Key Insights

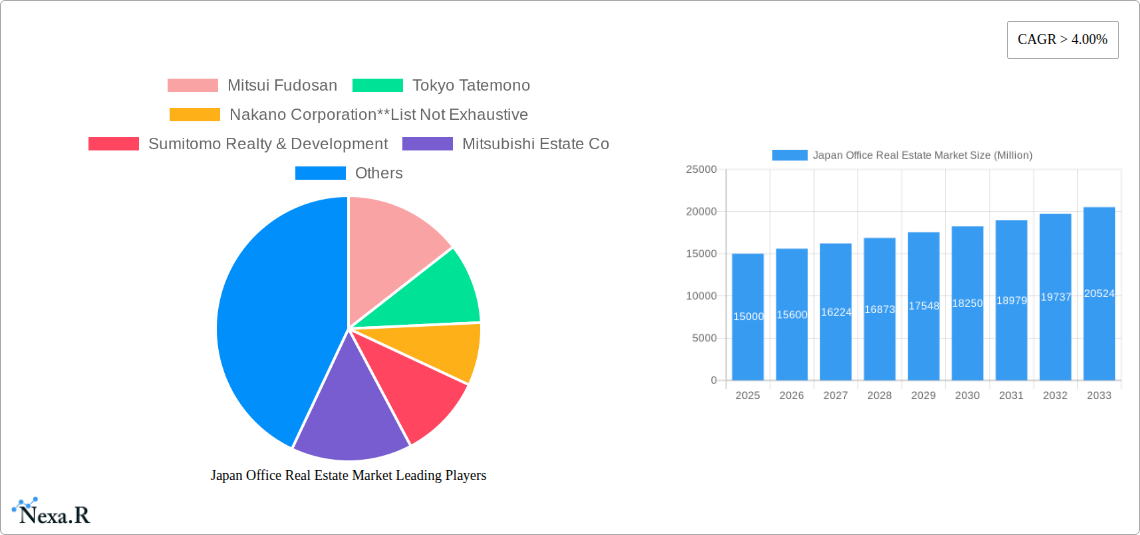

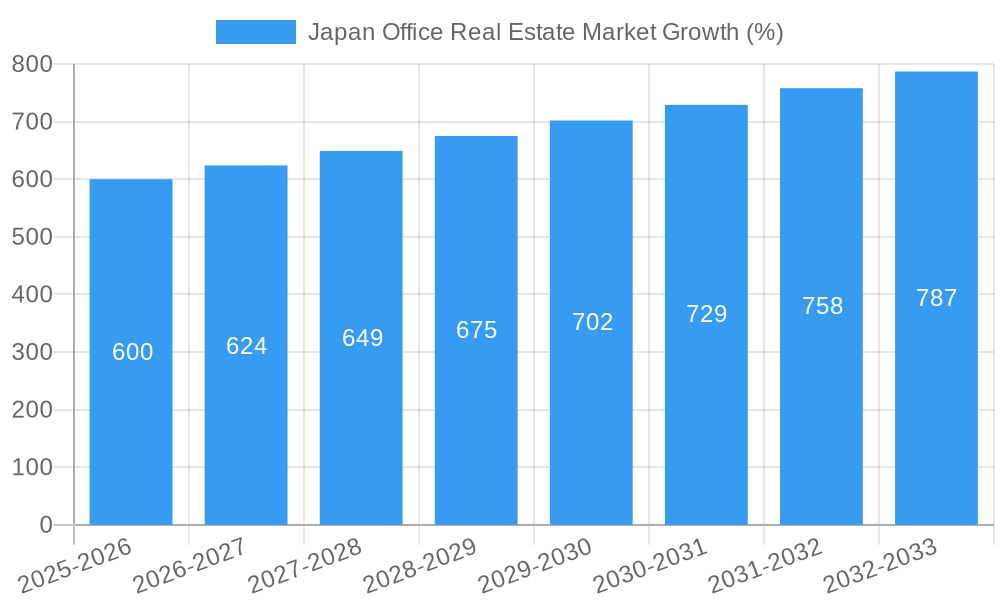

The Japan office real estate market, valued at approximately ¥15 trillion (assuming a market size "XX" in the millions translates to this order of magnitude based on typical market values for major economies) in 2025, is projected to experience robust growth with a compound annual growth rate (CAGR) exceeding 4% from 2025 to 2033. This expansion is driven by several key factors. Firstly, Japan's sustained economic recovery, coupled with increasing foreign direct investment, fuels demand for modern and efficient office spaces, particularly in major metropolitan areas like Tokyo and Kyoto. Secondly, the ongoing shift towards flexible work arrangements and the rise of co-working spaces are reshaping the office landscape, leading to a higher demand for adaptable and technologically advanced buildings. Thirdly, government initiatives promoting urban redevelopment and infrastructure improvements further contribute to market dynamism. However, challenges persist, including a potential oversupply in certain submarkets and fluctuations in interest rates which can affect investment and development.

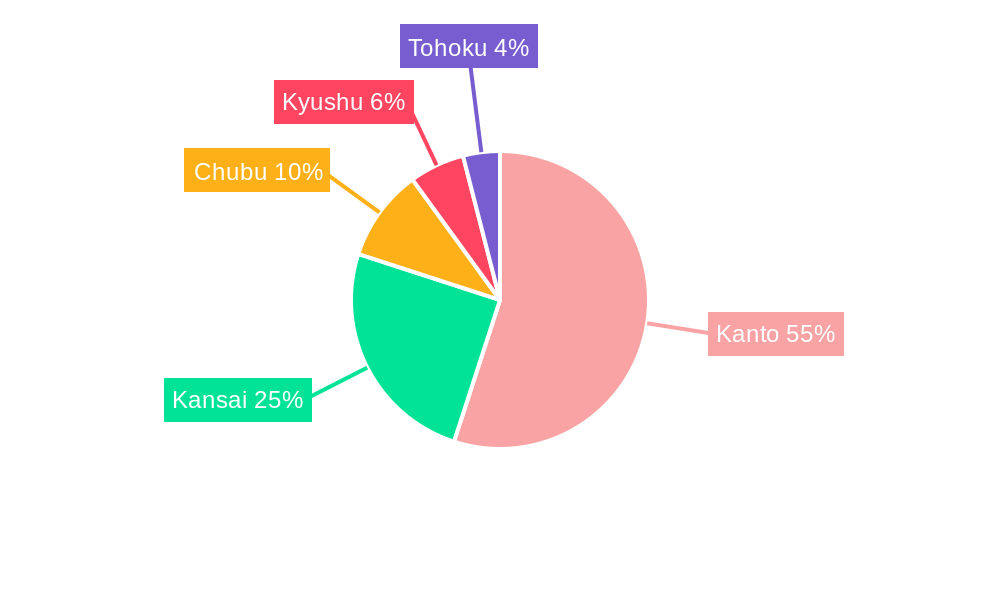

The market segmentation reveals Tokyo's dominance, followed by Kyoto, with the "Rest of Japan" segment exhibiting steady, though slower growth. Leading players such as Mitsui Fudosan, Tokyo Tatemono, and Sumitomo Realty & Development are strategically positioned to capitalize on these trends through acquisitions, new developments, and portfolio diversification. Regional variations exist, with the Kanto region (including Tokyo) commanding the largest market share, followed by Kansai (including Kyoto) and other regions. The forecast period (2025-2033) anticipates continued growth, albeit with potential variations based on macroeconomic conditions and evolving tenant preferences. Strategic investments in sustainable and technologically advanced buildings are likely to garner higher returns in this dynamic market.

Japan Office Real Estate Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Japan office real estate market, covering market dynamics, growth trends, key players, and future outlook. With a focus on the parent market (Japan Real Estate) and child market (Office Real Estate), this report offers invaluable insights for investors, developers, and industry professionals. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. Market values are presented in millions.

Japan Office Real Estate Market Dynamics & Structure

The Japanese office real estate market exhibits a concentrated structure, with major players like Mitsui Fudosan, Mitsui Fudosan, Tokyo Tatemono, Nakano Corporation, Sumitomo Realty & Development, Mitsubishi Estate Co, Mori Trust, Hulic, Mori Building, Nomura Real Estate Holdings, and Tokyu Land Corporation holding significant market share. The market's dynamics are shaped by technological innovation (e.g., smart building technologies, PropTech), stringent regulatory frameworks, and the increasing adoption of flexible workspaces. Competition exists from alternative office solutions, such as co-working spaces. End-user demographics are evolving, with a growing demand for sustainable and technologically advanced office spaces. M&A activity remains moderate, with approximately xx million USD in deal volume during 2019-2024, representing an average annual growth rate of xx%.

- Market Concentration: Top 10 players account for approximately xx% of the market.

- Technological Innovation: Smart building technology adoption is growing at xx% annually.

- Regulatory Framework: Stringent building codes and environmental regulations.

- Competitive Substitutes: Growth of co-working spaces and remote work options.

- End-User Demographics: Shift towards smaller, more flexible workspaces.

- M&A Trends: Consolidation expected to increase in the forecast period.

Japan Office Real Estate Market Growth Trends & Insights

The Japanese office real estate market experienced a period of xx% CAGR from 2019 to 2024, reaching a market size of xx million in 2024. This growth was fueled by factors including sustained economic growth in certain sectors and increasing demand for modern office spaces, particularly in major cities. However, the market faced challenges from the COVID-19 pandemic, leading to a temporary slowdown in 2020 and 2021. The subsequent recovery has been uneven, with varying adoption rates of flexible work models across different industries. Consumer behavior shifts toward hybrid work models are reshaping demand, impacting the types and sizes of office spaces in demand. The forecast period (2025-2033) projects a CAGR of xx%, reaching a market size of xx million by 2033. This growth will be driven by ongoing technological advancements and a gradual return to in-office work, albeit in a more flexible format.

Dominant Regions, Countries, or Segments in Japan Office Real Estate Market

Tokyo remains the dominant region within the Japanese office real estate market, commanding over xx% of the market share. This dominance is attributed to its status as Japan's economic and financial center, attracting numerous multinational corporations and domestic businesses. Kyoto, while smaller in size, exhibits a robust and growing office market driven by tourism and a significant presence of technology companies. The rest of Japan comprises a more fragmented market with varying growth rates depending on regional economic performance and infrastructure development. Key drivers for Tokyo include robust economic policies, well-developed infrastructure, and a highly skilled workforce. Kyoto benefits from its cultural significance and a growing tech sector.

- Tokyo: Strong economic activity, excellent infrastructure, and high concentration of businesses.

- Kyoto: Growing technology sector and tourism contribute to office space demand.

- Rest of Japan: Growth depends on regional economic performance and infrastructure investments.

Japan Office Real Estate Market Product Landscape

The Japanese office real estate market offers a range of products, from traditional high-rise office buildings to modern, flexible co-working spaces and sustainable green buildings. Recent innovations include smart building technologies improving energy efficiency and enhancing tenant experience. Performance metrics, such as occupancy rates and rental yields, vary across different regions and building types. Unique selling propositions include prime locations, sophisticated amenities, and technological integration.

Key Drivers, Barriers & Challenges in Japan Office Real Estate Market

Key Drivers: Strong economic fundamentals in Japan, increasing demand for modern office spaces, technological advancements (smart building technologies), and government initiatives promoting sustainable development.

Key Challenges: High construction costs, land scarcity in major cities, increasing competition from alternative work arrangements (remote work, co-working spaces), and potential economic slowdowns. The impact of these challenges on the market is estimated to reduce annual growth by approximately xx percentage points.

Emerging Opportunities in Japan Office Real Estate Market

Emerging opportunities include the increasing demand for sustainable and energy-efficient office buildings, the growth of co-working spaces catering to specific industry needs, and the development of smart building technologies integrating IoT and AI. Untapped markets exist in regional cities with potential for growth through infrastructure development and attracting new businesses.

Growth Accelerators in the Japan Office Real Estate Market Industry

Technological advancements in building management systems and the adoption of sustainable design principles are key growth accelerators. Strategic partnerships between developers and technology companies are fostering innovation. Expansion into regional cities and offering flexible lease terms to meet evolving tenant demands are also critical for growth.

Key Players Shaping the Japan Office Real Estate Market Market

- Mitsui Fudosan

- Tokyo Tatemono

- Nakano Corporation

- Sumitomo Realty & Development

- Mitsubishi Estate Co

- Mori Trust

- Hulic

- Mori Building

- Nomura Real Estate Holdings

- Tokyu Land Corporation

Notable Milestones in Japan Office Real Estate Market Sector

- 2020: Impact of the COVID-19 pandemic leads to a temporary slowdown in market activity.

- 2022: Increased focus on sustainable building practices and technological integration in new developments.

- 2023: Several significant M&A deals reshape the competitive landscape. (Specific details need to be added based on data.)

In-Depth Japan Office Real Estate Market Market Outlook

The Japanese office real estate market is poised for continued growth, driven by technological innovation and evolving tenant demands. Strategic investments in sustainable infrastructure and flexible workspaces will be crucial for success. The market's future potential hinges on adapting to changing work styles and effectively managing economic fluctuations. Opportunities for growth exist in regional markets and in the development of specialized office spaces catering to specific industry needs.

Japan Office Real Estate Market Segmentation

-

1. Key Cities

- 1.1. Tokyo

- 1.2. Kyoto

- 1.3. Rest of Japan

Japan Office Real Estate Market Segmentation By Geography

- 1. Japan

Japan Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urbanization is driving the market4.; Government Initiatives Actively promoting the Construction Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Infrastructure4.; Shortage of Skilled Labours

- 3.4. Market Trends

- 3.4.1. Rise in Start-ups Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 5.1.1. Tokyo

- 5.1.2. Kyoto

- 5.1.3. Rest of Japan

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 6. Kanto Japan Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Mitsui Fudosan

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tokyo Tatemono

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nakano Corporation**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sumitomo Realty & Development

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mitsubishi Estate Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mori Trust

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hulic

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mori Building

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nomura Real Estate Holdings

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tokyu Land Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Mitsui Fudosan

List of Figures

- Figure 1: Japan Office Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Office Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Office Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 3: Japan Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Japan Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Kanto Japan Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Kansai Japan Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Chubu Japan Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Kyushu Japan Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tohoku Japan Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Office Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 11: Japan Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Office Real Estate Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Japan Office Real Estate Market?

Key companies in the market include Mitsui Fudosan, Tokyo Tatemono, Nakano Corporation**List Not Exhaustive, Sumitomo Realty & Development, Mitsubishi Estate Co, Mori Trust, Hulic, Mori Building, Nomura Real Estate Holdings, Tokyu Land Corporation.

3. What are the main segments of the Japan Office Real Estate Market?

The market segments include Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urbanization is driving the market4.; Government Initiatives Actively promoting the Construction Activities.

6. What are the notable trends driving market growth?

Rise in Start-ups Driving the Market.

7. Are there any restraints impacting market growth?

4.; Limited Infrastructure4.; Shortage of Skilled Labours.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Japan Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence