Key Insights

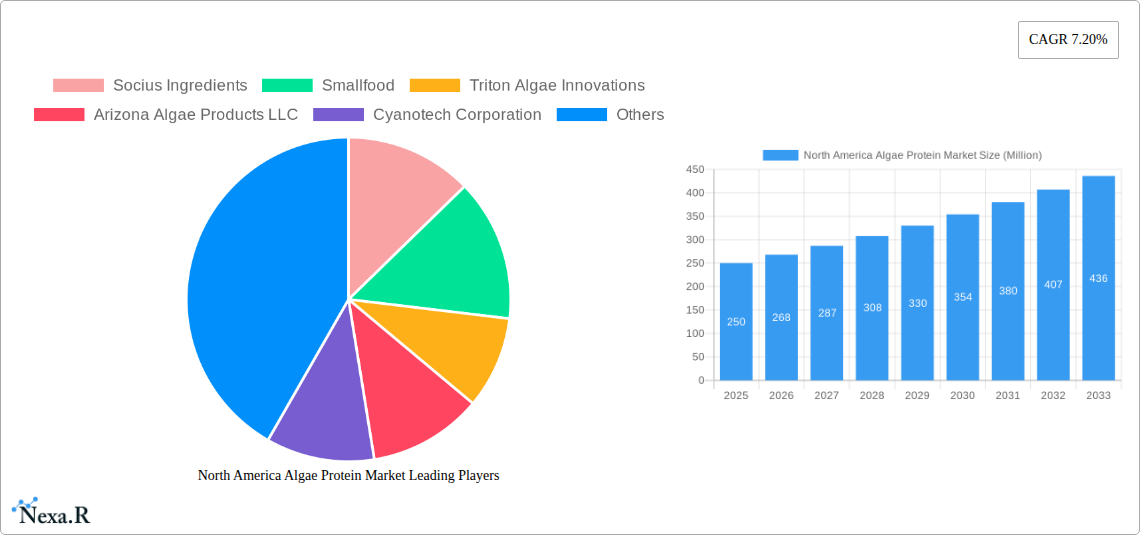

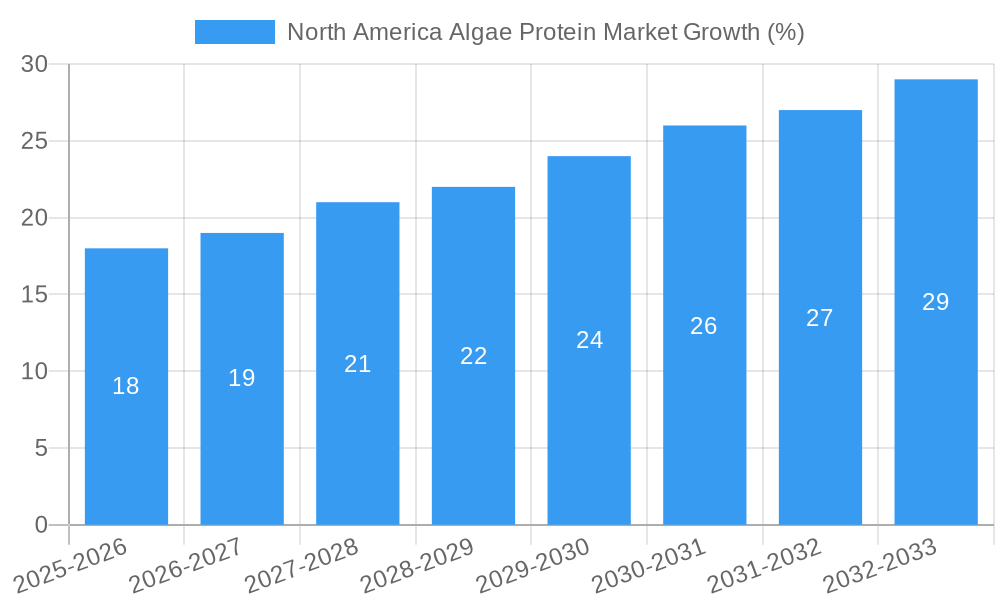

The North American algae protein market, currently experiencing robust growth, is projected to maintain a significant upward trajectory throughout the forecast period (2025-2033). A Compound Annual Growth Rate (CAGR) of 7.20% indicates substantial market expansion, driven by increasing consumer demand for plant-based protein sources, heightened awareness of the environmental sustainability of algae cultivation compared to traditional protein production methods, and the growing recognition of algae's nutritional benefits. The market's segmentation reveals a strong emphasis on the supplements sector within the end-user category, suggesting a significant portion of market demand originates from the health and wellness industry. Geographically, the United States commands a leading market share within North America, followed by Canada and Mexico, with the "Rest of North America" segment representing a smaller, yet still growing, portion of the market. Key players like Socius Ingredients, Smallfood, and Cyanotech Corporation are actively shaping the market landscape through innovation in algae cultivation, processing, and product development. The market's expansion is further fueled by ongoing research and development efforts aimed at improving the taste and texture of algae-based protein products, thus broadening their appeal to a wider consumer base.

The competitive landscape is characterized by a mix of established companies and emerging players, driving innovation and competition. While challenges such as overcoming consumer perceptions related to the taste and odor of algae-based products remain, the industry is actively addressing these concerns through technological advancements in processing and formulation. Regulatory factors and the cost of production are potential restraints, but the overarching trend indicates a positive outlook for continued growth, particularly given the increasing demand for sustainable and healthy food options. The market is likely to see further consolidation as larger companies acquire smaller players and the expansion of product offerings into diverse food and beverage applications, solidifying algae protein's position as a viable alternative protein source in North America. Furthermore, strategic partnerships between algae producers and food manufacturers are likely to accelerate market penetration and drive overall market expansion.

North America Algae Protein Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America algae protein market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. This report is crucial for businesses, investors, and researchers seeking to understand and capitalize on the burgeoning opportunities within this dynamic market segment. The market size is predicted to reach xx Million by 2033.

North America Algae Protein Market Dynamics & Structure

The North America algae protein market is experiencing significant growth, driven by factors such as increasing consumer demand for sustainable and plant-based protein sources, coupled with technological advancements in algae cultivation and processing. Market concentration is currently moderate, with several key players competing for market share. However, the market is expected to become more consolidated in the coming years as larger companies acquire smaller firms and expand their product portfolios. Technological innovation, particularly in areas such as high-yield cultivation and cost-effective extraction methods, is crucial for driving market growth. Regulatory frameworks related to food safety and labeling significantly influence market expansion. The market faces competition from traditional protein sources (soy, meat, dairy), but algae protein offers unique advantages like sustainability and nutritional profile. Furthermore, mergers and acquisitions (M&A) activities are increasing, indicating market consolidation and expansion.

- Market Concentration: Moderate, expected to increase through M&A.

- Technological Innovation: Key driver, focusing on cultivation yield and extraction efficiency.

- Regulatory Framework: Significant impact on market entry and product labeling.

- Competitive Substitutes: Traditional protein sources pose competition, while algae protein offers sustainability benefits.

- End-User Demographics: Increasing demand from health-conscious consumers and those seeking plant-based alternatives.

- M&A Trends: Increasing consolidation through acquisitions, driving market expansion. The number of M&A deals is estimated at xx in the past 5 years, with a projected increase of xx% over the forecast period.

North America Algae Protein Market Growth Trends & Insights

The North America algae protein market exhibits a robust growth trajectory, fueled by escalating consumer preference for sustainable and healthy food options. The market size expanded from xx Million in 2019 to xx Million in 2024, registering a CAGR of xx% during this period. This growth is expected to continue, with a projected CAGR of xx% from 2025 to 2033, reaching an estimated market value of xx Million by 2033. Technological advancements in algae cultivation and processing are streamlining production and lowering costs, accelerating market adoption. Consumer behavior is shifting towards plant-based diets, boosting demand for alternative protein sources like algae. The market penetration rate for algae protein in the food and supplement sectors is expected to increase from xx% in 2025 to xx% by 2033. These factors collectively indicate a promising future for the North American algae protein market.

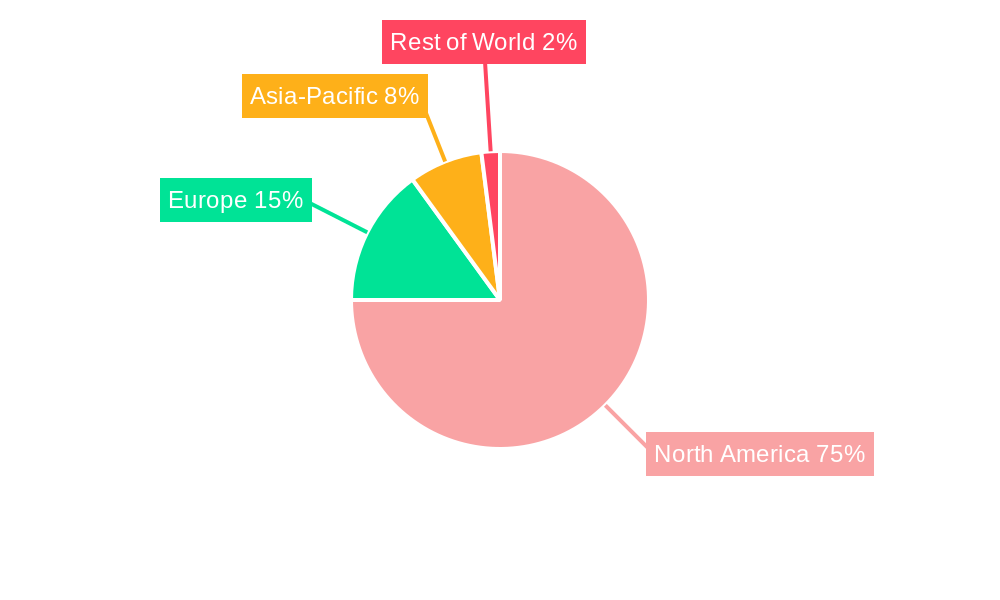

Dominant Regions, Countries, or Segments in North America Algae Protein Market

The United States dominates the North America algae protein market, accounting for the largest market share, primarily due to its robust consumer base and established food processing infrastructure. Canada and Mexico are also significant contributors, with growing demand and investments in the algae protein sector. Within end-user segments, the supplements sector currently leads, driven by the health and wellness trend among consumers. The Rest of North America segment is expected to exhibit the highest growth rate, fueled by increasing awareness of plant-based protein benefits.

- United States: Largest market share due to high consumer demand and established infrastructure.

- Canada: Significant market contributor with growing investments in algae protein production.

- Mexico: Rising market share due to increasing awareness of sustainable and healthy food options.

- Rest of North America: Fastest growth rate driven by increasing awareness and demand.

- Supplements Segment: Leading segment driven by the health and wellness trend among consumers.

North America Algae Protein Market Product Landscape

Algae protein products are increasingly diverse, ranging from protein powders and bars to innovative ingredients used in meat alternatives and other food products. Product innovation focuses on enhancing the taste, texture, and functionality of algae protein to broaden consumer appeal. Technological advancements in extraction and processing methods are improving the quality and yield of algae protein, while simultaneously reducing production costs. Unique selling propositions include high protein content, sustainability, and diverse nutritional profiles, giving algae protein a competitive edge over traditional protein sources.

Key Drivers, Barriers & Challenges in North America Algae Protein Market

Key Drivers:

- Increasing demand for plant-based protein sources.

- Growing consumer awareness of sustainability and environmental concerns.

- Technological advancements in algae cultivation and processing.

- Favorable government regulations and incentives for sustainable food production.

Challenges & Restraints:

- High production costs compared to traditional protein sources.

- Taste and texture limitations that may hinder consumer adoption.

- Regulatory hurdles and uncertainties related to food safety and labeling.

- Competition from established protein sources. The price competitiveness with soy protein, for example, presents a significant challenge. The price difference is estimated at approximately xx $/kg.

Emerging Opportunities in North America Algae Protein Market

Emerging opportunities lie in expanding applications of algae protein beyond supplements into various food and beverage products. Untapped markets include functional foods, pet food, and cosmetics. Consumer preferences for clean-label and natural ingredients create an opportunity for algae protein to establish itself as a premium ingredient. Innovative applications, such as algae-based meat alternatives and protein-enriched snacks, hold immense potential for market expansion.

Growth Accelerators in the North America Algae Protein Market Industry

Strategic partnerships between algae producers, food manufacturers, and ingredient suppliers are key growth accelerators. Technological breakthroughs in improving algae cultivation efficiency and reducing production costs are crucial. Market expansion strategies focused on introducing algae protein products to new consumer segments and geographical areas are also vital for long-term growth.

Key Players Shaping the North America Algae Protein Market Market

- Socius Ingredients

- Smallfood

- Triton Algae Innovations

- Arizona Algae Products LLC

- Cyanotech Corporation

- Pond Technologies Holdings Inc

- Algenol Biotech LLC

- Tofurky

- Roquette Frères

- Corbion NV

Notable Milestones in North America Algae Protein Market Sector

- May 2023: NewFish and Socius Ingredients announce a co-development partnership for microalgae proteins targeting the active nutrition market.

- March 2021: Triton Algae Innovations launches plant-based algae ingredients and a tuna analog, showcasing the potential of algae protein.

- February 2021: Smallfood launches a new microalgae strain producing a "perfect protein" for alternative meat development.

In-Depth North America Algae Protein Market Market Outlook

The North America algae protein market is poised for significant expansion, driven by strong consumer demand, technological advancements, and strategic partnerships. Future market potential is substantial, with untapped opportunities across diverse food and non-food applications. Companies that successfully address the challenges related to cost reduction and consumer acceptance will be well-positioned to capitalize on the long-term growth prospects of this dynamic market.

North America Algae Protein Market Segmentation

-

1. End User

-

1.1. Supplements

- 1.1.1. Elderly Nutrition and Medical Nutrition

- 1.1.2. Sport/Performance Nutrition

-

1.1. Supplements

North America Algae Protein Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Algae Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Escalating Consumer Investment in Preventive Healthcare Products; Increasing Algal Protein Applications Among Various Supplements

- 3.3. Market Restrains

- 3.3.1. Availability of Alternative Protein Sources

- 3.4. Market Trends

- 3.4.1. Escalating Consumer Investment in Preventive Healthcare Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Supplements

- 5.1.1.1. Elderly Nutrition and Medical Nutrition

- 5.1.1.2. Sport/Performance Nutrition

- 5.1.1. Supplements

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. United States North America Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Algae Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Socius Ingredients

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Smallfood

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Triton Algae Innovations

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Arizona Algae Products LLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Cyanotech Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Pond Technologies Holdings Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Algenol Biotech LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tofurky*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Roquette FrA res

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Corbion NV

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Socius Ingredients

List of Figures

- Figure 1: North America Algae Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Algae Protein Market Share (%) by Company 2024

List of Tables

- Table 1: North America Algae Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Algae Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 3: North America Algae Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: North America Algae Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States North America Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada North America Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico North America Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Rest of North America North America Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: North America Algae Protein Market Revenue Million Forecast, by End User 2019 & 2032

- Table 10: North America Algae Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States North America Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada North America Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico North America Algae Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Algae Protein Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the North America Algae Protein Market?

Key companies in the market include Socius Ingredients, Smallfood, Triton Algae Innovations, Arizona Algae Products LLC, Cyanotech Corporation, Pond Technologies Holdings Inc, Algenol Biotech LLC, Tofurky*List Not Exhaustive, Roquette FrA res, Corbion NV.

3. What are the main segments of the North America Algae Protein Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Escalating Consumer Investment in Preventive Healthcare Products; Increasing Algal Protein Applications Among Various Supplements.

6. What are the notable trends driving market growth?

Escalating Consumer Investment in Preventive Healthcare Products.

7. Are there any restraints impacting market growth?

Availability of Alternative Protein Sources.

8. Can you provide examples of recent developments in the market?

In May 2023, NewFish entered into a co-development partnership agreement with Chicago-based Socius Ingredients to commercialize microalgae proteins and specialized ingredients targeting the active nutrition market in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Algae Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Algae Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Algae Protein Market?

To stay informed about further developments, trends, and reports in the North America Algae Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence