Key Insights

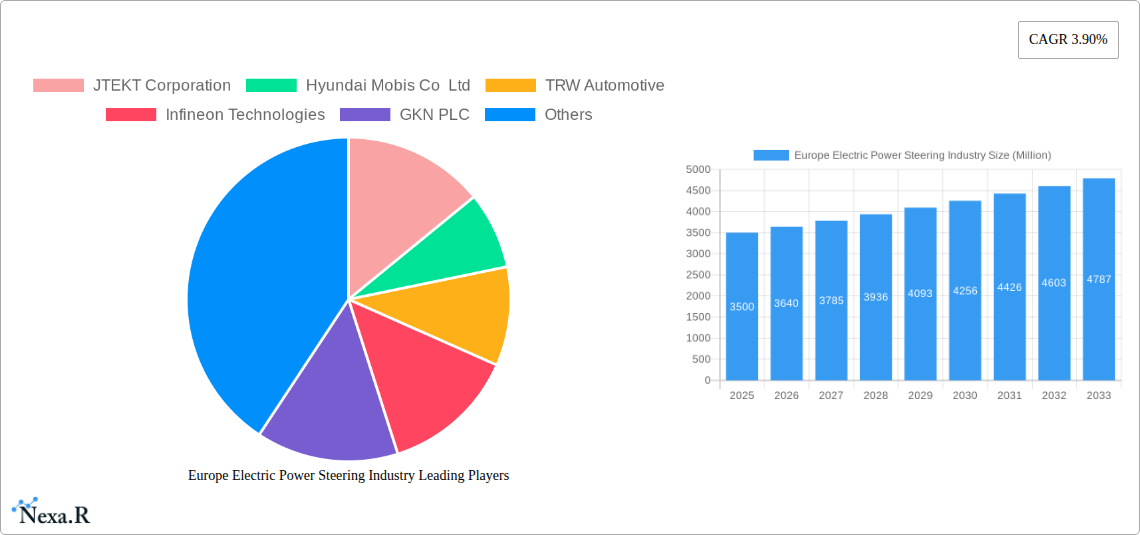

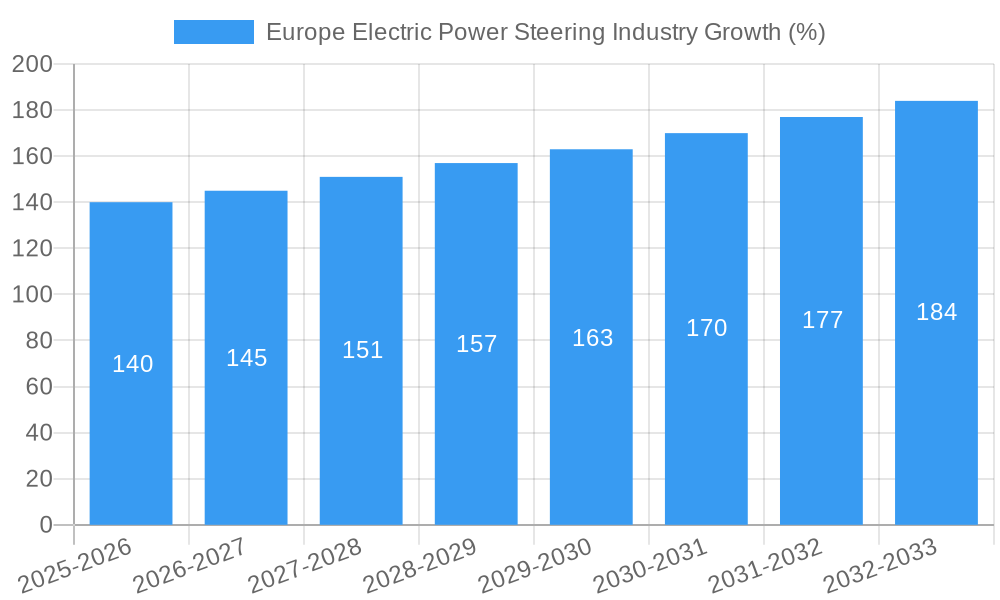

The European electric power steering (EPS) market is experiencing robust growth, driven by increasing demand for fuel-efficient vehicles and advancements in autonomous driving technologies. The market, currently valued in the billions (a precise figure cannot be provided without the missing market size 'XX' value, but a logical estimation based on similar markets and a 3.90% CAGR would place it in the several billion euro range), is projected to maintain a compound annual growth rate (CAGR) of 3.90% from 2025 to 2033. This growth is fueled by several key factors. Stringent emission regulations across Europe are pushing automakers towards electric and hybrid vehicles, which inherently require EPS systems. Furthermore, the integration of advanced driver-assistance systems (ADAS) and autonomous driving features necessitates precise and reliable steering control, further boosting demand for sophisticated EPS technologies. The market is segmented by type (column, pinion, dual pinion), component (steering wheel/column, sensors, steering motor, other components), and vehicle type (passenger cars, LCVs, heavy vehicles). Passenger cars currently dominate the market, but the LCV and heavy vehicle segments are expected to show significant growth due to increasing adoption of EPS in commercial fleets for enhanced fuel efficiency and driver comfort. Competition is fierce, with major players such as JTEKT, Hyundai Mobis, and Bosch vying for market share through continuous innovation and strategic partnerships.

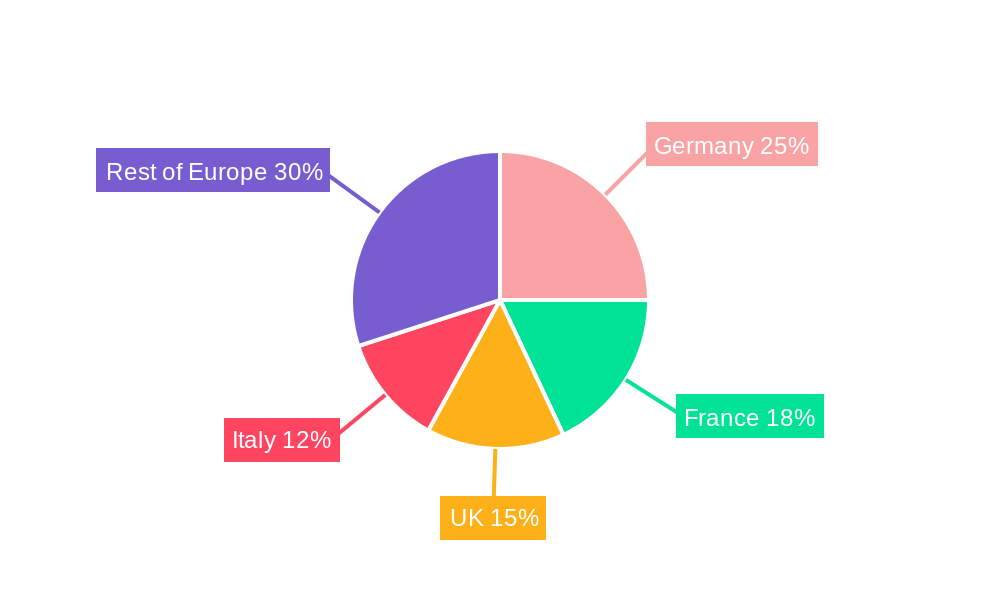

The European EPS market presents significant opportunities for both established players and new entrants. However, challenges remain. High initial investment costs associated with advanced EPS technologies could hinder adoption, particularly in the LCV and heavy vehicle segments. Fluctuations in raw material prices and supply chain disruptions also pose risks to market growth. Nevertheless, the long-term outlook for the European EPS market remains positive, with the ongoing shift towards electric mobility and the increasing demand for enhanced vehicle safety and driver assistance features driving sustained expansion. Germany, France, and the UK are currently the largest national markets within Europe, but other countries are also expected to experience strong growth as adoption of electric and advanced-driver-assistance vehicles increases. The market's success will depend on continuous innovation in EPS technology, cost reduction strategies, and the ability to address supply chain vulnerabilities.

Europe Electric Power Steering Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Electric Power Steering (EPS) industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on the parent market (Automotive Industry) and child markets (Passenger Cars, LCVs, Heavy Vehicles), this report offers crucial insights for industry professionals, investors, and strategists. The study period spans 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. Market values are presented in million units.

Europe Electric Power Steering Industry Market Dynamics & Structure

The European EPS market is characterized by a moderately consolidated landscape, with key players like Robert Bosch GmbH, ZF Friedrichshafen AG, Nexteer Automotive, and JTEKT Corporation holding significant market share. Technological innovation, driven by advancements in electric vehicle (EV) technology and autonomous driving systems, is a major growth driver. Stringent emission regulations and safety standards within the European Union are shaping industry practices, favoring EPS adoption. The market faces competition from traditional hydraulic steering systems, albeit with decreasing market penetration. The end-user demographic is shifting towards higher adoption rates in electric vehicles, influencing market demand. Mergers and acquisitions (M&A) activity in the sector has been relatively moderate in recent years, with approximately xx M&A deals completed between 2019 and 2024, resulting in a xx% market share shift among top players.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% market share.

- Technological Innovation: Focus on energy efficiency, improved responsiveness, and integration with ADAS.

- Regulatory Framework: Stringent EU regulations on emissions and safety drive EPS adoption.

- Competitive Substitutes: Hydraulic steering systems, but with declining market share.

- End-User Demographics: Increasing demand from the EV segment.

- M&A Trends: Moderate activity, leading to shifts in market share.

- Innovation Barriers: High R&D costs, complex integration with vehicle systems, and competition for talent.

Europe Electric Power Steering Industry Growth Trends & Insights

The European EPS market experienced significant growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is primarily attributed to the increasing adoption of EVs and the rising demand for advanced driver-assistance systems (ADAS). The market size is projected to reach xx million units by 2025 and further expand to xx million units by 2033, exhibiting a CAGR of xx% during the forecast period. Technological disruptions, such as the introduction of highly integrated EPS systems and the adoption of advanced materials, are accelerating growth. Consumer behavior is shifting towards prioritizing fuel efficiency and safety features, boosting demand for EPS. Market penetration is expected to reach xx% by 2033, driven by stringent emission regulations and increased consumer awareness.

Dominant Regions, Countries, or Segments in Europe Electric Power Steering Industry

Germany, France, and the United Kingdom are the leading regions in the European EPS market, driven by robust automotive manufacturing sectors and high adoption rates of EVs and ADAS. The Passenger Car segment dominates the market due to the high volume of passenger car production. Within the component type, Steering Motors account for the largest market share, followed by Sensors. The Column type EPS system holds a significant share in the market due to its cost-effectiveness and compatibility with various vehicle types.

- Key Drivers:

- Strong automotive manufacturing base in Germany, France, and the UK.

- High EV adoption rates.

- Favorable government policies supporting the transition to EVs.

- Well-developed infrastructure for automotive parts manufacturing and distribution.

- Dominance Factors:

- High vehicle production volume in leading regions.

- Early adoption of EPS technology by major OEMs.

- Established supply chains and manufacturing capabilities.

- Growing consumer demand for fuel-efficient and safe vehicles.

Europe Electric Power Steering Industry Product Landscape

The EPS product landscape is characterized by continuous innovation, focusing on improved efficiency, enhanced performance, and integration with advanced safety systems. Manufacturers are developing smaller, lighter, and more energy-efficient EPS units to meet the demands of the EV market. Product innovations include systems with improved responsiveness, reduced NVH (noise, vibration, and harshness), and increased safety features. Unique selling propositions revolve around enhanced performance, reduced power consumption, and seamless integration with ADAS functionalities.

Key Drivers, Barriers & Challenges in Europe Electric Power Steering Industry

Key Drivers:

- The rising demand for EVs and HEVs is a primary driver of the market’s growth, directly increasing EPS demand.

- Advancements in sensor technologies and algorithms further enhance EPS performance and safety features, leading to higher adoption rates.

- Stringent government regulations promoting fuel efficiency and safety are compelling automakers to integrate EPS in their vehicles.

Challenges:

- High initial investment costs for EPS integration can pose a barrier for smaller automakers.

- The complex integration process of EPS with other vehicle systems can result in delays and cost overruns.

- Intense competition among established and emerging players puts pressure on profit margins and innovation pace. Supply chain disruptions can cause production delays and price increases. An estimated xx% increase in material costs was observed in 2022 due to these disruptions.

Emerging Opportunities in Europe Electric Power Steering Industry

- The growing adoption of autonomous driving technologies presents significant opportunities for EPS manufacturers. Integrated EPS systems with advanced driver-assistance capabilities are becoming increasingly crucial.

- The market for heavy commercial vehicles (HCVs) presents an expanding market segment for EPS. Increased fuel efficiency and enhanced safety requirements in the HVC segment are bolstering EPS integration.

- The development of advanced materials and manufacturing processes creates opportunities for enhanced product performance and cost reduction.

Growth Accelerators in the Europe Electric Power Steering Industry Industry

The long-term growth of the European EPS market will be driven by the ongoing electrification of the automotive industry, the expanding adoption of advanced driver-assistance systems (ADAS), and the development of increasingly sophisticated EPS technologies. Strategic partnerships between EPS manufacturers and automotive OEMs will play a significant role in accelerating market penetration. Continuous R&D efforts focused on improving energy efficiency, enhancing responsiveness, and integrating advanced safety features will also fuel growth.

Key Players Shaping the Europe Electric Power Steering Industry Market

- JTEKT Corporation

- Hyundai Mobis Co Ltd

- TRW Automotive

- Infineon Technologies

- GKN PLC

- NSK Ltd

- Hitachi Automotive Systems

- Mitsubishi Electric Corporation

- Mando Corporation

- Nexteer Automotive

- Robert Bosch GmbH

- ATS Automation Tooling Systems Inc

- Delphi Automotive Systems

- Thyssenkrupp Presta AG

- Hafei Industrial Group Automobile Redirector Obligate Co Ltd

- ZF Friedrichshafen AG

Notable Milestones in Europe Electric Power Steering Industry Sector

- September 2022: Knorr-Bremse AG showcased its all-electric EPS steering system at IAA Transportation, highlighting advancements in safety technologies.

- May 2023: Infineon Technologies AG introduced the OptiMOS 7 40V MOSFET family, enhancing power efficiency in EPS systems.

- May 2023: ZF Friedrichshafen AG unveiled its AxTrax 2 electric axle platform, including EPS fully electric steering, emphasizing its commitment to electrification.

- June 2023: Bosch showcased its steering systems at the Shanghai International Carbon Neutrality Expo 2023, demonstrating its focus on sustainable mobility solutions.

In-Depth Europe Electric Power Steering Industry Market Outlook

The future of the European EPS market looks promising, driven by the continued growth of the electric vehicle market, advancements in ADAS, and the increasing demand for enhanced safety and fuel efficiency. Strategic partnerships and collaborations between EPS manufacturers and automotive OEMs are expected to drive innovation and market penetration. The focus on developing lighter, more energy-efficient, and integrated EPS systems will shape future product development. Expansion into new segments, such as heavy commercial vehicles, will further contribute to market growth. The market is poised for sustained growth, propelled by technological advancements and a favorable regulatory landscape.

Europe Electric Power Steering Industry Segmentation

-

1. Type

- 1.1. Column Type

- 1.2. Pinion Type

- 1.3. Dual Pinion Type

-

2. Component Type

- 2.1. Steering Wheel/Column

- 2.2. Sensors

- 2.3. Steering Motor

- 2.4. Other Component Types

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. LCV

- 3.3. Heavy Vehicles

Europe Electric Power Steering Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. France

- 1.3. Germany

- 1.4. Italy

- 1.5. Russia

- 1.6. Rest of Europe

Europe Electric Power Steering Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements in Steering Systems Would Drive the Market

- 3.3. Market Restrains

- 3.3.1. Growing Popularity of Steer-By-Wire Technology Can Hinder the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Technological Advancements in Steering Systems Would Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electric Power Steering Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Column Type

- 5.1.2. Pinion Type

- 5.1.3. Dual Pinion Type

- 5.2. Market Analysis, Insights and Forecast - by Component Type

- 5.2.1. Steering Wheel/Column

- 5.2.2. Sensors

- 5.2.3. Steering Motor

- 5.2.4. Other Component Types

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. LCV

- 5.3.3. Heavy Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Electric Power Steering Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Electric Power Steering Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Electric Power Steering Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Electric Power Steering Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Electric Power Steering Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Electric Power Steering Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Electric Power Steering Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 JTEKT Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hyundai Mobis Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 TRW Automotive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Infineon Technologies

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 GKN PLC

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 NSK Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Hitachi Automotive Systems

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Mitsubishi Electric Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Mando Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Nexteer Automotive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Robert Bosch GmbH

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 ATS Automation Tooling Systems Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Delphi Automotive Systems

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Thyssenkrupp Presta AG

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Hafei Industrial Group Automobile Redirector Obligate Co Ltd*List Not Exhaustive

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 ZF Friedrichshafen AG

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.1 JTEKT Corporation

List of Figures

- Figure 1: Europe Electric Power Steering Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Electric Power Steering Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Electric Power Steering Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Electric Power Steering Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Electric Power Steering Industry Revenue Million Forecast, by Component Type 2019 & 2032

- Table 4: Europe Electric Power Steering Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: Europe Electric Power Steering Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Electric Power Steering Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Electric Power Steering Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Electric Power Steering Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Electric Power Steering Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Electric Power Steering Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Electric Power Steering Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Electric Power Steering Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Electric Power Steering Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Electric Power Steering Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Europe Electric Power Steering Industry Revenue Million Forecast, by Component Type 2019 & 2032

- Table 16: Europe Electric Power Steering Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 17: Europe Electric Power Steering Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Electric Power Steering Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Europe Electric Power Steering Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Germany Europe Electric Power Steering Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Electric Power Steering Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Europe Electric Power Steering Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Electric Power Steering Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electric Power Steering Industry?

The projected CAGR is approximately 3.90%.

2. Which companies are prominent players in the Europe Electric Power Steering Industry?

Key companies in the market include JTEKT Corporation, Hyundai Mobis Co Ltd, TRW Automotive, Infineon Technologies, GKN PLC, NSK Ltd, Hitachi Automotive Systems, Mitsubishi Electric Corporation, Mando Corporation, Nexteer Automotive, Robert Bosch GmbH, ATS Automation Tooling Systems Inc, Delphi Automotive Systems, Thyssenkrupp Presta AG, Hafei Industrial Group Automobile Redirector Obligate Co Ltd*List Not Exhaustive, ZF Friedrichshafen AG.

3. What are the main segments of the Europe Electric Power Steering Industry?

The market segments include Type, Component Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements in Steering Systems Would Drive the Market.

6. What are the notable trends driving market growth?

Technological Advancements in Steering Systems Would Drive the Market.

7. Are there any restraints impacting market growth?

Growing Popularity of Steer-By-Wire Technology Can Hinder the Growth of the Market.

8. Can you provide examples of recent developments in the market?

June 2023: Bosch announced its participation in the Shanghai International Carbon Neutrality Expo 2023, where it will set up exhibition areas for New Energy electric drive systems, steering systems and driving safety, recycling and short-distance green mobility, and autonomous driving enabling intelligent mobility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electric Power Steering Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electric Power Steering Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electric Power Steering Industry?

To stay informed about further developments, trends, and reports in the Europe Electric Power Steering Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence