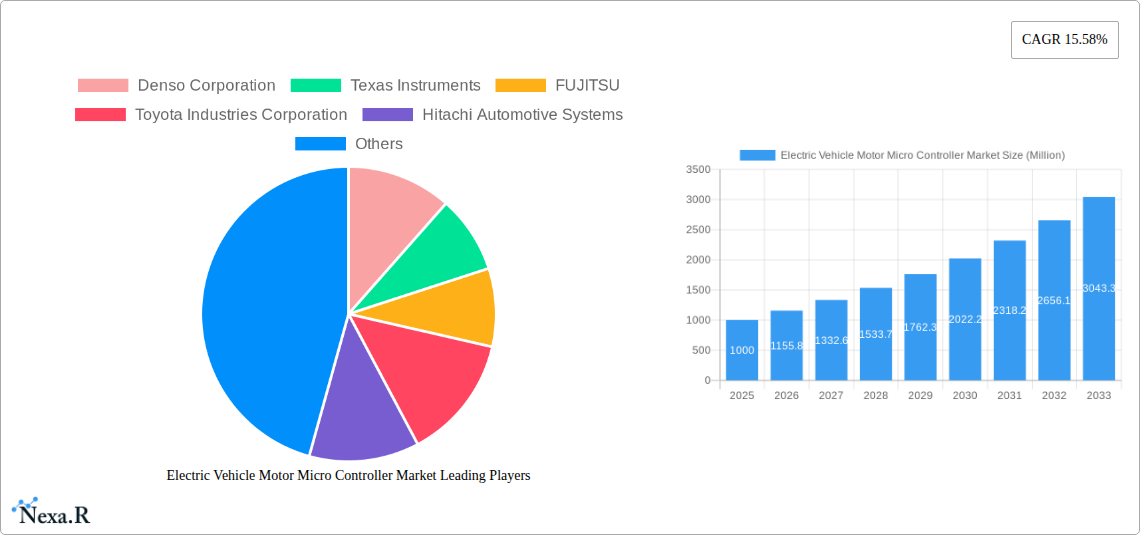

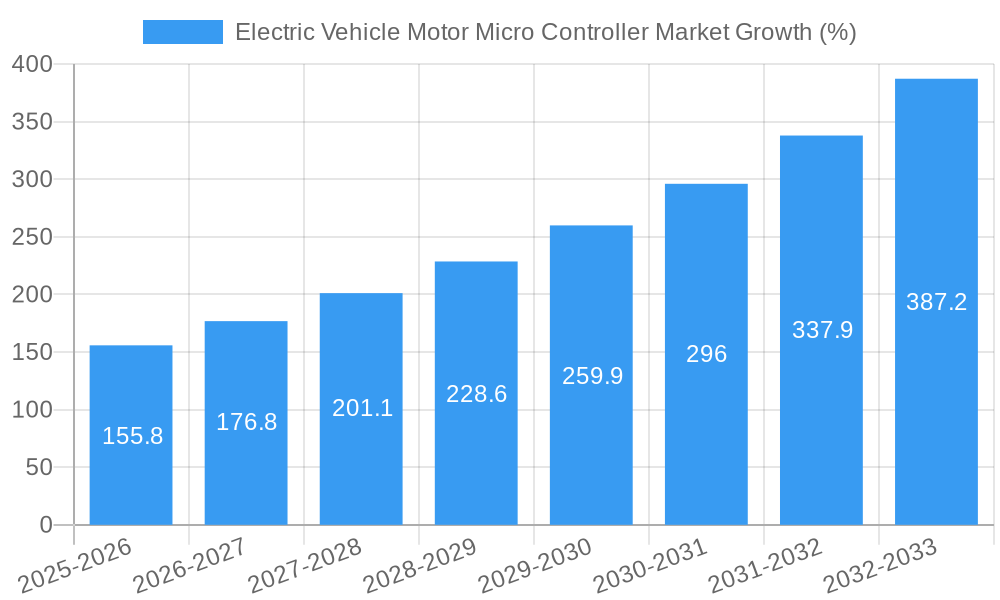

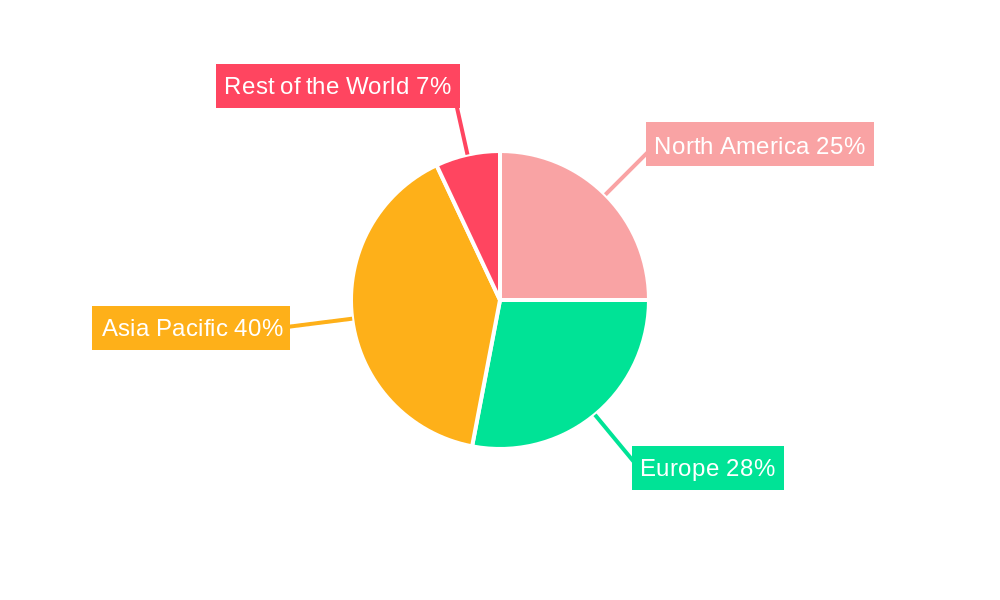

The Electric Vehicle (EV) Motor Microcontroller Market is experiencing robust growth, driven by the global surge in EV adoption and the increasing demand for efficient and reliable powertrain systems. The market, valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR of 15.58% and a base year of 2025), is projected to expand significantly over the forecast period (2025-2033). This growth is fueled by several key factors. Stringent government regulations aimed at reducing carbon emissions are incentivizing EV manufacturing and sales. Furthermore, advancements in battery technology, leading to improved EV range and performance, are boosting consumer confidence and demand. The market segmentation reveals strong growth potential across various motor types (AC Permanent Magnet Synchronous Motor Controller, AC Asynchronous Motor Controller, and DC Motor Controller), power output ranges, and propulsion systems (Plug-in Hybrid Vehicle, Battery Electric Vehicle, and Fuel Cell Electric Vehicle). The competitive landscape is dominated by established automotive component suppliers and semiconductor manufacturers, indicating a mature yet dynamic market. Geographical analysis points towards Asia Pacific, particularly China, as a key market driver, given the region's substantial EV production and sales. North America and Europe also contribute significantly, reflecting the growing EV adoption in these regions.

Continued market expansion is expected due to ongoing technological advancements in microcontroller technology, leading to improved energy efficiency, enhanced performance, and increased safety features within EV powertrains. The integration of advanced driver-assistance systems (ADAS) and autonomous driving functionalities further adds to the demand for sophisticated motor controllers. However, challenges remain, including the high initial cost of EVs and the need for widespread development of charging infrastructure. Nevertheless, the long-term outlook remains positive, driven by sustained government support, technological innovation, and growing consumer preference for environmentally friendly transportation solutions. The market is poised for significant growth, making it an attractive investment opportunity for stakeholders.

Electric Vehicle Motor Micro Controller Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Electric Vehicle (EV) Motor Micro Controller Market, encompassing its parent market (Automotive Microcontrollers) and child markets (various motor types and power outputs). The study period covers 2019-2033, with 2025 as the base and estimated year. The report projects a market size of xx Million units by 2033, revealing significant growth opportunities for stakeholders.

Electric Vehicle Motor Micro Controller Market Dynamics & Structure

The EV Motor Micro Controller market exhibits a moderately concentrated structure, with key players like Denso Corporation, Texas Instruments, and Bosch holding significant market share (estimated at xx%). Technological innovation, particularly in power density and efficiency, is a major driver. Stringent emission regulations globally are accelerating EV adoption, directly impacting demand. Competitive substitutes, such as legacy internal combustion engine controllers, are facing declining relevance. The end-user demographic skews toward major automotive manufacturers and Tier-1 suppliers. Recent M&A activity is characterized by xx deals in the last five years, primarily focused on enhancing technological capabilities and geographical reach.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share.

- Technological Innovation: Focus on increasing power density, efficiency, and integration.

- Regulatory Framework: Stringent emission norms are a key growth driver.

- Competitive Substitutes: Legacy ICE controllers are facing declining market share.

- End-User Demographics: Primarily automotive manufacturers and Tier-1 suppliers.

- M&A Trends: xx deals in the last 5 years, focused on technology and geographic expansion.

Electric Vehicle Motor Micro Controller Market Growth Trends & Insights

The EV Motor Micro Controller market experienced robust growth during the historical period (2019-2024), with a CAGR of xx%. This growth is fueled by the burgeoning EV market, rising demand for electric vehicles across various segments (passenger cars, commercial vehicles), and increasing focus on improving energy efficiency and range. Technological advancements, such as the introduction of silicon carbide (SiC) based power modules, are enabling higher power density and efficiency in controllers. Consumer preference for eco-friendly transportation is a further catalyst. The market is expected to maintain strong growth momentum in the forecast period (2025-2033), driven by continued expansion in the EV market and ongoing technological innovations. The market is projected to reach xx Million units by 2033, indicating a CAGR of xx% during the forecast period. Market penetration is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Electric Vehicle Motor Micro Controller Market

The Asia Pacific region, particularly China, dominates the EV Motor Micro Controller market, driven by strong government support for EV adoption and a large domestic manufacturing base. The European Union and North America also show substantial growth potential, driven by ambitious emission reduction targets and increasing consumer demand. Within the segments, the AC Permanent Magnet Synchronous Motor Controller holds the largest market share due to its high efficiency and widespread adoption in EVs. The 21-40 kW power output segment is experiencing rapid growth due to its suitability for a wide range of EV models. The Battery Electric Vehicle (BEV) segment leads in terms of controller adoption, followed by Plug-in Hybrid Vehicles (PHEVs).

- Dominant Region: Asia Pacific (China) due to government support and large manufacturing base.

- Leading Segment (Type): AC Permanent Magnet Synchronous Motor Controller (xx% market share).

- Leading Segment (Power Output): 21-40 kW (xx% market share).

- Leading Segment (Propulsion): Battery Electric Vehicle (BEV) (xx% market share).

- Key Growth Drivers: Government incentives, emission regulations, and increasing consumer demand.

Electric Vehicle Motor Micro Controller Market Product Landscape

Recent product innovations focus on miniaturization, higher power density, improved thermal management, and enhanced integration capabilities. These advancements are achieved through the use of advanced materials, such as SiC, and sophisticated control algorithms. The controllers are increasingly being integrated with other EV components, such as power inverters and battery management systems. Key performance metrics include efficiency, power density, cost, and reliability. Unique selling propositions involve superior power handling capabilities, reduced electromagnetic interference, and improved diagnostic features.

Key Drivers, Barriers & Challenges in Electric Vehicle Motor Micro Controller Market

Key Drivers:

- Rising EV adoption fueled by stringent emission regulations and government incentives.

- Technological advancements leading to improved controller performance and efficiency.

- Increasing demand for higher power density and integrated solutions.

Key Challenges:

- Intense competition among established players and new entrants.

- Supply chain disruptions impacting the availability of key components.

- High development costs and stringent quality requirements.

Emerging Opportunities in Electric Vehicle Motor Micro Controller Market

Emerging opportunities lie in the development of controllers for next-generation EVs with advanced features such as autonomous driving and enhanced connectivity. Growth in the commercial EV segment, including buses and trucks, presents significant potential. Expansion into developing markets with growing EV adoption is another avenue for growth.

Growth Accelerators in the Electric Vehicle Motor Micro Controller Market Industry

Technological breakthroughs in power semiconductor materials, such as wide bandgap semiconductors, are driving efficiency improvements. Strategic partnerships between microcontroller manufacturers and automotive OEMs are fostering innovation and accelerating product development. Aggressive market expansion strategies by leading players are further fueling the market's growth trajectory.

Key Players Shaping the Electric Vehicle Motor Micro Controller Market Market

- Denso Corporation

- Texas Instruments

- FUJITSU

- Toyota Industries Corporation

- Hitachi Automotive Systems

- Siemens AG

- Continental AG

- BorgWarner Inc

- Delta Electronics

- Robert Bosch GmbH

- Delphi Technologies PLC

- Infineon Technology AG

- Mitsubishi Electric

- Renesas Electronics Corporation

Notable Milestones in Electric Vehicle Motor Micro Controller Market Sector

- August 2022: BorgWarner announced its motor controller for Changan Automobile's Oshan Z6 iDD PHEV, showcasing high energy density and use of the Viper series power units.

- July 2022: Infineon released the MOTIX IMD700A and IMD701A fully programmable motor controllers, designed for EVs and automated guided vehicles, featuring enhanced integration and power density.

- March 2022: Honda and Renesas expanded their partnership for advanced driver-assistance systems (ADAS), integrating Renesas' R-Car and RH850 microcontrollers into Honda's SENSING 360 system.

In-Depth Electric Vehicle Motor Micro Controller Market Market Outlook

The future of the EV Motor Micro Controller market is exceptionally bright, driven by sustained growth in EV adoption globally and ongoing technological advancements. Strategic partnerships, coupled with the development of more efficient and integrated controllers, will shape the market landscape. Untapped markets in developing economies and the emergence of new EV applications will present lucrative growth opportunities for industry participants. The market is poised for significant expansion, offering attractive prospects for investors and businesses alike.

Electric Vehicle Motor Micro Controller Market Segmentation

-

1. Type

- 1.1. AC Permanent Magnet Synchronous Motor Controller

- 1.2. AC Asynchronous Motor Controller

- 1.3. DC Motor Controller

-

2. Power Output

- 2.1. 1 to 20 KW

- 2.2. 21 to 40 KW

- 2.3. 41 to 80 KW

- 2.4. Above 80 KW

-

3. Propulsion Type

- 3.1. Plug-in Hybrid Vehicle

- 3.2. Battery Electric Vehicle

- 3.3. Fuel Cell Electric Vehicle

Electric Vehicle Motor Micro Controller Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Australia

- 3.6. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Electric Vehicle Motor Micro Controller Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.58% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption of Fast Food is Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Increase in the Online Food Deliveries May Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Increased Electric Vehicle Adoption Globally

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Vehicle Motor Micro Controller Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. AC Permanent Magnet Synchronous Motor Controller

- 5.1.2. AC Asynchronous Motor Controller

- 5.1.3. DC Motor Controller

- 5.2. Market Analysis, Insights and Forecast - by Power Output

- 5.2.1. 1 to 20 KW

- 5.2.2. 21 to 40 KW

- 5.2.3. 41 to 80 KW

- 5.2.4. Above 80 KW

- 5.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.3.1. Plug-in Hybrid Vehicle

- 5.3.2. Battery Electric Vehicle

- 5.3.3. Fuel Cell Electric Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Electric Vehicle Motor Micro Controller Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. AC Permanent Magnet Synchronous Motor Controller

- 6.1.2. AC Asynchronous Motor Controller

- 6.1.3. DC Motor Controller

- 6.2. Market Analysis, Insights and Forecast - by Power Output

- 6.2.1. 1 to 20 KW

- 6.2.2. 21 to 40 KW

- 6.2.3. 41 to 80 KW

- 6.2.4. Above 80 KW

- 6.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.3.1. Plug-in Hybrid Vehicle

- 6.3.2. Battery Electric Vehicle

- 6.3.3. Fuel Cell Electric Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Electric Vehicle Motor Micro Controller Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. AC Permanent Magnet Synchronous Motor Controller

- 7.1.2. AC Asynchronous Motor Controller

- 7.1.3. DC Motor Controller

- 7.2. Market Analysis, Insights and Forecast - by Power Output

- 7.2.1. 1 to 20 KW

- 7.2.2. 21 to 40 KW

- 7.2.3. 41 to 80 KW

- 7.2.4. Above 80 KW

- 7.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.3.1. Plug-in Hybrid Vehicle

- 7.3.2. Battery Electric Vehicle

- 7.3.3. Fuel Cell Electric Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Electric Vehicle Motor Micro Controller Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. AC Permanent Magnet Synchronous Motor Controller

- 8.1.2. AC Asynchronous Motor Controller

- 8.1.3. DC Motor Controller

- 8.2. Market Analysis, Insights and Forecast - by Power Output

- 8.2.1. 1 to 20 KW

- 8.2.2. 21 to 40 KW

- 8.2.3. 41 to 80 KW

- 8.2.4. Above 80 KW

- 8.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.3.1. Plug-in Hybrid Vehicle

- 8.3.2. Battery Electric Vehicle

- 8.3.3. Fuel Cell Electric Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Electric Vehicle Motor Micro Controller Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. AC Permanent Magnet Synchronous Motor Controller

- 9.1.2. AC Asynchronous Motor Controller

- 9.1.3. DC Motor Controller

- 9.2. Market Analysis, Insights and Forecast - by Power Output

- 9.2.1. 1 to 20 KW

- 9.2.2. 21 to 40 KW

- 9.2.3. 41 to 80 KW

- 9.2.4. Above 80 KW

- 9.3. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.3.1. Plug-in Hybrid Vehicle

- 9.3.2. Battery Electric Vehicle

- 9.3.3. Fuel Cell Electric Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Electric Vehicle Motor Micro Controller Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Mexico

- 10.1.4 Rest of North America

- 11. Europe Electric Vehicle Motor Micro Controller Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Italy

- 11.1.5 Russia

- 11.1.6 Rest of Europe

- 12. Asia Pacific Electric Vehicle Motor Micro Controller Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 South Korea

- 12.1.5 Australia

- 12.1.6 Rest of Asia Pacific

- 13. Rest of the World Electric Vehicle Motor Micro Controller Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East and Africa

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Denso Corporation

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Texas Instruments

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 FUJITSU

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Toyota Industries Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Hitachi Automotive Systems

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Siemens AG

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Continental AG

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 BorgWarner Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Delta Electronics

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Robert Bosch GmbH

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Delphi Technologies PLC

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Infineon Technology AG

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Mitsubishi Electric

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Renesas Electronics Corporatio

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.1 Denso Corporation

List of Figures

- Figure 1: Global Electric Vehicle Motor Micro Controller Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Electric Vehicle Motor Micro Controller Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Electric Vehicle Motor Micro Controller Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Electric Vehicle Motor Micro Controller Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Electric Vehicle Motor Micro Controller Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Electric Vehicle Motor Micro Controller Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Electric Vehicle Motor Micro Controller Market Revenue (Million), by Power Output 2024 & 2032

- Figure 13: North America Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Power Output 2024 & 2032

- Figure 14: North America Electric Vehicle Motor Micro Controller Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 15: North America Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 16: North America Electric Vehicle Motor Micro Controller Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Electric Vehicle Motor Micro Controller Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Electric Vehicle Motor Micro Controller Market Revenue (Million), by Power Output 2024 & 2032

- Figure 21: Europe Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Power Output 2024 & 2032

- Figure 22: Europe Electric Vehicle Motor Micro Controller Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 23: Europe Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 24: Europe Electric Vehicle Motor Micro Controller Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Electric Vehicle Motor Micro Controller Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Electric Vehicle Motor Micro Controller Market Revenue (Million), by Power Output 2024 & 2032

- Figure 29: Asia Pacific Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Power Output 2024 & 2032

- Figure 30: Asia Pacific Electric Vehicle Motor Micro Controller Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 31: Asia Pacific Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 32: Asia Pacific Electric Vehicle Motor Micro Controller Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Electric Vehicle Motor Micro Controller Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Rest of the World Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Rest of the World Electric Vehicle Motor Micro Controller Market Revenue (Million), by Power Output 2024 & 2032

- Figure 37: Rest of the World Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Power Output 2024 & 2032

- Figure 38: Rest of the World Electric Vehicle Motor Micro Controller Market Revenue (Million), by Propulsion Type 2024 & 2032

- Figure 39: Rest of the World Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Propulsion Type 2024 & 2032

- Figure 40: Rest of the World Electric Vehicle Motor Micro Controller Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Electric Vehicle Motor Micro Controller Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Power Output 2019 & 2032

- Table 4: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 5: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Russia Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: China Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: India Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Australia Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia Pacific Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South America Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Middle East and Africa Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Type 2019 & 2032

- Table 29: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Power Output 2019 & 2032

- Table 30: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 31: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Canada Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Rest of North America Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Type 2019 & 2032

- Table 37: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Power Output 2019 & 2032

- Table 38: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 39: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Russia Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Type 2019 & 2032

- Table 47: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Power Output 2019 & 2032

- Table 48: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 49: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: China Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Japan Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: India Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Korea Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Australia Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Asia Pacific Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Type 2019 & 2032

- Table 57: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Power Output 2019 & 2032

- Table 58: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 59: Global Electric Vehicle Motor Micro Controller Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: South America Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Middle East and Africa Electric Vehicle Motor Micro Controller Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Vehicle Motor Micro Controller Market?

The projected CAGR is approximately 15.58%.

2. Which companies are prominent players in the Electric Vehicle Motor Micro Controller Market?

Key companies in the market include Denso Corporation, Texas Instruments, FUJITSU, Toyota Industries Corporation, Hitachi Automotive Systems, Siemens AG, Continental AG, BorgWarner Inc, Delta Electronics, Robert Bosch GmbH, Delphi Technologies PLC, Infineon Technology AG, Mitsubishi Electric, Renesas Electronics Corporatio.

3. What are the main segments of the Electric Vehicle Motor Micro Controller Market?

The market segments include Type, Power Output, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption of Fast Food is Expected to Drive the Market.

6. What are the notable trends driving market growth?

Increased Electric Vehicle Adoption Globally.

7. Are there any restraints impacting market growth?

Increase in the Online Food Deliveries May Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

August 2022: Borgwarner announced that Changan Automobile's Oshan Z6 iDD PHEV will use a Blue Core triple-clutch electric drive transmission unit. BorgWarner provides the triple-clutch transmission, hydraulic control unit, motor, and motor controller in the unit. The triple-clutch electric drive transmission unit comprises a more compact and integrated wet three-clutch unit, a high-efficiency high-pressure hydraulic system, and an S-Winding motor with faster coupling response and higher efficiency thanks to smart electronic dual pump technology. The motor controller is designed with a high energy density and uses BorgWarner's in-house Viper series of scalable power units.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Vehicle Motor Micro Controller Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Vehicle Motor Micro Controller Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Vehicle Motor Micro Controller Market?

To stay informed about further developments, trends, and reports in the Electric Vehicle Motor Micro Controller Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence