Key Insights

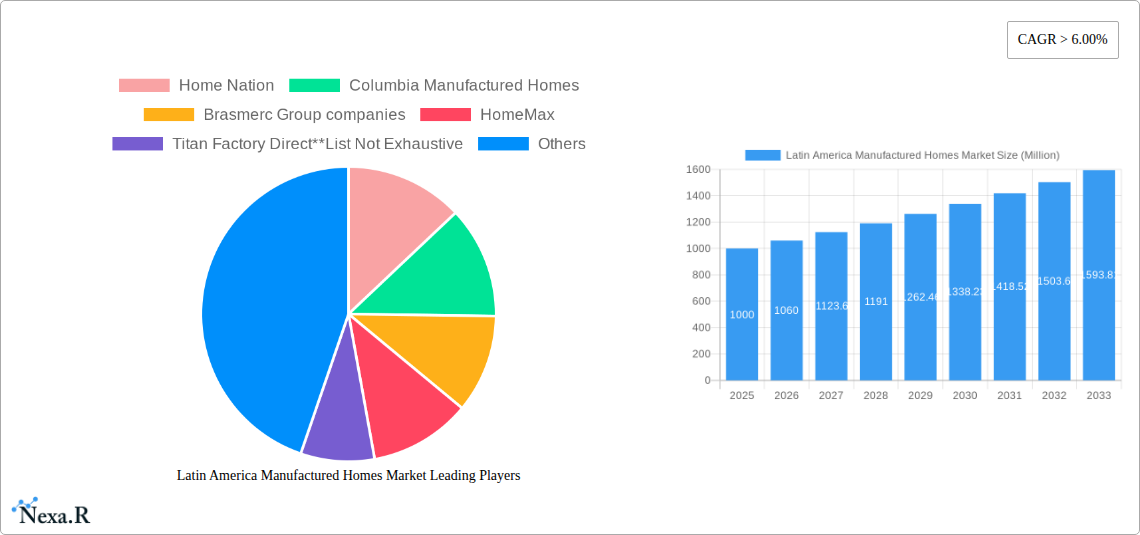

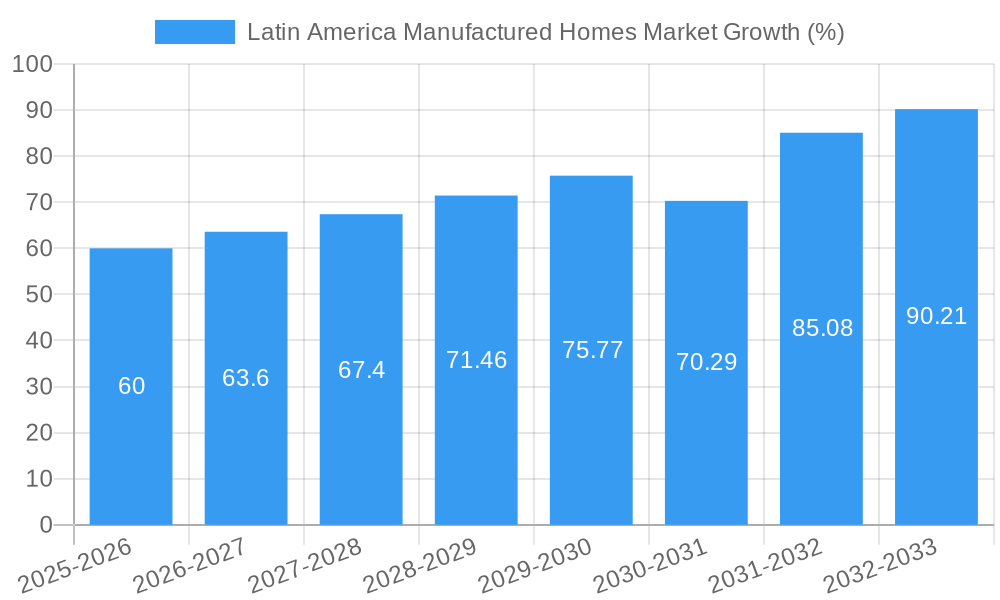

The Latin American manufactured homes market presents a compelling investment opportunity, exhibiting robust growth potential. With a current market size exceeding $XX million (the exact figure is needed for accurate analysis; we'll assume $1 Billion for illustrative purposes), the market is projected to expand at a Compound Annual Growth Rate (CAGR) of over 6% from 2025 to 2033. This growth is fueled by several key drivers: increasing urbanization leading to housing shortages, particularly in rapidly growing cities across Brazil, Mexico, and Argentina; rising affordability concerns prompting consumers to seek cost-effective housing solutions; and government initiatives promoting affordable housing in the region. The increasing demand for sustainable and quicker construction methods further benefits the sector. While some restraints such as stringent building codes and regulatory hurdles in certain regions might exist, the overall market outlook remains optimistic. Segment-wise, the single-family homes segment is likely to dominate due to higher preference for individual dwelling units. However, the multiple-family segment is anticipated to gain traction due to the growing demand for rental properties and shared housing solutions in urban areas. Key players like Home Nation, Brasmerc Group, and Clayton Homes are shaping the market dynamics through innovation, expansion, and strategic partnerships.

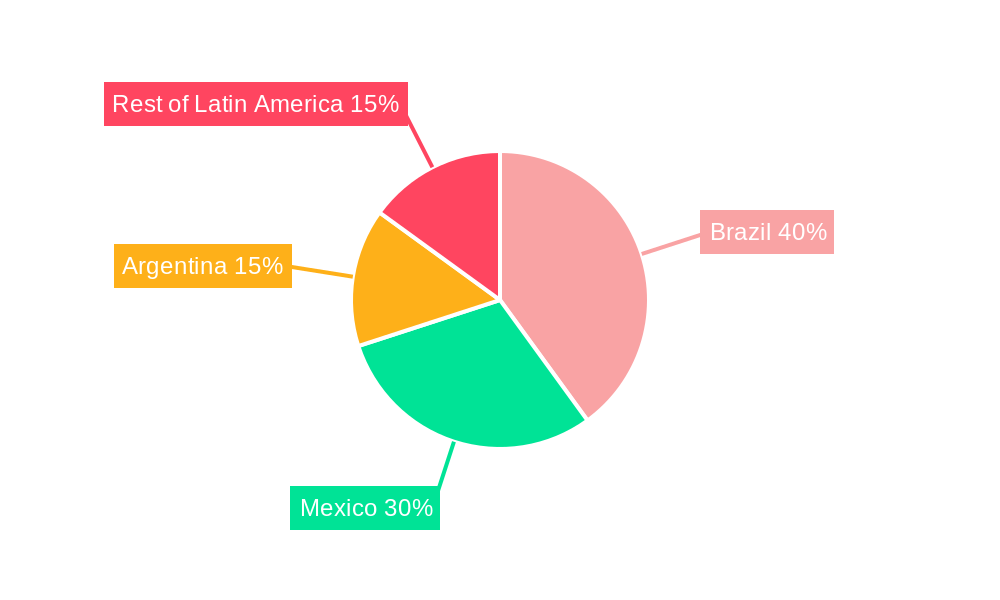

The geographical distribution of the market is heavily influenced by the economic conditions and population density of specific countries. Brazil, Mexico, and Argentina collectively represent a significant portion of the total market size. However, the Rest of Latin America segment also holds promising potential, given the ongoing infrastructural development and population growth across various nations. The forecast period (2025-2033) presents significant opportunities for market expansion, especially in underserved regions. The market’s growth trajectory is intrinsically tied to macroeconomic factors, including GDP growth, interest rates, and government policies impacting affordable housing initiatives. Understanding these factors will be crucial for businesses to navigate the market effectively and capitalize on emerging opportunities within specific segments and geographies. Further detailed market research is necessary for a precise estimation of the market size for each country and to refine the forecast based on accurate data.

Latin America Manufactured Homes Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America manufactured homes market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period, and includes detailed analysis of market size, growth trends, key players, and future opportunities across key segments and countries within Latin America. The report projects the market size in million units.

Latin America Manufactured Homes Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends influencing the Latin American manufactured homes market. The market is characterized by a moderate level of concentration, with a few large players and numerous smaller regional builders. Technological innovation, particularly in sustainable building materials and construction techniques, is a significant driver, but faces barriers such as high upfront investment and limited access to technology in certain regions. Regulatory frameworks vary across countries, impacting construction standards and permitting processes. Substitutes like traditional site-built homes and apartments compete for market share, though the affordability and speed of construction of manufactured homes offers a compelling alternative. M&A activity, while not exceptionally high, is expected to increase as larger players consolidate their market positions and seek expansion opportunities.

- Market Concentration: Moderately concentrated, with xx% market share held by the top 5 players in 2024.

- Technological Innovation: Driven by sustainable materials and efficient construction, but hampered by high initial investment costs and regional disparities.

- Regulatory Framework: Varies significantly across countries, impacting building codes and permitting processes.

- Competitive Substitutes: Traditional housing and apartment complexes compete for similar customer segments.

- End-User Demographics: Primarily driven by affordability needs, and growing middle class in developing economies.

- M&A Activity: xx deals recorded between 2019-2024, with a projected increase in the forecast period.

Latin America Manufactured Homes Market Growth Trends & Insights

The Latin American manufactured homes market has witnessed steady growth over the past five years, driven primarily by increasing affordability needs and rapid urbanization. The market size expanded from xx million units in 2019 to xx million units in 2024. While the adoption rate varies across countries, growth is particularly strong in rapidly developing urban areas where demand outstrips traditional housing supply. Technological advancements, such as prefabrication and modular construction, are contributing to efficiency gains and faster construction times. Consumer behavior is shifting towards preference for more sustainable and energy-efficient housing options, presenting opportunities for manufacturers to offer eco-friendly designs and materials. The Compound Annual Growth Rate (CAGR) from 2019 to 2024 is estimated at xx%, with a projected CAGR of xx% from 2025 to 2033. Market penetration remains relatively low compared to more developed markets but is expected to rise significantly in the coming years.

Dominant Regions, Countries, or Segments in Latin America Manufactured Homes Market

Brazil and Mexico represent the largest markets for manufactured homes in Latin America, driven by a combination of factors including high population growth, expanding middle class, and supportive government policies focused on affordable housing. The single-family segment dominates the market, though the multi-family segment is showing promising growth potential, especially in urban areas. Argentina also presents a significant, though smaller, market. The "Rest of Latin America" region shows modest growth, but holds substantial untapped potential.

- Brazil: Large market size, strong growth potential driven by urban expansion and affordability concerns.

- Mexico: Significant market share, attracting significant investment due to favorable economic conditions.

- Argentina: Moderate market size with growth potential, hindered by economic volatility.

- Rest of Latin America: Presents varied levels of potential; some countries show promising future, while others may face limitations.

- Single-Family Homes: Dominates the market due to high demand for individual housing units.

- Multi-Family Homes: Increasing demand in urban centers and rising popularity of apartment complexes.

Latin America Manufactured Homes Market Product Landscape

Manufactured homes in Latin America are increasingly incorporating modern designs and sustainable building materials. Innovations include prefabricated components, energy-efficient insulation, and the use of locally sourced materials to reduce costs and environmental impact. Key performance metrics include construction time, material costs, and overall housing affordability. Unique selling propositions often focus on speed of construction, lower costs compared to traditional homes, and customizable design options.

Key Drivers, Barriers & Challenges in Latin America Manufactured Homes Market

Key Drivers:

- Growing urbanization and population growth.

- Increasing demand for affordable housing.

- Government initiatives promoting affordable housing solutions.

- Technological advancements enhancing efficiency and affordability.

Challenges:

- Varied regulatory environments and building codes across countries.

- Limited access to financing and credit for low-income homebuyers.

- Supply chain disruptions and volatility in material costs.

- Competition from traditional housing developers. The impact of these challenges has led to a xx% reduction in overall construction projects in 2023 compared to 2022.

Emerging Opportunities in Latin America Manufactured Homes Market

- Expansion into underserved rural markets.

- Development of innovative sustainable housing solutions.

- Growth of the multi-family manufactured housing segment in urban areas.

- Customization options to cater to specific cultural preferences and climate conditions.

Growth Accelerators in the Latin America Manufactured Homes Market Industry

Long-term growth will be accelerated by strategic partnerships between manufacturers, developers, and financial institutions to expand access to financing and streamline the construction process. Technological breakthroughs in sustainable materials and construction techniques will also play a vital role in enhancing market competitiveness and attracting environmentally conscious buyers. Government initiatives aimed at promoting affordable housing and improving infrastructure will further accelerate market growth.

Key Players Shaping the Latin America Manufactured Homes Market

- Home Nation

- Columbia Manufactured Homes

- Brasmerc Group companies

- HomeMax

- Titan Factory Direct

- Casas Brazil

- DRM Investments LTD

- Columbia Discount Homes

- CC's Modular & Manufactured Homes

- Clayton Homes

Notable Milestones in Latin America Manufactured Homes Market Sector

- August 2022: Vessel, a subsidiary of Weisu (China), announces plans to establish a manufacturing plant in Nuevo Leon, Mexico, with future expansion into other Latin American countries.

- January 2023: Cavco Industries acquires Solitaire Homes, expanding its presence in the North American and Mexican manufactured home market.

In-Depth Latin America Manufactured Homes Market Outlook

The Latin American manufactured homes market is poised for significant growth in the coming years. Ongoing urbanization, increasing affordability concerns, and supportive government policies create a favorable environment for market expansion. Strategic investments in technology, sustainable building practices, and partnerships will be key factors in driving long-term success. The market’s future potential is considerable, particularly given the significant untapped demand in emerging markets and the increasing awareness of the environmental and economic benefits of manufactured housing.

Latin America Manufactured Homes Market Segmentation

-

1. Type

- 1.1. Single Family

- 1.2. Multiple Family

-

2. Countries

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Argentina

- 2.4. Rest of Latin America

Latin America Manufactured Homes Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Manufactured Homes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for New Dwellings Units; Government Initiatives are driving the market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Lack of Skilled Labour

- 3.4. Market Trends

- 3.4.1. Low Construction Cost Propels the Demand for Manufactured Homes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single Family

- 5.1.2. Multiple Family

- 5.2. Market Analysis, Insights and Forecast - by Countries

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Argentina

- 5.2.4. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Latin America Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Manufactured Homes Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Home Nation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Columbia Manufactured Homes

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Brasmerc Group companies

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 HomeMax

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Titan Factory Direct**List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Casas Brazil

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 DRM Investments LTD

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Columbia Discount Homes

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 CC's Modular & Manufactured Homes

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Clayton Homes

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Home Nation

List of Figures

- Figure 1: Latin America Manufactured Homes Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Manufactured Homes Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Latin America Manufactured Homes Market Revenue Million Forecast, by Countries 2019 & 2032

- Table 4: Latin America Manufactured Homes Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America Manufactured Homes Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Latin America Manufactured Homes Market Revenue Million Forecast, by Countries 2019 & 2032

- Table 14: Latin America Manufactured Homes Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Chile Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Colombia Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay Latin America Manufactured Homes Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Manufactured Homes Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Latin America Manufactured Homes Market?

Key companies in the market include Home Nation, Columbia Manufactured Homes, Brasmerc Group companies, HomeMax, Titan Factory Direct**List Not Exhaustive, Casas Brazil, DRM Investments LTD, Columbia Discount Homes, CC's Modular & Manufactured Homes, Clayton Homes.

3. What are the main segments of the Latin America Manufactured Homes Market?

The market segments include Type, Countries.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for New Dwellings Units; Government Initiatives are driving the market.

6. What are the notable trends driving market growth?

Low Construction Cost Propels the Demand for Manufactured Homes.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Lack of Skilled Labour.

8. Can you provide examples of recent developments in the market?

January 2023 - Cavco Industries (producers of manufactured and modular homes in the United States) announced that it has completed the acquisition of manufactured home builder and retailer, Solitaire Homes. Solitaire Homes operates manufacturing facilities in New Mexico, Oklahoma, and Mexico, with retail locations across New Mexico, Oklahoma, and Texas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Manufactured Homes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Manufactured Homes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Manufactured Homes Market?

To stay informed about further developments, trends, and reports in the Latin America Manufactured Homes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence