Key Insights

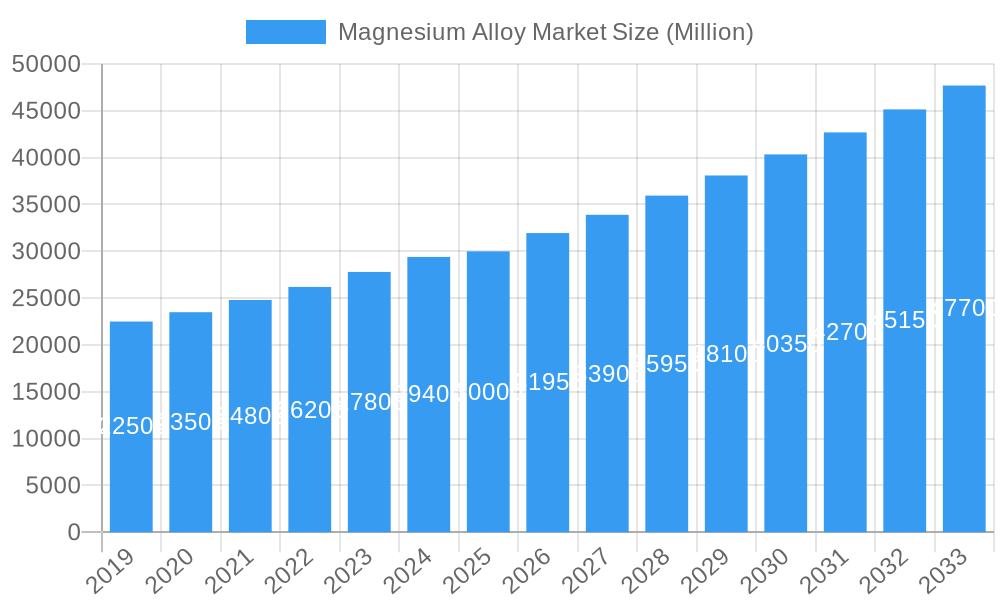

The global Magnesium Alloy Market is poised for significant expansion, driven by an increasing demand for lightweight yet strong materials across various industries. Valued at an estimated $30 billion in 2025, the market is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% throughout the study period of 2019-2033. This impressive growth trajectory is fueled by the automotive sector's relentless pursuit of fuel efficiency and reduced emissions, making magnesium alloys an ideal substitute for heavier metals like steel and aluminum in vehicle components such as engine blocks, steering wheels, and seat frames. Furthermore, the aerospace industry's need for high-performance materials in aircraft construction, coupled with the expanding applications in electronics, medical devices, and consumer goods, will continue to propel market demand. Emerging economies, with their burgeoning manufacturing sectors and increasing adoption of advanced materials, are expected to contribute substantially to this growth.

Magnesium Alloy Market Market Size (In Billion)

The historical performance from 2019 to 2024 demonstrates a steady upward trend, setting a strong foundation for future expansion. The market's current estimated valuation of $30 billion for 2025 is a testament to its inherent value and the ongoing innovation in magnesium alloy production and application development. The forecast period of 2025-2033 anticipates sustained momentum, with the CAGR of 6.5% indicating a dynamic and evolving market landscape. Key drivers beyond automotive and aerospace include the growing emphasis on sustainability and recyclability, where magnesium alloys offer an environmentally friendly alternative. Advancements in alloying technologies, such as the development of new corrosion-resistant magnesium alloys, are also expanding their usability in more demanding environments, further solidifying their market position. The continuous R&D efforts and strategic collaborations among market players are expected to unlock new avenues for growth and innovation in the coming years.

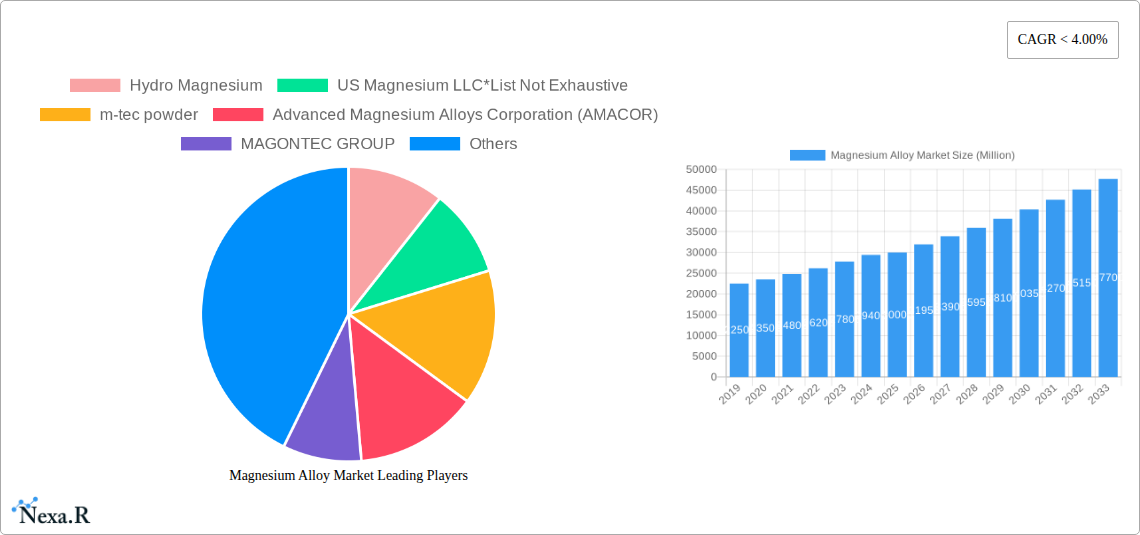

Magnesium Alloy Market Company Market Share

Unleash the Power of Lightweight: Magnesium Alloy Market Report (2019-2033)

Dive deep into the dynamic Magnesium Alloy Market, a sector poised for explosive growth driven by its unparalleled lightweight properties and increasing demand across critical industries. This comprehensive report, spanning 2019-2033 with a base year of 2025, offers in-depth analysis of market dynamics, growth trends, regional dominance, product landscape, key players, and future opportunities. Unlock insights into parent and child markets, understand technological advancements, and leverage critical data to inform your strategic decisions.

Magnesium Alloy Market Market Dynamics & Structure

The Magnesium Alloy Market is characterized by a moderate to high level of market concentration, with key players investing heavily in technological innovation to enhance material performance and broaden applications. Drivers of innovation include the relentless pursuit of lightweighting in the automotive and aerospace sectors, coupled with advancements in casting and forming technologies that improve alloy manufacturability. Regulatory frameworks, particularly concerning environmental impact and safety standards, are influencing material selection and production processes. Competitive product substitutes, primarily aluminum alloys and high-strength steels, pose a constant challenge, necessitating continuous innovation in magnesium alloys to maintain a competitive edge. End-user demographics are shifting, with increasing adoption in consumer electronics and medical devices, driven by demand for durability and portability. Mergers and acquisitions (M&A) trends, though less frequent than in more mature markets, are indicative of strategic consolidation and expansion efforts by leading companies.

- Technological Innovation: Focus on developing advanced alloys with improved corrosion resistance and higher strength-to-weight ratios.

- Regulatory Landscape: Increasing scrutiny on environmental sustainability and recycling initiatives for magnesium alloys.

- Competitive Substitutes: Ongoing efforts to bridge the cost and performance gap with aluminum alloys in high-volume applications.

- End-User Demographics: Growing demand from emerging applications beyond traditional automotive and aerospace.

- M&A Activity: Strategic partnerships and acquisitions aimed at expanding production capacity and technological capabilities.

Magnesium Alloy Market Growth Trends & Insights

The Magnesium Alloy Market is experiencing robust growth, projected to witness a significant Compound Annual Growth Rate (CAGR) during the forecast period. This expansion is fueled by the escalating demand for lightweight materials across various end-user industries, primarily driven by the global push for fuel efficiency and reduced emissions in the automotive sector. The inherent strength-to-weight ratio of magnesium alloys makes them an ideal substitute for heavier metals, leading to improved vehicle performance and lower operational costs. Furthermore, advancements in processing technologies, such as high-pressure die casting and extrusion, are making magnesium alloys more accessible and cost-effective for a wider range of applications. The aerospace industry continues to be a significant consumer, leveraging magnesium alloys for their structural integrity and weight savings in aircraft components. Beyond these traditional sectors, burgeoning adoption in consumer electronics, particularly in premium smartphone and laptop casings, and in medical devices for implants and prosthetics, is contributing substantially to market penetration. Consumer behavior shifts towards more sustainable and high-performance products are also indirectly propelling the demand for advanced materials like magnesium alloys. The market is also influenced by government initiatives and R&D funding aimed at promoting the use of lightweight and recyclable materials. The overall market size evolution reflects a sustained upward trajectory, indicating a strong market potential for magnesium alloys in the coming years.

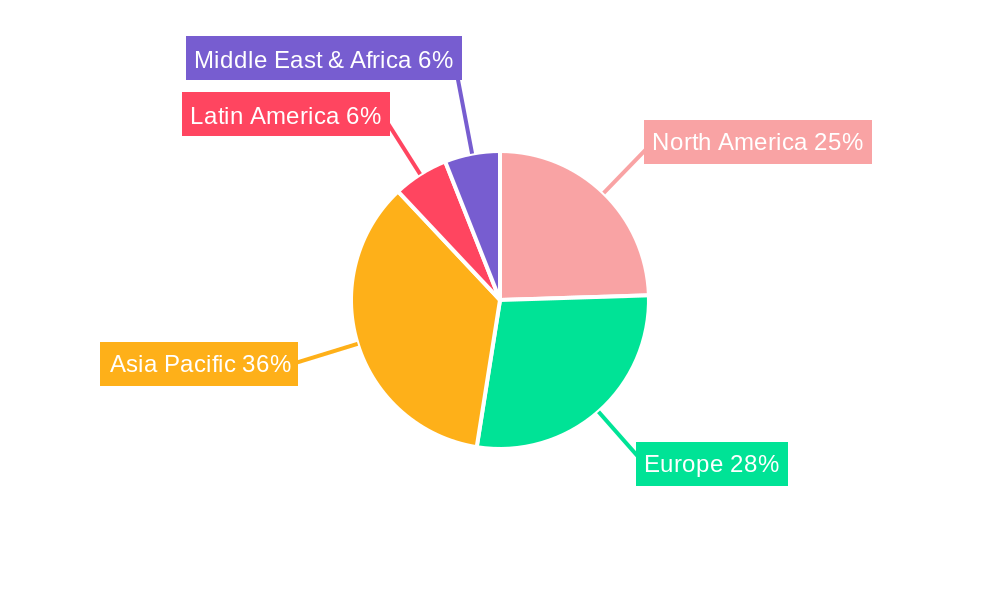

Dominant Regions, Countries, or Segments in Magnesium Alloy Market

The Magnesium Alloy Market is witnessing significant growth, with the Automotive end-user industry emerging as a dominant force driving market expansion. The relentless pursuit of fuel efficiency and reduced emissions across global automotive manufacturing hubs is a primary catalyst for this dominance. Automakers are increasingly integrating magnesium alloys into various vehicle components, including steering wheels, seat frames, instrument panels, and engine blocks, due to their exceptional lightweighting capabilities without compromising structural integrity. This widespread adoption translates into substantial market share for cast alloys, which are predominantly used in automotive applications due to their intricate design possibilities and cost-effectiveness in high-volume production.

- Dominant Segment: Cast Alloys: This segment commands a significant market share due to its versatility in creating complex shapes and its cost-effectiveness for large-scale automotive component manufacturing.

- Key Driver: Automotive Industry: The global demand for lighter, more fuel-efficient vehicles is the primary engine behind the growth in magnesium alloy consumption.

- Leading Region: Asia Pacific: Countries within this region, particularly China, are at the forefront of both magnesium alloy production and consumption, driven by their massive automotive manufacturing base and supportive industrial policies. The "One Belt, One Road" initiative and "Intelligent Manufacturing" strategies are further bolstering the growth of related industries.

- Emerging Market Drivers: Increasing investments in lightweight materials research and development, coupled with stringent environmental regulations, are propelling the adoption of magnesium alloys in other regions like North America and Europe.

- Growth Potential: The continuous innovation in magnesium alloy formulations and processing techniques, alongside the expanding applications in electric vehicles (EVs), promises sustained growth for the automotive segment.

Magnesium Alloy Market Product Landscape

The Magnesium Alloy Market product landscape is evolving rapidly with a strong emphasis on enhanced performance and novel applications. Innovations in alloy composition are yielding materials with superior corrosion resistance, increased tensile strength, and improved ductility, catering to demanding industrial requirements. For instance, the development of advanced wrought alloys is enabling the creation of thinner, lighter, and more durable components for consumer electronics and sporting goods. Applications are expanding beyond traditional automotive and aerospace uses, with significant strides being made in the medical sector for biocompatible implants and in the electronics industry for heat dissipation solutions. Unique selling propositions of magnesium alloys include their exceptional strength-to-weight ratio (approximately one-third that of aluminum), excellent damping properties, and good recyclability, making them an environmentally friendly choice.

Key Drivers, Barriers & Challenges in Magnesium Alloy Market

Key Drivers:

- Lightweighting Mandates: Stringent fuel efficiency standards and emissions regulations in the automotive and aerospace sectors are primary drivers for magnesium alloy adoption.

- Technological Advancements: Innovations in casting, extrusion, and forming processes are making magnesium alloys more accessible and cost-effective for a wider range of applications.

- Performance Superiority: The exceptional strength-to-weight ratio and damping properties of magnesium alloys offer distinct advantages over competing materials.

- Growing Demand in Electronics and Medical Devices: Increasing use in smartphones, laptops, and biocompatible medical implants is opening new avenues for market growth.

Barriers & Challenges:

- Cost Competitiveness: Magnesium alloys can be more expensive than traditional materials like aluminum and steel, posing a challenge in cost-sensitive applications.

- Corrosion Susceptibility: While improving, certain magnesium alloys can still exhibit corrosion issues in specific environments, requiring protective coatings.

- Processing Complexity: Some advanced magnesium alloys can be more challenging to process and fabricate compared to other metals, requiring specialized equipment and expertise.

- Supply Chain Volatility: The global supply chain for magnesium can be subject to geopolitical factors and production capacity fluctuations, impacting availability and pricing.

- Industry Inertia: Resistance to adopting new materials due to established manufacturing processes and perceived risks within certain industries.

Emerging Opportunities in Magnesium Alloy Market

Emerging opportunities in the Magnesium Alloy Market are abundant and diverse, driven by evolving technological frontiers and shifting consumer preferences. The burgeoning electric vehicle (EV) market presents a significant opportunity, as lightweighting is paramount for battery range optimization. Magnesium alloys are ideal for EV battery enclosures, motor housings, and structural components. Furthermore, advancements in additive manufacturing (3D printing) are enabling the creation of intricate and customized magnesium alloy parts, opening doors for prototyping and low-volume production in aerospace and defense. The increasing focus on sustainability is also creating demand for alloys with higher recycled content and improved end-of-life recyclability. The medical sector is exploring magnesium alloys for biodegradable implants, which offer the advantage of dissolving in the body over time, eliminating the need for secondary removal surgery.

Growth Accelerators in the Magnesium Alloy Market Industry

Several critical catalysts are accelerating the growth of the Magnesium Alloy Market. Technological breakthroughs in alloy development, focusing on enhanced corrosion resistance and high-temperature performance, are expanding the applicability of these materials into more demanding environments. Strategic partnerships between alloy manufacturers and end-users, particularly in the automotive and aerospace sectors, are fostering collaborative innovation and accelerating adoption rates. Market expansion strategies, including increased investment in production capacity and the development of robust recycling infrastructure, are crucial for meeting the rising global demand. Government initiatives promoting lightweight materials for environmental benefits and the growing awareness among manufacturers about the lifecycle cost advantages of magnesium alloys are also significant growth accelerators.

Key Players Shaping the Magnesium Alloy Market Market

- Hydro Magnesium

- US Magnesium LLC

- m-tec powder

- Advanced Magnesium Alloys Corporation (AMACOR)

- MAGONTEC GROUP

- Canada Magnesium

- Rima Group

- Dead Sea Magnesium Ltd

- Shanghai Regal Magnesium Limited Company

- Smiths Advanced Metals

- Nippon Kinzoku

- Ka Shui International Holdings Ltd

Notable Milestones in Magnesium Alloy Market Sector

- January 2023: Olight launched the Baton 3 Pro Max Magnesium Alloy in Desert Tan, marking the first-ever flashlight constructed from this material, signaling potential for broader flashlight applications and challenging aluminum alloy's dominance.

- April 2022: Yulin Energy Group and Ka Shui Group collaborated to advance the Yulin magnesium and aluminum industry plan, strategically aligning with China's "One Belt, One Road" and "Intelligent Manufacturing" national development strategies.

In-Depth Magnesium Alloy Market Market Outlook

The future outlook for the Magnesium Alloy Market is exceptionally bright, driven by a confluence of powerful growth accelerators. Continuous innovation in alloy formulations, coupled with significant advancements in processing technologies like additive manufacturing, will unlock new applications and enhance performance metrics. Strategic collaborations between material suppliers and key end-user industries, particularly in the automotive and electronics sectors, will foster accelerated adoption and product development. The increasing global focus on sustainability and circular economy principles further positions magnesium alloys as a preferred material due to their high recyclability. As manufacturers increasingly prioritize lightweighting for efficiency and reduced environmental impact, the demand for magnesium alloys is poised for substantial and sustained growth, solidifying its position as a critical material for future innovation.

Magnesium Alloy Market Segmentation

-

1. Type

- 1.1. Cast Alloys

- 1.2. Wrought Alloys

-

2. End-user Industry

- 2.1. Aerospace

- 2.2. Automotive

- 2.3. Medical

- 2.4. Electronics

- 2.5. Other End-user Industries

Magnesium Alloy Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Magnesium Alloy Market Regional Market Share

Geographic Coverage of Magnesium Alloy Market

Magnesium Alloy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of < 4.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Need for Weight Reduction; Increasing Demand for Castings in Electronic Applications

- 3.3. Market Restrains

- 3.3.1. Issues Associated with the Corrosion and Welding of Magnesium Alloys; Competition from Substitutes

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Automotive and Aerospace Manufacturing Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Magnesium Alloy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cast Alloys

- 5.1.2. Wrought Alloys

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Aerospace

- 5.2.2. Automotive

- 5.2.3. Medical

- 5.2.4. Electronics

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Magnesium Alloy Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cast Alloys

- 6.1.2. Wrought Alloys

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Aerospace

- 6.2.2. Automotive

- 6.2.3. Medical

- 6.2.4. Electronics

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Magnesium Alloy Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cast Alloys

- 7.1.2. Wrought Alloys

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Aerospace

- 7.2.2. Automotive

- 7.2.3. Medical

- 7.2.4. Electronics

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Magnesium Alloy Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cast Alloys

- 8.1.2. Wrought Alloys

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Aerospace

- 8.2.2. Automotive

- 8.2.3. Medical

- 8.2.4. Electronics

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Magnesium Alloy Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cast Alloys

- 9.1.2. Wrought Alloys

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Aerospace

- 9.2.2. Automotive

- 9.2.3. Medical

- 9.2.4. Electronics

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Magnesium Alloy Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cast Alloys

- 10.1.2. Wrought Alloys

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Aerospace

- 10.2.2. Automotive

- 10.2.3. Medical

- 10.2.4. Electronics

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hydro Magnesium

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 US Magnesium LLC*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 m-tec powder

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Advanced Magnesium Alloys Corporation (AMACOR)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 MAGONTEC GROUP

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Canada Magnesium

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rima Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dead Sea Magnesium Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Shanghai Regal Magnesium Limited Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Smiths Advanced Metals

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nippon Kinzoku

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ka Shui International Holdings Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Hydro Magnesium

List of Figures

- Figure 1: Global Magnesium Alloy Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Magnesium Alloy Market Revenue (Million), by Type 2025 & 2033

- Figure 3: Asia Pacific Magnesium Alloy Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Magnesium Alloy Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Magnesium Alloy Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Magnesium Alloy Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Magnesium Alloy Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Magnesium Alloy Market Revenue (Million), by Type 2025 & 2033

- Figure 9: North America Magnesium Alloy Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Magnesium Alloy Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: North America Magnesium Alloy Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Magnesium Alloy Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Magnesium Alloy Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Magnesium Alloy Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Magnesium Alloy Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Magnesium Alloy Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe Magnesium Alloy Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Magnesium Alloy Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Magnesium Alloy Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Magnesium Alloy Market Revenue (Million), by Type 2025 & 2033

- Figure 21: South America Magnesium Alloy Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Magnesium Alloy Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: South America Magnesium Alloy Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Magnesium Alloy Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Magnesium Alloy Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Magnesium Alloy Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Magnesium Alloy Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Magnesium Alloy Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Magnesium Alloy Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Magnesium Alloy Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Magnesium Alloy Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Magnesium Alloy Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Magnesium Alloy Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Magnesium Alloy Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Magnesium Alloy Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Magnesium Alloy Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Magnesium Alloy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Magnesium Alloy Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Magnesium Alloy Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Magnesium Alloy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Magnesium Alloy Market Revenue Million Forecast, by Type 2020 & 2033

- Table 19: Global Magnesium Alloy Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Magnesium Alloy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Magnesium Alloy Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Global Magnesium Alloy Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Magnesium Alloy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Magnesium Alloy Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Magnesium Alloy Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Magnesium Alloy Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Magnesium Alloy Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Magnesium Alloy Market?

The projected CAGR is approximately < 4.00%.

2. Which companies are prominent players in the Magnesium Alloy Market?

Key companies in the market include Hydro Magnesium, US Magnesium LLC*List Not Exhaustive, m-tec powder, Advanced Magnesium Alloys Corporation (AMACOR), MAGONTEC GROUP, Canada Magnesium, Rima Group, Dead Sea Magnesium Ltd, Shanghai Regal Magnesium Limited Company, Smiths Advanced Metals, Nippon Kinzoku, Ka Shui International Holdings Ltd.

3. What are the main segments of the Magnesium Alloy Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Need for Weight Reduction; Increasing Demand for Castings in Electronic Applications.

6. What are the notable trends driving market growth?

Increasing Demand from the Automotive and Aerospace Manufacturing Industries.

7. Are there any restraints impacting market growth?

Issues Associated with the Corrosion and Welding of Magnesium Alloys; Competition from Substitutes.

8. Can you provide examples of recent developments in the market?

January 2023: Olight has made the Baton 3 Pro Max Magnesium Alloy in Desert Tan, the first-ever flashlight made from this material. The launch of the Baton 3 Pro Max Magnesium Alloy Desert Tan opens the doors for more use of magnesium alloy in the flashlight, which is very possibly a metal that can rival aluminum alloy in the future

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Magnesium Alloy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Magnesium Alloy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Magnesium Alloy Market?

To stay informed about further developments, trends, and reports in the Magnesium Alloy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence