Key Insights

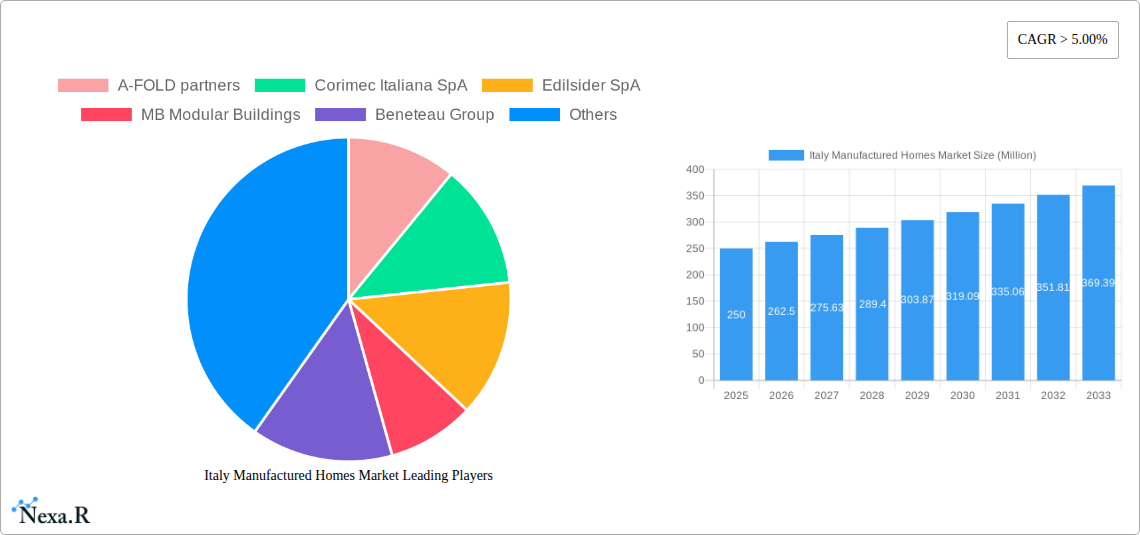

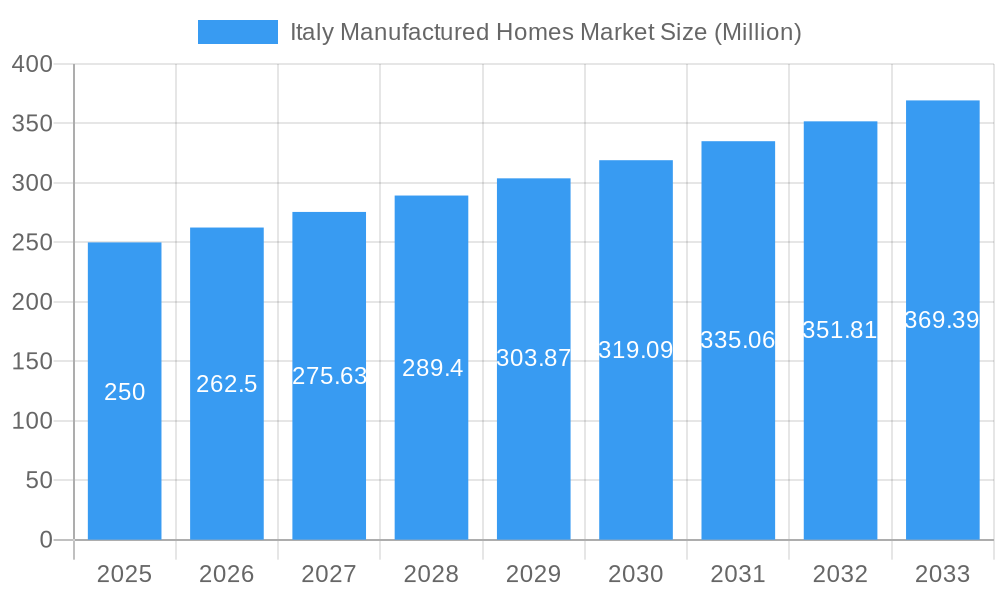

The Italian manufactured homes market, projected to reach 458.6 million by 2024 (base year), demonstrates significant expansion prospects. This growth is propelled by escalating demand for cost-effective housing solutions, accelerated urbanization, and government incentives promoting sustainable construction. The market is forecast to grow at a Compound Annual Growth Rate (CAGR) of 6.2% through 2032. Key drivers include the adoption of modular and prefabricated construction for faster project completion and reduced labor expenses, a growing consumer preference for energy-efficient and environmentally friendly residences, and increased investment in R&D for innovative building materials and technologies. Despite regulatory hurdles and potential supply chain issues, the market outlook remains favorable. The multi-family manufactured homes segment is anticipated to outpace single-family units, driven by the urgent need for affordable urban rental accommodations. Leading entities like A-FOLD partners and Corimec Italiana SpA are prioritizing innovation and expansion to leverage market opportunities, alongside a surge of smaller, innovative firms introducing novel designs and technologies.

Italy Manufactured Homes Market Market Size (In Million)

The increasing embrace of sustainable housing options further bolsters the Italian manufactured housing market's growth trajectory. Heightened consumer awareness regarding the environmental impact of conventional construction methods is stimulating demand for eco-friendly and energy-efficient manufactured homes, aligning with Italy's sustainable development objectives. The market is expected to segment further based on material choices, such as sustainable wood and recycled materials, and advancements in smart home technology. Intensified competition among established and emerging companies will foster innovation and enhance affordability. Government initiatives to simplify building permits and support affordable housing programs are critical for future market expansion. Moreover, potential collaborations between traditional builders and manufactured housing specialists offer substantial opportunities for shared growth and innovation.

Italy Manufactured Homes Market Company Market Share

Italy Manufactured Homes Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Italy manufactured homes market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and anyone seeking to understand the potential of this dynamic market segment within the broader European prefabricated housing sector.

Italy Manufactured Homes Market Dynamics & Structure

The Italian manufactured homes market, a segment of the wider European prefabricated construction industry, presents a complex interplay of factors influencing its growth trajectory. Market concentration is moderate, with several key players competing alongside numerous smaller, regional manufacturers. Technological innovation, particularly in sustainable building materials and construction techniques, is a significant driver, pushing towards energy-efficient and eco-friendly homes. Regulatory frameworks, encompassing building codes and environmental regulations, play a crucial role in shaping market dynamics, impacting both production and consumer preferences. The emergence of competitive substitutes, such as traditional construction methods, necessitates continuous innovation to maintain competitiveness. End-user demographics, including a growing younger population and an aging population seeking adaptable housing solutions, significantly influence demand. Finally, M&A activity within the sector has been relatively low (xx deals in the past 5 years), indicating opportunities for consolidation and market share expansion.

- Market Concentration: Moderate (xx% market share held by top 5 players)

- Technological Innovation: Focus on sustainable materials and energy efficiency.

- Regulatory Framework: Stringent building codes and environmental standards.

- Competitive Substitutes: Traditional construction methods.

- End-User Demographics: Shifting towards younger and older demographic segments.

- M&A Activity: Relatively low, with potential for future consolidation. (xx deals in the past 5 years)

Italy Manufactured Homes Market Growth Trends & Insights

The Italian manufactured homes market has witnessed steady growth in recent years, driven by factors such as increasing urbanization, affordability concerns, and a growing preference for faster construction times. The market size, estimated at xx million units in 2025, is projected to experience a CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. This growth is fueled by technological advancements, including the adoption of modular construction techniques and sustainable materials. Consumer behavior shifts towards environmentally friendly housing options and the desire for customizable homes further boost market expansion. Market penetration currently stands at xx%, with significant potential for future growth, especially in underserved regions. The adoption rate of prefabricated homes is increasing steadily, driven by factors such as reduced construction time and improved cost efficiency compared to traditional construction methods. Technological disruptions, such as 3D printing and advanced automation, are poised to further accelerate market growth and transform manufacturing processes.

Dominant Regions, Countries, or Segments in Italy Manufactured Homes Market

Northern Italy, particularly regions like Lombardy and Piedmont, currently dominates the manufactured homes market, driven by higher disposable incomes, robust infrastructure, and a high demand for housing in urban areas. The "Single Family" segment constitutes the largest share (xx%) of the market, reflecting the strong demand for individual homes, while the "Multi-family" segment is expected to witness significant growth in the coming years, driven by rising population density and the need for affordable housing solutions.

- Key Drivers in Northern Italy:

- High disposable incomes

- Robust infrastructure development

- Urbanization and increased housing demand

- Single Family Segment Dominance: Higher individual home demand

- Multi-family Segment Growth: Driven by urbanization and affordability needs.

Italy Manufactured Homes Market Product Landscape

The Italian manufactured homes market showcases a diverse product range, featuring single-family and multi-family units with varying sizes, designs, and functionalities. Significant innovations revolve around sustainable materials, such as cross-laminated timber (CLT) and recycled content, as well as improved energy efficiency features like smart home technology and advanced insulation systems. These improvements enhance product performance metrics, including reduced energy consumption and improved thermal comfort. Unique selling propositions emphasize speed of construction, customization options, and eco-friendly designs to cater to a diverse range of customer preferences.

Key Drivers, Barriers & Challenges in Italy Manufactured Homes Market

Key Drivers:

- Increasing urbanization and housing demand.

- Growing preference for sustainable and energy-efficient homes.

- Faster construction timelines compared to traditional methods.

- Government initiatives promoting sustainable building practices.

Key Challenges:

- Competition from traditional construction methods.

- Regulatory hurdles and bureaucratic processes.

- Supply chain disruptions impacting material availability and costs (xx% increase in material costs in 2022).

- Skilled labor shortages in the construction industry.

Emerging Opportunities in Italy Manufactured Homes Market

Emerging opportunities lie in tapping into underserved rural markets with affordable and adaptable housing solutions. Innovative applications, such as using manufactured homes for temporary housing solutions during natural disasters or for accommodating tourists, present significant growth potential. The increasing demand for eco-friendly and customizable housing options opens doors for manufacturers specializing in sustainable building materials and design flexibility.

Growth Accelerators in the Italy Manufactured Homes Market Industry

Technological breakthroughs in modular construction, such as 3D printing and advanced automation, are poised to dramatically accelerate market growth. Strategic partnerships between manufacturers, developers, and technology providers can foster innovation and drive market expansion. Moreover, government incentives and policies encouraging sustainable building practices are crucial in stimulating long-term growth.

Key Players Shaping the Italy Manufactured Homes Market Market

- A-FOLD partners

- Corimec Italiana SpA

- Edilsider SpA

- MB Modular Buildings

- Beneteau Group

- Wolf System Italy

- RI Group

- LEAPfactory SRL

- New House SpA

- Prefab SRL

- VPF Mobile Homes

- Sarda TMC

- Eureka Case Mobili

Notable Milestones in Italy Manufactured Homes Market Sector

- October 2022: Mask Architects unveils the world's first "Exosteel" modular prefabricated houses in Orani, Sardinia, demonstrating innovative design and sustainable construction.

- May 2022: Capreon's joint venture with FIDE plans to build 40 high-end apartments in Milan, indicating the market's expansion into high-end residential segments.

In-Depth Italy Manufactured Homes Market Market Outlook

The future of the Italian manufactured homes market is bright, driven by consistent growth in urbanization, rising demand for sustainable housing, and technological advancements. Strategic opportunities lie in capitalizing on market expansion into underserved regions and embracing innovative construction techniques. Focusing on sustainable materials and customizable designs will prove crucial for success. Continued government support and favorable regulatory frameworks will further solidify the market's long-term growth trajectory.

Italy Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multi-family

Italy Manufactured Homes Market Segmentation By Geography

- 1. Italy

Italy Manufactured Homes Market Regional Market Share

Geographic Coverage of Italy Manufactured Homes Market

Italy Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise in e-commerce and digitalization

- 3.3. Market Restrains

- 3.3.1. The Complexity of regulations and property ownership

- 3.4. Market Trends

- 3.4.1. Increasing Residential Real Estate Prices Demanding More Manufactured Homes Construction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Manufactured Homes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multi-family

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A-FOLD partners

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Corimec Italiana SpA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Edilsider SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MB Modular Buildings

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Beneteau Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wolf System Italy

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RI Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LEAPfactory SRL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 New House SpA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Prefab SRL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 VPF Mobile Homes**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sarda TMC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Eureka Case Mobili

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 A-FOLD partners

List of Figures

- Figure 1: Italy Manufactured Homes Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Italy Manufactured Homes Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Manufactured Homes Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Italy Manufactured Homes Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Italy Manufactured Homes Market Revenue million Forecast, by Type 2020 & 2033

- Table 4: Italy Manufactured Homes Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Manufactured Homes Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Italy Manufactured Homes Market?

Key companies in the market include A-FOLD partners, Corimec Italiana SpA, Edilsider SpA, MB Modular Buildings, Beneteau Group, Wolf System Italy, RI Group, LEAPfactory SRL, New House SpA, Prefab SRL, VPF Mobile Homes**List Not Exhaustive, Sarda TMC, Eureka Case Mobili.

3. What are the main segments of the Italy Manufactured Homes Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 458.6 million as of 2022.

5. What are some drivers contributing to market growth?

The Rise in e-commerce and digitalization.

6. What are the notable trends driving market growth?

Increasing Residential Real Estate Prices Demanding More Manufactured Homes Construction.

7. Are there any restraints impacting market growth?

The Complexity of regulations and property ownership.

8. Can you provide examples of recent developments in the market?

October 2022 - Mask Architects, based in Sardinia, Perugia, and Istanbul, designed the world's first "Exosteel" mother nature modular prefabricated living houses in Orani, Sardinia, Italy, led by Znur Pinar er and Danilo Petta. The "Mother Nature" project, designed for Nivola Museum visitors, tourists, and artists in Orani, consists of 14 modular houses. The house is made up of several organic branches that support the three floors of the building and a hollow central column that is inserted into the ground for one-third of its length.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the Italy Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence