Key Insights

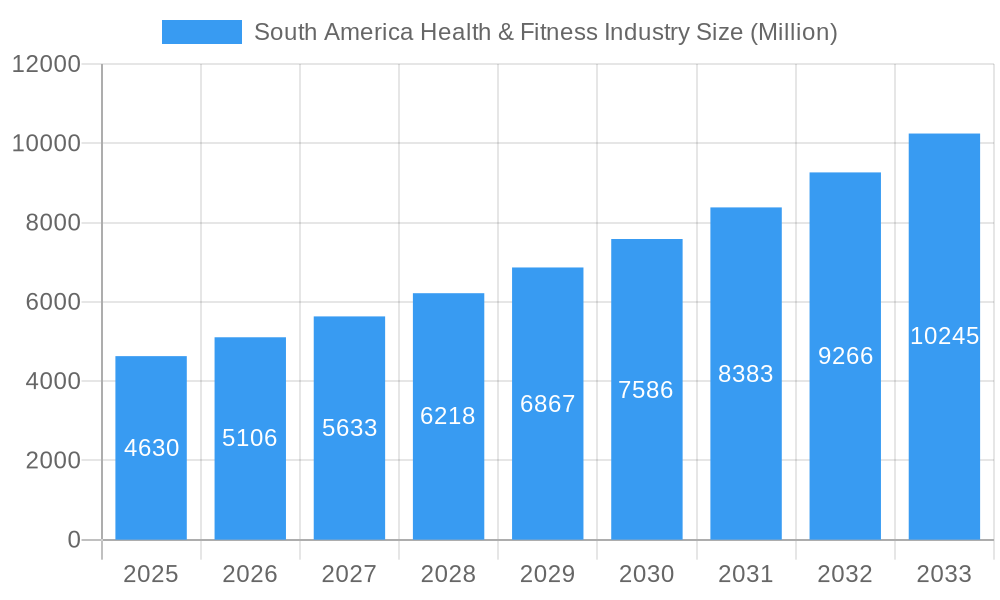

The South American health and fitness industry, currently valued at $4.63 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 10.26% from 2025 to 2033. This expansion is fueled by several key factors. Increasing health consciousness among consumers, driven by rising obesity rates and a growing awareness of preventative healthcare, is a major driver. Further propelling market growth is the increasing disposable income in key markets like Brazil and Argentina, allowing more individuals to afford gym memberships and personal training services. The emergence of innovative fitness technologies, such as fitness apps and wearable devices, contributes to a more engaging and accessible fitness landscape. The industry is segmented by service type, with membership fees, total admission fees, and personal training and instruction services forming the core revenue streams. Major players like Megatlon Club, OX Fitness Club, Academia Bio Ritmo, GOLD'S GYM, Planet Fitness, Bodytech Sports Medicine, Anytime Fitness, and AYO Fitness Club are shaping the competitive landscape through strategic expansion and service diversification. The focus on personalized fitness plans and specialized programs catering to diverse needs and demographics further fuels market growth.

South America Health & Fitness Industry Market Size (In Billion)

The market's growth trajectory is influenced by several trends. A rising preference for boutique fitness studios offering specialized classes like yoga, Pilates, and Zumba is contributing to market diversification. The integration of technology into fitness experiences, including virtual and online fitness programs, is catering to broader accessibility and convenience. However, the market faces some restraints. Economic fluctuations in the region can impact consumer spending on discretionary items like fitness memberships. Furthermore, competition among established players and new entrants necessitates strategic pricing and service differentiation to maintain market share. Geographic disparity in access to fitness facilities also presents a challenge, with urban areas generally having greater access compared to rural communities. Despite these challenges, the overall outlook for the South American health and fitness industry remains positive, driven by a growing focus on wellness and expanding consumer base. The market's continued growth relies on adapting to evolving consumer preferences, embracing technological advancements, and addressing accessibility challenges to fully realize its potential.

South America Health & Fitness Industry Company Market Share

South America Health & Fitness Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South America health & fitness industry, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic planners. The report analyzes the market segmented by service type: Membership Fees, Total Admission Fees, and Personal Training and Instruction Services. Market values are presented in millions of units.

South America Health & Fitness Industry Market Dynamics & Structure

The South American health and fitness market is characterized by a fragmented landscape with a mix of international and regional players. Market concentration is relatively low, with no single dominant player commanding a significant share. Technological innovation, particularly in fitness tracking and virtual training, is a key driver, although adoption rates vary across countries due to differing levels of digital infrastructure and consumer tech adoption. Regulatory frameworks related to health and safety standards influence market operations, and the presence of substitute products, such as home fitness equipment and outdoor activities, impacts market growth. End-user demographics, particularly the rising middle class with increasing disposable income, are a major growth catalyst. M&A activity has been moderate, with xx deals recorded in the historical period (2019-2024), reflecting consolidation and expansion strategies by key players.

- Market Concentration: Low, with a Herfindahl-Hirschman Index (HHI) of xx in 2024.

- Technological Innovation: Strong growth in wearables and fitness apps, but varying adoption across countries.

- Regulatory Frameworks: Varying regulations across countries affecting licensing and safety standards.

- Competitive Substitutes: Home fitness equipment and outdoor activities pose a competitive threat.

- End-User Demographics: Rising middle class fuels market growth, particularly in urban areas.

- M&A Activity: xx deals recorded between 2019 and 2024, driven by expansion and consolidation.

South America Health & Fitness Industry Growth Trends & Insights

The South American health and fitness market experienced significant growth in the historical period (2019-2024), driven by factors such as rising health consciousness, increasing disposable incomes, and the growing popularity of fitness and wellness activities. The market size reached xx million in 2024 and is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx million by 2033. Market penetration remains relatively low compared to developed economies, indicating substantial growth potential. Technological disruptions, such as the rise of online fitness platforms and wearable technology, are reshaping consumer preferences and creating new opportunities. Consumer behavior is shifting towards personalized fitness experiences, demand for convenience, and value-added services.

Dominant Regions, Countries, or Segments in South America Health & Fitness Industry

Brazil and Argentina represent the largest markets within South America, contributing to xx% and xx% of the total market value in 2024, respectively. The high population density in major urban areas and a rapidly growing middle class in these countries are primary growth drivers. Within the service type segmentation, Membership Fees constitutes the largest segment, accounting for xx% of the market in 2024, followed by Personal Training and Instruction Services (xx%) and Total Admission Fees (xx%).

- Brazil: Strong economic growth and a large population base fuel market expansion.

- Argentina: Increasing health consciousness and rising disposable incomes drive demand.

- Membership Fees: Dominant segment due to recurring revenue streams and higher profit margins.

- Personal Training: Growing demand for personalized fitness guidance and specialized programs.

- Total Admission Fees: Market growth driven by increased accessibility and affordability of fitness centers.

South America Health & Fitness Industry Product Landscape

The South American health and fitness industry offers a diverse range of products and services, including gym memberships, personal training, group fitness classes, fitness equipment, and wellness programs. Innovation is focused on enhancing user experience through technology integration, such as virtual reality fitness classes, interactive training equipment, and personalized fitness apps. Unique selling propositions increasingly emphasize convenience, personalization, and community building. Technological advancements are driving the development of more sophisticated fitness tracking devices and data-driven training programs.

Key Drivers, Barriers & Challenges in South America Health & Fitness Industry

Key Drivers:

- Rising disposable incomes and a growing middle class.

- Increasing health consciousness and awareness of the importance of physical activity.

- Technological advancements such as wearable technology and online fitness platforms.

- Government initiatives promoting health and wellness.

Key Challenges:

- Economic instability and inflation in some countries.

- High operating costs, including rent and staffing.

- Competition from low-cost providers and substitute products.

- Limited access to fitness facilities in certain regions.

Emerging Opportunities in South America Health & Fitness Industry

- Expansion into underserved markets, particularly in smaller cities and rural areas.

- Development of affordable and accessible fitness solutions for low-income populations.

- Integration of technology to enhance the user experience and personalize fitness programs.

- Focus on niche fitness segments, such as specialized training programs and corporate wellness solutions.

Growth Accelerators in the South America Health & Fitness Industry

Strategic partnerships between fitness providers and technology companies are accelerating market growth. Expansion into new geographic markets and diversification of service offerings are also key strategies for long-term growth. Investment in technology and infrastructure will be crucial to support the expanding market. The development of innovative fitness concepts and programs that cater to the evolving needs and preferences of consumers will play a significant role in shaping future market trends.

Key Players Shaping the South America Health & Fitness Industry Market

- Megatlon Club

- OX Fitness Club

- Academia Bio Ritmo

- GOLD'S GYM

- Planet Fitness Franchising LLC

- Bodytech Sports Medicine

- Anytime Fitness LLC

- AYO Fitness Club

Notable Milestones in South America Health & Fitness Industry Sector

- 2020: Increased adoption of online fitness platforms due to pandemic-related lockdowns.

- 2021: Launch of several new fitness apps with personalized workout programs.

- 2022: Acquisition of a regional fitness chain by a larger international player.

- 2023: Introduction of several new wearable fitness trackers in the market.

- 2024: Several gyms launched hybrid models incorporating both physical and digital services.

In-Depth South America Health & Fitness Industry Market Outlook

The South American health and fitness market is poised for significant growth over the next decade, driven by several factors, including rising health awareness, increasing disposable incomes, and technological advancements. Strategic opportunities exist in expanding into underserved markets, developing innovative fitness solutions, and leveraging technology to enhance the user experience. The market's continued evolution will be shaped by consumer preferences for personalized fitness experiences, convenient access to fitness facilities, and value-added services that go beyond traditional gym memberships.

South America Health & Fitness Industry Segmentation

-

1. Service Type

- 1.1. Membership Fees

- 1.2. Total Admission Fees

- 1.3. Personal Training and Instruction Services

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Health & Fitness Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Health & Fitness Industry Regional Market Share

Geographic Coverage of South America Health & Fitness Industry

South America Health & Fitness Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Leading to Ban on Smokeless Tobacco

- 3.4. Market Trends

- 3.4.1. Increasing Inclination toward Health Clubs for Fitness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Membership Fees

- 5.1.2. Total Admission Fees

- 5.1.3. Personal Training and Instruction Services

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Brazil South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Membership Fees

- 6.1.2. Total Admission Fees

- 6.1.3. Personal Training and Instruction Services

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Argentina South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Membership Fees

- 7.1.2. Total Admission Fees

- 7.1.3. Personal Training and Instruction Services

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Colombia South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Membership Fees

- 8.1.2. Total Admission Fees

- 8.1.3. Personal Training and Instruction Services

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of South America South America Health & Fitness Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Membership Fees

- 9.1.2. Total Admission Fees

- 9.1.3. Personal Training and Instruction Services

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Megatlon Club

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 OX Fitness Club*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Academia Bio Ritmo

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 GOLD'S GYM

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Planet Fitness Franchising LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Bodytech Sports Medicine

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Anytime Fitness LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 AYO Fitness Club

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Megatlon Club

List of Figures

- Figure 1: South America Health & Fitness Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Health & Fitness Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: South America Health & Fitness Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: South America Health & Fitness Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: South America Health & Fitness Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: South America Health & Fitness Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Health & Fitness Industry?

The projected CAGR is approximately 10.26%.

2. Which companies are prominent players in the South America Health & Fitness Industry?

Key companies in the market include Megatlon Club, OX Fitness Club*List Not Exhaustive, Academia Bio Ritmo, GOLD'S GYM, Planet Fitness Franchising LLC, Bodytech Sports Medicine, Anytime Fitness LLC, AYO Fitness Club.

3. What are the main segments of the South America Health & Fitness Industry?

The market segments include Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Marketing and Strategic Investments by Key Players; Growing Prevalence of Smokeless Tobacco Supported By Growth in Production of Tobacco.

6. What are the notable trends driving market growth?

Increasing Inclination toward Health Clubs for Fitness.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Leading to Ban on Smokeless Tobacco.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Health & Fitness Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Health & Fitness Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Health & Fitness Industry?

To stay informed about further developments, trends, and reports in the South America Health & Fitness Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence