Key Insights

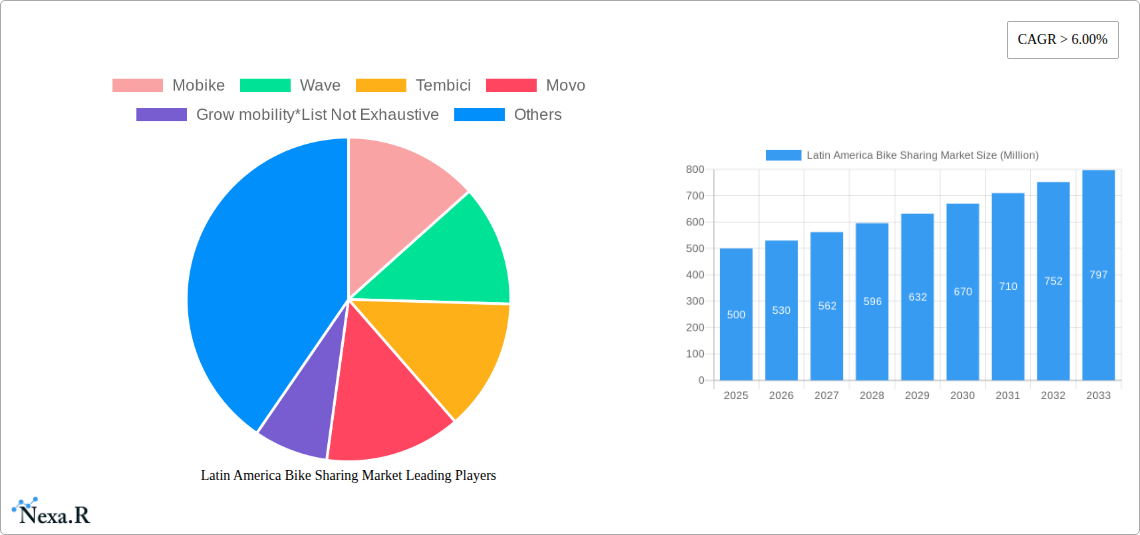

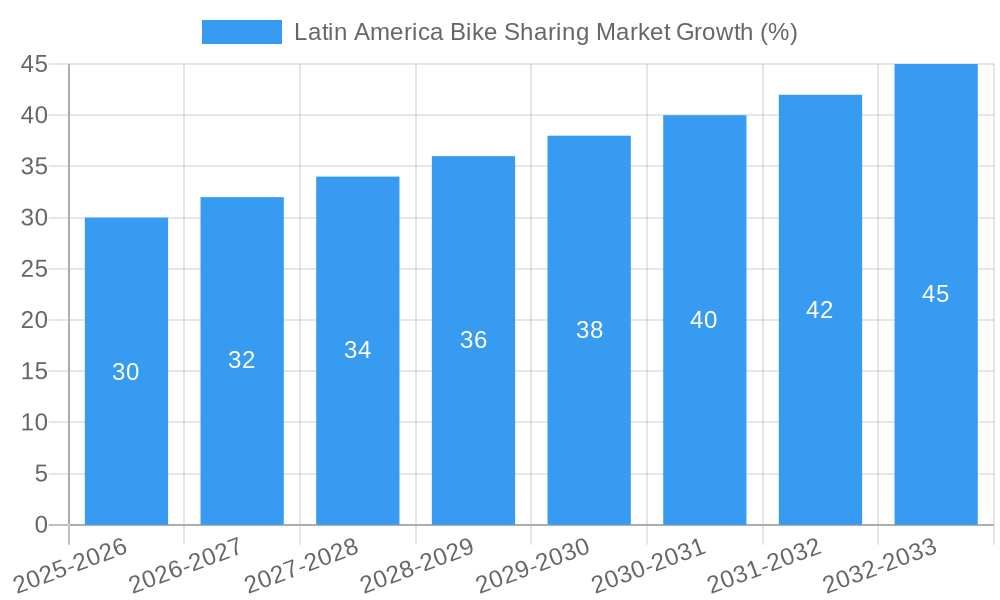

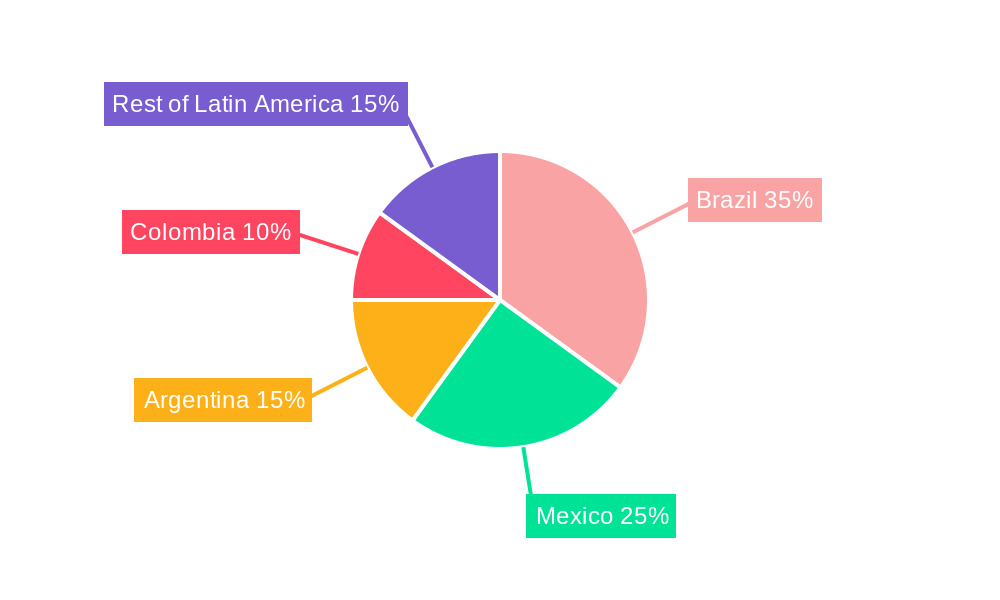

The Latin American bike-sharing market is experiencing robust growth, driven by increasing urbanization, rising environmental awareness, and the adoption of innovative technologies. The market, valued at approximately $X million in 2025 (assuming a reasonable market size based on a 6% CAGR from a prior year), is projected to expand significantly over the forecast period (2025-2033). This growth is fueled by the increasing popularity of both traditional bicycles and e-bikes, particularly within rapidly expanding urban centers across Brazil, Mexico, Argentina, and Colombia. The rise of dockless systems contributes to this expansion, offering greater convenience and accessibility to users. However, challenges remain, including infrastructure limitations in some regions, fluctuating fuel prices impacting e-bike operation costs, and the need for robust regulatory frameworks to ensure sustainable market development. Successful operators, such as Mobike, Tembici, and others, are focusing on strategic partnerships with local governments, expanding their service areas, and enhancing their technological capabilities, including integrated mobile payment systems and improved bike maintenance. The segmentation by bike type and sharing system type allows for a granular understanding of market dynamics, informing strategic investment decisions. Growth is expected to be most pronounced in larger metropolitan areas with robust public transit systems that complement bike-sharing programs.

Further expansion depends on several factors, including successful integration with existing public transit networks, the adoption of innovative pricing models and subscription services, and addressing safety concerns through robust user education and improved infrastructure. The continued expansion of e-bike adoption, driven by government incentives and consumer preference for electric mobility solutions, will also contribute to market growth. While the "Rest of Latin America" segment shows potential, it lags behind the larger markets due to varying levels of infrastructure development and economic conditions. Consequently, strategic focus should be placed on establishing a strong regulatory environment across the region that fosters responsible and sustainable bike-sharing operations.

Latin America Bike Sharing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America bike-sharing market, encompassing its current state, future trends, and key players. With a focus on market segmentation by bike type (traditional/regular bikes and e-bikes), sharing system type (docked and dockless), and country (Brazil, Argentina, Mexico, Colombia, and Rest of Latin America), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

Latin America Bike Sharing Market Dynamics & Structure

This section analyzes the Latin American bike-sharing market's structure, revealing its competitive landscape and key dynamics. We delve into market concentration, identifying the leading players and their respective market shares. Technological innovations, regulatory frameworks, and the presence of competitive substitutes are examined to understand their influence on market growth. Furthermore, we explore end-user demographics, pinpointing key customer segments and their preferences. Finally, the analysis includes an overview of mergers and acquisitions (M&A) activities, quantifying deal volumes and evaluating their impact on market consolidation.

- Market Concentration: The market is moderately fragmented, with a few dominant players and numerous smaller operators. The top 5 players hold approximately xx% of the market share in 2025.

- Technological Innovation: E-bike adoption is a significant driver, while innovations in dockless systems and smart locking mechanisms are gaining traction. Barriers include high initial investment costs and infrastructure limitations.

- Regulatory Frameworks: Varying regulations across countries impact market expansion. Standardization and harmonization of regulations are crucial for future growth.

- Competitive Substitutes: Public transport, ride-hailing services, and private vehicle ownership pose competition.

- M&A Activity: xx M&A deals were recorded between 2019 and 2024, indicating a trend towards consolidation. xx% of these deals involved the acquisition of smaller players by larger established companies.

- End-User Demographics: Younger demographics (18-35) are the primary users, with increasing adoption amongst older age groups. Urban professionals and students represent significant segments.

Latin America Bike Sharing Market Growth Trends & Insights

This section leverages extensive data analysis to provide a detailed overview of the Latin America bike-sharing market's growth trajectory. We examine market size evolution, adoption rates, technological disruptions, and shifting consumer behaviors. Key metrics, such as Compound Annual Growth Rate (CAGR) and market penetration, are incorporated to offer precise quantitative insights. The analysis also explores factors influencing growth, including economic development, urbanization, and evolving consumer preferences for sustainable transportation.

- Market Size: The market size reached xx million units in 2024 and is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period.

- Adoption Rates: E-bike adoption is growing rapidly, with a projected xx% market share by 2033, driven by increasing consumer demand for convenience and speed.

- Technological Disruptions: The introduction of smart features, such as integrated payment systems and GPS tracking, is enhancing user experience and operational efficiency.

- Consumer Behavior Shifts: Growing environmental awareness and a preference for healthier lifestyles are driving the adoption of bike-sharing services.

Dominant Regions, Countries, or Segments in Latin America Bike Sharing Market

This section identifies the leading regions, countries, and segments within the Latin American bike-sharing market that are driving significant growth. We analyze the dominance factors, including market share and growth potential, for each segment (by bike type, sharing system type, and country). Key drivers, such as economic policies and infrastructure development, are highlighted.

- By Country: Brazil holds the largest market share, followed by Mexico and Argentina. The Rest of Latin America is showing significant growth potential, fueled by urbanization and increasing investments in cycling infrastructure.

- By Bike Type: E-bikes are experiencing the fastest growth rate due to their convenience and ability to cover longer distances.

- By Sharing System Type: Dockless systems are gaining popularity due to their flexibility and ease of use.

Key Drivers:

- Increasing urbanization and traffic congestion

- Government initiatives promoting sustainable transportation

- Growing environmental awareness among consumers

- Investments in cycling infrastructure

Dominance Factors: Brazil's dominance is attributed to its large population, high level of urbanization, and early adoption of bike-sharing technology.

Latin America Bike Sharing Market Product Landscape

The Latin American bike-sharing market offers a diverse range of products, each characterized by unique features and innovations. E-bikes, with their enhanced speed and range, have significantly broadened the market's reach. Smart features like integrated payment systems, GPS tracking, and anti-theft mechanisms enhance user experience and operational efficiency. The evolution of bike designs focuses on durability, comfort, and ease of use, catering to diverse user needs and preferences.

Key Drivers, Barriers & Challenges in Latin America Bike Sharing Market

Several factors are driving the growth of the Latin American bike-sharing market. These include increased urbanization, government initiatives promoting sustainable transportation, growing environmental awareness, and rising disposable incomes. However, several challenges hinder market expansion. These include inadequate cycling infrastructure in many areas, safety concerns, high initial investment costs for operators, and varying regulatory frameworks across different countries that create operational complexities.

Emerging Opportunities in Latin America Bike Sharing Market

The Latin American bike-sharing market presents several emerging opportunities. These include expanding into untapped markets within the region, particularly in smaller cities with growing populations. Further opportunities lie in developing innovative applications, such as integrating bike-sharing with other mobility services or incorporating smart features for enhanced user experience. Catering to specific user needs, such as developing specialized bikes for delivery services or creating subscription-based models tailored to different demographics, also offers potential.

Growth Accelerators in the Latin America Bike Sharing Market Industry

Several catalysts will fuel the long-term growth of the Latin America bike-sharing market. Technological advancements, such as the development of more durable and affordable e-bikes with enhanced safety features, will expand the market’s reach. Strategic partnerships between bike-sharing operators and other mobility providers, such as public transport systems, will create more integrated transportation solutions. Government initiatives promoting sustainable transportation and investments in cycling infrastructure will further contribute to market growth.

Key Players Shaping the Latin America Bike Sharing Market Market

- Mobike

- Wave

- Tembici

- Movo

- Grow mobility

- Bird

- Loop

- Bim Bim Bikes

Notable Milestones in Latin America Bike Sharing Market Sector

- 2020: Launch of the first large-scale e-bike sharing program in São Paulo, Brazil.

- 2021: Government incentives for bike-sharing programs announced in Mexico City.

- 2022: Merger between two major bike-sharing operators in Argentina.

- 2023: Introduction of a new dockless system with improved security features in Colombia.

- 2024: Significant investment in bike lane infrastructure in major Brazilian cities.

In-Depth Latin America Bike Sharing Market Market Outlook

The future of the Latin American bike-sharing market appears promising. Continued urbanization, growing environmental awareness, and technological advancements will drive robust market expansion. Strategic partnerships, government support, and investments in cycling infrastructure will create an environment conducive for growth. The focus on e-bikes and the adoption of innovative business models will further unlock market potential. The market is poised for significant growth in the coming years, driven by the factors mentioned above.

Latin America Bike Sharing Market Segmentation

-

1. Bike Type

- 1.1. Traditional/Regular Bike

- 1.2. E-bike

-

2. Sharing System Type

- 2.1. Docked

- 2.2. Dockless

Latin America Bike Sharing Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Bike Sharing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing disposable income and Low-interest rates from lenders increase the market demand

- 3.3. Market Restrains

- 3.3.1. High initial costs may obstruct the growth

- 3.4. Market Trends

- 3.4.1. E-Bike Rental is providing the growth in Bike Sharing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Bike Sharing Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 5.1.1. Traditional/Regular Bike

- 5.1.2. E-bike

- 5.2. Market Analysis, Insights and Forecast - by Sharing System Type

- 5.2.1. Docked

- 5.2.2. Dockless

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Bike Type

- 6. Brazil Latin America Bike Sharing Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Bike Sharing Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Bike Sharing Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Bike Sharing Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Bike Sharing Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Bike Sharing Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Mobike

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Wave

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Tembici

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Movo

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Grow mobility*List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Bird

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Loop

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Bim Bim Bikes

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Mobike

List of Figures

- Figure 1: Latin America Bike Sharing Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Bike Sharing Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Bike Sharing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Bike Sharing Market Revenue Million Forecast, by Bike Type 2019 & 2032

- Table 3: Latin America Bike Sharing Market Revenue Million Forecast, by Sharing System Type 2019 & 2032

- Table 4: Latin America Bike Sharing Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Bike Sharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America Bike Sharing Market Revenue Million Forecast, by Bike Type 2019 & 2032

- Table 13: Latin America Bike Sharing Market Revenue Million Forecast, by Sharing System Type 2019 & 2032

- Table 14: Latin America Bike Sharing Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Chile Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Colombia Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay Latin America Bike Sharing Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Bike Sharing Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Latin America Bike Sharing Market?

Key companies in the market include Mobike, Wave, Tembici, Movo, Grow mobility*List Not Exhaustive, Bird, Loop, Bim Bim Bikes.

3. What are the main segments of the Latin America Bike Sharing Market?

The market segments include Bike Type, Sharing System Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing disposable income and Low-interest rates from lenders increase the market demand.

6. What are the notable trends driving market growth?

E-Bike Rental is providing the growth in Bike Sharing Market.

7. Are there any restraints impacting market growth?

High initial costs may obstruct the growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Bike Sharing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Bike Sharing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Bike Sharing Market?

To stay informed about further developments, trends, and reports in the Latin America Bike Sharing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence