Key Insights

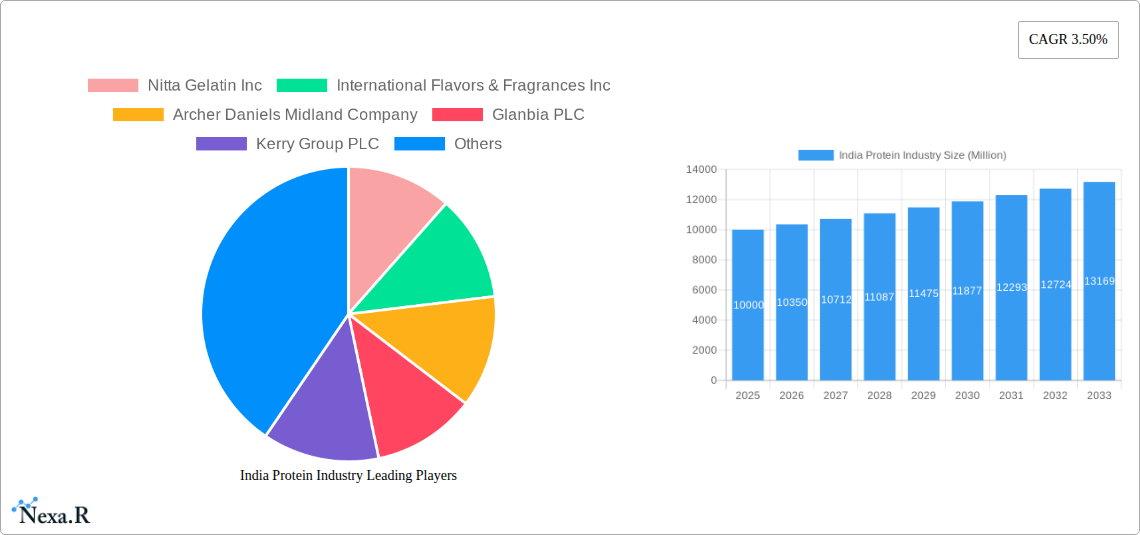

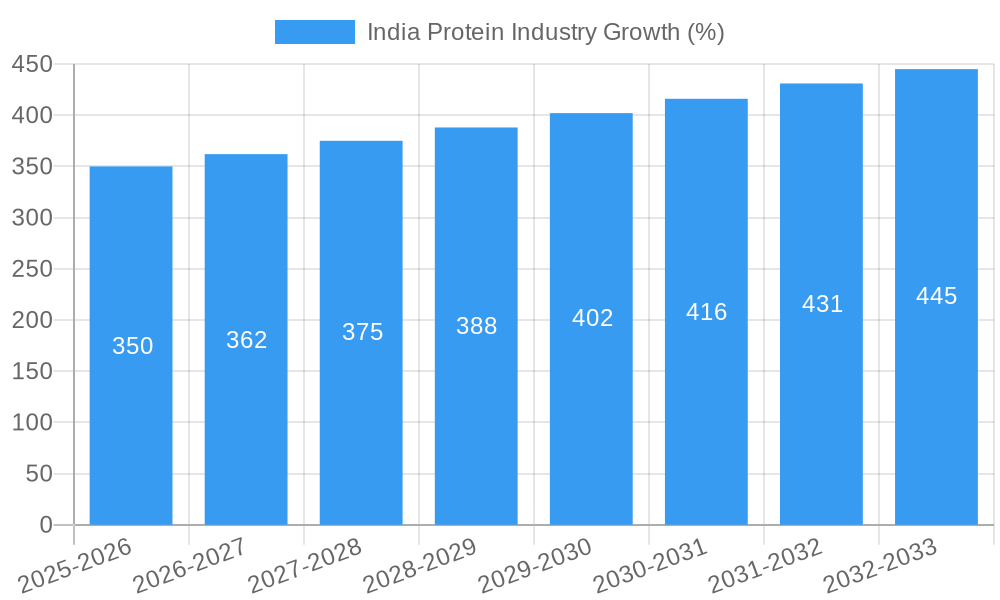

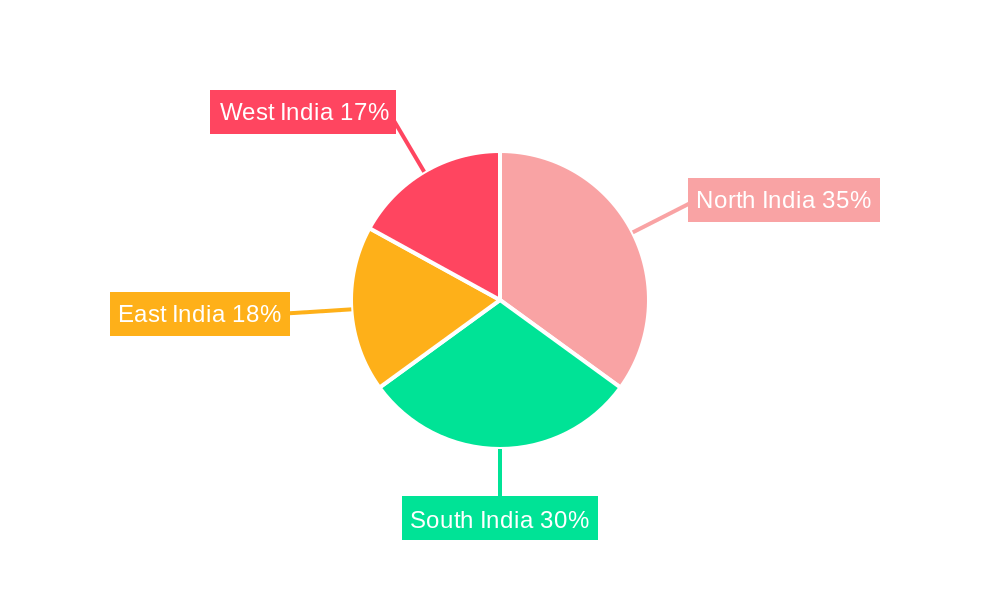

The Indian protein industry is experiencing robust growth, fueled by rising health consciousness, increasing disposable incomes, and a burgeoning population. The market, valued at approximately ₹X billion (estimated based on the provided CAGR and market size, converting “Million” value unit to appropriate Indian currency) in 2025, is projected to expand at a compound annual growth rate (CAGR) of 3.50% from 2025 to 2033. This growth is driven by several factors including the increasing demand for protein-rich foods and supplements across various segments – sport/performance nutrition showing significant traction, animal feed maintaining a large market share due to livestock farming practices, and the food and beverage sector incorporating protein-enriched products. The rising adoption of plant-based protein sources is also influencing market dynamics, adding further diversification. However, challenges remain, including price volatility of raw materials, stringent regulatory norms, and supply chain complexities. Regional variations exist, with North and South India exhibiting potentially higher growth rates compared to East and West India, possibly due to varying consumer preferences and economic conditions. This necessitates targeted strategies for companies operating within this dynamic market.

The competitive landscape is characterized by a mix of international and domestic players. Key players like Nitta Gelatin Inc, International Flavors & Fragrances Inc, Archer Daniels Midland Company, Glanbia PLC, Kerry Group PLC, and others are strategically positioning themselves to capitalize on market opportunities. Successful strategies will likely involve innovation in product development, catering to evolving consumer needs, and leveraging technological advancements in protein extraction and processing. The long-term outlook for the Indian protein industry remains positive, promising significant growth opportunities for businesses adept at navigating the nuances of this evolving market. Further expansion is anticipated in specialized protein segments, driven by increasing awareness of functional benefits and targeted marketing campaigns.

India Protein Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India protein industry, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. It examines the parent market (Protein Ingredients) and various child markets (Sport/Performance Nutrition, Animal Feed, Food and Beverages), offering granular insights for industry professionals, investors, and strategic planners. The report utilizes high-traffic keywords like "India Protein Market," "India Protein Industry Analysis," "Protein Ingredients Market India," and "Plant-Based Protein India" to maximize search engine visibility.

India Protein Industry Market Dynamics & Structure

The Indian protein industry is characterized by a moderately concentrated market structure, with both multinational and domestic players competing for market share. The market is witnessing significant technological innovation, driven by the increasing demand for plant-based proteins and functional food ingredients. Regulatory frameworks, including food safety and labeling regulations, influence product development and market access. Competitive product substitutes, such as alternative protein sources, pose a challenge to traditional protein sources. End-user demographics, particularly the growing middle class with increasing disposable incomes and health consciousness, are driving demand. Mergers and acquisitions (M&A) activity, as illustrated by the recent merger of DuPont Nutrition & Biosciences and IFF, reshape the industry landscape.

- Market Concentration: Moderately concentrated, with a few large players dominating specific segments. xx% market share held by top 5 players in 2024.

- Technological Innovation: Focus on plant-based protein sources, protein fortification technologies, and sustainable sourcing practices.

- Regulatory Framework: Food Safety and Standards Authority of India (FSSAI) regulations influence product development and labeling.

- Competitive Substitutes: Plant-based alternatives (pea, soy, etc.) and insect protein are emerging competitors.

- End-User Demographics: Growing middle class fuels demand for high-protein foods and dietary supplements.

- M&A Trends: Consolidation expected to continue, with larger players acquiring smaller companies for market expansion. XX M&A deals recorded in the historical period.

India Protein Industry Growth Trends & Insights

The India protein industry experienced robust growth during the historical period (2019-2024), fueled by increasing consumer awareness of health and nutrition. Market size expanded significantly, exhibiting a CAGR of xx% during this period. The adoption rate of protein-rich products across various segments, notably in the food and beverage sector, reflects this growing consumer preference. Technological disruptions, such as the development of novel plant-based protein sources and advanced processing technologies, have accelerated market growth. Shifting consumer behavior, towards healthier diets and increased protein intake, is a major growth driver. The forecast period (2025-2033) anticipates sustained growth, driven by factors like rising incomes, changing lifestyles, and the continued expansion of the food and beverage, and animal feed industries. Market penetration will further increase to xx% by 2033.

Dominant Regions, Countries, or Segments in India Protein Industry

The food and beverage segment is currently the largest contributor to the India protein industry’s growth, followed by the animal feed segment. The demand for protein-rich products in urban areas is significantly high. Within the source category, animal-based proteins like dairy and whey protein currently dominate. However, plant-based protein sources are rapidly gaining traction due to their health benefits and sustainable production methods.

- Food & Beverage: High demand for protein-rich snacks, dairy products, and beverages. High growth potential.

- Animal Feed: Increasing livestock production and demand for high-protein animal feed drives this segment.

- Sport/Performance Nutrition: Growing fitness awareness and adoption of sports nutrition products.

Key Drivers:

- Increasing disposable incomes and changing lifestyles.

- Growing awareness of health and nutrition.

- Favorable government policies promoting agricultural and livestock development.

India Protein Industry Product Landscape

Product innovation in the Indian protein industry is characterized by a shift towards healthier, more sustainable, and functional protein sources. Plant-based proteins, such as pea and soy protein, are experiencing rapid growth, driven by consumer demand for vegan and vegetarian options. The industry is witnessing the development of innovative protein delivery systems and functional formulations to enhance product appeal and nutritional benefits. This includes textured protein products mimicking meat and novel protein blends with added functional benefits. Performance metrics, such as protein content, digestibility, and bioavailability, are key factors influencing product development and consumer choice.

Key Drivers, Barriers & Challenges in India Protein Industry

Key Drivers:

- Rising disposable incomes and changing dietary habits.

- Growing awareness of the importance of protein in diets.

- Increasing demand for convenience foods and functional foods.

- Government initiatives supporting the growth of the food processing sector.

Key Challenges:

- Fluctuations in raw material prices and supply chain disruptions.

- Stringent regulatory requirements and compliance costs.

- Intense competition among established and emerging players.

- Maintaining consistent product quality and meeting consumer expectations.

Emerging Opportunities in India Protein Industry

The Indian protein industry presents significant emerging opportunities, notably in plant-based protein innovation, functional food products, and customized protein solutions. Untapped markets in rural areas and expanding e-commerce channels offer growth potential. Innovative applications of protein ingredients in new food categories, such as plant-based meat alternatives and protein-fortified snacks, are driving market expansion. Evolving consumer preferences for sustainability and ethical sourcing are shaping product development and market strategies.

Growth Accelerators in the India Protein Industry

Technological advancements in protein extraction, processing, and formulation, coupled with strategic partnerships between ingredient suppliers and food manufacturers, are key growth catalysts. Market expansion strategies focused on tapping into untapped rural markets and international collaborations will drive the industry's long-term growth. Increased focus on sustainable sourcing and production practices will also bolster the industry’s sustainability and appeal.

Key Players Shaping the India Protein Industry Market

- Nitta Gelatin Inc

- International Flavors & Fragrances Inc

- Archer Daniels Midland Company

- Glanbia PLC

- Kerry Group PLC

- VIPPY INDUSTRIES LIMITE

- Nakoda Dairy Private Limited

- Südzucker AG

- Fonterra Co-operative Group Limited

- Roquette Frère

- Hilmar Cheese Company Inc

Notable Milestones in India Protein Industry Sector

- September 2020: ADM launched Acron T textured pea proteins and Prolite MeatTEX/XT wheat proteins, expanding the plant-based protein options.

- February 2021: NZMP (Fonterra) launched a new whey protein ingredient with 10% higher protein content, enhancing product offerings.

- February 2021: DuPont Nutrition & Biosciences merged with IFF, creating a stronger player in the soy protein market.

In-Depth India Protein Industry Market Outlook

The India protein industry is poised for continued robust growth, driven by favorable macroeconomic conditions, increasing health awareness, and ongoing innovation in protein sources and applications. Strategic opportunities exist in developing sustainable, affordable, and nutritious protein products tailored to the diverse needs of the Indian population. Expanding into untapped markets and leveraging technological advancements will be crucial for players seeking to capitalize on the industry's immense potential.

India Protein Industry Segmentation

-

1. Source

-

1.1. Animal

-

1.1.1. By Protein Type

- 1.1.1.1. Casein and Caseinates

- 1.1.1.2. Collagen

- 1.1.1.3. Egg Protein

- 1.1.1.4. Gelatin

- 1.1.1.5. Insect Protein

- 1.1.1.6. Milk Protein

- 1.1.1.7. Whey Protein

- 1.1.1.8. Other Animal Protein

-

1.1.1. By Protein Type

-

1.2. Microbial

- 1.2.1. Algae Protein

- 1.2.2. Mycoprotein

-

1.3. Plant

- 1.3.1. Hemp Protein

- 1.3.2. Pea Protein

- 1.3.3. Potato Protein

- 1.3.4. Rice Protein

- 1.3.5. Soy Protein

- 1.3.6. Wheat Protein

- 1.3.7. Other Plant Protein

-

1.1. Animal

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.7. RTE/RTC Food Products

- 2.2.1.8. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

India Protein Industry Segmentation By Geography

- 1. India

India Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology

- 3.3. Market Restrains

- 3.3.1. Deteriorating Fertility of Agricultural Lands

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Protein Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Animal

- 5.1.1.1. By Protein Type

- 5.1.1.1.1. Casein and Caseinates

- 5.1.1.1.2. Collagen

- 5.1.1.1.3. Egg Protein

- 5.1.1.1.4. Gelatin

- 5.1.1.1.5. Insect Protein

- 5.1.1.1.6. Milk Protein

- 5.1.1.1.7. Whey Protein

- 5.1.1.1.8. Other Animal Protein

- 5.1.1.1. By Protein Type

- 5.1.2. Microbial

- 5.1.2.1. Algae Protein

- 5.1.2.2. Mycoprotein

- 5.1.3. Plant

- 5.1.3.1. Hemp Protein

- 5.1.3.2. Pea Protein

- 5.1.3.3. Potato Protein

- 5.1.3.4. Rice Protein

- 5.1.3.5. Soy Protein

- 5.1.3.6. Wheat Protein

- 5.1.3.7. Other Plant Protein

- 5.1.1. Animal

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.7. RTE/RTC Food Products

- 5.2.2.1.8. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. North India India Protein Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Protein Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Protein Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Protein Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nitta Gelatin Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 International Flavors & Fragrances Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Archer Daniels Midland Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Glanbia PLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kerry Group PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 VIPPY INDUSTRIES LIMITE

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Nakoda Dairy Private Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Südzucker AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Fonterra Co-operative Group Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Roquette Frère

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hilmar Cheese Company Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Nitta Gelatin Inc

List of Figures

- Figure 1: India Protein Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Protein Industry Share (%) by Company 2024

List of Tables

- Table 1: India Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Protein Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 3: India Protein Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 4: India Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Protein Industry Revenue Million Forecast, by Source 2019 & 2032

- Table 11: India Protein Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 12: India Protein Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Protein Industry?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the India Protein Industry?

Key companies in the market include Nitta Gelatin Inc, International Flavors & Fragrances Inc, Archer Daniels Midland Company, Glanbia PLC, Kerry Group PLC, VIPPY INDUSTRIES LIMITE, Nakoda Dairy Private Limited, Südzucker AG, Fonterra Co-operative Group Limited, Roquette Frère, Hilmar Cheese Company Inc.

3. What are the main segments of the India Protein Industry?

The market segments include Source, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Demand for Products with Low Environmental Impacts; Dedicated Policies and Government Efforts to Promote the use of Biotechnology.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Deteriorating Fertility of Agricultural Lands.

8. Can you provide examples of recent developments in the market?

February 2021: NZMP, Fonterra's dairy ingredients business, launched a new protein ingredient that delivers 10% more protein than other standard whey protein offerings.February 2021: DuPont's Nutrition & Biosciences and the ingredient company IFF announced their merger in 2021. The combined company will continue to operate under the name IFF. The complementary portfolios give the company leadership positions within a range of ingredients, including soy protein.September 2020: ADM launched Acron T textured pea proteins, namely, Prolite MeatTEX textured wheat protein and Prolite MeatXT non-textured wheat protein. These highly functional proteins improve the texture and density of meat alternatives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Protein Industry?

To stay informed about further developments, trends, and reports in the India Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence