Key Insights

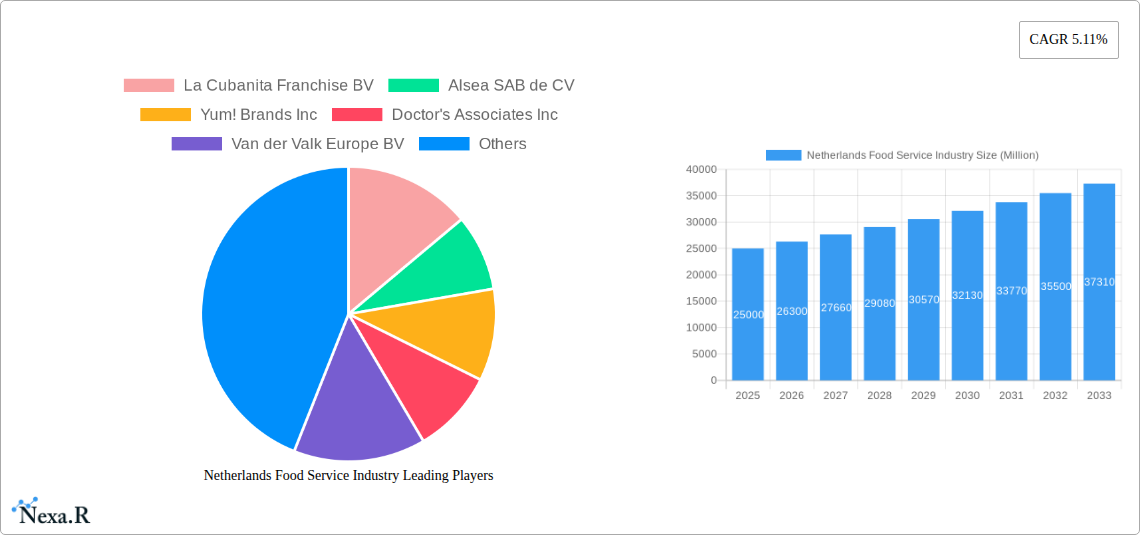

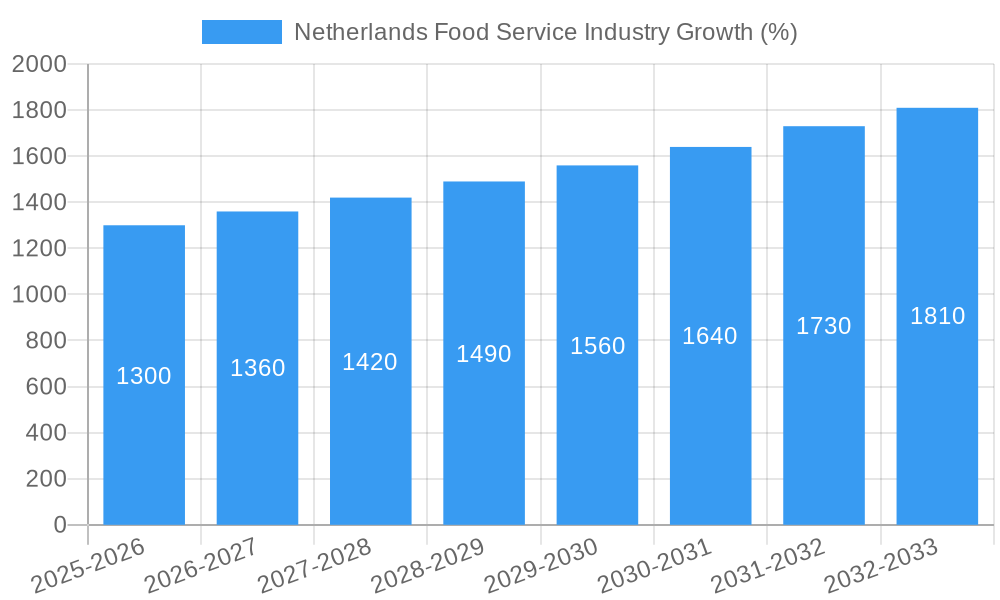

The Netherlands food service industry, valued at €XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.11% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes and a burgeoning young population with a preference for dining out contribute significantly to market growth. Furthermore, the increasing popularity of diverse culinary experiences, fueled by globalization and tourism, fuels demand across various segments. The strong presence of both international and local chains, coupled with the rise of independent outlets and innovative food concepts, creates a dynamic and competitive market landscape. Growth is particularly evident in the quick-service restaurant (QSR) sector, with cafes, bars, and other QSR cuisines witnessing significant traction. The trend towards healthier and more sustainable food options presents both a challenge and an opportunity for industry players. While increasing operational costs and intense competition pose potential restraints, strategic partnerships, technological advancements in areas like delivery services, and a focus on customer experience are vital for sustained growth.

The segmentation of the market reflects these trends. Chained outlets dominate market share, leveraging their brand recognition and established supply chains. However, independent outlets are gaining ground, offering unique concepts and localized experiences. Location-wise, the leisure, lodging, and retail segments contribute significantly, with standalone locations holding a strong presence. The travel sector, particularly airports and train stations, also represents a significant growth area. Key players such as McDonald's Corporation, Domino's Pizza Enterprises Ltd, and other established brands are actively shaping the market, while smaller, niche players are capitalizing on evolving consumer preferences. The Netherlands' robust tourism sector and strategically central location within Europe further contribute to the overall dynamism and attractiveness of this expanding food service market. Future growth will hinge on companies’ ability to adapt to changing consumer preferences and efficiently navigate the evolving competitive environment.

Netherlands Food Service Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Netherlands food service industry, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic planners. The report analyzes the parent market of the Food Service Industry and its child markets like Cafes & Bars and Other QSR Cuisines. Market values are presented in millions of units.

Netherlands Food Service Industry Market Dynamics & Structure

The Netherlands food service industry is a dynamic and competitive landscape characterized by a mix of large international chains and smaller independent businesses. Market concentration is moderate, with several key players holding significant market share, but a substantial portion held by independent operators. Technological innovation, driven by digital ordering, delivery platforms, and automation, is transforming operations and customer experience. Stringent food safety regulations and labor laws form the regulatory framework. Competitive substitutes include home-cooked meals and meal delivery services. The end-user demographic is diverse, reflecting the Netherlands' multicultural society and varying consumer preferences. M&A activity is relatively frequent, particularly among QSR chains, driven by expansion strategies and consolidation.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Strong emphasis on online ordering, delivery apps, and kitchen automation.

- Regulatory Framework: Stringent food safety and labor regulations.

- Competitive Substitutes: Home-cooked meals, meal kits, and online grocery delivery services.

- End-User Demographics: Diverse, reflecting the multicultural nature of the Netherlands.

- M&A Trends: Increased activity, particularly among QSR chains, with approximately xx deals in the last 5 years. Deal value totaled approximately xx million.

Netherlands Food Service Industry Growth Trends & Insights

The Netherlands food service market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. The market size is estimated at xx million in 2025, driven by factors such as rising disposable incomes, changing lifestyles, and increased demand for convenience. Technological disruptions, including the rise of online ordering and delivery platforms, have significantly impacted consumer behavior, accelerating the adoption of digital solutions within the industry. Consumer preferences are shifting towards healthier options, sustainable practices, and personalized experiences. The forecast period (2025-2033) projects continued growth, with a projected CAGR of xx%, driven by sustained economic growth and evolving consumer demands. Market penetration of online ordering is expected to reach xx% by 2033. Specific growth areas include the expansion of quick-service restaurants (QSR) and the increasing popularity of diverse culinary experiences.

Dominant Regions, Countries, or Segments in Netherlands Food Service Industry

The Randstad region (Amsterdam, Rotterdam, The Hague, Utrecht) is the dominant market segment, driven by high population density, strong tourism, and significant economic activity. Within food service types, cafes and bars maintain a substantial market share, driven by social trends and a vibrant nightlife. Chained outlets dominate the market in terms of revenue, with a significant portion of the market composed of independent outlets. The Retail location type accounts for the largest share, driven by high foot traffic and accessibility.

- Key Drivers (Randstad): High population density, strong tourism, robust economic activity.

- Key Drivers (Cafes & Bars): Social trends, nightlife culture, diverse offerings.

- Key Drivers (Chained Outlets): Brand recognition, economies of scale, efficient operations.

- Key Drivers (Retail): High foot traffic, accessibility, convenience.

- Market Share (Randstad): Approximately xx% of total market revenue.

- Growth Potential: Strong, driven by population growth and increasing consumer spending.

Netherlands Food Service Industry Product Landscape

The product landscape is diverse, encompassing traditional Dutch cuisine alongside international offerings. Innovation focuses on healthy, sustainable, and personalized food options. Technological advancements in food preparation, digital ordering systems, and personalized customer experiences are key differentiators. Unique selling propositions include high-quality ingredients, locally sourced produce, and specialized culinary skills. The emphasis is shifting towards efficient operations and optimized supply chains to reduce costs and enhance customer satisfaction.

Key Drivers, Barriers & Challenges in Netherlands Food Service Industry

Key Drivers:

- Rising disposable incomes and changing lifestyles

- Growing demand for convenience and diverse culinary experiences.

- Technological advancements in food preparation and service.

- Government initiatives supporting the food service sector.

Key Challenges:

- Increasing labor costs and skills shortages.

- Intense competition and fluctuating consumer preferences.

- Supply chain disruptions, especially in ingredient sourcing.

- Regulatory hurdles and compliance costs, such as sustainability regulations. Impact on costs: xx million annually.

Emerging Opportunities in Netherlands Food Service Industry

- Growth in healthy and sustainable food options: Demand for plant-based alternatives and locally sourced ingredients is increasing.

- Expansion of delivery and online ordering services: Opportunities exist in improving logistics and technological integration.

- Customization and personalization of dining experiences: Tailoring offerings to individual customer preferences can boost revenue.

- Development of innovative food concepts: Unique culinary experiences can attract a wider customer base.

Growth Accelerators in the Netherlands Food Service Industry

Technological advancements, such as AI-powered ordering systems and automated kitchens, are streamlining operations and enhancing efficiency, leading to cost savings and improved customer experience. Strategic partnerships, such as collaborations between food service providers and delivery platforms, expand market reach and increase customer base. Market expansion strategies, including opening new locations in underserved areas or targeting specific demographics, create new revenue streams and increase market share.

Key Players Shaping the Netherlands Food Service Industry Market

- La Cubanita Franchise BV

- Alsea SAB de CV

- Yum! Brands Inc

- Doctor's Associates Inc

- Van der Valk Europe BV

- Inter IKEA Holding BV

- Franchise Friendly Concepts BV

- Five Guys Enterprises LLC

- Spar International

- Autogrill SpA

- Bagels & Beans BV

- Domino's Pizza Enterprises Ltd

- Papa John's International Inc

- Meyer Horeca Group

- McDonald's Corporation

Notable Milestones in Netherlands Food Service Industry Sector

- July 2022: Autogrill and Dufry announced a merger, impacting the travel food service segment.

- February 2023: Collins Foods acquired eight KFC restaurants, increasing its market share.

- March 2023: Bagels & Beans launched its "Bagelbus" food truck concept, expanding its reach.

In-Depth Netherlands Food Service Industry Market Outlook

The Netherlands food service industry is poised for continued growth, driven by sustained economic growth, evolving consumer preferences, and technological advancements. Strategic opportunities exist in expanding into underserved markets, investing in sustainable practices, and leveraging digital technologies to improve efficiency and customer experience. The focus on innovation and adaptation to evolving consumer demands will be crucial for success in the coming years. The market is expected to reach xx million by 2033, presenting significant opportunities for both established players and new entrants.

Netherlands Food Service Industry Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Netherlands Food Service Industry Segmentation By Geography

- 1. Netherlands

Netherlands Food Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products

- 3.3. Market Restrains

- 3.3.1. Presence of Preservatives in Ready Meals may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. Penetration of various global brands in the market and the popularity of fast food make QSR the major segment in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Food Service Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 La Cubanita Franchise BV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alsea SAB de CV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yum! Brands Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Doctor's Associates Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Van der Valk Europe BV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Inter IKEA Holding BV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Franchise Friendly Concepts BV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Five Guys Enterprises LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Spar International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Autogrill SpA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bagels & Beans BV

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Domino's Pizza Enterprises Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Papa John's International Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Meyer Horeca Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 McDonald's Corporation

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 La Cubanita Franchise BV

List of Figures

- Figure 1: Netherlands Food Service Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Netherlands Food Service Industry Share (%) by Company 2024

List of Tables

- Table 1: Netherlands Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Netherlands Food Service Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Netherlands Food Service Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Netherlands Food Service Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Netherlands Food Service Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Netherlands Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Netherlands Food Service Industry Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 8: Netherlands Food Service Industry Revenue Million Forecast, by Outlet 2019 & 2032

- Table 9: Netherlands Food Service Industry Revenue Million Forecast, by Location 2019 & 2032

- Table 10: Netherlands Food Service Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Food Service Industry?

The projected CAGR is approximately 5.11%.

2. Which companies are prominent players in the Netherlands Food Service Industry?

Key companies in the market include La Cubanita Franchise BV, Alsea SAB de CV, Yum! Brands Inc, Doctor's Associates Inc, Van der Valk Europe BV, Inter IKEA Holding BV, Franchise Friendly Concepts BV, Five Guys Enterprises LLC, Spar International, Autogrill SpA, Bagels & Beans BV, Domino's Pizza Enterprises Ltd, Papa John's International Inc, Meyer Horeca Group, McDonald's Corporation.

3. What are the main segments of the Netherlands Food Service Industry?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products.

6. What are the notable trends driving market growth?

Penetration of various global brands in the market and the popularity of fast food make QSR the major segment in the country.

7. Are there any restraints impacting market growth?

Presence of Preservatives in Ready Meals may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

March 2023: Bagels & Beans launched its food truck concept called "Bagelbus".February 2023: Collins Foods Netherlands Operations, the fully owned Dutch subsidiary of Australia-based Collins Foods, signed a share purchase agreement to acquire eight KFC restaurants in the Netherlands. It will buy the restaurants from R Sambo Holding. Following the completion of the deal, the KFC restaurant network in the Netherlands under Collins Foods will increase to 56.July 2022: Autogrill and Dufry announced plans for a merger. Edizione, the investment arm of Italy's Benetton family, will transfer its entire stake of 50.3% in Autogrill to Dufry. Edizione will ultimately become Dufry's largest shareholder, with a stake of about 25% and 20% at the end of the transaction.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Food Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Food Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Food Service Industry?

To stay informed about further developments, trends, and reports in the Netherlands Food Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence