Key Insights

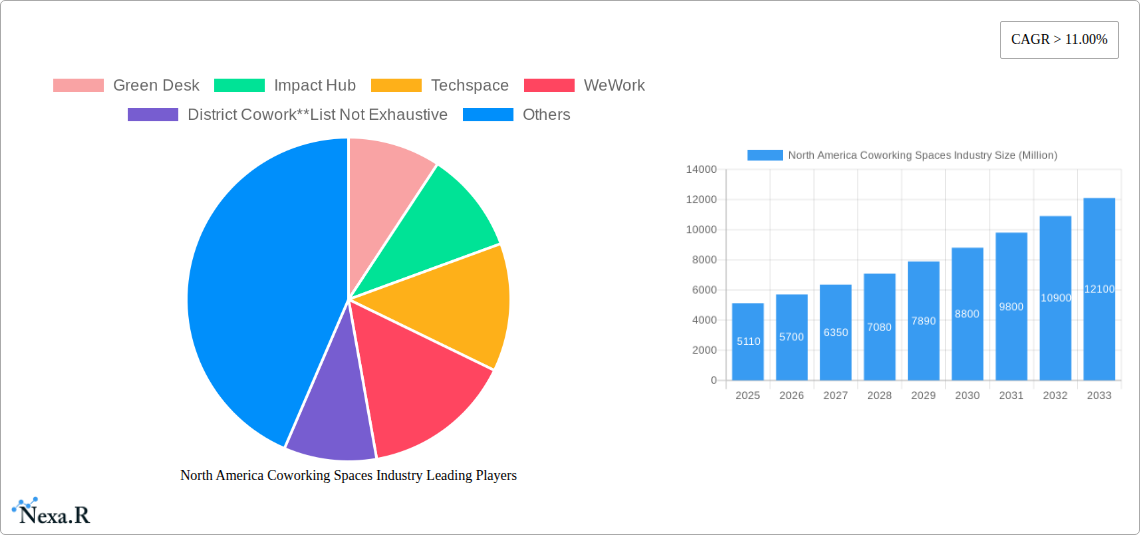

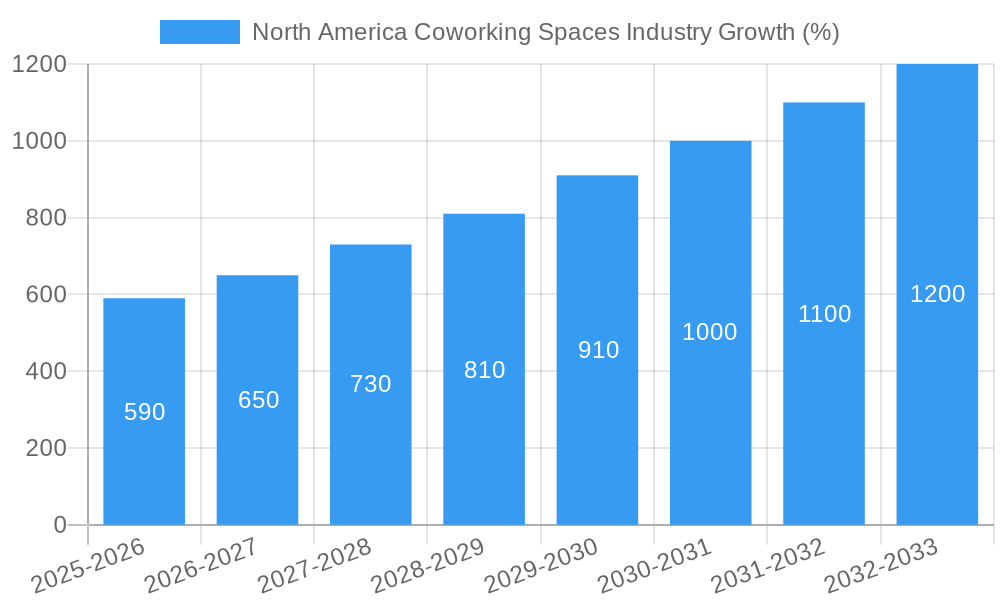

The North American coworking space industry is experiencing robust growth, projected to reach a market size of $5.11 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 11% through 2033. This expansion is driven by several key factors. The increasing popularity of remote work and flexible work arrangements, particularly among freelancers, startups, and SMEs, fuels demand for shared workspaces. The diverse business models offered, including sub-lease, revenue sharing, and owner-operator models, cater to a wide range of needs and budgets. Furthermore, the industry benefits from a growing preference for collaborative work environments, fostering innovation and networking opportunities. Expansion into new spaces and existing chains are further solidifying the market's position. Geographical expansion within North America, specifically targeting major metropolitan areas in the United States, Canada, and Mexico, will continue to contribute to this growth. However, factors such as increasing competition, fluctuating real estate prices, and economic downturns present potential restraints.

Despite these potential headwinds, the long-term outlook for the North American coworking space market remains positive. The continued rise of the gig economy and the increasing adoption of hybrid work models will sustain demand for flexible and cost-effective workspace solutions. The industry's ability to adapt to evolving market needs, through technological advancements and innovative service offerings, will be crucial for maintaining its strong growth trajectory. The presence of established players like WeWork, Regus, and Industrious, alongside smaller, specialized providers, ensures a dynamic and competitive landscape. This competition drives innovation and offers a wide array of choices to suit diverse user requirements, solidifying the market's long-term prospects.

North America Coworking Spaces Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America coworking spaces industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. The report segments the market by business type (new spaces, expansions, chains), business model (sub-lease, revenue sharing, owner-operator), end-user (independent professionals, startups, SMEs, large corporations), and country (United States, Canada, Mexico). Key players analyzed include WeWork, Regus Coworking, Industrious Office, Knotel, Green Desk, Impact Hub, Techspace, District Cowork, Serendipity Labs, and Mix Pace (list not exhaustive). The report projects a market value of xx Million by 2033.

North America Coworking Spaces Industry Market Dynamics & Structure

The North American coworking space market exhibits a dynamic interplay of factors influencing its structure and growth. Market concentration is moderate, with a few large players like WeWork commanding significant share, while numerous smaller, independent spaces cater to niche demands. Technological innovation, particularly in space management software and booking platforms, drives efficiency and enhances user experience. Regulatory frameworks, varying across states and provinces, impact operational costs and expansion strategies. The industry faces competition from traditional office rentals and virtual office solutions. End-user demographics are diverse, encompassing freelancers, startups, SMEs, and large corporations, each with unique space requirements. M&A activity has been significant, with larger players acquiring smaller firms to consolidate market share.

- Market Concentration: Moderate, with a few dominant players and numerous smaller operators.

- Technological Innovation: Focus on space management software, booking platforms, and flexible workspace solutions.

- Regulatory Framework: Varies significantly across regions, impacting operational costs and expansion plans.

- Competitive Substitutes: Traditional office rentals, virtual offices, and remote work arrangements.

- End-User Demographics: Diverse, including freelancers, startups, SMEs, and large corporations.

- M&A Trends: Significant consolidation activity, with larger players acquiring smaller businesses. Estimated xx Million in M&A deals during 2019-2024.

North America Coworking Spaces Industry Growth Trends & Insights

The North American coworking space market experienced robust growth during the historical period (2019-2024), driven by factors such as the rise of the gig economy, increasing demand for flexible workspaces, and technological advancements improving operational efficiency. The COVID-19 pandemic initially impacted the industry, with occupancy rates declining, but a subsequent rebound occurred, fueled by the need for flexible and adaptable work environments. The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024, reaching a value of xx Million in 2024. The market penetration rate among businesses is projected to increase from xx% in 2024 to xx% by 2033. Technological disruptions, such as the adoption of smart building technologies and enhanced booking platforms, are expected to further accelerate growth. Consumer behavior shifts towards prioritizing flexibility and community over traditional office spaces continue to support market expansion. The forecast period (2025-2033) anticipates continued growth at a CAGR of xx%, with the market reaching a projected value of xx Million by 2033.

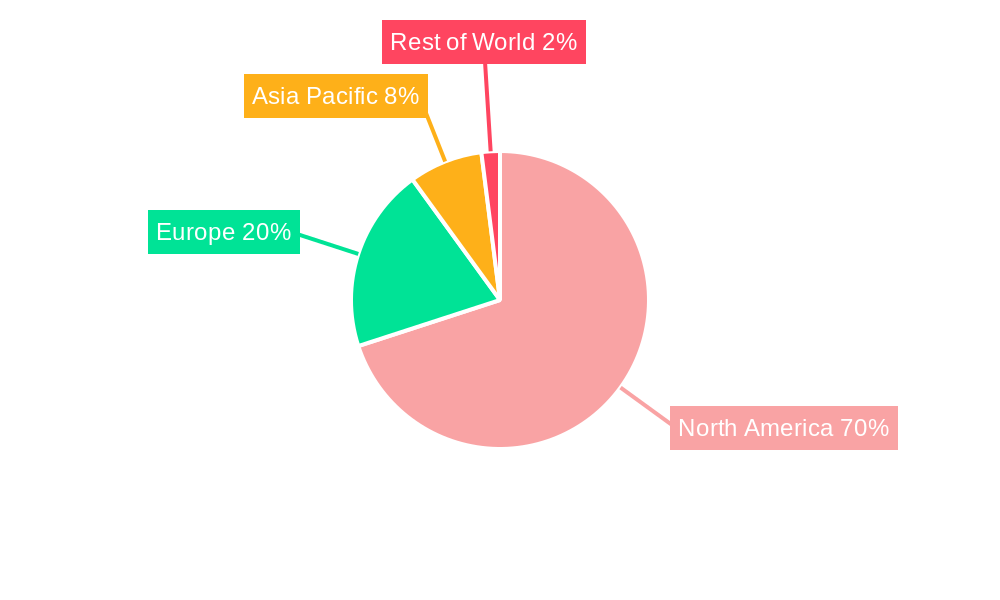

Dominant Regions, Countries, or Segments in North America Coworking Spaces Industry

The United States dominates the North American coworking space market, driven by a larger economy, higher concentration of businesses, and greater adoption of flexible work arrangements. Within the US, major metropolitan areas like New York, San Francisco, and Los Angeles exhibit particularly high concentrations of coworking spaces. The "Chains" segment in Business Type demonstrates significant growth, reflecting the expansion strategies of major players. In terms of Business Model, the "Sub-lease Model" shows strong performance due to its cost-effectiveness. Among End-Users, "Small to Medium Sized Enterprises (SMEs)" represent a substantial portion of the market, indicating the appeal of flexible workspaces for businesses of this size.

- Key Drivers (US): Strong economy, high business density in major cities, favorable regulatory environment, and high adoption of flexible work models.

- Key Drivers (Chains): Economies of scale, established brand recognition, and standardized service offerings.

- Key Drivers (Sub-lease Model): Cost-effectiveness and efficient use of existing office spaces.

- Key Drivers (SMEs): Need for flexible and scalable workspace solutions, cost savings compared to traditional offices, and access to networking opportunities.

North America Coworking Spaces Industry Product Landscape

The coworking space product landscape is evolving rapidly, with a focus on providing flexible and customizable solutions. Innovations include modular furniture, smart building technologies (e.g., automated lighting and climate control), enhanced booking platforms, and community-building initiatives to foster collaboration among members. Key performance metrics include occupancy rates, average revenue per member, and customer satisfaction. Unique selling propositions often revolve around location, amenities (e.g., meeting rooms, event spaces), and community features. Technological advancements play a crucial role in optimizing space utilization, enhancing member experience, and improving operational efficiency.

Key Drivers, Barriers & Challenges in North America Coworking Spaces Industry

Key Drivers: The rise of the gig economy, increasing demand for flexible work arrangements, technological advancements enhancing space management and member experience, and government initiatives promoting entrepreneurship and small business growth all contribute to expansion of the coworking market.

Challenges: Intense competition among operators, high real estate costs in major urban areas, economic downturns impacting demand, and evolving regulatory environments pose significant challenges. Supply chain disruptions can impact build-out timelines and increase costs. Additionally, competition from traditional office spaces and virtual office solutions presents ongoing pressure.

Emerging Opportunities in North America Coworking Spaces Industry

Emerging opportunities lie in expanding into secondary and tertiary markets, offering specialized spaces tailored to specific industries (e.g., creative, tech), integrating sustainable and eco-friendly practices, and leveraging technology to enhance member experience and streamline operations. Furthermore, focus on providing value-added services like mentorship programs and business development support will create increased demand.

Growth Accelerators in the North America Coworking Spaces Industry

Strategic partnerships with businesses, offering bundled services like IT support and HR solutions, and focusing on niche markets with high growth potential will accelerate growth. Technological advancements in smart building technology, AI-powered space management tools, and flexible workspace design will also boost industry expansion. Expansion into underserved geographic markets and targeting specific industry segments will create further growth opportunities.

Key Players Shaping the North America Coworking Spaces Industry Market

- Green Desk

- Impact Hub

- Techspace

- WeWork

- District Cowork

- Serendipity Labs

- Regus Coworking

- Mix Pace

- Industrious Office

- Knotel

Notable Milestones in North America Coworking Spaces Industry Sector

- June 2022: IWG plans to add 500-700 new flexible office sites in the US within 12 months, significantly expanding its market presence.

- November 2022: Knotel secures a long-term lease for 23,700 square feet in Coral Gables, Florida, indicating continued expansion despite market challenges.

In-Depth North America Coworking Spaces Industry Market Outlook

The North American coworking space market exhibits strong growth potential, driven by ongoing demand for flexible and adaptable workspaces. Strategic acquisitions, technological innovation, and expansion into new markets will shape the industry's future. The increasing adoption of hybrid work models and the growth of the gig economy will further contribute to market expansion. Opportunities for innovation exist in providing specialized services and tailored workspaces to specific industry segments, promising significant growth in the coming years.

North America Coworking Spaces Industry Segmentation

-

1. Business Type

- 1.1. New Spaces

- 1.2. Expansions

- 1.3. Chains

-

2. Business Model

- 2.1. Sub-lease Model

- 2.2. Revenue Sharing Model

- 2.3. Owner-Operator Model

-

3. End User

- 3.1. Independent Professionals (Freelancers)

- 3.2. Startup Teams

- 3.3. Small to Medium Sized Enterprises (SMEs)

- 3.4. Large Scale Corporations

North America Coworking Spaces Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Coworking Spaces Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 11.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing demand for flexible office spaces; Surge in investments in niche co-working spaces such as women-only spaces

- 3.2.2 LGBTQ+ spaces

- 3.2.3 and other social groups

- 3.3. Market Restrains

- 3.3.1. Low Awareness and Privacy Issues

- 3.4. Market Trends

- 3.4.1. Increasing number of Startups Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Coworking Spaces Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Business Type

- 5.1.1. New Spaces

- 5.1.2. Expansions

- 5.1.3. Chains

- 5.2. Market Analysis, Insights and Forecast - by Business Model

- 5.2.1. Sub-lease Model

- 5.2.2. Revenue Sharing Model

- 5.2.3. Owner-Operator Model

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Independent Professionals (Freelancers)

- 5.3.2. Startup Teams

- 5.3.3. Small to Medium Sized Enterprises (SMEs)

- 5.3.4. Large Scale Corporations

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Business Type

- 6. United States North America Coworking Spaces Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Coworking Spaces Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Coworking Spaces Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Coworking Spaces Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Green Desk

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Impact Hub

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Techspace

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 WeWork

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 District Cowork**List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Serendipity Labs

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Regus Coworking

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Mix Pace

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Industrious Office

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Knotel

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Green Desk

List of Figures

- Figure 1: North America Coworking Spaces Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Coworking Spaces Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Coworking Spaces Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Coworking Spaces Industry Revenue Million Forecast, by Business Type 2019 & 2032

- Table 3: North America Coworking Spaces Industry Revenue Million Forecast, by Business Model 2019 & 2032

- Table 4: North America Coworking Spaces Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: North America Coworking Spaces Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Coworking Spaces Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Coworking Spaces Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Coworking Spaces Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Coworking Spaces Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Coworking Spaces Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Coworking Spaces Industry Revenue Million Forecast, by Business Type 2019 & 2032

- Table 12: North America Coworking Spaces Industry Revenue Million Forecast, by Business Model 2019 & 2032

- Table 13: North America Coworking Spaces Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 14: North America Coworking Spaces Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Coworking Spaces Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Coworking Spaces Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Coworking Spaces Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Coworking Spaces Industry?

The projected CAGR is approximately > 11.00%.

2. Which companies are prominent players in the North America Coworking Spaces Industry?

Key companies in the market include Green Desk, Impact Hub, Techspace, WeWork, District Cowork**List Not Exhaustive, Serendipity Labs, Regus Coworking, Mix Pace, Industrious Office, Knotel.

3. What are the main segments of the North America Coworking Spaces Industry?

The market segments include Business Type, Business Model, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for flexible office spaces; Surge in investments in niche co-working spaces such as women-only spaces. LGBTQ+ spaces. and other social groups.

6. What are the notable trends driving market growth?

Increasing number of Startups Boosting the Market.

7. Are there any restraints impacting market growth?

Low Awareness and Privacy Issues.

8. Can you provide examples of recent developments in the market?

November 2022: The Newmark-owned firm Knotel secured a long-term lease for 23,700 square feet at Ofizzina, a Coral Gables, Florida, office condo project. Knotel intends to finish three complete stories of the 16-story skyscraper at 1200 Ponce De Leon Boulevard. TSG Group and BF Group created Offizina, which comprises 60 office condominiums.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Coworking Spaces Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Coworking Spaces Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Coworking Spaces Industry?

To stay informed about further developments, trends, and reports in the North America Coworking Spaces Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence