Key Insights

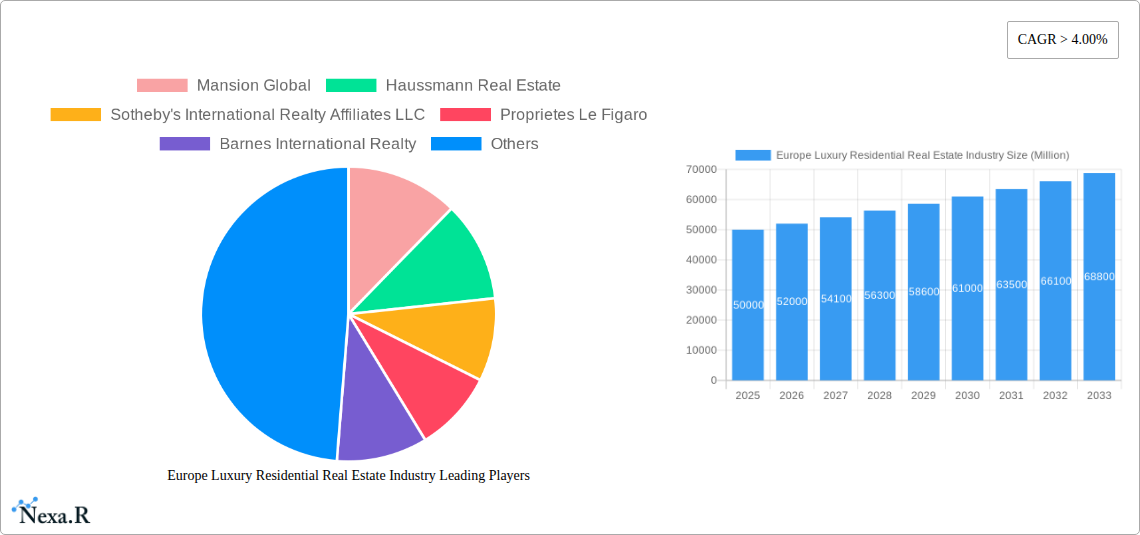

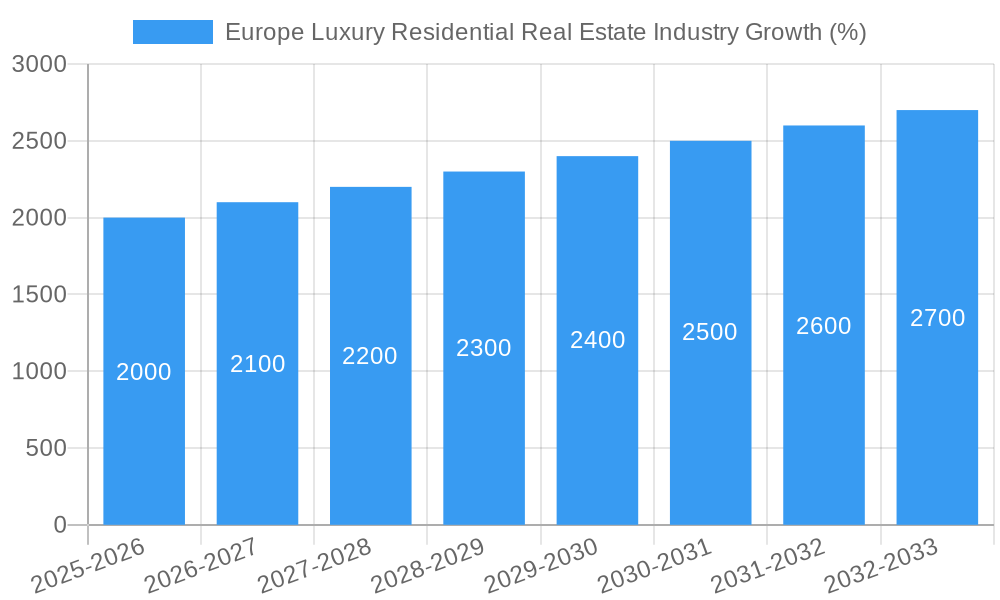

The European luxury residential real estate market, valued at approximately €50 billion in 2025, is experiencing robust growth, projected to maintain a compound annual growth rate (CAGR) exceeding 4% through 2033. This expansion is driven by several key factors. Firstly, the increasing affluence of high-net-worth individuals (HNWIs) across Europe fuels demand for premium properties, particularly in established luxury markets like Germany, the United Kingdom, France, and Italy. Secondly, the ongoing trend of urbanization and a desire for larger, more luxurious living spaces in prime locations continues to underpin market growth. Thirdly, a relatively low supply of luxury properties in desirable areas creates a seller's market, supporting sustained price appreciation. Furthermore, the increasing popularity of second homes as investments and vacation retreats is contributing to market dynamism. Finally, global economic stability and favourable interest rates, at least in the near term, are creating a positive investment environment for luxury real estate.

However, the market also faces certain headwinds. Geopolitical uncertainties, particularly impacting investor confidence in certain regions, could dampen growth. Furthermore, stringent regulatory measures targeting money laundering and tax evasion in the luxury property sector, could impact transaction volumes. Additionally, rising construction costs and material shortages may limit the supply of new luxury developments, potentially exacerbating price pressures. Despite these potential constraints, the overall outlook for the European luxury residential real estate market remains positive, with a continued strong demand expected to drive sustained growth throughout the forecast period. Segmentation by property type (villas/landed houses versus condominiums/apartments) reveals varying growth trajectories, with villas likely exhibiting higher price appreciation due to their scarcity in prime locations. Market leaders such as Mansion Global, Sotheby's International Realty, and Barnes International Realty continue to dominate the market through their established networks and brand recognition.

Europe Luxury Residential Real Estate Industry: Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe luxury residential real estate industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans 2019-2033, with 2025 as the base and estimated year. The report segments the market by type (Villas/Landed Houses, Condominiums/Apartments) and country (Germany, United Kingdom, France, Italy, Russia, Rest of Europe), offering granular insights into this lucrative sector.

Europe Luxury Residential Real Estate Industry Market Dynamics & Structure

The European luxury residential real estate market is characterized by a moderately concentrated structure, with several major players commanding significant market share. Mansion Global, Haussmann Real Estate, Sotheby's International Realty Affiliates LLC, Proprietes Le Figaro, Barnes International Realty, Rodgaard Ejendomme, John Taylor, Belles Demeures, Juvel Ejendomme, and Luxury Places SA are key players, though the market is not saturated and allows for the entrance of new players. Market concentration is estimated at xx% in 2025, with the top 5 players holding approximately xx% of the total market share.

- Technological Innovation: While adoption of proptech is increasing, there's notable resistance to full digital transformation among some established players. Integration of VR/AR for virtual tours is gaining traction, while blockchain for secure transactions remains niche.

- Regulatory Frameworks: Varying regulations across European countries create complexity for both investors and developers. Tax policies and building codes significantly impact project viability and pricing.

- Competitive Product Substitutes: While direct substitutes are limited, increased demand for high-end rental properties poses indirect competition.

- End-User Demographics: High-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) are the primary target demographic, driving demand for exclusive properties. Their preferences for location, amenities, and sustainability are key factors influencing development.

- M&A Trends: The past five years have witnessed xx major M&A deals, driven by consolidation within the sector. The average deal size has increased to approximately xx Million, indicating a higher investment appetite for acquiring valuable assets in the luxury sector.

Europe Luxury Residential Real Estate Industry Growth Trends & Insights

The European luxury residential real estate market experienced robust growth between 2019 and 2024, with a Compound Annual Growth Rate (CAGR) of xx%. Market size reached xx Million in 2024 and is projected to reach xx Million in 2025, driven by increasing HNWIs, geopolitical stability, and recovering tourism. The forecast period (2025-2033) anticipates continued growth, with a projected CAGR of xx%, reaching an estimated market size of xx Million by 2033. Several factors contribute to this growth: increasing disposable income among high-net-worth individuals, urbanization trends, the growing popularity of second homes, and increasing demand for luxurious properties with eco-friendly features.

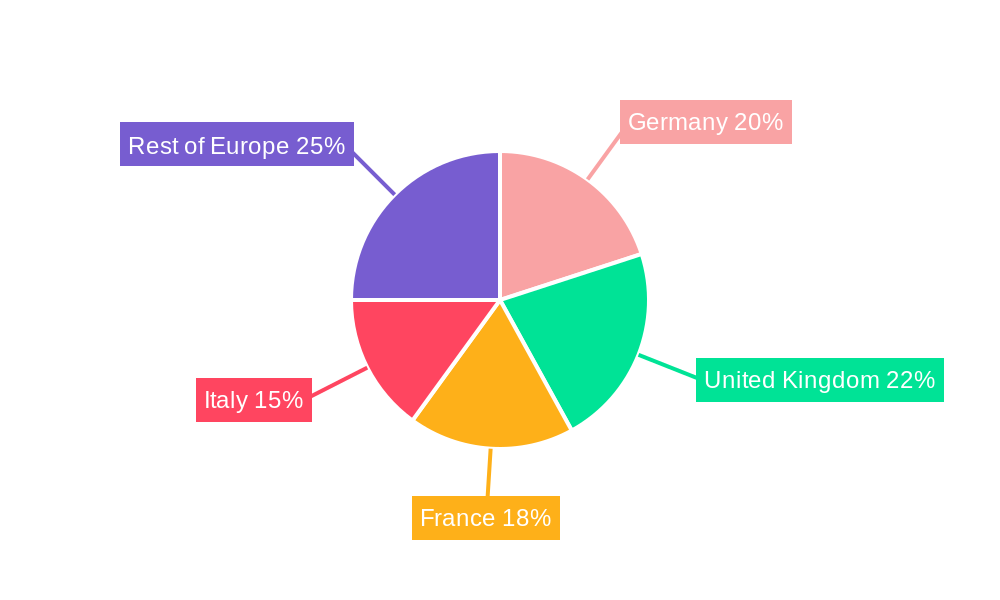

Dominant Regions, Countries, or Segments in Europe Luxury Residential Real Estate Industry

The United Kingdom and France currently hold the largest market share, followed by Germany and Italy. The Villas/Landed Houses segment dominates overall sales value and is expected to maintain this position throughout the forecast period.

United Kingdom: Strong economic performance, favorable tax policies, and a robust international investor base fuel growth.

France: Iconic properties and lifestyle appeal to international buyers, alongside strong domestic demand.

Germany: Stable economy and consistent demand for high-end properties in major cities are key growth drivers.

Italy: Tourism and cultural significance drive demand for luxury villas in popular regions like Tuscany and the Amalfi Coast.

Russia: Political instability impacts this market, yet investment from other sources helps to maintain some stability.

Rest of Europe: Smaller yet growing markets, driven by individual country economic performance.

Villas/Landed Houses: Continuous demand due to spaciousness, privacy, and lifestyle appeal.

Condominiums/Apartments: Growth is primarily in prime urban locations, driven by convenience and luxury amenities.

Europe Luxury Residential Real Estate Industry Product Landscape

The luxury residential real estate sector offers a range of high-end properties, characterized by exceptional architecture, premium materials, advanced technology, and bespoke amenities. Smart home technology is increasingly integrated, and eco-friendly features are becoming more critical, responding to growing environmental awareness. This segment is also focusing on creating unique selling propositions that cater to specific needs and preferences of high-net-worth individuals, such as bespoke designs, security systems, and exclusive concierge services.

Key Drivers, Barriers & Challenges in Europe Luxury Residential Real Estate Industry

Key Drivers: Increasing HNWIs, strong economic performance in key markets, favorable regulatory environments in some countries, and demand for second homes are propelling growth. Technological advancements like VR/AR property tours are enhancing accessibility.

Key Challenges: Geopolitical instability, fluctuating exchange rates, the need to balance luxury with sustainability concerns, and competition from other investment asset classes pose significant challenges. Supply chain disruptions related to construction materials lead to significant cost increases and project delays. Regulatory hurdles including stringent building codes and taxation policies further add to project development complexity.

Emerging Opportunities in Europe Luxury Residential Real Estate Industry

Growing demand for sustainable and eco-friendly properties presents a significant opportunity. Untapped markets in some Eastern European countries show potential for growth. Furthermore, the rise of flexible living arrangements creates opportunities for luxury rentals, co-living spaces, and unique property offerings.

Growth Accelerators in the Europe Luxury Residential Real Estate Industry

Technological advancements, strategic partnerships between developers and luxury brands, and expansion into new markets (particularly across Eastern Europe) will be key drivers for long-term growth. The adoption of smart home technology, sustainable building practices, and digital marketing strategies are crucial for enhancing competitiveness.

Key Players Shaping the Europe Luxury Residential Real Estate Industry Market

- Mansion Global

- Haussmann Real Estate

- Sotheby's International Realty Affiliates LLC

- Proprietes Le Figaro

- Barnes International Realty

- Rodgaard Ejendomme

- John Taylor

- Belles Demeures

- Juvel Ejendomme

- Luxury Places SA

Notable Milestones in Europe Luxury Residential Real Estate Industry Sector

- August 2022: Slate Asset Management acquired a portfolio of 36 key real estate properties in Norway for USD 0.15 billion, significantly expanding its presence in the region.

- January 2022: Instone Real Estate sold approximately 330 apartments in Germany to LEG, highlighting continued strong demand in the German market.

In-Depth Europe Luxury Residential Real Estate Industry Market Outlook

The European luxury residential real estate market is poised for continued expansion throughout the forecast period, fueled by strong demand from high-net-worth individuals and innovative development strategies. Strategic partnerships, technological advancements, and sustainable practices will shape the future landscape, creating opportunities for both established players and new entrants. Further expansion into untapped markets in Eastern Europe and a focus on eco-friendly development offer high growth potential.

Europe Luxury Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Villas/Landed Houses

- 1.2. Condominiums/Apartments

Europe Luxury Residential Real Estate Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Luxury Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Commercial Property Development; Rapid Digitalization of Commercial Construction

- 3.3. Market Restrains

- 3.3.1. Emerging Safety and Labour Issues; Rise in Cost of Construction

- 3.4. Market Trends

- 3.4.1. Largest Real Estate Companies in Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas/Landed Houses

- 5.1.2. Condominiums/Apartments

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Mansion Global

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Haussmann Real Estate

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Sotheby's International Realty Affiliates LLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Proprietes Le Figaro

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Barnes International Realty

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Rodgaard Ejendomme

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 John Taylor

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 BellesDemeures**List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Juvel Ejendomme

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Luxury places SA

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Mansion Global

List of Figures

- Figure 1: Europe Luxury Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Luxury Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Luxury Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Luxury Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Luxury Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Luxury Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Luxury Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Europe Luxury Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe Luxury Residential Real Estate Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Luxury Residential Real Estate Industry?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Europe Luxury Residential Real Estate Industry?

Key companies in the market include Mansion Global, Haussmann Real Estate, Sotheby's International Realty Affiliates LLC, Proprietes Le Figaro, Barnes International Realty, Rodgaard Ejendomme, John Taylor, BellesDemeures**List Not Exhaustive, Juvel Ejendomme, Luxury places SA.

3. What are the main segments of the Europe Luxury Residential Real Estate Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Commercial Property Development; Rapid Digitalization of Commercial Construction.

6. What are the notable trends driving market growth?

Largest Real Estate Companies in Europe.

7. Are there any restraints impacting market growth?

Emerging Safety and Labour Issues; Rise in Cost of Construction.

8. Can you provide examples of recent developments in the market?

August 2022: Slate Asset Management, a global alternative investment platform that focuses on real assets, stated that it had paid more than NOK 1.5 billion (USD 0.15 billion) for a portfolio of 36 key real estate properties in Norway. Following closely on the heels of the company's initial two portfolio purchases in the area in December 2021 and March 2022, this deal increases Slate's presence in Norway to a total of 63 critical real estate assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Luxury Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Luxury Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Luxury Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Europe Luxury Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence