Key Insights

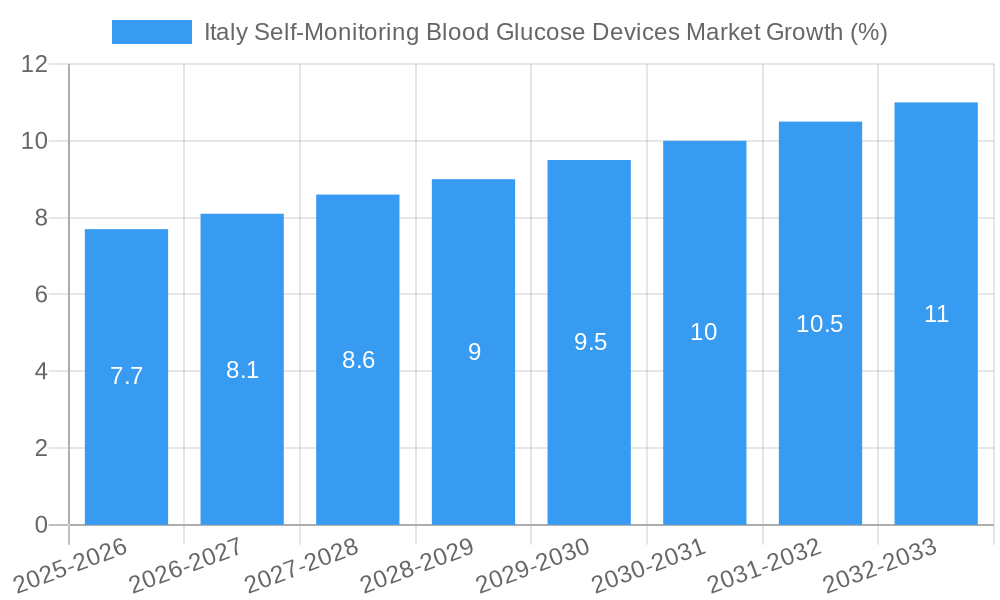

The Italy self-monitoring blood glucose (SMBG) devices market, valued at €120 million in 2025, is projected to experience robust growth, driven by the rising prevalence of diabetes and an aging population. A Compound Annual Growth Rate (CAGR) of 5.92% is anticipated from 2025 to 2033, indicating a significant market expansion. Key growth drivers include increased awareness of diabetes management, technological advancements in SMBG devices (such as improved accuracy and ease of use), and government initiatives promoting early detection and effective diabetes control. The market is segmented into glucometer devices, test strips, and lancets, with glucometer devices likely holding the largest market share due to their crucial role in diabetes management. Competitive pressures are significant, with major players like Roche Diabetes Care, Abbott Diabetes Care, and LifeScan vying for market share alongside smaller, specialized companies. While the exact market share of each company isn't available, competition will likely be intense given the technological advancements in SMBG devices and the ongoing need for cost-effective solutions. This dynamic environment presents opportunities for innovative companies offering advanced features and competitive pricing. The increasing demand for continuous glucose monitoring (CGM) systems might also affect the market dynamics in the coming years as a viable alternative to SMBG, although this remains a niche market segment currently. This growth is predicted despite potential restraints such as high healthcare costs and the availability of other diabetes management methods, especially for type 2 diabetes that often requires lifestyle and dietary changes.

The forecast period (2025-2033) is expected to witness a substantial increase in market value, fueled by ongoing technological improvements and increasing healthcare expenditure. This growth, however, may be moderated by factors such as the price sensitivity of consumers and the introduction of alternative diabetes management technologies. Nevertheless, considering the high prevalence of diabetes in Italy and the growing need for effective self-monitoring, the SMBG market in Italy is poised for continued expansion in the long term. Future growth is anticipated to stem from increased adoption of advanced technologies that provide greater convenience and accuracy, as well as tailored solutions to meet the diverse needs of the diabetic population. Regional variations within Italy might also influence market growth, with potentially higher demand in areas with higher diabetes prevalence.

Italy Self-Monitoring Blood Glucose Devices Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Italy Self-Monitoring Blood Glucose Devices market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. Focusing on the parent market of Medical Devices and the child market of Diabetes Management Devices, this report offers crucial insights for industry professionals, investors, and stakeholders seeking a thorough understanding of this vital sector. The report covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The market size is presented in million units.

Italy Self-Monitoring Blood Glucose Devices Market Market Dynamics & Structure

The Italy Self-Monitoring Blood Glucose Devices market is characterized by a moderate level of concentration, with key players such as Roche Diabetes Care, Abbott Diabetes Care, and LifeScan holding significant market share. Technological innovation, particularly in areas like continuous glucose monitoring (CGM) and connected devices, is a key driver. The regulatory framework, aligned with EU directives, plays a significant role in shaping market practices. Competitive substitutes, primarily in the form of alternative diabetes management technologies, pose a moderate challenge. The end-user demographic is primarily comprised of individuals with diabetes, with a growing elderly population driving demand. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with xx deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with top 3 players holding approximately xx% market share in 2024.

- Technological Innovation: Strong driver, with focus on CGM, mobile app integration, and improved accuracy.

- Regulatory Framework: Compliant with EU directives, influencing product approvals and market access.

- Competitive Substitutes: Alternative diabetes management technologies pose a moderate threat.

- End-User Demographics: Predominantly individuals with diabetes, with a growing elderly population.

- M&A Activity: xx deals recorded between 2019 and 2024, indicating moderate consolidation.

Italy Self-Monitoring Blood Glucose Devices Market Growth Trends & Insights

The Italy Self-Monitoring Blood Glucose Devices market experienced steady growth between 2019 and 2024, with a CAGR of xx%. This growth is attributed to increasing prevalence of diabetes, rising healthcare expenditure, and growing awareness of self-management techniques. Technological advancements, such as the introduction of more user-friendly and accurate devices, have further fueled market expansion. Adoption rates are expected to increase further, driven by the growing acceptance of connected health solutions and the rise in telemedicine. Market penetration is estimated at xx% in 2024 and projected to reach xx% by 2033. Consumer behavior is shifting towards preference for advanced features, such as data connectivity and mobile app integration.

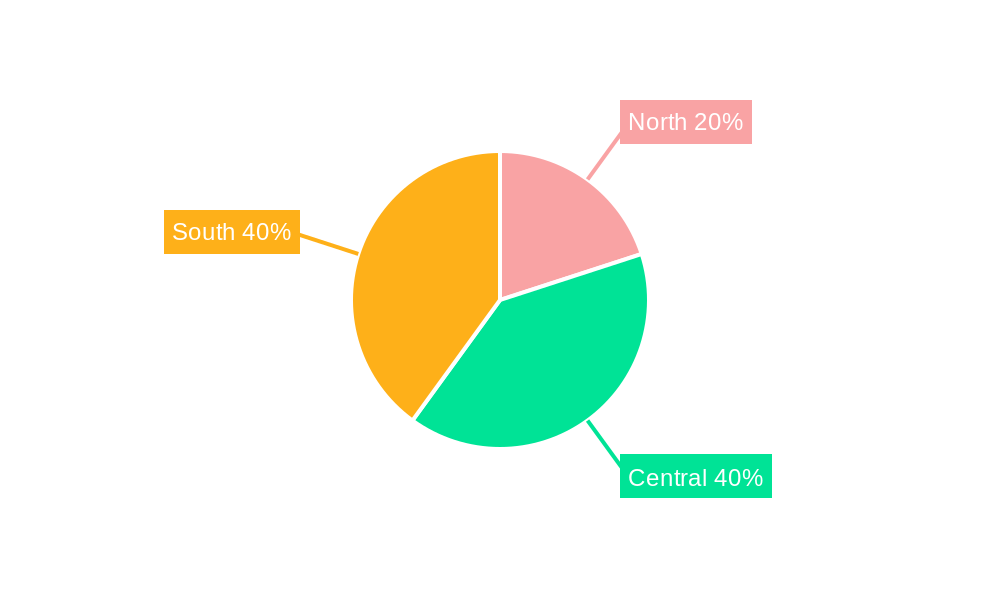

Dominant Regions, Countries, or Segments in Italy Self-Monitoring Blood Glucose Devices Market

The Northern region of Italy demonstrates the highest market share and growth potential within the Italy Self-Monitoring Blood Glucose Devices market. This dominance is driven by factors such as higher healthcare infrastructure development, greater physician awareness, and improved access to advanced healthcare technologies. Within the components, Test Strips represent the largest segment, followed by Glucometer Devices and Lancets.

Key Drivers in Northern Italy:

- Well-developed healthcare infrastructure

- Higher physician awareness and adoption of advanced technologies

- Strong government support for diabetes management programs.

Segment Dominance: Test Strips hold the largest market share due to recurring consumption patterns.

Italy Self-Monitoring Blood Glucose Devices Market Product Landscape

The Italy Self-Monitoring Blood Glucose Devices market showcases a diverse product landscape, encompassing traditional glucometers, advanced wireless connected devices, and integrated systems offering data management and remote monitoring capabilities. Innovation focuses on enhanced accuracy, smaller device size, and seamless integration with mobile health applications. Unique selling propositions often revolve around ease of use, accuracy, data connectivity features and integration with other health monitoring tools.

Key Drivers, Barriers & Challenges in Italy Self-Monitoring Blood Glucose Devices Market

Key Drivers: Rising prevalence of diabetes, increasing healthcare expenditure, technological advancements in device accuracy and connectivity, and government initiatives promoting self-management of chronic conditions are key drivers.

Challenges: High device cost, reimbursement challenges, and competition from alternative diabetes management technologies present significant barriers. Supply chain disruptions and regulatory complexities associated with obtaining market approval further complicate market dynamics.

Emerging Opportunities in Italy Self-Monitoring Blood Glucose Devices Market

Untapped potential lies in increasing penetration in rural areas, focusing on patient education programs, and expanding the use of connected devices for remote patient monitoring. The integration of AI and machine learning for improved data analysis and predictive capabilities represents another significant opportunity. The growth of telemedicine and remote monitoring services presents a further area of expansion.

Growth Accelerators in the Italy Self-Monitoring Blood Glucose Devices Market Industry

Technological breakthroughs, particularly in the area of continuous glucose monitoring (CGM), are anticipated to be major growth catalysts. Strategic partnerships between device manufacturers, healthcare providers, and technology companies will facilitate broader market penetration. The development of innovative value-added services and data analytics solutions targeting patient adherence and improved treatment outcomes promises significant market expansion.

Key Players Shaping the Italy Self-Monitoring Blood Glucose Devices Market Market

- Roche Diabetes Care

- Rossmax International Ltd

- Abbott Diabetes Care

- Bionime Corporation

- LifeScan

- Menarini

- Ascensia Diabetes Care

- Arkray Inc

Notable Milestones in Italy Self-Monitoring Blood Glucose Devices Market Sector

- January 2023: LifeScan published real-world data demonstrating improved glycemic control using a Bluetooth-connected blood glucose meter and a mobile diabetes app from over 144,000 people. This underscores the growing importance of integrated digital solutions.

- January 2022: Roche launched the Cobas Pulse point-of-care blood glucose monitor for hospital professionals, highlighting advancements in hospital-based glucose monitoring technology.

In-Depth Italy Self-Monitoring Blood Glucose Devices Market Market Outlook

The Italy Self-Monitoring Blood Glucose Devices market is poised for continued growth, driven by technological advancements, expanding adoption of digital health solutions, and a growing emphasis on patient-centric care. Strategic investments in R&D, innovative product launches, and partnerships to enhance market access will shape the future of this dynamic sector. The market is projected to reach xx million units by 2033, presenting significant opportunities for both established players and new entrants.

Italy Self-Monitoring Blood Glucose Devices Market Segmentation

-

1. Component

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

Italy Self-Monitoring Blood Glucose Devices Market Segmentation By Geography

- 1. Italy

Italy Self-Monitoring Blood Glucose Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.92% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in Italy

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Self-Monitoring Blood Glucose Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Roche Diabetes Care

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rossmax International Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Abbott Diabetes Care

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bionime Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LifeScan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Other Company Share Analyse

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Menarini

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 7 COMPETITIVE LANDSCAPE7 1 COMPANY PROFILES

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ascensia Diabetes Care

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Arkray Inc *List Not Exhaustive 7 2 COMPANY SHARE ANALYSIS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Roche Diabetes Care

List of Figures

- Figure 1: Italy Self-Monitoring Blood Glucose Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italy Self-Monitoring Blood Glucose Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Italy Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italy Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Italy Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Italy Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Component 2019 & 2032

- Table 5: Italy Self-Monitoring Blood Glucose Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Self-Monitoring Blood Glucose Devices Market?

The projected CAGR is approximately 5.92%.

2. Which companies are prominent players in the Italy Self-Monitoring Blood Glucose Devices Market?

Key companies in the market include Roche Diabetes Care, Rossmax International Ltd, Abbott Diabetes Care, Bionime Corporation, LifeScan, Other Company Share Analyse, Menarini, 7 COMPETITIVE LANDSCAPE7 1 COMPANY PROFILES, Ascensia Diabetes Care, Arkray Inc *List Not Exhaustive 7 2 COMPANY SHARE ANALYSIS.

3. What are the main segments of the Italy Self-Monitoring Blood Glucose Devices Market?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in Italy.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

January 2023: LifeScan announced that the peer-reviewed Journal of Diabetes Science and Technology published Improved Glycemic Control Using a Bluetooth Connected Blood Glucose Meter and a Mobile Diabetes App: Real-World Evidence From Over 144,000 People With Diabetes, detailing results from a retrospective analysis of real-world data from over 144,000 people with diabetes - one of the largest combined blood glucose meter and mobile diabetes app datasets ever published.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Self-Monitoring Blood Glucose Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Self-Monitoring Blood Glucose Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Self-Monitoring Blood Glucose Devices Market?

To stay informed about further developments, trends, and reports in the Italy Self-Monitoring Blood Glucose Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence