Key Insights

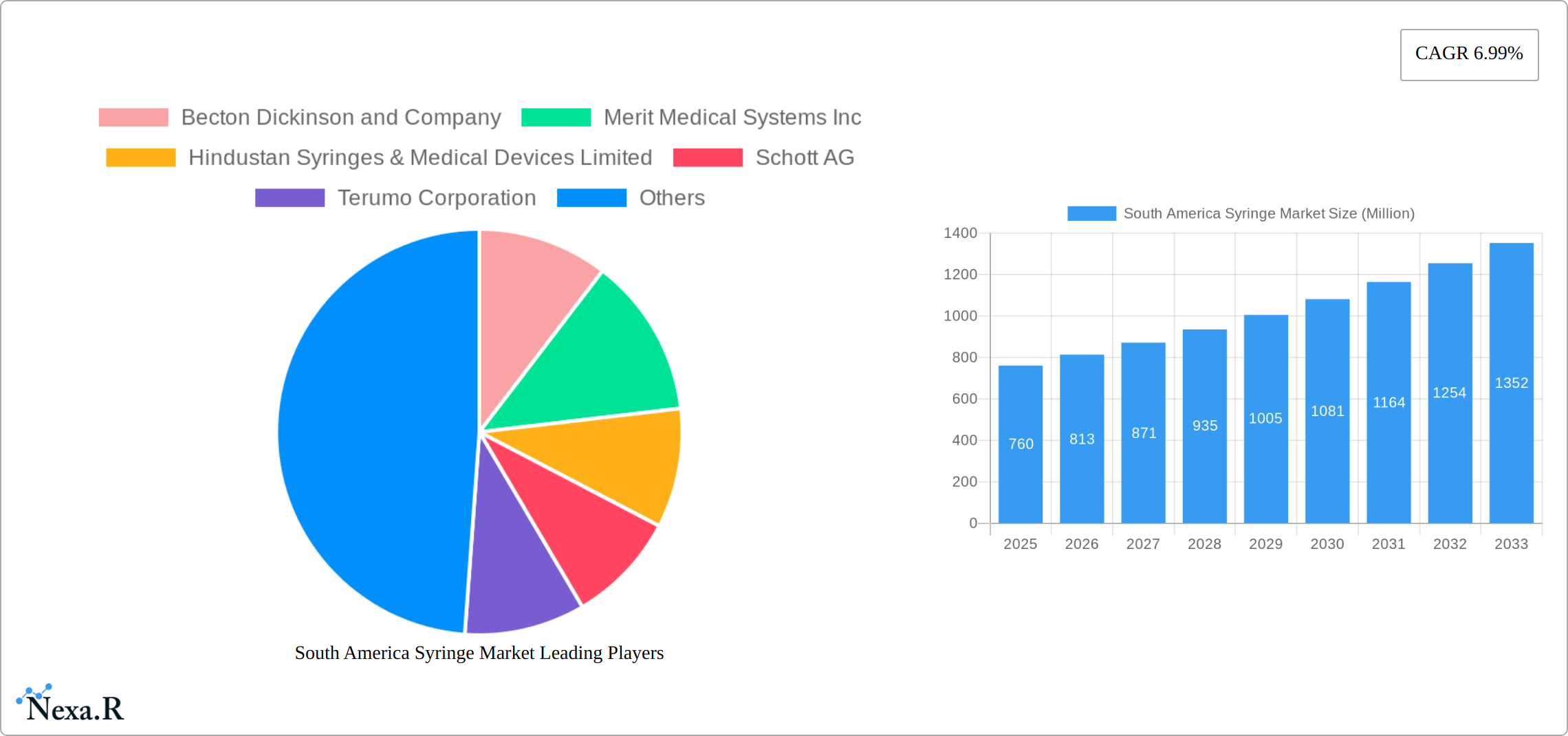

The South American syringe market, valued at approximately $0.76 billion in 2025, is projected to experience robust growth, driven by factors such as increasing prevalence of chronic diseases like diabetes and osteoarthritis, rising demand for injectables in aesthetic procedures (Botox), and expanding healthcare infrastructure. The market is segmented by application (diabetes, Botox, osteoarthritis, human growth hormone, and other applications) and usage (sterilizable/reusable and disposable syringes). Disposable syringes are anticipated to dominate the market due to concerns regarding hygiene and infection control. Growth is further fueled by government initiatives promoting vaccination campaigns and improved healthcare access across the region, particularly in countries like Brazil and Argentina. However, challenges remain, including economic instability in certain South American nations which can impact healthcare spending and the adoption of advanced syringe technologies. The market’s competitive landscape involves both multinational corporations like Becton Dickinson and Terumo Corporation, and regional players like Hindustan Syringes & Medical Devices Limited. These companies are focusing on product innovation, strategic partnerships, and expanding their distribution networks to cater to the rising demand.

The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) of 6.99%, indicating substantial expansion. This growth will be fueled by increasing disposable incomes in several South American countries, leading to greater affordability of healthcare products, including syringes. Furthermore, the ongoing technological advancements in syringe design, such as the development of safety syringes and pre-filled syringes, are expected to contribute significantly to the market's expansion. While economic volatility and regulatory hurdles present potential restraints, the overall positive growth trajectory is driven by the fundamental increase in healthcare needs and technological improvements within the syringe sector in South America.

South America Syringe Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America syringe market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers crucial insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is segmented by application (Diabetes, Botox, Osteoarthritis, Human Growth Hormone, Other Applications) and usage (Sterilizable/Reusable Syringes, Disposable Syringes). The report projects a market size in Million units (exact figures will be detailed in the full report).

South America Syringe Market Dynamics & Structure

The South America syringe market is characterized by a moderately concentrated landscape, with key players such as Becton Dickinson and Company, Merit Medical Systems Inc, and Terumo Corporation holding significant market share. Technological innovation, driven by the demand for safer and more efficient injection systems, plays a crucial role. Stringent regulatory frameworks govern the manufacturing and distribution of syringes, impacting market dynamics. Competition from substitute products, such as auto-injectors, also needs consideration. The market is influenced by end-user demographics, with significant demand from hospitals, clinics, and home healthcare settings. M&A activity has been moderate, with xx deals recorded in the historical period (2019-2024), primarily focused on expanding geographic reach and product portfolios.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2024).

- Technological Innovation: Focus on safety features (e.g., needle safety devices), pre-filled syringes, and improved materials.

- Regulatory Landscape: Stringent regulations regarding sterilization, safety, and quality control.

- Competitive Substitutes: Auto-injectors and other drug delivery systems present competitive pressure.

- End-User Demographics: Hospitals, clinics, home healthcare, and pharmacies are major end-users.

- M&A Activity: xx M&A deals in 2019-2024, driven by expansion and product diversification strategies.

South America Syringe Market Growth Trends & Insights

The South American syringe market demonstrated robust growth from 2019 to 2024, fueled by a confluence of factors. The rising prevalence of chronic diseases necessitating injectable medications, such as diabetes and autoimmune disorders, significantly boosted demand. Concurrently, increased healthcare expenditure across the region and heightened awareness of hygiene, driving preference for disposable syringes, further propelled market expansion. This positive trajectory is projected to continue throughout the forecast period (2025-2033), with a projected Compound Annual Growth Rate (CAGR) of [Insert Projected CAGR Here]%. Technological advancements are a key driver; the introduction of innovative products like smart safety syringes and pre-filled syringes enhances convenience and safety, contributing to market growth. The increasing adoption of these advanced technologies, while still lagging behind developed markets, represents a significant opportunity for future expansion. By 2033, the market size is anticipated to reach [Insert Projected Market Size Here] million units.

Dominant Regions, Countries, or Segments in South America Syringe Market

Brazil and Colombia are the leading markets within South America, accounting for xx% and xx% of the total market share, respectively, in 2024. The Disposable Syringes segment dominates the usage category, driven by the preference for single-use devices to minimize infection risk. In terms of application, the Diabetes segment holds the largest market share due to the high prevalence of diabetes across the region and the reliance on insulin injections.

- Brazil: Large population, high prevalence of chronic diseases, and growing healthcare infrastructure.

- Colombia: Expanding healthcare system and growing adoption of advanced syringe technologies.

- Disposable Syringes: Dominant segment driven by hygiene concerns and ease of use.

- Diabetes Application: Largest application segment due to high diabetes prevalence.

South America Syringe Market Product Landscape

The South American syringe market showcases a diverse product portfolio, encompassing disposable syringes crafted from various materials including glass and plastic. Safety syringes, incorporating integrated needle safety mechanisms to mitigate needlestick injuries, are gaining traction. Furthermore, pre-filled syringes are experiencing increased demand due to their enhanced convenience, accuracy in dosage administration, and reduction in medication errors. This focus on pre-filled syringes reflects a broader market trend towards improved efficiency and reduced waste within healthcare settings. Ongoing product innovation centers on enhancing safety features, minimizing waste generation, and optimizing the overall user experience. The market is seeing a noticeable shift towards products that improve the efficiency and safety of drug delivery.

Key Drivers, Barriers & Challenges in South America Syringe Market

Key Drivers:

- Rising prevalence of chronic diseases requiring injectable medications.

- Increasing healthcare expenditure and improved healthcare infrastructure in certain regions.

- Growing awareness of infection control and hygiene.

- Technological advancements leading to improved safety and convenience.

Key Barriers & Challenges:

- Price sensitivity in certain market segments limiting the adoption of advanced syringe technologies.

- Regulatory hurdles and complex approval processes impacting product launches.

- Supply chain disruptions affecting availability and cost of raw materials.

- Competition from generic and low-cost syringe manufacturers.

Emerging Opportunities in South America Syringe Market

Emerging opportunities lie in expanding into underserved regions, introducing innovative safety features (e.g., connected syringes for drug traceability), and catering to the growing demand for pre-filled syringes. Further, leveraging digital technologies to enhance supply chain efficiency and product traceability presents significant opportunities. There’s a growing market for specialized syringes catering to specific therapeutic areas.

Growth Accelerators in the South America Syringe Market Industry

Technological advancements, strategic partnerships between manufacturers and healthcare providers, and government initiatives promoting healthcare access will be key growth accelerators. Expansion into untapped markets and investments in research and development for innovative syringe technologies will play a crucial role in long-term market growth.

Key Players Shaping the South America Syringe Market Market

- Becton Dickinson and Company

- Merit Medical Systems Inc

- Hindustan Syringes & Medical Devices Limited

- Schott AG

- Terumo Corporation

- Medtronic (Covidien)

- Cardinal Health Inc

- UltiMed Inc

- Vygon

- Helapet Ltd

- B Braun SE

- Gerresheimer AG

Notable Milestones in South America Syringe Market Sector

- March 2024: SCHOTT Pharma initiated construction of a new South American facility dedicated to the production of prefillable polymer and glass syringes, catering specifically to mRNA and GLP-1 therapies. This signifies a significant investment in the region's pharmaceutical manufacturing capabilities.

- February 2024: Sharps Technology secured its first orders for Securegard smart safety syringes in Colombia, marking a successful entry into the Latin American market and highlighting the growing demand for advanced safety features.

- [Add other notable milestones here, with dates and brief descriptions. Consider including regulatory changes, partnerships, or significant market entry events.]

In-Depth South America Syringe Market Market Outlook

The South America syringe market is poised for robust growth, driven by a confluence of factors including rising healthcare expenditure, increasing prevalence of chronic diseases, and technological advancements. Strategic investments in manufacturing capacity, strategic partnerships to improve distribution networks, and a focus on developing innovative and cost-effective products will be critical for success in this dynamic market. The focus on safety and convenience will continue to shape the future of the market.

South America Syringe Market Segmentation

-

1. Usage

- 1.1. Sterilizable Syringes/Reusable Syringes

-

1.2. Disposable Syringes

- 1.2.1. Conventional Syringes

- 1.2.2. Safety Syringes

- 1.2.3. Prefillable Syringes

-

2. Application

- 2.1. Diabetes

- 2.2. Botox

- 2.3. Osteoarthritis

- 2.4. Human Growth Hormone

- 2.5. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Syringe Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Syringe Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.99% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Chronic Diseases and Infectious Diseases; Increase In the Number of Mass Vaccination Programs; Manufactures Focusing on Development

- 3.3. Market Restrains

- 3.3.1. High Cost of Safety Syringes; Availability of Alternate Drug Delivery Methods

- 3.4. Market Trends

- 3.4.1. The Diabetes Segment is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Syringe Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Usage

- 5.1.1. Sterilizable Syringes/Reusable Syringes

- 5.1.2. Disposable Syringes

- 5.1.2.1. Conventional Syringes

- 5.1.2.2. Safety Syringes

- 5.1.2.3. Prefillable Syringes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Diabetes

- 5.2.2. Botox

- 5.2.3. Osteoarthritis

- 5.2.4. Human Growth Hormone

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Usage

- 6. Brazil South America Syringe Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Usage

- 6.1.1. Sterilizable Syringes/Reusable Syringes

- 6.1.2. Disposable Syringes

- 6.1.2.1. Conventional Syringes

- 6.1.2.2. Safety Syringes

- 6.1.2.3. Prefillable Syringes

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Diabetes

- 6.2.2. Botox

- 6.2.3. Osteoarthritis

- 6.2.4. Human Growth Hormone

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Usage

- 7. Argentina South America Syringe Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Usage

- 7.1.1. Sterilizable Syringes/Reusable Syringes

- 7.1.2. Disposable Syringes

- 7.1.2.1. Conventional Syringes

- 7.1.2.2. Safety Syringes

- 7.1.2.3. Prefillable Syringes

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Diabetes

- 7.2.2. Botox

- 7.2.3. Osteoarthritis

- 7.2.4. Human Growth Hormone

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Usage

- 8. Rest of South America South America Syringe Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Usage

- 8.1.1. Sterilizable Syringes/Reusable Syringes

- 8.1.2. Disposable Syringes

- 8.1.2.1. Conventional Syringes

- 8.1.2.2. Safety Syringes

- 8.1.2.3. Prefillable Syringes

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Diabetes

- 8.2.2. Botox

- 8.2.3. Osteoarthritis

- 8.2.4. Human Growth Hormone

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Usage

- 9. Brazil South America Syringe Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina South America Syringe Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of South America South America Syringe Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Becton Dickinson and Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Merit Medical Systems Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Hindustan Syringes & Medical Devices Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Schott AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Terumo Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Medtronic (Covidien)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Cardinal Health Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 UltiMed Inc *List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Vygon

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Helapet Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 B Braun SE

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Gerresheimer AG

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: South America Syringe Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Syringe Market Share (%) by Company 2024

List of Tables

- Table 1: South America Syringe Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Syringe Market Revenue Million Forecast, by Usage 2019 & 2032

- Table 3: South America Syringe Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: South America Syringe Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: South America Syringe Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South America Syringe Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil South America Syringe Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina South America Syringe Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of South America South America Syringe Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South America Syringe Market Revenue Million Forecast, by Usage 2019 & 2032

- Table 11: South America Syringe Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: South America Syringe Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: South America Syringe Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: South America Syringe Market Revenue Million Forecast, by Usage 2019 & 2032

- Table 15: South America Syringe Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: South America Syringe Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: South America Syringe Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: South America Syringe Market Revenue Million Forecast, by Usage 2019 & 2032

- Table 19: South America Syringe Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: South America Syringe Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: South America Syringe Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Syringe Market?

The projected CAGR is approximately 6.99%.

2. Which companies are prominent players in the South America Syringe Market?

Key companies in the market include Becton Dickinson and Company, Merit Medical Systems Inc, Hindustan Syringes & Medical Devices Limited, Schott AG, Terumo Corporation, Medtronic (Covidien), Cardinal Health Inc, UltiMed Inc *List Not Exhaustive, Vygon, Helapet Ltd, B Braun SE, Gerresheimer AG.

3. What are the main segments of the South America Syringe Market?

The market segments include Usage, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.76 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Chronic Diseases and Infectious Diseases; Increase In the Number of Mass Vaccination Programs; Manufactures Focusing on Development.

6. What are the notable trends driving market growth?

The Diabetes Segment is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Safety Syringes; Availability of Alternate Drug Delivery Methods.

8. Can you provide examples of recent developments in the market?

March 2024: SCHOTT Pharma started constructing a facility dedicated to producing prefillable polymer syringes, essential for storing and transporting mRNA medications at ultra-low temperatures. The site will also be able to manufacture glass prefillable syringes designed for GLP-1 therapies, addressing conditions like diabetes and obesity. With 16 manufacturing sites, including South America, the company has established a strong presence in key pharmaceutical regions worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Syringe Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Syringe Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Syringe Market?

To stay informed about further developments, trends, and reports in the South America Syringe Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence