Key Insights

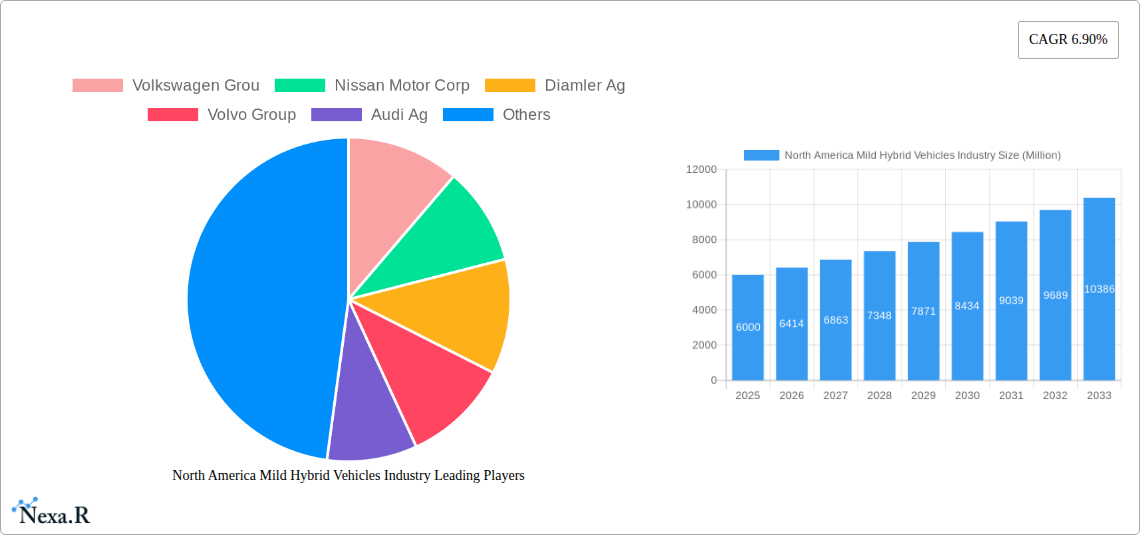

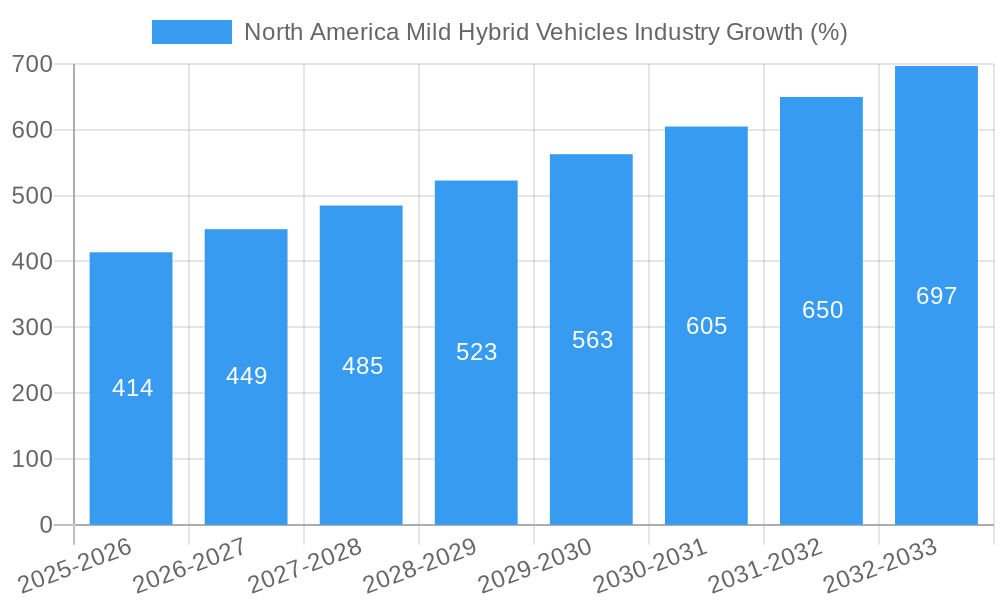

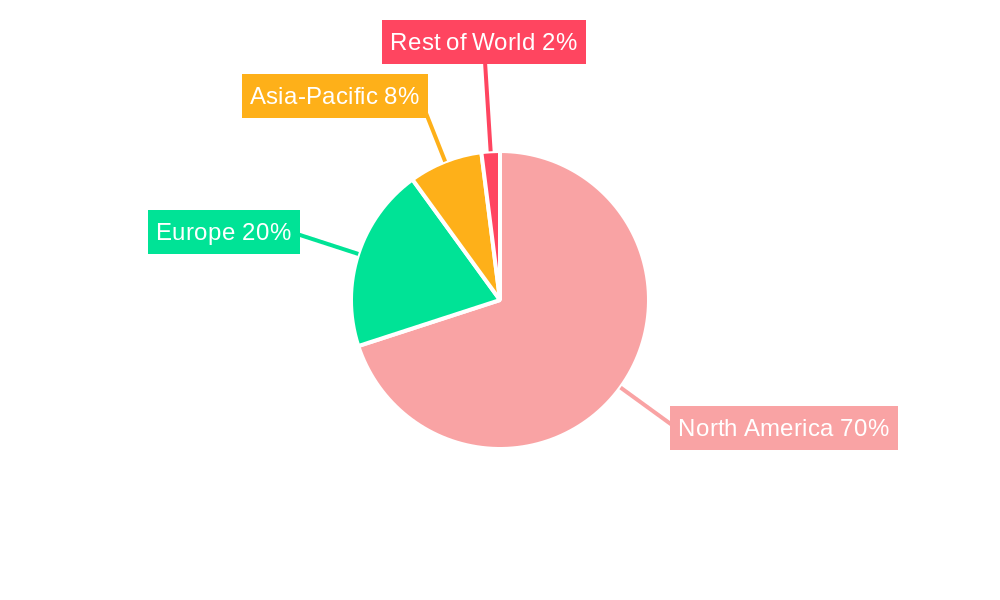

The North American mild hybrid vehicle (MHEV) market, currently experiencing robust growth, is projected to expand significantly over the next decade. A 6.90% CAGR indicates a substantial increase in market value from its 2025 base. While precise figures for 2025 market size are unavailable, considering the global context and the increasing adoption of fuel-efficient technologies in North America, we can reasonably estimate the 2025 market value to be in the range of $5-7 billion USD. This growth is driven by stringent government regulations aimed at reducing carbon emissions, increasing fuel prices, and consumer preference for enhanced fuel economy. The segment breakdown shows a higher market share for passenger cars compared to commercial vehicles, although both segments are anticipated to witness considerable growth. Key players such as Volkswagen Group, Nissan, Daimler, Volvo, and Toyota are actively investing in R&D and expanding their MHEV offerings to capture this expanding market. The 48V and above capacity segment is expected to dominate due to its superior performance and efficiency compared to lower voltage systems. The continued advancement of battery technology, along with decreasing production costs, further contributes to the market's positive trajectory. The market is expected to continue its expansion over the forecast period of 2025-2033, fueled by the continuous rollout of new MHEV models and the increasing affordability of these technologies.

Despite the positive outlook, challenges remain. Competition from other fuel-efficient technologies, like plug-in hybrids and fully electric vehicles, poses a challenge. Consumer awareness and understanding of MHEV technology also need further improvement to drive widespread adoption. The availability of charging infrastructure, although less critical than for fully electric vehicles, still plays a role in consumer decision-making. Overcoming these hurdles will be crucial for sustaining the predicted growth and maximizing the potential of the North American mild hybrid vehicle market throughout the forecast period. Regional variations within North America (United States, Canada, and Mexico) will also need to be considered, with the United States likely maintaining the largest market share.

North America Mild Hybrid Vehicles Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America mild hybrid vehicle market, encompassing market dynamics, growth trends, regional dominance, product landscape, challenges, opportunities, and key players. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report caters to industry professionals, investors, and stakeholders seeking a detailed understanding of this rapidly evolving sector within the broader automotive industry. The parent market is the North American automotive industry, and the child market is mild hybrid vehicles within North America.

North America Mild Hybrid Vehicles Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the North American mild hybrid vehicle industry. The analysis incorporates quantitative data, including market share and M&A activity, and qualitative factors affecting market growth.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few major players holding significant market share (approximately xx%). However, increased competition from smaller, more agile companies is expected.

- Technological Innovation: Key innovation drivers include advancements in 48V battery technology, improved energy recuperation systems, and integration with advanced driver-assistance systems (ADAS). Barriers include high initial investment costs for R&D and manufacturing.

- Regulatory Framework: Government regulations promoting fuel efficiency and emission reduction are significant drivers. The evolving regulatory landscape in different North American regions significantly influences market dynamics.

- Competitive Product Substitutes: Mild hybrid vehicles face competition from full hybrid and electric vehicles. However, mild hybrids offer a lower cost entry point for consumers transitioning towards fuel-efficient vehicles.

- End-User Demographics: The primary end-users are environmentally conscious consumers seeking improved fuel economy and reduced emissions. Growing urbanization and increasing traffic congestion are also contributing factors to adoption.

- M&A Trends: The number of M&A deals in the mild hybrid vehicle sector during 2019-2024 was approximately xx. These deals primarily focused on technology acquisition and market expansion. We forecast xx M&A deals during the forecast period.

North America Mild Hybrid Vehicles Industry Growth Trends & Insights

This section details the historical and projected market size evolution, adoption rates, technological disruptions, and consumer behavior shifts. The analysis incorporates key metrics such as CAGR and market penetration rates, providing a comprehensive overview of growth trajectories.

The North American mild hybrid vehicle market experienced significant growth between 2019 and 2024, with an estimated CAGR of xx%. This growth is attributed to [Insert detailed analysis of factors like government incentives, technological advancements, consumer preferences]. The market is expected to continue its growth trajectory during the forecast period (2025-2033), driven by [Insert detailed analysis of future growth drivers]. Market penetration is projected to reach xx% by 2033, with passenger car segments leading the way. Technological advancements in battery technology and improved fuel efficiency are expected to further accelerate adoption. Consumer behavior shifts, such as a growing preference for eco-friendly vehicles and rising fuel prices, are also driving market growth. [Insert analysis on specific consumer behavior including willingness to pay, brand perception, etc]

Dominant Regions, Countries, or Segments in North America Mild Hybrid Vehicles Industry

This section identifies the leading regions, countries, and segments within the North American mild hybrid vehicle market, analyzing factors driving their dominance.

- Leading Region/Country: [Specify the leading region/country based on sales volume and market share]. Reasons for dominance include favorable government policies, well-established automotive manufacturing infrastructure, and high consumer demand.

- Dominant Capacity Type: The 48V and above capacity type segment is projected to dominate the market due to its superior fuel efficiency and performance compared to the less than 48V segment.

- Dominant Vehicle Type: The passenger car segment currently holds the largest market share, but the commercial vehicle segment is poised for substantial growth.

- Key Growth Drivers:

- Government Incentives: Tax credits and subsidies for mild hybrid vehicles significantly impact market growth in certain regions.

- Stringent Emission Regulations: Compliance with stricter emission standards is pushing automakers to adopt mild hybrid technology.

- Technological Advancements: Improvements in battery technology and cost reduction are making mild hybrids more accessible.

[Insert detailed analysis about specific regions, countries, and segments including market size, growth rate, and key factors contributing to growth.]

North America Mild Hybrid Vehicles Industry Product Landscape

The North American mild hybrid vehicle market features a diverse range of products, encompassing various capacity types (less than 48V and 48V and above) and vehicle types (passenger cars and commercial vehicles). Key product innovations include improved battery technology, enhanced energy recuperation systems, and integration with advanced driver-assistance systems. Unique selling propositions focus on increased fuel efficiency, reduced emissions, and improved performance compared to conventional internal combustion engine vehicles. Technological advancements are continuously improving the efficiency, cost-effectiveness, and performance of mild hybrid vehicles.

Key Drivers, Barriers & Challenges in North America Mild Hybrid Vehicles Industry

Key Drivers:

- Growing consumer demand for fuel-efficient and environmentally friendly vehicles.

- Stringent government regulations on vehicle emissions.

- Technological advancements in battery technology and powertrain systems.

Key Challenges and Restraints:

- High initial cost: The high initial purchase price of mild hybrid vehicles compared to conventional vehicles remains a barrier to wider adoption. This is estimated to impact market growth by xx% by 2030.

- Limited range: Mild hybrids offer limited improvement in fuel economy and electric range compared to full hybrids and electric vehicles.

- Supply chain disruptions: Global supply chain disruptions can negatively impact the production and availability of mild hybrid vehicles.

[Insert detailed analysis of these drivers, barriers and quantify their impact.]

Emerging Opportunities in North America Mild Hybrid Vehicles Industry

Emerging opportunities include untapped markets in developing regions, increased adoption in commercial vehicle segments (e.g., light-duty trucks and vans), and the integration of mild hybrid systems with advanced driver-assistance systems (ADAS) and connected car technologies. Further development in battery technology leading to higher energy density and lower costs creates a significant opportunity for market expansion.

Growth Accelerators in the North America Mild Hybrid Vehicles Industry

Technological breakthroughs in battery technology, leading to increased energy density and reduced costs, are significant growth accelerators. Strategic partnerships between automakers and technology providers foster innovation and accelerate product development. Expansion into new geographical markets and the integration of mild hybrid systems into various vehicle types will further stimulate growth.

Key Players Shaping the North America Mild Hybrid Vehicles Industry Market

- Volkswagen Group

- Nissan Motor Corp

- Daimler AG

- Volvo Group

- Audi AG

- Honda Motor Corp

- BMW AG

- Toyota Motor Corp

- Suzuki Motor Corp

Notable Milestones in North America Mild Hybrid Vehicles Industry Sector

- 2020-Q3: Introduction of a new 48V mild hybrid system by [Company Name].

- 2021-Q4: Significant increase in government incentives for mild hybrid vehicles in [Region].

- 2022-Q1: Strategic partnership formed between [Company A] and [Company B] for the development of advanced mild hybrid technology.

- 2023-Q2: [Insert a significant development]

[Add more significant milestones with dates and impact on market dynamics]

In-Depth North America Mild Hybrid Vehicles Industry Market Outlook

The North American mild hybrid vehicle market is poised for robust growth over the forecast period (2025-2033), driven by favorable government policies, technological advancements, and rising consumer demand for fuel-efficient vehicles. Strategic opportunities lie in focusing on technological innovation, particularly in battery technology and system integration. Expansion into the commercial vehicle sector and international markets presents significant untapped potential. Further, proactive adaptation to changing consumer preferences and regulatory landscape will be crucial for success.

North America Mild Hybrid Vehicles Industry Segmentation

-

1. Capacity type

- 1.1. Less than 48V

- 1.2. 48V & Above

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

North America Mild Hybrid Vehicles Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest Of North America

North America Mild Hybrid Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Warehousing and Logistics Sector to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Purchase Cost to Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Mild Hybrid Vehicles will face competition from HEV and PHEV

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Capacity type

- 5.1.1. Less than 48V

- 5.1.2. 48V & Above

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest Of North America

- 5.1. Market Analysis, Insights and Forecast - by Capacity type

- 6. United States North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Capacity type

- 6.1.1. Less than 48V

- 6.1.2. 48V & Above

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Capacity type

- 7. Canada North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Capacity type

- 7.1.1. Less than 48V

- 7.1.2. 48V & Above

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Capacity type

- 8. Rest Of North America North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Capacity type

- 8.1.1. Less than 48V

- 8.1.2. 48V & Above

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Capacity type

- 9. United States North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Volkswagen Grou

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Nissan Motor Corp

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Diamler Ag

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Volvo Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Audi Ag

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Honda Motor Corp

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 BMW AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Toyota Motor Corp

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Suzuki Motor Corp

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Volkswagen Grou

List of Figures

- Figure 1: North America Mild Hybrid Vehicles Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Mild Hybrid Vehicles Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Capacity type 2019 & 2032

- Table 3: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Mild Hybrid Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Mild Hybrid Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Mild Hybrid Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Mild Hybrid Vehicles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Capacity type 2019 & 2032

- Table 11: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 12: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Capacity type 2019 & 2032

- Table 14: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 15: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Capacity type 2019 & 2032

- Table 17: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 18: North America Mild Hybrid Vehicles Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mild Hybrid Vehicles Industry?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the North America Mild Hybrid Vehicles Industry?

Key companies in the market include Volkswagen Grou, Nissan Motor Corp, Diamler Ag, Volvo Group, Audi Ag, Honda Motor Corp, BMW AG, Toyota Motor Corp, Suzuki Motor Corp.

3. What are the main segments of the North America Mild Hybrid Vehicles Industry?

The market segments include Capacity type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Warehousing and Logistics Sector to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Mild Hybrid Vehicles will face competition from HEV and PHEV.

7. Are there any restraints impacting market growth?

High Initial Purchase Cost to Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mild Hybrid Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mild Hybrid Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mild Hybrid Vehicles Industry?

To stay informed about further developments, trends, and reports in the North America Mild Hybrid Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence