Key Insights

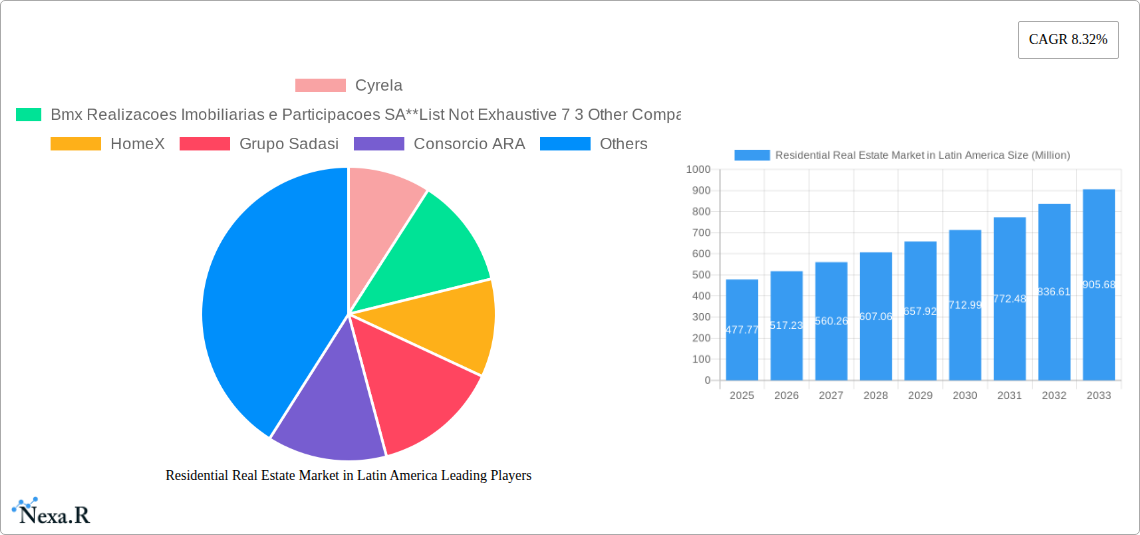

The Latin American residential real estate market, valued at $477.77 million in 2025, is projected to experience robust growth, driven by factors such as increasing urbanization, a burgeoning middle class with rising disposable incomes, and government initiatives promoting affordable housing. Strong economic performance in key markets like Brazil, Mexico, and Argentina is further fueling demand. The market is segmented primarily by property type, with apartments and condominiums holding a significant share, reflecting a preference for urban living and convenience. However, landed houses and villas also represent a substantial segment, particularly in areas with more established suburban communities. The market faces challenges including fluctuating interest rates, inflation, and regulatory hurdles in some countries. Nevertheless, the long-term outlook remains positive, with a Compound Annual Growth Rate (CAGR) of 8.32% projected through 2033. Leading players like Cyrela, MRV Engenharia, and Grupo Sadasi are actively shaping the market landscape through strategic development and acquisitions. The market's growth trajectory is significantly influenced by regional economic conditions and government policies aimed at stimulating construction and infrastructure development. Competitive pressures from both established developers and emerging players are likely to intensify, requiring continuous innovation and adaptation to market demands.

Growth will be particularly strong in rapidly expanding urban centers, where demand for apartments and condominiums is consistently high. While the market exhibits resilience in the face of economic fluctuations, potential risks include shifts in government regulations, infrastructure limitations in certain regions, and potential volatility in commodity prices affecting construction costs. Careful analysis of these factors will be crucial for developers and investors to navigate the complexities of this dynamic market. The ongoing focus on sustainable development practices and the increasing adoption of smart home technologies are also emerging trends that will influence the long-term growth trajectory.

Residential Real Estate Market in Latin America: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Residential Real Estate Market in Latin America, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is an invaluable resource for real estate investors, developers, policymakers, and industry professionals seeking to understand and capitalize on opportunities within this dynamic market. The report segments the market by type (Apartments and Condominiums, Landed Houses and Villas) providing granular insights into various sub-segments.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Residential Real Estate Market in Latin America: Market Dynamics & Structure

This section analyzes the Latin American residential real estate market's structure, focusing on market concentration, technological advancements, regulatory landscapes, competitive dynamics, and demographic influences. We explore M&A activity, providing quantitative insights into market share and deal volumes.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few large players like Cyrela and MRV Engenharia e Participacoes SA holding significant market share, alongside a substantial number of smaller regional developers. xx% of the market is controlled by the top 5 players.

- Technological Innovation: Proptech adoption is increasing, driven by platforms offering virtual tours, online property listings, and streamlined transaction processes. However, barriers remain, such as digital literacy and infrastructure limitations in certain regions.

- Regulatory Frameworks: Varying regulations across Latin American countries significantly impact market dynamics. Some countries offer investor-friendly policies, while others grapple with bureaucratic complexities hindering development.

- Competitive Product Substitutes: The availability of rental properties and government-supported social housing programs presents some degree of competition to the market.

- End-User Demographics: The growing middle class, urbanization trends, and changing family structures are key demographic drivers influencing demand. The millennial generation is increasingly shaping housing preferences.

- M&A Trends: The past five years have seen xx M&A deals in the Latin American residential real estate market, with a notable increase in cross-border acquisitions. Consolidation is expected to continue, driven by expansion strategies of larger players.

Residential Real Estate Market in Latin America: Growth Trends & Insights

This section analyzes the historical and projected growth of the Latin American residential real estate market, highlighting key factors driving expansion and contraction. We delve into adoption rates of new technologies, disruptive innovations, and evolving consumer behavior impacting market trajectories. Utilizing robust data analysis, we provide a detailed examination of market size evolution, growth rates, and penetration metrics.

- Market Size Evolution: The market size has grown from xx Million units in 2019 to an estimated xx Million units in 2025, demonstrating a CAGR of xx%. This is projected to reach xx Million units by 2033.

- Adoption Rates: Adoption of Proptech solutions is growing at a CAGR of xx%, driven by increasing smartphone penetration and internet access.

- Technological Disruptions: The rise of 3D printing and modular construction are showing potential to improve efficiency and affordability.

- Consumer Behavior Shifts: A preference for sustainable and smart homes, as well as a demand for flexible living arrangements, are shaping consumer choices.

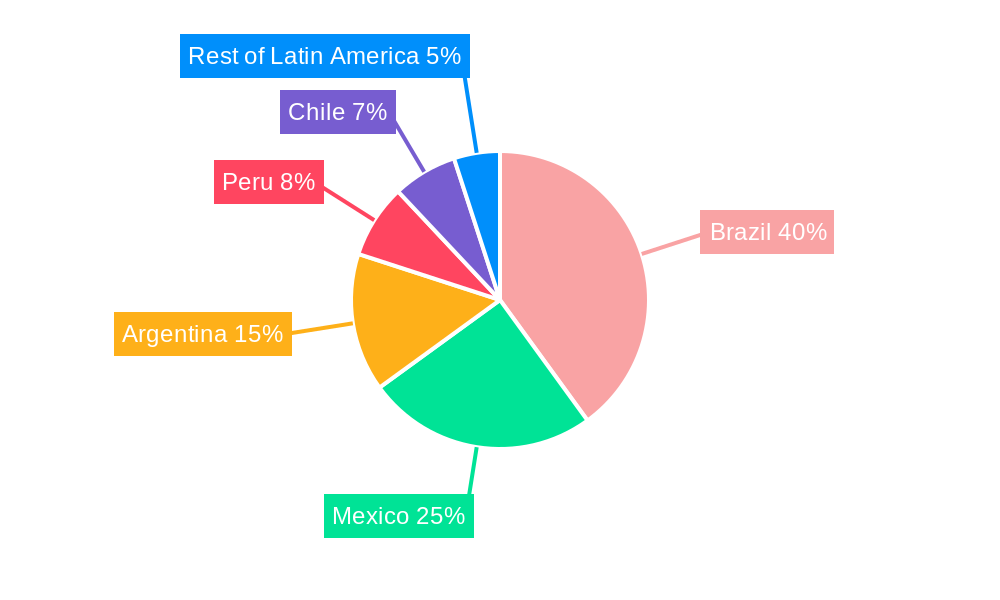

Dominant Regions, Countries, or Segments in Residential Real Estate Market in Latin America

This section identifies the leading regions, countries, and segments within the Latin American residential real estate market. We delve into the factors contributing to their dominance, analyzing market share, growth potential, and key drivers, such as economic policies and infrastructure development.

- Leading Segment: Apartments and condominiums currently represent the largest segment, accounting for xx% of the market.

- Key Drivers: Urbanization, increased affordability in comparison to landed properties, and government incentives for high-density development are key growth drivers.

- Dominant Countries: Brazil, Mexico, and Colombia are among the largest markets, driven by robust economic growth and expanding middle classes.

Brazil’s market share is xx%, Mexico’s is xx%, and Colombia’s is xx%. Growth in these markets is driven by factors such as robust economic growth, increasing urbanization, and government initiatives promoting affordable housing.

Residential Real Estate Market in Latin America: Product Landscape

The residential real estate market in Latin America offers a diverse product landscape, encompassing apartments, condominiums, landed houses, and villas. Innovative designs, incorporating sustainable features and smart home technologies, are gaining popularity. Focus is shifting towards energy-efficient buildings and enhanced security systems. This trend reflects an increasing consumer awareness towards environmental concerns and a desire for enhanced safety and convenience.

Key Drivers, Barriers & Challenges in Residential Real Estate Market in Latin America

Key Drivers: Strong population growth, expanding middle class, urbanization, and government initiatives promoting affordable housing are key drivers of growth in the Latin American residential real estate market. Furthermore, advancements in construction technology are improving efficiency and affordability.

Key Barriers and Challenges: Economic instability in certain countries, high interest rates, inconsistent regulatory frameworks, and supply chain disruptions hinder market growth. These challenges cause delays in project completion, increase costs, and limit housing affordability for many. For example, xx% of construction projects experienced delays in 2024 due to supply chain issues.

Emerging Opportunities in Residential Real Estate Market in Latin America

Emerging opportunities include the growth of eco-friendly housing, increasing demand for rental properties, and the expansion of the PropTech sector. Untapped markets in secondary cities and the increasing adoption of smart home technology present significant growth prospects.

Growth Accelerators in the Residential Real Estate Market in Latin America Industry

Long-term growth is expected to be fueled by government initiatives promoting affordable housing, technological innovation in construction and property management, and the rise of the sharing economy. Strategic partnerships between developers and technology companies will further accelerate growth.

Key Players Shaping the Residential Real Estate Market in Latin America Market

- Cyrela

- BMX Realizações Imobiliárias e Participações SA

- 7 3 Other Companies

- HomeX

- Grupo Sadasi

- Consorcio ARA

- MRV Engenharia e Participações SA

- Groupe CARSO

- Multiplan Real Estate Asset Management

- JLL

- CBRE

Notable Milestones in Residential Real Estate Market in Latin America Sector

- November 2023: CBRE launches the Latam-Iberia platform to stimulate investment and collaboration in the real estate sector across both regions.

- May 2023: CJ do Brasil expands its plant in Piracicaba, Brazil, creating 650 jobs and fostering associated residential development.

In-Depth Residential Real Estate Market in Latin America Market Outlook

The Latin American residential real estate market is poised for continued growth, driven by a young and expanding population, increasing urbanization, and improving economic conditions in many countries. Strategic investment in affordable housing initiatives and the adoption of innovative construction technologies will be crucial for sustained market expansion. The growing middle class and evolving consumer preferences offer significant opportunities for developers and investors to tap into a dynamic and expanding sector.

Residential Real Estate Market in Latin America Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Geography

- 2.1. Mexico

- 2.2. Brazil

- 2.3. Colombia

- 2.4. Rest of Latin America

Residential Real Estate Market in Latin America Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Colombia

- 4. Rest of Latin America

Residential Real Estate Market in Latin America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Population is Boosting the Residential Real Estate Market; Rapid Growth in Urbanization

- 3.3. Market Restrains

- 3.3.1. Accelerated Increase in Construction Costs

- 3.4. Market Trends

- 3.4.1. Increase in Urbanization Boosting Demand for Residential Real Estate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Mexico

- 5.2.2. Brazil

- 5.2.3. Colombia

- 5.2.4. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.3.2. Brazil

- 5.3.3. Colombia

- 5.3.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Mexico Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Mexico

- 6.2.2. Brazil

- 6.2.3. Colombia

- 6.2.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Brazil Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Mexico

- 7.2.2. Brazil

- 7.2.3. Colombia

- 7.2.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Colombia Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Landed Houses and Villas

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Mexico

- 8.2.2. Brazil

- 8.2.3. Colombia

- 8.2.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Latin America Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Landed Houses and Villas

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Mexico

- 9.2.2. Brazil

- 9.2.3. Colombia

- 9.2.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Brazil Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 11. Argentina Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 12. Mexico Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 13. Peru Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 14. Chile Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Latin America Residential Real Estate Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Cyrela

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Bmx Realizacoes Imobiliarias e Participacoes SA**List Not Exhaustive 7 3 Other Companie

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 HomeX

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Grupo Sadasi

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Consorcio ARA

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Mrv Engenharia e Participacoes SA

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Groupe CARSO

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Multiplan Real Estate Asset Management

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 JLL

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 CBRE

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Cyrela

List of Figures

- Figure 1: Residential Real Estate Market in Latin America Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Residential Real Estate Market in Latin America Share (%) by Company 2024

List of Tables

- Table 1: Residential Real Estate Market in Latin America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Residential Real Estate Market in Latin America Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Residential Real Estate Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Residential Real Estate Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Residential Real Estate Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Residential Real Estate Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Residential Real Estate Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Residential Real Estate Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Residential Real Estate Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Residential Real Estate Market in Latin America Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Residential Real Estate Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Real Estate Market in Latin America?

The projected CAGR is approximately 8.32%.

2. Which companies are prominent players in the Residential Real Estate Market in Latin America?

Key companies in the market include Cyrela, Bmx Realizacoes Imobiliarias e Participacoes SA**List Not Exhaustive 7 3 Other Companie, HomeX, Grupo Sadasi, Consorcio ARA, Mrv Engenharia e Participacoes SA, Groupe CARSO, Multiplan Real Estate Asset Management, JLL, CBRE.

3. What are the main segments of the Residential Real Estate Market in Latin America?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 477.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Population is Boosting the Residential Real Estate Market; Rapid Growth in Urbanization.

6. What are the notable trends driving market growth?

Increase in Urbanization Boosting Demand for Residential Real Estate.

7. Are there any restraints impacting market growth?

Accelerated Increase in Construction Costs.

8. Can you provide examples of recent developments in the market?

November 2023: CBRE, a prominent global consultancy and real estate services firm, unveiled its latest initiative, the Latam-Iberia platform. The platform's primary goal is to reinvigorate the real estate markets in Europe and Latin America while fostering investment ties between the two regions. By enhancing business collaborations and amplifying the visibility of real estate solutions, CBRE aims to catalyze growth in the sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Residential Real Estate Market in Latin America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Residential Real Estate Market in Latin America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Residential Real Estate Market in Latin America?

To stay informed about further developments, trends, and reports in the Residential Real Estate Market in Latin America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence