Key Insights

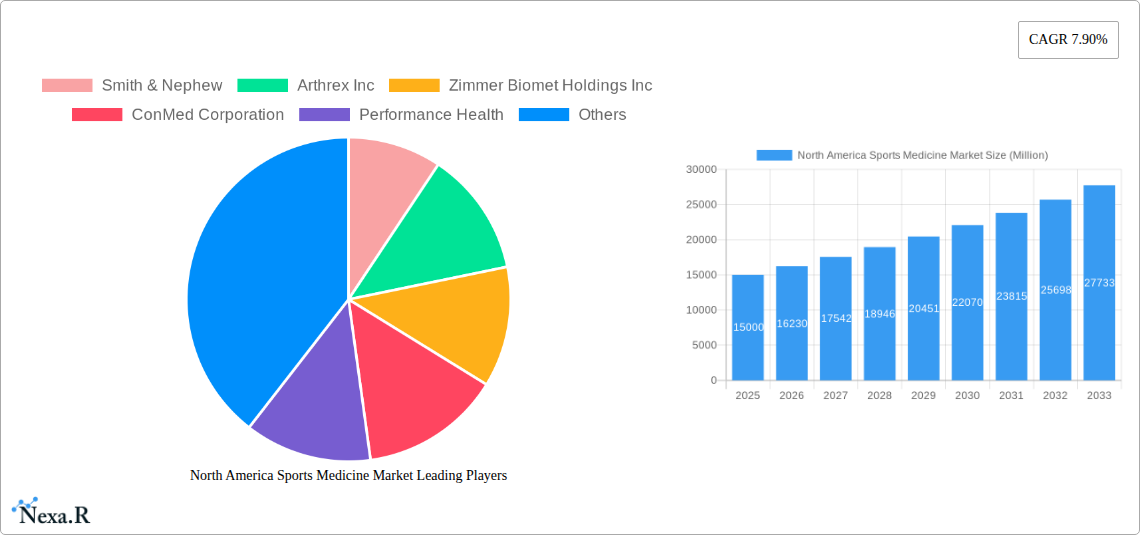

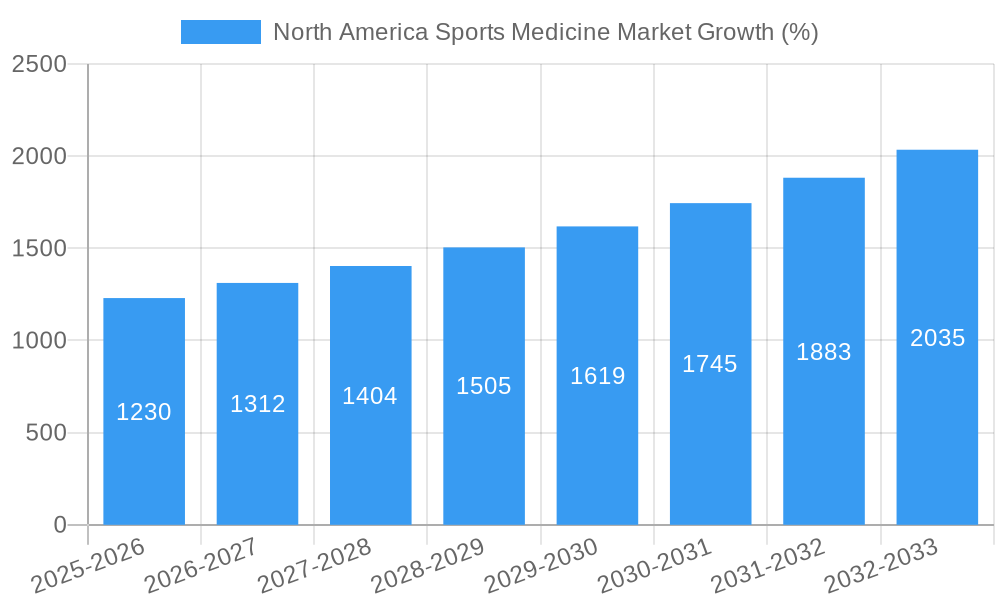

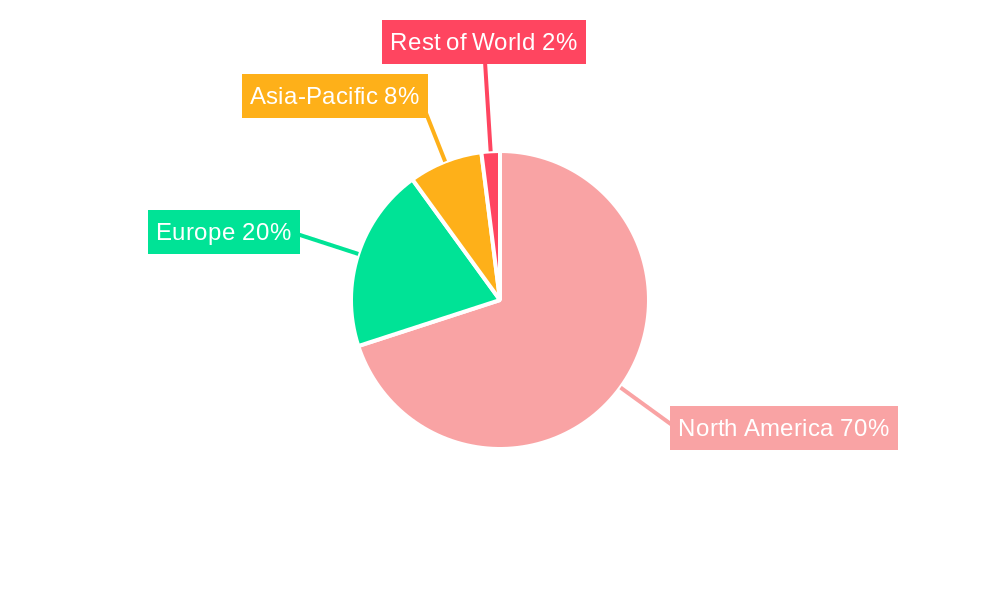

The North American sports medicine market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by several key factors. The rising prevalence of sports-related injuries across diverse age groups, coupled with an increasing awareness of advanced treatment options, fuels market expansion. Technological advancements in minimally invasive surgical techniques (like arthroscopy) and the development of innovative implants and biomaterials contribute significantly to this growth. The aging population in North America is also a significant driver, as older adults are more susceptible to injuries requiring sports medicine interventions. Furthermore, the increasing participation in recreational sports and fitness activities contributes to a larger pool of potential patients. The market segmentation reveals strong performance across various product categories, with implants, arthroscopy devices, and orthobiologics leading the way. Geographically, the United States dominates the market due to its large population, higher healthcare expenditure, and advanced medical infrastructure. While Canada and Mexico represent smaller segments, they are expected to experience growth driven by rising disposable incomes and improved healthcare access. However, high treatment costs and potential insurance coverage limitations remain as market restraints. The competitive landscape is characterized by the presence of established multinational corporations alongside specialized players, leading to a dynamic market with ongoing innovation and consolidation.

Looking forward, the North American sports medicine market is poised for considerable expansion over the forecast period (2025-2033). The continued development and adoption of technologically advanced treatments, including robotic surgery and personalized medicine approaches, will further enhance market growth. A focus on preventive care and injury rehabilitation programs will likely play a crucial role in mitigating the long-term impact of sports-related injuries. Furthermore, market players are actively pursuing strategic partnerships and collaborations to expand their product portfolios and market reach. Increased research and development efforts aimed at improving the efficacy and safety of existing treatments and developing novel solutions will continue to shape the market trajectory. The market's growth trajectory is expected to be influenced by factors such as regulatory approvals for new technologies, the economic climate, and evolving healthcare policies.

North America Sports Medicine Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the North America sports medicine market, encompassing market size, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report segments the market by product (Implants, Arthroscopy Devices, Prosthetics, Orthobiologics, Braces, Bandages and Tapes, Other Products) and application (Knee Injuries, Shoulder Injuries, Ankle and Foot Injuries, Back and Spine Injuries, Elbow and Wrist Injuries, Other Applications), offering granular insights for strategic decision-making. Key players analyzed include Smith & Nephew, Arthrex Inc, Zimmer Biomet Holdings Inc, ConMed Corporation, Performance Health, Medtronic PLC, Johnson & Johnson, Mueller Sports Medicine Inc, and Stryker Corporation. The market is projected to reach xx Million by 2033.

North America Sports Medicine Market Dynamics & Structure

The North America sports medicine market is characterized by a moderately concentrated landscape, with several multinational corporations holding significant market share. Technological innovation, particularly in minimally invasive surgical techniques and biomaterial development, is a primary growth driver. Stringent regulatory frameworks, including FDA approvals, influence product development and market entry. Competitive pressures from substitute products, such as physical therapy and rehabilitation, also shape market dynamics. The increasing prevalence of sports-related injuries across diverse age groups fuels market growth. Mergers and acquisitions (M&A) activity is substantial, indicating ongoing consolidation and expansion within the sector.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on minimally invasive surgery, advanced biomaterials, and smart implants.

- Regulatory Landscape: Stringent FDA regulations impacting product approvals and market entry.

- Competitive Substitutes: Physical therapy, rehabilitation, and conservative treatment options.

- End-User Demographics: Growing aging population and increasing participation in sports activities.

- M&A Trends: Significant M&A activity, reflecting consolidation and expansion strategies (xx deals in 2024).

North America Sports Medicine Market Growth Trends & Insights

The North America sports medicine market has witnessed robust growth over the historical period (2019-2024), driven by rising healthcare expenditure, technological advancements, and an increase in sports-related injuries. The market is expected to maintain a healthy CAGR of xx% during the forecast period (2025-2033), reaching a projected value of xx Million by 2033. Technological disruptions, such as the adoption of robotic surgery and 3D-printed implants, are accelerating market growth. Shifting consumer preferences towards minimally invasive procedures and personalized treatment options further contribute to market expansion. Market penetration of advanced products remains relatively low, offering significant future growth potential.

Dominant Regions, Countries, or Segments in North America Sports Medicine Market

The United States dominates the North America sports medicine market, owing to its advanced healthcare infrastructure, high prevalence of sports-related injuries, and robust healthcare expenditure. Within the product segment, implants hold the largest market share, driven by the increasing demand for joint replacements and trauma care. Similarly, knee injuries represent the leading application segment due to high incidence rates and treatment complexities.

- Key Drivers (United States): Advanced healthcare infrastructure, high healthcare expenditure, rising prevalence of sports-related injuries.

- Key Drivers (Implants Segment): Technological advancements, increasing demand for joint replacements.

- Key Drivers (Knee Injuries Segment): High incidence rates, complex treatment needs.

North America Sports Medicine Market Product Landscape

The North America sports medicine market exhibits a diverse product landscape, encompassing implants, arthroscopy devices, prosthetics, orthobiologics, braces, bandages and tapes, and other related products. Recent innovations focus on enhanced biocompatibility, improved functionality, and minimally invasive surgical techniques. Technological advancements in material science and surgical instrumentation are driving product differentiation and improved patient outcomes. Unique selling propositions often emphasize superior biointegration, reduced recovery times, and enhanced patient comfort.

Key Drivers, Barriers & Challenges in North America Sports Medicine Market

Key Drivers:

- Rising prevalence of sports-related injuries across various age groups.

- Technological advancements in minimally invasive surgical techniques and biomaterials.

- Increasing healthcare expenditure and insurance coverage.

Challenges & Restraints:

- High cost of advanced medical devices and procedures.

- Stringent regulatory approvals processes.

- Intense competition among established players and emerging companies.

- Supply chain disruptions impacting device availability.

Emerging Opportunities in North America Sports Medicine Market

- Growing demand for minimally invasive procedures and personalized medicine.

- Expansion into untapped markets, such as regenerative medicine and telehealth.

- Development of innovative biomaterials and advanced implants.

- Increased focus on patient education and rehabilitation programs.

Growth Accelerators in the North America Sports Medicine Market Industry

Technological breakthroughs in biomaterials, robotic surgery, and 3D printing are driving significant growth. Strategic partnerships between device manufacturers and healthcare providers enhance market access and product development. Market expansion strategies, including geographical diversification and new product launches, will play a vital role in the long-term growth of the industry.

Key Players Shaping the North America Sports Medicine Market Market

- Smith & Nephew

- Arthrex Inc

- Zimmer Biomet Holdings Inc

- ConMed Corporation

- Performance Health

- Medtronic PLC

- Johnson & Johnson

- Mueller Sports Medicine Inc

- Stryker Corporation

Notable Milestones in North America Sports Medicine Market Sector

- August 2022: ConMed acquires Biorez, gaining access to next-generation bio-inductive collagen scaffold technology.

- January 2023: Zimmer Biomet acquires Embody Inc, strengthening its soft tissue healing portfolio.

In-Depth North America Sports Medicine Market Market Outlook

The North America sports medicine market holds immense future potential, driven by technological innovation, increasing prevalence of sports-related injuries, and a growing aging population. Strategic partnerships, product diversification, and expanding into untapped markets will be key success factors for industry players. The market is poised for continued growth, offering lucrative opportunities for companies focused on delivering innovative and effective sports medicine solutions.

North America Sports Medicine Market Segmentation

-

1. Product

- 1.1. Implants

- 1.2. Arthroscopy Devices

- 1.3. Prosthetics

- 1.4. Orthobiologics

- 1.5. Braces

- 1.6. Bandages and Tapes

- 1.7. Other Products

-

2. Application

- 2.1. Knee Injuries

- 2.2. Shoulder Injuries

- 2.3. Ankle and Foot Injuries

- 2.4. Back and Spine Injuries

- 2.5. Elbow and Wrist Injuries

- 2.6. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Sports Medicine Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Sports Medicine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Sports Injuries; Consistent Innovation of New Products and Treatment Modalities; Rising Demand for Minimally Invasive Surgeries

- 3.3. Market Restrains

- 3.3.1. High Cost of Implants and Devices; Dearth of Proper Sports Ecosystem

- 3.4. Market Trends

- 3.4.1. Shoulder Injuries Segment is Expected to Witness Healthy Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Sports Medicine Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Implants

- 5.1.2. Arthroscopy Devices

- 5.1.3. Prosthetics

- 5.1.4. Orthobiologics

- 5.1.5. Braces

- 5.1.6. Bandages and Tapes

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Knee Injuries

- 5.2.2. Shoulder Injuries

- 5.2.3. Ankle and Foot Injuries

- 5.2.4. Back and Spine Injuries

- 5.2.5. Elbow and Wrist Injuries

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Sports Medicine Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Implants

- 6.1.2. Arthroscopy Devices

- 6.1.3. Prosthetics

- 6.1.4. Orthobiologics

- 6.1.5. Braces

- 6.1.6. Bandages and Tapes

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Knee Injuries

- 6.2.2. Shoulder Injuries

- 6.2.3. Ankle and Foot Injuries

- 6.2.4. Back and Spine Injuries

- 6.2.5. Elbow and Wrist Injuries

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Sports Medicine Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Implants

- 7.1.2. Arthroscopy Devices

- 7.1.3. Prosthetics

- 7.1.4. Orthobiologics

- 7.1.5. Braces

- 7.1.6. Bandages and Tapes

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Knee Injuries

- 7.2.2. Shoulder Injuries

- 7.2.3. Ankle and Foot Injuries

- 7.2.4. Back and Spine Injuries

- 7.2.5. Elbow and Wrist Injuries

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Sports Medicine Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Implants

- 8.1.2. Arthroscopy Devices

- 8.1.3. Prosthetics

- 8.1.4. Orthobiologics

- 8.1.5. Braces

- 8.1.6. Bandages and Tapes

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Knee Injuries

- 8.2.2. Shoulder Injuries

- 8.2.3. Ankle and Foot Injuries

- 8.2.4. Back and Spine Injuries

- 8.2.5. Elbow and Wrist Injuries

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. North America North America Sports Medicine Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. United States North America Sports Medicine Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1. undefined

- 11. Canada North America Sports Medicine Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Mexico North America Sports Medicine Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Smith & Nephew

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Arthrex Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Zimmer Biomet Holdings Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 ConMed Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Performance Health

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Medtronic PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Johnson & Johnson

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Mueller Sports Medicine Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Stryker Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Smith & Nephew

List of Figures

- Figure 1: North America Sports Medicine Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Sports Medicine Market Share (%) by Company 2024

List of Tables

- Table 1: North America Sports Medicine Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Sports Medicine Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Sports Medicine Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: North America Sports Medicine Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: North America Sports Medicine Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: North America Sports Medicine Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: North America Sports Medicine Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Sports Medicine Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 9: North America Sports Medicine Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Sports Medicine Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: North America Sports Medicine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Sports Medicine Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: North America Sports Medicine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: North America Sports Medicine Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: North America Sports Medicine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: North America Sports Medicine Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: North America Sports Medicine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: North America Sports Medicine Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: North America Sports Medicine Market Revenue Million Forecast, by Product 2019 & 2032

- Table 20: North America Sports Medicine Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 21: North America Sports Medicine Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: North America Sports Medicine Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 23: North America Sports Medicine Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: North America Sports Medicine Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 25: North America Sports Medicine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: North America Sports Medicine Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: North America Sports Medicine Market Revenue Million Forecast, by Product 2019 & 2032

- Table 28: North America Sports Medicine Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 29: North America Sports Medicine Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: North America Sports Medicine Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 31: North America Sports Medicine Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: North America Sports Medicine Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 33: North America Sports Medicine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: North America Sports Medicine Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: North America Sports Medicine Market Revenue Million Forecast, by Product 2019 & 2032

- Table 36: North America Sports Medicine Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 37: North America Sports Medicine Market Revenue Million Forecast, by Application 2019 & 2032

- Table 38: North America Sports Medicine Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 39: North America Sports Medicine Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: North America Sports Medicine Market Volume K Unit Forecast, by Geography 2019 & 2032

- Table 41: North America Sports Medicine Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: North America Sports Medicine Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Sports Medicine Market?

The projected CAGR is approximately 7.90%.

2. Which companies are prominent players in the North America Sports Medicine Market?

Key companies in the market include Smith & Nephew, Arthrex Inc, Zimmer Biomet Holdings Inc , ConMed Corporation, Performance Health, Medtronic PLC, Johnson & Johnson, Mueller Sports Medicine Inc, Stryker Corporation.

3. What are the main segments of the North America Sports Medicine Market?

The market segments include Product, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Sports Injuries; Consistent Innovation of New Products and Treatment Modalities; Rising Demand for Minimally Invasive Surgeries.

6. What are the notable trends driving market growth?

Shoulder Injuries Segment is Expected to Witness Healthy Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Implants and Devices; Dearth of Proper Sports Ecosystem.

8. Can you provide examples of recent developments in the market?

In August 2022, Conmed has mentioned that it has acquired Biorez a medical device company in the United States. Through this acquisition, Conmed will receive the next-generation bio-inductive collagen scaffold technology for application in sports medicine soft tissue healing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Sports Medicine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Sports Medicine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Sports Medicine Market?

To stay informed about further developments, trends, and reports in the North America Sports Medicine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence