Key Insights

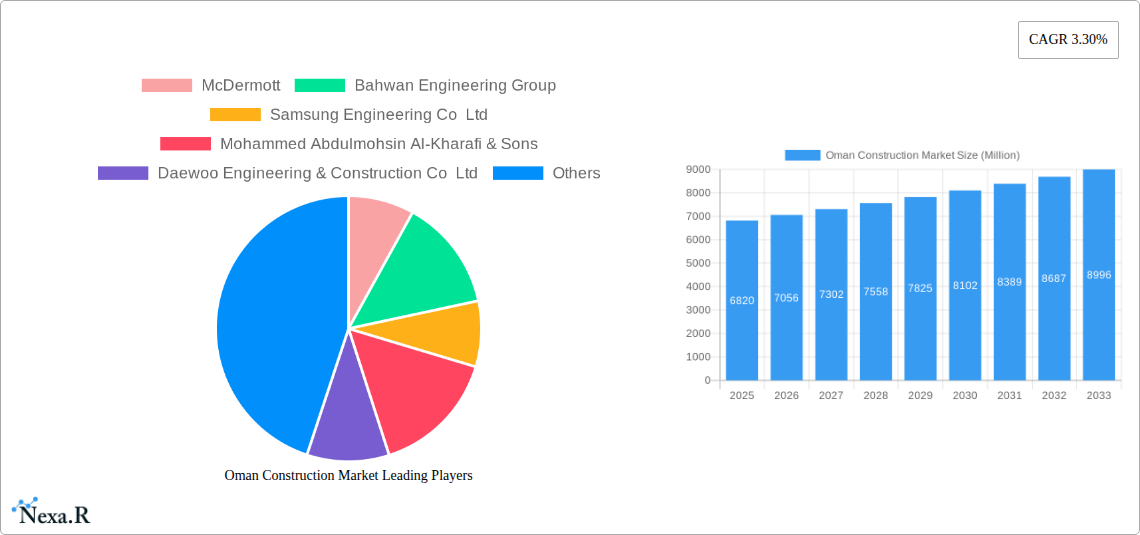

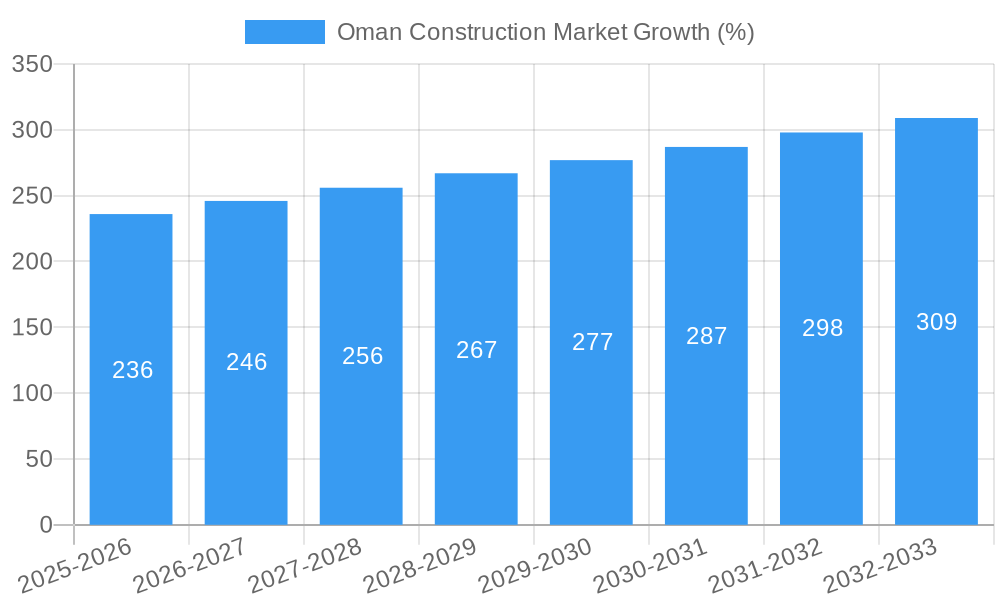

The Oman construction market, valued at $6.82 billion in 2025, is projected to experience steady growth, driven by robust government spending on infrastructure development and a burgeoning population necessitating increased residential and commercial construction. The 3.30% CAGR (Compound Annual Growth Rate) from 2025 to 2033 indicates a continuous expansion, although the pace might fluctuate depending on global economic conditions and oil price volatility. Key growth drivers include the government's Vision 2040, focusing on infrastructure modernization and diversification of the economy. This translates into significant investment in transportation networks (roads, railways, ports), energy projects (renewable energy adoption and power grid expansion), and industrial zones supporting economic diversification. While the residential sector contributes considerably, the industrial and infrastructure segments are expected to be strong drivers of future growth, given the ongoing and planned mega-projects in these sectors. Potential restraints could include the availability of skilled labor, material costs, and the overall global economic climate. The market is segmented by sector, encompassing Commercial, Residential, Industrial, Infrastructure (Transportation), and Energy & Utility construction, with major players like McDermott, Samsung Engineering, and Larsen & Toubro competing for market share. This competitive landscape fosters innovation and efficiency, contributing to market expansion. The historical period (2019-2024) likely showed varied performance, influenced by global events and the nation's economic cycles, offering valuable lessons for future projections.

The market's segmentation allows for targeted investment strategies. The infrastructure sector, notably transportation, will likely attract the lion's share of investment due to ongoing and planned projects. The energy and utility sector is also poised for significant growth given the nation's strategic focus on renewable energy integration. While residential construction will maintain a strong presence, the commercial sector’s growth will be contingent on the pace of economic diversification and foreign investment. Analyzing the individual contributions of these sectors and the competitive dynamics amongst major players is crucial for stakeholders to devise successful strategies and capitalize on growth opportunities. Market watchers should closely monitor government policy, global economic trends, and material price fluctuations for accurate future projections.

Oman Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Oman construction market, encompassing market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic sector. The report segments the market by key sectors: Commercial, Residential, Industrial, Infrastructure (Transportation), and Energy & Utility Construction.

Oman Construction Market Dynamics & Structure

The Oman construction market exhibits a moderately concentrated structure, with several large multinational and local players dominating various segments. Technological innovation, while present, faces barriers such as limited skilled labor and a preference for traditional methods. The regulatory framework is generally supportive of infrastructure development, but bureaucratic processes can sometimes cause delays. Competitive product substitutes are limited in certain areas, while end-user demographics are shifting towards a preference for sustainable and technologically advanced construction solutions. The market has witnessed an increase in mergers and acquisitions (M&A) activity in recent years, though exact deal volumes are not publicly accessible for precise quantification. We estimate the M&A activity to have resulted in a xx% shift in market share amongst the top 5 players during the historical period (2019-2024).

- Market Concentration: Moderately concentrated, with several dominant players.

- Technological Innovation: Driven by government initiatives, but faces labor skill limitations.

- Regulatory Framework: Supportive but can involve bureaucratic hurdles.

- M&A Activity: Significant increase during 2019-2024, leading to a xx% market share shift.

- End-User Demographics: Shifting towards sustainable and technologically advanced solutions.

Oman Construction Market Growth Trends & Insights

The Oman construction market is experiencing robust growth fueled by government investments in infrastructure projects, particularly within the transportation sector, and increased private sector activity in residential and commercial construction. The Compound Annual Growth Rate (CAGR) for the historical period (2019-2024) is estimated at xx%, while the projected CAGR for the forecast period (2025-2033) is xx%. This growth is driven by several factors, including the government's Vision 2040 development plan, which emphasizes diversification and infrastructure improvement. Technological advancements, particularly in building information modeling (BIM) and prefabrication, are gradually gaining traction, though adoption rates remain relatively low compared to other developed markets. Consumer behavior shows a growing preference for sustainable building materials and energy-efficient designs, prompting companies to adapt their offerings accordingly. Market penetration of advanced construction technologies is estimated at xx% in 2025, projected to increase to xx% by 2033.

Dominant Regions, Countries, or Segments in Oman Construction Market

The Infrastructure (Transportation) Construction segment is the dominant sector driving Oman's construction market growth, fueled by significant government investment in road networks, airports, and ports. The Muscat Governorate remains the leading region due to its concentration of major projects and higher population density. High-growth potential exists in the Southern Governorates due to planned industrial development, although this is currently a smaller contributor to overall market volume.

- Key Drivers:

- Government's Vision 2040 development plan.

- Massive investments in infrastructure projects (roads, airports, ports).

- Increased private sector participation in residential and commercial construction.

- Dominant Segments:

- Infrastructure (Transportation) Construction holds the largest market share (xx% in 2025, projected xx% in 2033).

- Commercial Construction is a significant segment, expected to grow at xx% CAGR.

- Residential construction is experiencing steady growth due to population increase and urbanization.

Oman Construction Market Product Landscape

The Oman construction market showcases a diverse product landscape encompassing traditional building materials alongside advanced solutions. Innovations include the increased use of prefabricated components, sustainable materials (like recycled concrete and locally sourced timber), and the implementation of smart building technologies. These advancements offer improved efficiency, reduced construction time, and enhanced sustainability. The market is also witnessing increased adoption of advanced construction equipment and digital technologies, driving overall project productivity and quality. The unique selling proposition for many new products is a combination of cost-effectiveness and sustainability features.

Key Drivers, Barriers & Challenges in Oman Construction Market

Key Drivers:

- Government investments in infrastructure development.

- Rising urbanization and population growth.

- Tourism sector expansion.

- Focus on sustainable construction practices.

Key Challenges & Restraints:

- Shortage of skilled labor.

- Fluctuations in global commodity prices for construction materials (estimated xx% impact on project costs).

- Bureaucratic processes and permitting delays (averaging xx days).

- Competition from international construction firms.

Emerging Opportunities in Oman Construction Market

- Green building technologies.

- Increased use of prefabrication methods.

- Development of affordable housing projects.

- Expansion into renewable energy infrastructure.

Growth Accelerators in the Oman Construction Market Industry

Technological advancements, strategic partnerships between local and international firms, and the government's continued commitment to infrastructure development are key catalysts for long-term growth. Expansion into new market segments, such as renewable energy, also presents substantial opportunities.

Key Players Shaping the Oman Construction Market Market

- McDermott

- Bahwan Engineering Group

- Samsung Engineering Co Ltd

- Mohammed Abdulmohsin Al-Kharafi & Sons

- Daewoo Engineering & Construction Co Ltd

- Larsen and Toubro

- Galfar Engineering and Contracting SAOG

- United Engineering Services

- Hyundai Engineering & Construction Co Ltd

- Oman Gulf Company LLC

- Bouygues

- Petrofac Ltd

- VINCI

- Ray International Group

- Bechtel

- Khalid Bin Ahmed & Sons LLC

- SNC-Lavalin Inc

- Al Hassan Engineering Co SAOG

Notable Milestones in Oman Construction Market Sector

- April 2023: Huaxin Cement acquired a 60% stake in Oman Cement for USD 193 million. This significantly altered the market dynamics within the cement sector.

- May 2023: Sika's acquisition of MBCC Group strengthened its market position and broadened its product portfolio, positively impacting the availability of advanced construction materials.

In-Depth Oman Construction Market Market Outlook

The Oman construction market is poised for sustained growth, driven by ongoing government investments, private sector activity, and technological advancements. Strategic partnerships and a focus on sustainable construction practices will play a crucial role in shaping the future landscape. The focus on infrastructure development, combined with increasing urbanization, suggests significant long-term potential for both domestic and international players.

Oman Construction Market Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utility Construction

Oman Construction Market Segmentation By Geography

- 1. Oman

Oman Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Governments Investments in Construction Projects4.; Urban Development Intiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Cost of Raw Materials Affecting the Construction Industry4.; Decrease in Foreign Investment Affecting the Market

- 3.4. Market Trends

- 3.4.1. Economic Diversification Plan (Vision 2040) has Been a Key Growth Factor in the Construction Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utility Construction

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 McDermott

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bahwan Engineering Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Engineering Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mohammed Abdulmohsin Al-Kharafi & Sons

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daewoo Engineering & Construction Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Larsen and Toubro

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Galfar Engineering and Contracting SAOG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Engineering Services

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hyundai Engineering & Construction Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oman Gulf Company LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bouygues

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Petrofac Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 VINCI

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Ray International Group**List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Bechtel

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Khalid Bin Ahmed & Sons LLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 SNC-Lavalin Inc

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Al Hassan Engineering Co SAOG

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 McDermott

List of Figures

- Figure 1: Oman Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Oman Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Oman Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Oman Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Oman Construction Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Oman Construction Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Construction Market?

The projected CAGR is approximately 3.30%.

2. Which companies are prominent players in the Oman Construction Market?

Key companies in the market include McDermott, Bahwan Engineering Group, Samsung Engineering Co Ltd, Mohammed Abdulmohsin Al-Kharafi & Sons, Daewoo Engineering & Construction Co Ltd, Larsen and Toubro, Galfar Engineering and Contracting SAOG, United Engineering Services, Hyundai Engineering & Construction Co Ltd, Oman Gulf Company LLC, Bouygues, Petrofac Ltd, VINCI, Ray International Group**List Not Exhaustive, Bechtel, Khalid Bin Ahmed & Sons LLC, SNC-Lavalin Inc, Al Hassan Engineering Co SAOG.

3. What are the main segments of the Oman Construction Market?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.82 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Governments Investments in Construction Projects4.; Urban Development Intiatives.

6. What are the notable trends driving market growth?

Economic Diversification Plan (Vision 2040) has Been a Key Growth Factor in the Construction Sector.

7. Are there any restraints impacting market growth?

4.; Increasing Cost of Raw Materials Affecting the Construction Industry4.; Decrease in Foreign Investment Affecting the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Sika acquired MBCC Group after receiving all necessary regulatory approvals. With this highly complementary transaction, Sika strengthened its footprint across all regions, reinforcing its range of products and services across the entire construction life cycle and driving the sustainable transformation of the construction industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Construction Market?

To stay informed about further developments, trends, and reports in the Oman Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence