Key Insights

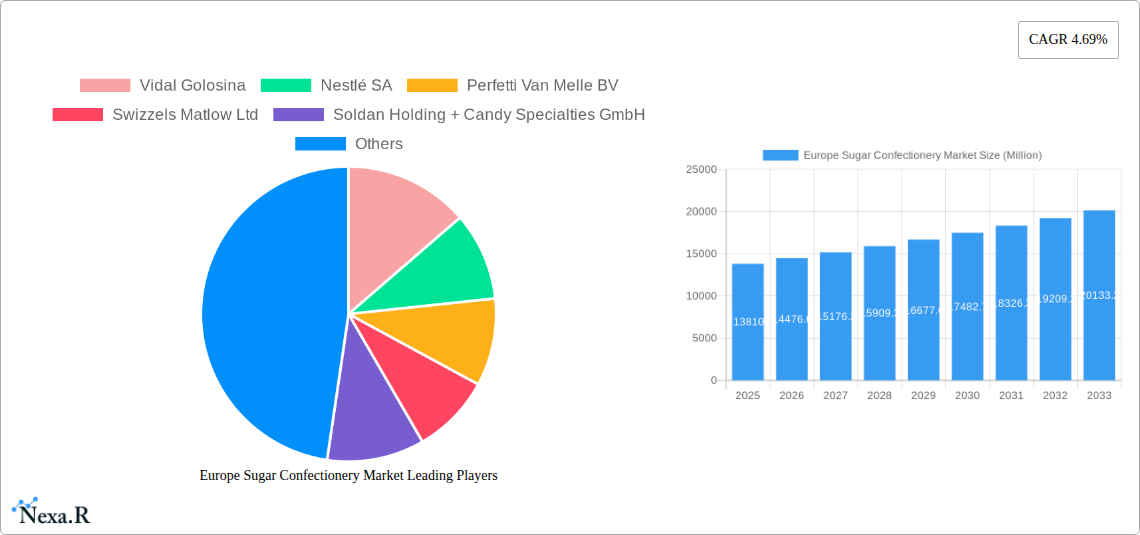

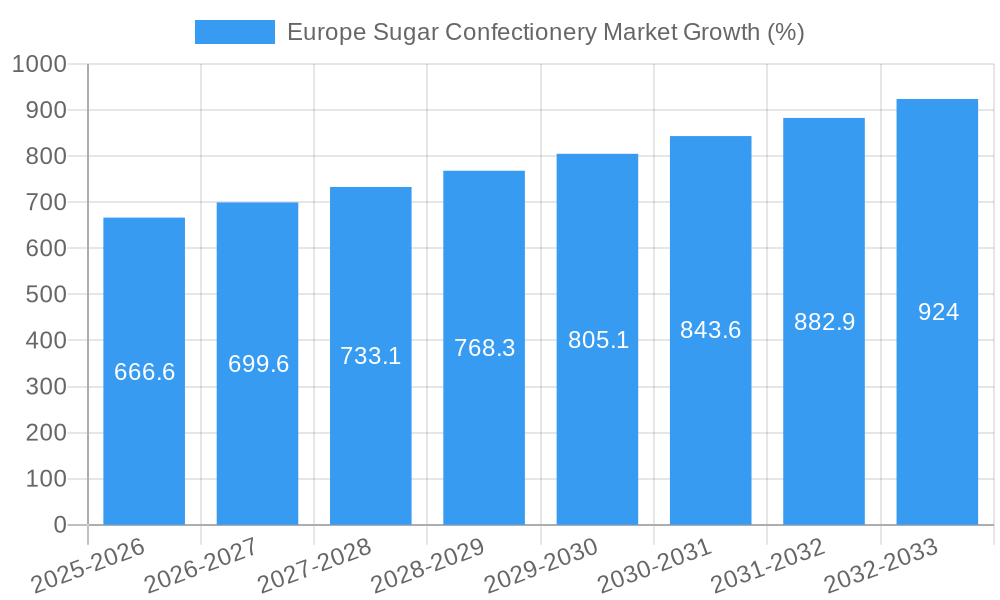

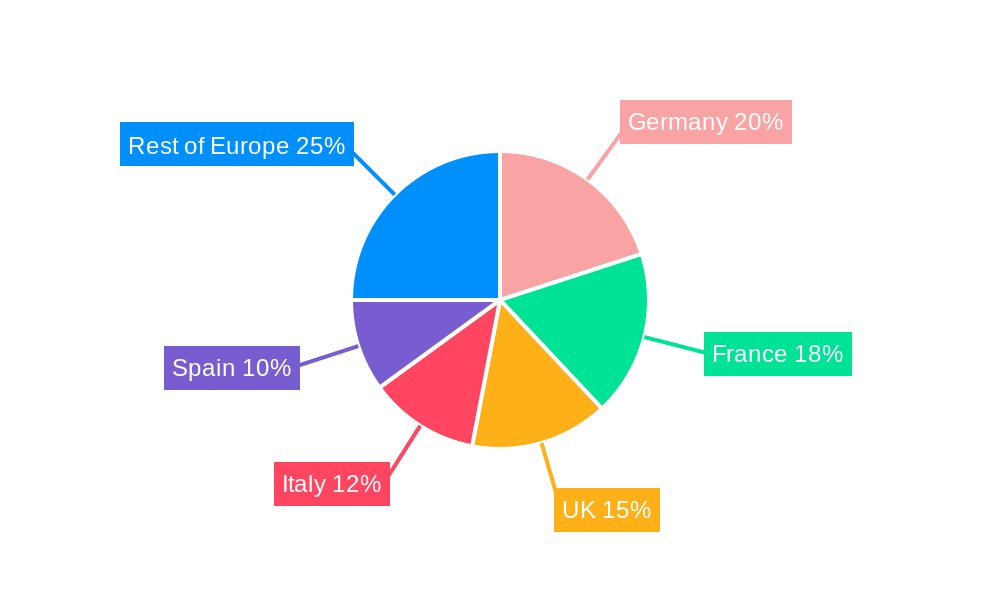

The European sugar confectionery market, valued at €13.81 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.69% from 2025 to 2033. This growth is driven by several key factors. Increasing consumer disposable incomes, particularly in emerging European economies, fuel demand for indulgent treats. Furthermore, the rise of online retail channels provides convenient access to a wider variety of sugar confectionery products, boosting sales. Innovative product development, such as healthier options with reduced sugar content or unique flavor profiles, caters to evolving consumer preferences and expands market appeal. Strong brand recognition from established players like Nestlé and Ferrero, coupled with the popularity of traditional confectionery types like hard candies and lollipops, provides a robust foundation for market expansion. However, growing health concerns regarding sugar consumption and the increasing prevalence of health-conscious consumers represent a significant restraint. Government regulations aimed at reducing sugar intake in food products also pose a challenge to the industry's growth trajectory. The market segmentation reveals the significant contribution of Germany, France, and the UK as major consumer markets. Within product categories, hard candies and lollipops maintain substantial market share, while gummies and jellies demonstrate notable growth potential, driven by their appeal to younger demographics. The supermarket/hypermarket distribution channel remains dominant, though online sales are expected to increase significantly in the forecast period.

The competitive landscape is characterized by both large multinational corporations and smaller regional players. Major players benefit from extensive distribution networks and strong brand equity. However, smaller companies are gaining traction through product differentiation and niche marketing strategies. The market's future will depend on the industry's ability to balance consumer demand for indulgent treats with the growing emphasis on healthier choices. This will involve innovative product formulations, transparent labeling, and a focus on sustainable sourcing and production practices. Successful navigation of these challenges will be key to maximizing the growth potential of the European sugar confectionery market over the next decade.

Europe Sugar Confectionery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe sugar confectionery market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. With a detailed study period spanning 2019-2033 (base year 2025), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The market is segmented by country (Belgium, France, Germany, Italy, Netherlands, Russia, Spain, Switzerland, Turkey, United Kingdom, Rest of Europe), confectionery variant (Hard Candy, Lollipops, Mints, Pastilles, Gummies and Jellies, Toffees and Nougats, Others), and distribution channel (Convenience Store, Online Retail Store, Supermarket/Hypermarket, Others). Key players analyzed include Vidal Golosina, Nestlé SA, Perfetti Van Melle BV, Swizzels Matlow Ltd, Soldan Holding + Candy Specialties GmbH, Lavdas SA, August Storck KG, Katjes International GmbH & Co KG, Ferrero International SA, Cloetta AB, Ricola AG, Mars Incorporated, HARIBO Holding GmbH & Co KG, Mondelēz International Inc, and The Hershey Company. The report projects a market value of xx Million by 2033.

Europe Sugar Confectionery Market Dynamics & Structure

The European sugar confectionery market is a dynamic landscape characterized by moderate concentration, with a few major players holding significant market share. Technological innovation, particularly in flavor development and packaging, plays a crucial role. Stringent regulatory frameworks concerning sugar content and labeling impact product formulation and marketing strategies. The market faces competition from healthier snack alternatives, necessitating continuous product innovation. Consumer demographics, especially shifting preferences towards healthier options and premium products, significantly influence market trends. M&A activity has been relatively moderate in recent years, with a focus on expanding product portfolios and geographical reach.

- Market Concentration: The top 5 players hold approximately xx% of the market share (2024).

- Technological Innovation: Focus on natural ingredients, innovative flavors, and sustainable packaging.

- Regulatory Framework: EU regulations on sugar content and labeling influence product development.

- Competitive Substitutes: Growth of healthy snacks and confectionery alternatives pose a challenge.

- End-User Demographics: Growing demand for premium and specialized confectionery products.

- M&A Trends: Consolidation expected to continue, driven by expansion strategies.

Europe Sugar Confectionery Market Growth Trends & Insights

The European sugar confectionery market experienced a xx% CAGR from 2019 to 2024, reaching a value of xx Million in 2024. Market growth is driven by several factors, including increasing disposable incomes in certain regions, changing consumer preferences, and the introduction of novel products. However, health concerns and regulations related to sugar consumption are creating challenges. Technological advancements in flavor creation and production processes contribute to market growth. The market penetration rate for sugar confectionery remains high, yet shifts towards healthier alternatives present opportunities for innovation. The forecast period (2025-2033) projects a CAGR of xx%, reaching a projected market size of xx Million by 2033. This growth is expected to be influenced by factors such as increasing consumer spending in specific regions and growing demand for premium products.

Dominant Regions, Countries, or Segments in Europe Sugar Confectionery Market

The United Kingdom, Germany, and France are the leading markets for sugar confectionery in Europe. These countries account for a significant share of the overall market due to their large populations and high per capita consumption rates. Factors driving growth in these regions include established distribution networks, strong consumer demand, and the presence of major confectionery manufacturers. The gummies and jellies segment holds the largest market share in terms of confectionery variants, driven by popularity across various age groups. Supermarket/Hypermarkets dominate distribution channels, owing to their extensive reach and consumer preference.

- Key Drivers: Strong consumer demand, established distribution networks, presence of major manufacturers.

- United Kingdom: Large population, high per capita consumption, strong retail infrastructure.

- Germany: Significant market size, strong domestic brands, robust economy.

- France: High consumer spending, developed retail sector, preference for premium products.

- Gummies and Jellies: High demand across age groups, diverse flavor profiles, attractive presentation.

- Supermarket/Hypermarket Channel: Wide reach, consumer preference, established distribution infrastructure.

Europe Sugar Confectionery Market Product Landscape

The European sugar confectionery market displays a wide array of products, from traditional hard candies and lollipops to innovative gummies and jellies. Product innovation focuses on unique flavors, natural ingredients, and healthier alternatives, often catering to specific dietary needs and preferences. Premiumization is a major trend, with manufacturers offering high-quality ingredients and sophisticated packaging. Technological advancements in production processes enhance efficiency and product quality.

Key Drivers, Barriers & Challenges in Europe Sugar Confectionery Market

Key Drivers: Growing disposable incomes, particularly in emerging European markets, increasing demand for convenient snacks, and the introduction of novel flavors and product formats.

Challenges: Stricter regulations regarding sugar content, concerns over health and well-being, and rising competition from healthier alternatives limit market expansion. Fluctuations in raw material prices also impact profitability.

Emerging Opportunities in Europe Sugar Confectionery Market

Emerging opportunities include increased demand for sugar-free and organic confectionery, personalized products tailored to individual needs, and expansion into online retail channels. Furthermore, sustainable and ethically sourced ingredients are gaining traction, presenting opportunities for manufacturers who prioritize sustainability.

Growth Accelerators in the Europe Sugar Confectionery Market Industry

Technological advancements in production processes, strategic partnerships to expand product lines and distribution reach, and focusing on specific regional preferences fuel long-term growth. Further, exploring niche markets like vegan confectionery and healthier alternatives provides substantial growth opportunities.

Key Players Shaping the Europe Sugar Confectionery Market Market

- Vidal Golosina

- Nestlé SA

- Perfetti Van Melle BV

- Swizzels Matlow Ltd

- Soldan Holding + Candy Specialties GmbH

- Lavdas SA

- August Storck KG

- Katjes International GmbH & Co KG

- Ferrero International SA

- Cloetta AB

- Ricola AG

- Mars Incorporated

- HARIBO Holding GmbH & Co KG

- Mondelēz International Inc

- The Hershey Company

Notable Milestones in Europe Sugar Confectionery Market Sector

- March 2023: Hershey's introduced new Hershey's Kisses’ Milklicious candies.

- April 2023: Swizzels Sweets partnered with Applied Nutrition to launch sports nutrition products.

- May 2023: Swizzels expanded its Minions product range with a Sherbet Dip.

In-Depth Europe Sugar Confectionery Market Market Outlook

The European sugar confectionery market is poised for continued growth, driven by product innovation, expanding distribution channels, and evolving consumer preferences. Strategic partnerships and investments in sustainable practices will play a vital role in shaping the future of the market. Focus on healthier alternatives and premium products will be crucial for long-term success.

Europe Sugar Confectionery Market Segmentation

-

1. Confectionery Variant

- 1.1. Hard Candy

- 1.2. Lollipops

- 1.3. Mints

- 1.4. Pastilles, Gummies, and Jellies

- 1.5. Toffees and Nougats

- 1.6. Others

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Europe Sugar Confectionery Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Sugar Confectionery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.69% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Consumption of Baked Goods; Demand for Indigenous Fermented Foods

- 3.3. Market Restrains

- 3.3.1. Potential Side-effects of Yeast

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Hard Candy

- 5.1.2. Lollipops

- 5.1.3. Mints

- 5.1.4. Pastilles, Gummies, and Jellies

- 5.1.5. Toffees and Nougats

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. Germany Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Vidal Golosina

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nestlé SA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Perfetti Van Melle BV

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Swizzels Matlow Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Soldan Holding + Candy Specialties GmbH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Lavdas SA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 August Storck KG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Katjes International GmbH & Co KG

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Ferrero International SA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Cloetta AB

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Ricola AG

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Mars Incorporated

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 HARIBO Holding GmbH & Co KG

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Mondelēz International Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 The Hershey Company

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 Vidal Golosina

List of Figures

- Figure 1: Europe Sugar Confectionery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Sugar Confectionery Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Sugar Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Sugar Confectionery Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Europe Sugar Confectionery Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 4: Europe Sugar Confectionery Market Volume K Tons Forecast, by Confectionery Variant 2019 & 2032

- Table 5: Europe Sugar Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Europe Sugar Confectionery Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: Europe Sugar Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Europe Sugar Confectionery Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Europe Sugar Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Europe Sugar Confectionery Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Germany Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: France Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Italy Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Netherlands Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Sweden Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Europe Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Europe Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Europe Sugar Confectionery Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 26: Europe Sugar Confectionery Market Volume K Tons Forecast, by Confectionery Variant 2019 & 2032

- Table 27: Europe Sugar Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Europe Sugar Confectionery Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 29: Europe Sugar Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Sugar Confectionery Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: United Kingdom Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: United Kingdom Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Germany Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Germany Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: France Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: France Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: Italy Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Italy Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Spain Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Spain Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Netherlands Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Netherlands Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Belgium Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Belgium Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Sweden Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Sweden Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Norway Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Norway Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 49: Poland Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Poland Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Denmark Europe Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Denmark Europe Sugar Confectionery Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Sugar Confectionery Market?

The projected CAGR is approximately 4.69%.

2. Which companies are prominent players in the Europe Sugar Confectionery Market?

Key companies in the market include Vidal Golosina, Nestlé SA, Perfetti Van Melle BV, Swizzels Matlow Ltd, Soldan Holding + Candy Specialties GmbH, Lavdas SA, August Storck KG, Katjes International GmbH & Co KG, Ferrero International SA, Cloetta AB, Ricola AG, Mars Incorporated, HARIBO Holding GmbH & Co KG, Mondelēz International Inc, The Hershey Company.

3. What are the main segments of the Europe Sugar Confectionery Market?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 13810 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Consumption of Baked Goods; Demand for Indigenous Fermented Foods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Potential Side-effects of Yeast.

8. Can you provide examples of recent developments in the market?

May 2023: British sweet manufacturer Swizzels expanded its popular range of Minions products with the addition of a Sherbet Dip. This Minions Sherbet Dip comprises three new flavors: Fizzy Orange, Sour Apple and Tangy Berry, and a classic Swizzelstick for dipping.April 2023: Swizzels Sweets has partnered with Applied Nutrition to launch a range of sports nutrition products in several of Swizzels’ well-known flavors. The sports brand Applied Nutrition announced Drumstick flavor lollies of both its bestselling hydration drink, BodyFuel, and a 60 ml shot variant of its popular pre-workout, A.B.E.March 2023: Hershey's introduced new Hershey's Kisses’ Milklicious candies, featuring a creamy chocolate milk filling packed into the delicious center of a rich, milk chocolate Hershey's Kisses candy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Sugar Confectionery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Sugar Confectionery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Sugar Confectionery Market?

To stay informed about further developments, trends, and reports in the Europe Sugar Confectionery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence