Key Insights

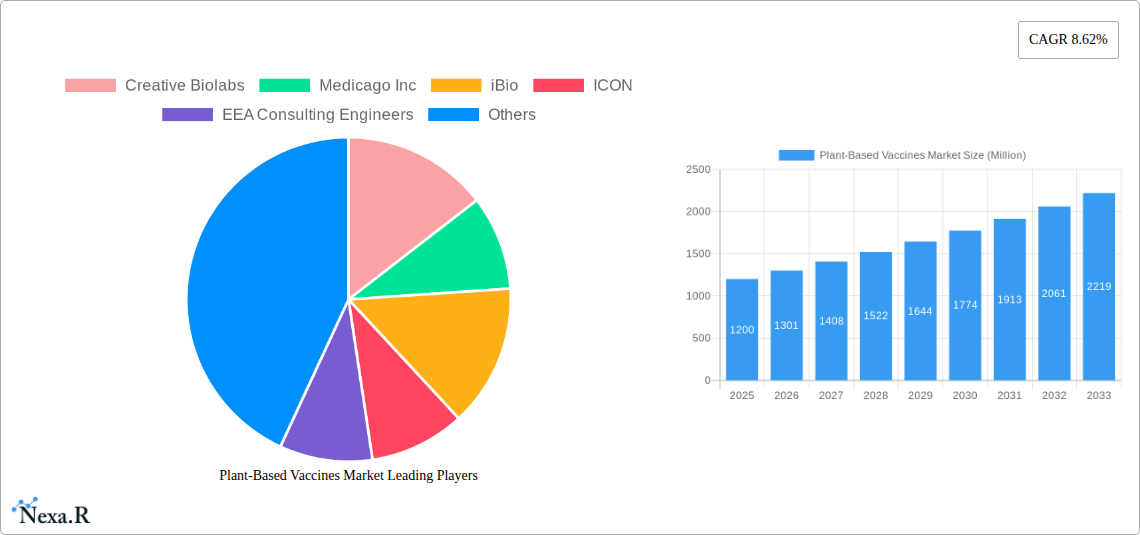

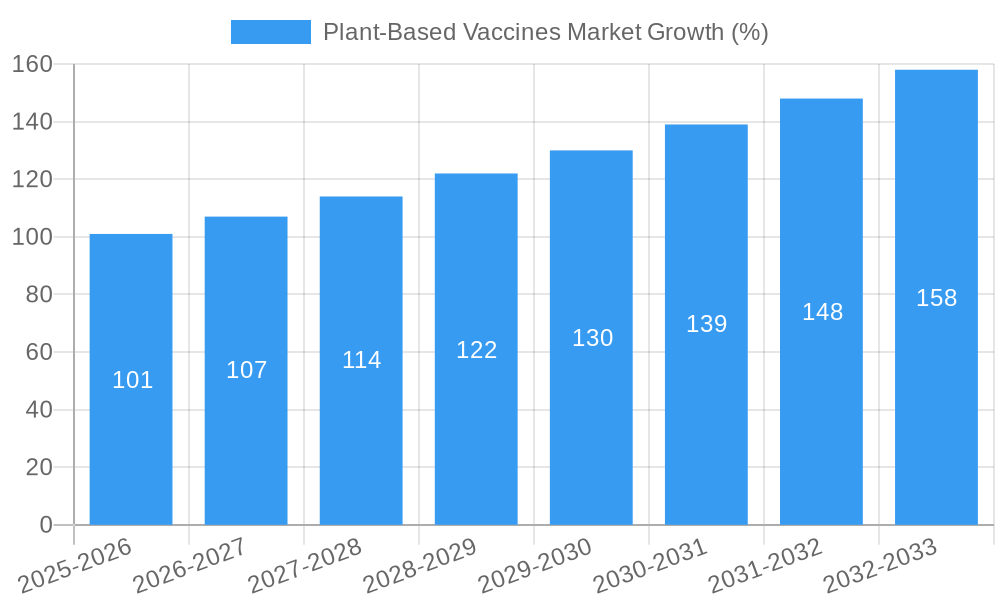

The plant-based vaccines market is experiencing robust growth, projected to reach $1.20 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 8.62% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing consumer demand for safer and more effective vaccines is fueling innovation in plant-based vaccine technology. This method offers several advantages over traditional approaches, including scalability, cost-effectiveness, and reduced reliance on animal-derived components, making it particularly attractive for mass vaccination campaigns. Secondly, advancements in genetic engineering and plant molecular farming are enhancing the efficiency and efficacy of plant-based vaccine production, leading to improved immunogenicity and broader applicability. Finally, growing government support for research and development in this area, coupled with increasing investments from both private and public sectors, further accelerates market growth.

However, the market also faces challenges. Initial high research and development costs can be a barrier to entry for smaller companies. Regulatory hurdles and the need for rigorous clinical trials to establish efficacy and safety standards are also potential restraints. Despite these challenges, the long-term prospects for plant-based vaccines remain positive. The inherent advantages of this technology, coupled with ongoing technological improvements and increasing market awareness, are poised to drive substantial growth in the coming years. Key players like Creative Biolabs, Medicago Inc., and iBio are actively contributing to this development, with their innovative solutions and strategic partnerships shaping the future of plant-based vaccine development and distribution. The market segmentation will likely see further differentiation based on vaccine type (e.g., viral, bacterial), target disease, and application (e.g., human, veterinary).

Plant-Based Vaccines Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Plant-Based Vaccines Market, encompassing market dynamics, growth trends, regional analysis, product landscape, and key player insights. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and researchers seeking a deep understanding of this rapidly evolving sector. The report also incorporates analysis of the parent market (Vaccines Market) and the child market (Plant-based pharmaceuticals). The market size is expected to reach xx Million by 2033.

Plant-Based Vaccines Market Dynamics & Structure

The Plant-Based Vaccines market is characterized by a moderately fragmented structure, with several key players competing alongside emerging companies. Technological innovation is a significant driver, fueled by advancements in plant-based expression systems and adjuvant technologies. Stringent regulatory frameworks influence product development and market entry. Competitive substitutes include traditional egg-based and cell-culture vaccines. The market’s end-users primarily include pharmaceutical companies, government health agencies, and research institutions. M&A activity has been moderate, with several smaller acquisitions in recent years.

- Market Concentration: Moderately fragmented, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: Focus on improving antigen expression, yield, and stability.

- Regulatory Landscape: Stringent regulatory pathways impacting time-to-market.

- Competitive Substitutes: Traditional vaccine platforms pose a competitive challenge.

- End-User Demographics: Dominated by pharmaceutical companies and government agencies.

- M&A Trends: Moderate activity, driven by technology acquisition and market expansion.

Plant-Based Vaccines Market Growth Trends & Insights

The Plant-Based Vaccines market has experienced significant growth over the historical period (2019-2024), driven by increasing demand for safe, cost-effective, and scalable vaccine production methods. The market size in 2024 was estimated at xx Million, exhibiting a CAGR of xx% during this period. Technological disruptions, such as advancements in plant-based expression systems and adjuvant technologies, have accelerated adoption rates. Consumer behavior shifts towards preference for plant-derived products are also influencing market growth. The market is expected to maintain robust growth during the forecast period (2025-2033), reaching xx Million by 2033, with a projected CAGR of xx%. This growth is fueled by increasing investments in R&D, favorable regulatory policies, and rising awareness regarding the advantages of plant-based vaccines. The market penetration is expected to reach xx% by 2033.

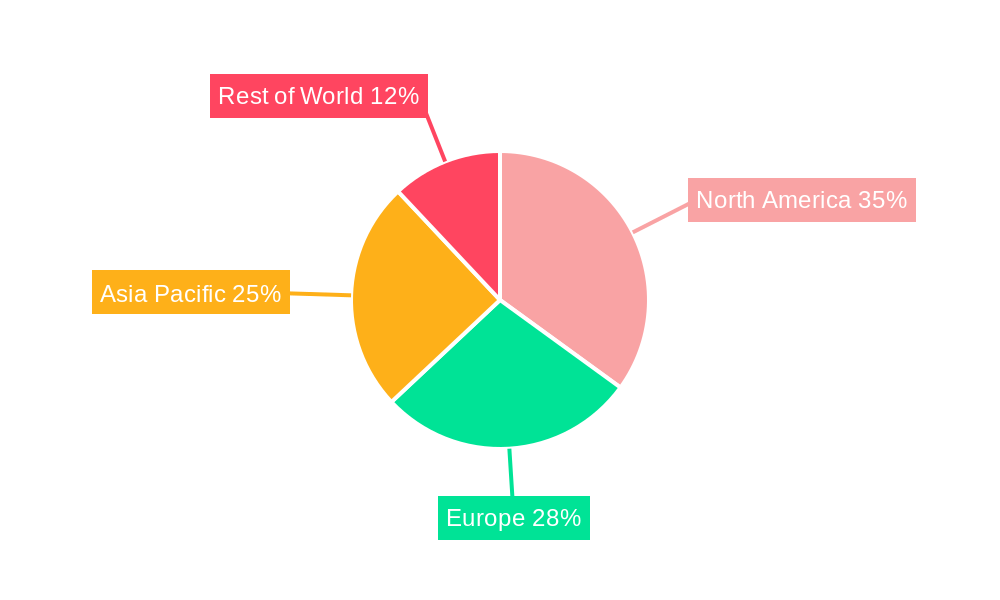

Dominant Regions, Countries, or Segments in Plant-Based Vaccines Market

North America currently dominates the Plant-Based Vaccines market, driven by significant investments in R&D, supportive government policies, and a robust pharmaceutical industry infrastructure. Europe follows as a prominent market, with substantial focus on plant-based technology development and growing demand for alternative vaccine platforms. Asia-Pacific shows high growth potential, fueled by increasing population, rising disposable incomes, and government initiatives to improve healthcare infrastructure.

- North America: Strong R&D infrastructure, favorable regulatory landscape, high per capita healthcare spending.

- Europe: Well-established pharmaceutical industry, stringent regulatory standards, focus on innovation.

- Asia-Pacific: High population density, increasing healthcare spending, government support for vaccine development.

Plant-Based Vaccines Market Product Landscape

Plant-based vaccines utilize various plant platforms, including tobacco, potato, and algae, for cost-effective and scalable vaccine production. Product innovations are focused on improving antigen expression, stability, and efficacy. Key applications include prophylactic and therapeutic vaccines targeting various infectious diseases. Performance metrics such as antigen yield, purity, and immunogenicity are critical for product success. Unique selling propositions center around safety, scalability, speed of production, and cost-effectiveness compared to traditional methods. Recent technological advancements include improved genetic engineering techniques and advanced adjuvant systems.

Key Drivers, Barriers & Challenges in Plant-Based Vaccines Market

Key Drivers: Growing demand for safe and cost-effective vaccines, increasing prevalence of infectious diseases, technological advancements in plant-based expression systems, and supportive government policies and funding (e.g., the USD 173 million allocated to Medicago's facility in Quebec).

Key Challenges: Regulatory hurdles for market entry, supply chain complexities, competition from traditional vaccine platforms, and challenges in scaling up production to meet global demand. Estimated losses due to regulatory delays are projected at xx Million annually.

Emerging Opportunities in Plant-Based Vaccines Market

Emerging opportunities lie in the development of vaccines for neglected tropical diseases, personalized vaccines, and mRNA vaccines delivered via plant-based systems. Untapped markets exist in developing countries with limited access to conventional vaccines. Innovative applications involve using plant-based platforms for multivalent vaccines and combination therapies. Evolving consumer preferences towards plant-derived products create significant market potential.

Growth Accelerators in the Plant-Based Vaccines Market Industry

Technological breakthroughs in plant-based expression systems, particularly with improved yield and immunogenicity, are driving long-term growth. Strategic partnerships between plant biotechnology companies, pharmaceutical giants, and research institutions accelerate innovation and market entry. Market expansion strategies focusing on emerging economies and unmet medical needs are crucial for sustained growth.

Key Players Shaping the Plant-Based Vaccines Market Market

- Creative Biolabs

- Medicago Inc

- iBio

- ICON

- EEA Consulting Engineers

- Kentucky Bioprocessing Inc

- Baiya Phytopharm

- Lumen Bioscience Inc

- PlantForm Corporation

- *List Not Exhaustive

Notable Milestones in Plant-Based Vaccines Market Sector

- November 2023: Medicago received over USD 300 million in government funding and a parliamentary study was initiated on its plant-based COVID-19 vaccine. USD 173 million was further allocated for R&D and facility construction.

- August 2024: Evonik launched PhytoSquene, a plant-based squalene for vaccine adjuvants, reducing reliance on shark-derived squalene.

In-Depth Plant-Based Vaccines Market Market Outlook

The Plant-Based Vaccines market is poised for substantial growth, driven by technological advancements, increasing demand for safe and effective vaccines, and supportive government initiatives. Strategic opportunities exist in expanding into new geographical markets, developing innovative vaccine platforms, and forging strategic collaborations to accelerate product development and market access. The future of this market is bright, promising a significant contribution to global health security and the advancement of vaccine technology.

Plant-Based Vaccines Market Segmentation

-

1. Type

- 1.1. Bacterial Vaccine

- 1.2. Viral Vaccine

- 1.3. Others

-

2. Plant Source

- 2.1. Tobacco

- 2.2. Potato

- 2.3. Others

-

3. Application

- 3.1. Infectious Agents

- 3.2. Anti-Cancer

-

3.3. Veterinary Applications

- 3.3.1. Others

Plant-Based Vaccines Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. South America

Plant-Based Vaccines Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Plant-Based Vaccines; Advancements in Plant-Based Virus Vaccines

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Plant-Based Vaccines; Advancements in Plant-Based Virus Vaccines

- 3.4. Market Trends

- 3.4.1. Viral Vaccine Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plant-Based Vaccines Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Bacterial Vaccine

- 5.1.2. Viral Vaccine

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Plant Source

- 5.2.1. Tobacco

- 5.2.2. Potato

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Infectious Agents

- 5.3.2. Anti-Cancer

- 5.3.3. Veterinary Applications

- 5.3.3.1. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Plant-Based Vaccines Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Bacterial Vaccine

- 6.1.2. Viral Vaccine

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Plant Source

- 6.2.1. Tobacco

- 6.2.2. Potato

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Infectious Agents

- 6.3.2. Anti-Cancer

- 6.3.3. Veterinary Applications

- 6.3.3.1. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Plant-Based Vaccines Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Bacterial Vaccine

- 7.1.2. Viral Vaccine

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Plant Source

- 7.2.1. Tobacco

- 7.2.2. Potato

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Infectious Agents

- 7.3.2. Anti-Cancer

- 7.3.3. Veterinary Applications

- 7.3.3.1. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Plant-Based Vaccines Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Bacterial Vaccine

- 8.1.2. Viral Vaccine

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Plant Source

- 8.2.1. Tobacco

- 8.2.2. Potato

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Infectious Agents

- 8.3.2. Anti-Cancer

- 8.3.3. Veterinary Applications

- 8.3.3.1. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Plant-Based Vaccines Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Bacterial Vaccine

- 9.1.2. Viral Vaccine

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Plant Source

- 9.2.1. Tobacco

- 9.2.2. Potato

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Infectious Agents

- 9.3.2. Anti-Cancer

- 9.3.3. Veterinary Applications

- 9.3.3.1. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Plant-Based Vaccines Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Bacterial Vaccine

- 10.1.2. Viral Vaccine

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Plant Source

- 10.2.1. Tobacco

- 10.2.2. Potato

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Infectious Agents

- 10.3.2. Anti-Cancer

- 10.3.3. Veterinary Applications

- 10.3.3.1. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Creative Biolabs

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Medicago Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 iBio

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ICON

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 EEA Consulting Engineers

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kentucky Bioprocessing Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Baiya Phytopharm

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lumen Bioscience Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PlantForm Corporation*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Creative Biolabs

List of Figures

- Figure 1: Global Plant-Based Vaccines Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Plant-Based Vaccines Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Plant-Based Vaccines Market Revenue (Million), by Type 2024 & 2032

- Figure 4: North America Plant-Based Vaccines Market Volume (Billion), by Type 2024 & 2032

- Figure 5: North America Plant-Based Vaccines Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Plant-Based Vaccines Market Volume Share (%), by Type 2024 & 2032

- Figure 7: North America Plant-Based Vaccines Market Revenue (Million), by Plant Source 2024 & 2032

- Figure 8: North America Plant-Based Vaccines Market Volume (Billion), by Plant Source 2024 & 2032

- Figure 9: North America Plant-Based Vaccines Market Revenue Share (%), by Plant Source 2024 & 2032

- Figure 10: North America Plant-Based Vaccines Market Volume Share (%), by Plant Source 2024 & 2032

- Figure 11: North America Plant-Based Vaccines Market Revenue (Million), by Application 2024 & 2032

- Figure 12: North America Plant-Based Vaccines Market Volume (Billion), by Application 2024 & 2032

- Figure 13: North America Plant-Based Vaccines Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Plant-Based Vaccines Market Volume Share (%), by Application 2024 & 2032

- Figure 15: North America Plant-Based Vaccines Market Revenue (Million), by Country 2024 & 2032

- Figure 16: North America Plant-Based Vaccines Market Volume (Billion), by Country 2024 & 2032

- Figure 17: North America Plant-Based Vaccines Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Plant-Based Vaccines Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Europe Plant-Based Vaccines Market Revenue (Million), by Type 2024 & 2032

- Figure 20: Europe Plant-Based Vaccines Market Volume (Billion), by Type 2024 & 2032

- Figure 21: Europe Plant-Based Vaccines Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Plant-Based Vaccines Market Volume Share (%), by Type 2024 & 2032

- Figure 23: Europe Plant-Based Vaccines Market Revenue (Million), by Plant Source 2024 & 2032

- Figure 24: Europe Plant-Based Vaccines Market Volume (Billion), by Plant Source 2024 & 2032

- Figure 25: Europe Plant-Based Vaccines Market Revenue Share (%), by Plant Source 2024 & 2032

- Figure 26: Europe Plant-Based Vaccines Market Volume Share (%), by Plant Source 2024 & 2032

- Figure 27: Europe Plant-Based Vaccines Market Revenue (Million), by Application 2024 & 2032

- Figure 28: Europe Plant-Based Vaccines Market Volume (Billion), by Application 2024 & 2032

- Figure 29: Europe Plant-Based Vaccines Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Plant-Based Vaccines Market Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Plant-Based Vaccines Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Europe Plant-Based Vaccines Market Volume (Billion), by Country 2024 & 2032

- Figure 33: Europe Plant-Based Vaccines Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Europe Plant-Based Vaccines Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Asia Pacific Plant-Based Vaccines Market Revenue (Million), by Type 2024 & 2032

- Figure 36: Asia Pacific Plant-Based Vaccines Market Volume (Billion), by Type 2024 & 2032

- Figure 37: Asia Pacific Plant-Based Vaccines Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Asia Pacific Plant-Based Vaccines Market Volume Share (%), by Type 2024 & 2032

- Figure 39: Asia Pacific Plant-Based Vaccines Market Revenue (Million), by Plant Source 2024 & 2032

- Figure 40: Asia Pacific Plant-Based Vaccines Market Volume (Billion), by Plant Source 2024 & 2032

- Figure 41: Asia Pacific Plant-Based Vaccines Market Revenue Share (%), by Plant Source 2024 & 2032

- Figure 42: Asia Pacific Plant-Based Vaccines Market Volume Share (%), by Plant Source 2024 & 2032

- Figure 43: Asia Pacific Plant-Based Vaccines Market Revenue (Million), by Application 2024 & 2032

- Figure 44: Asia Pacific Plant-Based Vaccines Market Volume (Billion), by Application 2024 & 2032

- Figure 45: Asia Pacific Plant-Based Vaccines Market Revenue Share (%), by Application 2024 & 2032

- Figure 46: Asia Pacific Plant-Based Vaccines Market Volume Share (%), by Application 2024 & 2032

- Figure 47: Asia Pacific Plant-Based Vaccines Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Asia Pacific Plant-Based Vaccines Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Asia Pacific Plant-Based Vaccines Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Asia Pacific Plant-Based Vaccines Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Middle East and Africa Plant-Based Vaccines Market Revenue (Million), by Type 2024 & 2032

- Figure 52: Middle East and Africa Plant-Based Vaccines Market Volume (Billion), by Type 2024 & 2032

- Figure 53: Middle East and Africa Plant-Based Vaccines Market Revenue Share (%), by Type 2024 & 2032

- Figure 54: Middle East and Africa Plant-Based Vaccines Market Volume Share (%), by Type 2024 & 2032

- Figure 55: Middle East and Africa Plant-Based Vaccines Market Revenue (Million), by Plant Source 2024 & 2032

- Figure 56: Middle East and Africa Plant-Based Vaccines Market Volume (Billion), by Plant Source 2024 & 2032

- Figure 57: Middle East and Africa Plant-Based Vaccines Market Revenue Share (%), by Plant Source 2024 & 2032

- Figure 58: Middle East and Africa Plant-Based Vaccines Market Volume Share (%), by Plant Source 2024 & 2032

- Figure 59: Middle East and Africa Plant-Based Vaccines Market Revenue (Million), by Application 2024 & 2032

- Figure 60: Middle East and Africa Plant-Based Vaccines Market Volume (Billion), by Application 2024 & 2032

- Figure 61: Middle East and Africa Plant-Based Vaccines Market Revenue Share (%), by Application 2024 & 2032

- Figure 62: Middle East and Africa Plant-Based Vaccines Market Volume Share (%), by Application 2024 & 2032

- Figure 63: Middle East and Africa Plant-Based Vaccines Market Revenue (Million), by Country 2024 & 2032

- Figure 64: Middle East and Africa Plant-Based Vaccines Market Volume (Billion), by Country 2024 & 2032

- Figure 65: Middle East and Africa Plant-Based Vaccines Market Revenue Share (%), by Country 2024 & 2032

- Figure 66: Middle East and Africa Plant-Based Vaccines Market Volume Share (%), by Country 2024 & 2032

- Figure 67: South America Plant-Based Vaccines Market Revenue (Million), by Type 2024 & 2032

- Figure 68: South America Plant-Based Vaccines Market Volume (Billion), by Type 2024 & 2032

- Figure 69: South America Plant-Based Vaccines Market Revenue Share (%), by Type 2024 & 2032

- Figure 70: South America Plant-Based Vaccines Market Volume Share (%), by Type 2024 & 2032

- Figure 71: South America Plant-Based Vaccines Market Revenue (Million), by Plant Source 2024 & 2032

- Figure 72: South America Plant-Based Vaccines Market Volume (Billion), by Plant Source 2024 & 2032

- Figure 73: South America Plant-Based Vaccines Market Revenue Share (%), by Plant Source 2024 & 2032

- Figure 74: South America Plant-Based Vaccines Market Volume Share (%), by Plant Source 2024 & 2032

- Figure 75: South America Plant-Based Vaccines Market Revenue (Million), by Application 2024 & 2032

- Figure 76: South America Plant-Based Vaccines Market Volume (Billion), by Application 2024 & 2032

- Figure 77: South America Plant-Based Vaccines Market Revenue Share (%), by Application 2024 & 2032

- Figure 78: South America Plant-Based Vaccines Market Volume Share (%), by Application 2024 & 2032

- Figure 79: South America Plant-Based Vaccines Market Revenue (Million), by Country 2024 & 2032

- Figure 80: South America Plant-Based Vaccines Market Volume (Billion), by Country 2024 & 2032

- Figure 81: South America Plant-Based Vaccines Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: South America Plant-Based Vaccines Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Plant-Based Vaccines Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Plant-Based Vaccines Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Plant-Based Vaccines Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Plant-Based Vaccines Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Global Plant-Based Vaccines Market Revenue Million Forecast, by Plant Source 2019 & 2032

- Table 6: Global Plant-Based Vaccines Market Volume Billion Forecast, by Plant Source 2019 & 2032

- Table 7: Global Plant-Based Vaccines Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Global Plant-Based Vaccines Market Volume Billion Forecast, by Application 2019 & 2032

- Table 9: Global Plant-Based Vaccines Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Plant-Based Vaccines Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Global Plant-Based Vaccines Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global Plant-Based Vaccines Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Global Plant-Based Vaccines Market Revenue Million Forecast, by Plant Source 2019 & 2032

- Table 14: Global Plant-Based Vaccines Market Volume Billion Forecast, by Plant Source 2019 & 2032

- Table 15: Global Plant-Based Vaccines Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Global Plant-Based Vaccines Market Volume Billion Forecast, by Application 2019 & 2032

- Table 17: Global Plant-Based Vaccines Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Plant-Based Vaccines Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: Global Plant-Based Vaccines Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global Plant-Based Vaccines Market Volume Billion Forecast, by Type 2019 & 2032

- Table 21: Global Plant-Based Vaccines Market Revenue Million Forecast, by Plant Source 2019 & 2032

- Table 22: Global Plant-Based Vaccines Market Volume Billion Forecast, by Plant Source 2019 & 2032

- Table 23: Global Plant-Based Vaccines Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Plant-Based Vaccines Market Volume Billion Forecast, by Application 2019 & 2032

- Table 25: Global Plant-Based Vaccines Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Plant-Based Vaccines Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Global Plant-Based Vaccines Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Plant-Based Vaccines Market Volume Billion Forecast, by Type 2019 & 2032

- Table 29: Global Plant-Based Vaccines Market Revenue Million Forecast, by Plant Source 2019 & 2032

- Table 30: Global Plant-Based Vaccines Market Volume Billion Forecast, by Plant Source 2019 & 2032

- Table 31: Global Plant-Based Vaccines Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Global Plant-Based Vaccines Market Volume Billion Forecast, by Application 2019 & 2032

- Table 33: Global Plant-Based Vaccines Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Plant-Based Vaccines Market Volume Billion Forecast, by Country 2019 & 2032

- Table 35: Global Plant-Based Vaccines Market Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global Plant-Based Vaccines Market Volume Billion Forecast, by Type 2019 & 2032

- Table 37: Global Plant-Based Vaccines Market Revenue Million Forecast, by Plant Source 2019 & 2032

- Table 38: Global Plant-Based Vaccines Market Volume Billion Forecast, by Plant Source 2019 & 2032

- Table 39: Global Plant-Based Vaccines Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Global Plant-Based Vaccines Market Volume Billion Forecast, by Application 2019 & 2032

- Table 41: Global Plant-Based Vaccines Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global Plant-Based Vaccines Market Volume Billion Forecast, by Country 2019 & 2032

- Table 43: Global Plant-Based Vaccines Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Global Plant-Based Vaccines Market Volume Billion Forecast, by Type 2019 & 2032

- Table 45: Global Plant-Based Vaccines Market Revenue Million Forecast, by Plant Source 2019 & 2032

- Table 46: Global Plant-Based Vaccines Market Volume Billion Forecast, by Plant Source 2019 & 2032

- Table 47: Global Plant-Based Vaccines Market Revenue Million Forecast, by Application 2019 & 2032

- Table 48: Global Plant-Based Vaccines Market Volume Billion Forecast, by Application 2019 & 2032

- Table 49: Global Plant-Based Vaccines Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Global Plant-Based Vaccines Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plant-Based Vaccines Market?

The projected CAGR is approximately 8.62%.

2. Which companies are prominent players in the Plant-Based Vaccines Market?

Key companies in the market include Creative Biolabs, Medicago Inc, iBio, ICON, EEA Consulting Engineers, Kentucky Bioprocessing Inc, Baiya Phytopharm, Lumen Bioscience Inc, PlantForm Corporation*List Not Exhaustive.

3. What are the main segments of the Plant-Based Vaccines Market?

The market segments include Type, Plant Source, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Plant-Based Vaccines; Advancements in Plant-Based Virus Vaccines.

6. What are the notable trends driving market growth?

Viral Vaccine Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Growing Demand for Plant-Based Vaccines; Advancements in Plant-Based Virus Vaccines.

8. Can you provide examples of recent developments in the market?

August 2024: Evonik launched PhytoSquene, the first plant-based, pharma-grade squalene specifically designed for use in vaccine adjuvants and other pharmaceutical applications. This innovative non-animal-derived squalene offers numerous advantages, primarily by reducing reliance on shark-derived squalene, thereby contributing to preserving biodiversity and ecosystems.November 2023: Medicago, a Quebec-based pharmaceutical company, received over USD 300 million in payments made by the Liberal government, and the House of Commons health committee initiated a study regarding the development of a plant-based COVID-19 vaccine. Additionally, the government allocated USD 173 million for research and development and constructing Medicago's manufacturing facility in Quebec City.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plant-Based Vaccines Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plant-Based Vaccines Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plant-Based Vaccines Market?

To stay informed about further developments, trends, and reports in the Plant-Based Vaccines Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence