Key Insights

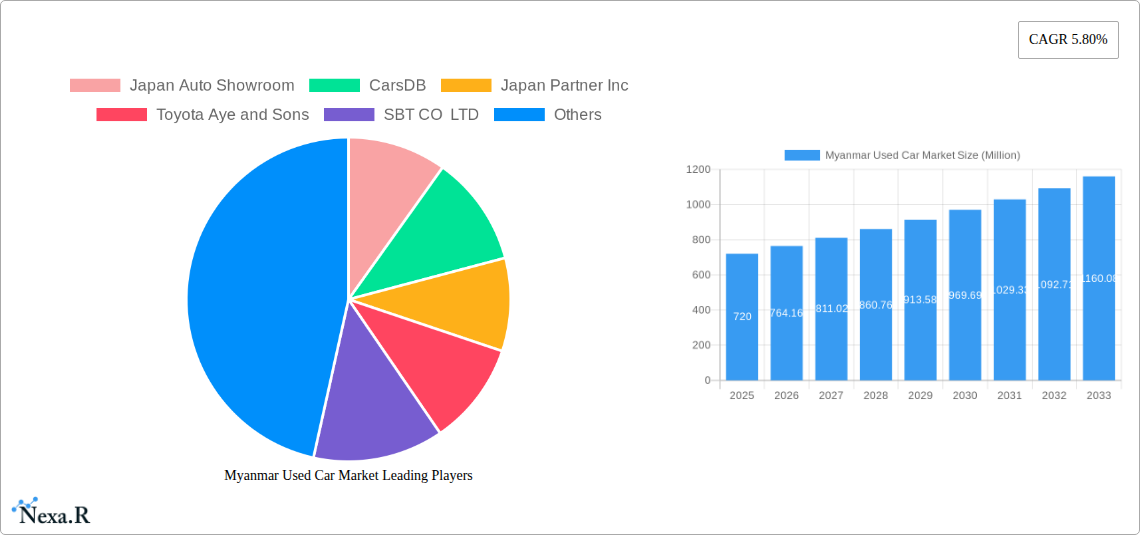

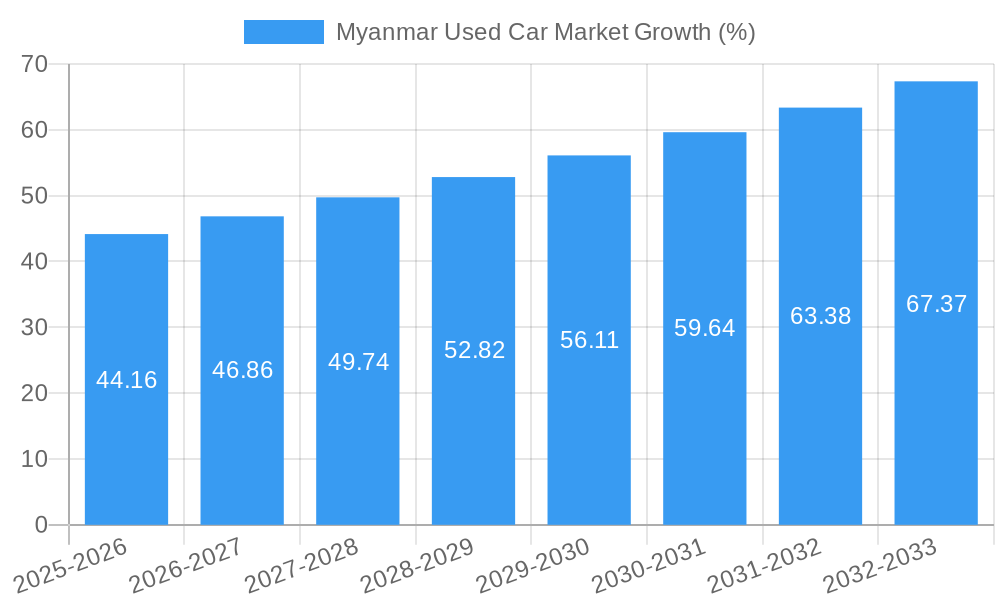

The Myanmar used car market, valued at $720 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.80% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes within Myanmar are enabling more individuals to purchase vehicles, driving demand for affordable used cars. The increasing urbanization and improved infrastructure in major cities further contribute to this trend, as personal transportation becomes increasingly necessary. Furthermore, a preference for newer models among a growing middle class pushes older vehicles into the used car market, adding to the supply. The market is segmented by fuel type (gasoline, diesel, electric, others), vehicle type (hatchback, sedan, SUV, MUV), and vendor type (organized, unorganized). While the electric vehicle segment is currently small, its anticipated growth could significantly impact the market in the coming years, particularly as government initiatives promote sustainable transportation. The organized sector, encompassing established dealerships and showrooms, is expected to gain market share due to its provision of financing options and better customer service. However, the unorganized sector remains a significant player, representing a large portion of individual sales and transactions.

Challenges for the Myanmar used car market include inconsistent regulatory frameworks, which may impede growth, and the need for improved consumer protection mechanisms. The limited availability of financing options for low-income buyers can also restrict market expansion. Nevertheless, the overall outlook for the Myanmar used car market remains positive, supported by sustained economic growth and increasing car ownership. The potential for increased government investment in road infrastructure and the promotion of used car sales through formal channels could further accelerate market growth. Key players like Japan Auto Showroom, CarsDB, and others are positioning themselves strategically to capitalize on this expanding opportunity. The ongoing evolution of the market will require adaptability and innovation from both buyers and sellers.

This comprehensive report provides an in-depth analysis of the Myanmar used car market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering valuable insights for industry professionals, investors, and businesses operating within this dynamic sector. The market is segmented by fuel type (Gasoline, Diesel, Electric, Other Fuel Types), vehicle type (Hatchback, Sedan, SUV, MUV), and vendor type (Organized, Unorganized). The total market size is projected to reach xx Million units by 2033.

Myanmar Used Car Market Dynamics & Structure

The Myanmar used car market exhibits a complex interplay of factors shaping its structure and growth trajectory. Market concentration is currently moderate, with a few large players like Capital Diamond Star Group Limited and Toyota Aye and Sons competing alongside numerous smaller, unorganized vendors. Technological innovation, while nascent, is driven by the increasing adoption of digital platforms like the one launched by Capital Diamond Star Group Limited in December 2021. However, significant barriers to innovation exist, including limited internet penetration and technological expertise. The regulatory framework, significantly impacted by the March 2023 announcement of new import rules and regulations (30-40% customs duty), presents both challenges and opportunities. The market is also influenced by the availability of competitive product substitutes and the evolving demographics of end-users, with increasing demand from the growing middle class. M&A activity remains relatively low (xx deals in the last 5 years), reflecting the market's developmental stage.

- Market Concentration: Moderate, with a few dominant players and numerous smaller vendors.

- Technological Innovation: Driven by digital platforms but constrained by limited internet access and expertise.

- Regulatory Framework: Significantly impacted by the new import regulations (March 2023).

- Competitive Substitutes: Limited due to relatively low new car ownership rates.

- End-User Demographics: Growing middle class is a key driver of demand.

- M&A Activity: Low (xx deals in the last 5 years).

Myanmar Used Car Market Growth Trends & Insights

The Myanmar used car market has witnessed significant growth throughout the historical period (2019-2024), driven primarily by rising disposable incomes, increasing urbanization, and a growing preference for personal transportation. While precise figures are difficult to obtain due to data limitations, the market size is estimated at xx Million units in 2025, exhibiting a CAGR of xx% during the historical period. The adoption rate of used cars is high relative to new car sales, primarily due to affordability. Technological disruptions, including the introduction of online platforms for buying and selling used vehicles, are transforming consumer behavior. Consumers increasingly rely on digital channels for research, price comparison, and transaction completion. The market penetration of used cars is high due to the lower purchase price compared to new vehicles. The forecast period (2025-2033) is expected to see continued growth, though at a potentially moderated pace compared to the historical period, influenced by the new import regulations.

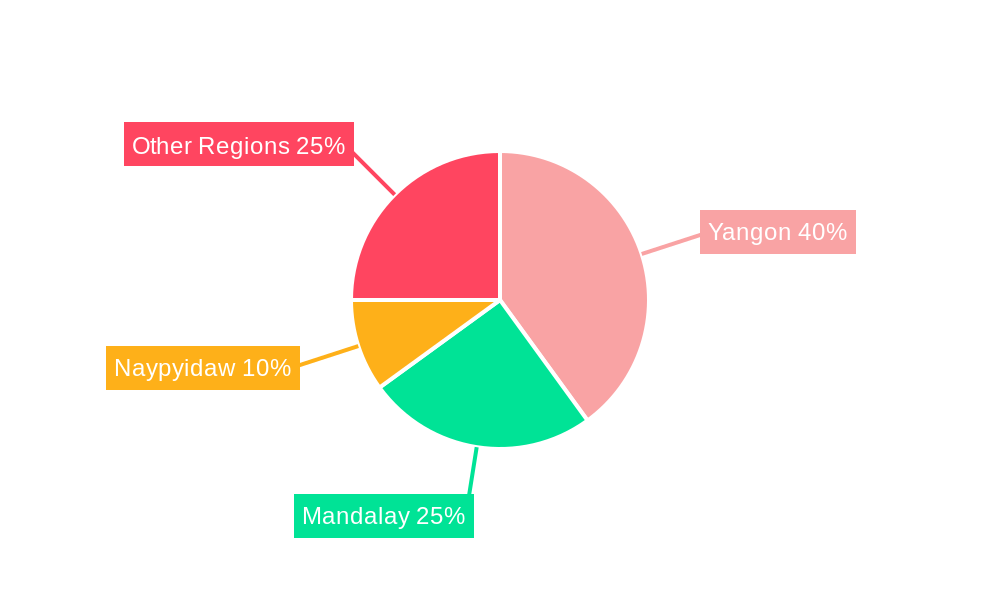

Dominant Regions, Countries, or Segments in Myanmar Used Car Market

The Yangon Region dominates the Myanmar used car market, accounting for approximately xx% of total sales in 2025, owing to its higher population density, economic activity, and infrastructure. Gasoline-powered vehicles represent the largest segment by fuel type (xx% market share in 2025), followed by diesel. SUVs and Sedans are the dominant vehicle types, reflecting consumer preferences for practicality and status. The organized vendor segment is growing steadily, albeit from a small base, aided by the rise of digital platforms and improved consumer trust. However, the unorganized sector continues to hold significant market share due to lower prices and wider accessibility.

- Key Drivers:

- Yangon Region's Economic Dominance: High population density and economic activity.

- Affordability of Used Cars: Lower price point compared to new vehicles.

- Growing Middle Class: Increased disposable income fuels demand.

- Dominant Segments:

- Region: Yangon Region (xx% market share)

- Fuel Type: Gasoline (xx% market share)

- Vehicle Type: SUVs and Sedans

- Vendor Type: Unorganized (xx% market share)

Myanmar Used Car Market Product Landscape

The Myanmar used car market features a diverse range of vehicles, from older models to relatively newer ones imported primarily from Japan. Innovation in the product landscape is limited, primarily focusing on enhancing the online presentation and information available to buyers. This includes features like high-quality images, detailed vehicle descriptions, and online financing options. However, the lack of comprehensive vehicle history reports remains a challenge.

Key Drivers, Barriers & Challenges in Myanmar Used Car Market

Key Drivers:

Rising disposable incomes, increasing urbanization, and the affordability of used cars are driving market growth. The expansion of online platforms is improving market transparency and access.

Key Challenges:

The newly implemented import regulations (30-40% customs duty) represent a significant barrier to growth, increasing the price of imported used vehicles. The lack of a robust regulatory framework for the unorganized sector presents risks for consumers. Supply chain disruptions, particularly in the post-pandemic era, can impact vehicle availability.

Emerging Opportunities in Myanmar Used Car Market

The increasing adoption of digital platforms presents opportunities for organized vendors to expand their market share. Providing financing options to buyers, combined with comprehensive vehicle history reports, could enhance consumer trust and stimulate sales. The relatively underdeveloped electric vehicle market represents a long-term opportunity, though significant infrastructure development will be required.

Growth Accelerators in the Myanmar Used Car Market Industry

Continued economic growth and urbanization in Myanmar will propel the market's long-term expansion. Government efforts to improve the regulatory framework and enhance consumer protection would further stimulate growth. The development of reliable vehicle history reporting services will also enhance transparency and trust in the market.

Key Players Shaping the Myanmar Used Car Market Market

- Japan Auto Showroom

- CarsDB

- Japan Partner Inc

- Toyota Aye and Sons

- SBT CO LTD

- Capital Diamond Star Group Limited

- Farmer Auto

- Prestige Automobiles Co Ltd

Notable Milestones in Myanmar Used Car Market Sector

- December 2021: Capital Diamond Star Group Limited launched a digital platform for used cars.

- March 2023: The government announced new used car import rules and regulations, imposing a 30-40% customs duty.

In-Depth Myanmar Used Car Market Market Outlook

The Myanmar used car market is poised for continued growth over the forecast period (2025-2033), though at a potentially moderated rate due to the impact of new import regulations. Strategic opportunities exist for businesses that can adapt to the changing regulatory landscape, leverage digital technologies to improve market transparency and access, and cater to the evolving needs of the growing middle class. The long-term potential of the market is significant, particularly with improvements in infrastructure and the wider adoption of digital solutions.

Myanmar Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sport Utility Vehicles (SUVs)

- 1.4. Multi-Purpose Vehicles (MUVs)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Gasoline

- 3.2. Diesel

- 3.3. Electric

- 3.4. Other Fuel Types

Myanmar Used Car Market Segmentation By Geography

- 1. Myanmar

Myanmar Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Price of New Cars

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Rising Internet penetration and Online Digital Platforms to drive demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Myanmar Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sport Utility Vehicles (SUVs)

- 5.1.4. Multi-Purpose Vehicles (MUVs)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gasoline

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Other Fuel Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Myanmar

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Japan Auto Showroom

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CarsDB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Japan Partner Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toyota Aye and Sons

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SBT CO LTD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Capital Diamond Star Group Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Farmer Auto

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Prestige Automobiles Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Japan Auto Showroom

List of Figures

- Figure 1: Myanmar Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Myanmar Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: Myanmar Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Myanmar Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Myanmar Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 4: Myanmar Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 5: Myanmar Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Myanmar Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Myanmar Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 8: Myanmar Used Car Market Revenue Million Forecast, by Vendor Type 2019 & 2032

- Table 9: Myanmar Used Car Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 10: Myanmar Used Car Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Myanmar Used Car Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Myanmar Used Car Market?

Key companies in the market include Japan Auto Showroom, CarsDB, Japan Partner Inc, Toyota Aye and Sons, SBT CO LTD, Capital Diamond Star Group Limited, Farmer Auto, Prestige Automobiles Co Ltd.

3. What are the main segments of the Myanmar Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Price of New Cars.

6. What are the notable trends driving market growth?

Rising Internet penetration and Online Digital Platforms to drive demand in the Market.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

March 2023: The government of Myanmar announced the used car Import Rules & Regulations in the country. The government imposed around 30-40% customs duty on used cars.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Myanmar Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Myanmar Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Myanmar Used Car Market?

To stay informed about further developments, trends, and reports in the Myanmar Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence