Key Insights

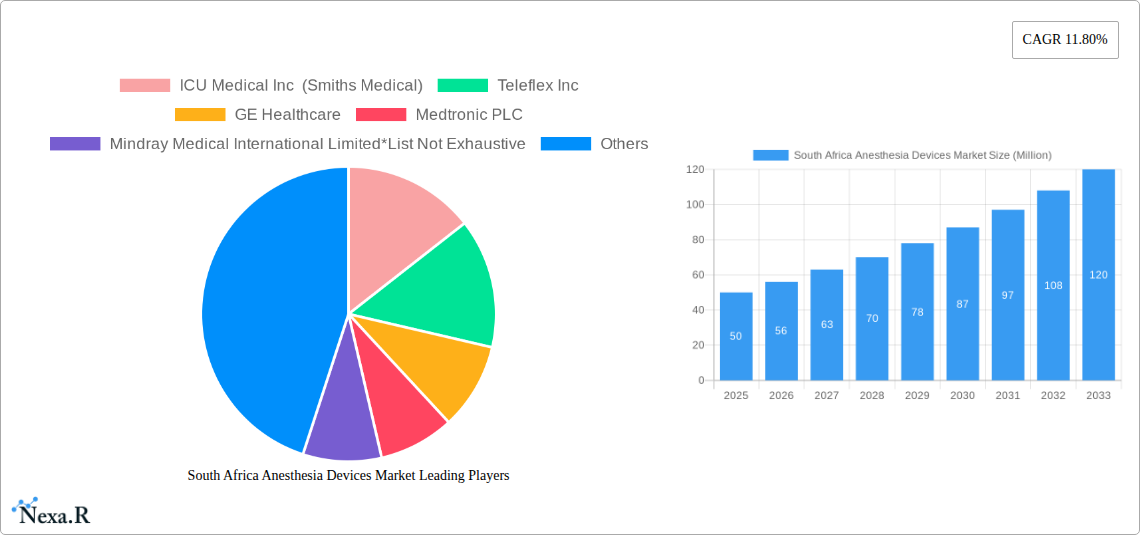

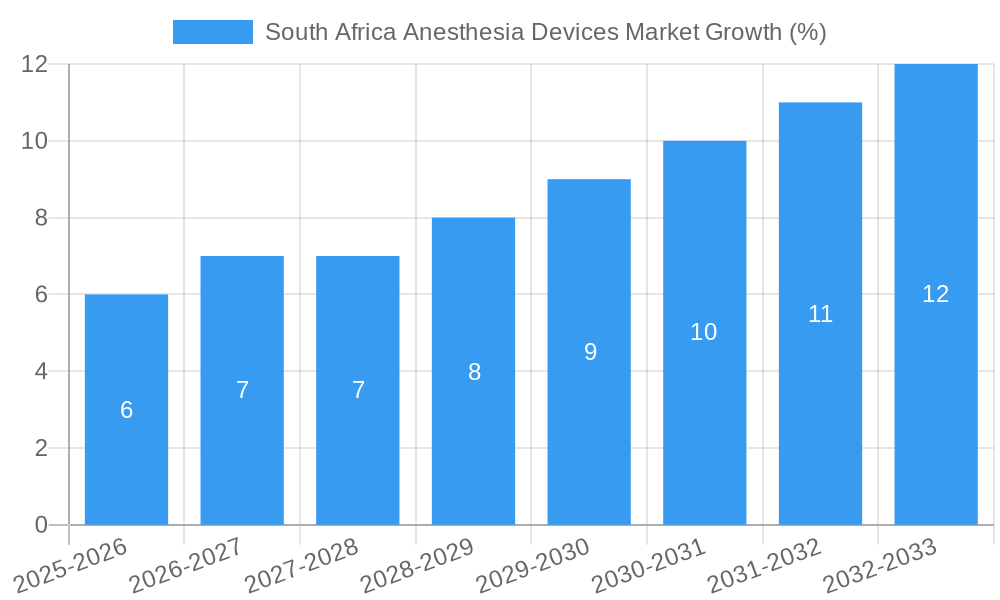

The South African anesthesia devices market, while a segment of a larger global market exhibiting a Compound Annual Growth Rate (CAGR) of 11.80%, presents unique opportunities and challenges. Considering the global CAGR and the increasing demand for advanced medical technologies in developing economies, we can project a robust growth trajectory for South Africa. Factors driving market expansion include the rising prevalence of chronic diseases necessitating surgical interventions, improvements in healthcare infrastructure, and a growing focus on minimally invasive surgical techniques. The increasing number of surgical procedures and a rise in the geriatric population further fuel this demand. While precise market sizing for South Africa isn't provided, a reasonable estimation can be made by considering regional factors. Given Africa's projected market growth and South Africa's relatively advanced healthcare system compared to other African nations, we can infer a significant, albeit smaller, market share within the African continent. This segment is likely driven by the demand for both anesthesia machines and disposables/accessories, with a potential skew towards the latter due to cost-effectiveness and frequency of replacement. The market is likely fragmented, with both multinational corporations like GE Healthcare and Medtronic, and local distributors playing significant roles.

However, restraining factors like the high cost of advanced anesthesia devices, limited healthcare budgets in certain regions within the country, and potential regulatory hurdles might influence market growth. The market is expected to witness increased adoption of technologically advanced anesthesia devices such as those offering enhanced monitoring capabilities and improved patient safety features. This trend is likely to be spurred by increasing physician awareness and patient demand for improved healthcare outcomes. Strategic partnerships between international players and local healthcare providers are likely to be crucial in navigating the market's complexities and achieving broader market penetration in under-served areas within South Africa. Further market segmentation analysis, including data on public versus private sector procurement, would enhance the understanding of the market dynamics.

South Africa Anesthesia Devices Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South Africa anesthesia devices market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report segments the market by product type (Anesthesia Machines, Anesthesia Monitors: Disposables and Accessories) offering granular insights into this vital healthcare sector. The parent market is the South African medical devices market, while the child market focuses specifically on anesthesia equipment. The total market value is predicted to reach xx Million units by 2033.

South Africa Anesthesia Devices Market Dynamics & Structure

The South African anesthesia devices market is characterized by a moderately concentrated landscape, with key players such as ICU Medical Inc (Smiths Medical), Teleflex Inc, GE Healthcare, Medtronic PLC, Mindray Medical International Limited, Koninklijke Philips NV, B. Braun Melsungen AG, Aspen, and Draegerwerk AG holding significant market share. Market concentration is estimated at xx% in 2025.

- Technological Innovation: Continuous advancements in monitoring capabilities, minimally invasive techniques, and improved drug delivery systems are key drivers. However, high initial investment costs and the need for skilled professionals represent barriers to widespread adoption.

- Regulatory Framework: Stringent regulatory requirements, such as those set by the South African Health Products Regulatory Authority (SAHPRA), influence market entry and product approval processes.

- Competitive Landscape: Intense competition among established players and emerging market entrants fosters innovation and price competitiveness. Strategic partnerships and acquisitions (M&A) are common strategies to expand market reach and product portfolios. The volume of M&A deals in the period 2019-2024 was xx.

- End-User Demographics: Growth is driven by increasing surgical procedures, a rising elderly population, and expanding access to healthcare services in both public and private sectors.

- Substitute Products: While limited, alternative anesthesia techniques and simpler devices pose indirect competitive pressures.

South Africa Anesthesia Devices Market Growth Trends & Insights

The South African anesthesia devices market exhibited a CAGR of xx% during the historical period (2019-2024), reaching a market size of xx Million units in 2024. This growth is projected to continue at a CAGR of xx% during the forecast period (2025-2033), driven by factors such as increasing healthcare expenditure, technological advancements, and government initiatives to improve healthcare infrastructure. Market penetration of advanced anesthesia devices remains relatively low, presenting significant growth opportunities. Technological disruptions, such as the introduction of AI-powered anesthesia monitoring systems, are anticipated to further accelerate market growth. Shifts in consumer behavior, including increasing demand for minimally invasive procedures, also contribute positively. The market penetration rate for advanced anesthesia devices is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in South Africa Anesthesia Devices Market

The Gauteng province, due to its concentration of major hospitals and medical facilities, holds the largest market share for anesthesia devices. Within the product segments, Anesthesia Machines dominate the market, accounting for xx% of the total market value in 2025, followed by Anesthesia Monitors and Disposables and Accessories.

- Key Drivers for Gauteng's Dominance:

- High concentration of healthcare facilities and specialized hospitals.

- Significant investment in healthcare infrastructure and technological advancements.

- Strong presence of major medical device distributors and manufacturers.

- Anesthesia Machine Segment Dominance:

- Growing demand for advanced features like sophisticated monitoring and ventilation capabilities.

- Increased adoption in private and public hospitals.

- Technological improvements, including ease of use and integration with other devices.

South Africa Anesthesia Devices Market Product Landscape

The market showcases a diverse range of anesthesia devices, from basic to advanced models featuring sophisticated monitoring, ventilation, and drug delivery systems. Key innovations include portable and wireless monitors, integrated systems offering streamlined workflows, and enhanced safety features to minimize risks. The focus is on improving patient safety, increasing efficiency in operating rooms, and reducing the overall cost of care. Unique selling propositions center around ease of use, integration, advanced monitoring, and improved patient outcomes.

Key Drivers, Barriers & Challenges in South Africa Anesthesia Devices Market

Key Drivers: Growing prevalence of chronic diseases requiring surgery, rising healthcare expenditure, government initiatives promoting healthcare infrastructure development, and technological advancements in anesthesia devices drive market growth.

Challenges & Restraints: High costs of advanced devices, limited healthcare infrastructure in rural areas, and the need for skilled professionals to operate these technologies hinder wider adoption. Supply chain disruptions can also impact market availability and pricing. The estimated impact of supply chain issues on market growth is a reduction of xx% in 2024.

Emerging Opportunities in South Africa Anesthesia Devices Market

Untapped markets in rural areas, the increasing adoption of minimally invasive surgical procedures, and the rising demand for advanced anesthesia monitoring and patient management systems create significant opportunities. The focus on tele-anesthesia and remote patient monitoring holds future growth potential.

Growth Accelerators in the South Africa Anesthesia Devices Market Industry

Technological breakthroughs in AI-powered anesthesia management, strategic partnerships between manufacturers and healthcare providers, and expansion into underserved markets will be critical for long-term growth. Initiatives to enhance training and education for healthcare professionals are crucial in maximizing the benefits of new technologies.

Key Players Shaping the South Africa Anesthesia Devices Market Market

- ICU Medical Inc (Smiths Medical)

- Teleflex Inc

- GE Healthcare

- Medtronic PLC

- Mindray Medical International Limited

- Koninklijke Philips NV

- B. Braun Melsungen AG

- Aspen

- Draegerwerk AG

Notable Milestones in South Africa Anesthesia Devices Market Sector

- October 2021: Aspen launched one of the leading anesthetics production lines with an investment of USD 204 million in South Africa. This significantly boosted local anesthetic production capacity and strengthened the domestic supply chain.

- September 2022: Gradian Health Systems and Penlon launched the Prima Anesthesia Machine, a high-specification anesthesia machine designed for use in busy operating rooms in South Africa and 49 other African countries. This introduction enhanced the availability of advanced anesthesia technology in the region.

In-Depth South Africa Anesthesia Devices Market Market Outlook

The South African anesthesia devices market is poised for substantial growth, driven by continued technological advancements, increasing healthcare spending, and a growing need for sophisticated anesthesia solutions. Strategic partnerships, investments in infrastructure, and government support will play a pivotal role in shaping the future market landscape. The focus on enhancing the quality and accessibility of healthcare services will further drive demand for advanced anesthesia devices.

South Africa Anesthesia Devices Market Segmentation

-

1. Product Type

-

1.1. Anesthesia Machines

- 1.1.1. Anesthesia Workstation

- 1.1.2. Anesthesia Delivery Machines

- 1.1.3. Anesthesia Ventilators

- 1.1.4. Anesthesia Monitors

-

1.2. Disposables and Accessories

- 1.2.1. Anesthesia Circuits (Breathing Circuits)

- 1.2.2. Anesthesia Masks

- 1.2.3. Others

-

1.1. Anesthesia Machines

South Africa Anesthesia Devices Market Segmentation By Geography

- 1. South Africa

South Africa Anesthesia Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancements in Anesthesia Delivery and Monitoring Technology; Increasing Prevalence of Chronic Diseases Coupled with Rising Number of Surgeries

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment Coupled with Reimbursement Issues; Difficulties Associated with the Usage of Anesthesia Devices

- 3.4. Market Trends

- 3.4.1. Anesthesia Monitors Segment is Expected to Register a Significant CAGR in the Anesthesia Devices Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Anesthesia Machines

- 5.1.1.1. Anesthesia Workstation

- 5.1.1.2. Anesthesia Delivery Machines

- 5.1.1.3. Anesthesia Ventilators

- 5.1.1.4. Anesthesia Monitors

- 5.1.2. Disposables and Accessories

- 5.1.2.1. Anesthesia Circuits (Breathing Circuits)

- 5.1.2.2. Anesthesia Masks

- 5.1.2.3. Others

- 5.1.1. Anesthesia Machines

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa South Africa Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 ICU Medical Inc (Smiths Medical)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Teleflex Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 GE Healthcare

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Medtronic PLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Mindray Medical International Limited*List Not Exhaustive

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Koninklijke Philips NV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 B Braun Melsungen AG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Aspen

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Draegerwerk AG

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 ICU Medical Inc (Smiths Medical)

List of Figures

- Figure 1: South Africa Anesthesia Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Anesthesia Devices Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Anesthesia Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Anesthesia Devices Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: South Africa Anesthesia Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: South Africa Anesthesia Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: South Africa South Africa Anesthesia Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Sudan South Africa Anesthesia Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Uganda South Africa Anesthesia Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Tanzania South Africa Anesthesia Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kenya South Africa Anesthesia Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Africa South Africa Anesthesia Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Africa Anesthesia Devices Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: South Africa Anesthesia Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Anesthesia Devices Market?

The projected CAGR is approximately 11.80%.

2. Which companies are prominent players in the South Africa Anesthesia Devices Market?

Key companies in the market include ICU Medical Inc (Smiths Medical), Teleflex Inc, GE Healthcare, Medtronic PLC, Mindray Medical International Limited*List Not Exhaustive, Koninklijke Philips NV, B Braun Melsungen AG, Aspen, Draegerwerk AG.

3. What are the main segments of the South Africa Anesthesia Devices Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Advancements in Anesthesia Delivery and Monitoring Technology; Increasing Prevalence of Chronic Diseases Coupled with Rising Number of Surgeries.

6. What are the notable trends driving market growth?

Anesthesia Monitors Segment is Expected to Register a Significant CAGR in the Anesthesia Devices Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Equipment Coupled with Reimbursement Issues; Difficulties Associated with the Usage of Anesthesia Devices.

8. Can you provide examples of recent developments in the market?

September 2022: Gradian Health Systems and Penlon launched the Prima Anesthesia Machine, a high-specification anesthesia machine designed for use in busy operating rooms in South Africa and 49 other African countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Anesthesia Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Anesthesia Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Anesthesia Devices Market?

To stay informed about further developments, trends, and reports in the South Africa Anesthesia Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence