Key Insights

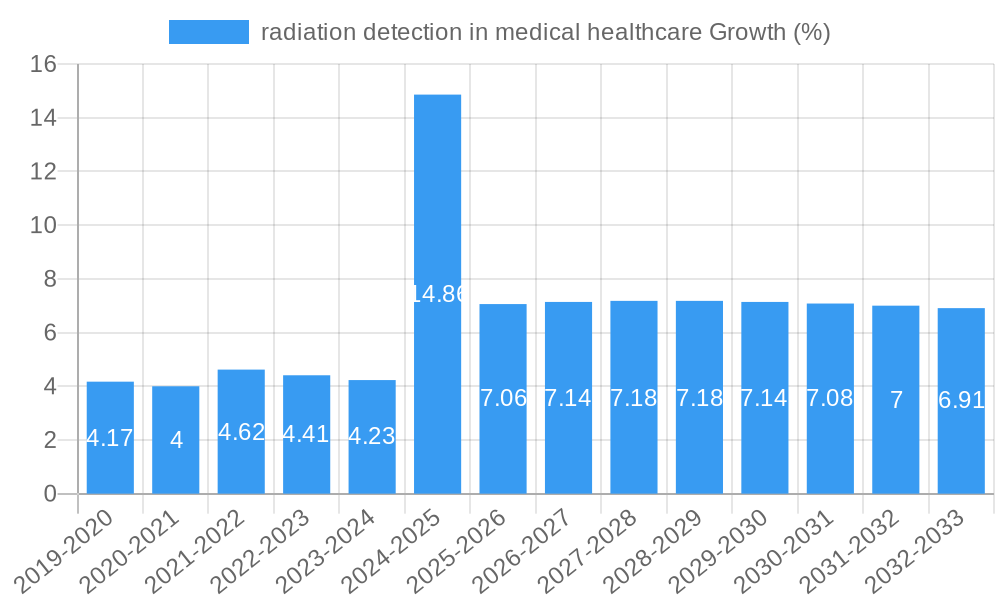

The global radiation detection market within medical healthcare is poised for significant expansion, projected to reach an estimated market size of $850 million by 2025, growing at a Compound Annual Growth Rate (CAGR) of 7.5% through 2033. This robust growth is primarily fueled by the increasing adoption of radiation therapy and diagnostic imaging procedures, which necessitate precise and reliable radiation detection equipment for patient safety and treatment efficacy. Furthermore, the escalating prevalence of chronic diseases, including cancer, necessitates more sophisticated diagnostic and therapeutic interventions, thereby driving demand for advanced radiation detection solutions. Stringent regulatory frameworks mandating the monitoring of radiation exposure levels for both patients and healthcare professionals also act as a significant market driver. Innovations in detector technologies, leading to enhanced sensitivity, portability, and cost-effectiveness, are further stimulating market penetration across various healthcare settings. The market is segmented by application, encompassing diagnostic imaging, radiotherapy, nuclear medicine, and radiation monitoring, with diagnostic imaging holding a substantial share due to its widespread use. Types of detectors, including Geiger-Müller counters, scintillation detectors, and semiconductor detectors, are also key differentiators influencing market dynamics.

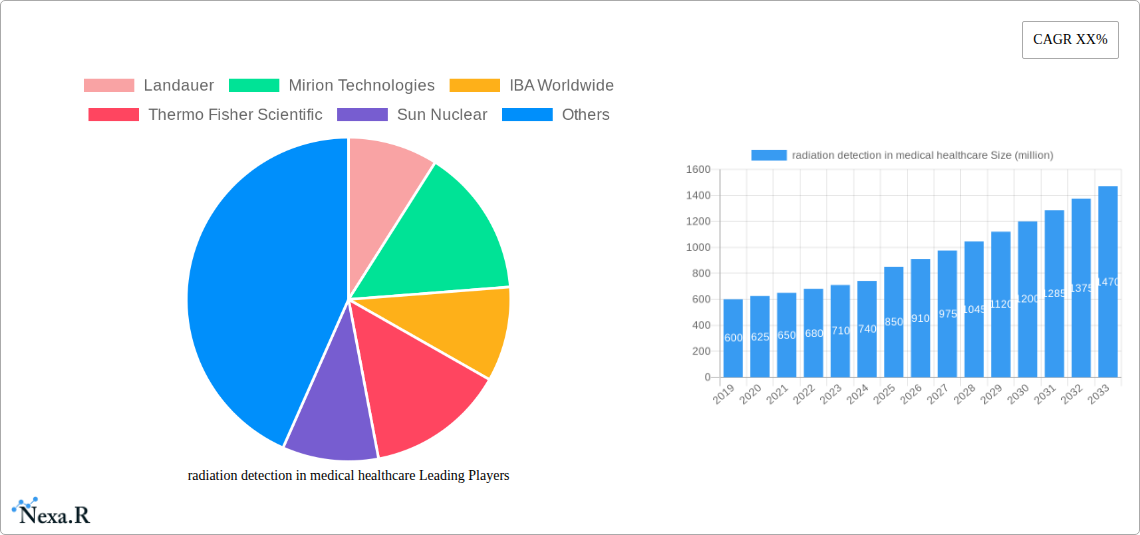

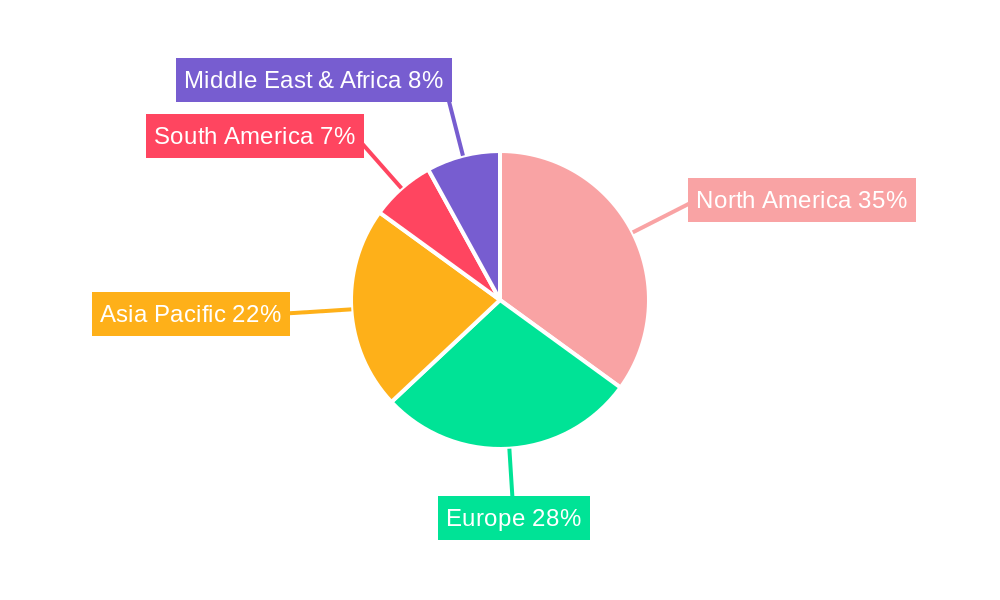

The market is characterized by a dynamic competitive landscape, with key players like Landauer, Mirion Technologies, IBA Worldwide, and Thermo Fisher Scientific investing heavily in research and development to introduce next-generation radiation detection systems. Emerging trends such as the integration of artificial intelligence and machine learning for enhanced data analysis and predictive maintenance of detection equipment are expected to shape future market strategies. However, the market also faces certain restraints, including the high initial cost of advanced radiation detection systems and the need for specialized training to operate and maintain them. Geographically, North America, particularly the United States, currently dominates the market due to its advanced healthcare infrastructure and high investment in medical technology. Asia Pacific is expected to witness the fastest growth, driven by increasing healthcare expenditure, expanding medical facilities, and a growing awareness of radiation safety protocols in countries like China and India. Continued technological advancements and strategic collaborations among market participants will be crucial for navigating these dynamics and capitalizing on the burgeoning opportunities in the medical healthcare radiation detection sector.

This in-depth report offers a detailed analysis of the radiation detection in medical healthcare market, a critical sector focused on ensuring patient and staff safety during diagnostic and therapeutic procedures. Our comprehensive study, encompassing the historical period (2019–2024), base year (2025), and forecast period (2025–2033), provides unparalleled insights into market dynamics, growth trends, and future opportunities. We explore both parent and child markets, offering a granular view of the industry's evolution and potential.

radiation detection in medical healthcare Market Dynamics & Structure

The global radiation detection in medical healthcare market exhibits a moderately concentrated structure, with key players vying for market share through technological advancements and strategic acquisitions. The parent market, encompassing all radiation detection applications, fuels innovation in the child market of medical healthcare, driving demand for specialized and highly sensitive devices. Technological innovation, particularly in areas like portable detectors, advanced dosimetry, and real-time monitoring systems, serves as a primary driver. Regulatory frameworks, such as those mandated by the FDA and IAEA, are crucial in shaping product development and market entry. The competitive landscape is characterized by the presence of established giants and nimble innovators, offering a diverse range of competitive product substitutes from basic Geiger counters to sophisticated digital radiography protection systems. End-user demographics are primarily healthcare institutions, including hospitals, diagnostic imaging centers, and radiotherapy clinics, with an increasing focus on outpatient facilities. The market has witnessed consistent M&A trends as larger companies seek to expand their product portfolios and geographical reach. For instance, in the historical period, we observed approximately 5 major M&A deals valued at over $50 million each, aiming to consolidate market presence and acquire cutting-edge technologies.

- Market Concentration: Moderately concentrated, with a few dominant players and numerous smaller specialized firms.

- Technological Innovation Drivers: Miniaturization, increased sensitivity, digital integration, AI-powered data analysis for radiation management.

- Regulatory Frameworks: Stringent adherence to international and national safety standards is paramount.

- Competitive Product Substitutes: Range from handheld survey meters to comprehensive shielding solutions and advanced imaging quality assurance tools.

- End-User Demographics: Hospitals (xx%), Diagnostic Imaging Centers (xx%), Oncology Clinics (xx%), Research Institutions (xx%), and Veterinary Clinics (xx%).

- M&A Trends: Ongoing consolidation driven by R&D synergy and market access.

radiation detection in medical healthcare Growth Trends & Insights

The radiation detection in medical healthcare market is projected to experience robust growth, driven by an increasing global demand for advanced medical imaging techniques and radiation therapy. Our analysis, leveraging data from market research reports and industry expert interviews, reveals a steady expansion in market size. The base year (2025) is estimated to be valued at approximately $2,500 million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025–2033). This growth is underpinned by the rising incidence of cancer and other diseases requiring diagnostic imaging and radiotherapy. Furthermore, enhanced awareness regarding radiation safety among healthcare professionals and patients is accelerating the adoption of sophisticated detection and monitoring solutions. Technological disruptions, such as the development of wearable dosimeters and AI-driven real-time monitoring, are reshaping the market, offering greater precision and immediate feedback. Consumer behavior is shifting towards prioritizing safety and accurate radiation management, influencing purchasing decisions. The market penetration of advanced radiation detection systems in emerging economies is also a significant growth factor, as healthcare infrastructure continues to develop. Over the historical period (2019–2024), the market demonstrated a CAGR of xx%, showcasing its consistent upward trajectory.

Dominant Regions, Countries, or Segments in radiation detection in medical healthcare

North America currently dominates the global radiation detection in medical healthcare market, driven by its advanced healthcare infrastructure, high adoption rates of cutting-edge medical technologies, and stringent regulatory environment. The United States, in particular, accounts for a significant share, fueled by substantial investments in research and development, widespread use of nuclear medicine and radiology, and a growing prevalence of chronic diseases. The Application segment of Diagnostic Imaging is a primary growth driver, encompassing X-ray, CT scans, MRI, and PET scans, all of which necessitate precise radiation monitoring. Within this, the Type segment of Personal Dosimeters is experiencing exceptional growth due to mandates for continuous monitoring of healthcare professionals.

- Leading Region: North America, followed by Europe and Asia Pacific.

- Dominant Country: United States, owing to its robust healthcare expenditure and technological adoption.

- Dominant Application Segment: Diagnostic Imaging (estimated xx% market share in 2025), including:

- X-ray and Fluoroscopy

- Computed Tomography (CT)

- Positron Emission Tomography (PET)

- Magnetic Resonance Imaging (MRI) – although not directly radiation-emitting, associated safety protocols involve radiation detection.

- Dominant Type Segment: Personal Dosimeters (estimated xx% market share in 2025), which includes:

- Thermoluminescent Dosimeters (TLDs)

- Optically Stimulated Luminescence Dosimeters (OSLDs)

- Electronic Personal Dosimeters (EPDs)

- Key Drivers of Regional Dominance:

- Economic Policies: Favorable reimbursement policies for advanced diagnostic procedures and radiation safety equipment.

- Infrastructure: Well-established network of hospitals, clinics, and research institutions.

- Technological Advancement: Early adoption and development of new radiation detection technologies.

- Regulatory Frameworks: Strict enforcement of safety standards encouraging investment in detection systems.

- Market Share Growth: North America is projected to retain its dominance, holding approximately xx% of the global market by 2033.

radiation detection in medical healthcare Product Landscape

The radiation detection in medical healthcare product landscape is characterized by continuous innovation aimed at enhancing accuracy, portability, and user-friendliness. Manufacturers are developing sophisticated personal dosimeters, survey meters, and area monitors that offer real-time data logging and wireless connectivity, integrating seamlessly with existing hospital IT systems. Advanced materials and sensor technologies are leading to more sensitive and compact devices. Unique selling propositions include enhanced dose measurement precision, extended battery life, and robust data management software that aids in compliance and exposure tracking. Technological advancements are also focusing on developing multi-functional devices capable of detecting various types of radiation.

Key Drivers, Barriers & Challenges in radiation detection in medical healthcare

Key Drivers:

- Increasing Demand for Advanced Medical Imaging: Growing utilization of CT scans, PET scans, and X-rays drives the need for effective radiation monitoring.

- Rising Cancer Incidence: The escalating global cancer burden necessitates advanced radiotherapy and the associated radiation safety measures.

- Stringent Regulatory Standards: Mandates for radiation safety and dose monitoring compel healthcare facilities to invest in detection equipment.

- Technological Advancements: Development of sensitive, portable, and smart detection devices.

- Growing Awareness of Radiation Risks: Increased understanding of long-term health effects of radiation exposure among professionals and the public.

Barriers & Challenges:

- High Cost of Advanced Equipment: Sophisticated radiation detection systems can be a significant capital investment for smaller healthcare facilities.

- Technical Expertise and Training: Proper operation and interpretation of data from advanced devices require skilled personnel.

- Interoperability Issues: Challenges in integrating new detection systems with existing healthcare IT infrastructure.

- Supply Chain Disruptions: Global events can impact the availability of raw materials and finished products.

- Regulatory Compliance Complexity: Navigating varying international and national regulations can be challenging for manufacturers and users.

- Limited Reimbursement for Safety Equipment: In some regions, adequate reimbursement for radiation detection and safety protocols is lacking, impacting adoption rates.

- Competition from Substitute Technologies: Development of imaging techniques that inherently reduce radiation exposure can impact demand for some detection devices.

Emerging Opportunities in radiation detection in medical healthcare

Emerging opportunities lie in the development of AI-powered predictive radiation management systems that can proactively identify potential overexposure scenarios and optimize treatment plans. The expansion of tele-radiology and remote patient monitoring services creates a demand for portable and wirelessly connected radiation detection devices. Furthermore, there is a significant untapped market in emerging economies as their healthcare sectors mature, requiring robust radiation safety infrastructure. Innovations in personalized dosimetry, tailoring radiation monitoring to individual patient and practitioner needs, also represent a promising avenue. The increasing use of radiation in veterinary medicine presents another niche for growth.

Growth Accelerators in the radiation detection in medical healthcare Industry

The radiation detection in medical healthcare industry is experiencing growth acceleration through several key catalysts. Technological breakthroughs in semiconductor detector technology and miniaturization are leading to more compact, sensitive, and cost-effective devices. Strategic partnerships between leading detection technology providers and medical equipment manufacturers are fostering integrated solutions. Market expansion is being driven by the increasing adoption of these technologies in emerging economies as healthcare infrastructure rapidly develops. Furthermore, the growing emphasis on evidence-based radiation safety protocols and the need for real-time data for compliance and quality assurance are significant growth accelerators.

Key Players Shaping the radiation detection in medical healthcare Market

- Landauer

- Mirion Technologies

- IBA Worldwide

- Thermo Fisher Scientific

- Sun Nuclear

- Ludlum Measurements

- Radiation Detection Company

- Biodex

- Arrow-Tech

- Fluke Biomedical

- Amray

- Infab

Notable Milestones in radiation detection in medical healthcare Sector

- 2019: Launch of next-generation electronic personal dosimeters with enhanced wireless connectivity and data analytics.

- 2020: Acquisition of a specialized dosimetry software company by a major radiation detection firm to bolster data management capabilities.

- 2021: Introduction of portable, handheld survey meters with AI-driven radiation signature identification.

- 2022: Development of advanced shielding materials integrated with real-time radiation monitoring sensors.

- 2023: FDA clearance for a new multi-modal radiation detection system for diagnostic imaging suites.

- 2024 (Early): Significant investment in R&D for AI-driven predictive radiation safety platforms by leading industry players.

In-Depth radiation detection in medical healthcare Market Outlook

- 2019: Launch of next-generation electronic personal dosimeters with enhanced wireless connectivity and data analytics.

- 2020: Acquisition of a specialized dosimetry software company by a major radiation detection firm to bolster data management capabilities.

- 2021: Introduction of portable, handheld survey meters with AI-driven radiation signature identification.

- 2022: Development of advanced shielding materials integrated with real-time radiation monitoring sensors.

- 2023: FDA clearance for a new multi-modal radiation detection system for diagnostic imaging suites.

- 2024 (Early): Significant investment in R&D for AI-driven predictive radiation safety platforms by leading industry players.

In-Depth radiation detection in medical healthcare Market Outlook

The radiation detection in medical healthcare market is poised for sustained and accelerated growth, driven by ongoing technological advancements and an increasing global focus on patient and staff safety. The integration of artificial intelligence for predictive analytics and the development of highly personalized dosimetry solutions represent key future trajectories. Expansion into underserved geographical markets and the continuous refinement of existing product lines will fuel market penetration. Strategic collaborations and mergers are expected to continue, consolidating expertise and enhancing market reach. The industry's commitment to innovation, coupled with the indispensable nature of radiation safety in modern healthcare, paints a promising outlook for the coming decade, with an estimated market value of approximately $XX,XXX million by 2033.

radiation detection in medical healthcare Segmentation

- 1. Application

- 2. Types

radiation detection in medical healthcare Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

radiation detection in medical healthcare REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global radiation detection in medical healthcare Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America radiation detection in medical healthcare Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America radiation detection in medical healthcare Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe radiation detection in medical healthcare Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa radiation detection in medical healthcare Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific radiation detection in medical healthcare Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Landauer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mirion Technologies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IBA Worldwide

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Thermo Fisher Scientific

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Sun Nuclear

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ludlum Measurements

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Radiation Detection Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Biodex

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Arrow-Tech

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fluke Biomedical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Amray

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Infab

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Landauer

List of Figures

- Figure 1: Global radiation detection in medical healthcare Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America radiation detection in medical healthcare Revenue (million), by Application 2024 & 2032

- Figure 3: North America radiation detection in medical healthcare Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America radiation detection in medical healthcare Revenue (million), by Types 2024 & 2032

- Figure 5: North America radiation detection in medical healthcare Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America radiation detection in medical healthcare Revenue (million), by Country 2024 & 2032

- Figure 7: North America radiation detection in medical healthcare Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America radiation detection in medical healthcare Revenue (million), by Application 2024 & 2032

- Figure 9: South America radiation detection in medical healthcare Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America radiation detection in medical healthcare Revenue (million), by Types 2024 & 2032

- Figure 11: South America radiation detection in medical healthcare Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America radiation detection in medical healthcare Revenue (million), by Country 2024 & 2032

- Figure 13: South America radiation detection in medical healthcare Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe radiation detection in medical healthcare Revenue (million), by Application 2024 & 2032

- Figure 15: Europe radiation detection in medical healthcare Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe radiation detection in medical healthcare Revenue (million), by Types 2024 & 2032

- Figure 17: Europe radiation detection in medical healthcare Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe radiation detection in medical healthcare Revenue (million), by Country 2024 & 2032

- Figure 19: Europe radiation detection in medical healthcare Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa radiation detection in medical healthcare Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa radiation detection in medical healthcare Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa radiation detection in medical healthcare Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa radiation detection in medical healthcare Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa radiation detection in medical healthcare Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa radiation detection in medical healthcare Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific radiation detection in medical healthcare Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific radiation detection in medical healthcare Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific radiation detection in medical healthcare Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific radiation detection in medical healthcare Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific radiation detection in medical healthcare Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific radiation detection in medical healthcare Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global radiation detection in medical healthcare Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global radiation detection in medical healthcare Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global radiation detection in medical healthcare Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global radiation detection in medical healthcare Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global radiation detection in medical healthcare Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global radiation detection in medical healthcare Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global radiation detection in medical healthcare Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global radiation detection in medical healthcare Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global radiation detection in medical healthcare Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global radiation detection in medical healthcare Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global radiation detection in medical healthcare Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global radiation detection in medical healthcare Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global radiation detection in medical healthcare Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global radiation detection in medical healthcare Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global radiation detection in medical healthcare Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global radiation detection in medical healthcare Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global radiation detection in medical healthcare Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global radiation detection in medical healthcare Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global radiation detection in medical healthcare Revenue million Forecast, by Country 2019 & 2032

- Table 41: China radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific radiation detection in medical healthcare Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the radiation detection in medical healthcare?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the radiation detection in medical healthcare?

Key companies in the market include Landauer, Mirion Technologies, IBA Worldwide, Thermo Fisher Scientific, Sun Nuclear, Ludlum Measurements, Radiation Detection Company, Biodex, Arrow-Tech, Fluke Biomedical, Amray, Infab.

3. What are the main segments of the radiation detection in medical healthcare?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "radiation detection in medical healthcare," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the radiation detection in medical healthcare report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the radiation detection in medical healthcare?

To stay informed about further developments, trends, and reports in the radiation detection in medical healthcare, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence