Key Insights

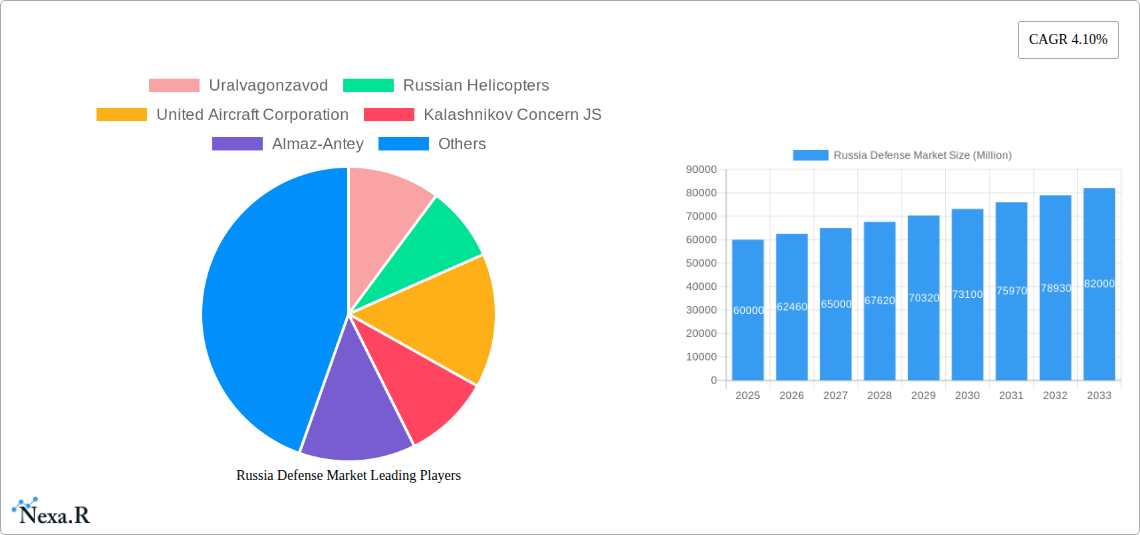

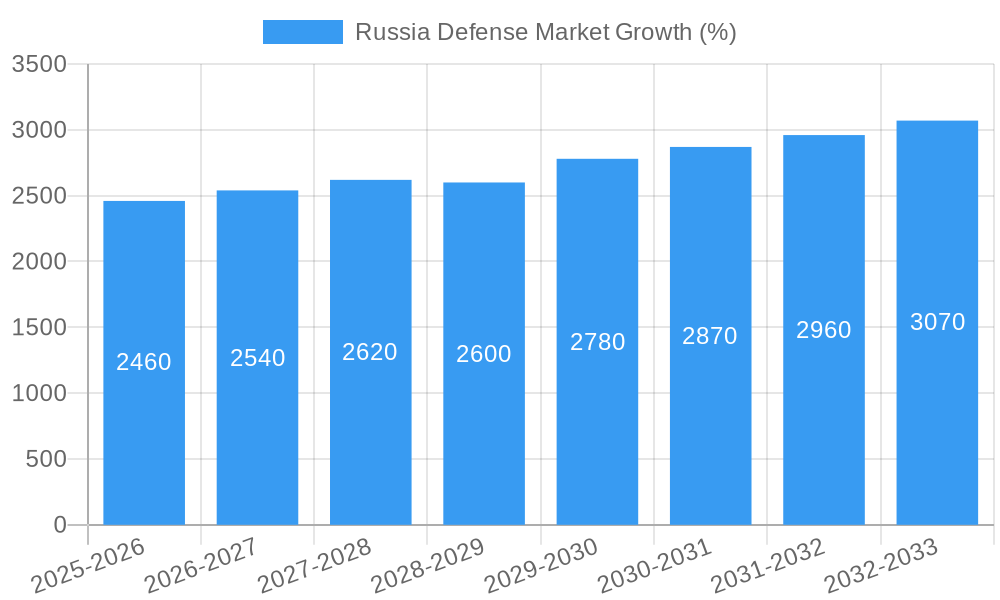

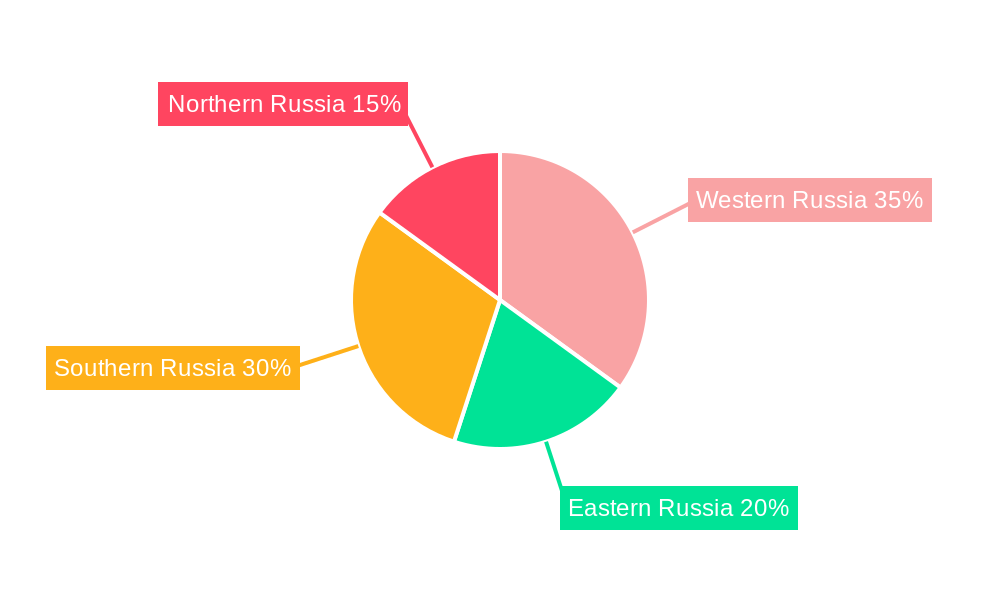

The Russian defense market, valued at approximately $60 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 4.10% from 2025 to 2033. This growth is driven by several factors, including ongoing geopolitical instability, modernization efforts within the Russian Armed Forces across all branches (Army, Navy, Air Force), a focus on technological advancements in areas like unmanned systems and C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance), and increasing defense spending to maintain a strong military presence. Key segments contributing to market expansion include weapons and ammunition, protection and training equipment, and advanced unmanned systems. Domestic manufacturers like Uralvagonzavod, Russian Helicopters, and United Aircraft Corporation play a dominant role, supplying a significant portion of the nation's defense needs. Furthermore, the regional distribution of the market likely reflects the strategic importance placed on different areas within the country, with Western and Southern Russia potentially holding larger shares due to proximity to geopolitical hotspots.

However, the market's growth trajectory is not without its constraints. Economic sanctions and fluctuations in global oil prices can significantly influence defense budgets. Competition from international defense contractors could also affect the market share of domestic companies. The focus on modernization might also create challenges related to technological advancements and infrastructure investment. Balancing these constraints with the ongoing need for military preparedness and technological upgrades will be crucial in shaping the future of the Russian defense market. Future growth will hinge on the success of modernization programs, the geopolitical climate, and the Russian government's commitment to defense spending in the face of economic challenges. Specific regional growth may be influenced by the strategic priorities assigned to each region.

Russia Defense Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Russia Defense Market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. This report is crucial for defense industry professionals, investors, and policymakers seeking a comprehensive understanding of this dynamic market. The report covers both parent market (Russia Defense Market) and child markets (by type and by armed forces).

Russia Defense Market Dynamics & Structure

The Russia defense market is characterized by a high degree of government control, significant state investment, and a concentrated market structure dominated by state-owned enterprises. Technological innovation, while present, faces challenges due to sanctions and import restrictions. The regulatory framework is tightly controlled, favoring domestic producers. Competitive product substitutes are limited, and end-user demographics primarily consist of the Russian Armed Forces (Army, Navy, and Air Force). M&A activity is largely driven by government consolidation efforts.

- Market Concentration: Highly concentrated, with state-owned enterprises holding significant market share (estimated at 85% in 2025).

- Technological Innovation: Driven by the need for modernization and countermeasures to Western military technology, but hampered by sanctions and limited access to foreign technology.

- Regulatory Framework: Stringent and government-controlled, favoring domestic players and limiting foreign participation.

- Competitive Product Substitutes: Limited availability due to sanctions and domestic production focus.

- End-User Demographics: Primarily the Russian Armed Forces (Army, Navy, Air Force), with potential for limited export markets.

- M&A Trends: Government-led consolidation and restructuring of defense enterprises, resulting in xx M&A deals in the past 5 years.

Russia Defense Market Growth Trends & Insights

The Russia defense market exhibits consistent growth driven by increased defense spending and modernization programs. The market size has grown steadily over the past five years and is expected to maintain a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching an estimated xx million units by 2033. This growth is influenced by geopolitical factors, technological advancements in areas such as unmanned systems and hypersonic weapons, and ongoing military conflicts. Increased adoption rates of advanced technologies and shifts in consumer behavior, particularly a focus on domestically produced equipment, further contribute to this growth. Market penetration of new technologies varies by segment, with faster adoption rates observed in weapons and ammunition and unmanned systems.

Dominant Regions, Countries, or Segments in Russia Defense Market

The Russian Federation itself dominates the market, with all major segments (By Type: Fixed Wing, Rotorcraft, Ground Vehicles, Naval Vessels, C4ISR, Weapons and Ammunition, Protection and Training Equipment, Unmanned Systems; By Armed Forces: Army, Navy, Air Force) concentrated within its borders.

- Army: Dominates in terms of spending and equipment procurement, driven by modernization programs focusing on ground forces.

- Weapons and Ammunition: This segment represents a significant portion of market revenue, owing to ongoing conflicts and the need for continuous supply.

- Ground Vehicles: High demand due to the modernization of ground forces and ongoing conflicts.

- Key Drivers: Increased defense budgets, modernization programs of all armed forces, geopolitical instability.

Russia Defense Market Product Landscape

The Russian defense industry focuses on the development and production of advanced weaponry, including hypersonic missiles, advanced fighter jets, and modernized ground vehicles. A key feature is the emphasis on domestic production to reduce reliance on foreign technology. Unique selling propositions center around cost-effectiveness, suitability for harsh environments, and tailored solutions for the specific needs of the Russian military. Technological advancements focus on areas like stealth technology, AI integration, and enhanced precision strike capabilities.

Key Drivers, Barriers & Challenges in Russia Defense Market

Key Drivers:

- Increased defense spending by the Russian government.

- Modernization programs aiming to enhance military capabilities.

- Geopolitical factors driving the demand for advanced weaponry.

Challenges & Restraints:

- International sanctions impacting access to crucial technologies and components.

- Supply chain disruptions due to sanctions and geopolitical tensions.

- Competition from other global defense manufacturers despite limitations. The impact on the market is estimated at xx million units annually in lost production potential.

Emerging Opportunities in Russia Defense Market

- Growth in unmanned systems (drones, UAVs) for intelligence, surveillance, and reconnaissance.

- Increased investment in cyber warfare capabilities.

- Development of advanced electronic warfare systems.

- Expansion into export markets, albeit limited by geopolitical sanctions.

Growth Accelerators in the Russia Defense Market Industry

Long-term growth will be fueled by ongoing defense modernization programs, the development and deployment of next-generation weapons systems, and the increasing focus on technological advancements, such as AI and hypersonic technology. Strategic partnerships and joint ventures with other nations could also unlock significant growth potential, although currently limited by international relations.

Key Players Shaping the Russia Defense Market Market

- Uralvagonzavod

- Russian Helicopters

- United Aircraft Corporation

- Kalashnikov Concern JS

- Almaz-Antey

- Tactical Missiles Corporation

- United Shipbuilding Corporation

Notable Milestones in Russia Defense Market Sector

- August 2022: Russia's Tactical Missile Corporation displayed the Kh-69 stealth cruise missile at the Army-2022 exhibition. This signifies advancements in cruise missile technology and potential market expansion.

- May 2022: Uralvagonzavod delivered a batch of T-90M "Proryv" tanks to the Ministry of Defense. This highlights continued modernization efforts within the ground forces segment.

In-Depth Russia Defense Market Market Outlook

The Russia defense market is poised for continued growth throughout the forecast period, driven by sustained government investment in modernization and technological advancements. Strategic opportunities exist in the development and export of advanced weaponry, unmanned systems, and cyber warfare capabilities, although geopolitical factors and sanctions will continue to shape market dynamics. The focus on domestic production and technological self-reliance will remain a key theme, creating unique opportunities for Russian defense companies.

Russia Defense Market Segmentation

-

1. Armed Forces

- 1.1. Army

- 1.2. Navy

- 1.3. Air Force

-

2. Type

- 2.1. Fixed Wing

- 2.2. Rotorcraft

- 2.3. Ground Vehicles

- 2.4. Naval Vessels

- 2.5. C4ISR

- 2.6. Weapons and Ammunition

- 2.7. Protection and Training Equipment

- 2.8. Unmanned Systems

Russia Defense Market Segmentation By Geography

- 1. Russia

Russia Defense Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Russo-Ukraine War Expected to Drive Significant Defense Investments

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Defense Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 5.1.1. Army

- 5.1.2. Navy

- 5.1.3. Air Force

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Fixed Wing

- 5.2.2. Rotorcraft

- 5.2.3. Ground Vehicles

- 5.2.4. Naval Vessels

- 5.2.5. C4ISR

- 5.2.6. Weapons and Ammunition

- 5.2.7. Protection and Training Equipment

- 5.2.8. Unmanned Systems

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Armed Forces

- 6. Western Russia Russia Defense Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Defense Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Defense Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Defense Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Uralvagonzavod

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Russian Helicopters

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 United Aircraft Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kalashnikov Concern JS

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Almaz-Antey

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tactical Missiles Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 United Shipbuilding Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Uralvagonzavod

List of Figures

- Figure 1: Russia Defense Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Defense Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Defense Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Defense Market Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 3: Russia Defense Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Russia Defense Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russia Defense Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Western Russia Russia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Russia Russia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Russia Russia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern Russia Russia Defense Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Russia Defense Market Revenue Million Forecast, by Armed Forces 2019 & 2032

- Table 11: Russia Defense Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Russia Defense Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Defense Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Russia Defense Market?

Key companies in the market include Uralvagonzavod, Russian Helicopters, United Aircraft Corporation, Kalashnikov Concern JS, Almaz-Antey, Tactical Missiles Corporation, United Shipbuilding Corporation.

3. What are the main segments of the Russia Defense Market?

The market segments include Armed Forces, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Russo-Ukraine War Expected to Drive Significant Defense Investments.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In August 2022, Russia's Tactical Missile Corporation displayed a new stealth cruise missile, the Kh-69, at the Army-2022 exhibition near Moscow.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Defense Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Defense Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Defense Market?

To stay informed about further developments, trends, and reports in the Russia Defense Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence