Key Insights

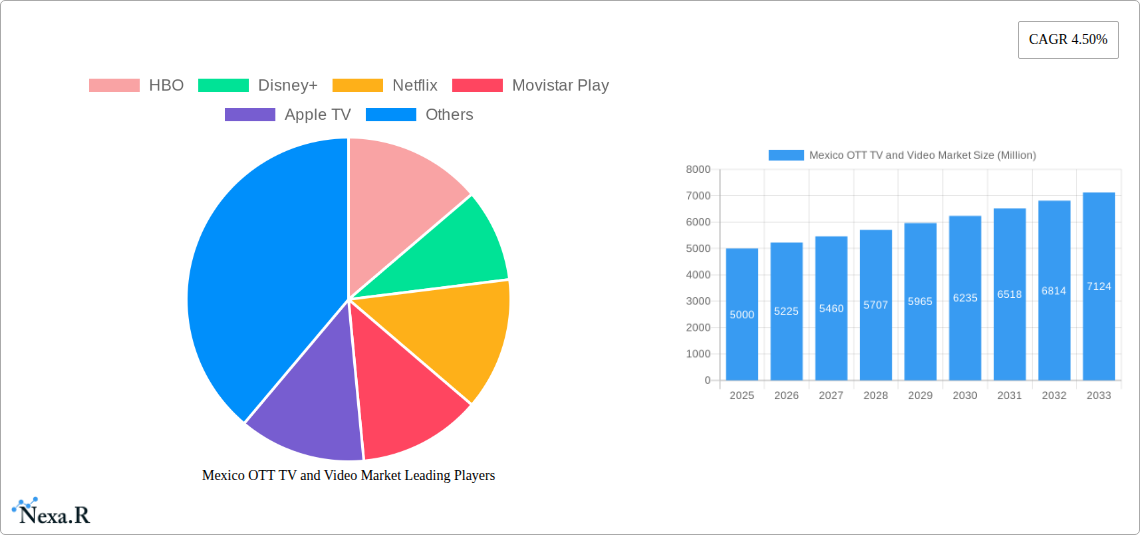

The Mexico OTT TV and Video market exhibits robust growth, projected to reach a substantial size over the forecast period (2025-2033). Fueled by increasing internet penetration, smartphone adoption, and a growing preference for on-demand content, the market demonstrates significant potential. The dominance of SVOD (Subscription Video on Demand) services like Netflix, Disney+, and HBO Max is undeniable, contributing significantly to market revenue. However, the rise of AVOD (Advertising-based Video on Demand) platforms like Crackle and Blim, offering free content supported by ads, presents a compelling alternative, particularly for price-sensitive consumers. Competition is fierce, with established international players vying for market share against local providers such as Movistar Play and Claro Video. The market's evolution is further shaped by factors such as the increasing affordability of data plans, improved streaming infrastructure, and the growing popularity of original local content. This blend of international and local programming caters to diverse viewing preferences, driving overall market expansion.

The market's segmentation reveals a dynamic landscape. While SVOD currently holds the largest segment share, the AVOD segment is expected to experience accelerated growth, driven by its accessibility and affordability. TVOD (Transactional Video on Demand) continues to hold a niche position, catering to viewers seeking specific titles on a pay-per-view basis. The continued expansion of high-speed internet access across Mexico and the increasing availability of smart TVs are expected to further propel the growth of the OTT market. Challenges remain, however, including concerns about content piracy and the digital divide, which could hinder market penetration in certain regions. Nevertheless, the long-term outlook for the Mexico OTT TV and Video market remains positive, characterized by consistent growth and ongoing innovation.

Mexico OTT TV and Video Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the dynamic Mexico OTT TV and Video Market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand the market's growth trajectory, key players, and emerging opportunities. The report segments the market by source (SVOD, TVOD, DTO, AVOD) and analyzes key players like Netflix, Disney+, and HBO Max, providing a granular understanding of the Mexican OTT landscape. The base year for this analysis is 2025.

Mexico OTT TV and Video Market Dynamics & Structure

This section analyzes the competitive landscape of the Mexican OTT market, considering market concentration, technological advancements, regulatory influences, and market trends. The analysis explores the impact of mergers and acquisitions (M&A) activity, end-user demographics, and the presence of substitute products.

- Market Concentration: The Mexican OTT market exhibits a moderately concentrated structure, with a few dominant players holding significant market share (Netflix, Disney+, HBO Max) and numerous smaller players competing for the remaining share. The market share of the top 5 players is estimated at 70% in 2025.

- Technological Innovation: High-speed internet penetration and the increasing affordability of smart TVs are major drivers of technological innovation, leading to improved streaming quality and personalized user experiences. However, challenges remain in addressing the digital divide and ensuring reliable internet access across the country.

- Regulatory Framework: The Mexican government's regulatory policies influence the market, impacting content licensing, data privacy, and competition. The regulatory landscape is relatively stable but is continuously evolving with changes in laws regarding content and data protection.

- Competitive Product Substitutes: Traditional pay-TV services remain a significant competitive force, although their market share is declining steadily due to the increasing popularity of OTT platforms.

- End-User Demographics: The market is predominantly driven by younger demographics (18-45 years old), with high smartphone and internet penetration among this group. The growing middle class also plays a crucial role in increasing subscription rates.

- M&A Trends: The Mexican OTT landscape has witnessed notable M&A activity in recent years. xx major M&A deals involving OTT players were recorded between 2019 and 2024, resulting in greater market consolidation.

Mexico OTT TV and Video Market Growth Trends & Insights

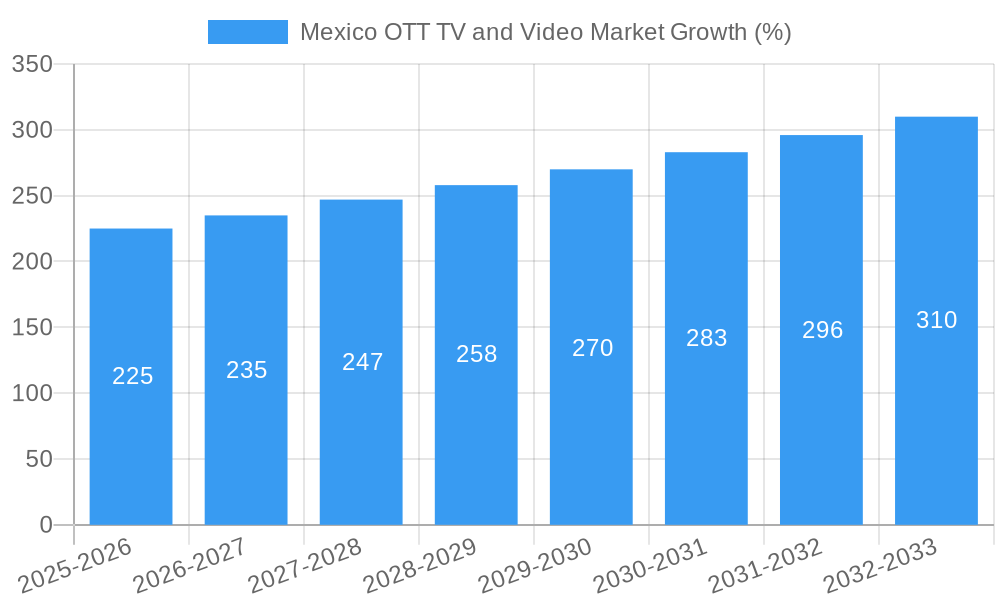

The Mexican OTT TV and Video market experienced substantial growth during the historical period (2019-2024), driven by increased internet penetration, affordable smartphones, and the growing popularity of streaming services. This trend is expected to continue in the forecast period (2025-2033). The market size is projected to reach xx million units by 2033, reflecting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Consumer behavior is shifting rapidly towards on-demand content, with viewers increasingly cutting the cord from traditional pay-TV. Technological disruptions, like the introduction of 4K and HDR streaming, enhance user experience and further drive market growth. Market penetration is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Mexico OTT TV and Video Market

The Mexican OTT market demonstrates significant regional variations in adoption rates and preferences. Urban areas, particularly Mexico City and Guadalajara, exhibit the highest penetration of OTT services, driven by higher internet connectivity rates and disposable incomes. The SVOD segment currently holds the largest market share, followed by AVOD and TVOD. The growth of AVOD is fueled by the rising popularity of free, ad-supported streaming services like ViX.

Key Drivers:

- High Smartphone Penetration: Widespread smartphone ownership fuels access to OTT platforms.

- Rising Internet Accessibility: Increasing broadband internet penetration extends access to streaming services, especially in urban areas.

- Affordable Data Plans: Competitive mobile data plans make streaming more accessible to a broader population.

- Government Initiatives: Government policies promoting digital inclusion also contribute to growth.

Dominance Factors: The SVOD segment's dominance stems from its vast content libraries, user-friendly interfaces, and diverse subscription options. The AVOD segment’s growth is primarily due to its free access and ability to reach audiences with lower disposable incomes.

Mexico OTT TV and Video Market Product Landscape

The Mexican OTT market offers a diverse range of streaming services, catering to varied consumer preferences and budgets. SVOD platforms like Netflix and Disney+ are known for their high-quality original content and extensive libraries of movies and TV shows. AVOD platforms provide access to a substantial amount of content free of charge, supported by advertising revenue. TVOD platforms offer a pay-per-view model, offering viewers the ability to rent or buy content. Technological advancements such as 4K resolution, HDR, and Dolby Atmos are enhancing the overall user experience, driving adoption. Unique selling propositions among different platforms include original programming, exclusive content deals, and personalized recommendations.

Key Drivers, Barriers & Challenges in Mexico OTT TV and Video Market

Key Drivers:

The market is driven by increasing internet and smartphone penetration, a growing young population with high digital engagement, and the rising disposable incomes of the middle class. Government initiatives aimed at improving digital infrastructure also contribute to growth. The introduction of innovative features such as interactive content and personalized recommendations further enhances the user experience.

Key Challenges:

- Piracy: Illegal streaming remains a major challenge, impacting revenue generation for legitimate platforms.

- Digital Divide: Unequal access to high-speed internet across the country limits market penetration in rural areas.

- Competition: Intense competition among established and emerging players creates pressure on pricing and content acquisition.

- Regulatory Uncertainty: Changes in regulatory frameworks can pose challenges to market stability.

Emerging Opportunities in Mexico OTT TV and Video Market

- Hyper-personalization: Tailored content recommendations and interactive features.

- Expansion into Rural Markets: Leveraging mobile networks and satellite technology to reach underserved regions.

- Localized Content: Investing in original Spanish-language content to cater to local preferences.

- Integration of AR/VR: Enhancing the viewing experience through immersive technologies.

Growth Accelerators in the Mexico OTT TV and Video Market Industry

Long-term growth is fueled by the continued expansion of high-speed internet infrastructure, increasing smartphone ownership, and growing demand for diverse, high-quality streaming content. Strategic partnerships between telecom companies and OTT providers, as well as investments in original local productions, will also contribute to market expansion. Technological innovations like 5G connectivity and improved streaming technologies will enhance the viewing experience, increasing the demand for OTT services.

Key Players Shaping the Mexico OTT TV and Video Market Market

- HBO Max

- Disney+

- Netflix

- Movistar Play

- Apple TV

- Blim

- Crackle

- Claro Video

- Amazon Prime Video

Notable Milestones in Mexico OTT TV and Video Market Sector

- March 2022: Launch of TelevisaUnivision's ViX, a free, ad-supported streaming service offering a large library of Spanish-language content. This significantly impacted the AVOD segment, increasing competition and expanding content options for Mexican viewers.

In-Depth Mexico OTT TV and Video Market Market Outlook

The future of the Mexican OTT market is bright, characterized by continued growth driven by technological advancements, increasing internet penetration, and the rising popularity of streaming services. Strategic partnerships, investments in original local content, and the adoption of innovative technologies will further shape market dynamics. The market is poised for significant expansion, presenting substantial opportunities for both established and emerging players. The forecast period suggests a robust expansion, with continued penetration and sustained growth across various segments.

Mexico OTT TV and Video Market Segmentation

-

1. Source

- 1.1. SVOD

-

1.2. TVOD

- 1.2.1. Rental

- 1.2.2. Download to Own (DTO)

- 1.3. AVOD

Mexico OTT TV and Video Market Segmentation By Geography

- 1. Mexico

Mexico OTT TV and Video Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Penetration of Smart TVs and the Presence of Major OTT Providers

- 3.3. Market Restrains

- 3.3.1. Payment for Premium OTT Take-up; Challenges and Costs of Licensing Premium Quality Content

- 3.4. Market Trends

- 3.4.1. OTT industry is expected to register a significant growth in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico OTT TV and Video Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. SVOD

- 5.1.2. TVOD

- 5.1.2.1. Rental

- 5.1.2.2. Download to Own (DTO)

- 5.1.3. AVOD

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 HBO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Disney+

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Netflix

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Movistar Play

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Apple TV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Blim

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Crackle

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Claro Video

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amazon Prime Video

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 HBO

List of Figures

- Figure 1: Mexico OTT TV and Video Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico OTT TV and Video Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico OTT TV and Video Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico OTT TV and Video Market Revenue Million Forecast, by Source 2019 & 2032

- Table 3: Mexico OTT TV and Video Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Mexico OTT TV and Video Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Mexico OTT TV and Video Market Revenue Million Forecast, by Source 2019 & 2032

- Table 6: Mexico OTT TV and Video Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico OTT TV and Video Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Mexico OTT TV and Video Market?

Key companies in the market include HBO, Disney+, Netflix, Movistar Play, Apple TV, Blim, Crackle, Claro Video, Amazon Prime Video.

3. What are the main segments of the Mexico OTT TV and Video Market?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Penetration of Smart TVs and the Presence of Major OTT Providers.

6. What are the notable trends driving market growth?

OTT industry is expected to register a significant growth in the market.

7. Are there any restraints impacting market growth?

Payment for Premium OTT Take-up; Challenges and Costs of Licensing Premium Quality Content.

8. Can you provide examples of recent developments in the market?

March 2022: TelevisaUnivision's new streaming service ViX, which brings the world's largest offering of Spanish-language entertainment, news, and sports content, became available to all users in the United States, Mexico, and most Spanish-speaking Latin America. ViX users can stream original programming and top live sports and news free of charge in the first broadcast-quality ad-supported offering for Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico OTT TV and Video Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico OTT TV and Video Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico OTT TV and Video Market?

To stay informed about further developments, trends, and reports in the Mexico OTT TV and Video Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence