Key Insights

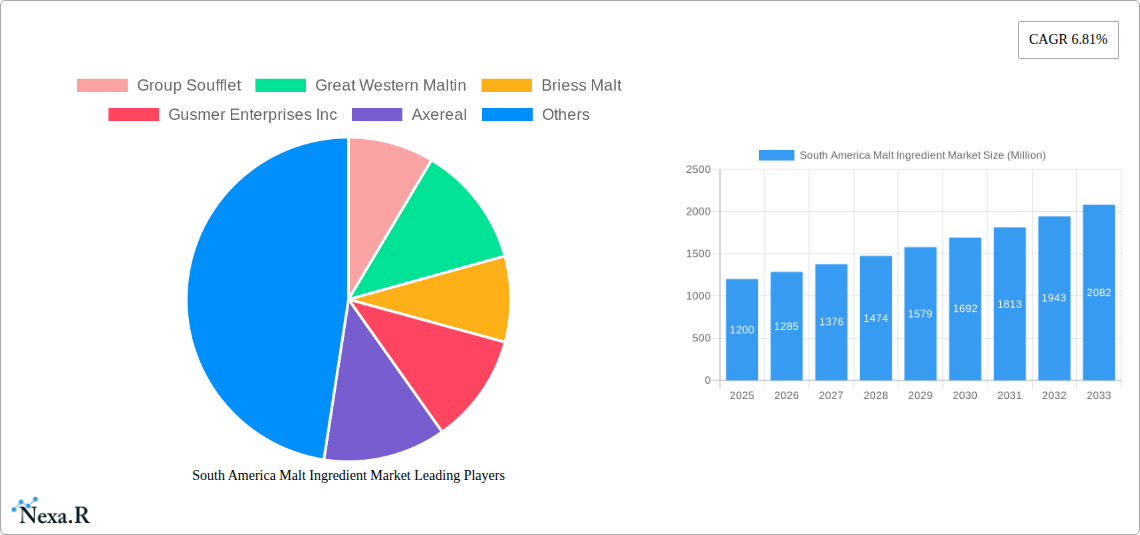

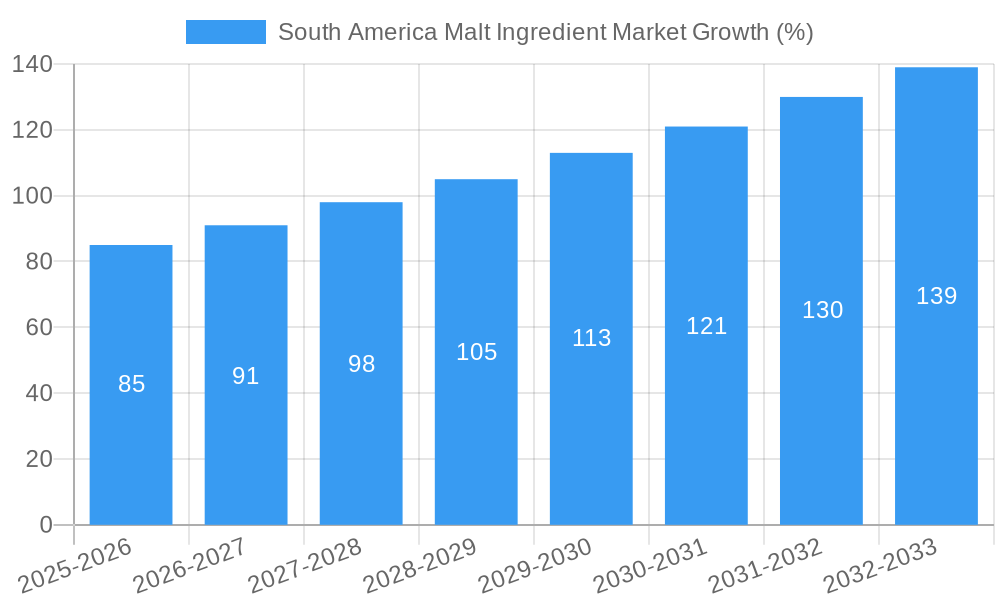

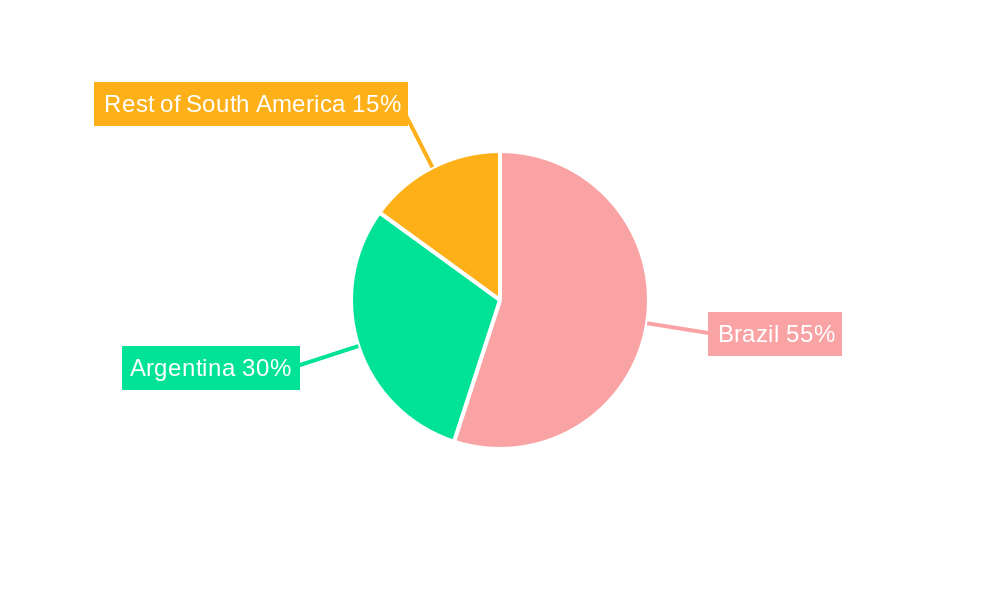

The South American malt ingredient market, currently valued at approximately $1200 million in 2025, is projected to experience robust growth, driven by increasing demand from the alcoholic and non-alcoholic beverage sectors. The burgeoning craft brewing scene across Brazil and Argentina, coupled with rising consumer preference for malt-based beverages, is a significant catalyst for this expansion. Furthermore, the expanding food industry's utilization of malt extracts for flavor enhancement and nutritional benefits contributes to market growth. The pharmaceutical and animal feed industries also present niche applications, although their contributions are currently smaller compared to the beverage and food sectors. While a lack of large-scale malt production in certain South American regions might present a restraint, ongoing investments in malt production infrastructure and technological advancements are expected to mitigate these challenges. The market's segmentation, encompassing barley, wheat, and other malt sources, along with diverse applications, signifies market diversification and offers promising opportunities for growth across the forecast period (2025-2033). Brazil and Argentina represent the largest market segments within South America, driven by established industries and higher per capita consumption of malt-based products. The projected CAGR of 6.81% indicates sustained and healthy growth throughout the forecast period, promising substantial market expansion.

The competitive landscape is characterized by a mix of both global and regional players. Major international players like Cargill and AB InBev, along with regional malt producers, contribute to a dynamic market. This blend fosters both competition and innovation, pushing boundaries in product development and market penetration. The market is likely to see consolidation as smaller players face pressure from larger, more established companies. However, the increasing demand for locally sourced and specialized malt ingredients presents opportunities for smaller players to niche themselves effectively. The consistent growth trajectory, supported by favorable market dynamics and increasing consumption, makes the South American malt ingredient market an attractive prospect for both investors and industry participants. Focus on sustainable sourcing practices and technological innovation to improve efficiency will play a key role in shaping the future of this market.

South America Malt Ingredient Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America Malt Ingredient market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The report segments the market by source (Barley, Wheat, Other Sources) and application (Alcoholic beverages, Non-alcoholic beverages, Food, Pharmaceuticals, Animal Feed), providing a granular understanding of market dynamics and growth potential across various segments and countries within South America. Key players like Group Soufflet, Great Western Malting, Briess Malt, Gusmer Enterprises Inc, Axereal, Otro Mundo Brewing Company, Patagonia Malt, Maltexco SA, Cargill, Incorporated, and AB InBev (Anheuser-Busch InBev) are analyzed in detail. The market size is presented in million units.

South America Malt Ingredient Market Dynamics & Structure

This section delves into the intricate structure of the South America malt ingredient market, analyzing market concentration, technological advancements, regulatory landscapes, competitive dynamics, and prevailing end-user demographics. We examine M&A trends and their influence on market consolidation. The analysis utilizes both qualitative and quantitative data, providing a holistic view of the market's dynamics.

- Market Concentration: The market exhibits a [XX]% concentration ratio, with the top [XX] players holding a significant market share. [Provide details on market share percentages of major players if available, otherwise use predicted values and state that they are predicted].

- Technological Innovation: Technological advancements in malting processes, such as [mention specific advancements if available, otherwise use predicted advancements], are driving efficiency and product quality improvements. However, [XX]% of businesses still utilize traditional methods, highlighting an opportunity for technology adoption.

- Regulatory Framework: Regulatory frameworks governing food and beverage production in South America vary across countries, impacting market access and operational costs. [Describe specific regulations and their impact if available].

- Competitive Substitutes: [Mention potential substitutes for malt ingredients and their market impact].

- End-User Demographics: The growing [mention specific end-user demographics] is significantly boosting demand for malt ingredients in the region.

- M&A Trends: The market has witnessed [XX] M&A deals in the past [XX] years, primarily driven by [mention reasons for M&A activity].

South America Malt Ingredient Market Growth Trends & Insights

This section provides a comprehensive overview of the South America malt ingredient market's growth trajectory, utilizing extensive market research data to present a detailed picture of market size evolution, adoption rates, and technological disruption’s impact. We further explore consumer behavior shifts and their influence on market dynamics.

[Insert 600-word analysis here, including specific metrics such as CAGR and market penetration rates, detailing market size evolution, adoption rates across segments, technological disruptions (e.g., automation, precision malting), and shifts in consumer preferences (e.g., demand for craft beers, health-conscious malt-based products). Include relevant charts and graphs if available.]

Dominant Regions, Countries, or Segments in South America Malt Ingredient Market

This section pinpoints the leading regions, countries, and market segments driving the South American malt ingredient market's growth. A detailed analysis highlights key growth drivers and dominance factors, including market share and future growth potential.

- Leading Region/Country: [Identify the leading region/country and provide supporting data (e.g., market share, growth rate)].

- Dominant Segments: [Identify the dominant segments by source and application, provide data to support claim (e.g., market size, growth rate)].

- Key Drivers:

- [List key drivers, such as economic growth, infrastructure development, favorable government policies, etc., with supporting data].

- [Include paragraphs explaining the influence of these drivers in detail.]

[Insert remaining 600 words explaining dominance factors for the leading region/country and segment. Include qualitative and quantitative data, such as market share, growth potential, and influencing factors.]

South America Malt Ingredient Market Product Landscape

This section provides a concise overview of product innovations, applications, and performance metrics within the South America malt ingredient market. It highlights unique selling propositions and technological advancements driving product development and differentiation.

[Insert 100-150 word paragraph describing product innovations (e.g., specialty malts, organic malts), applications (e.g., craft brewing, food processing), and performance metrics (e.g., enzyme activity, extract yield). Highlight unique selling propositions and technological advancements.]

Key Drivers, Barriers & Challenges in South America Malt Ingredient Market

This section outlines the key drivers and challenges shaping the South America malt ingredient market.

Key Drivers: [Insert 150 words describing key drivers, such as rising consumer demand for alcoholic and non-alcoholic beverages, growing food and pharmaceutical industries, and technological advancements improving efficiency and quality.]

Key Challenges and Restraints: [Insert 150 words discussing challenges like supply chain disruptions, fluctuating raw material prices, stringent regulations, and intense competition. Quantify the impact of these challenges wherever possible.]

Emerging Opportunities in South America Malt Ingredient Market

This section identifies emerging trends and untapped opportunities within the South America malt ingredient market.

[Insert 150 words highlighting emerging opportunities, such as increased demand for specialty malts, expansion into new geographical areas, development of innovative applications in food and pharmaceuticals, and catering to growing consumer preferences for health-conscious products.]

Growth Accelerators in the South America Malt Ingredient Market Industry

This section discusses catalysts driving long-term growth in the South America malt ingredient market.

[Insert 150-word paragraph emphasizing technological breakthroughs, strategic partnerships (e.g., collaborations between malt producers and breweries), and market expansion strategies (e.g., targeting new consumer segments) as key growth accelerators.]

Key Players Shaping the South America Malt Ingredient Market Market

- Group Soufflet

- Great Western Malting

- Briess Malt

- Gusmer Enterprises Inc

- Axereal

- Otro Mundo Brewing Company

- Patagonia Malt

- Maltexco SA

- Cargill, Incorporated

- AB InBev (Anheuser-Busch InBev)

Notable Milestones in South America Malt Ingredient Market Sector

- [Insert bullet points detailing notable milestones, such as acquisitions, mergers, new product launches, strategic partnerships, and technological advancements, including dates where available.]

In-Depth South America Malt Ingredient Market Outlook

This section summarizes growth accelerators and offers a perspective on the future market potential and strategic opportunities.

[Insert 150-word paragraph summarizing the growth accelerators identified in the report and outlining the future market potential for the South American malt ingredient market. Highlight potential strategic opportunities for market players, such as investments in technology, expansion into new markets, and development of new products.]

South America Malt Ingredient Market Segmentation

-

1. Source

- 1.1. Barley

- 1.2. Wheat

- 1.3. Other Sources

-

2. Application

- 2.1. Alcoholic beverages

- 2.2. Non-alcoholic beverages

- 2.3. Food

- 2.4. Pharmaceuticals

- 2.5. Animal Feed

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Malt Ingredient Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Malt Ingredient Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.81% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Consumption of Baked Goods; Demand for Indigenous Fermented Foods

- 3.3. Market Restrains

- 3.3.1. Potential Side-effects of Yeast

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Craft Beer Boosting the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Malt Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Barley

- 5.1.2. Wheat

- 5.1.3. Other Sources

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Alcoholic beverages

- 5.2.2. Non-alcoholic beverages

- 5.2.3. Food

- 5.2.4. Pharmaceuticals

- 5.2.5. Animal Feed

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Brazil South America Malt Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Source

- 6.1.1. Barley

- 6.1.2. Wheat

- 6.1.3. Other Sources

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Alcoholic beverages

- 6.2.2. Non-alcoholic beverages

- 6.2.3. Food

- 6.2.4. Pharmaceuticals

- 6.2.5. Animal Feed

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Source

- 7. Argentina South America Malt Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Source

- 7.1.1. Barley

- 7.1.2. Wheat

- 7.1.3. Other Sources

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Alcoholic beverages

- 7.2.2. Non-alcoholic beverages

- 7.2.3. Food

- 7.2.4. Pharmaceuticals

- 7.2.5. Animal Feed

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Source

- 8. Rest of South America South America Malt Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Source

- 8.1.1. Barley

- 8.1.2. Wheat

- 8.1.3. Other Sources

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Alcoholic beverages

- 8.2.2. Non-alcoholic beverages

- 8.2.3. Food

- 8.2.4. Pharmaceuticals

- 8.2.5. Animal Feed

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Source

- 9. Brazil South America Malt Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Malt Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Malt Ingredient Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Group Soufflet

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Great Western Maltin

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Briess Malt

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Gusmer Enterprises Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Axereal

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Otro Mundo Brewing Company

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Patagonia Malt

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Maltexco SA

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Cargill Incorporated

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 AB InBev (Anheuser-Busch InBev)

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Group Soufflet

List of Figures

- Figure 1: South America Malt Ingredient Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Malt Ingredient Market Share (%) by Company 2024

List of Tables

- Table 1: South America Malt Ingredient Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Malt Ingredient Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: South America Malt Ingredient Market Revenue Million Forecast, by Source 2019 & 2032

- Table 4: South America Malt Ingredient Market Volume K Tons Forecast, by Source 2019 & 2032

- Table 5: South America Malt Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: South America Malt Ingredient Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 7: South America Malt Ingredient Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: South America Malt Ingredient Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 9: South America Malt Ingredient Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: South America Malt Ingredient Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: South America Malt Ingredient Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South America Malt Ingredient Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: Brazil South America Malt Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Brazil South America Malt Ingredient Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Argentina South America Malt Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina South America Malt Ingredient Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America South America Malt Ingredient Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of South America South America Malt Ingredient Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: South America Malt Ingredient Market Revenue Million Forecast, by Source 2019 & 2032

- Table 20: South America Malt Ingredient Market Volume K Tons Forecast, by Source 2019 & 2032

- Table 21: South America Malt Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: South America Malt Ingredient Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 23: South America Malt Ingredient Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: South America Malt Ingredient Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 25: South America Malt Ingredient Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South America Malt Ingredient Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 27: South America Malt Ingredient Market Revenue Million Forecast, by Source 2019 & 2032

- Table 28: South America Malt Ingredient Market Volume K Tons Forecast, by Source 2019 & 2032

- Table 29: South America Malt Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: South America Malt Ingredient Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 31: South America Malt Ingredient Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: South America Malt Ingredient Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 33: South America Malt Ingredient Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: South America Malt Ingredient Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 35: South America Malt Ingredient Market Revenue Million Forecast, by Source 2019 & 2032

- Table 36: South America Malt Ingredient Market Volume K Tons Forecast, by Source 2019 & 2032

- Table 37: South America Malt Ingredient Market Revenue Million Forecast, by Application 2019 & 2032

- Table 38: South America Malt Ingredient Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 39: South America Malt Ingredient Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: South America Malt Ingredient Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 41: South America Malt Ingredient Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: South America Malt Ingredient Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Malt Ingredient Market?

The projected CAGR is approximately 6.81%.

2. Which companies are prominent players in the South America Malt Ingredient Market?

Key companies in the market include Group Soufflet, Great Western Maltin, Briess Malt, Gusmer Enterprises Inc, Axereal, Otro Mundo Brewing Company, Patagonia Malt, Maltexco SA, Cargill, Incorporated , AB InBev (Anheuser-Busch InBev).

3. What are the main segments of the South America Malt Ingredient Market?

The market segments include Source, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1200 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Consumption of Baked Goods; Demand for Indigenous Fermented Foods.

6. What are the notable trends driving market growth?

Growing Popularity of Craft Beer Boosting the Market Studied.

7. Are there any restraints impacting market growth?

Potential Side-effects of Yeast.

8. Can you provide examples of recent developments in the market?

Recent developments in the South America Malt Ingredient Sector include: Acquisitions and mergers New product launches Strategic partnerships Technological advancements

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Malt Ingredient Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Malt Ingredient Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Malt Ingredient Market?

To stay informed about further developments, trends, and reports in the South America Malt Ingredient Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence