Key Insights

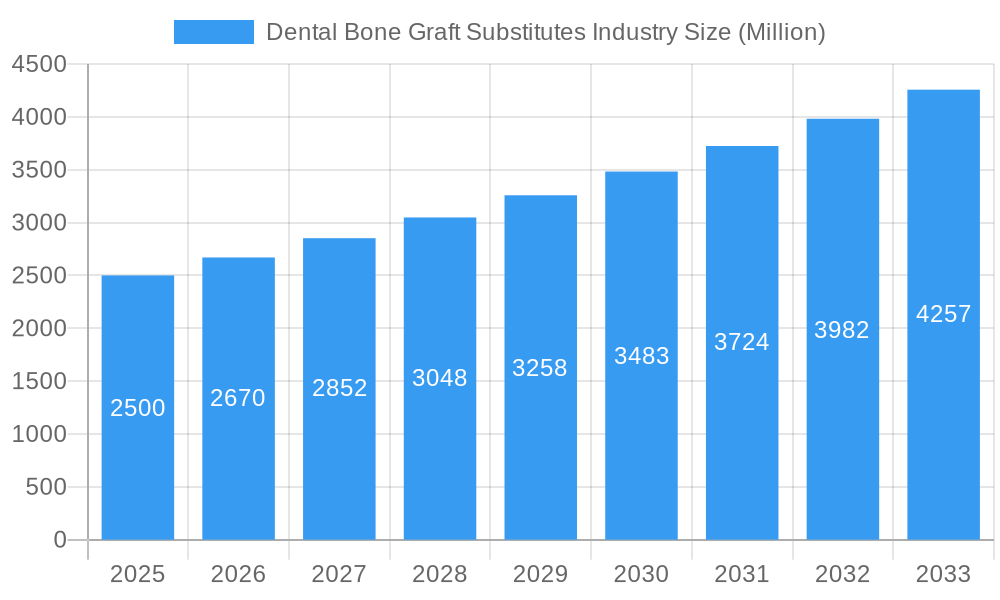

The global dental bone graft substitutes market is experiencing robust growth, projected to reach a substantial size by 2033. A Compound Annual Growth Rate (CAGR) of 6.80% from 2019 to 2024 indicates a steadily expanding market driven by several key factors. The increasing prevalence of periodontal diseases and dental implant procedures fuels the demand for bone graft substitutes, as they are crucial for successful implant placement and bone regeneration. Advancements in biomaterial science, leading to the development of more biocompatible and effective substitutes like osteoconductive, osteoinductive, and osteogenic materials, further contribute to market expansion. The market is segmented by mechanism of action (e.g., osteoconduction, osteoinduction), end-users (hospitals, dental clinics), and type of graft (xenograft, allograft, autograft). North America currently holds a significant market share due to high dental implant penetration rates and advanced healthcare infrastructure. However, the Asia-Pacific region is expected to witness significant growth in the coming years, driven by rising disposable incomes and increasing awareness of advanced dental care. While the high cost of certain bone graft substitutes might pose a restraint, the overall market trajectory indicates continued expansion as technological advancements improve efficacy and affordability.

Dental Bone Graft Substitutes Industry Market Size (In Billion)

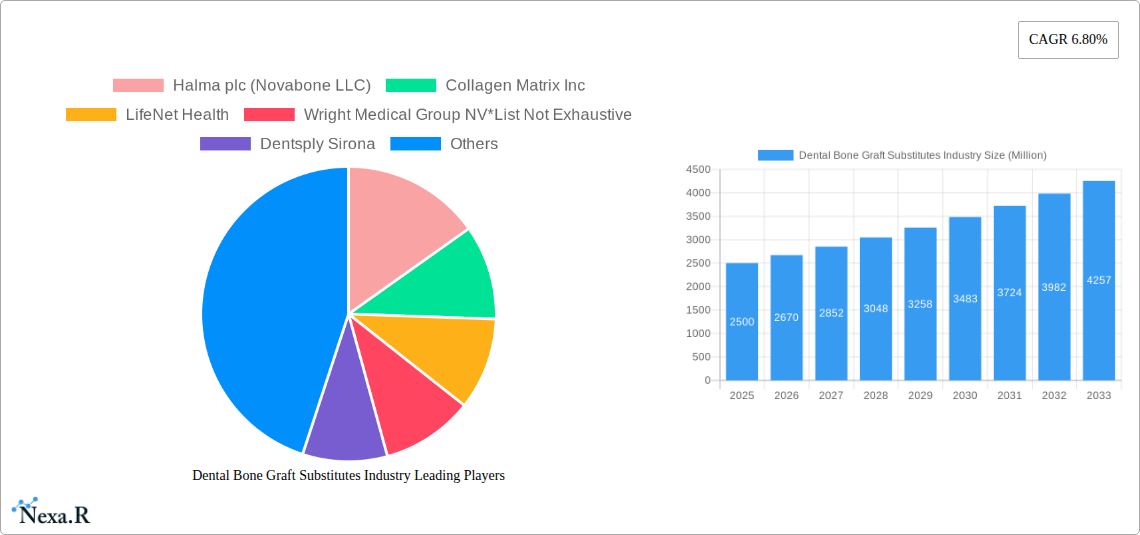

The competitive landscape is marked by the presence of both established multinational corporations like Zimmer Biomet, Dentsply Sirona, and Medtronic, and specialized smaller companies focusing on innovative biomaterials. These companies are engaged in continuous research and development efforts to enhance the properties of bone graft substitutes, expanding their applications, and improving patient outcomes. Strategic partnerships, acquisitions, and the introduction of novel products are key competitive strategies in this dynamic market. Future growth will likely be driven by the increasing adoption of minimally invasive surgical techniques, personalized medicine approaches tailored to individual patient needs, and a growing focus on regenerative dentistry. The market is poised for substantial growth, presenting significant opportunities for both established players and new entrants, particularly in emerging markets where awareness and accessibility to advanced dental care continue to improve.

Dental Bone Graft Substitutes Industry Company Market Share

Dental Bone Graft Substitutes Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Dental Bone Graft Substitutes market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and forecast period extending to 2033. The report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic sector. The global market size is projected to reach xx Million by 2033.

Dental Bone Graft Substitutes Industry Market Dynamics & Structure

The Dental Bone Graft Substitutes market is characterized by moderate concentration, with key players such as Halma plc (Novabone LLC), Collagen Matrix Inc, LifeNet Health, Wright Medical Group NV, Dentsply Sirona, Dentium, Medtronic PLC, Johnson & Johnson, ZIMMER BIOMET, Institut Straumann AG, Botiss biomaterials GmbH, and Geistlich Pharm competing for market share. Technological innovation, particularly in biomaterials and regenerative techniques, is a primary driver of market growth. Regulatory frameworks governing medical devices significantly impact market access and product approvals. The market also faces competition from alternative treatments, influencing adoption rates. Furthermore, mergers and acquisitions (M&A) activity plays a role in shaping the competitive landscape.

- Market Concentration: Moderately concentrated, with a few dominant players and several smaller niche players. The top 5 players hold approximately xx% of the market share (2025).

- Technological Innovation: Focus on biocompatible materials, improved osteointegration, minimally invasive techniques, and personalized solutions.

- Regulatory Landscape: Stringent regulatory approvals (e.g., FDA, CE Mark) impacting time-to-market and product development costs.

- Competitive Substitutes: Autologous bone grafting remains a significant competitor, but limitations drive demand for substitutes.

- M&A Activity: Consolidation trends, with larger companies acquiring smaller innovative firms to expand product portfolios and enhance market presence. An estimated xx M&A deals occurred in the period 2019-2024.

- End-User Demographics: Growth driven by aging populations, increasing prevalence of periodontal diseases, and rising demand for aesthetically pleasing dental solutions.

Dental Bone Graft Substitutes Industry Growth Trends & Insights

The Dental Bone Graft Substitutes market has experienced substantial growth over the past years, driven by factors such as the increasing prevalence of periodontal diseases, advancements in dental implant technology, and rising demand for minimally invasive procedures. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. Technological disruptions, such as the introduction of novel biomaterials and improved surgical techniques, have significantly influenced adoption rates. Consumer behavior shifts toward advanced restorative solutions further fuel market growth. Market penetration is estimated at xx% in 2025, with significant growth potential in emerging economies. The increasing preference for faster healing times and reduced post-operative discomfort is driving demand for advanced bone graft substitutes.

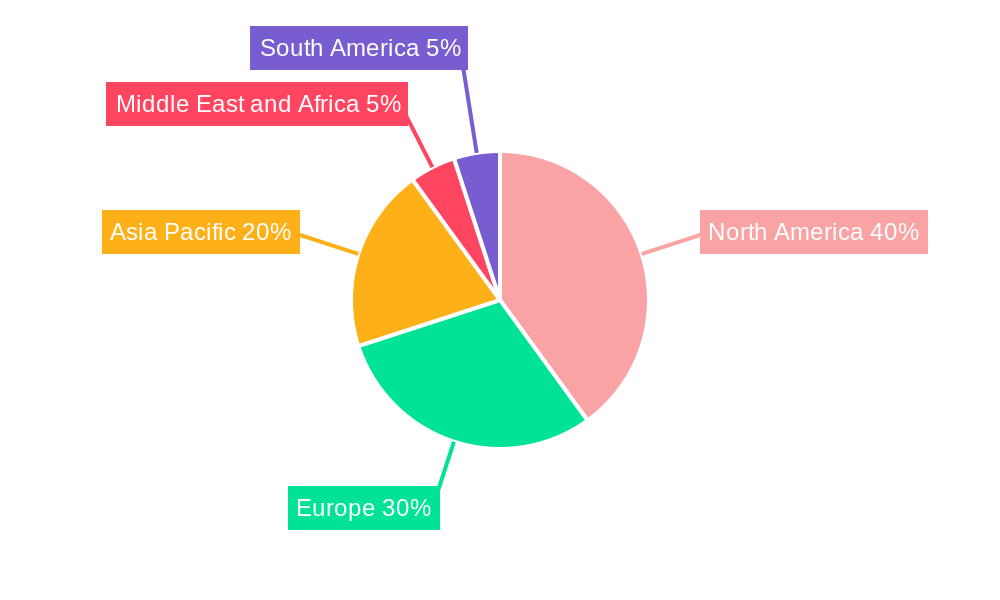

Dominant Regions, Countries, or Segments in Dental Bone Graft Substitutes Industry

North America currently dominates the Dental Bone Graft Substitutes market, driven by factors including high healthcare expenditure, advanced medical infrastructure, and a robust regulatory framework. Europe follows as a significant market, with strong growth expected in Asia-Pacific due to increasing dental awareness and rising disposable incomes.

By Mechanism: Osteoconduction is the currently dominant segment, owing to its established efficacy and widespread adoption. However, Osteoinduction and Osteogenesis segments are expected to witness significant growth driven by technological advancements.

By End Users: Hospitals and specialized dental clinics are the primary end users, accounting for xx% and xx% of the market share respectively (2025).

By Type: Xenografts currently hold the largest market share due to their cost-effectiveness and availability. Allografts and autografts follow, with ongoing research and development leading to increased adoption rates for other advanced types.

- North America: High adoption rates due to advanced healthcare infrastructure and high disposable incomes.

- Europe: Mature market with stable growth, driven by a strong regulatory framework and increased awareness.

- Asia-Pacific: High growth potential due to rising disposable incomes, increasing dental awareness, and expanding healthcare infrastructure.

- Key Drivers: Technological advancements, increasing prevalence of periodontal disease, rising demand for dental implants, and favorable regulatory environments.

Dental Bone Graft Substitutes Industry Product Landscape

The product landscape is characterized by a wide range of bone graft substitutes, each designed to meet specific clinical needs. Innovations focus on improving biocompatibility, osteoconductivity, and handling characteristics. Products are categorized by material type (e.g., xenografts, allografts, synthetic substitutes), and their unique selling propositions often center on enhanced bone regeneration capabilities, reduced inflammation, and faster healing times. Advancements in 3D printing and tissue engineering are creating novel products with improved performance metrics.

Key Drivers, Barriers & Challenges in Dental Bone Graft Substitutes Industry

Key Drivers:

- Increasing prevalence of periodontal disease and dental implant procedures.

- Technological advancements leading to improved biocompatibility and efficacy of bone graft substitutes.

- Rising disposable incomes and increased healthcare spending in emerging economies.

Key Challenges:

- High cost of advanced bone graft substitutes limiting accessibility.

- Stringent regulatory requirements leading to extended product development timelines.

- Competition from autologous bone grafting and other treatment alternatives. The competition is projected to reduce the market share of bone graft substitutes by approximately xx% by 2033.

- Supply chain disruptions impacting the availability of raw materials and finished products.

Emerging Opportunities in Dental Bone Graft Substitutes Industry

- Growing demand for minimally invasive procedures and personalized medicine.

- Development of novel biomaterials with enhanced osteoinductive and osteogenic properties.

- Expansion into untapped markets in emerging economies.

- Development of innovative applications for bone graft substitutes beyond dental procedures (e.g., orthopedic surgeries).

Growth Accelerators in the Dental Bone Graft Substitutes Industry Industry

Long-term growth will be fueled by technological breakthroughs in biomaterials science, strategic partnerships between manufacturers and healthcare providers, and expansion into new geographic markets. The development of more biocompatible and effective bone graft substitutes will play a crucial role in driving market growth. Collaborative research initiatives and investment in R&D will foster innovation and increase product diversity.

Key Players Shaping the Dental Bone Graft Substitutes Industry Market

- Halma plc (Novabone LLC)

- Collagen Matrix Inc

- LifeNet Health

- Wright Medical Group NV

- Dentsply Sirona

- Dentium

- Medtronic PLC

- Johnson & Johnson

- ZIMMER BIOMET

- Institut Straumann AG

- Botiss biomaterials GmbH

- Geistlich Pharma

Notable Milestones in Dental Bone Graft Substitutes Industry Sector

- March 2022: Biocomposites signed an agreement with Zimmer Biomet to distribute the new Genex Bone Graft Substitute, a biphasic composite designed for optimal bone remodeling.

- March 2022: CGbio signed a five-year contract with Kerunxi Medical for the export of Bongros Dental, a bone graft material, signaling expansion into the Chinese market.

In-Depth Dental Bone Graft Substitutes Industry Market Outlook

The Dental Bone Graft Substitutes market is poised for significant growth over the next decade, driven by continuous innovation in biomaterials, increasing adoption of advanced dental procedures, and expansion into emerging markets. Strategic partnerships, collaborations, and investments in research and development will be crucial for companies to maintain a competitive edge. The focus on minimally invasive techniques and personalized medicine will shape the future of the market, creating opportunities for companies that can deliver innovative and effective solutions.

Dental Bone Graft Substitutes Industry Segmentation

-

1. Type

- 1.1. Xenograft

- 1.2. Allograft

- 1.3. Autograft

- 1.4. Other Types

-

2. Mechanism

- 2.1. Osteoconduction

- 2.2. Osteoinduction

- 2.3. Osteogenesis

- 2.4. Osteopromotion

-

3. End Users

- 3.1. Hospitals

- 3.2. Dental Clinics

- 3.3. Other End Users

Dental Bone Graft Substitutes Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Dental Bone Graft Substitutes Industry Regional Market Share

Geographic Coverage of Dental Bone Graft Substitutes Industry

Dental Bone Graft Substitutes Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand of Medical and Dental Tourism; Rising Burden of Dental Diseases; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. Expensive Dental Procedures; Reimbursement Issues

- 3.4. Market Trends

- 3.4.1. The Xenogaft Segment is Expected to Grow Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Xenograft

- 5.1.2. Allograft

- 5.1.3. Autograft

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Mechanism

- 5.2.1. Osteoconduction

- 5.2.2. Osteoinduction

- 5.2.3. Osteogenesis

- 5.2.4. Osteopromotion

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Hospitals

- 5.3.2. Dental Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Xenograft

- 6.1.2. Allograft

- 6.1.3. Autograft

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Mechanism

- 6.2.1. Osteoconduction

- 6.2.2. Osteoinduction

- 6.2.3. Osteogenesis

- 6.2.4. Osteopromotion

- 6.3. Market Analysis, Insights and Forecast - by End Users

- 6.3.1. Hospitals

- 6.3.2. Dental Clinics

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Xenograft

- 7.1.2. Allograft

- 7.1.3. Autograft

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Mechanism

- 7.2.1. Osteoconduction

- 7.2.2. Osteoinduction

- 7.2.3. Osteogenesis

- 7.2.4. Osteopromotion

- 7.3. Market Analysis, Insights and Forecast - by End Users

- 7.3.1. Hospitals

- 7.3.2. Dental Clinics

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Xenograft

- 8.1.2. Allograft

- 8.1.3. Autograft

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Mechanism

- 8.2.1. Osteoconduction

- 8.2.2. Osteoinduction

- 8.2.3. Osteogenesis

- 8.2.4. Osteopromotion

- 8.3. Market Analysis, Insights and Forecast - by End Users

- 8.3.1. Hospitals

- 8.3.2. Dental Clinics

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Xenograft

- 9.1.2. Allograft

- 9.1.3. Autograft

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Mechanism

- 9.2.1. Osteoconduction

- 9.2.2. Osteoinduction

- 9.2.3. Osteogenesis

- 9.2.4. Osteopromotion

- 9.3. Market Analysis, Insights and Forecast - by End Users

- 9.3.1. Hospitals

- 9.3.2. Dental Clinics

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Dental Bone Graft Substitutes Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Xenograft

- 10.1.2. Allograft

- 10.1.3. Autograft

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Mechanism

- 10.2.1. Osteoconduction

- 10.2.2. Osteoinduction

- 10.2.3. Osteogenesis

- 10.2.4. Osteopromotion

- 10.3. Market Analysis, Insights and Forecast - by End Users

- 10.3.1. Hospitals

- 10.3.2. Dental Clinics

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Halma plc (Novabone LLC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Collagen Matrix Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LifeNet Health

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Wright Medical Group NV*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dentsply Sirona

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dentium

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Medtronic PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Johnson & Johnson

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ZIMMER BIOMET

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Institut Straumann AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Botiss biomaterials GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Geistlich Pharm

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Halma plc (Novabone LLC)

List of Figures

- Figure 1: Global Dental Bone Graft Substitutes Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Dental Bone Graft Substitutes Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Dental Bone Graft Substitutes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Dental Bone Graft Substitutes Industry Revenue (Million), by Mechanism 2025 & 2033

- Figure 5: North America Dental Bone Graft Substitutes Industry Revenue Share (%), by Mechanism 2025 & 2033

- Figure 6: North America Dental Bone Graft Substitutes Industry Revenue (Million), by End Users 2025 & 2033

- Figure 7: North America Dental Bone Graft Substitutes Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 8: North America Dental Bone Graft Substitutes Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Dental Bone Graft Substitutes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Dental Bone Graft Substitutes Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Dental Bone Graft Substitutes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Dental Bone Graft Substitutes Industry Revenue (Million), by Mechanism 2025 & 2033

- Figure 13: Europe Dental Bone Graft Substitutes Industry Revenue Share (%), by Mechanism 2025 & 2033

- Figure 14: Europe Dental Bone Graft Substitutes Industry Revenue (Million), by End Users 2025 & 2033

- Figure 15: Europe Dental Bone Graft Substitutes Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 16: Europe Dental Bone Graft Substitutes Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Dental Bone Graft Substitutes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Dental Bone Graft Substitutes Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Dental Bone Graft Substitutes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Dental Bone Graft Substitutes Industry Revenue (Million), by Mechanism 2025 & 2033

- Figure 21: Asia Pacific Dental Bone Graft Substitutes Industry Revenue Share (%), by Mechanism 2025 & 2033

- Figure 22: Asia Pacific Dental Bone Graft Substitutes Industry Revenue (Million), by End Users 2025 & 2033

- Figure 23: Asia Pacific Dental Bone Graft Substitutes Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 24: Asia Pacific Dental Bone Graft Substitutes Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Dental Bone Graft Substitutes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue (Million), by Mechanism 2025 & 2033

- Figure 29: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue Share (%), by Mechanism 2025 & 2033

- Figure 30: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue (Million), by End Users 2025 & 2033

- Figure 31: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 32: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Dental Bone Graft Substitutes Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Dental Bone Graft Substitutes Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: South America Dental Bone Graft Substitutes Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: South America Dental Bone Graft Substitutes Industry Revenue (Million), by Mechanism 2025 & 2033

- Figure 37: South America Dental Bone Graft Substitutes Industry Revenue Share (%), by Mechanism 2025 & 2033

- Figure 38: South America Dental Bone Graft Substitutes Industry Revenue (Million), by End Users 2025 & 2033

- Figure 39: South America Dental Bone Graft Substitutes Industry Revenue Share (%), by End Users 2025 & 2033

- Figure 40: South America Dental Bone Graft Substitutes Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Dental Bone Graft Substitutes Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Mechanism 2020 & 2033

- Table 3: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by End Users 2020 & 2033

- Table 4: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Mechanism 2020 & 2033

- Table 7: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by End Users 2020 & 2033

- Table 8: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Mechanism 2020 & 2033

- Table 14: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by End Users 2020 & 2033

- Table 15: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 23: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Mechanism 2020 & 2033

- Table 24: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by End Users 2020 & 2033

- Table 25: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Mechanism 2020 & 2033

- Table 34: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by End Users 2020 & 2033

- Table 35: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: GCC Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 40: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Mechanism 2020 & 2033

- Table 41: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by End Users 2020 & 2033

- Table 42: Global Dental Bone Graft Substitutes Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Dental Bone Graft Substitutes Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Bone Graft Substitutes Industry?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Dental Bone Graft Substitutes Industry?

Key companies in the market include Halma plc (Novabone LLC), Collagen Matrix Inc, LifeNet Health, Wright Medical Group NV*List Not Exhaustive, Dentsply Sirona, Dentium, Medtronic PLC, Johnson & Johnson, ZIMMER BIOMET, Institut Straumann AG, Botiss biomaterials GmbH, Geistlich Pharm.

3. What are the main segments of the Dental Bone Graft Substitutes Industry?

The market segments include Type, Mechanism, End Users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand of Medical and Dental Tourism; Rising Burden of Dental Diseases; Technological Advancements.

6. What are the notable trends driving market growth?

The Xenogaft Segment is Expected to Grow Over the Forecast Period.

7. Are there any restraints impacting market growth?

Expensive Dental Procedures; Reimbursement Issues.

8. Can you provide examples of recent developments in the market?

In March 2022, Biocomposites signed an agreement with Zimmer Biomet to distribute the new genex Bone Graft Substitute. Genex Bone Graft Substitute is a biphasic composite of exceptional purity specifically formulated to balance osteoconductive scaffold strength and persistence in the body to enable the optimal remodeling of bone architecture.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Bone Graft Substitutes Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Bone Graft Substitutes Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Bone Graft Substitutes Industry?

To stay informed about further developments, trends, and reports in the Dental Bone Graft Substitutes Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence