Key Insights

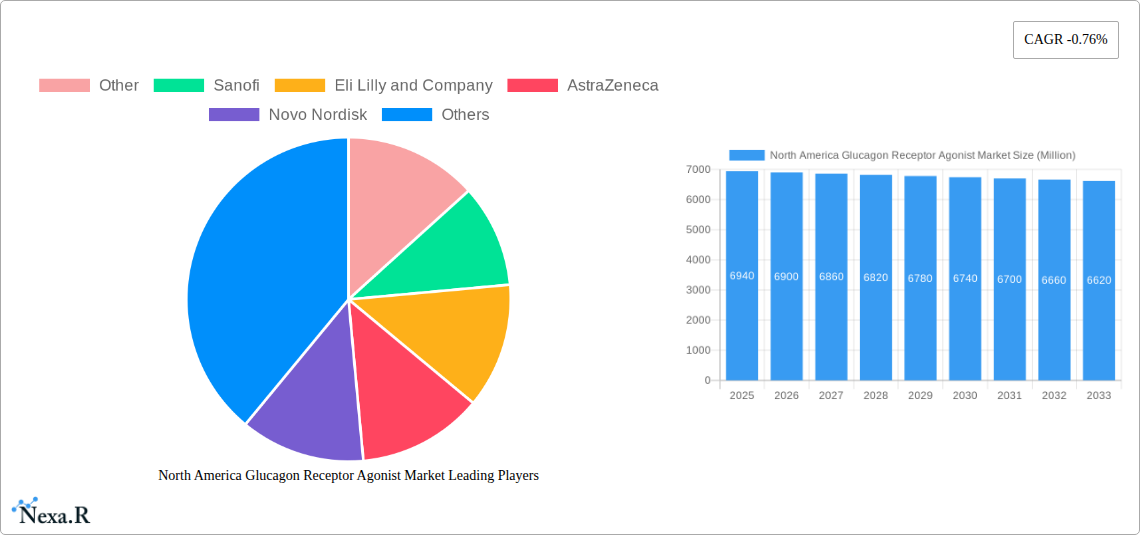

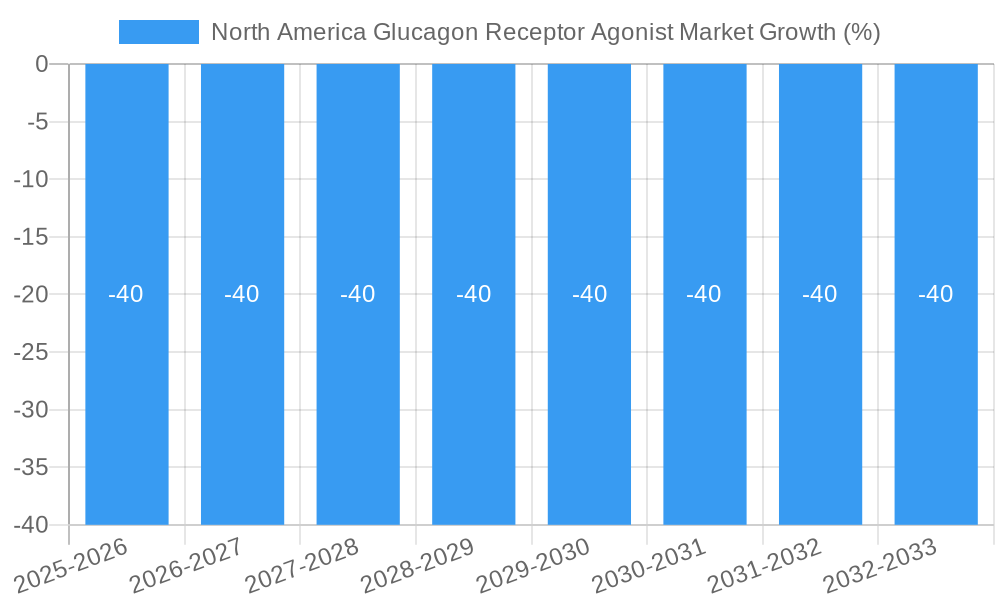

The North America glucagon receptor agonist market, valued at $6.94 billion in 2025, is projected to experience a slight contraction over the forecast period (2025-2033), reflecting a Compound Annual Growth Rate (CAGR) of -0.76%. This modest decline, however, doesn't signal market stagnation but rather a shift in market dynamics. While the overall market size might decrease marginally, the segment landscape is undergoing a transformation. Increased competition among established players like Novo Nordisk, Eli Lilly and Company, AstraZeneca, and Sanofi, alongside the emergence of "Other" players, is driving innovation and potentially impacting individual drug market shares. The market's relatively low growth rate is likely influenced by factors such as the maturation of existing drugs like Bydureon (Liraglutide), Victoza (Lixisenatide), and Lyxumia (Semaglutide), and the increasing availability of alternative treatment options for diabetes and obesity. Furthermore, pricing pressures and evolving healthcare reimbursement policies in North America can influence the market's trajectory. However, ongoing research and development efforts focusing on improved efficacy, safety profiles, and novel delivery methods could potentially revitalize growth within specific segments in the later years of the forecast period.

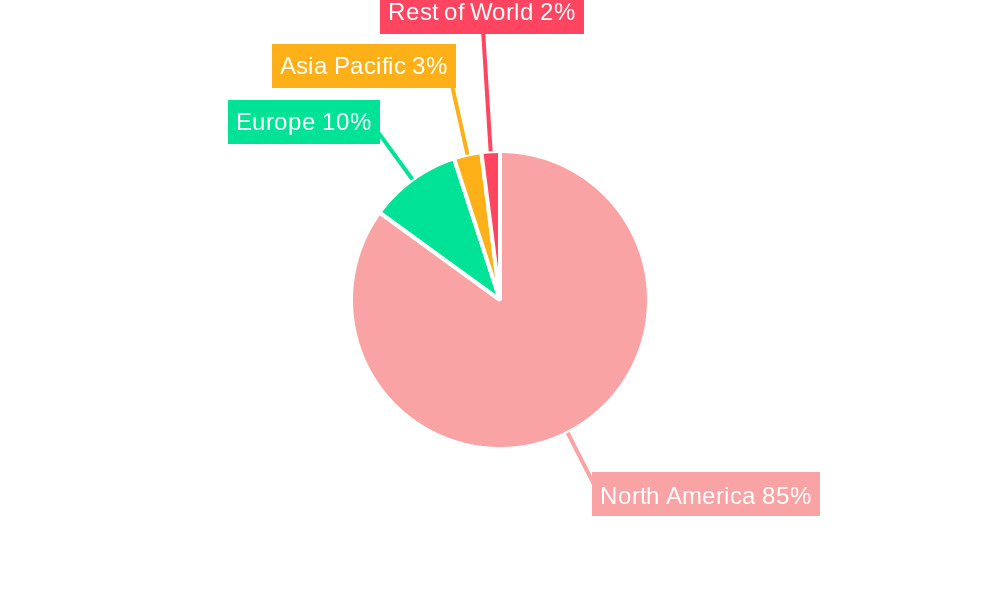

The regional focus on North America—specifically the United States, Canada, and Mexico—highlights the significant contribution of this region to the global market. The high prevalence of diabetes and obesity within North America, coupled with increasing awareness and adoption of glucagon receptor agonists as effective treatment options, continues to drive demand. Nevertheless, the market's future hinges on the success of new drug launches, sustained research and development, and the regulatory landscape. A key factor will be the emergence of newer, more effective drugs with better tolerability, potentially offsetting the anticipated decline in market size driven by existing drugs reaching maturity and facing competition. This makes strategic positioning and innovation crucial for success in this evolving market segment.

North America Glucagon Receptor Agonist Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America Glucagon Receptor Agonist market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this rapidly evolving market. The parent market is the Diabetes Treatment Market and the child market is Glucagon Receptor Agonist Market.

North America Glucagon Receptor Agonist Market Dynamics & Structure

The North American glucagon receptor agonist market is characterized by moderate concentration, with key players like Novo Nordisk, Eli Lilly and Company, and Sanofi holding significant market share. Technological innovation, particularly in the development of novel drug delivery systems and improved efficacy profiles, is a key driver. Regulatory frameworks, including FDA approvals, significantly impact market access and growth. Competitive pressures stem from existing therapies and emerging substitutes. The market's end-user demographics primarily include individuals with type 2 diabetes and increasingly, those with obesity. M&A activity in this sector remains relatively active, with strategic partnerships and acquisitions shaping the competitive landscape.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2025.

- Innovation Drivers: Novel drug delivery systems, improved efficacy, combination therapies.

- Regulatory Landscape: FDA approvals and guidelines heavily influence market entry and growth.

- Competitive Substitutes: Existing diabetes treatments pose competitive pressure.

- End-User Demographics: Primarily individuals with type 2 diabetes and obesity.

- M&A Activity: xx major deals observed between 2019 and 2024, indicating ongoing consolidation.

North America Glucagon Receptor Agonist Market Growth Trends & Insights

The North America glucagon receptor agonist market exhibits robust growth, driven by increasing prevalence of type 2 diabetes and obesity. Market size is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Adoption rates are increasing due to improved efficacy and safety profiles of newer agonists. Technological disruptions, such as the development of once-weekly injections, enhance patient convenience and compliance. Shifting consumer behavior towards proactive health management and preference for convenient treatment options further fuels market expansion.

Dominant Regions, Countries, or Segments in North America Glucagon Receptor Agonist Market

The United States dominates the North American glucagon receptor agonist market, accounting for the largest market share due to high prevalence of diabetes and obesity, coupled with robust healthcare infrastructure and greater access to advanced therapies. Within the segments, drugs like Semaglutide (Lyxumia and Wegovy) and Dulaglutide (Trulicity) exhibit strong growth potential, driven by their efficacy and favorable safety profiles.

- United States: Highest market share due to high prevalence of target conditions and advanced healthcare infrastructure.

- Canada: Significant but smaller market size compared to the US, showing steady growth.

- Bydureon (Liraglutide): Mature segment with stable market share.

- Victoza (Lixisenatide): Mature segment with moderate growth.

- Lyxumia (Semaglutide): High growth potential due to recent approvals for obesity treatment.

- Trulicity (Dulaglutide): High growth potential due to its once-weekly administration.

- Key Drivers: High prevalence of diabetes and obesity, improved treatment efficacy, and favorable reimbursement policies.

North America Glucagon Receptor Agonist Market Product Landscape

The market offers a range of glucagon receptor agonists, varying in administration routes (injections), dosages, and efficacy profiles. Innovations focus on improving patient compliance through once-weekly or longer-acting formulations, enhanced delivery systems, and combination therapies targeting multiple metabolic pathways. Unique selling propositions often revolve around improved glucose control, weight management, and cardiovascular benefits. Technological advancements are driving the development of more effective and convenient products.

Key Drivers, Barriers & Challenges in North America Glucagon Receptor Agonist Market

Key Drivers:

- Increasing prevalence of type 2 diabetes and obesity.

- Favorable regulatory landscape supporting new drug approvals.

- Technological advancements leading to improved product efficacy and convenience.

Key Barriers and Challenges:

- High cost of treatment limiting accessibility for certain patient populations.

- Potential side effects associated with some agonists limiting adoption.

- Intense competition from existing therapies and new entrants. This leads to pricing pressure and market share erosion for some players. The impact is estimated to be a 5% reduction in market growth in 2025

Emerging Opportunities in North America Glucagon Receptor Agonist Market

- Expanding use in earlier stages of diabetes management.

- Exploring combination therapies with other anti-diabetic drugs to maximize efficacy.

- Development of novel delivery systems to improve convenience and patient compliance.

- Untapped market potential in the treatment of obesity in pediatric patients.

Growth Accelerators in the North America Glucagon Receptor Agonist Market Industry

Technological advancements continue to fuel market growth, enabling the development of more effective and convenient therapies. Strategic partnerships between pharmaceutical companies and technology providers facilitate innovation and market expansion. Expanding awareness of the benefits of glucagon receptor agonists among healthcare professionals and patients drives increased adoption.

Key Players Shaping the North America Glucagon Receptor Agonist Market Market

- Other (Replace with actual link if available)

- Sanofi

- Eli Lilly and Company

- AstraZeneca

- Novo Nordisk

- Pfizer

Notable Milestones in North America Glucagon Receptor Agonist Market Sector

- January 2023: FDA approves semaglutide (Wegovy - Novo Nordisk) for treating obesity in pediatric patients aged 12 and older. This significantly expands the addressable market for semaglutide.

- May 2022: FDA approves Eli Lilly and Company's Mounjaro (tirzepatide) for type 2 diabetes. This new once-weekly dual GLP-1 and GIP receptor agonist introduces a highly competitive new product.

In-Depth North America Glucagon Receptor Agonist Market Market Outlook

The North America glucagon receptor agonist market presents significant long-term growth potential. Continued innovation, expanding patient populations, and favorable regulatory environments will drive market expansion. Strategic acquisitions and partnerships will further shape the competitive landscape, leading to enhanced product offerings and increased market penetration. The market is poised for sustained growth, driven by advancements in treatment efficacy, convenience, and patient access.

North America Glucagon Receptor Agonist Market Segmentation

-

1. Drugs

-

1.1. Dulaglutide

- 1.1.1. Trulicity

-

1.2. Exenatide

- 1.2.1. Byetta

- 1.2.2. Bydureon

-

1.3. Liraglutide

- 1.3.1. Victoza

-

1.4. Lixisenatide

- 1.4.1. Lyxumia

-

1.5. Semaglutide

- 1.5.1. Ozempic

-

1.1. Dulaglutide

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Glucagon Receptor Agonist Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Glucagon Receptor Agonist Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of -0.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising R&D Focus on the Development of Biotechnology-engineered Anti-cancer Drugs; Rapid Growth in the Usage of Pre-filled Syringes for Biologics; Increased Outsourcing Activities Across Value Chain Expected to Boost Supply of Injectable Products

- 3.3. Market Restrains

- 3.3.1. High Expenses Associated with Inventory Management; Availability of Alternate Drug Delivery Methods

- 3.4. Market Trends

- 3.4.1. Liraglutide Segment holds the highest market share in the North American Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Drugs

- 5.1.1. Dulaglutide

- 5.1.1.1. Trulicity

- 5.1.2. Exenatide

- 5.1.2.1. Byetta

- 5.1.2.2. Bydureon

- 5.1.3. Liraglutide

- 5.1.3.1. Victoza

- 5.1.4. Lixisenatide

- 5.1.4.1. Lyxumia

- 5.1.5. Semaglutide

- 5.1.5.1. Ozempic

- 5.1.1. Dulaglutide

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Drugs

- 6. United States North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Drugs

- 6.1.1. Dulaglutide

- 6.1.1.1. Trulicity

- 6.1.2. Exenatide

- 6.1.2.1. Byetta

- 6.1.2.2. Bydureon

- 6.1.3. Liraglutide

- 6.1.3.1. Victoza

- 6.1.4. Lixisenatide

- 6.1.4.1. Lyxumia

- 6.1.5. Semaglutide

- 6.1.5.1. Ozempic

- 6.1.1. Dulaglutide

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Drugs

- 7. Canada North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Drugs

- 7.1.1. Dulaglutide

- 7.1.1.1. Trulicity

- 7.1.2. Exenatide

- 7.1.2.1. Byetta

- 7.1.2.2. Bydureon

- 7.1.3. Liraglutide

- 7.1.3.1. Victoza

- 7.1.4. Lixisenatide

- 7.1.4.1. Lyxumia

- 7.1.5. Semaglutide

- 7.1.5.1. Ozempic

- 7.1.1. Dulaglutide

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Drugs

- 8. Rest of North America North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Drugs

- 8.1.1. Dulaglutide

- 8.1.1.1. Trulicity

- 8.1.2. Exenatide

- 8.1.2.1. Byetta

- 8.1.2.2. Bydureon

- 8.1.3. Liraglutide

- 8.1.3.1. Victoza

- 8.1.4. Lixisenatide

- 8.1.4.1. Lyxumia

- 8.1.5. Semaglutide

- 8.1.5.1. Ozempic

- 8.1.1. Dulaglutide

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Drugs

- 9. United States North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Glucagon Receptor Agonist Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Other

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Sanofi

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Eli Lilly and Company

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 AstraZeneca

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Novo Nordisk

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Pfizer

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.1 Other

List of Figures

- Figure 1: North America Glucagon Receptor Agonist Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Glucagon Receptor Agonist Market Share (%) by Company 2024

List of Tables

- Table 1: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Drugs 2019 & 2032

- Table 4: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 5: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 7: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States North America Glucagon Receptor Agonist Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Glucagon Receptor Agonist Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Glucagon Receptor Agonist Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Glucagon Receptor Agonist Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Glucagon Receptor Agonist Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Glucagon Receptor Agonist Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Glucagon Receptor Agonist Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Glucagon Receptor Agonist Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Drugs 2019 & 2032

- Table 20: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 21: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 23: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Drugs 2019 & 2032

- Table 26: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 27: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 29: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Drugs 2019 & 2032

- Table 32: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Drugs 2019 & 2032

- Table 33: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 35: North America Glucagon Receptor Agonist Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Glucagon Receptor Agonist Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Glucagon Receptor Agonist Market?

The projected CAGR is approximately -0.76%.

2. Which companies are prominent players in the North America Glucagon Receptor Agonist Market?

Key companies in the market include Other, Sanofi, Eli Lilly and Company, AstraZeneca, Novo Nordisk, Pfizer.

3. What are the main segments of the North America Glucagon Receptor Agonist Market?

The market segments include Drugs, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising R&D Focus on the Development of Biotechnology-engineered Anti-cancer Drugs; Rapid Growth in the Usage of Pre-filled Syringes for Biologics; Increased Outsourcing Activities Across Value Chain Expected to Boost Supply of Injectable Products.

6. What are the notable trends driving market growth?

Liraglutide Segment holds the highest market share in the North American Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year.

7. Are there any restraints impacting market growth?

High Expenses Associated with Inventory Management; Availability of Alternate Drug Delivery Methods.

8. Can you provide examples of recent developments in the market?

January 2023: The U.S. Food and Drug Administration approved semaglutide (Wegovy- Novo Nordisk) for treating obesity in pediatric patients 12 years and older. The approval was granted following the results of a phase 3a study published in the New England Journal of Medicine. Participants in the trial were given semaglutide or a placebo for 68 weeks alongside lifestyle intervention. Safety, efficacy, and tolerability were compared between these 2 groups.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Glucagon Receptor Agonist Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Glucagon Receptor Agonist Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Glucagon Receptor Agonist Market?

To stay informed about further developments, trends, and reports in the North America Glucagon Receptor Agonist Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence