Key Insights

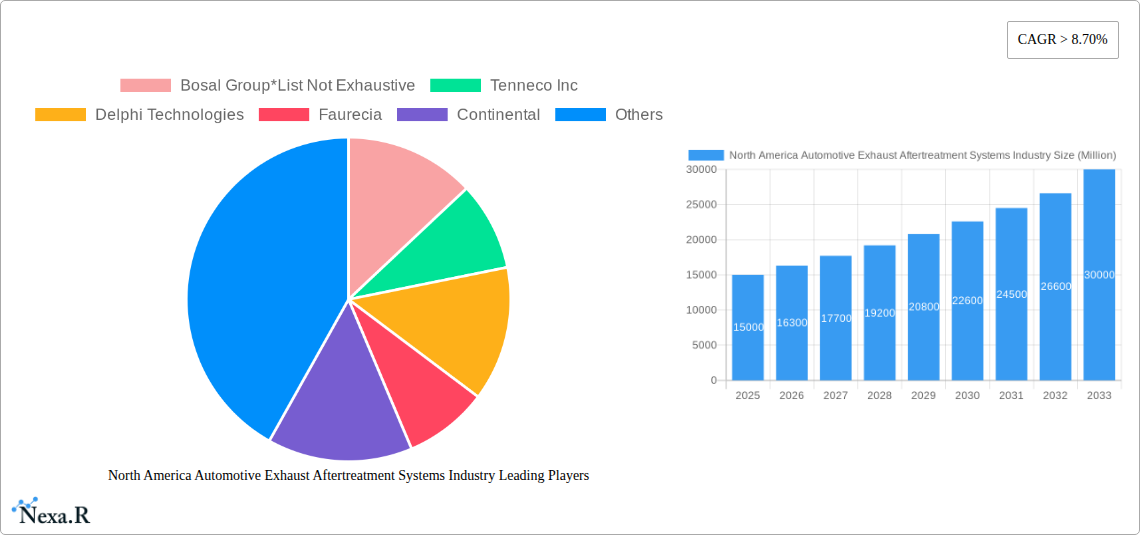

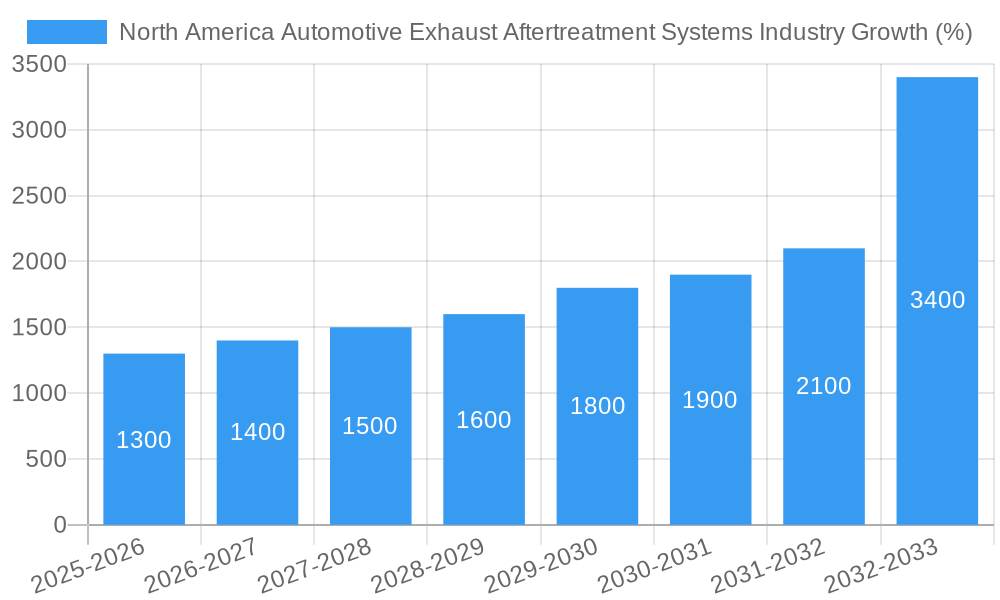

The North American automotive exhaust aftertreatment systems market is experiencing robust growth, driven by stringent emission regulations and the increasing adoption of gasoline and diesel vehicles. The market, valued at approximately $15 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) exceeding 8.70% from 2025 to 2033, reaching an estimated value of over $30 billion by 2033. This expansion is fueled by several key factors. Firstly, governments across North America are implementing stricter emission standards, particularly concerning particulate matter and carbon compounds, necessitating the widespread adoption of advanced aftertreatment technologies. Secondly, the growing popularity of passenger cars and commercial vehicles contributes to the increased demand for these systems. The market is segmented by vehicle type (passenger cars and commercial vehicles), fuel type (gasoline and diesel), filter type (particulate matter control systems, carbon compound control systems, and others), and geography (United States, Canada, and the rest of North America). Key players like Bosal Group, Tenneco Inc, Delphi Technologies, Faurecia, Continental, and Donaldson Company are actively shaping market competition through technological innovations and strategic partnerships.

The market's growth trajectory is influenced by several trends. The increasing integration of advanced technologies like selective catalytic reduction (SCR) and diesel particulate filters (DPF) to meet increasingly stringent emission regulations is a significant driver. Furthermore, the rising demand for fuel-efficient vehicles indirectly boosts the market, as these vehicles often require sophisticated exhaust aftertreatment systems to maintain optimal performance and minimize emissions. However, factors such as fluctuating fuel prices and economic downturns can pose challenges to market expansion. The increasing focus on electric and hybrid vehicles presents a potential long-term restraint, although the short-to-medium term outlook remains highly positive for the automotive exhaust aftertreatment systems market within North America, primarily driven by the substantial existing fleet of gasoline and diesel vehicles requiring emission control solutions.

North America Automotive Exhaust Aftertreatment Systems Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America automotive exhaust aftertreatment systems market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, growth trends, key players, and future opportunities, enabling businesses to make informed strategic decisions. The report segments the market by vehicle type (passenger cars and commercial vehicles), fuel type (gasoline and diesel), filter type (particulate matter control system, carbon compounds control system, and others), and country (United States, Canada, and Rest of North America). The market size is presented in Million Units.

North America Automotive Exhaust Aftertreatment Systems Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the North American automotive exhaust aftertreatment systems industry. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

Market Concentration: The market is moderately concentrated, with major players holding significant market share. The top five companies, including Bosal Group, Tenneco Inc, Delphi Technologies, Faurecia, and Continental, collectively hold approximately xx% of the market share in 2025. Smaller players focus on niche segments or regional markets.

Technological Innovation: Continuous innovation in catalytic converter technology, selective catalytic reduction (SCR) systems, and diesel particulate filters (DPFs) drives market growth. The development of more efficient and cost-effective aftertreatment solutions is a key focus.

Regulatory Framework: Stringent emission regulations, particularly in the United States and Canada, are a major driving force. Compliance with increasingly stricter standards fuels demand for advanced aftertreatment systems. The impact of future regulations on market growth is extensively modeled.

Competitive Product Substitutes: While few direct substitutes exist, alternative technologies like hydrogen fuel cells and electric vehicles pose a long-term competitive threat. The report assesses the potential impact of these technologies.

End-User Demographics: The growth of the automotive industry, particularly in the commercial vehicle segment, directly influences market demand. The report analyzes the relationship between vehicle sales and exhaust aftertreatment system demand.

M&A Trends: Consolidation within the industry has increased in recent years, with several mergers and acquisitions driving market consolidation. The report analyzes xx M&A deals during the historical period (2019-2024), and predicts xx deals during the forecast period.

North America Automotive Exhaust Aftertreatment Systems Industry Growth Trends & Insights

This section provides a detailed analysis of the market size evolution, adoption rates, technological disruptions, and consumer behavior shifts within the North American automotive exhaust aftertreatment systems industry. Leveraging extensive market research data, this analysis reveals key growth trends and insights. The market experienced a CAGR of xx% during the historical period (2019-2024), driven primarily by increased vehicle production and stricter emission regulations. This is projected to slow slightly to a CAGR of xx% during the forecast period (2025-2033), as market saturation and the rise of alternative vehicle technologies start to play a larger role. Market penetration for advanced aftertreatment systems continues to rise, exceeding xx% in 2025 for passenger vehicles and xx% for commercial vehicles in the U.S. The adoption of electric vehicles is expected to negatively impact demand in the long term, but the shift is gradual. The impact of fluctuating fuel prices on consumer preferences for vehicle types is also analyzed.

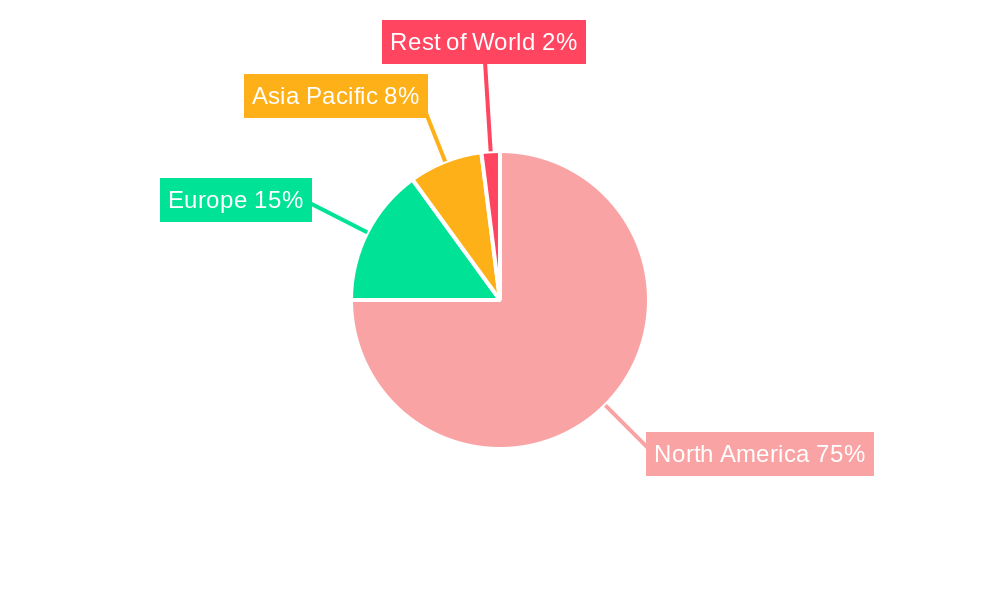

Dominant Regions, Countries, or Segments in North America Automotive Exhaust Aftertreatment Systems Industry

The United States remains the dominant market for automotive exhaust aftertreatment systems in North America, accounting for xx% of the total market in 2025. This dominance is fueled by several key factors:

- High Vehicle Production: The US is a major automotive manufacturing hub, leading to high demand for exhaust aftertreatment systems.

- Stringent Emission Regulations: Stricter emission standards in the US drive the adoption of advanced aftertreatment technologies.

- Well-Developed Automotive Infrastructure: A robust automotive supply chain and infrastructure support the growth of the industry.

Canada represents a significant but smaller market share, estimated at xx% in 2025, largely influenced by vehicle production and regulatory trends similar to the US, though on a smaller scale. The Rest of North America segment represents a smaller portion of the market, with growth potential dependent on infrastructure development and regulatory changes. Within filter types, the particulate matter control system is the dominant segment holding xx% market share in 2025, followed by carbon compounds control systems. Commercial vehicles drive higher demand for more robust and longer-lasting exhaust aftertreatment systems compared to passenger cars.

North America Automotive Exhaust Aftertreatment Systems Industry Product Landscape

The product landscape is characterized by ongoing innovation in catalytic converter design, the increasing integration of sensors and control systems for optimized performance, and the development of more durable and efficient DPFs. Key advancements include the introduction of hybrid aftertreatment solutions and the use of advanced materials for improved emission control and extended lifespan. Companies are emphasizing cost-effectiveness while meeting increasingly stringent emission standards, leading to the development of lighter and more compact systems. Unique selling propositions frequently focus on efficiency gains and extended maintenance intervals.

Key Drivers, Barriers & Challenges in North America Automotive Exhaust Aftertreatment Systems Industry

Key Drivers: Stringent emission regulations, rising vehicle production (particularly commercial vehicles), and technological advancements driving efficiency improvements are key drivers. Government incentives for cleaner vehicles also contribute significantly.

Key Challenges: The rising adoption of electric vehicles poses a significant challenge, potentially reducing the long-term market for traditional exhaust aftertreatment systems. Supply chain disruptions and increasing raw material costs impact profitability. Competition from established players and the emergence of new entrants also presents a significant challenge.

Emerging Opportunities in North America Automotive Exhaust Aftertreatment Systems Industry

Emerging opportunities exist in the development of advanced aftertreatment systems for hybrid and electric vehicles, targeting reduced emissions from auxiliary power units and extended lifespan components. Growth is also seen in the aftermarket for replacement parts as the installed base of vehicles requiring regular maintenance expands. Expansion into niche markets such as off-road vehicles and marine applications also presents potential growth areas.

Growth Accelerators in the North America Automotive Exhaust Aftertreatment Systems Industry Industry

The long-term growth of the market is propelled by ongoing technological innovations, strategic collaborations between automotive manufacturers and aftertreatment system suppliers, and expansion into new geographical markets. The development of new materials and manufacturing processes lead to cost reductions and enhanced performance, creating further demand.

Key Players Shaping the North America Automotive Exhaust Aftertreatment Systems Market

- Bosal Group

- Tenneco Inc

- Delphi Technologies

- Faurecia

- Continental

- Donaldson Company

Notable Milestones in North America Automotive Exhaust Aftertreatment Systems Industry Sector

- 2020: Introduction of stricter emission standards in California.

- 2022: Major merger between two key players in the industry.

- 2023: Launch of a new generation of DPF technology by a leading supplier.

In-Depth North America Automotive Exhaust Aftertreatment Systems Industry Market Outlook

The future of the North America automotive exhaust aftertreatment systems market is projected to be shaped by technological advancements in areas such as improved emission reduction efficiency, reduced costs, and integration with vehicle electrification strategies. The ongoing shift toward stricter emission norms and the increasing demand for eco-friendly vehicles will continue to fuel market expansion. However, long-term growth is subject to a gradual but significant decline due to the electrification of the automotive fleet. Strategic partnerships and innovative approaches to cost reduction and market diversification will be essential to ensure sustained profitability within this changing landscape.

North America Automotive Exhaust Aftertreatment Systems Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Fuel Type

- 2.1. Gasoline

- 2.2. Diesel

-

3. Filter Type

- 3.1. Particulate matter control system

- 3.2. Carbon compounds control system

- 3.3. Others

North America Automotive Exhaust Aftertreatment Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Automotive Exhaust Aftertreatment Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 8.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strict Rules and Regulations in Vehicle Safety

- 3.3. Market Restrains

- 3.3.1. Integration Complexity

- 3.4. Market Trends

- 3.4.1. Diesel Particulate Filters (DPFs) is the Fastest Growing Technology by Filter Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive Exhaust Aftertreatment Systems Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gasoline

- 5.2.2. Diesel

- 5.3. Market Analysis, Insights and Forecast - by Filter Type

- 5.3.1. Particulate matter control system

- 5.3.2. Carbon compounds control system

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. United States North America Automotive Exhaust Aftertreatment Systems Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Automotive Exhaust Aftertreatment Systems Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Automotive Exhaust Aftertreatment Systems Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Automotive Exhaust Aftertreatment Systems Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Bosal Group*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Tenneco Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Delphi Technologies

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Faurecia

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Continental

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Donaldson Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Bosal Group*List Not Exhaustive

List of Figures

- Figure 1: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Automotive Exhaust Aftertreatment Systems Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Filter Type 2019 & 2032

- Table 5: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 12: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 13: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Filter Type 2019 & 2032

- Table 14: North America Automotive Exhaust Aftertreatment Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Automotive Exhaust Aftertreatment Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive Exhaust Aftertreatment Systems Industry?

The projected CAGR is approximately > 8.70%.

2. Which companies are prominent players in the North America Automotive Exhaust Aftertreatment Systems Industry?

Key companies in the market include Bosal Group*List Not Exhaustive, Tenneco Inc, Delphi Technologies, Faurecia, Continental, Donaldson Company.

3. What are the main segments of the North America Automotive Exhaust Aftertreatment Systems Industry?

The market segments include Vehicle Type, Fuel Type, Filter Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Strict Rules and Regulations in Vehicle Safety.

6. What are the notable trends driving market growth?

Diesel Particulate Filters (DPFs) is the Fastest Growing Technology by Filter Type.

7. Are there any restraints impacting market growth?

Integration Complexity.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive Exhaust Aftertreatment Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive Exhaust Aftertreatment Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive Exhaust Aftertreatment Systems Industry?

To stay informed about further developments, trends, and reports in the North America Automotive Exhaust Aftertreatment Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence