Key Insights

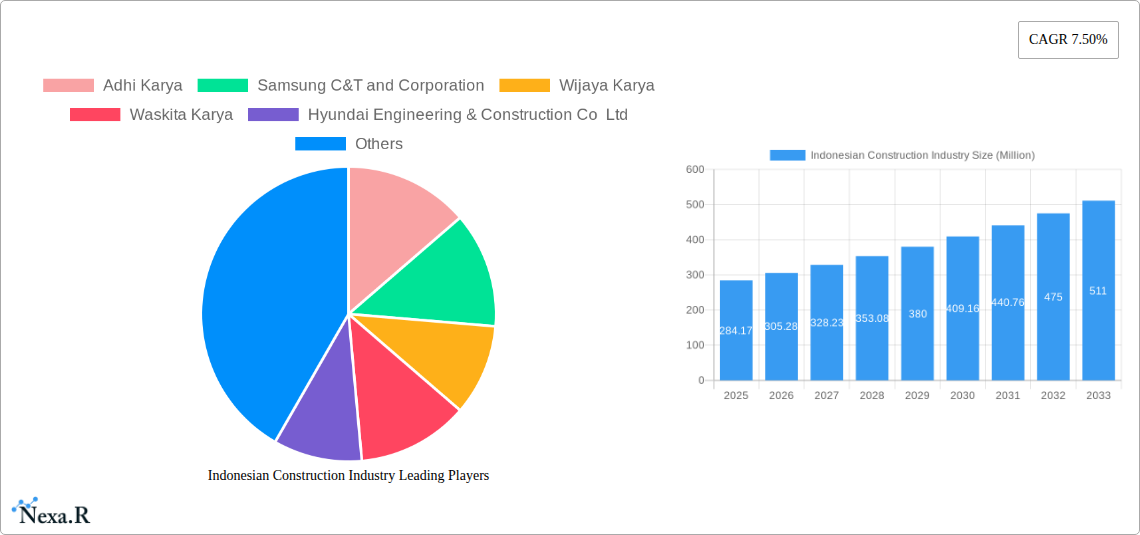

The Indonesian construction industry, valued at $284.17 million in 2025, is projected to experience robust growth, fueled by a Compound Annual Growth Rate (CAGR) of 7.50% from 2025 to 2033. This expansion is driven by several key factors. Firstly, significant government investments in infrastructure development, particularly in transportation projects like roads, railways, and ports, are creating substantial demand. Secondly, Indonesia's burgeoning population and rapid urbanization are boosting the residential construction sector, necessitating the construction of new housing and commercial spaces. Furthermore, the increasing focus on sustainable and resilient infrastructure, driven by climate change concerns and the need for improved disaster preparedness, presents lucrative opportunities for environmentally conscious construction practices. The industrial sector also contributes significantly, with ongoing expansions and upgrades across various manufacturing and processing facilities. Key players such as Adhi Karya, Samsung C&T, Wijaya Karya, and Waskita Karya are actively shaping the market landscape, leveraging their experience and expertise to secure major projects. Competition is expected to remain fierce, requiring companies to innovate in areas like technology adoption, project management efficiency, and sustainable building practices to maintain a competitive edge.

While the industry's outlook is positive, challenges remain. Land acquisition complexities and bureaucratic hurdles can delay project timelines and increase costs. Fluctuations in material prices, influenced by global supply chain dynamics, can also impact profitability. The need for skilled labor remains a persistent concern, demanding investment in training and development programs to meet the industry's growing human resource requirements. Furthermore, effectively managing environmental and social impacts associated with large-scale construction projects is crucial for sustainable and responsible growth. Addressing these challenges through proactive measures will be essential for realizing the industry's full potential and ensuring its long-term prosperity.

Indonesian Construction Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Indonesian construction industry, covering market dynamics, growth trends, key players, and future outlook from 2019 to 2033. This report is ideal for investors, construction companies, policymakers, and industry professionals seeking to understand this dynamic market. The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period covers 2025-2033, and the historical period encompasses 2019-2024. Market values are presented in Million units.

Indonesian Construction Industry Market Dynamics & Structure

This section analyzes the Indonesian construction market's structure, focusing on market concentration, technological advancements, regulatory aspects, competitive landscape, and end-user demographics. The analysis includes M&A trends and their impact on market dynamics.

Market Concentration: The Indonesian construction market exhibits a moderately concentrated structure, with a few large players dominating specific segments (e.g., infrastructure projects). The top five companies—Adhi Karya, Wijaya Karya, Waskita Karya, PT PP (Persero), and PT Jaya Konstruksi Manggala Pratama—hold an estimated xx% market share in 2025, leaving considerable room for smaller players and international firms. The market share of the top 5 contractors has seen a slight fluctuation in the last 5 years.

Technological Innovation: While adoption of Building Information Modeling (BIM) and other advanced technologies is growing, the penetration remains relatively low compared to developed markets. This is primarily due to high implementation costs and a lack of skilled labor. However, increasing government initiatives promoting digitalization in the sector are expected to accelerate technology adoption.

Regulatory Framework: The Indonesian government's focus on infrastructure development through various programs drives industry growth. However, navigating complex regulations and obtaining permits can be challenging, leading to project delays.

Competitive Landscape: Intense competition exists among both domestic and international companies, leading to price wars and pressure on profit margins. The entry of large international firms like Samsung C&T and Corporation, Hyundai Engineering & Construction Co Ltd, McConnell Dowell, Toyo Construction Co Ltd, Chiyoda Corp, and TBEA Co Ltd further intensifies the competition.

M&A Activity: The M&A landscape has seen xx deals in the past five years, predominantly involving smaller firms being acquired by larger players seeking to expand their market share and expertise.

End-User Demographics: The expanding middle class and urbanization are key drivers for residential and commercial construction growth. The government's focus on infrastructure development is driving strong demand in the infrastructure segment.

Indonesian Construction Industry Growth Trends & Insights

This section details the Indonesian construction market's evolution, analyzing market size, adoption rates, technological disruptions, and evolving consumer preferences. The analysis leverages extensive data sources to provide a comprehensive overview of the industry's growth trajectory.

The Indonesian construction market has witnessed significant growth over the past five years, registering a CAGR of xx% from 2019 to 2024 and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by government initiatives focusing on infrastructure development and the increasing demand for residential and commercial properties fueled by population growth and urbanization. Technological disruptions, such as the adoption of prefabrication techniques and BIM, are gradually improving efficiency and reducing construction timelines. Shifting consumer preferences towards sustainable and smart buildings also present new opportunities for market players. Market penetration of sustainable construction materials is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Regions, Countries, or Segments in Indonesian Construction Industry

This section identifies the leading regions and segments within the Indonesian construction industry, analyzing their growth drivers and dominance factors.

Infrastructure (Transportation) Construction: This segment is the largest and fastest-growing, driven by the government's massive infrastructure development program. Key drivers include the construction of roads, railways, airports, and ports to support economic growth and improve connectivity across the archipelago. The segment holds an estimated xx% market share in 2025.

Residential Construction: Rapid urbanization and a growing middle class fuel strong demand for housing, making residential construction a significant segment. However, affordability remains a challenge, and government policies promoting affordable housing play a crucial role in the sector's growth.

Commercial Construction: This segment exhibits steady growth, driven by foreign investment and expansion of businesses in major cities. The demand for office spaces, shopping malls, and other commercial properties contributes significantly to the overall market.

Industrial Construction: This sector is witnessing increasing investment driven by manufacturing expansion and the development of industrial zones. However, it is subject to fluctuations due to global economic conditions and shifts in manufacturing activities.

Energy and Utilities Construction: The energy sector is showing growth driven by investments in renewable energy projects and upgrades to existing power infrastructure. This area will also be positively impacted by increasing government regulation.

Indonesian Construction Industry Product Landscape

The Indonesian construction industry is characterized by a diverse range of products and materials, encompassing conventional and innovative solutions. Technological advancements are driving the adoption of prefabricated components, sustainable building materials (e.g., bamboo, recycled materials), and smart building technologies to improve efficiency, reduce environmental impact, and enhance building performance. The increasing focus on sustainability is driving demand for green building materials and technologies, with a growing emphasis on achieving green building certifications.

Key Drivers, Barriers & Challenges in Indonesian Construction Industry

Key Drivers:

- Government investment in infrastructure projects.

- Increasing urbanization and population growth.

- Rising foreign direct investment in the construction sector.

- Growing adoption of advanced construction technologies.

Key Barriers and Challenges:

- Land acquisition complexities and regulatory hurdles.

- Skilled labor shortages and high labor costs.

- Infrastructure limitations in certain regions.

- Fluctuations in commodity prices and global economic uncertainty. This has resulted in a xx% increase in project costs in the last two years.

Emerging Opportunities in Indonesian Construction Industry

- Sustainable and green construction: Growing environmental awareness and government regulations are driving demand for eco-friendly building materials and technologies.

- Smart building technologies: Integration of IoT and automation in buildings offer opportunities for improved energy efficiency and building management.

- Prefabrication and modular construction: Prefabricated components offer faster construction times and reduced on-site labor costs.

- Rural infrastructure development: Government initiatives to improve infrastructure in rural areas offer significant potential for construction companies.

Growth Accelerators in the Indonesian Construction Industry

The long-term growth of the Indonesian construction industry will be driven by continued government investment in infrastructure, coupled with technological advancements and strategic partnerships between domestic and international players. The increasing adoption of prefabrication and modular construction, along with the development of smart cities, will significantly contribute to the sector's expansion.

Key Players Shaping the Indonesian Construction Industry Market

- Adhi Karya

- Samsung C&T and Corporation

- Wijaya Karya

- Waskita Karya

- Hyundai Engineering & Construction Co Ltd

- PT Jaya Konstruksi Manggala Pratama

- McConnell Dowell

- Toyo Construction Co Ltd

- Chiyoda Corp

- TBEA Co Ltd

- PT PP (Persero)

Notable Milestones in Indonesian Construction Industry Sector

- 2020: Government launches a large-scale infrastructure development program.

- 2021: Significant increase in foreign investment in the construction sector.

- 2022: Launch of several large-scale residential and commercial projects.

- 2023: Increased adoption of BIM and other construction technologies.

- 2024: Several key infrastructure projects are completed, boosting connectivity.

In-Depth Indonesian Construction Industry Market Outlook

The Indonesian construction market is poised for sustained growth over the next decade, driven by robust government spending on infrastructure, a burgeoning middle class, and increasing urbanization. Opportunities exist across various segments, particularly in sustainable construction, smart building technologies, and rural infrastructure development. Strategic partnerships and the adoption of innovative construction methods will be crucial for companies to succeed in this dynamic market.

Indonesian Construction Industry Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

Indonesian Construction Industry Segmentation By Geography

- 1. Indonesia

Indonesian Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Policies and Regulatory Support; Tourism and Hospitality Sector Growth

- 3.3. Market Restrains

- 3.3.1. Financial and Funding Challenges

- 3.4. Market Trends

- 3.4.1. Growth of Infrastructural Plans Drives the Construction Market In Indonesia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesian Construction Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Adhi Karya

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samsung C&T and Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wijaya Karya

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Waskita Karya

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hyundai Engineering & Construction Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Jaya Konstruksi Manggala Pratama**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 McConnell Dowell

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toyo Construction Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Chiyoda Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TBEA Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PT PP (Persero)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Adhi Karya

List of Figures

- Figure 1: Indonesian Construction Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesian Construction Industry Share (%) by Company 2024

List of Tables

- Table 1: Indonesian Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesian Construction Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Indonesian Construction Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Indonesian Construction Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Indonesian Construction Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Indonesian Construction Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesian Construction Industry?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Indonesian Construction Industry?

Key companies in the market include Adhi Karya, Samsung C&T and Corporation, Wijaya Karya, Waskita Karya, Hyundai Engineering & Construction Co Ltd, PT Jaya Konstruksi Manggala Pratama**List Not Exhaustive, McConnell Dowell, Toyo Construction Co Ltd, Chiyoda Corp, TBEA Co Ltd, PT PP (Persero).

3. What are the main segments of the Indonesian Construction Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 284.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Policies and Regulatory Support; Tourism and Hospitality Sector Growth.

6. What are the notable trends driving market growth?

Growth of Infrastructural Plans Drives the Construction Market In Indonesia.

7. Are there any restraints impacting market growth?

Financial and Funding Challenges.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesian Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesian Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesian Construction Industry?

To stay informed about further developments, trends, and reports in the Indonesian Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence