Key Insights

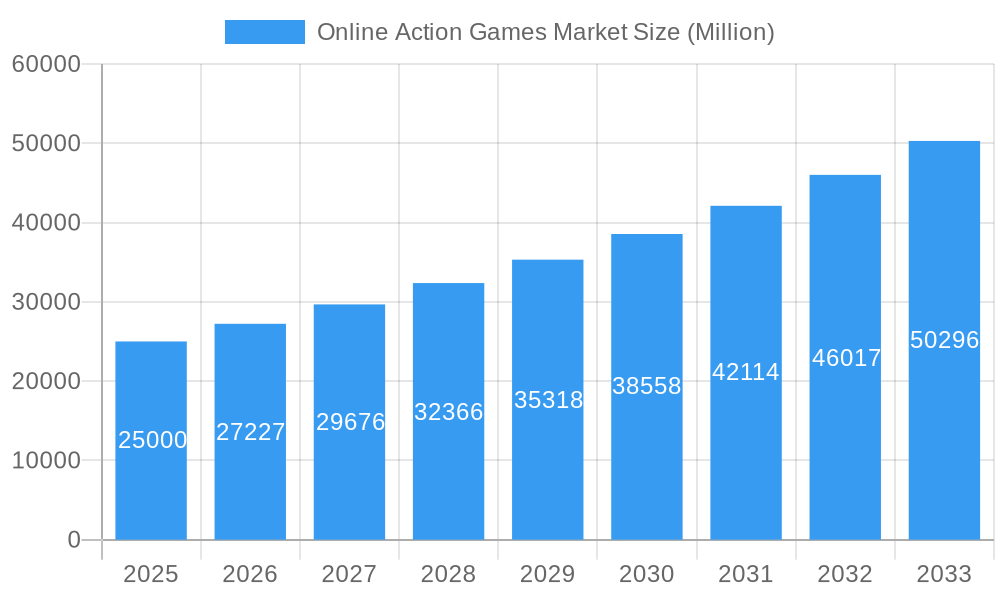

The global online action games market is projected for substantial expansion, forecasting a Compound Annual Growth Rate (CAGR) of 7.2% from a market size of $6.39 billion in 2025. This growth is propelled by the surging popularity of esports, advancements in graphics technology, and the widespread accessibility of mobile gaming platforms, attracting a vast and varied player base. Key market segments highlight dominant trends, with mobile gaming outpacing PC and console gaming in terms of player reach and revenue, particularly within the free-to-play (F2P) model. This surge is attributed to widespread smartphone adoption and high-speed internet availability. While paid gaming services remain vital for PC and console segments, the F2P model, supported by in-app purchases and microtransactions, demonstrates significant revenue-generating potential. The market's global reach is further supported by diverse operating systems, with Android and iOS leading the mobile sector. Intense competition among industry leaders such as Tencent, Sony Interactive Entertainment, and EA, alongside innovative independent studios, drives continuous innovation in game design and player experience, fostering further market growth.

Online Action Games Market Market Size (In Billion)

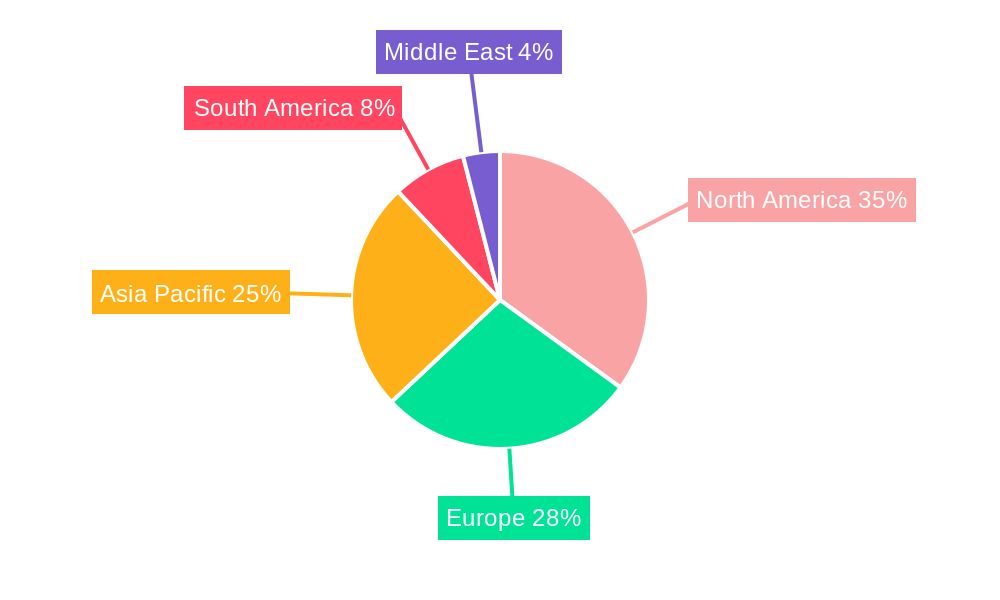

Geographically, North America and Europe maintain strong market positions, supported by established gaming cultures and high disposable incomes. However, the Asia-Pacific region, particularly China and India, presents the most significant growth opportunities due to rapidly expanding internet penetration and a rapidly developing gaming community. Challenges facing the market include concerns over game addiction and the imperative for responsible gaming practices, alongside the continuous need for game developers to adapt to evolving technological advancements. Nevertheless, these are offset by the enduring appeal of online action games and the consistent introduction of innovative gameplay mechanics and immersive experiences that ensure sustained player engagement. The market outlook remains robust, anticipating considerable future growth across all segments and regions.

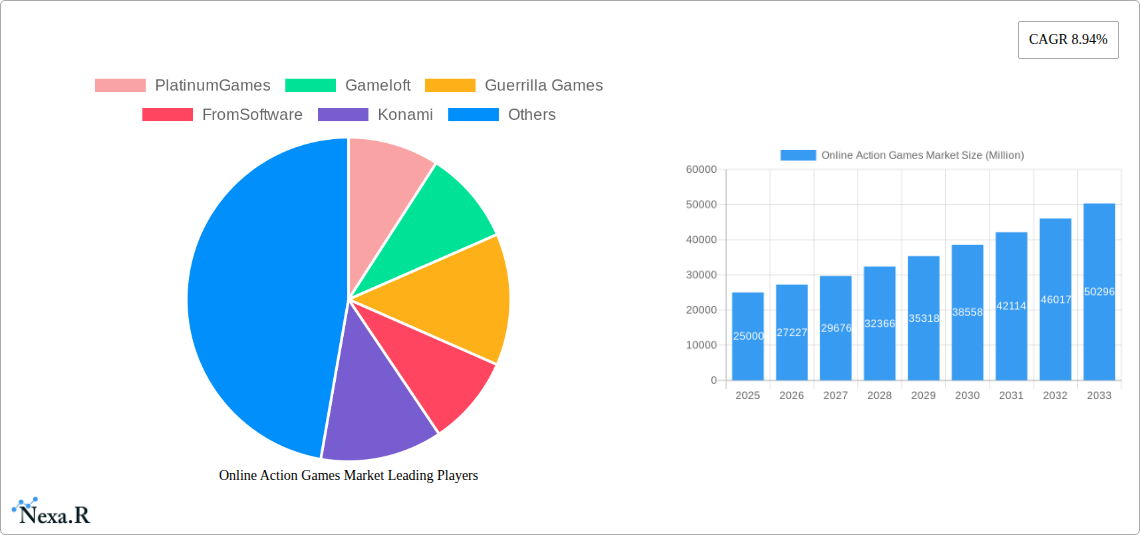

Online Action Games Market Company Market Share

Online Action Games Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Online Action Games market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). We delve into market dynamics, growth trends, dominant segments, key players, and emerging opportunities within the broader gaming industry, focusing on the parent market of online gaming and the child market of action games. The report utilizes a robust methodology incorporating both qualitative and quantitative insights, offering invaluable strategic guidance for industry stakeholders. The total market size is projected to reach xx Million units by 2033.

Online Action Games Market Market Dynamics & Structure

The online action games market is characterized by intense competition, rapid technological advancements, and evolving regulatory landscapes. Market concentration is moderate, with a few major players holding significant market share, while numerous smaller studios contribute to a diverse product landscape. Technological innovation, particularly in graphics rendering, AI-driven gameplay, and cross-platform compatibility, is a key driver. Regulatory frameworks concerning data privacy, in-app purchases, and content appropriateness vary across regions, influencing market dynamics. The rise of mobile gaming has created new competitive product substitutes, while the increasing popularity of esports contributes to market expansion. Mergers and acquisitions (M&A) activity is prevalent, with larger companies acquiring smaller studios to expand their portfolios and technological capabilities. The market shows a preference for established franchises and well-known brands.

- Market Concentration: Moderate, with top 5 players holding approximately 40% market share in 2025.

- Technological Innovation Drivers: Enhanced graphics, AI-powered NPCs, cross-platform play, cloud gaming.

- Regulatory Frameworks: Vary by region, impacting monetization strategies and content restrictions.

- Competitive Product Substitutes: Other online game genres, mobile casual games, alternative entertainment forms.

- End-User Demographics: Primarily young adults (18-35), with a growing segment of older gamers.

- M&A Trends: Increasing consolidation, with larger companies acquiring smaller developers for IP and talent. An estimated xx M&A deals occurred between 2019 and 2024.

Online Action Games Market Growth Trends & Insights

The online action games market has experienced significant growth in recent years, fueled by increased internet penetration, the proliferation of smartphones, and the rising popularity of esports. The market size grew from xx Million units in 2019 to xx Million units in 2024, exhibiting a CAGR of xx%. This growth is projected to continue, with a forecasted CAGR of xx% from 2025 to 2033, reaching xx Million units by 2033. Technological advancements, such as improved graphics and immersive gameplay, have enhanced the player experience, driving adoption rates. The shift towards free-to-play models with in-app purchases has broadened market accessibility and contributed to revenue growth. Changing consumer preferences towards multiplayer and competitive gaming have also significantly impacted market evolution.

- Market Size Evolution: Steady growth driven by technological advancements and evolving gaming preferences.

- Adoption Rates: High growth in mobile gaming, particularly in emerging markets.

- Technological Disruptions: VR/AR integration, cloud gaming, and AI-driven game mechanics are reshaping the market.

- Consumer Behavior Shifts: Increased preference for multiplayer, competitive, and free-to-play models.

Dominant Regions, Countries, or Segments in Online Action Games Market

The North American and Asian markets are the dominant regions in the online action games market, driven by high internet penetration, strong gaming culture, and significant spending on gaming content. Within these regions, specific countries such as the USA, China, Japan, and South Korea show particularly robust growth. In terms of revenue models, Free Gaming Services are experiencing the fastest growth, driven by the broader accessibility and the monetization through in-app purchases. PC and Mobile platforms are the leading segments, with mobile experiencing faster growth due to its accessibility and broad reach. Among operating systems, Android and iOS dominate the mobile market, while Windows maintains a strong presence on the PC segment.

- Key Drivers: High internet penetration, strong gaming culture, favorable economic conditions, supportive government policies in certain countries.

- Dominance Factors: Large player base, high spending power, supportive infrastructure, strong developer communities.

- Growth Potential: Emerging markets in Asia, Latin America, and Africa offer significant growth opportunities.

Online Action Games Market Product Landscape

The online action game market features a diverse range of products, from established franchises with decades-long legacies to innovative new titles leveraging cutting-edge technologies. Products are characterized by increasingly sophisticated graphics, immersive gameplay mechanics, and compelling narratives. Unique selling propositions often include unique game mechanics, compelling storylines, strong multiplayer components, and extensive content updates. Technological advancements such as advanced AI, procedural generation, and improved networking capabilities are constantly enhancing the player experience.

Key Drivers, Barriers & Challenges in Online Action Games Market

Key Drivers: The increasing popularity of esports, technological advancements in graphics and gameplay, and the growing accessibility of mobile gaming are major drivers. Free-to-play models also contribute to greater accessibility and market expansion. The rise of streaming platforms and influencer marketing also boost market exposure.

Key Barriers & Challenges: Intense competition, the high cost of game development, and the need to adapt to evolving consumer preferences represent significant challenges. The risk of piracy and the complexities of regulatory environments in various regions also pose significant hurdles. Supply chain disruptions can impact the timely release of games, potentially affecting revenue.

Emerging Opportunities in Online Action Games Market

Emerging opportunities exist in untapped markets such as Africa and parts of Southeast Asia, the expansion of cloud gaming, and increased integration of VR/AR technology. The growing demand for cross-platform compatibility and personalized gaming experiences also present significant opportunities for growth. The rise of new game genres within the action genre such as Battle Royale or hero shooters also creates new space for expansion.

Growth Accelerators in the Online Action Games Market Industry

Technological breakthroughs in AI, graphics rendering, and VR/AR integration will continue to drive market growth. Strategic partnerships between game developers and technology companies will enhance innovation and market reach. Expansion into new markets with growing internet penetration will also fuel long-term growth.

Key Players Shaping the Online Action Games Market Market

Notable Milestones in Online Action Games Market Sector

- July 2022: Ubisoft unveils Tom Clancy's The Division® Resurgence, a free-to-play mobile game for iOS and Android, expanding the franchise's reach and demonstrating the growing importance of mobile gaming.

In-Depth Online Action Games Market Market Outlook

The online action games market is poised for continued strong growth, driven by technological innovation, expanding market reach, and the increasing popularity of esports. Strategic partnerships, focused investment in R&D, and the emergence of new gaming platforms will create exciting opportunities for both established and emerging players. The market's future potential is considerable, with significant expansion expected in untapped markets and continued innovation in game mechanics and technology.

Online Action Games Market Segmentation

-

1. Revenue Model

- 1.1. Free Gaming Services

- 1.2. Paid Gaming Services

-

2. Platform

- 2.1. PCs

- 2.2. Consoles

- 2.3. Mobile Phones

-

3. Operating System

- 3.1. iOS

- 3.2. Android

- 3.3. Windows

- 3.4. Other Operating Systems

Online Action Games Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

-

5. Middle East

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of the Middle East

Online Action Games Market Regional Market Share

Geographic Coverage of Online Action Games Market

Online Action Games Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Adoption of Smartphones; Increased Utilization of Gaming Simulation for Training and Analysis Across a Variety of Fields; Growing Demand for VR Headsets

- 3.3. Market Restrains

- 3.3.1. Need for Expensive Graphic Cards

- 3.4. Market Trends

- 3.4.1. Surge in the usage of MMORPG Games

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Action Games Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Revenue Model

- 5.1.1. Free Gaming Services

- 5.1.2. Paid Gaming Services

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. PCs

- 5.2.2. Consoles

- 5.2.3. Mobile Phones

- 5.3. Market Analysis, Insights and Forecast - by Operating System

- 5.3.1. iOS

- 5.3.2. Android

- 5.3.3. Windows

- 5.3.4. Other Operating Systems

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Revenue Model

- 6. North America Online Action Games Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Revenue Model

- 6.1.1. Free Gaming Services

- 6.1.2. Paid Gaming Services

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. PCs

- 6.2.2. Consoles

- 6.2.3. Mobile Phones

- 6.3. Market Analysis, Insights and Forecast - by Operating System

- 6.3.1. iOS

- 6.3.2. Android

- 6.3.3. Windows

- 6.3.4. Other Operating Systems

- 6.1. Market Analysis, Insights and Forecast - by Revenue Model

- 7. Europe Online Action Games Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Revenue Model

- 7.1.1. Free Gaming Services

- 7.1.2. Paid Gaming Services

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. PCs

- 7.2.2. Consoles

- 7.2.3. Mobile Phones

- 7.3. Market Analysis, Insights and Forecast - by Operating System

- 7.3.1. iOS

- 7.3.2. Android

- 7.3.3. Windows

- 7.3.4. Other Operating Systems

- 7.1. Market Analysis, Insights and Forecast - by Revenue Model

- 8. Asia Pacific Online Action Games Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Revenue Model

- 8.1.1. Free Gaming Services

- 8.1.2. Paid Gaming Services

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. PCs

- 8.2.2. Consoles

- 8.2.3. Mobile Phones

- 8.3. Market Analysis, Insights and Forecast - by Operating System

- 8.3.1. iOS

- 8.3.2. Android

- 8.3.3. Windows

- 8.3.4. Other Operating Systems

- 8.1. Market Analysis, Insights and Forecast - by Revenue Model

- 9. South America Online Action Games Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Revenue Model

- 9.1.1. Free Gaming Services

- 9.1.2. Paid Gaming Services

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. PCs

- 9.2.2. Consoles

- 9.2.3. Mobile Phones

- 9.3. Market Analysis, Insights and Forecast - by Operating System

- 9.3.1. iOS

- 9.3.2. Android

- 9.3.3. Windows

- 9.3.4. Other Operating Systems

- 9.1. Market Analysis, Insights and Forecast - by Revenue Model

- 10. Middle East Online Action Games Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Revenue Model

- 10.1.1. Free Gaming Services

- 10.1.2. Paid Gaming Services

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. PCs

- 10.2.2. Consoles

- 10.2.3. Mobile Phones

- 10.3. Market Analysis, Insights and Forecast - by Operating System

- 10.3.1. iOS

- 10.3.2. Android

- 10.3.3. Windows

- 10.3.4. Other Operating Systems

- 10.1. Market Analysis, Insights and Forecast - by Revenue Model

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PlatinumGames

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Gameloft

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Guerrilla Games

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FromSoftware

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Konami

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SIE Santa Monica Studio

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nintendo EPD

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rocksteady Studios

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tencent

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rockstar North

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sony Interactive Entertainment

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 EA DICE*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Bethesda Game Studios

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Capcom

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Ubisoft

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 id Software

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 PlatinumGames

List of Figures

- Figure 1: Global Online Action Games Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Online Action Games Market Revenue (billion), by Revenue Model 2025 & 2033

- Figure 3: North America Online Action Games Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 4: North America Online Action Games Market Revenue (billion), by Platform 2025 & 2033

- Figure 5: North America Online Action Games Market Revenue Share (%), by Platform 2025 & 2033

- Figure 6: North America Online Action Games Market Revenue (billion), by Operating System 2025 & 2033

- Figure 7: North America Online Action Games Market Revenue Share (%), by Operating System 2025 & 2033

- Figure 8: North America Online Action Games Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Online Action Games Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Online Action Games Market Revenue (billion), by Revenue Model 2025 & 2033

- Figure 11: Europe Online Action Games Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 12: Europe Online Action Games Market Revenue (billion), by Platform 2025 & 2033

- Figure 13: Europe Online Action Games Market Revenue Share (%), by Platform 2025 & 2033

- Figure 14: Europe Online Action Games Market Revenue (billion), by Operating System 2025 & 2033

- Figure 15: Europe Online Action Games Market Revenue Share (%), by Operating System 2025 & 2033

- Figure 16: Europe Online Action Games Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Online Action Games Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Online Action Games Market Revenue (billion), by Revenue Model 2025 & 2033

- Figure 19: Asia Pacific Online Action Games Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 20: Asia Pacific Online Action Games Market Revenue (billion), by Platform 2025 & 2033

- Figure 21: Asia Pacific Online Action Games Market Revenue Share (%), by Platform 2025 & 2033

- Figure 22: Asia Pacific Online Action Games Market Revenue (billion), by Operating System 2025 & 2033

- Figure 23: Asia Pacific Online Action Games Market Revenue Share (%), by Operating System 2025 & 2033

- Figure 24: Asia Pacific Online Action Games Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Online Action Games Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Online Action Games Market Revenue (billion), by Revenue Model 2025 & 2033

- Figure 27: South America Online Action Games Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 28: South America Online Action Games Market Revenue (billion), by Platform 2025 & 2033

- Figure 29: South America Online Action Games Market Revenue Share (%), by Platform 2025 & 2033

- Figure 30: South America Online Action Games Market Revenue (billion), by Operating System 2025 & 2033

- Figure 31: South America Online Action Games Market Revenue Share (%), by Operating System 2025 & 2033

- Figure 32: South America Online Action Games Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Online Action Games Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Online Action Games Market Revenue (billion), by Revenue Model 2025 & 2033

- Figure 35: Middle East Online Action Games Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 36: Middle East Online Action Games Market Revenue (billion), by Platform 2025 & 2033

- Figure 37: Middle East Online Action Games Market Revenue Share (%), by Platform 2025 & 2033

- Figure 38: Middle East Online Action Games Market Revenue (billion), by Operating System 2025 & 2033

- Figure 39: Middle East Online Action Games Market Revenue Share (%), by Operating System 2025 & 2033

- Figure 40: Middle East Online Action Games Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Online Action Games Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Online Action Games Market Revenue billion Forecast, by Revenue Model 2020 & 2033

- Table 2: Global Online Action Games Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 3: Global Online Action Games Market Revenue billion Forecast, by Operating System 2020 & 2033

- Table 4: Global Online Action Games Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Online Action Games Market Revenue billion Forecast, by Revenue Model 2020 & 2033

- Table 6: Global Online Action Games Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 7: Global Online Action Games Market Revenue billion Forecast, by Operating System 2020 & 2033

- Table 8: Global Online Action Games Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Online Action Games Market Revenue billion Forecast, by Revenue Model 2020 & 2033

- Table 14: Global Online Action Games Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 15: Global Online Action Games Market Revenue billion Forecast, by Operating System 2020 & 2033

- Table 16: Global Online Action Games Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Germany Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: France Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Online Action Games Market Revenue billion Forecast, by Revenue Model 2020 & 2033

- Table 24: Global Online Action Games Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 25: Global Online Action Games Market Revenue billion Forecast, by Operating System 2020 & 2033

- Table 26: Global Online Action Games Market Revenue billion Forecast, by Country 2020 & 2033

- Table 27: India Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: China Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Japan Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Global Online Action Games Market Revenue billion Forecast, by Revenue Model 2020 & 2033

- Table 32: Global Online Action Games Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 33: Global Online Action Games Market Revenue billion Forecast, by Operating System 2020 & 2033

- Table 34: Global Online Action Games Market Revenue billion Forecast, by Country 2020 & 2033

- Table 35: Brazil Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Argentina Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Online Action Games Market Revenue billion Forecast, by Revenue Model 2020 & 2033

- Table 38: Global Online Action Games Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 39: Global Online Action Games Market Revenue billion Forecast, by Operating System 2020 & 2033

- Table 40: Global Online Action Games Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: United Arab Emirates Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Saudi Arabia Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Rest of the Middle East Online Action Games Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Action Games Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Online Action Games Market?

Key companies in the market include PlatinumGames, Gameloft, Guerrilla Games, FromSoftware, Konami, SIE Santa Monica Studio, Nintendo EPD, Rocksteady Studios, Tencent, Rockstar North, Sony Interactive Entertainment, EA DICE*List Not Exhaustive, Bethesda Game Studios, Capcom, Ubisoft, id Software.

3. What are the main segments of the Online Action Games Market?

The market segments include Revenue Model, Platform, Operating System.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.39 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Adoption of Smartphones; Increased Utilization of Gaming Simulation for Training and Analysis Across a Variety of Fields; Growing Demand for VR Headsets.

6. What are the notable trends driving market growth?

Surge in the usage of MMORPG Games.

7. Are there any restraints impacting market growth?

Need for Expensive Graphic Cards.

8. Can you provide examples of recent developments in the market?

In July 2022 - Tom Clancy's The Division® Resurgence, a new free-to-play third-person shooter RPG mobile game from Tom Clancy's The Division franchise, was unveiled by Ubisoft. The Division Resurgence by Tom Clancy is a masterpiece with a fresh plot, a new storyline, and difficult opponent groups. The game is accessible for iOS and Android devices in the App Store® and Google PlayTM.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Action Games Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Action Games Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Action Games Market?

To stay informed about further developments, trends, and reports in the Online Action Games Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence