Key Insights

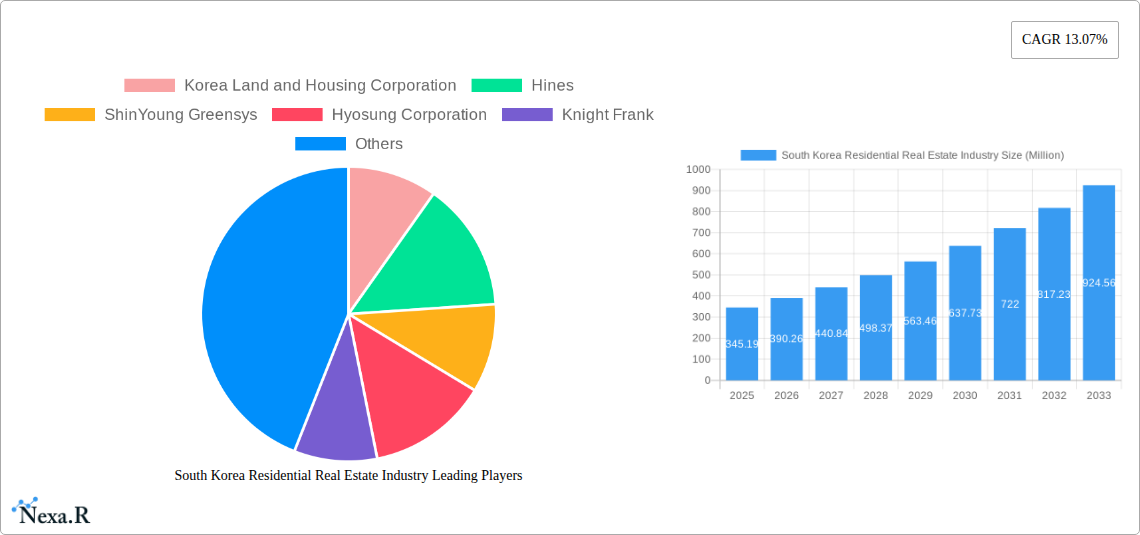

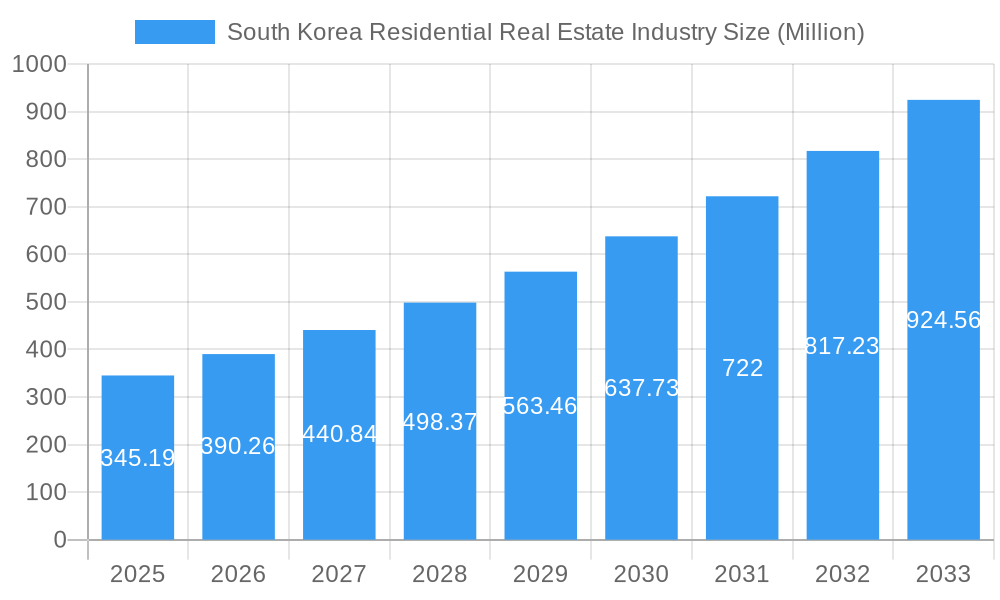

The South Korean residential real estate market, valued at $345.19 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 13.07% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, a growing population, particularly in urban centers like Seoul, Busan, and Incheon, continues to increase demand for housing. Secondly, rising disposable incomes and a preference for improved living standards are contributing to a surge in demand for larger, more modern apartments and landed properties. Government initiatives aimed at boosting affordable housing and infrastructure development also play a positive role. However, the market faces challenges. Stringent regulations on construction and land availability, coupled with fluctuating interest rates, could temper growth. Competition among established players like Korea Land and Housing Corporation, Hines, and ShinYoung Greensys, alongside the emergence of new developers, is intensifying, impacting pricing and market share. The market is segmented by property type, with apartments and condominiums holding the largest share, followed by landed houses and villas, reflecting diverse consumer preferences and purchasing power. The increasing popularity of sustainable and eco-friendly housing options is also shaping the market landscape.

South Korea Residential Real Estate Industry Market Size (In Million)

The forecast period (2025-2033) anticipates sustained growth, although the CAGR might fluctuate slightly year-on-year due to external economic factors and government policies. The market's segmentation offers diverse investment opportunities. The dominance of apartments and condominiums suggests a continued focus on high-density urban living, while the landed houses and villas segment reflects a growing demand for spacious and private residences, potentially in suburban areas. The competitive landscape necessitates strategic adaptations by existing players and presents opportunities for new entrants with innovative approaches to design, construction, and affordability. Long-term projections indicate a thriving market, but careful consideration of potential economic headwinds and regulatory changes remains crucial for successful navigation.

South Korea Residential Real Estate Industry Company Market Share

South Korea Residential Real Estate Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South Korea residential real estate market, encompassing historical data (2019-2024), current market conditions (2025), and future projections (2025-2033). It examines market dynamics, growth trends, key players, and emerging opportunities within the parent market of South Korea's real estate sector and its child market segments of apartments, condominiums, landed houses, and villas. This report is essential for investors, developers, policymakers, and industry professionals seeking a comprehensive understanding of this dynamic market.

South Korea Residential Real Estate Industry Market Dynamics & Structure

The South Korean residential real estate market is characterized by a moderately concentrated landscape with a few dominant players like Korea Land and Housing Corporation and several large conglomerates. Technological innovation, while present, faces certain barriers, including regulatory hurdles and resistance to adopting new construction methods. The regulatory framework significantly impacts market dynamics, influencing pricing, supply, and demand. Competitive substitutes are limited, primarily driven by existing housing stock and alternative living arrangements. End-user demographics are shifting towards smaller households and a growing preference for urban living. M&A activity has been moderate in recent years, with xx million units worth of transactions recorded in 2024.

- Market Concentration: High concentration in the apartment and condominium segment; more fragmented in the landed houses and villas sector. Top 5 players hold approximately 40% market share.

- Technological Innovation: Slow adoption of modular construction and green building technologies. Barriers include high initial investment costs and lack of widespread skilled labor.

- Regulatory Framework: Stringent building codes and land-use regulations influence development costs and project timelines. Government policies regarding affordable housing significantly impact market accessibility.

- Competitive Product Substitutes: Limited direct substitutes; increasing interest in rental housing and co-living arrangements.

- End-User Demographics: Aging population and shrinking household sizes leading to a demand shift towards smaller residential units.

- M&A Trends: Steady level of activity driven by consolidation among smaller developers and expansion by larger players. xx million units involved in mergers and acquisitions between 2019 and 2024.

South Korea Residential Real Estate Industry Growth Trends & Insights

The South Korean residential real estate market exhibited a CAGR of xx% between 2019 and 2024. This growth was driven primarily by economic expansion, urbanization, and increasing disposable incomes during the historical period. The estimated market size in 2025 is xx million units, expected to reach xx million units by 2033, driven by a projected CAGR of xx%. However, rising interest rates and stringent lending regulations may moderate growth in the forecast period. Technological disruptions, such as the introduction of modular construction (like GS E&C's XiGEIST), are expected to increase efficiency and affordability, influencing market dynamics in the long term. Consumer behavior is leaning towards sustainable and technologically advanced housing options, reflected in the rising popularity of smart home features and energy-efficient designs.

Dominant Regions, Countries, or Segments in South Korea Residential Real Estate Industry

The Seoul Metropolitan Area remains the dominant region, accounting for approximately xx% of the total residential market in 2024. High population density, robust employment opportunities, and well-developed infrastructure drive demand in this area. Within the "By Type" segmentation, Apartments and Condominiums constitute the largest segment, holding approximately 75% of the market in 2024.

- Key Drivers for Seoul Metropolitan Area: Strong economic activity, high population density, excellent public transportation, and proximity to major employment centers.

- Key Drivers for Apartments & Condominiums: Affordability (relative to landed properties), convenience, and availability of amenities.

- Growth Potential: Continued urbanization and the demand for smaller, more efficient living spaces support the growth potential of apartments and condominiums. Secondary and tertiary cities present significant growth opportunities for strategically located, well-designed residential projects.

South Korea Residential Real Estate Industry Product Landscape

The residential real estate landscape is diversifying, with a notable increase in the supply of smart homes integrating technologies for enhanced security, energy efficiency, and convenience. Developments such as Parkside Seoul reflect a focus on integrating residential spaces with public amenities and natural environments. Premium modular housing, such as that offered by GS E&C's XiGEIST, is emerging as a significant trend, potentially streamlining construction and reducing costs. These innovations are enhancing the overall value proposition and attracting discerning buyers.

Key Drivers, Barriers & Challenges in South Korea Residential Real Estate Industry

Key Drivers: Continued urbanization, rising disposable incomes, government initiatives to boost housing supply, and technological advancements are driving market growth. Specifically, the expansion of the tech industry in areas like Seoul is a significant driver.

Key Challenges & Restraints: High land prices, stringent regulations, increasing construction costs, and a fluctuating interest rate environment are major barriers to market expansion. Supply chain disruptions also pose a significant challenge, impacting project timelines and overall costs. The government’s response to the challenges, although active, faces the difficult balancing act of meeting social housing needs and overall economic pressures. A shortage of skilled labor is contributing to construction delays and increasing costs, affecting approximately xx% of projects.

Emerging Opportunities in South Korea Residential Real Estate Industry

Emerging opportunities include the growing demand for sustainable and eco-friendly housing, the expansion of rental markets, and the increasing adoption of smart home technologies. Untapped markets exist in secondary and tertiary cities and amongst specific demographic segments (e.g., young professionals and elderly populations) with specialized housing needs. The government's push for green initiatives further supports the development of eco-friendly buildings, attracting investment and consumer interest.

Growth Accelerators in the South Korea Residential Real Estate Industry

Strategic partnerships between developers and technology firms, accelerating the integration of smart home technologies and sustainable building practices, will act as key growth catalysts. Government initiatives focused on streamlining approvals and increasing housing affordability, coupled with investment in infrastructure, will further contribute to market expansion. The continued urbanization of the population and a focus on creating live-work-play developments will fuel long-term growth.

Key Players Shaping the South Korea Residential Real Estate Industry Market

- Korea Land and Housing Corporation

- Hines

- ShinYoung Greensys

- Hyosung Corporation

- Knight Frank

- Booyoung Group

- Dongbu Corporation

- Daelim Corporation

- Hyundai Development Company

Notable Milestones in South Korea Residential Real Estate Industry Sector

- January 2023: KPF unveils the design for Parkside Seoul, a large-scale mixed-use development integrating residential, commercial, and public spaces, signifying a shift towards integrated urban developments.

- April 2023: GS E&C launches XiGEIST, a premium modular housing division, indicating a move towards more efficient and potentially cost-effective construction methods.

In-Depth South Korea Residential Real Estate Industry Market Outlook

The South Korean residential real estate market is poised for continued growth, driven by underlying demographic trends, economic development, and technological advancements. Strategic opportunities exist for developers focusing on sustainable, technologically advanced, and well-located projects. However, navigating regulatory hurdles and managing fluctuating economic conditions remain crucial for long-term success. The integration of modular construction and smart technologies offers significant potential to enhance efficiency and attract buyers, creating a promising outlook for innovative players.

South Korea Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Geography

- 2.1. Seoul

- 2.2. Other Locations

South Korea Residential Real Estate Industry Segmentation By Geography

- 1. Seoul

- 2. Other Locations

South Korea Residential Real Estate Industry Regional Market Share

Geographic Coverage of South Korea Residential Real Estate Industry

South Korea Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government's Plans to Supply New Homes

- 3.3. Market Restrains

- 3.3.1. Rising Interest Rates

- 3.4. Market Trends

- 3.4.1. Urbanization in the Country is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Seoul

- 5.2.2. Other Locations

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Seoul

- 5.3.2. Other Locations

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Seoul South Korea Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Seoul

- 6.2.2. Other Locations

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Other Locations South Korea Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Seoul

- 7.2.2. Other Locations

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Korea Land and Housing Corporation

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Hines

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 ShinYoung Greensys

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Hyosung Corporation

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Knight Frank

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Booyoung Group

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Dongbu Corporation

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Daelim Corporation

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Hyundai Development Company

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.1 Korea Land and Housing Corporation

List of Figures

- Figure 1: South Korea Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: South Korea Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: South Korea Residential Real Estate Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: South Korea Residential Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South Korea Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: South Korea Residential Real Estate Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: South Korea Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: South Korea Residential Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: South Korea Residential Real Estate Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: South Korea Residential Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Residential Real Estate Industry?

The projected CAGR is approximately 13.07%.

2. Which companies are prominent players in the South Korea Residential Real Estate Industry?

Key companies in the market include Korea Land and Housing Corporation, Hines, ShinYoung Greensys, Hyosung Corporation, Knight Frank, Booyoung Group, Dongbu Corporation, Daelim Corporation, Hyundai Development Company.

3. What are the main segments of the South Korea Residential Real Estate Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 345.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Government's Plans to Supply New Homes.

6. What are the notable trends driving market growth?

Urbanization in the Country is Driving the Market.

7. Are there any restraints impacting market growth?

Rising Interest Rates.

8. Can you provide examples of recent developments in the market?

January 2023: International architecture office KPF has unveiled the design for Parkside Seoul, a new mixed-use neighborhood planned for the South Korean capital to complement the surrounding natural elements and pay homage to Yongsan Park. The 482,600 square meter development is composed of a layered exterior envelope encompassing various programs and public amenities to enhance the residents’ experience of space. Besides the residential units, the complex includes office and retail spaces, hospitality facilities, and public and green spaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the South Korea Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence