Key Insights

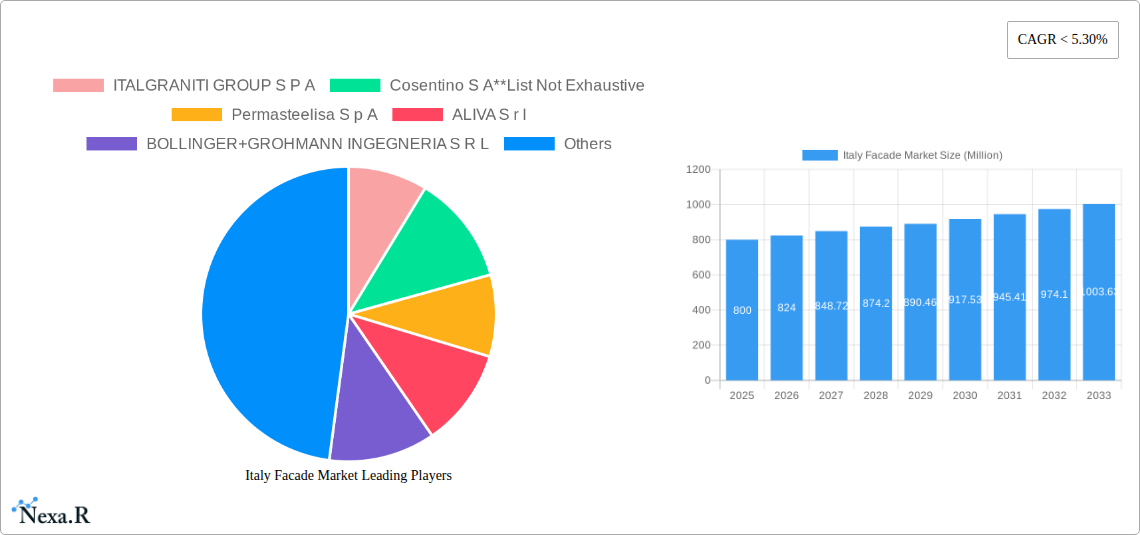

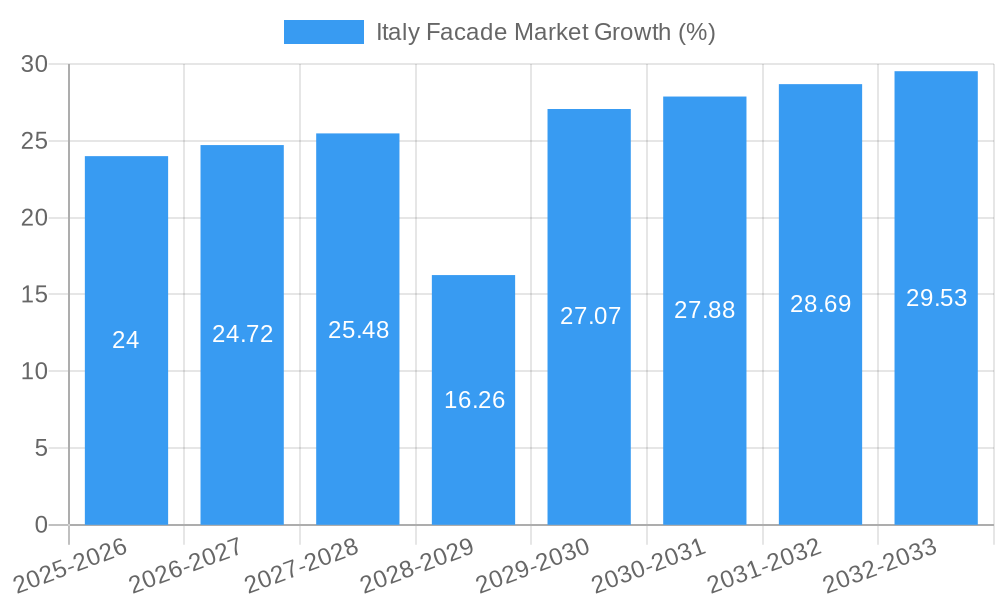

The Italy facade market, encompassing the design, manufacturing, and installation of exterior building coverings, is experiencing steady growth. While precise market size figures for 2019-2024 are unavailable, analysis of similar European markets and construction activity in Italy suggests a market size of approximately €800 million in 2025. This signifies a robust market driven by factors including ongoing urban renewal projects, particularly in historical city centers requiring careful facade restoration and modernization. Furthermore, increasing government initiatives promoting energy efficiency and sustainable building practices are stimulating demand for high-performance facade systems, such as those incorporating insulation and renewable energy technologies. The rising popularity of modern architectural designs in both residential and commercial construction is also contributing to the market's expansion.

Looking ahead to 2033, a conservative Compound Annual Growth Rate (CAGR) of 3% is projected, considering potential economic fluctuations and material cost variations. This growth trajectory is underpinned by the ongoing need for building maintenance and renovations, coupled with new construction projects, particularly in high-growth urban areas. Factors influencing the market's future trajectory include advancements in facade technology, evolving aesthetic preferences, and the increasing integration of smart building functionalities within facade systems. Competition among various facade material suppliers, including those offering traditional materials like stone and brick alongside innovative solutions like metal cladding and high-performance glass, will further shape the market landscape. The market is expected to reach approximately €1,100 million by 2033.

Italy Facade Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Italy facade market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the parent market of construction materials and the child market of building facades, offering a granular view of this dynamic sector. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market values are presented in million units.

Italy Facade Market Dynamics & Structure

The Italian facade market is characterized by a moderately concentrated landscape, with key players such as ITALGRANITI GROUP S P A, Cosentino S.A., Permasteelisa S p A, and others vying for market share. Technological innovation, driven by the demand for energy-efficient and aesthetically pleasing facades, is a major growth driver. Stringent building codes and environmental regulations also shape market dynamics. The market faces competition from alternative cladding materials, influencing material choices. The residential sector currently holds a significant share, although commercial construction also contributes substantially. Recent M&A activity, as seen with Wienerberger’s acquisition of Terreal assets, indicates ongoing consolidation and expansion within the industry.

- Market Concentration: Moderately concentrated, with the top 5 players holding an estimated xx% market share in 2025.

- Technological Innovation: Emphasis on sustainable materials, smart facades, and prefabrication technologies.

- Regulatory Framework: Stringent building codes influencing material selection and installation methods.

- Competitive Substitutes: Alternative cladding materials (e.g., brick, wood) pose competitive pressure.

- End-User Demographics: A mix of residential and commercial projects, with a growing focus on refurbishment projects.

- M&A Trends: Increased consolidation through acquisitions and mergers, signaling market maturity.

Italy Facade Market Growth Trends & Insights

The Italy facade market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx million units by 2033. This growth is fueled by a combination of factors, including rising construction activity, particularly in the residential and commercial sectors, and increasing demand for aesthetically pleasing and energy-efficient buildings. Adoption rates for advanced facade systems, like ventilated facades, are steadily increasing, driven by improved insulation and longevity. Technological disruptions such as the integration of Building Information Modeling (BIM) and the use of advanced materials are influencing construction techniques. Consumer behavior shifts are favoring sustainable and innovative facade solutions.

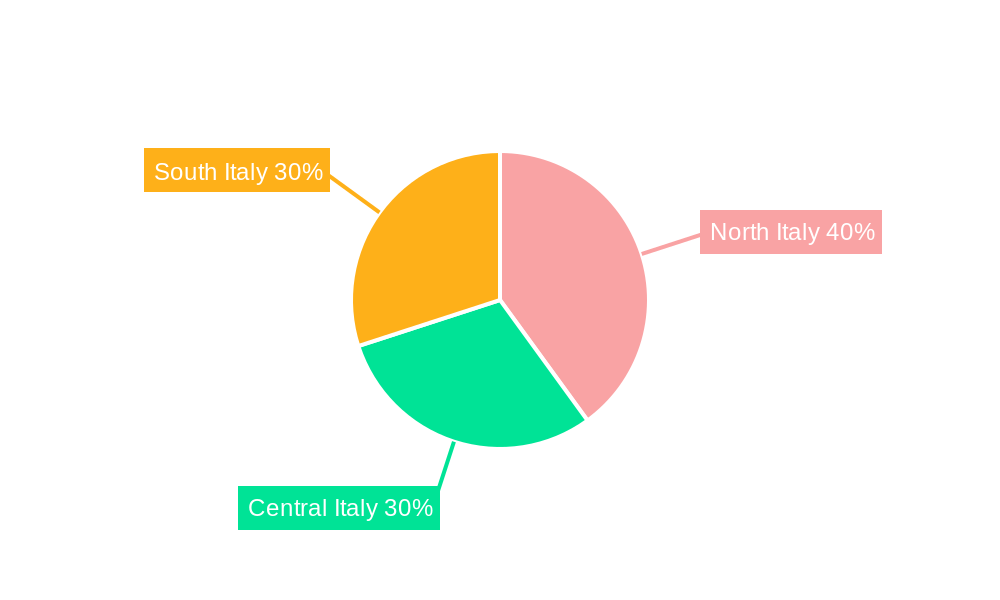

Dominant Regions, Countries, or Segments in Italy Facade Market

The Northern regions of Italy demonstrate the strongest growth in the facade market, driven by robust construction activity and higher disposable incomes. Within the segmentation, the commercial sector currently holds the largest market share due to large-scale infrastructure projects and high demand for modern office spaces. Ventilated facades are gaining popularity, driven by their energy-efficiency benefits and aesthetic appeal. The most dominant material category is currently Glass, followed by metal.

- Key Drivers:

- Strong construction activity in northern regions.

- Government initiatives promoting energy-efficient buildings.

- Increasing demand for aesthetically pleasing facades in the commercial sector.

- Dominance Factors:

- High concentration of construction projects in Northern regions.

- Preference for energy-efficient ventilated facades.

- Growing adoption of glass and metal materials.

- Increased government spending on infrastructure development.

Italy Facade Market Product Landscape

Product innovation in the Italian facade market is focused on enhancing energy efficiency, durability, and aesthetic appeal. Ventilated facades incorporating advanced insulation materials and smart building technologies are gaining traction. The use of sustainable and recycled materials is also becoming increasingly prevalent. Manufacturers are focusing on unique selling propositions, such as improved thermal performance, reduced maintenance requirements, and customizable designs. Technological advancements are evident in the integration of Building Information Modeling (BIM) and the adoption of advanced fabrication techniques.

Key Drivers, Barriers & Challenges in Italy Facade Market

Key Drivers:

- Rising construction activity, especially in residential and commercial sectors.

- Increasing focus on energy-efficient and sustainable building practices.

- Government initiatives promoting green buildings and infrastructure development.

- Advancements in facade technology and material science.

Key Challenges:

- Fluctuations in raw material prices impacting production costs.

- Skilled labor shortages in the construction industry.

- Stringent regulatory compliance requirements.

- Competition from traditional cladding materials.

Emerging Opportunities in Italy Facade Market

Emerging opportunities lie in the growing demand for sustainable and smart building facades. There is significant potential for growth in the refurbishment market, particularly with the retrofitting of existing buildings with energy-efficient facade systems. Innovative applications such as integrated solar panels and dynamic facades offer exciting prospects. The increasing awareness of environmental concerns among consumers is driving the demand for eco-friendly materials and technologies.

Growth Accelerators in the Italy Facade Market Industry

Long-term growth in the Italian facade market will be driven by technological breakthroughs leading to more energy-efficient, durable, and aesthetically pleasing facades. Strategic partnerships between facade manufacturers and construction companies will expedite the adoption of innovative products and technologies. Market expansion strategies targeting niche segments, such as historical preservation projects or high-end residential developments, will also contribute to market growth.

Key Players Shaping the Italy Facade Market Market

- ITALGRANITI GROUP S P A

- Cosentino S.A.

- Permasteelisa S p A

- ALIVA S r l

- BOLLINGER+GROHMANN INGEGNERIA S R L

- Arup

- BEMO SYSTEMS GmbH

- Bluesteel S r l

- Focchi S p A

- Ramboll Group A/S

- Aghito Zambonini S p a

- CANTORI S r l

- Wienerberger

- Zanetti Srl

- Incide Engineering SRL

Notable Milestones in Italy Facade Market Sector

- December 2022: Wienerberger's acquisition of key Terreal assets expands its production footprint and market reach within the building materials sector, including Italy.

- February 2022: Italian Radical Design's acquisition of Memphis Milano brings design innovation and historical expertise to the facade industry.

In-Depth Italy Facade Market Market Outlook

The Italy facade market is poised for continued growth driven by technological innovation, supportive government policies, and rising construction activity. Strategic investments in sustainable materials and energy-efficient technologies will shape the future of the market. The focus on smart building technologies and green construction practices will attract investors and further accelerate market growth. Opportunities for consolidation and strategic partnerships will continue to shape the competitive landscape.

Italy Facade Market Segmentation

-

1. Type

- 1.1. Ventilated

- 1.2. Non-Ventilated

- 1.3. Other Types

-

2. Material

- 2.1. Glass

- 2.2. Metal

- 2.3. Plastic and Fibres

- 2.4. Stones

- 2.5. Other Materials

-

3. End Users

- 3.1. Commercial

- 3.2. Residential

- 3.3. Other End-Users

Italy Facade Market Segmentation By Geography

- 1. Italy

Italy Facade Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 5.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Energy efficiency in construction; Flexibility and customization options

- 3.3. Market Restrains

- 3.3.1. Limited availability of suitable land for construction; Lower quality compared to traditional construction

- 3.4. Market Trends

- 3.4.1. Facade as An Environmental Architecture Propelling Market Growth in Italy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Facade Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ventilated

- 5.1.2. Non-Ventilated

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Glass

- 5.2.2. Metal

- 5.2.3. Plastic and Fibres

- 5.2.4. Stones

- 5.2.5. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ITALGRANITI GROUP S P A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cosentino S A**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Permasteelisa S p A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ALIVA S r l

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BOLLINGER+GROHMANN INGEGNERIA S R L

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arup

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BEMO SYSTEMS GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bluesteel S r l

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Focchi S p A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ramboll Group A/S

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Aghito Zambonini S p a

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 CANTORI S r l

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Wienerberger

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Zanetti Srl

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Incide Engineering SRL

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 ITALGRANITI GROUP S P A

List of Figures

- Figure 1: Italy Facade Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Facade Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Facade Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Italy Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: Italy Facade Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 5: Italy Facade Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Italy Facade Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Italy Facade Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Italy Facade Market Revenue Million Forecast, by Material 2019 & 2032

- Table 9: Italy Facade Market Revenue Million Forecast, by End Users 2019 & 2032

- Table 10: Italy Facade Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Facade Market?

The projected CAGR is approximately < 5.30%.

2. Which companies are prominent players in the Italy Facade Market?

Key companies in the market include ITALGRANITI GROUP S P A, Cosentino S A**List Not Exhaustive, Permasteelisa S p A, ALIVA S r l, BOLLINGER+GROHMANN INGEGNERIA S R L, Arup, BEMO SYSTEMS GmbH, Bluesteel S r l, Focchi S p A, Ramboll Group A/S, Aghito Zambonini S p a, CANTORI S r l, Wienerberger, Zanetti Srl, Incide Engineering SRL.

3. What are the main segments of the Italy Facade Market?

The market segments include Type, Material, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Energy efficiency in construction; Flexibility and customization options.

6. What are the notable trends driving market growth?

Facade as An Environmental Architecture Propelling Market Growth in Italy.

7. Are there any restraints impacting market growth?

Limited availability of suitable land for construction; Lower quality compared to traditional construction.

8. Can you provide examples of recent developments in the market?

December 2022: The Wienerberger Group, a top supplier of environmentally friendly construction materials and infrastructure solutions, announced that it has made an offer to Terreal's shareholders to purchase certain key assets of Terreal. The acquisition would cover Terreal's operations in France, Italy, Spain, and the United States, as well as Creaton's businesses in Germany and the Benelux, which Terreal acquired in 2020 and which collectively employ close to 3,000 people. After the deal, Wienerberger would add 29 new sites to its production footprint.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Facade Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Facade Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Facade Market?

To stay informed about further developments, trends, and reports in the Italy Facade Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence