Key Insights

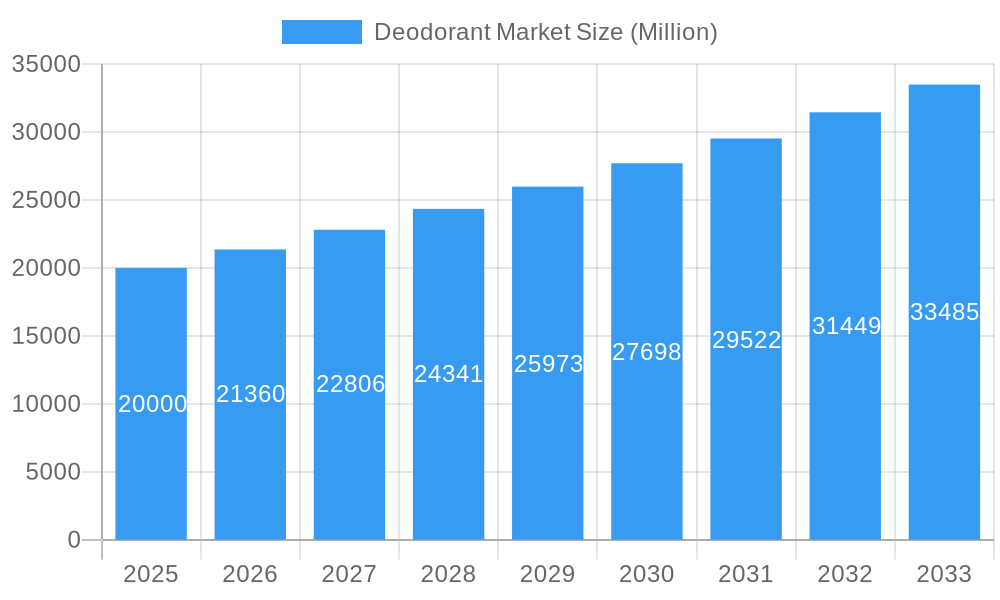

The global deodorant market, valued at an estimated $28.41 billion in 2025, is poised for significant expansion, projecting a compound annual growth rate (CAGR) of 5.81% between 2025 and 2033. This growth trajectory is underpinned by escalating consumer emphasis on personal hygiene and odor control, particularly among younger demographics. The burgeoning demand for natural and organic deodorant formulations, appealing to health-conscious individuals, is a key market driver. A diverse array of product formats, including sprays, creams, roll-ons, and wipes, ensures broad consumer appeal by accommodating varied preferences and lifestyles. Furthermore, the expanding reach of e-commerce platforms provides enhanced accessibility and broadens market penetration. Conversely, market expansion may be moderated by volatile raw material costs and consumer concerns regarding specific ingredient safety. The market is segmented by product type and distribution channel, with substantial revenue generated in developed economies such as North America and Europe. Intense competition exists among established industry leaders and innovative niche brands.

Deodorant Market Market Size (In Billion)

Geographically, North America and Europe currently dominate the deodorant market, characterized by high per capita consumption and well-established distribution infrastructures. The Asia-Pacific region is anticipated to experience robust growth during the forecast period, driven by rising disposable incomes and increasing urbanization, particularly in India and China. South America and the Middle East & Africa present emerging opportunities, though market maturity and infrastructure vary. Future market evolution will be influenced by innovations in deodorant efficacy, the integration of natural ingredients, and the adoption of sustainable packaging. The increasing demand for personalized deodorant solutions tailored to specific skin types and sensitivities will also be a significant shaping factor.

Deodorant Market Company Market Share

Deodorant Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global deodorant market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive data analysis to deliver actionable insights for industry professionals, investors, and stakeholders. Market values are presented in million units.

Deodorant Market Dynamics & Structure

The deodorant market is characterized by a moderately concentrated landscape with several multinational corporations holding significant market shares. Technological innovation, particularly in natural and sustainable formulations, is a key driver, while regulatory frameworks concerning ingredient safety and environmental impact exert considerable influence. Competitive product substitutes, such as natural remedies and alternative personal care products, pose a growing challenge. End-user demographics, with a focus on younger, environmentally conscious consumers, are shaping product development and marketing strategies. M&A activity in the sector has been relatively moderate in recent years, with a focus on expanding product portfolios and geographic reach.

- Market Concentration: The top 10 players hold approximately xx% of the global market share (2024).

- Technological Innovation: Focus on natural ingredients, sustainable packaging, and innovative delivery systems (e.g., solid sticks, wipes).

- Regulatory Landscape: Stringent regulations on ingredient safety and environmental impact vary across regions.

- Competitive Substitutes: Growing popularity of natural alternatives and homemade remedies.

- M&A Activity: xx major M&A deals recorded between 2019 and 2024, primarily focused on expanding product lines and geographical presence.

- End-User Demographics: Growing demand from millennials and Gen Z for natural and sustainable products.

Deodorant Market Growth Trends & Insights

The global deodorant market exhibited a CAGR of xx% during the historical period (2019-2024), reaching a market size of xx million units in 2024. The forecast period (2025-2033) projects continued growth, driven by rising disposable incomes, increasing awareness of personal hygiene, and the expansion of e-commerce channels. Technological disruptions, such as the introduction of new formulations (aluminum-free, natural deodorants) and sustainable packaging solutions, are further fueling market expansion. Shifting consumer preferences towards natural and organic products are also contributing significantly. Market penetration is expected to reach xx% by 2033, driven by increased adoption in emerging markets. The adoption rate is significantly higher in developed countries, with saturation levels in many regions.

Dominant Regions, Countries, or Segments in Deodorant Market

North America currently holds the largest market share in the global deodorant market, followed by Europe and Asia-Pacific. Within product types, spray deodorants maintain the dominant position, followed by roll-ons and other formats (sticks, creams, gels). Supermarkets/hypermarkets represent the largest distribution channel, although online retail is experiencing rapid growth.

- Leading Region: North America (market share xx% in 2024).

- Key Drivers: High disposable incomes, strong brand awareness, and established distribution networks in developed regions.

- Dominant Product Type: Spray deodorants (xx% market share in 2024), driven by convenience and efficacy.

- Largest Distribution Channel: Supermarkets/Hypermarkets (xx% market share in 2024), offering broad reach and established consumer purchasing habits.

- High Growth Potential: Asia-Pacific region, fueled by rising disposable incomes and growing middle class.

Deodorant Market Product Landscape

The deodorant market features a diverse range of products, encompassing sprays, roll-ons, creams, sticks, and gels. Innovation focuses on natural ingredients, eco-friendly packaging, and enhanced efficacy. Unique selling propositions (USPs) often center around specific scents, long-lasting protection, and skin-friendly formulations. Technological advancements have led to the development of aluminum-free and natural deodorants, catering to health-conscious consumers.

Key Drivers, Barriers & Challenges in Deodorant Market

Key Drivers: Rising disposable incomes, increasing awareness of personal hygiene, expanding e-commerce channels, and the introduction of innovative, natural, and sustainable products.

Key Challenges: Intense competition, stringent regulations on ingredients, fluctuations in raw material prices, and increasing consumer preference towards natural alternatives. Supply chain disruptions can lead to significant cost increases and decreased product availability. For example, a 10% increase in raw material costs could result in a xx% increase in final product pricing.

Emerging Opportunities in Deodorant Market

Emerging opportunities lie in the development of personalized deodorants catering to individual needs and preferences. Untapped markets in developing countries present significant growth potential. Further innovation in natural and sustainable formulations, including recycled packaging and biodegradable ingredients, offers significant opportunities. Marketing campaigns highlighting the health and environmental benefits of specific products will appeal to the growing environmental conscience.

Growth Accelerators in the Deodorant Market Industry

Strategic partnerships, product diversification, and expansion into emerging markets are key growth accelerators. Technological breakthroughs in formulation and packaging will drive innovation and increased market penetration. The focus on natural, sustainable, and ethical products will ensure long-term growth.

Key Players Shaping the Deodorant Market Market

Notable Milestones in Deodorant Market Sector

- December 2021: Beiersdorf introduced a "climate-friendly" aerosol valve for its Nivea Ecodeo product line and used 100% recycled aluminum cans for its Nivea Men line in Europe.

- March 2022: Procter & Gamble launched a new weightless dry spray collection under its Secret brand in the United States.

- September 2022: Unilever launched Schmidt's, a new certified natural aerosol deodorant brand, in Australia and New Zealand, with a supporting marketing campaign.

In-Depth Deodorant Market Market Outlook

The deodorant market is poised for continued growth, driven by factors such as increasing disposable incomes, expanding e-commerce channels, and the growing popularity of natural and sustainable products. Strategic opportunities exist in developing innovative formulations, expanding into untapped markets, and leveraging strategic partnerships. The focus on sustainable and ethical products will be crucial for long-term success in this evolving market.

Deodorant Market Segmentation

-

1. Product Type

- 1.1. Spray

- 1.2. Creams

- 1.3. Roll-on

- 1.4. Other Product Types (Wipes, Gel, Sticks, etc.)

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Pharmacies & Drug Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channel

Deodorant Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Deodorant Market Regional Market Share

Geographic Coverage of Deodorant Market

Deodorant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovative Launches; Hair Concerns Among Consumers

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Growing Concern About Hygiene and Freshness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Deodorant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Spray

- 5.1.2. Creams

- 5.1.3. Roll-on

- 5.1.4. Other Product Types (Wipes, Gel, Sticks, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Pharmacies & Drug Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Deodorant Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Spray

- 6.1.2. Creams

- 6.1.3. Roll-on

- 6.1.4. Other Product Types (Wipes, Gel, Sticks, etc.)

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Pharmacies & Drug Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channel

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Deodorant Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Spray

- 7.1.2. Creams

- 7.1.3. Roll-on

- 7.1.4. Other Product Types (Wipes, Gel, Sticks, etc.)

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Pharmacies & Drug Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channel

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Deodorant Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Spray

- 8.1.2. Creams

- 8.1.3. Roll-on

- 8.1.4. Other Product Types (Wipes, Gel, Sticks, etc.)

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Pharmacies & Drug Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channel

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Deodorant Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Spray

- 9.1.2. Creams

- 9.1.3. Roll-on

- 9.1.4. Other Product Types (Wipes, Gel, Sticks, etc.)

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Pharmacies & Drug Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channel

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Deodorant Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Spray

- 10.1.2. Creams

- 10.1.3. Roll-on

- 10.1.4. Other Product Types (Wipes, Gel, Sticks, etc.)

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Pharmacies & Drug Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channel

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Estée Lauder Companies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Church & Dwight Co Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Natura & Co*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 L'Occitane Groupe S A

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Unilever PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Colgate-Palmolive Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 L'Oréal S A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Revlon Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Maxingvest AG (Beiersdorf AG)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Procter & Gamble Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 The Estée Lauder Companies Inc

List of Figures

- Figure 1: Global Deodorant Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Deodorant Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Deodorant Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Deodorant Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Deodorant Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Deodorant Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Deodorant Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Deodorant Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Deodorant Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Deodorant Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Deodorant Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Deodorant Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Deodorant Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Deodorant Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Deodorant Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Deodorant Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Deodorant Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Deodorant Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Deodorant Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Deodorant Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Deodorant Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Deodorant Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: South America Deodorant Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Deodorant Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Deodorant Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Deodorant Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Deodorant Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Deodorant Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Deodorant Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Deodorant Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Deodorant Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Deodorant Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Deodorant Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Deodorant Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Deodorant Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Deodorant Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Deodorant Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Deodorant Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Deodorant Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Deodorant Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Spain Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Russia Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Deodorant Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Deodorant Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Deodorant Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Deodorant Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Deodorant Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Deodorant Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Deodorant Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Deodorant Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Deodorant Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Deodorant Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Deodorant Market?

The projected CAGR is approximately 5.81%.

2. Which companies are prominent players in the Deodorant Market?

Key companies in the market include The Estée Lauder Companies Inc, Church & Dwight Co Inc, Natura & Co*List Not Exhaustive, L'Occitane Groupe S A, Unilever PLC, Colgate-Palmolive Company, L'Oréal S A, Revlon Inc, Maxingvest AG (Beiersdorf AG), Procter & Gamble Company.

3. What are the main segments of the Deodorant Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.41 billion as of 2022.

5. What are some drivers contributing to market growth?

Innovative Launches; Hair Concerns Among Consumers.

6. What are the notable trends driving market growth?

Growing Concern About Hygiene and Freshness.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

September 2022: Unilever launched a new certified natural aerosol deodorant brand Schmidt's in Australia and New Zealand. Additionally, the company launched its first-ever campaign developed by the independent creative agency Emotive in Australia and New Zealand to raise awareness of the new brand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Deodorant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Deodorant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Deodorant Market?

To stay informed about further developments, trends, and reports in the Deodorant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence