Key Insights

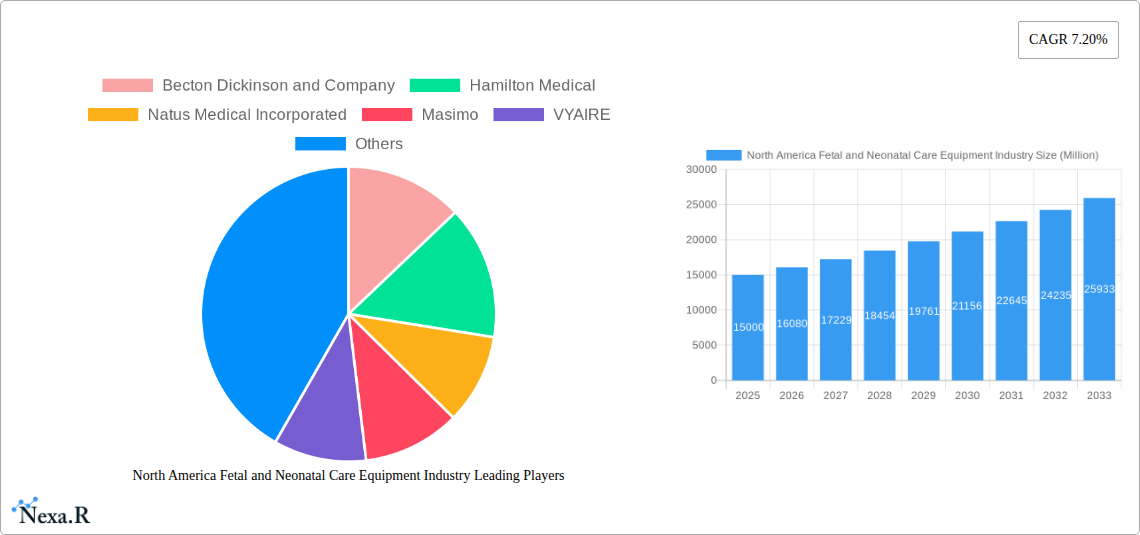

The North American fetal and neonatal care equipment market is experiencing robust growth, driven by several key factors. The rising prevalence of preterm births and low birth weight infants necessitates advanced equipment for monitoring and treatment, fueling market expansion. Technological advancements, such as the development of smaller, more portable, and user-friendly devices, are enhancing the accessibility and effectiveness of care. Furthermore, increasing investments in healthcare infrastructure and a growing emphasis on preventative care contribute significantly to market growth. The market is segmented into fetal care equipment and neonatal care equipment, with both experiencing substantial growth. Major players like Becton Dickinson, Hamilton Medical, and Natus Medical are leading the innovation and market share, leveraging their strong research and development capabilities and established distribution networks. The market is characterized by a high degree of competition, with companies focused on developing cutting-edge technologies, expanding their product portfolios, and forming strategic partnerships to enhance their market positioning. Regulatory approvals and reimbursement policies play a vital role in shaping market dynamics.

Looking ahead, the market is projected to continue its upward trajectory, driven by the increasing demand for advanced neonatal intensive care units (NICUs) and the growing adoption of minimally invasive procedures. The continued focus on improving patient outcomes, coupled with technological innovations, such as artificial intelligence-powered diagnostic tools and remote patient monitoring systems, will further stimulate market growth. While challenges remain, such as high equipment costs and potential reimbursement constraints, the overall outlook for the North American fetal and neonatal care equipment market remains positive over the forecast period (2025-2033). The market's expansion is anticipated to be influenced by factors like an aging population, increased chronic disease prevalence, and the growing adoption of telehealth solutions.

North America Fetal and Neonatal Care Equipment Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America fetal and neonatal care equipment market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report meticulously examines market dynamics, growth trends, dominant segments, and key players, empowering stakeholders to navigate this dynamic landscape effectively. The market is valued at xx Million units in 2025 and is projected to reach xx Million units by 2033.

North America Fetal and Neonatal Care Equipment Industry Market Dynamics & Structure

This section delves into the intricate structure of the North America fetal and neonatal care equipment market, providing a 360-degree view of its dynamics. We analyze market concentration, revealing the competitive landscape and identifying key players' market shares. The report also explores the role of technological innovation, regulatory frameworks (FDA guidelines, etc.), and the presence of competitive product substitutes. End-user demographics (hospitals, clinics, birthing centers) are carefully examined, along with a detailed overview of recent mergers and acquisitions (M&A) activities within the sector. Quantitative data, including market share percentages and M&A deal volumes, are presented alongside qualitative factors like innovation barriers and regulatory hurdles.

- Market Concentration: The market is moderately concentrated, with the top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: AI-powered diagnostics and advanced imaging technologies are key drivers.

- Regulatory Framework: FDA approvals and clearances significantly influence market access.

- M&A Activity: A moderate level of consolidation is observed, with xx M&A deals recorded between 2019 and 2024.

- Competitive Substitutes: Limited direct substitutes exist, but alternative diagnostic methods pose indirect competition.

North America Fetal and Neonatal Care Equipment Industry Growth Trends & Insights

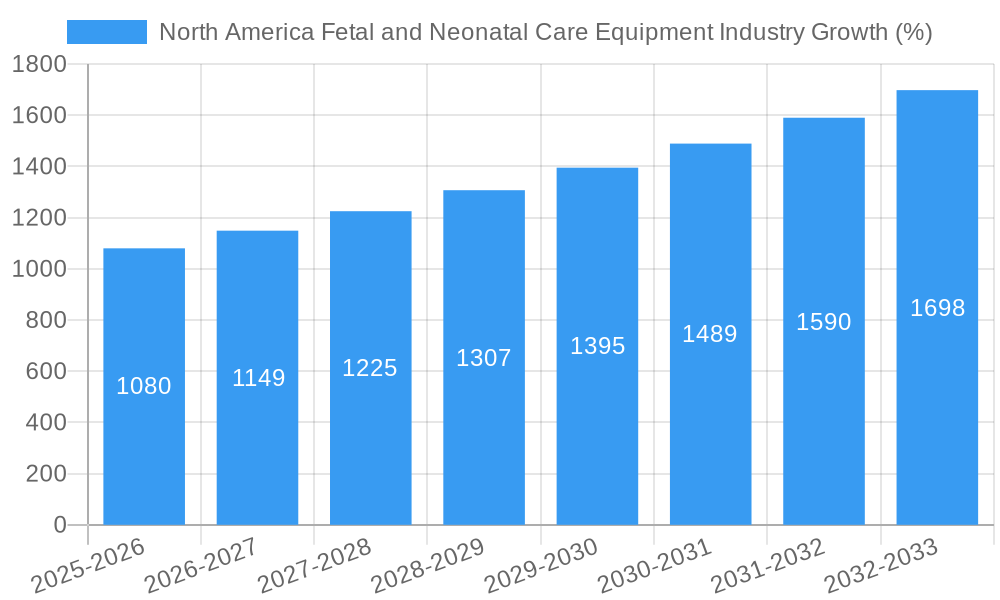

This section leverages extensive data analysis to present a comprehensive overview of the North America fetal and neonatal care equipment market's growth trajectory. We explore market size evolution throughout the historical period (2019-2024) and forecast period (2025-2033), calculating the Compound Annual Growth Rate (CAGR) and analyzing market penetration rates. Technological disruptions, such as the increasing adoption of AI and telemedicine, are analyzed for their impact on market growth. Furthermore, shifting consumer behaviors (e.g., increased demand for advanced diagnostic tools) and their implications are discussed in detail.

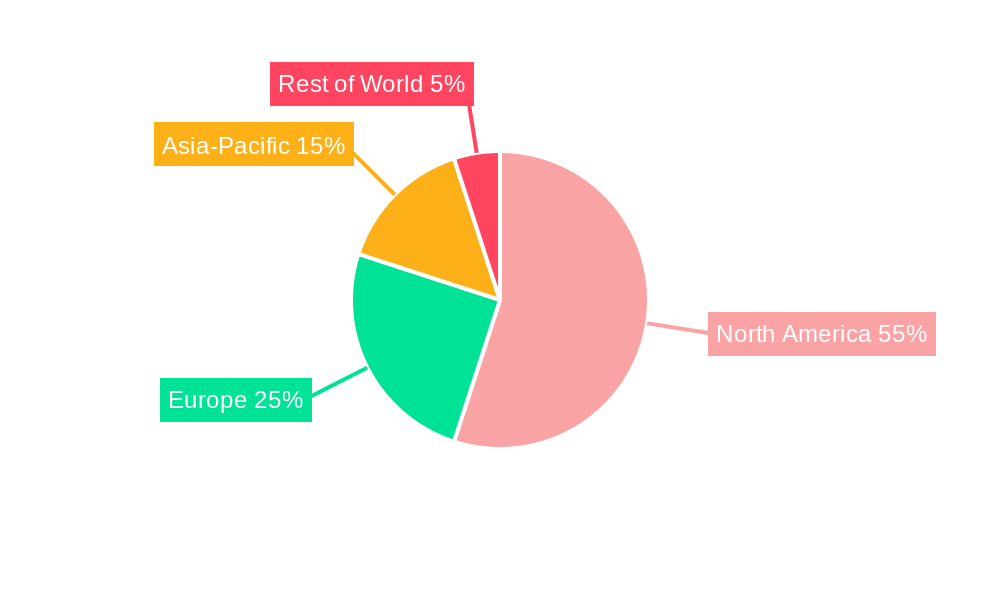

Dominant Regions, Countries, or Segments in North America Fetal and Neonatal Care Equipment Industry

This segment pinpoints the leading regions, countries, and product segments within the North America fetal and neonatal care equipment market driving overall growth. A detailed analysis differentiates between Fetal Care Equipment and Neonatal Care Equipment, identifying the dominant segment and its key drivers. Geographic dominance is assessed based on market share and growth potential. Key drivers, including economic policies supportive of healthcare infrastructure development and advancements in medical technology, are thoroughly explored.

- Dominant Segment: The Neonatal Care Equipment segment is projected to dominate the market, holding approximately xx% market share in 2025.

- Key Drivers (Neonatal Care): Increasing preterm birth rates, rising awareness of neonatal health, and technological advancements in neonatal intensive care units (NICUs).

- Key Drivers (Fetal Care): Improved prenatal diagnostics and growing adoption of non-invasive prenatal testing (NIPT).

- Dominant Region: The US is expected to remain the largest market, followed by Canada and Mexico.

North America Fetal and Neonatal Care Equipment Industry Product Landscape

This section provides a concise overview of product innovations, applications, and performance metrics within the fetal and neonatal care equipment industry. It highlights the unique selling propositions (USPs) of leading products and discusses technological advancements that enhance diagnostic capabilities, patient safety, and treatment efficacy.

Key Drivers, Barriers & Challenges in North America Fetal and Neonatal Care Equipment Industry

This section identifies and analyzes the key drivers and challenges facing the North America fetal and neonatal care equipment market. Drivers are discussed in relation to technological progress (AI integration, advanced imaging), economic factors (healthcare spending growth), and favorable government policies (incentives for healthcare technology adoption). Challenges include supply chain disruptions impacting production costs and timelines, regulatory hurdles (FDA approval processes), and intense competition among established and emerging players.

Emerging Opportunities in North America Fetal and Neonatal Care Equipment Industry

This section explores promising emerging opportunities within the North America fetal and neonatal care equipment market. These include expanding into underserved markets, leveraging new applications for existing technologies (e.g., telemedicine integration), and capitalizing on evolving consumer preferences (demand for minimally invasive procedures).

Growth Accelerators in the North America Fetal and Neonatal Care Equipment Industry Industry

This section identifies and analyzes factors that are expected to fuel long-term growth in the North America fetal and neonatal care equipment market. This includes technological innovation, strategic partnerships, and market expansion strategies.

Key Players Shaping the North America Fetal and Neonatal Care Equipment Industry Market

- Becton Dickinson and Company

- Hamilton Medical

- Natus Medical Incorporated

- Masimo

- VYAIRE

- ICU Medical

- GE Healthcare

- Atom Medical Corporation

- Koninklijke Philips N V

- Medtronic PLC

- Siemens Healthineers AG

- Dragerwerk AG & Co KGaA

Notable Milestones in North America Fetal and Neonatal Care Equipment Industry Sector

- July 2022: Royal Philips received FDA 510(k) clearance for its SmartSpeed AI-powered magnetic resonance acceleration software, enhancing diagnostic capabilities and productivity.

- July 2022: GE Healthcare launched an ultra-premium ultrasound system with AI-powered tools, improving image quality and diagnostic consistency in women's health.

In-Depth North America Fetal and Neonatal Care Equipment Industry Market Outlook

This section summarizes the key growth drivers and provides a concise outlook on the future market potential and strategic opportunities within the North America fetal and neonatal care equipment market. The continued advancements in AI, increasing demand for non-invasive procedures, and expanding healthcare infrastructure will further drive market growth in the coming years, creating significant opportunities for industry players.

North America Fetal and Neonatal Care Equipment Industry Segmentation

-

1. Product

-

1.1. Fetal Care Equipment

- 1.1.1. Fetal Dopplers

- 1.1.2. Fetal Magnetic Resonance Imaging (MRI) Devices

- 1.1.3. Ultrasound Devices

- 1.1.4. Fetal Pulse Oximeters

- 1.1.5. Other Fetal Care Equipment

-

1.2. Neonatal Care Equipment

- 1.2.1. Incubators

- 1.2.2. Neonatal Monitoring Devices

- 1.2.3. Phototherapy Equipment

- 1.2.4. Respiratory Assistance and Monitoring Devices

- 1.2.5. Other Neonatal Care Equipment

-

1.1. Fetal Care Equipment

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

North America Fetal and Neonatal Care Equipment Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Fetal and Neonatal Care Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Preterm and Low-weight Births; Increasing Awareness for Prenatal and Neonatal Care and Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Policies for New Devices Approval

- 3.4. Market Trends

- 3.4.1. Ultrasound Devices Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fetal and Neonatal Care Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Fetal Care Equipment

- 5.1.1.1. Fetal Dopplers

- 5.1.1.2. Fetal Magnetic Resonance Imaging (MRI) Devices

- 5.1.1.3. Ultrasound Devices

- 5.1.1.4. Fetal Pulse Oximeters

- 5.1.1.5. Other Fetal Care Equipment

- 5.1.2. Neonatal Care Equipment

- 5.1.2.1. Incubators

- 5.1.2.2. Neonatal Monitoring Devices

- 5.1.2.3. Phototherapy Equipment

- 5.1.2.4. Respiratory Assistance and Monitoring Devices

- 5.1.2.5. Other Neonatal Care Equipment

- 5.1.1. Fetal Care Equipment

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Mexico

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Fetal and Neonatal Care Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Fetal Care Equipment

- 6.1.1.1. Fetal Dopplers

- 6.1.1.2. Fetal Magnetic Resonance Imaging (MRI) Devices

- 6.1.1.3. Ultrasound Devices

- 6.1.1.4. Fetal Pulse Oximeters

- 6.1.1.5. Other Fetal Care Equipment

- 6.1.2. Neonatal Care Equipment

- 6.1.2.1. Incubators

- 6.1.2.2. Neonatal Monitoring Devices

- 6.1.2.3. Phototherapy Equipment

- 6.1.2.4. Respiratory Assistance and Monitoring Devices

- 6.1.2.5. Other Neonatal Care Equipment

- 6.1.1. Fetal Care Equipment

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Fetal and Neonatal Care Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Fetal Care Equipment

- 7.1.1.1. Fetal Dopplers

- 7.1.1.2. Fetal Magnetic Resonance Imaging (MRI) Devices

- 7.1.1.3. Ultrasound Devices

- 7.1.1.4. Fetal Pulse Oximeters

- 7.1.1.5. Other Fetal Care Equipment

- 7.1.2. Neonatal Care Equipment

- 7.1.2.1. Incubators

- 7.1.2.2. Neonatal Monitoring Devices

- 7.1.2.3. Phototherapy Equipment

- 7.1.2.4. Respiratory Assistance and Monitoring Devices

- 7.1.2.5. Other Neonatal Care Equipment

- 7.1.1. Fetal Care Equipment

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Fetal and Neonatal Care Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Fetal Care Equipment

- 8.1.1.1. Fetal Dopplers

- 8.1.1.2. Fetal Magnetic Resonance Imaging (MRI) Devices

- 8.1.1.3. Ultrasound Devices

- 8.1.1.4. Fetal Pulse Oximeters

- 8.1.1.5. Other Fetal Care Equipment

- 8.1.2. Neonatal Care Equipment

- 8.1.2.1. Incubators

- 8.1.2.2. Neonatal Monitoring Devices

- 8.1.2.3. Phototherapy Equipment

- 8.1.2.4. Respiratory Assistance and Monitoring Devices

- 8.1.2.5. Other Neonatal Care Equipment

- 8.1.1. Fetal Care Equipment

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. United States North America Fetal and Neonatal Care Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Fetal and Neonatal Care Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Fetal and Neonatal Care Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Fetal and Neonatal Care Equipment Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Becton Dickinson and Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hamilton Medical

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Natus Medical Incorporated

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Masimo

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 VYAIRE

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ICU Medical

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 GE Healthcare

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Atom Medical Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Koninklijke Philips N V

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Medtronic PLC

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Siemens Healthineers AG

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Dragerwerk AG & Co KGaA

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: North America Fetal and Neonatal Care Equipment Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Fetal and Neonatal Care Equipment Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Fetal and Neonatal Care Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Fetal and Neonatal Care Equipment Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Fetal and Neonatal Care Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 4: North America Fetal and Neonatal Care Equipment Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: North America Fetal and Neonatal Care Equipment Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Fetal and Neonatal Care Equipment Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 7: North America Fetal and Neonatal Care Equipment Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Fetal and Neonatal Care Equipment Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: North America Fetal and Neonatal Care Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Fetal and Neonatal Care Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States North America Fetal and Neonatal Care Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Fetal and Neonatal Care Equipment Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Fetal and Neonatal Care Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Fetal and Neonatal Care Equipment Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Fetal and Neonatal Care Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Fetal and Neonatal Care Equipment Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Fetal and Neonatal Care Equipment Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Fetal and Neonatal Care Equipment Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: North America Fetal and Neonatal Care Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 20: North America Fetal and Neonatal Care Equipment Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 21: North America Fetal and Neonatal Care Equipment Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Fetal and Neonatal Care Equipment Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 23: North America Fetal and Neonatal Care Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Fetal and Neonatal Care Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: North America Fetal and Neonatal Care Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 26: North America Fetal and Neonatal Care Equipment Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 27: North America Fetal and Neonatal Care Equipment Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: North America Fetal and Neonatal Care Equipment Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 29: North America Fetal and Neonatal Care Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North America Fetal and Neonatal Care Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: North America Fetal and Neonatal Care Equipment Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 32: North America Fetal and Neonatal Care Equipment Industry Volume K Unit Forecast, by Product 2019 & 2032

- Table 33: North America Fetal and Neonatal Care Equipment Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Fetal and Neonatal Care Equipment Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 35: North America Fetal and Neonatal Care Equipment Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Fetal and Neonatal Care Equipment Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fetal and Neonatal Care Equipment Industry?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the North America Fetal and Neonatal Care Equipment Industry?

Key companies in the market include Becton Dickinson and Company, Hamilton Medical, Natus Medical Incorporated, Masimo, VYAIRE, ICU Medical, GE Healthcare, Atom Medical Corporation, Koninklijke Philips N V, Medtronic PLC, Siemens Healthineers AG, Dragerwerk AG & Co KGaA.

3. What are the main segments of the North America Fetal and Neonatal Care Equipment Industry?

The market segments include Product, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Preterm and Low-weight Births; Increasing Awareness for Prenatal and Neonatal Care and Technological Advancements.

6. What are the notable trends driving market growth?

Ultrasound Devices Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Policies for New Devices Approval.

8. Can you provide examples of recent developments in the market?

July 2022: Royal Philips announced that its SmartSpeed artificial intelligence (AI)-powered magnetic resonance acceleration software has received United States Food and Drug Administration (FDA) 510(k) clearance. Philips SmartSpeed delivers higher image resolution with 3 times faster scan times and virtually no loss in image quality, representing a major step forward in diagnostic confidence and magnetic resonance department productivity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fetal and Neonatal Care Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fetal and Neonatal Care Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fetal and Neonatal Care Equipment Industry?

To stay informed about further developments, trends, and reports in the North America Fetal and Neonatal Care Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence