Key Insights

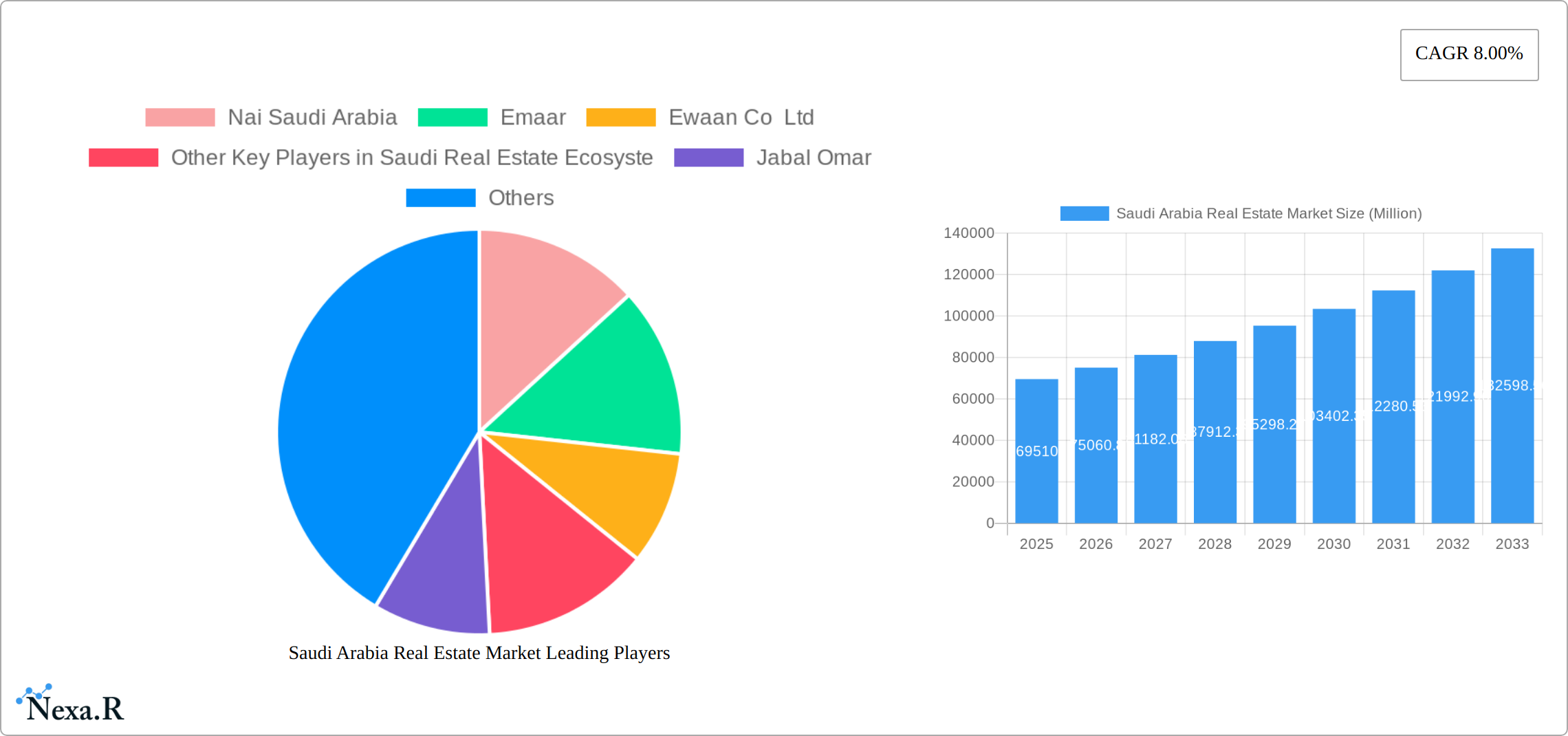

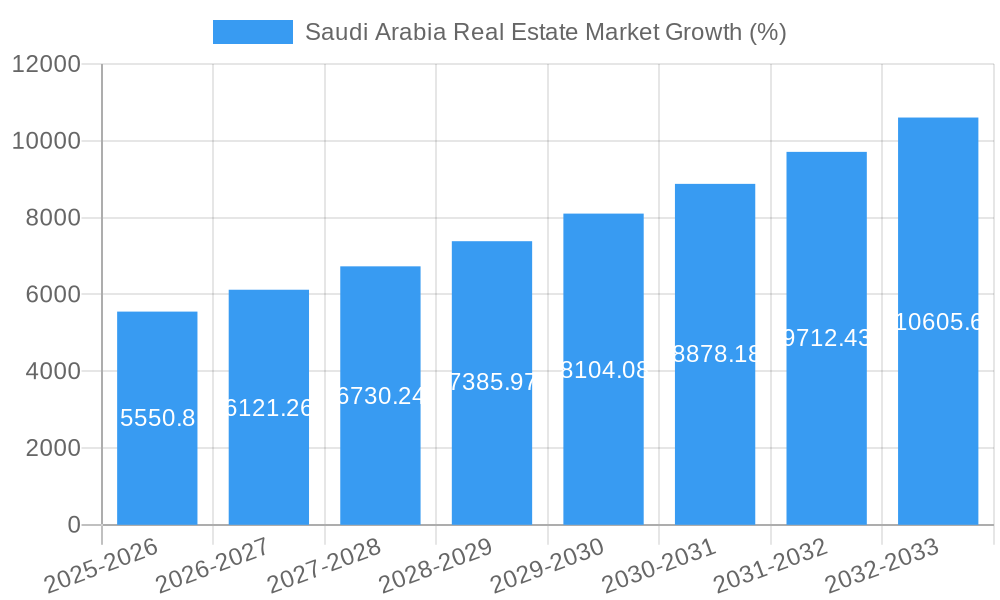

The Saudi Arabian real estate market, valued at $69.51 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 8% from 2025 to 2033. This expansion is fueled by several key drivers. Government initiatives like Vision 2030, aimed at diversifying the economy and improving infrastructure, are significantly boosting investment and development. A growing population, increasing urbanization, and rising disposable incomes are also driving demand for both residential and commercial properties. The residential sector, encompassing various property types, is a major contributor to this growth, propelled by increased demand from both Saudi nationals and expatriates. The commercial real estate sector is similarly experiencing growth, driven by burgeoning business activity and the expansion of various industries within the Kingdom. While challenges such as fluctuating oil prices and potential regulatory changes exist, the overall outlook remains positive, with a significant long-term growth trajectory expected.

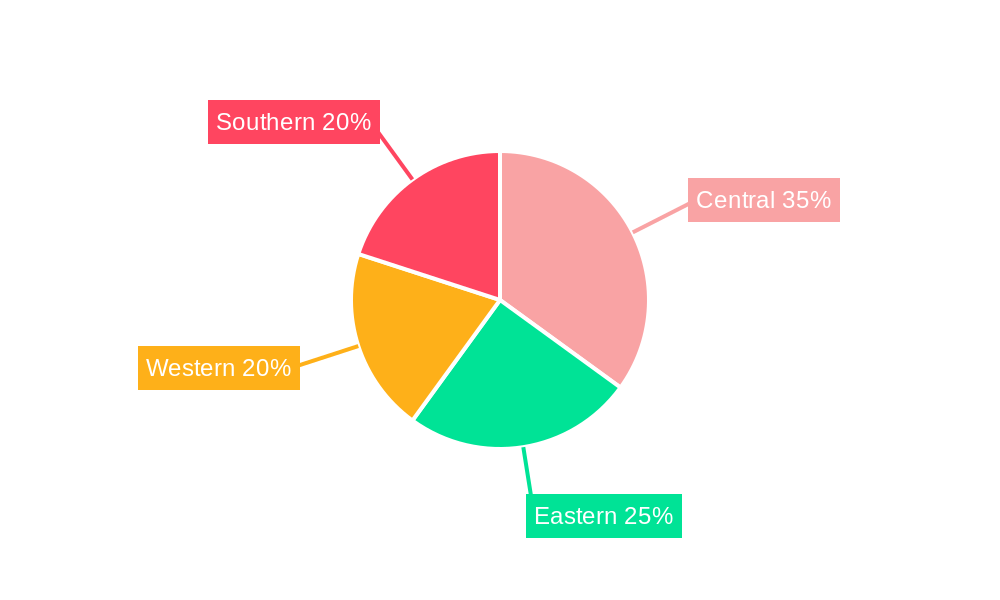

The market is segmented geographically, with Central, Eastern, Western, and Southern regions contributing differentially to the overall market value. Major players like Emaar, Jabal Omar, Kingdom Holding Company, and several other prominent national and international companies are actively shaping market dynamics through large-scale projects and development initiatives. Competition is intense, with both established players and new entrants vying for market share. This competitive landscape is likely to further drive innovation and efficiency improvements within the sector. Future growth will depend on continued government support, efficient regulatory frameworks, and the ability of developers to meet the evolving demands of a dynamic and expanding population. The market's potential attracts both domestic and foreign investment, further fueling the expansion and diversification of the Saudi Arabian real estate landscape.

Saudi Arabia Real Estate Market: Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia real estate market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by property type (Residential and Commercial) and analyzes key regional variations. This report is essential for real estate investors, developers, policymakers, and industry professionals seeking to understand and capitalize on opportunities within this rapidly evolving market.

Saudi Arabia Real Estate Market Market Dynamics & Structure

The Saudi Arabian real estate market exhibits a dynamic interplay of factors influencing its structure and growth. Market concentration is moderate, with several major players alongside numerous smaller firms. Technological innovations, particularly in construction techniques and property management, are steadily gaining traction, although barriers such as initial investment costs and workforce training remain. The regulatory framework, under continuous evolution, plays a crucial role in shaping market access and investment attractiveness. The market witnesses a considerable influence from substitute products like serviced apartments and co-living spaces, impacting the demand for traditional housing. End-user demographics show a growing young population driving the need for affordable housing, while the high-net-worth individual segment fuels the luxury real estate sector. Mergers and acquisitions (M&A) activity is substantial, particularly amongst REITs (Real Estate Investment Trusts), indicating market consolidation and capital inflow.

- Market Concentration: Moderate, with a few dominant players and numerous smaller firms. Market share distribution among top 5 players: xx%.

- Technological Innovation: Growing adoption of BIM (Building Information Modeling), smart home technology, and proptech solutions. Barriers include high initial costs and skill gaps.

- Regulatory Framework: Government initiatives focused on Vision 2030 are actively reshaping regulations, encouraging foreign investment, and fostering sustainable development.

- Competitive Product Substitutes: Serviced apartments and co-living spaces pose increasing competition to traditional housing.

- End-User Demographics: A young and growing population drives demand for affordable housing, while high-net-worth individuals fuel luxury segments.

- M&A Trends: Significant M&A activity, especially within the REIT sector, signifying ongoing market consolidation. Volume of M&A deals in 2024: xx Million USD.

Saudi Arabia Real Estate Market Growth Trends & Insights

The Saudi Arabian real estate market is projected to experience robust growth during the forecast period. Driven by government initiatives like Vision 2030 and substantial investments in infrastructure, the market shows promising prospects. Adoption rates of sustainable building practices and innovative technologies are increasing steadily. Consumer behaviour is shifting towards greater preference for smart homes and sustainable living spaces. The market size is experiencing a compound annual growth rate (CAGR) of xx% during 2025-2033, with market penetration rates consistently improving across various segments.

Dominant Regions, Countries, or Segments in Saudi Arabia Real Estate Market

Riyadh and Jeddah lead the Saudi Arabian real estate market, experiencing significant growth in both residential and commercial sectors. The residential sector enjoys a greater share of the market size, followed by the commercial sector, in relation to total market value. The dominance of these regions is driven by robust economic activity, government infrastructure projects (e.g., NEOM), and a high concentration of population and employment opportunities. Other factors include improved transportation infrastructure and the ongoing diversification of the Saudi Arabian economy.

- Key Drivers for Riyadh and Jeddah:

- Strong economic activity and job creation.

- Government infrastructure investments.

- High population density and demand for housing.

- Favorable regulatory environment.

- Market Share: Riyadh holds xx% of the market share, while Jeddah holds xx%. Growth Potential: Both regions are projected to maintain strong growth rates for the foreseeable future.

Saudi Arabia Real Estate Market Product Landscape

The Saudi Arabian real estate market showcases a growing diversity of product offerings. Innovations focus on sustainable construction materials, smart home technology integration, and efficient building designs. This leads to enhanced energy efficiency and improved living experiences for residents. The emphasis is on creating high-quality, functional spaces that align with modern living standards and cater to evolving consumer preferences.

Key Drivers, Barriers & Challenges in Saudi Arabia Real Estate Market

Key Drivers: Government initiatives like Vision 2030, infrastructure development projects, population growth, and increased foreign investment are major catalysts for growth. The increasing diversification of the Saudi economy and associated job creation also fuel market expansion.

Challenges: Supply chain disruptions (particularly concerning construction materials), regulatory complexities, and intense competition among developers present significant hurdles. Land scarcity in prime locations further constrains market expansion. The impact of these challenges can be quantified through delays in project completion and increased costs.

Emerging Opportunities in Saudi Arabia Real Estate Market

Untapped opportunities exist in developing affordable housing solutions, targeting the growing middle-income segment. The potential for integrating renewable energy technologies into new constructions is significant. Furthermore, creating specialized properties for specific demographics, such as senior living facilities, represents a promising avenue for growth. The increasing awareness of sustainability is also creating opportunities for eco-friendly developments.

Growth Accelerators in the Saudi Arabia Real Estate Market Industry

Technological advancements in construction and property management, coupled with strategic partnerships between domestic and international companies, are set to propel market growth. The government's continued investment in infrastructure, alongside the successful implementation of Vision 2030 initiatives, offers substantial momentum for long-term development within the real estate sector. Strategic partnerships focused on knowledge transfer and technology integration are critical in this acceleration.

Key Players Shaping the Saudi Arabia Real Estate Market Market

- Nai Saudi Arabia

- Emaar

- Ewaan Co Ltd

- Other Key Players in Saudi Real Estate Ecosystem

- Jabal Omar

- Kingdom Holding Company

- Jenan Real Estate Company

- Abdul Latif Jameel

- Sedco Development

- JLL Riyadh

- Dar Ar Alkan

- 6 3 Other Companies

- Century 21 Saudi Arabia

- Saudi Real Estate Company

- Al Saedan Real Estate

Notable Milestones in Saudi Arabia Real Estate Market Sector

- July 2022: SEDCO Capital REIT Fund acquires two income-generating real estate assets worth SR700 million (USD 187 million) in Riyadh and Jeddah, boosting the REIT sector's investment activity.

- May 2023: The National Security Services Company (SAFE) acquires ABANA Enterprises Group Company's assets related to cash and valuable goods transit, impacting the security services sector's real estate needs.

In-Depth Saudi Arabia Real Estate Market Market Outlook

The Saudi Arabian real estate market exhibits strong growth potential, fuelled by Vision 2030's ambitious goals, strategic infrastructure investments, and a supportive regulatory environment. Opportunities abound in sustainable development, affordable housing, and technological integration within the sector. Strategic partnerships and innovative approaches to construction and property management will define the market's future success. The market is poised for continued expansion, with significant potential for both domestic and international players.

Saudi Arabia Real Estate Market Segmentation

-

1. Property Type

-

1.1. Residential Real Estate

- 1.1.1. Apartments

- 1.1.2. Villas

-

1.2. Commercial Real Estate

- 1.2.1. Offices

- 1.2.2. Retail

- 1.2.3. Hospitality

- 1.2.4. Others

-

1.1. Residential Real Estate

Saudi Arabia Real Estate Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges

- 3.4. Market Trends

- 3.4.1. The Residential Sector Sustains Country's Real Estate Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Residential Real Estate

- 5.1.1.1. Apartments

- 5.1.1.2. Villas

- 5.1.2. Commercial Real Estate

- 5.1.2.1. Offices

- 5.1.2.2. Retail

- 5.1.2.3. Hospitality

- 5.1.2.4. Others

- 5.1.1. Residential Real Estate

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. Central Saudi Arabia Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nai Saudi Arabia

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Emaar

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Ewaan Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Other Key Players in Saudi Real Estate Ecosyste

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Jabal Omar

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Kingdom Holding Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Jenan Real Estate Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Abdul Latif Jameel

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sedco Development

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 JLL Riyadh

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Dar Ar Alkan**List Not Exhaustive 6 3 Other Companies

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Century 21 Saudi Arabia

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Saudi Real Estate Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Al Saedan Real Estate

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Nai Saudi Arabia

List of Figures

- Figure 1: Saudi Arabia Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Real Estate Market Revenue Million Forecast, by Property Type 2019 & 2032

- Table 3: Saudi Arabia Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Saudi Arabia Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Central Saudi Arabia Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Eastern Saudi Arabia Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Saudi Arabia Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Saudi Arabia Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Real Estate Market Revenue Million Forecast, by Property Type 2019 & 2032

- Table 10: Saudi Arabia Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Real Estate Market?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Saudi Arabia Real Estate Market?

Key companies in the market include Nai Saudi Arabia, Emaar, Ewaan Co Ltd, Other Key Players in Saudi Real Estate Ecosyste, Jabal Omar, Kingdom Holding Company, Jenan Real Estate Company, Abdul Latif Jameel, Sedco Development, JLL Riyadh, Dar Ar Alkan**List Not Exhaustive 6 3 Other Companies, Century 21 Saudi Arabia, Saudi Real Estate Company, Al Saedan Real Estate.

3. What are the main segments of the Saudi Arabia Real Estate Market?

The market segments include Property Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 69.51 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units.

6. What are the notable trends driving market growth?

The Residential Sector Sustains Country's Real Estate Market.

7. Are there any restraints impacting market growth?

4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges.

8. Can you provide examples of recent developments in the market?

May 2023, The National Security Services Company (SAFE), which leads the transformation of the local security services sector, has signed an acquisition agreement to acquire ABANA Enterprises Group Company's assets connected to the transit of cash and valuable goods. ABANA Enterprises Group Company is at the forefront of providing such services in the Kingdom. The acquisition of ABANA Enterprises Group Company's assets connected to the transit of cash and valuable goods will help SAFE achieve its primary goal of providing the most advanced security solutions and services for customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Real Estate Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence