Key Insights

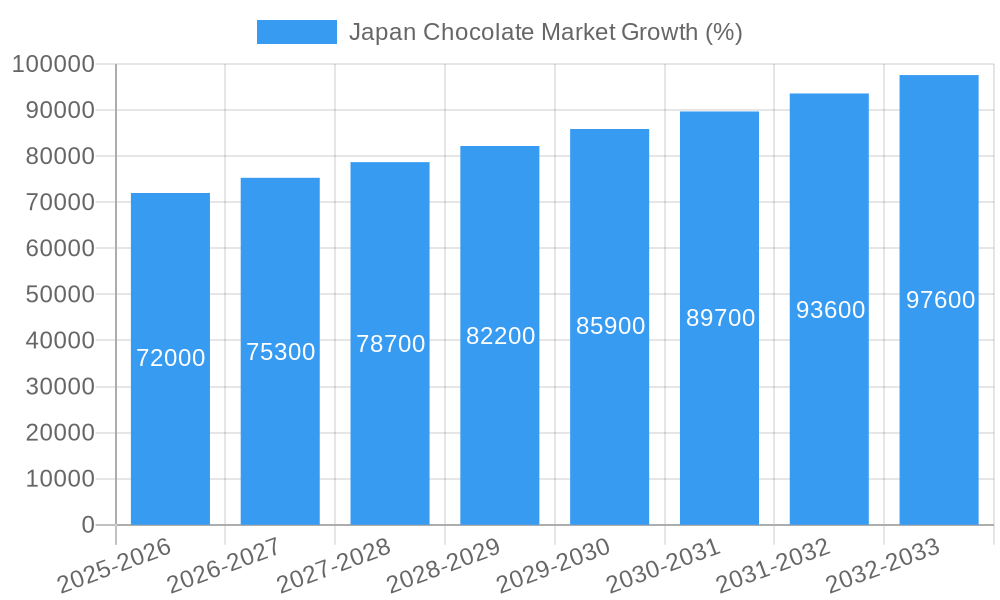

The Japan chocolate market, valued at approximately ¥1.5 trillion (assuming a market size "XX" of around $10 Billion USD in 2025, converted to Japanese Yen at an average exchange rate) in 2025, is projected to experience steady growth at a Compound Annual Growth Rate (CAGR) of 4.80% from 2025 to 2033. This growth is driven by several key factors. Rising disposable incomes, particularly amongst younger demographics, fuel increased spending on premium chocolate products and innovative confectionery variants. The popularity of gifting chocolate during holidays like Valentine's Day and Christmas continues to be a significant market driver. Furthermore, the expansion of online retail channels offers convenient access to a broader range of chocolate products, fueling market expansion. Trends such as the growing demand for healthier chocolate options (e.g., dark chocolate with high cocoa content, reduced sugar options) and the increasing popularity of unique flavors and artisanal chocolates are shaping consumer preferences and influencing product development strategies.

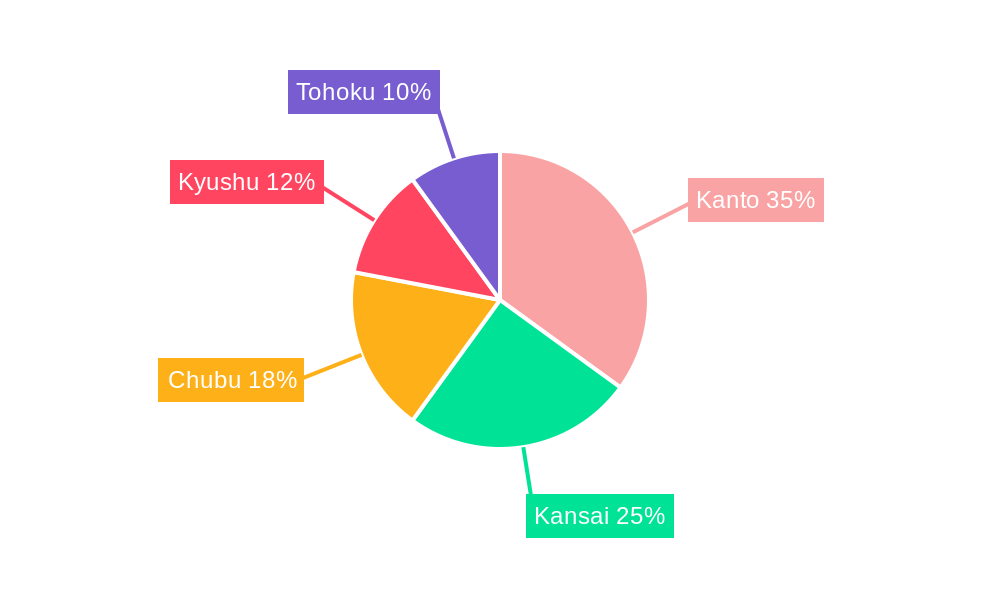

However, the market faces some restraints. Fluctuations in cocoa bean prices and potential economic downturns could impact affordability and consumer spending. Intense competition among established domestic and international players, including Nestlé SA, Lindt & Sprüngli AG, and Meiji Holdings Company Ltd, necessitates continuous innovation and effective marketing strategies to maintain market share. The segmentation of the market reveals strong performance across different distribution channels, with convenience stores and supermarkets/hypermarkets dominating, but the online retail sector is showing substantial growth potential. Regional variations exist within Japan, with Kanto and Kansai regions likely leading the market due to higher population density and economic activity. The market's future trajectory depends heavily on adapting to evolving consumer preferences, managing supply chain costs, and leveraging digital platforms for growth.

Japan Chocolate Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Japan chocolate market, covering market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. With a focus on both parent and child markets (confectionery and specific chocolate variants), this report is essential for industry professionals, investors, and anyone seeking to understand this dynamic sector. The report utilizes data from 2019-2024 (Historical Period), with the base year set at 2025 and a forecast period extending to 2033 (Study Period: 2019–2033, Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025–2033). Market values are presented in million units.

Japan Chocolate Market Dynamics & Structure

The Japanese chocolate market is a mature yet dynamic landscape characterized by intense competition, technological advancements, and evolving consumer preferences. Market concentration is relatively high, with several major players dominating market share. Technological innovations, such as improved production processes and sustainable sourcing initiatives, are key drivers, while stringent regulatory frameworks concerning food safety and labeling impact market operations. The market also faces competition from substitute products like confectionery and healthier snack options. End-user demographics, particularly shifting age groups and evolving consumption habits (e.g., increasing demand for premium and specialized chocolates), are crucial factors.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- M&A Activity: An average of xx M&A deals occurred annually during the historical period (2019-2024), primarily focused on expanding product portfolios and market reach.

- Innovation Barriers: High R&D costs and stringent regulatory approval processes create significant barriers to entry for new players.

- Regulatory Framework: Japan's strict food safety regulations impact product development and ingredient sourcing.

- Substitute Products: Growing popularity of healthier snack alternatives poses a challenge to chocolate market growth.

Japan Chocolate Market Growth Trends & Insights

The Japan chocolate market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to several factors, including increasing disposable incomes, changing consumer preferences towards premium and specialized chocolate varieties (e.g., dark chocolate), and the expansion of e-commerce channels. Technological advancements in production and packaging have also boosted efficiency and enhanced product appeal. However, economic downturns and health-conscious consumer trends have presented challenges. Market penetration for premium chocolate segments is expected to rise to xx% by 2033. The adoption rate of online retail channels is accelerating, creating significant growth opportunities.

Dominant Regions, Countries, or Segments in Japan Chocolate Market

The Kanto region consistently leads the market due to higher population density and stronger purchasing power. Among confectionery variants, milk and white chocolate still hold the largest market share, but dark chocolate is experiencing faster growth, driven by health-conscious consumers. Supermarkets/hypermarkets remain the dominant distribution channel, but online retail is witnessing rapid expansion, particularly for premium chocolate brands.

- Kanto Region Dominance: Higher population density and disposable incomes drive robust sales.

- Milk & White Chocolate: Traditional preferences maintain the largest segment share.

- Dark Chocolate Growth: Health trends fuel increasing demand for healthier chocolate options.

- Supermarket/Hypermarket Channel: Traditional retail maintains significant market share.

- Online Retail Expansion: E-commerce channels show the fastest growth rate.

Japan Chocolate Market Product Landscape

The Japanese chocolate market offers a diverse range of products, from mass-market to premium offerings. Product innovation focuses on unique flavors, textures, and ethically sourced ingredients, responding to consumer demands for premium quality and unique experiences. Technological advancements include improved chocolate processing techniques and sustainable packaging solutions. Companies are differentiating products through unique selling propositions (USPs), such as organic certification, fair-trade labeling, or innovative flavor combinations.

Key Drivers, Barriers & Challenges in Japan Chocolate Market

Key Drivers:

- Rising disposable incomes and increasing purchasing power.

- Growing demand for premium and specialized chocolates.

- Expansion of online retail channels and e-commerce platforms.

- Technological advancements in chocolate production and packaging.

Challenges:

- Intense competition among established and emerging players.

- Fluctuating raw material prices (e.g., cocoa beans).

- Stringent regulatory standards and compliance costs.

- Growing consumer preference for healthier alternatives.

- Supply chain disruptions (e.g., xx% impact on chocolate production due to xx in 2022).

Emerging Opportunities in Japan Chocolate Market

- Expanding the market for functional chocolates with added health benefits (e.g., probiotics).

- Targeting niche consumer segments (e.g., vegan, gluten-free).

- Exploring innovative packaging solutions for enhanced shelf life and sustainability.

- Leveraging e-commerce platforms for direct-to-consumer sales and brand building.

Growth Accelerators in the Japan Chocolate Market Industry

The Japan chocolate market's long-term growth will be propelled by continued innovation in product development, focusing on unique flavors and health-conscious formulations. Strategic partnerships and collaborations within the supply chain will enhance efficiency and sustainability. Expansion into new market segments and distribution channels, particularly e-commerce, will further fuel growth.

Key Players Shaping the Japan Chocolate Market Market

- Nestlé SA

- Chocoladefabriken Lindt & Sprüngli AG

- Ezaki Glico Co Ltd

- Morinaga & Co Ltd

- Ferrero International SA

- Mars Incorporated

- Yıldız Holding A.Ş.

- Lotte Corporation

- Yuraku Confectionery Co Ltd

- Mondelēz International Inc

- Meiji Holdings Company Ltd

- Fujiya Co Ltd

- The Hershey Company

- ROYCE' Confect Co Ltd

Notable Milestones in Japan Chocolate Market Sector

- August 2023: Lotte Corporation partnered with DLT Labs to enhance cacao bean supply chain sustainability and traceability using blockchain technology.

- November 2022: Godiva launched its Limited Edition Holiday Gold Collection.

- June 2022: Ferrero expanded its Kinder Joy portfolio in India with the launch of Kinder Joy ‘Natoons’.

In-Depth Japan Chocolate Market Market Outlook

The future of the Japan chocolate market is promising, driven by evolving consumer preferences, technological advancements, and strategic initiatives by key players. The market is poised for sustained growth, with opportunities in premium segments, e-commerce channels, and innovative product formulations. Strategic partnerships and investments in sustainable sourcing will play a crucial role in shaping the market's future.

Japan Chocolate Market Segmentation

-

1. Confectionery Variant

- 1.1. Dark Chocolate

- 1.2. Milk and White Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Japan Chocolate Market Segmentation By Geography

- 1. Japan

Japan Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Influence of Endorsements

- 3.2.2 Aggressive Marketing

- 3.2.3 and Strategic Investments; Demand for Sustainable Chocolates and Single Origin Certified Chocolates

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products; Fluctuating Price of Raw Materials

- 3.4. Market Trends

- 3.4.1 Increasing networking of stores benefits the supermarkets/hypermarkets and convenience stores

- 3.4.2 making almost 70% of the value share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Dark Chocolate

- 5.1.2. Milk and White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. Kanto Japan Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Nestlé SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chocoladefabriken Lindt & Sprüngli AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ezaki Glico Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Morinaga & Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ferrero International SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mars Incorporated

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Yıldız Holding A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lotte Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Yuraku Confectionery Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mondelēz International Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Meiji Holdings Company Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Fujiya Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 The Hershey Company

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ROYCE' Confect Co Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Nestlé SA

List of Figures

- Figure 1: Japan Chocolate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Chocolate Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Chocolate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Chocolate Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 3: Japan Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Japan Chocolate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Kanto Japan Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Kansai Japan Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Chubu Japan Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kyushu Japan Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tohoku Japan Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Japan Chocolate Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 12: Japan Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Japan Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Chocolate Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the Japan Chocolate Market?

Key companies in the market include Nestlé SA, Chocoladefabriken Lindt & Sprüngli AG, Ezaki Glico Co Ltd, Morinaga & Co Ltd, Ferrero International SA, Mars Incorporated, Yıldız Holding A, Lotte Corporation, Yuraku Confectionery Co Ltd, Mondelēz International Inc, Meiji Holdings Company Ltd, Fujiya Co Ltd, The Hershey Company, ROYCE' Confect Co Ltd.

3. What are the main segments of the Japan Chocolate Market?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements. Aggressive Marketing. and Strategic Investments; Demand for Sustainable Chocolates and Single Origin Certified Chocolates.

6. What are the notable trends driving market growth?

Increasing networking of stores benefits the supermarkets/hypermarkets and convenience stores. making almost 70% of the value share.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products; Fluctuating Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

August 2023: Lotte Corporation partnered with DLT Labs to promote sustainability and ethical practices in the cacao bean supply chain. Lotte is commencing its pilot project on the traceability of cacao beans from Ghana and child labor monitoring using blockchain technology.November 2022: Godiva launched its Limited Edition Holiday Gold Collection with a new festive design.June 2022: Kinder Joy, the confectionery brand of Ferrero, announced its portfolio expansion in India with the launch of Kinder Joy ‘Natoons' emphasizing on the purpose of ‘Learning about Animals’ for kids. Kinder Joy has partnered with Discovery Channel to showcase toy figures of animals such as Moorish Idols, Whales, Killer Whales, Tortoises, Macaw Yellow, Macaw Blue, Toucans, Turtle, Porcupines, Armadillo, Seal, and Basilisk.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Chocolate Market?

To stay informed about further developments, trends, and reports in the Japan Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence