Key Insights

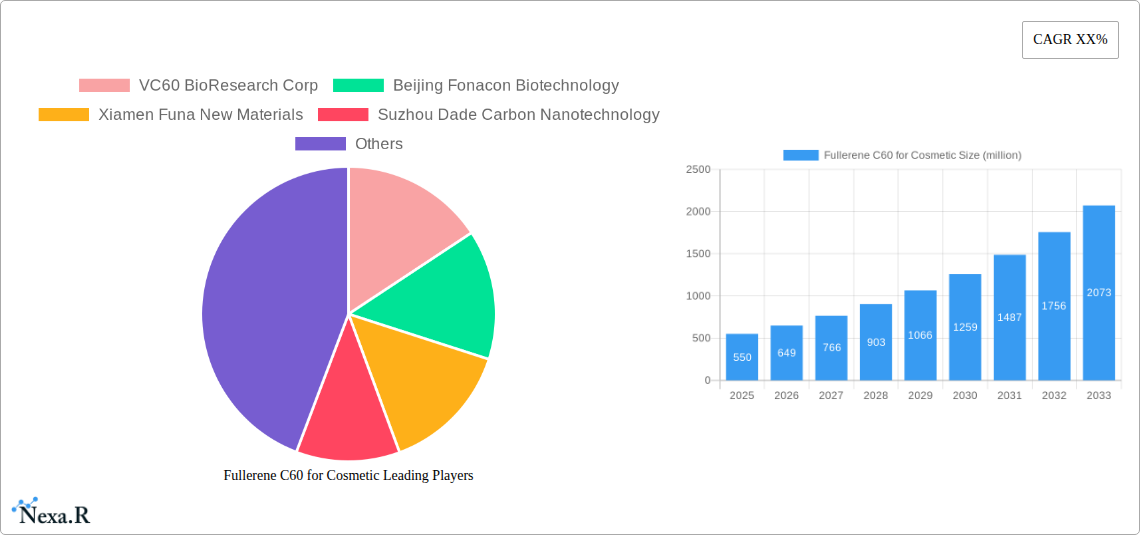

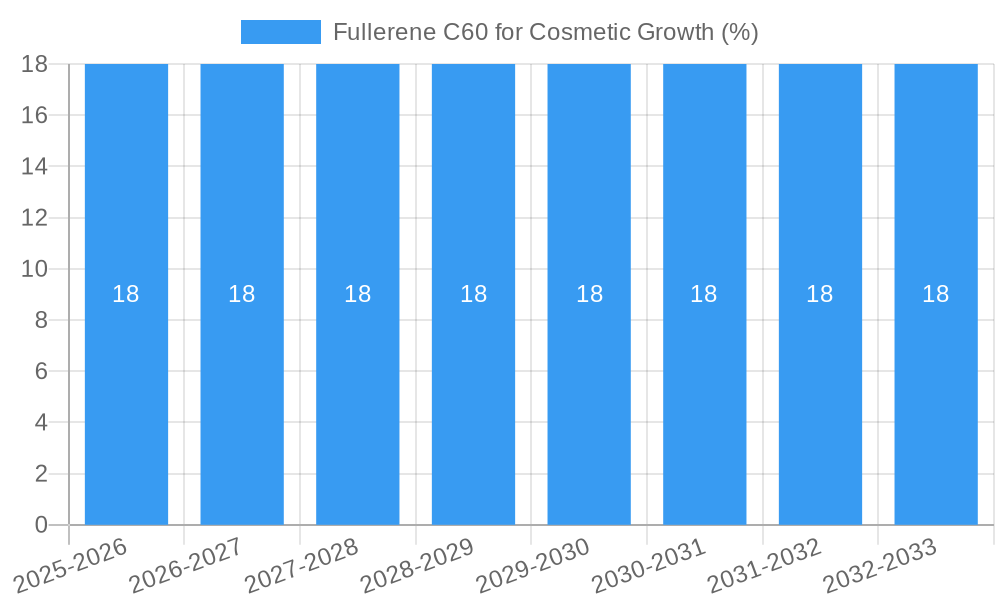

The global Fullerene C60 for Cosmetics market is poised for significant expansion, projected to reach an estimated $550 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 18% anticipated through 2033. This impressive growth is primarily fueled by increasing consumer demand for advanced anti-aging and skincare solutions, driven by a growing awareness of Fullerene C60's exceptional antioxidant properties. Its ability to neutralize free radicals, thereby protecting skin from oxidative stress and delaying the signs of aging, is a key differentiator. The market's expansion is further bolstered by the burgeoning trend of incorporating novel, high-performance ingredients into cosmetic formulations, catering to a discerning consumer base actively seeking scientifically backed products. Innovations in encapsulation technologies are also playing a crucial role, enhancing the stability and efficacy of Fullerene C60 in topical applications, thereby widening its appeal across various cosmetic segments.

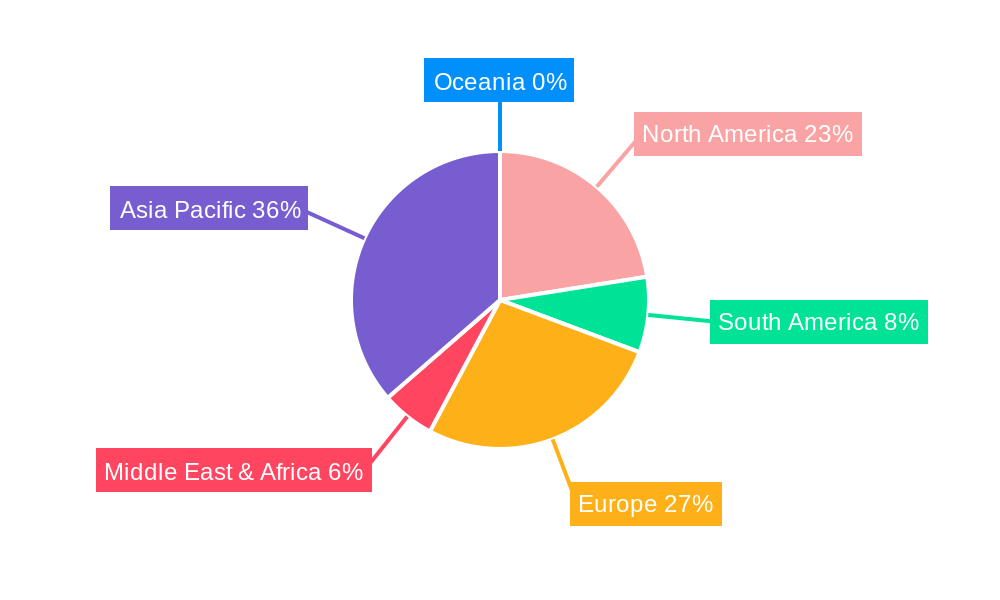

The market is segmented into distinct applications, with Skin Care emerging as the dominant segment, accounting for over 60% of the market share. This is directly attributable to Fullerene C60's proven efficacy in combating wrinkles, fine lines, and hyperpigmentation. The Hair Care segment is also witnessing steady growth, driven by its potential to protect hair from environmental damage and promote scalp health. Within types, Water Soluble Fullerene C60 is experiencing higher adoption due to its ease of formulation and integration into aqueous-based cosmetic products. Key players like VC60 BioResearch Corp, Beijing Fonacon Biotechnology, and Xiamen Funa New Materials are actively investing in research and development to introduce innovative products and expand their market reach. Geographically, the Asia Pacific region, particularly China and Japan, is leading the market due to strong consumer interest in advanced skincare and a well-established beauty industry. North America and Europe also represent significant markets, driven by premium cosmetic brands and a growing demand for scientifically validated ingredients.

Here is a compelling, SEO-optimized report description for Fullerene C60 for Cosmetic, integrating high-traffic keywords and structured as requested:

Report Title: Fullerene C60 for Cosmetic Market: Advanced Antioxidant, Anti-Aging, and UV Protection Insights (2019-2033)

Unlock the future of cosmetic formulations with our in-depth analysis of the Fullerene C60 for Cosmetic market. This comprehensive report provides critical intelligence for industry leaders, R&D professionals, and strategic planners seeking to capitalize on the burgeoning demand for advanced skincare, hair care, and makeup products infused with cutting-edge nanotechnology. Explore market dynamics, growth trends, competitive landscapes, and future opportunities for both water-soluble and lipid-soluble fullerene C60 derivatives. Gain actionable insights into key players, technological innovations, and regulatory considerations shaping this dynamic sector.

Fullerene C60 for Cosmetic Market Dynamics & Structure

The Fullerene C60 for Cosmetic market exhibits a moderately concentrated structure, with key players investing heavily in research and development to unlock novel applications and enhance product efficacy. Technological innovation serves as a primary driver, particularly advancements in synthesis methods that improve purity and reduce production costs. The market is also influenced by evolving regulatory frameworks concerning nanomaterials in cosmetics, requiring stringent safety assessments and clear labeling. Competitive product substitutes, such as traditional antioxidants and advanced peptide technologies, pose a constant challenge, necessitating continuous product differentiation through superior performance. End-user demographics are increasingly sophisticated, demanding scientifically backed, potent anti-aging and skin protection solutions. Merger and acquisition (M&A) activities, though currently limited in volume, are anticipated to increase as larger cosmetic corporations seek to integrate innovative fullerene C60 technologies into their portfolios.

- Market Concentration: Moderately concentrated with strategic R&D investments.

- Technological Innovation Drivers: Enhanced synthesis, novel application development, improved safety profiles.

- Regulatory Frameworks: Growing scrutiny on nanomaterials, requiring robust safety data.

- Competitive Product Substitutes: Traditional antioxidants, peptides, growth factors.

- End-User Demographics: Demanding, science-literate consumers seeking effective anti-aging and protection.

- M&A Trends: Potential for consolidation as larger players seek technological acquisition.

Fullerene C60 for Cosmetic Growth Trends & Insights

The Fullerene C60 for Cosmetic market is poised for substantial growth, driven by a confluence of accelerating consumer demand for advanced anti-aging and protective cosmetic solutions and significant advancements in nanotech ingredient development. From its foundational establishment in the historical period (2019-2024), the market has demonstrated a consistent upward trajectory. The base year of 2025 marks a pivotal point, with the estimated market size projected to be valued in the hundreds of millions, driven by increasing adoption across premium skincare, specialized hair care treatments, and innovative makeup formulations. The study period extending to 2033, with a forecast period from 2025-2033, anticipates a Compound Annual Growth Rate (CAGR) of xx%, signifying a robust expansion.

Consumer behavior has undergone a significant shift, with a heightened awareness and preference for ingredients backed by scientific evidence of efficacy. Fullerene C60's exceptional antioxidant capabilities, its ability to scavenge free radicals, and its potent UV-protective properties align perfectly with these evolving demands. This has led to a surge in market penetration within the premium and cosmeceutical segments, where consumers are willing to invest in scientifically advanced ingredients. Technological disruptions, including the development of more stable and bioavailable fullerene C60 derivatives (e.g., water-soluble and lipid-soluble forms), are further enhancing its appeal and expanding its application scope. The integration of fullerene C60 into topical formulations not only combats oxidative stress, a key contributor to premature aging, but also offers enhanced photoprotection, addressing a critical consumer concern. Furthermore, advancements in encapsulation technologies are improving the delivery and effectiveness of fullerene C60, solidifying its position as a premium ingredient. The market is also witnessing a trend towards personalized cosmetics, where the unique properties of fullerene C60 can be tailored to address specific skin concerns, further fueling its adoption. The projected growth is underpinned by ongoing research validating its multifaceted benefits, including anti-inflammatory effects and potential for collagen stimulation, creating a compelling value proposition for brands and consumers alike.

Dominant Regions, Countries, or Segments in Fullerene C60 for Cosmetic

The Skin Care segment is unequivocally the dominant force driving growth within the global Fullerene C60 for Cosmetic market, projected to hold a significant market share in the forecast period. This dominance is fueled by a confluence of factors including advanced technological adoption, robust consumer demand for anti-aging and photoprotective solutions, and favorable market penetration. Within the Skin Care segment, the Water Soluble Fullerene C60 variant is emerging as particularly influential due to its ease of formulation in aqueous-based products, wider compatibility, and enhanced bioavailability in topical applications.

Geographically, North America and Europe currently lead the market, characterized by high consumer disposable income, a sophisticated understanding of advanced skincare ingredients, and a strong presence of premium cosmetic brands. These regions exhibit substantial investment in R&D and a willingness to embrace innovative technologies. Asia-Pacific, however, is demonstrating the fastest growth potential, driven by an expanding middle class, increasing awareness of anti-aging treatments, and a burgeoning domestic cosmetic industry that is actively seeking to incorporate novel, high-performance ingredients. Countries like South Korea and Japan are at the forefront of this growth, known for their rapid adoption of new beauty technologies.

- Dominant Application Segment: Skin Care, accounting for an estimated xx% of the total market share.

- Key Drivers in Skin Care: Demand for advanced anti-aging, antioxidant, and UV protection; integration into serums, creams, and sunscreens.

- Dominant Fullerene C60 Type: Water Soluble Fullerene C60, favored for its formulation versatility and bioavailability.

- Growth Potential for Water Soluble: Expanding applications in serums, toners, and hydrators; better skin penetration.

- Leading Regions: North America and Europe, with strong established markets for premium cosmetics.

- Dominance Factors: High disposable income, advanced R&D infrastructure, consumer awareness of nanotechnology.

- Fastest Growing Region: Asia-Pacific, driven by increasing consumer demand and a dynamic cosmetic industry.

- Growth Accelerators in APAC: Rising middle class, rapid adoption of beauty trends, local manufacturing capabilities.

- Emerging Application Trends: Growing interest in Hair Care (anti-hair loss, scalp protection) and Makeup Products (UV defense, anti-pollution).

Fullerene C60 for Cosmetic Product Landscape

The product landscape for Fullerene C60 for Cosmetic is characterized by innovation focused on maximizing its potent antioxidant and photoprotective capabilities. Key product developments include advanced anti-aging serums that leverage Fullerene C60's ability to neutralize free radicals and stimulate collagen production, leading to reduced fine lines and wrinkles. Its inclusion in high-SPF sunscreens offers superior broad-spectrum UV protection by scavenging reactive oxygen species generated by UV exposure, thereby minimizing sun damage and photoaging. Furthermore, specialized hair care formulations are emerging that utilize Fullerene C60 to protect hair follicles from oxidative stress and environmental aggressors, promoting healthier hair growth. The market is witnessing the introduction of both water-soluble and lipid-soluble derivatives, catering to diverse formulation needs and enhancing ingredient delivery and efficacy. These advancements underscore Fullerene C60's versatility as a high-performance ingredient in the modern cosmetic industry.

Key Drivers, Barriers & Challenges in Fullerene C60 for Cosmetic

Key Drivers:

The Fullerene C60 for Cosmetic market is propelled by significant growth drivers. Increasing consumer demand for effective anti-aging and protective skincare solutions is paramount, fueled by a growing awareness of oxidative stress and environmental damage. Technological advancements in nanotechnology, leading to more efficient synthesis and improved bioavailability of Fullerene C60, further enhance its appeal. Growing scientific evidence validating its superior antioxidant and photoprotective properties compared to traditional ingredients plays a crucial role in driving adoption by cosmetic formulators and consumers.

Barriers & Challenges:

Despite its promising attributes, the market faces several challenges. High production costs associated with synthesizing pure Fullerene C60 can limit its widespread use in mass-market products. Regulatory scrutiny and safety assessments for nanomaterials in cosmetics create a hurdle, requiring extensive testing and adherence to evolving guidelines, which can be time-consuming and expensive. Consumer perception and education regarding nanotechnology in cosmetics can also be a barrier, necessitating clear communication about safety and efficacy. Supply chain complexities and the need for specialized handling further add to operational challenges.

Emerging Opportunities in Fullerene C60 for Cosmetic

Emerging opportunities lie in the development of next-generation formulations that synergize Fullerene C60 with other active ingredients, such as peptides and growth factors, to create multi-functional, high-performance cosmetic products. The untapped potential within the men's grooming segment, which is increasingly seeking advanced anti-aging and protective solutions, presents a significant avenue for growth. Furthermore, exploring novel delivery systems and encapsulation technologies that enhance the stability and targeted delivery of Fullerene C60 will open doors to innovative product applications and improved efficacy. Expanding into cosmeceutical and medical aesthetic applications for post-treatment care and skin repair also represents a lucrative opportunity.

Growth Accelerators in the Fullerene C60 for Cosmetic Industry

Several catalysts are accelerating growth in the Fullerene C60 for Cosmetic industry. Continued investment in research and development by key players to uncover new therapeutic and aesthetic benefits is a primary accelerator. Strategic partnerships between nanotechnology providers and established cosmetic brands are crucial for wider market penetration and consumer reach. The increasing focus on sustainable sourcing and manufacturing of nanomaterials will also drive innovation and market acceptance. Furthermore, positive clinical trial results and endorsements from dermatological experts will significantly bolster consumer confidence and accelerate adoption rates.

Key Players Shaping the Fullerene C60 for Cosmetic Market

- VC60 BioResearch Corp

- Beijing Fonacon Biotechnology

- Xiamen Funa New Materials

- Suzhou Dade Carbon Nanotechnology

Notable Milestones in Fullerene C60 for Cosmetic Sector

- 2019: Initial research on Fullerene C60’s potent antioxidant properties gains traction within the cosmetic science community.

- 2020: Development of scalable synthesis methods for high-purity Fullerene C60 begins to impact R&D budgets.

- 2021: First commercial skincare products featuring Fullerene C60 derivatives are launched in niche premium markets.

- 2022: Increased investment in studies validating the photoprotective benefits of Fullerene C60, leading to its inclusion in advanced sun care research.

- 2023: Significant advancements in water-soluble Fullerene C60 formulations enhance its applicability in a wider range of cosmetic products.

- 2024: Growing regulatory discussions around nanomaterials in cosmetics prompt increased focus on safety data and substantiation for Fullerene C60.

In-Depth Fullerene C60 for Cosmetic Market Outlook

The Fullerene C60 for Cosmetic market is poised for a dynamic future, driven by its unparalleled antioxidant and photoprotective capabilities. Growth accelerators such as ongoing R&D, strategic brand collaborations, and increasing consumer demand for scientifically validated anti-aging solutions will fuel market expansion. The anticipated market size, projected to reach substantial figures by 2033, reflects the ingredient's rising prominence. Strategic opportunities lie in leveraging its unique properties for innovative product development, particularly in specialized skin and hair care. The convergence of nanotechnology, cosmetic science, and consumer desire for advanced efficacy positions Fullerene C60 as a cornerstone ingredient for the next generation of premium beauty products.

Fullerene C60 for Cosmetic Segmentation

-

1. Application

- 1.1. Skin Care

- 1.2. Hair Care

- 1.3. Makeup Products

-

2. Types

- 2.1. Water Soluble Fullerene C60

- 2.2. Lipid Soluble Fullerene C60

Fullerene C60 for Cosmetic Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Fullerene C60 for Cosmetic REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fullerene C60 for Cosmetic Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Skin Care

- 5.1.2. Hair Care

- 5.1.3. Makeup Products

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Water Soluble Fullerene C60

- 5.2.2. Lipid Soluble Fullerene C60

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Fullerene C60 for Cosmetic Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Skin Care

- 6.1.2. Hair Care

- 6.1.3. Makeup Products

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Water Soluble Fullerene C60

- 6.2.2. Lipid Soluble Fullerene C60

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Fullerene C60 for Cosmetic Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Skin Care

- 7.1.2. Hair Care

- 7.1.3. Makeup Products

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Water Soluble Fullerene C60

- 7.2.2. Lipid Soluble Fullerene C60

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Fullerene C60 for Cosmetic Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Skin Care

- 8.1.2. Hair Care

- 8.1.3. Makeup Products

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Water Soluble Fullerene C60

- 8.2.2. Lipid Soluble Fullerene C60

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Fullerene C60 for Cosmetic Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Skin Care

- 9.1.2. Hair Care

- 9.1.3. Makeup Products

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Water Soluble Fullerene C60

- 9.2.2. Lipid Soluble Fullerene C60

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Fullerene C60 for Cosmetic Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Skin Care

- 10.1.2. Hair Care

- 10.1.3. Makeup Products

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Water Soluble Fullerene C60

- 10.2.2. Lipid Soluble Fullerene C60

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 VC60 BioResearch Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Beijing Fonacon Biotechnology

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Xiamen Funa New Materials

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Suzhou Dade Carbon Nanotechnology

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 VC60 BioResearch Corp

List of Figures

- Figure 1: Global Fullerene C60 for Cosmetic Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Fullerene C60 for Cosmetic Revenue (million), by Application 2024 & 2032

- Figure 3: North America Fullerene C60 for Cosmetic Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Fullerene C60 for Cosmetic Revenue (million), by Types 2024 & 2032

- Figure 5: North America Fullerene C60 for Cosmetic Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Fullerene C60 for Cosmetic Revenue (million), by Country 2024 & 2032

- Figure 7: North America Fullerene C60 for Cosmetic Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Fullerene C60 for Cosmetic Revenue (million), by Application 2024 & 2032

- Figure 9: South America Fullerene C60 for Cosmetic Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Fullerene C60 for Cosmetic Revenue (million), by Types 2024 & 2032

- Figure 11: South America Fullerene C60 for Cosmetic Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Fullerene C60 for Cosmetic Revenue (million), by Country 2024 & 2032

- Figure 13: South America Fullerene C60 for Cosmetic Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Fullerene C60 for Cosmetic Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Fullerene C60 for Cosmetic Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Fullerene C60 for Cosmetic Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Fullerene C60 for Cosmetic Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Fullerene C60 for Cosmetic Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Fullerene C60 for Cosmetic Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Fullerene C60 for Cosmetic Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Fullerene C60 for Cosmetic Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Fullerene C60 for Cosmetic Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Fullerene C60 for Cosmetic Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Fullerene C60 for Cosmetic Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Fullerene C60 for Cosmetic Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Fullerene C60 for Cosmetic Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Fullerene C60 for Cosmetic Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Fullerene C60 for Cosmetic Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Fullerene C60 for Cosmetic Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Fullerene C60 for Cosmetic Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Fullerene C60 for Cosmetic Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Fullerene C60 for Cosmetic Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Fullerene C60 for Cosmetic Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fullerene C60 for Cosmetic?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Fullerene C60 for Cosmetic?

Key companies in the market include VC60 BioResearch Corp, Beijing Fonacon Biotechnology, Xiamen Funa New Materials, Suzhou Dade Carbon Nanotechnology.

3. What are the main segments of the Fullerene C60 for Cosmetic?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fullerene C60 for Cosmetic," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fullerene C60 for Cosmetic report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fullerene C60 for Cosmetic?

To stay informed about further developments, trends, and reports in the Fullerene C60 for Cosmetic, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence