Key Insights

The French fuel cell market is poised for substantial expansion, with an anticipated Compound Annual Growth Rate (CAGR) of 14.8% from 2025 to 2033. This significant growth is propelled by robust government backing for renewable energy, escalating demand for sustainable transportation, and technological advancements, especially in Polymer Electrolyte Membrane Fuel Cells (PEMFCs) suitable for automotive and portable applications. The stationary power generation sector for buildings and industrial facilities also offers considerable opportunities. Despite hurdles like high upfront investment and hydrogen refueling infrastructure needs, the market outlook remains highly positive. PEMFC technology dominates market segmentation due to its versatility. Leading companies such as Symbio Fcell SA, Ballard Power Systems Inc., and Plug Power Inc. are spearheading innovation, capitalizing on France's decarbonization efforts. Continuous development of efficient and cost-effective fuel cell systems will be pivotal for sustained growth. France's strategic European position facilitates regional collaboration and market access within the EU's decarbonization initiatives.

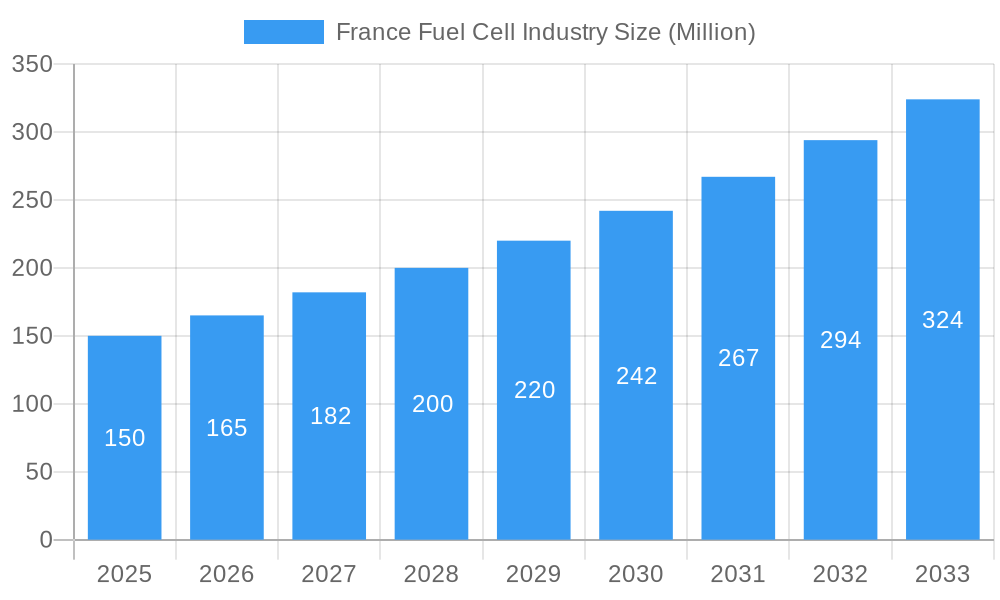

France Fuel Cell Industry Market Size (In Billion)

Addressing market restraints, including the higher cost of fuel cell systems compared to conventional energy, limited hydrogen refueling infrastructure, and the necessity for ongoing R&D to enhance durability and performance, is critical for unlocking the full potential of the French fuel cell market. Public-private partnerships, strategic infrastructure investments, and persistent technological innovation will drive long-term sustainability. The market's strong growth trajectory signifies considerable investment and expansion potential. While growth is expected across all segments, portable and transportation applications are projected to experience particularly rapid expansion due to the increasing demand for clean energy solutions.

France Fuel Cell Industry Company Market Share

This comprehensive report offers an in-depth analysis of the France fuel cell industry, covering market dynamics, growth trends, key players, and future projections. With a study period from 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The analysis is grounded in extensive primary and secondary research, providing actionable insights into this dynamic market. The current market size stands at 10.76 billion.

France Fuel Cell Industry Market Dynamics & Structure

The French fuel cell market, valued at xx Million in 2024, exhibits a moderately concentrated structure with key players like Symbio Fcell SA, Ballard Power Systems Inc, and Plug Power Inc. holding significant market share. However, the presence of several smaller players fosters a competitive landscape. Technological innovation, particularly in PEMFC (Polymer Electrolyte Membrane Fuel Cell) technology, is a major driver, alongside supportive government policies aimed at decarbonization. Regulatory frameworks promoting renewable energy adoption further stimulate market growth. While battery technology presents a competitive substitute, the unique advantages of fuel cells in terms of energy density and refueling time continue to drive demand, particularly in the transport segment. The market is segmented by application (portable, stationary, transport) and fuel cell technology (PEMFC, SOFC, others).

- Market Concentration: Moderately concentrated, with a few major players and numerous smaller companies.

- Technological Innovation: PEMFC technology dominates, with ongoing R&D in SOFC and other fuel cell technologies.

- Regulatory Framework: Supportive government policies and incentives for renewable energy adoption.

- Competitive Substitutes: Primarily battery technology, posing a challenge in certain applications.

- M&A Activity: Significant M&A activity observed, particularly in the transport segment (e.g., Symbio's HyMotive project). xx deals were recorded in the period 2019-2024, contributing to market consolidation.

- End-User Demographics: Primarily focused on industrial, commercial, and transportation sectors.

France Fuel Cell Industry Growth Trends & Insights

The France fuel cell market is projected to experience robust growth, driven by increasing environmental concerns, stringent emission regulations, and government initiatives to promote green energy solutions. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), reaching a value of xx Million by 2033. The transport sector is the largest and fastest-growing segment, fueled by the rising adoption of fuel cell electric vehicles (FCEVs). This adoption is bolstered by advancements in fuel cell technology, leading to improved efficiency, durability, and cost reductions. Consumer behavior is shifting towards environmentally friendly transportation options, further contributing to market expansion. Technological advancements, particularly in PEMFC technology, are pivotal in reducing production costs and improving performance, ultimately driving market penetration and accelerating market growth.

Dominant Regions, Countries, or Segments in France Fuel Cell Industry

The transport segment is the dominant application area within the French fuel cell market, commanding a market share of xx% in 2024, followed by stationary and portable applications with xx% and xx% respectively. This dominance is primarily attributed to substantial government investments in FCEV infrastructure and supportive policies aimed at reducing carbon emissions from the transportation sector. Furthermore, the significant investments by major automakers in fuel cell technology and the development of FCEV production facilities are significant contributors to growth within the transport segment. Within fuel cell technologies, PEMFC remains the leading technology, capturing xx% of the market. The Ile-de-France region is expected to remain a leading market due to its strong industrial base and supportive government initiatives.

- Key Drivers in Transport Segment: Government subsidies, investments from automakers, and rising environmental awareness.

- Key Drivers in PEMFC Technology: Cost reductions, improved performance, and wider availability.

- Ile-de-France Region Dominance: Strong industrial base, government support, and strategic location.

France Fuel Cell Industry Product Landscape

Fuel cell systems in France are witnessing significant advancements, with improved efficiency, longer lifespans, and reduced costs being key priorities. Innovations focus on optimizing stack design, enhancing catalyst performance, and developing more durable materials. PEMFC technology remains dominant, catering to diverse applications including transportation, stationary power generation, and portable devices. Unique selling propositions include high power density, low emissions, and rapid refueling capability.

Key Drivers, Barriers & Challenges in France Fuel Cell Industry

Key Drivers:

- Increasing environmental concerns and stringent emission regulations.

- Government incentives and policies promoting renewable energy adoption.

- Advancements in fuel cell technology, leading to improved performance and cost reduction.

- Growing demand for clean energy solutions across various sectors.

Challenges & Restraints:

- High initial investment costs associated with fuel cell technology.

- Limited hydrogen refueling infrastructure, hindering widespread adoption of FCEVs.

- Competition from alternative energy storage technologies such as batteries.

- Supply chain disruptions impacting the availability of critical materials. This constraint impacted production by approximately xx% in 2022.

Emerging Opportunities in France Fuel Cell Industry

Emerging opportunities lie in expanding the application of fuel cell technology into niche markets, such as marine and aviation. Further integration of fuel cells into distributed energy systems for microgrids and backup power represents significant potential. The growing demand for decentralized power generation is fueling increased interest in stationary fuel cell applications.

Growth Accelerators in the France Fuel Cell Industry

Long-term growth will be fueled by breakthroughs in fuel cell technology, enabling higher efficiency and lower costs. Strategic partnerships between fuel cell manufacturers, automotive companies, and energy providers will play a crucial role in expanding market penetration. Government investment in hydrogen infrastructure is vital to overcome challenges related to refueling infrastructure.

Key Players Shaping the France Fuel Cell Industry Market

- Symbio Fcell SA

- Ballard Power System Inc

- Plug Power Inc

- Powercell Sweden AB

- Fuelcell Energy Inc

Notable Milestones in France Fuel Cell Industry Sector

- October 2022: Symbio (Faurecia & Michelin JV) announces EUR 1 billion investment in HyMotive project, scaling fuel cell production.

- March 2022: Hyvia (Renault & Plug Power JV) opens fuel cell module assembly and testing plant in Flins, France.

In-Depth France Fuel Cell Industry Market Outlook

The France fuel cell market is poised for significant growth driven by technological advancements, supportive government policies, and increasing demand for clean energy solutions. Strategic partnerships, infrastructure development, and further cost reductions will unlock substantial market potential, creating exciting opportunities for industry players in the years to come. The market's future hinges on addressing challenges related to hydrogen infrastructure and costs.

France Fuel Cell Industry Segmentation

-

1. Application

- 1.1. Portable

- 1.2. Stationary

- 1.3. Transport

-

2. Fuel Cell Technology

- 2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 2.2. Solid Oxide Fuel Cell (SOFC)

- 2.3. Other Fuel Cell Technologies

France Fuel Cell Industry Segmentation By Geography

- 1. France

France Fuel Cell Industry Regional Market Share

Geographic Coverage of France Fuel Cell Industry

France Fuel Cell Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Rise in Oil and Gas Drilling Activities4.; Increased Shale Gas Exploration

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Share of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Increasing Hydrogen Filling Stations

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Fuel Cell Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Portable

- 5.1.2. Stationary

- 5.1.3. Transport

- 5.2. Market Analysis, Insights and Forecast - by Fuel Cell Technology

- 5.2.1. Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2. Solid Oxide Fuel Cell (SOFC)

- 5.2.3. Other Fuel Cell Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Symbio Fcell SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ballard Power System Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Plug Power Inc *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Powercell Sweden AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fuelcell Energy Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Symbio Fcell SA

List of Figures

- Figure 1: France Fuel Cell Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Fuel Cell Industry Share (%) by Company 2025

List of Tables

- Table 1: France Fuel Cell Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: France Fuel Cell Industry Revenue billion Forecast, by Fuel Cell Technology 2020 & 2033

- Table 3: France Fuel Cell Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Fuel Cell Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 5: France Fuel Cell Industry Revenue billion Forecast, by Fuel Cell Technology 2020 & 2033

- Table 6: France Fuel Cell Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Fuel Cell Industry?

The projected CAGR is approximately 14.8%.

2. Which companies are prominent players in the France Fuel Cell Industry?

Key companies in the market include Symbio Fcell SA, Ballard Power System Inc, Plug Power Inc *List Not Exhaustive, Powercell Sweden AB, Fuelcell Energy Inc.

3. What are the main segments of the France Fuel Cell Industry?

The market segments include Application, Fuel Cell Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.76 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The Rise in Oil and Gas Drilling Activities4.; Increased Shale Gas Exploration.

6. What are the notable trends driving market growth?

Increasing Hydrogen Filling Stations.

7. Are there any restraints impacting market growth?

4.; Increasing Share of Renewable Energy.

8. Can you provide examples of recent developments in the market?

In October 2022, Faurecia and Michelin's joint venture, Symbio, announced the global scaling of its HyMotive project, with a total investment of EUR 1 billion in fuel cell production across France through 2028.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Fuel Cell Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Fuel Cell Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Fuel Cell Industry?

To stay informed about further developments, trends, and reports in the France Fuel Cell Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence