Key Insights

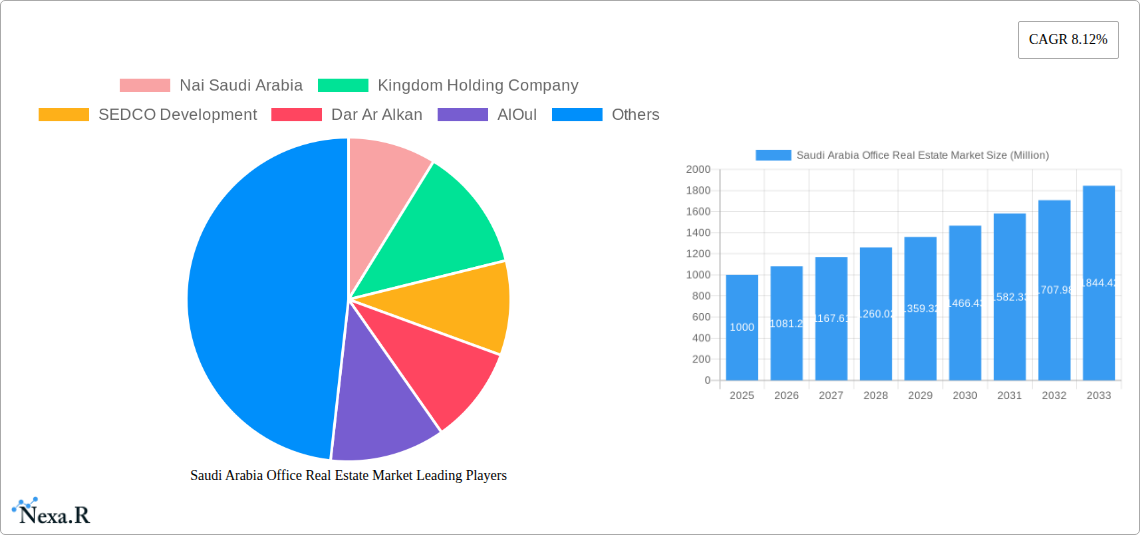

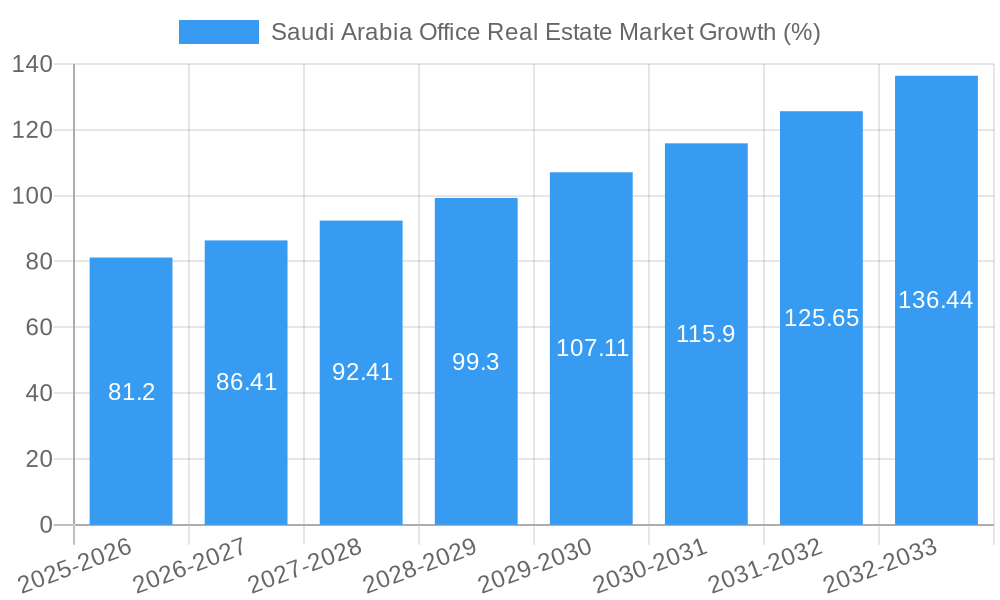

The Saudi Arabian office real estate market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 8.12% from 2025 to 2033. This expansion is fueled by several key factors. The Kingdom's Vision 2030 initiative, aimed at diversifying the economy and fostering private sector growth, is a significant catalyst. Increased foreign direct investment (FDI), spurred by economic reforms and infrastructure development, is leading to heightened demand for office space, particularly in major cities like Riyadh and Jeddah. Furthermore, the burgeoning technology sector and the expansion of existing businesses are contributing to this surge in demand. The growth is not uniform across all regions, with Riyadh and Jeddah expected to dominate the market share due to their established business hubs and concentration of multinational corporations.

However, the market also faces certain challenges. Potential restraints include fluctuations in oil prices, which can impact overall economic activity, and the ongoing development of flexible work arrangements, which might influence the demand for traditional office spaces. The market is segmented geographically by key cities (Riyadh, Jeddah, Makkah, and other cities) and regionally (Central, Eastern, Western, and Southern Saudi Arabia). Key players like Nai Saudi Arabia, Kingdom Holding Company, and SEDCO Development are actively shaping the market landscape through developments and investments. The forecast period of 2025-2033 offers significant opportunities for investors and developers, provided they navigate the market's nuances effectively and adapt to evolving trends. Careful consideration of factors like sustainability, technological integration, and evolving workplace preferences will be crucial for success.

Saudi Arabia Office Real Estate Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia office real estate market, offering invaluable insights for investors, developers, and industry professionals. We delve into market dynamics, growth trends, key players, and future opportunities across key cities like Riyadh, Jeddah, and Makkah, providing a detailed forecast from 2025 to 2033. The report covers the historical period (2019-2024), with 2025 as the base and estimated year. This analysis uses data to provide accurate predictions until 2033, enabling informed decision-making in this dynamic sector.

Study Period: 2019-2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025-2033 Historical Period: 2019-2024

Saudi Arabia Office Real Estate Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory environment, and key trends influencing the Saudi Arabian office real estate sector. The market is characterized by a moderate level of concentration, with a few large players holding significant market share, while smaller firms cater to niche segments. Technological innovations, such as smart building technologies and improved property management systems, are gradually transforming the industry. The regulatory framework, while evolving, plays a crucial role in shaping market dynamics. The emergence of flexible workspaces and co-working spaces presents a competitive substitute to traditional office spaces. The end-user demographics comprise a diverse range of businesses, from SMEs to large multinational corporations, while M&A activity has been steadily increasing in recent years.

- Market Concentration: Moderate, with a few dominant players holding xx% of market share.

- Technological Innovation: Adoption of smart building technologies increasing at xx% CAGR.

- Regulatory Framework: Government initiatives focusing on diversification and infrastructure development.

- Competitive Substitutes: Rise of co-working spaces and flexible office solutions impacting demand.

- End-User Demographics: Diverse mix of SMEs and large corporations driving demand across various segments.

- M&A Trends: xx billion SAR in M&A deals recorded in the past five years, indicating consolidation.

Saudi Arabia Office Real Estate Market Growth Trends & Insights

The Saudi Arabian office real estate market has witnessed substantial growth in recent years, driven by factors such as economic diversification, infrastructural development, and increasing urbanization. The market size is expected to reach xx billion SAR by 2033, exhibiting a compound annual growth rate (CAGR) of xx% during the forecast period. This growth is propelled by strong demand from various sectors, including finance, technology, and government. The market penetration of smart building technologies is also expected to increase significantly during the forecast period, leading to increased efficiency and sustainability. The changing consumer behavior, favoring flexible and collaborative workspaces, is also shaping market dynamics, further enhancing the rate of technological disruption.

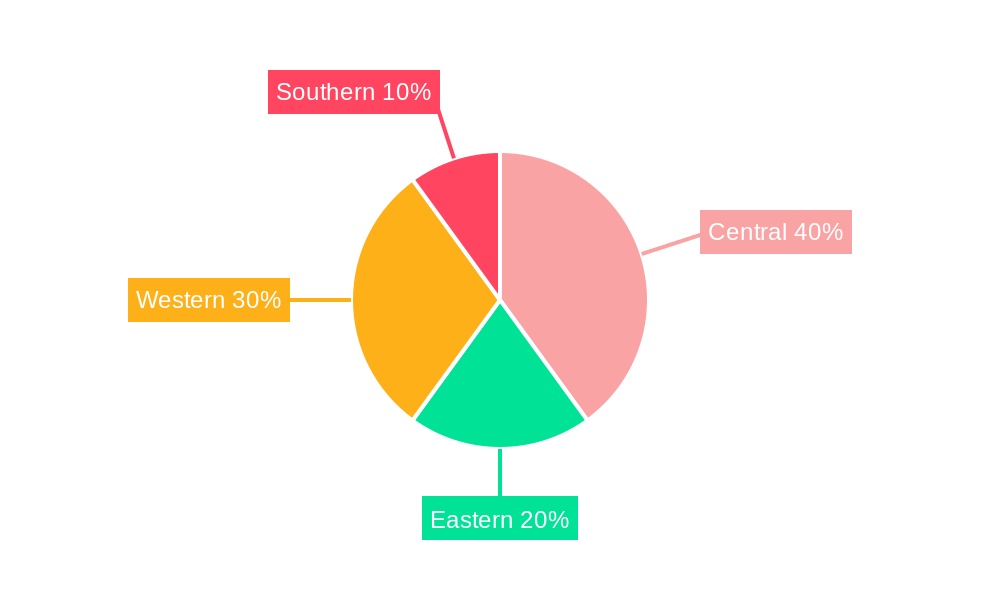

Dominant Regions, Countries, or Segments in Saudi Arabia Office Real Estate Market

Riyadh, as the capital city and major economic hub, dominates the Saudi Arabian office real estate market. It accounts for the largest share of office space, driven by the presence of government entities, major corporations, and thriving commercial activities. Jeddah, another significant economic center, commands a substantial market share, fueled by its prominence as a port city and its robust industrial and business activities. Makkah, while exhibiting a comparatively smaller market share, benefits from significant religious tourism and related commercial activities. Other cities also contribute to the overall market growth.

- Riyadh: High concentration of corporate headquarters, government offices, and commercial businesses.

- Jeddah: Strong industrial sector, port activities, and thriving commercial center.

- Makkah: Religious tourism driving demand for short-term and long-term office spaces.

- Other Cities: Gradual expansion and diversification of office space across secondary and tertiary markets.

Saudi Arabia Office Real Estate Market Product Landscape

The Saudi Arabian office real estate market features a range of office spaces, from traditional office buildings to modern, technologically advanced smart buildings. The market is seeing a rise in the popularity of flexible office spaces, co-working spaces, and serviced offices. There is also a growing demand for sustainable and environmentally friendly office buildings, reflecting increased awareness of environmental concerns. Key features driving product differentiation include amenities such as advanced security systems, high-speed internet, and energy-efficient designs. Innovative solutions such as modular office spaces and build-to-suit options are also emerging.

Key Drivers, Barriers & Challenges in Saudi Arabia Office Real Estate Market

Key Drivers:

- Vision 2030's economic diversification initiatives are driving investments in infrastructure and real estate.

- Growing foreign direct investment (FDI) is increasing demand for high-quality office spaces.

- Rapid urbanization and population growth are creating a surge in demand for office accommodations.

Challenges and Restraints:

- High construction costs and limited availability of skilled labor.

- Regulatory hurdles and bureaucratic processes can hinder development projects.

- Fluctuations in oil prices, impacting investor confidence.

- Competition from alternative workspace models such as co-working spaces.

Emerging Opportunities in Saudi Arabia Office Real Estate Market

The Saudi Arabian office real estate market presents several promising opportunities. The rising demand for sustainable and environmentally friendly office spaces creates an opportunity for developers to build green buildings. Furthermore, the growth of the technology sector and increasing digitalization offer opportunities to develop and market technologically advanced smart office spaces. The focus on enhancing quality of life and creating vibrant communities opens doors for integrated developments.

Growth Accelerators in the Saudi Arabia Office Real Estate Market Industry

Saudi Arabia's Vision 2030 is a primary catalyst, driving economic diversification and infrastructure development. This, combined with sustained FDI and the country's growing population, fuels considerable long-term growth. Technological advancements, such as smart building technologies and improved property management systems, are increasing efficiency and sustainability. Strategic partnerships between local and international developers are further accelerating the market's expansion.

Key Players Shaping the Saudi Arabia Office Real Estate Market Market

- Nai Saudi Arabia

- Kingdom Holding Company

- SEDCO Development

- Dar Al Arkan

- AlOul

- Abdul Latif Jameel

- JLL Riyadh

- Century 21 Saudi Arabia

- Saudi Real Estate Company

Notable Milestones in Saudi Arabia Office Real Estate Market Sector

- November 2022: Arabian Centres Company's sale of non-core assets (2 billion SAR) to Adeer Real Estate for potential office development.

- October 2022: Ajdan Real Estate's contract with Al-Muhaidib Group to develop the Bayfront commercial project (250 million SAR) in Al-Khobar.

In-Depth Saudi Arabia Office Real Estate Market Market Outlook

The Saudi Arabian office real estate market holds immense potential for long-term growth. Vision 2030's continued implementation, coupled with ongoing infrastructural advancements and increased foreign investment, will propel market expansion. The adoption of sustainable practices and technological innovation further enhances the sector's appeal to both domestic and international players, creating significant strategic opportunities for investors and developers alike. The focus on developing smart cities and creating world-class infrastructure will continue to attract investors in the years ahead.

Saudi Arabia Office Real Estate Market Segmentation

-

1. Key Cities

- 1.1. Riyadh

- 1.2. Jeddah

- 1.3. Makkah

- 1.4. Other Cities

Saudi Arabia Office Real Estate Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Office Spaces in Key Commercial Cities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 5.1.1. Riyadh

- 5.1.2. Jeddah

- 5.1.3. Makkah

- 5.1.4. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 6. Central Saudi Arabia Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Office Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nai Saudi Arabia

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kingdom Holding Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 SEDCO Development

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Dar Ar Alkan

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 AlOul

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Abdul Latif Jameel

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 JLL Riyadh

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Century 21 Saudi Arabia

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Saudi Real Estate Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Nai Saudi Arabia

List of Figures

- Figure 1: Saudi Arabia Office Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Office Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Office Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 3: Saudi Arabia Office Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Saudi Arabia Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Central Saudi Arabia Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Eastern Saudi Arabia Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Saudi Arabia Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Saudi Arabia Office Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Office Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 10: Saudi Arabia Office Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Office Real Estate Market?

The projected CAGR is approximately 8.12%.

2. Which companies are prominent players in the Saudi Arabia Office Real Estate Market?

Key companies in the market include Nai Saudi Arabia, Kingdom Holding Company, SEDCO Development, Dar Ar Alkan, AlOul, Abdul Latif Jameel, JLL Riyadh, Century 21 Saudi Arabia, Saudi Real Estate Company.

3. What are the main segments of the Saudi Arabia Office Real Estate Market?

The market segments include Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Increasing Demand for Office Spaces in Key Commercial Cities.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

November 2022: Arabian Centres Company, Saudi Arabia's largest mall operator, has agreed to sell non-core assets worth 2 billion Saudi riyals to Adeer Real Estate. A study determined that the assets were best suited for residential or office space development rather than supporting the mall operator's strategic priorities of developing lifestyle destinations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence