Key Insights

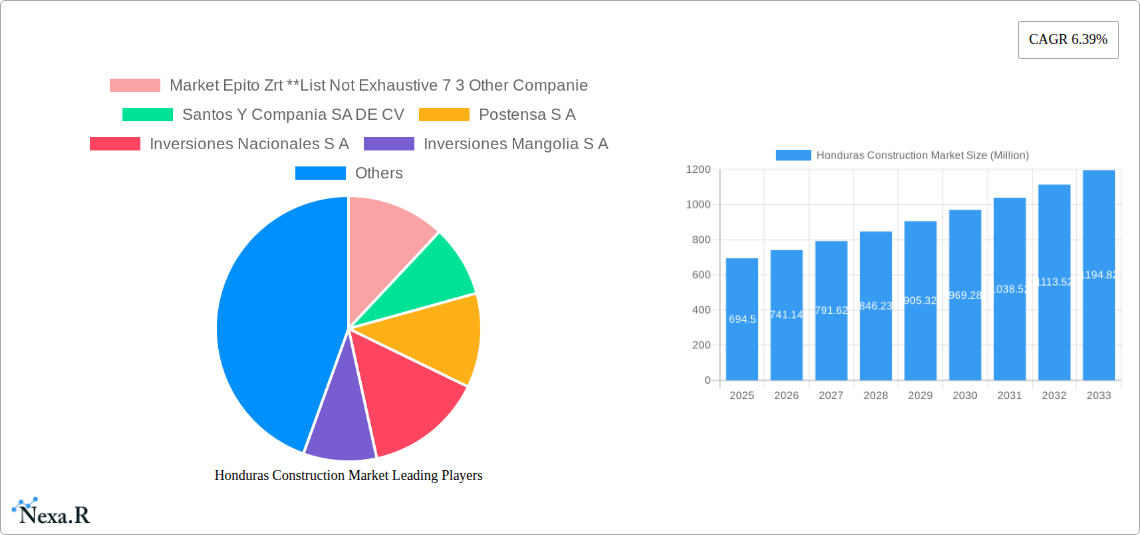

The Honduras construction market, valued at $694.5 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.39% from 2025 to 2033. This growth is driven by several factors. Increased government investment in infrastructure projects, particularly in transportation and energy, is a significant catalyst. Furthermore, a growing population and rising urbanization are fueling demand for residential and commercial construction. The expanding tourism sector also contributes, necessitating new hotels, resorts, and related infrastructure. While specific details on restraining factors are unavailable, potential challenges could include material cost fluctuations, skilled labor shortages, and potential regulatory hurdles. The market is segmented by sector, encompassing residential, commercial, industrial, institutional, infrastructure, and energy & utility construction. Residential construction likely holds the largest market share, reflecting the population growth and urbanization trends. Infrastructure development, however, is anticipated to witness significant growth due to government initiatives. Key players in the market include Market Epito Zrt, Santos Y Compania SA DE CV, and others, indicating a competitive landscape with both domestic and potentially international firms vying for market share. The forecast period (2025-2033) suggests a considerable expansion of the Honduran construction market, offering significant opportunities for both local and international investors and construction companies.

Honduras Construction Market Market Size (In Million)

The analysis suggests a positive outlook for the Honduran construction sector, with consistent growth expected over the next decade. However, sustained growth will hinge on effective management of potential challenges, including securing sufficient skilled labor, mitigating supply chain disruptions, and ensuring a stable regulatory environment. The ongoing government investment in infrastructure is crucial for maintaining this positive trajectory. The diverse segmentation of the market, catering to various construction needs, suggests opportunities for specialized companies to thrive within their respective niches. The presence of both local and international companies indicates a dynamic market landscape, with potential for further competition and innovation.

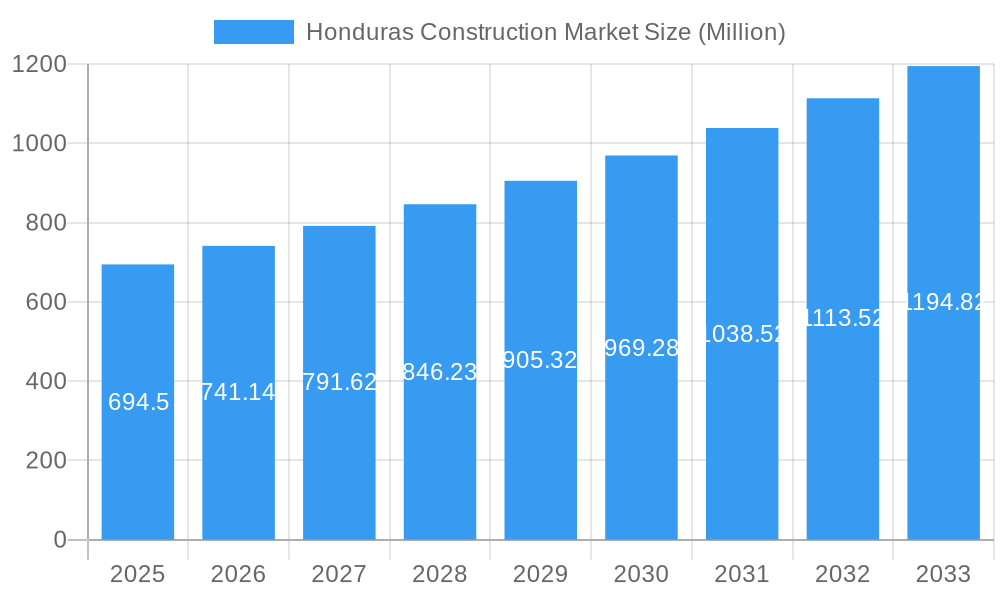

Honduras Construction Market Company Market Share

Honduras Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Honduras construction market, covering market dynamics, growth trends, key players, and future opportunities. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on the evolving landscape of the Honduran construction sector. The report utilizes data from the historical period (2019-2024) and projects values in Million units.

Honduras Construction Market Market Dynamics & Structure

The Honduran construction market exhibits a moderately concentrated structure, with several large players and numerous smaller firms. Technological innovation, while present, faces barriers such as limited access to advanced technologies and a skilled workforce. The regulatory framework, while evolving, can present challenges for project approvals and compliance. Substitutes for traditional construction materials are slowly emerging, driven by environmental concerns and rising material costs. End-user demographics show a rising middle class, increasing demand for residential and commercial construction. M&A activity in the Honduran construction sector has been moderate in recent years, with xx Million in deal volume recorded between 2019-2024, representing an average annual growth rate of xx%.

- Market Concentration: Moderately concentrated, with a Herfindahl-Hirschman Index (HHI) estimated at xx.

- Technological Innovation: Slow adoption of Building Information Modeling (BIM) and other advanced technologies due to cost and skill limitations.

- Regulatory Framework: Complex permitting processes and evolving building codes present challenges.

- Competitive Substitutes: Increased use of prefabricated building materials is slowly emerging.

- M&A Activity: Moderate activity, xx Million in deal volume between 2019-2024.

Honduras Construction Market Growth Trends & Insights

The Honduran construction market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), reaching a market size of xx Million in 2024. This growth was driven primarily by investment in infrastructure projects and increasing demand for residential and commercial buildings. However, the market faced challenges from economic fluctuations and political instability. Technological disruptions, such as the adoption of prefabricated construction methods, are expected to further transform the sector. Shifts in consumer behavior towards sustainable and energy-efficient buildings are creating new opportunities. Market penetration of green building technologies is projected to increase from xx% in 2024 to xx% by 2033. The forecast period (2025-2033) anticipates a CAGR of xx%, with the market size expected to reach xx Million by 2033.

Dominant Regions, Countries, or Segments in Honduras Construction Market

The Infrastructure Construction segment has been the dominant driver of growth in the Honduran construction market, accounting for approximately xx% of the total market value in 2024. This is mainly attributed to government initiatives focused on improving the country's infrastructure, including roads, bridges, and utilities. The residential construction sector, driven by population growth and urbanization, also shows strong growth potential. Tegucigalpa and San Pedro Sula, the largest cities, are major hubs for construction activity.

- Key Drivers for Infrastructure Construction: Government investments in public works projects, improving logistics and transportation networks.

- Key Drivers for Residential Construction: Population growth, rising urbanization, and increasing middle class.

- Market Share: Infrastructure Construction (xx%), Residential Construction (xx%), Commercial Construction (xx%), Industrial Construction (xx%), Institutional Construction (xx%), Energy & Utility Construction (xx%).

Honduras Construction Market Product Landscape

The Honduran construction market showcases a diverse product landscape, encompassing traditional building materials like concrete and steel alongside emerging solutions like prefabricated components and sustainable building materials. Technological advancements are leading to improved efficiency, reduced construction times, and enhanced building performance. Innovative products with unique selling propositions focusing on cost-effectiveness and sustainability are gaining traction in the market.

Key Drivers, Barriers & Challenges in Honduras Construction Market

Key Drivers:

- Government investments in infrastructure development.

- Growth of the tourism sector, fueling demand for hotels and resorts.

- Expanding middle class, increasing demand for housing.

Key Challenges:

- Corruption and bureaucratic inefficiencies in the permitting process.

- Shortage of skilled labor, impacting project timelines and costs.

- Volatility in the price of building materials due to global market fluctuations.

- Natural disasters affecting construction activities.

Emerging Opportunities in Honduras Construction Market

Emerging opportunities include the growing demand for sustainable and eco-friendly construction, the development of affordable housing solutions to cater to the growing population, and the expansion of the tourism sector driving hospitality projects. The adoption of innovative construction technologies and the potential for public-private partnerships offer further growth prospects.

Growth Accelerators in the Honduras Construction Market Industry

Government initiatives to stimulate the construction sector through tax breaks and incentives, coupled with strategic partnerships between domestic and international players, are poised to accelerate market growth. Technological advancements in construction materials and techniques, alongside streamlined regulatory processes, will further fuel this growth.

Key Players Shaping the Honduras Construction Market Market

- Market Epito Zrt

- Santos Y Compania SA DE CV

- Postensa S A

- Inversiones Nacionales S A

- Inversiones Mangolia S A

- Ingenieros Civiles Asociades Inversions

- Conmoxa SRL

- Empresa de Construccion y Transporte Eterna S A De C V

- Servicious de Imgeniera Salvador Garcia y Asociados SRL

- Roaton Zelaya Construction

- Salvador Gracia Constructions

- Kesz Group

- 7 Other Companies

Notable Milestones in Honduras Construction Market Sector

- May 2023: Completion of the MOL Campus in Hungary (although not in Honduras, this highlights a regional trend of large-scale, sustainable projects that could influence the Honduran market).

- May 2023: Completion of the Panattoni City Dock in Hungary (again, highlights regional trends).

In-Depth Honduras Construction Market Market Outlook

The Honduran construction market exhibits significant long-term growth potential, driven by robust infrastructure development, a growing population, and increasing foreign investment. Strategic partnerships focusing on sustainable development and technological adoption are crucial for tapping into this potential. The market is expected to experience consistent growth, although subject to economic and political stability.

Honduras Construction Market Segmentation

-

1. Sector

- 1.1. Residential Construction

- 1.2. Commercial Construction

- 1.3. Industrial Construction

- 1.4. Institutional Construction

- 1.5. Infrastructure Construction

- 1.6. Energy & Utility Construction

Honduras Construction Market Segmentation By Geography

- 1. Honduras

Honduras Construction Market Regional Market Share

Geographic Coverage of Honduras Construction Market

Honduras Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.39% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The growing number of high-rise buildings and skyscrapers globally has created a robust market for facade systems4.; Building owners and developers are placing greater emphasis on the overall performance of their structures

- 3.3. Market Restrains

- 3.3.1 4.; High-quality facade materials and designs can be costly

- 3.3.2 making it challenging for some projects to meet budget constraint4.; Facades must comply with building codes and safety regulations

- 3.3.3 which can vary based on location

- 3.4. Market Trends

- 3.4.1. Increase in residential constructions is boosting the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Honduras Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Residential Construction

- 5.1.2. Commercial Construction

- 5.1.3. Industrial Construction

- 5.1.4. Institutional Construction

- 5.1.5. Infrastructure Construction

- 5.1.6. Energy & Utility Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Honduras

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Market Epito Zrt **List Not Exhaustive 7 3 Other Companie

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Santos Y Compania SA DE CV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Postensa S A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Inversiones Nacionales S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Inversiones Mangolia S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ingenieros Civiles Asociades Inversions

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Conmoxa SRL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Empresa de Construccion y Transporte Eterna S A De C V

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Servicious de Imgeniera Salvador Garcia y Asociados SRL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Roaton Zelaya Construction

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Salvador Gracia Constructions

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kesz Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Market Epito Zrt **List Not Exhaustive 7 3 Other Companie

List of Figures

- Figure 1: Honduras Construction Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Honduras Construction Market Share (%) by Company 2025

List of Tables

- Table 1: Honduras Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Honduras Construction Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Honduras Construction Market Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: Honduras Construction Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Honduras Construction Market?

The projected CAGR is approximately 6.39%.

2. Which companies are prominent players in the Honduras Construction Market?

Key companies in the market include Market Epito Zrt **List Not Exhaustive 7 3 Other Companie, Santos Y Compania SA DE CV, Postensa S A, Inversiones Nacionales S A, Inversiones Mangolia S A, Ingenieros Civiles Asociades Inversions, Conmoxa SRL, Empresa de Construccion y Transporte Eterna S A De C V, Servicious de Imgeniera Salvador Garcia y Asociados SRL, Roaton Zelaya Construction, Salvador Gracia Constructions, Kesz Group.

3. What are the main segments of the Honduras Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 694.5 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The growing number of high-rise buildings and skyscrapers globally has created a robust market for facade systems4.; Building owners and developers are placing greater emphasis on the overall performance of their structures.

6. What are the notable trends driving market growth?

Increase in residential constructions is boosting the market.

7. Are there any restraints impacting market growth?

4.; High-quality facade materials and designs can be costly. making it challenging for some projects to meet budget constraint4.; Facades must comply with building codes and safety regulations. which can vary based on location.

8. Can you provide examples of recent developments in the market?

May 2023: Hungary achieved a significant milestone with the completion of the MOL Campus, its inaugural high-rise structure, constructed by Market Építő Zrt. Following the attainment of the BREEAM Excellent certification, this architectural marvel secured the prestigious LEED Platinum certification, signifying the highest level of recognition in sustainable building certification.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Honduras Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Honduras Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Honduras Construction Market?

To stay informed about further developments, trends, and reports in the Honduras Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence