Key Insights

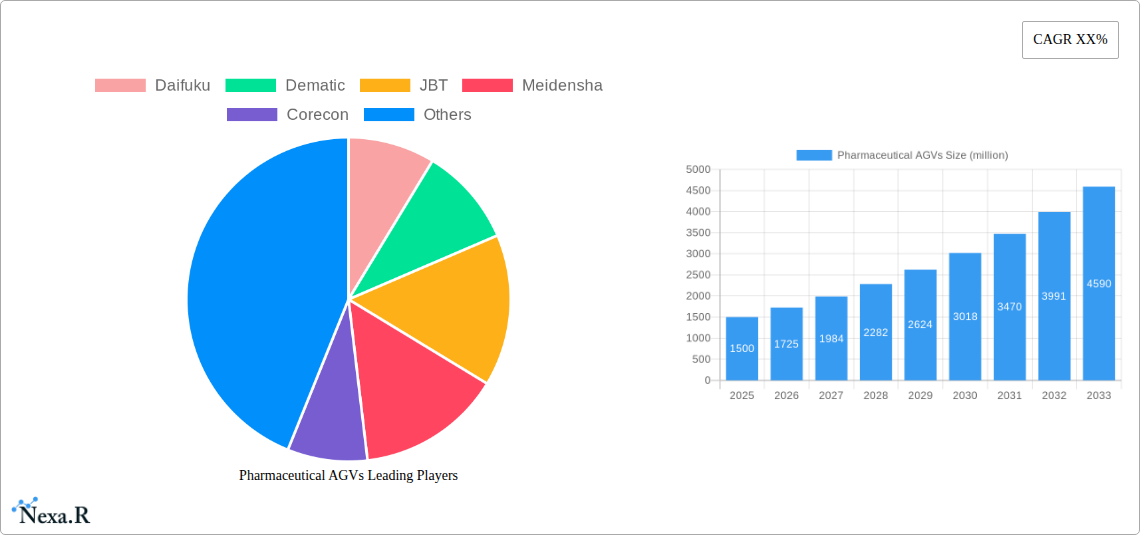

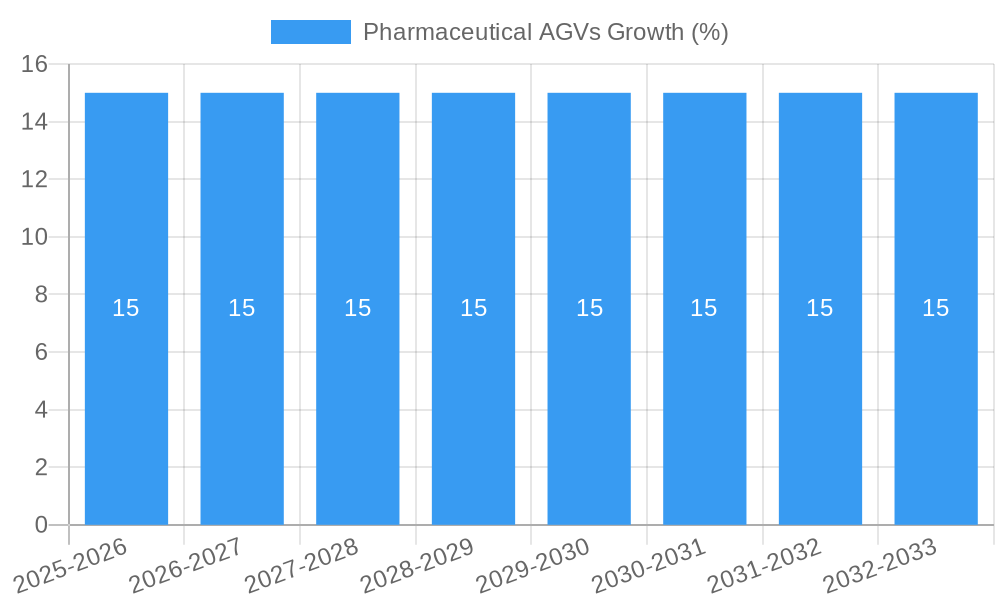

The global Pharmaceutical AGV market is poised for robust expansion, projected to reach approximately $1.5 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 15% through 2033. This significant growth trajectory is fueled by the pharmaceutical industry's relentless pursuit of enhanced operational efficiency, stringent quality control, and improved safety standards. The increasing demand for sterile and automated material handling solutions within pharmaceutical manufacturing and distribution facilities serves as a primary driver. AGVs play a crucial role in minimizing human intervention, thereby reducing the risk of contamination and ensuring product integrity, which are paramount in pharmaceutical operations. The adoption of advanced technologies like AI-powered navigation and sophisticated sensor systems further bolsters the market, enabling AGVs to perform complex tasks with precision and reliability.

Key growth drivers include the escalating need for supply chain automation, particularly in response to global health challenges that have highlighted vulnerabilities in traditional logistics. The implementation of stricter regulatory compliance mandates across the pharmaceutical sector also necessitates the use of highly controlled and documented material flow, which AGVs excel at providing. Furthermore, the ongoing trend towards Industry 4.0 integration within pharmaceutical manufacturing creates a fertile ground for AGV deployment, as these automated systems seamlessly integrate with other smart factory technologies. While the initial investment cost and the need for significant infrastructure modifications can present challenges, the long-term benefits of increased throughput, reduced labor costs, and enhanced safety are compelling. The market is segmented by application into Production & Manufacturing, Distribution & Logistics, and Others, with Unit Load Type AGVs being a prominent sub-segment due to their versatility in handling various pharmaceutical materials and products.

Pharmaceutical AGVs Market: Comprehensive Report Description

This in-depth market research report provides a definitive analysis of the global Pharmaceutical Automated Guided Vehicles (AGVs) market. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report offers unparalleled insights into market dynamics, growth trends, regional dominance, product innovations, and key industry players. With a meticulous focus on SEO optimization and high-traffic keywords, this report is designed to be the go-to resource for pharmaceutical manufacturers, logistics providers, technology developers, and market strategists seeking to understand and capitalize on the burgeoning pharmaceutical AGV sector. We delve into both the parent and child markets to ensure a holistic understanding of market opportunities and challenges.

Pharmaceutical AGVs Market Dynamics & Structure

The global Pharmaceutical AGVs market is characterized by a moderately concentrated structure, driven by continuous technological innovation and an increasingly stringent regulatory landscape aimed at enhancing safety and efficiency in pharmaceutical handling. Key drivers include the escalating demand for sterile environments, the need for improved supply chain visibility, and the imperative to reduce human error in sensitive drug manufacturing and distribution processes. Competitive product substitutes, such as traditional forklifts and manual labor, are steadily being outpaced by the precision, automation, and data-logging capabilities of AGVs. End-user demographics are shifting towards larger pharmaceutical corporations with significant R&D budgets and established global supply chains, alongside a growing segment of mid-sized companies adopting automation to maintain competitiveness. Mergers and acquisitions (M&A) are playing a crucial role in market consolidation and the acquisition of specialized technologies, with an estimated 5-8 significant M&A deals anticipated between 2025 and 2033. Barriers to innovation include the high initial investment costs for sophisticated AGV systems and the need for extensive validation and regulatory approvals specific to pharmaceutical applications.

- Market Concentration: Moderately concentrated, with top players holding substantial market share.

- Technological Innovation Drivers: Demand for sterile environments, enhanced supply chain visibility, reduced human error.

- Regulatory Frameworks: Stringent regulations in pharmaceutical handling driving adoption of automation for compliance.

- Competitive Product Substitutes: Traditional forklifts, manual labor, and other automated material handling solutions.

- End-User Demographics: Large pharmaceutical corporations and increasingly, mid-sized enterprises.

- M&A Trends: Active M&A landscape for technology acquisition and market consolidation. Estimated 5-8 deals between 2025-2033.

- Innovation Barriers: High initial investment, extensive validation requirements, and pharmaceutical-specific regulatory hurdles.

Pharmaceutical AGVs Growth Trends & Insights

The Pharmaceutical AGVs market is poised for substantial growth, driven by a confluence of factors that are reshaping the pharmaceutical supply chain. The market size is projected to grow from an estimated $450 million in 2025 to over $1.2 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 13.5% during the forecast period. Adoption rates for pharmaceutical AGVs are accelerating, fueled by the increasing complexity of global pharmaceutical logistics and the critical need for maintaining product integrity throughout the cold chain and beyond. Technological disruptions, including advancements in AI-powered navigation, sensor technology for enhanced safety, and interoperability with Warehouse Management Systems (WMS) and Manufacturing Execution Systems (MES), are key enablers of this growth. Consumer behavior shifts, particularly the growing patient and regulatory demand for drug traceability and tamper-proof supply chains, are further propelling the adoption of automated material handling solutions. The parent market for industrial AGVs is expected to provide a strong foundation, with the pharmaceutical segment demonstrating a faster growth trajectory due to its unique demands. The child market, encompassing specialized AGV solutions for sterile environments and pharmaceutical logistics, is also witnessing rapid innovation and market penetration. Market penetration is expected to rise from approximately 15% in 2025 to over 35% by 2033. The historical period (2019-2024) laid the groundwork for this expansion, with steady early adoption and increasing awareness of AGV benefits within the pharmaceutical industry. The estimated year of 2025 marks a significant inflection point, with widespread recognition of the ROI and critical advantages of AGV deployment in pharmaceutical operations.

Dominant Regions, Countries, or Segments in Pharmaceutical AGVs

The Application segment of Production & Manufacturing is currently the dominant force driving growth in the Pharmaceutical AGVs market, projected to hold an estimated 45% market share in 2025. This dominance is attributed to the pharmaceutical industry's continuous pursuit of sterile environments, increased production efficiency, and minimized contamination risks in drug synthesis, formulation, and packaging. Within this segment, the need for precise and repeatable material movements in cleanroom environments, coupled with the traceability required by regulatory bodies like the FDA and EMA, makes AGVs indispensable. The Distribution & Logistics segment is rapidly catching up, expected to represent 35% of the market share in 2025, driven by the global expansion of pharmaceutical supply chains and the increasing importance of efficient, temperature-controlled warehousing and last-mile delivery of medicines.

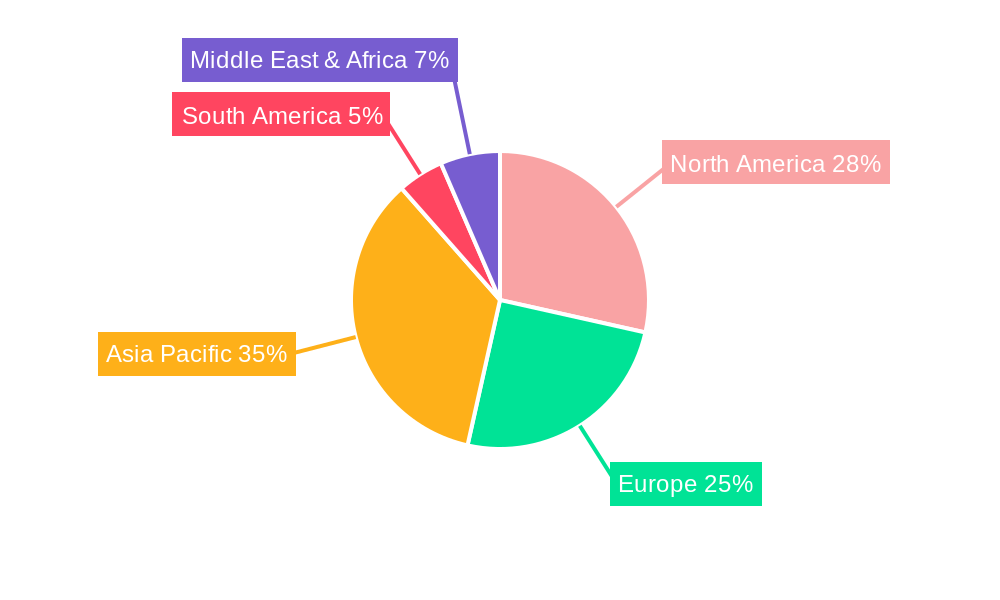

Geographically, North America is leading the charge, currently accounting for an estimated 30% of the global pharmaceutical AGV market share in 2025, due to its robust pharmaceutical industry, strong regulatory compliance culture, and high adoption rate of advanced automation technologies. Europe follows closely, with an estimated 25% market share, bolstered by significant investments in pharmaceutical R&D and manufacturing, and a strong emphasis on operational efficiency and patient safety. Asia Pacific is emerging as a high-growth region, with an estimated 20% market share in 2025, driven by the expanding pharmaceutical manufacturing base in countries like China and India, and increasing investments in automation to meet global quality standards.

Among Types, the Unit Load Type AGVs are expected to hold the largest market share in 2025, estimated at 40%, due to their versatility in handling pallets, totes, and containers crucial for pharmaceutical production and distribution. Automated Forklift Type AGVs follow, with an estimated 30% market share, particularly for heavy-duty lifting and warehousing operations. Tugger Type AGVs, estimated at 20%, are crucial for moving multiple loads in a train configuration within large manufacturing facilities.

- Dominant Application Segment: Production & Manufacturing (estimated 45% market share in 2025).

- Key Drivers: Sterile environment requirements, production efficiency, contamination risk reduction, regulatory compliance (FDA, EMA).

- Leading Region: North America (estimated 30% market share in 2025).

- Key Drivers: Strong pharmaceutical industry, regulatory compliance, advanced technology adoption.

- Key Country: United States (largest contributor within North America).

- Dominant Type: Unit Load Type AGVs (estimated 40% market share in 2025).

- Applications: Pallet handling, tote movement, container transport in manufacturing and logistics.

- Growth Potential Segment: Distribution & Logistics (estimated 35% market share in 2025).

- Drivers: Global supply chain expansion, cold chain logistics, last-mile delivery efficiency.

- Emerging Region: Asia Pacific (estimated 20% market share in 2025).

- Drivers: Growing pharmaceutical manufacturing, investment in quality standards.

Pharmaceutical AGVs Product Landscape

The pharmaceutical AGV product landscape is defined by continuous innovation focused on enhanced precision, safety, and compliance. Manufacturers are increasingly offering specialized AGVs designed for cleanroom environments, featuring materials that minimize particulate generation and facilitate easy sterilization. Advanced navigation systems, including LiDAR and AI-powered vision, enable AGVs to operate autonomously in dynamic manufacturing and warehouse settings with high accuracy. Product performance metrics are rigorously evaluated based on payload capacity, travel speed, operational uptime, and energy efficiency, with a strong emphasis on integration capabilities with existing enterprise software solutions. Unique selling propositions often revolve around GMP compliance, explosion-proof options for certain chemical handling, and the ability to handle sensitive or high-value pharmaceutical products without damage. Technological advancements are also focusing on modular designs for scalability and ease of maintenance, catering to the evolving needs of the pharmaceutical industry.

Key Drivers, Barriers & Challenges in Pharmaceutical AGVs

The Pharmaceutical AGVs market is propelled by several key drivers, including the relentless pursuit of operational efficiency and cost reduction in pharmaceutical manufacturing and logistics. The increasing stringency of regulatory compliance, particularly concerning Good Manufacturing Practices (GMP) and drug traceability, creates a strong demand for automated solutions that minimize human intervention and error. Furthermore, the growing complexity of global pharmaceutical supply chains, coupled with the need for sophisticated cold chain management, necessitates reliable and precise material handling. Technological advancements in AGV navigation, sensor technology, and AI are making these systems more capable and adaptable.

However, significant barriers and challenges exist. The high upfront investment cost for sophisticated AGV systems remains a primary concern for many pharmaceutical companies, particularly smaller enterprises. The need for extensive validation, qualification, and integration within existing pharmaceutical infrastructure, which often involves strict change control procedures, can lead to prolonged implementation timelines. Supply chain disruptions, as witnessed in recent global events, can impact the availability of components and the timely delivery of AGV systems. Competitive pressures from established manual handling solutions and other automation technologies also present a challenge, requiring clear demonstration of ROI.

Key Drivers:

- Operational efficiency and cost reduction

- Stringent regulatory compliance (GMP, traceability)

- Complex global pharmaceutical supply chains

- Advancements in AGV technology (AI, sensors)

- Need for advanced cold chain management

Key Barriers & Challenges:

- High upfront investment costs

- Extensive validation and qualification processes

- Lengthy implementation timelines

- Supply chain disruptions impacting component availability

- Competitive pressure from existing solutions

Emerging Opportunities in Pharmaceutical AGVs

Emerging opportunities in the Pharmaceutical AGVs market lie in the burgeoning demand for AGVs in specialized pharmaceutical applications such as sterile drug compounding, automated laboratory sample handling, and the expansion of the cold chain logistics network for biologics and vaccines. Untapped markets within emerging economies, where the pharmaceutical manufacturing sector is rapidly growing and adopting advanced technologies, present significant potential. Innovative applications include the integration of AGVs with advanced robotics for automated pick-and-place operations of sensitive pharmaceutical materials and the development of collaborative AGVs that can work alongside human personnel in production environments. Evolving consumer preferences for personalized medicine and on-demand drug delivery are also creating opportunities for more agile and adaptable AGV-powered logistics solutions.

Growth Accelerators in the Pharmaceutical AGVs Industry

The long-term growth of the Pharmaceutical AGVs industry is being significantly accelerated by breakthrough technological advancements, particularly in artificial intelligence and machine learning, enabling AGVs to perform more complex tasks and adapt to changing environments. Strategic partnerships between AGV manufacturers, pharmaceutical companies, and automation solution providers are fostering collaborative innovation and faster market penetration. Furthermore, the increasing focus on supply chain resilience and the need to de-risk pharmaceutical operations against disruptions are driving investments in autonomous material handling. Market expansion strategies by key players, including the development of tailored solutions for specific pharmaceutical sub-segments and the establishment of robust after-sales support networks, are also acting as significant growth accelerators.

Key Players Shaping the Pharmaceutical AGVs Market

- Daifuku

- Dematic

- JBT

- Meidensha

- Corecon

- Seegrid

- Aethon

- Doerfer

- Savant Automation

- Bastian Solutions

- Murata

- Transbotics

Notable Milestones in Pharmaceutical AGVs Sector

- 2019: Increased adoption of AI in AGV navigation for enhanced obstacle avoidance in pharmaceutical cleanrooms.

- 2020: Launch of explosion-proof AGV models designed for handling specific pharmaceutical chemicals.

- 2021: Significant surge in demand for AGVs to support vaccine distribution and cold chain logistics.

- 2022: Key partnerships formed between AGV providers and major pharmaceutical manufacturers for custom solution development.

- 2023: Advancements in IoT integration enabling real-time data tracking and monitoring of pharmaceutical materials handled by AGVs.

- 2024: Growing emphasis on sustainability in AGV design, with increased use of energy-efficient technologies and recyclable materials.

In-Depth Pharmaceutical AGVs Market Outlook

The future outlook for the Pharmaceutical AGVs market is exceptionally robust, driven by an unyielding commitment to enhancing safety, efficiency, and compliance within the pharmaceutical industry. Growth accelerators such as the continuous evolution of AI and robotics, coupled with strategic collaborations, will pave the way for more sophisticated and integrated AGV solutions. The increasing imperative for supply chain resilience and the proactive mitigation of risks will further fuel investment in autonomous material handling. Strategic opportunities abound in untapped emerging markets and the development of specialized AGV applications for niche pharmaceutical processes. The market is poised for sustained expansion, offering significant value to stakeholders committed to embracing automation.

Pharmaceutical AGVs Segmentation

-

1. Application

- 1.1. Production & Manufacturing

- 1.2. Distribution & Logistics

- 1.3. Others

-

2. Types

- 2.1. Unit Load Type

- 2.2. Automated Forklift Type

- 2.3. Tugger Type

- 2.4. Others

Pharmaceutical AGVs Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pharmaceutical AGVs REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical AGVs Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Production & Manufacturing

- 5.1.2. Distribution & Logistics

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Unit Load Type

- 5.2.2. Automated Forklift Type

- 5.2.3. Tugger Type

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Pharmaceutical AGVs Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Production & Manufacturing

- 6.1.2. Distribution & Logistics

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Unit Load Type

- 6.2.2. Automated Forklift Type

- 6.2.3. Tugger Type

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Pharmaceutical AGVs Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Production & Manufacturing

- 7.1.2. Distribution & Logistics

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Unit Load Type

- 7.2.2. Automated Forklift Type

- 7.2.3. Tugger Type

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Pharmaceutical AGVs Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Production & Manufacturing

- 8.1.2. Distribution & Logistics

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Unit Load Type

- 8.2.2. Automated Forklift Type

- 8.2.3. Tugger Type

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Pharmaceutical AGVs Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Production & Manufacturing

- 9.1.2. Distribution & Logistics

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Unit Load Type

- 9.2.2. Automated Forklift Type

- 9.2.3. Tugger Type

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Pharmaceutical AGVs Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Production & Manufacturing

- 10.1.2. Distribution & Logistics

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Unit Load Type

- 10.2.2. Automated Forklift Type

- 10.2.3. Tugger Type

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Daifuku

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dematic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JBT

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Meidensha

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Corecon

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Seegrid

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aethon

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Doerfer

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Savant Automation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bastian Solutions

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Murata

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Transbotics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Daifuku

List of Figures

- Figure 1: Global Pharmaceutical AGVs Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Pharmaceutical AGVs Revenue (million), by Application 2024 & 2032

- Figure 3: North America Pharmaceutical AGVs Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Pharmaceutical AGVs Revenue (million), by Types 2024 & 2032

- Figure 5: North America Pharmaceutical AGVs Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Pharmaceutical AGVs Revenue (million), by Country 2024 & 2032

- Figure 7: North America Pharmaceutical AGVs Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Pharmaceutical AGVs Revenue (million), by Application 2024 & 2032

- Figure 9: South America Pharmaceutical AGVs Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Pharmaceutical AGVs Revenue (million), by Types 2024 & 2032

- Figure 11: South America Pharmaceutical AGVs Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Pharmaceutical AGVs Revenue (million), by Country 2024 & 2032

- Figure 13: South America Pharmaceutical AGVs Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Pharmaceutical AGVs Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Pharmaceutical AGVs Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Pharmaceutical AGVs Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Pharmaceutical AGVs Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Pharmaceutical AGVs Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Pharmaceutical AGVs Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Pharmaceutical AGVs Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Pharmaceutical AGVs Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Pharmaceutical AGVs Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Pharmaceutical AGVs Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Pharmaceutical AGVs Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Pharmaceutical AGVs Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Pharmaceutical AGVs Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Pharmaceutical AGVs Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Pharmaceutical AGVs Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Pharmaceutical AGVs Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Pharmaceutical AGVs Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Pharmaceutical AGVs Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pharmaceutical AGVs Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Pharmaceutical AGVs Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Pharmaceutical AGVs Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Pharmaceutical AGVs Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Pharmaceutical AGVs Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Pharmaceutical AGVs Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Pharmaceutical AGVs Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Pharmaceutical AGVs Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Pharmaceutical AGVs Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Pharmaceutical AGVs Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Pharmaceutical AGVs Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Pharmaceutical AGVs Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Pharmaceutical AGVs Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Pharmaceutical AGVs Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Pharmaceutical AGVs Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Pharmaceutical AGVs Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Pharmaceutical AGVs Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Pharmaceutical AGVs Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Pharmaceutical AGVs Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Pharmaceutical AGVs Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical AGVs?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Pharmaceutical AGVs?

Key companies in the market include Daifuku, Dematic, JBT, Meidensha, Corecon, Seegrid, Aethon, Doerfer, Savant Automation, Bastian Solutions, Murata, Transbotics.

3. What are the main segments of the Pharmaceutical AGVs?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical AGVs," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical AGVs report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical AGVs?

To stay informed about further developments, trends, and reports in the Pharmaceutical AGVs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence