Key Insights

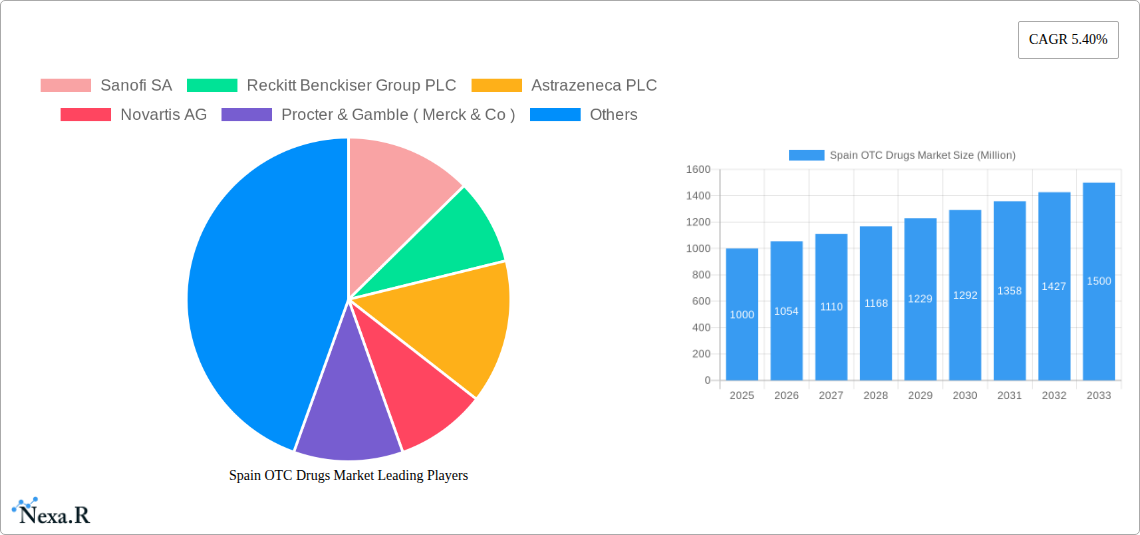

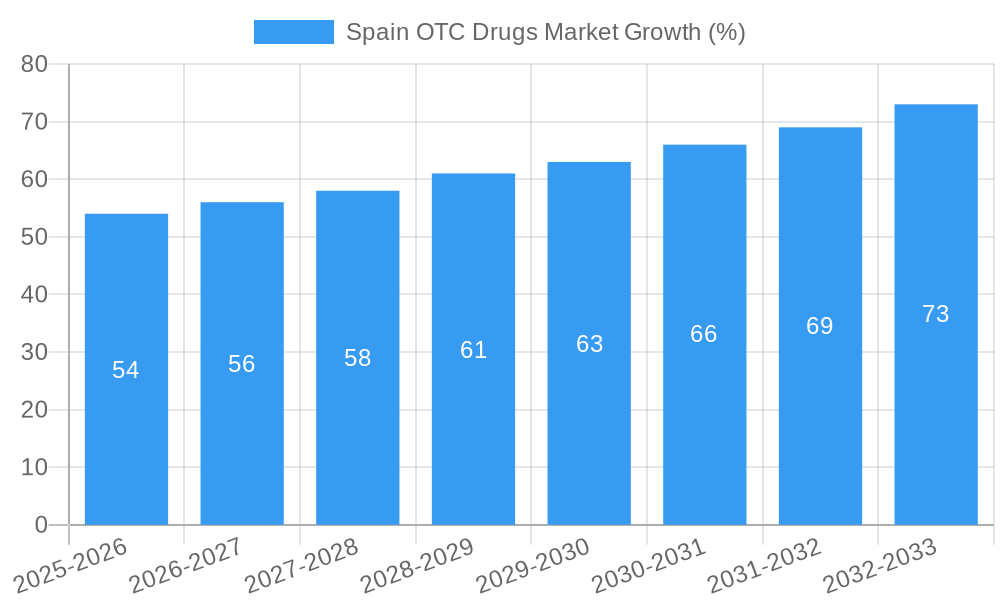

The Spain OTC Drugs Market, valued at approximately €[Estimate based on market size XX and value unit Million. For example, if XX represents 1000, then the value would be €1000 million in 2025], is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 5.40% from 2025 to 2033. This growth is driven by several key factors. Increasing prevalence of chronic conditions like allergies, digestive issues, and musculoskeletal pain fuels demand for self-treatment options. Rising consumer awareness of health and wellness, coupled with increased accessibility through retail and online pharmacies, further contributes to market expansion. The aging population in Spain also plays a significant role, as older individuals tend to utilize OTC medications more frequently. Specific product segments like analgesics, cough, cold, and flu products, and dermatology products are expected to be significant revenue contributors, reflecting prevalent health concerns within the Spanish population.

However, the market faces certain restraints. Stringent regulatory approvals for new drug launches could potentially impede growth. Furthermore, price competition among various brands and generic alternatives, coupled with fluctuating economic conditions, may impact market profitability. The increasing popularity of alternative medicine and herbal remedies could also pose a challenge to the growth trajectory of the traditional OTC drugs market. Despite these challenges, the market’s overall growth outlook remains positive, driven by strong underlying trends and the consistent demand for convenient and accessible self-care solutions. The competitive landscape, characterized by major players like Sanofi SA, Reckitt Benckiser Group PLC, and Pfizer Inc., suggests a market with established players and opportunities for further innovation and market penetration. Strategic partnerships and product diversification are expected to be key strategies for companies seeking sustained success within this dynamic market.

Spain OTC Drugs Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Spain OTC Drugs Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period from 2025 to 2033. The report segments the market by product type (Cough, Cold, and Flu Products; Analgesics; Dermatology Products; Gastrointestinal Products; Vitamin, Mineral, and Supplement (VMS) Products; Weight-loss/Dietary Products; Ophthalmic Products; Sleeping Aids; Other Product Types) and distribution channel (Retail Pharmacies; Online Pharmacies; Other Distribution Channels), providing a granular understanding of market dynamics. Key players analyzed include Sanofi SA, Reckitt Benckiser Group PLC, AstraZeneca PLC, Novartis AG, Procter & Gamble (Merck & Co), Leo Pharma AS, Bristol-Myers Squibb, Johnson & Johnson, Cardinal Health, Takeda Pharmaceutical Company Ltd, Bayer, GlaxoSmithKline PLC, and Pfizer Inc. The market size is presented in million units.

Spain OTC Drugs Market Dynamics & Structure

This section delves into the competitive landscape of the Spanish OTC drug market, analyzing market concentration, technological advancements, regulatory influences, and strategic activities. The report examines the impact of mergers and acquisitions (M&A) on market structure and explores the dynamics of competitive substitution among various product types. Consumer demographics and their influence on market trends are also detailed.

- Market Concentration: The Spanish OTC market exhibits a [XX]% concentration ratio for the top 5 players in 2025, indicating [describe the level of concentration - e.g., high, moderate, low] competition.

- Technological Innovation: Technological advancements in drug delivery systems (e.g., transdermal patches, inhalers) are driving market growth, with a projected [XX]% increase in adoption rates by 2033.

- Regulatory Framework: The Spanish Agency of Medicines and Health Products (AEMPS) plays a crucial role in shaping the market through its regulations. Recent regulatory changes have [describe impact of regulations - e.g., increased/decreased market access, spurred/hindered innovation].

- Competitive Product Substitutes: The availability of herbal remedies and homeopathic products poses a competitive challenge to conventional OTC drugs, with an estimated [XX]% market share in 2025.

- End-User Demographics: The aging population in Spain significantly influences the demand for certain OTC categories, particularly analgesics and gastrointestinal products. The [XX]% increase in the senior population from 2019-2025 has fueled a rise in demand for these products.

- M&A Trends: The number of M&A deals in the Spanish OTC market between 2019 and 2024 totaled [XX], signaling [describe the trend - e.g., consolidation, expansion] in the sector.

Spain OTC Drugs Market Growth Trends & Insights

This section presents a comprehensive analysis of the market's growth trajectory, leveraging [XXX - mention data sources like market research databases, industry reports]. It explores factors such as evolving consumer behavior, technological disruptions (e.g., online pharmacies, telemedicine), and market size evolution.

[Insert 600-word analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior shifts. Include specific metrics (e.g., CAGR, market penetration) for deeper insights. This section should use paragraphs and incorporate data and insights relevant to the provided keywords and market segments.] Example: "The Spain OTC drugs market experienced a CAGR of XX% between 2019 and 2024, driven by factors such as… ".

Dominant Regions, Countries, or Segments in Spain OTC Drugs Market

This section identifies the leading regions, countries, or segments within the Spanish OTC drug market driving growth. The analysis considers all product and distribution channel segments provided.

- Leading Product Segment: Analgesics are projected to dominate the market in 2025, with a market share of [XX]%, driven by the high prevalence of musculoskeletal pain among the aging population.

- Fastest-Growing Segment: Online pharmacies are experiencing rapid growth, with an estimated [XX]% CAGR between 2025 and 2033, fueled by increasing internet penetration and convenience.

- Key Regional Variations: The demand for specific OTC products may vary across different regions in Spain due to factors such as climate, lifestyle, and healthcare access.

[Insert 600 words analyzing dominance factors, including market share and growth potential, for each identified leading segment using bullet points and paragraphs. Remember to include specific data and quantitative insights wherever possible.]

Spain OTC Drugs Market Product Landscape

The Spanish OTC drug market showcases a diverse product landscape, featuring continuous innovation in formulations, delivery systems, and active ingredients. Recent advancements include the introduction of [mention specific product innovations, e.g., extended-release formulations, targeted delivery systems]. These innovations aim to improve efficacy, enhance patient compliance, and address unmet needs, leading to a more competitive and diversified market.

Key Drivers, Barriers & Challenges in Spain OTC Drugs Market

Key Drivers:

The Spanish OTC drug market is driven by factors such as the aging population, increasing prevalence of chronic diseases, rising healthcare expenditure, and growing awareness of self-medication. Government initiatives to promote self-care and the expansion of online pharmacies are also contributing to market growth.

Challenges & Restraints:

Challenges include stringent regulatory requirements, price competition from generic drugs, and potential supply chain disruptions. The impact of economic downturns on consumer spending can also restrain market growth, as consumers might opt for cheaper alternatives.

Emerging Opportunities in Spain OTC Drugs Market

Emerging opportunities include the growing demand for natural and herbal remedies, the increasing adoption of personalized medicine, and the expansion of telemedicine services. Further opportunities exist in developing innovative products that address specific unmet needs and catering to the preferences of younger generations.

Growth Accelerators in the Spain OTC Drugs Market Industry

Long-term growth will be accelerated by technological advancements in drug delivery, strategic partnerships between pharmaceutical companies and digital health platforms, and expansion into untapped markets, such as rural areas. Continued investment in research and development will also play a crucial role in driving future growth.

Key Players Shaping the Spain OTC Drugs Market Market

- Sanofi SA

- Reckitt Benckiser Group PLC

- AstraZeneca PLC

- Novartis AG

- Procter & Gamble (Merck & Co)

- Leo Pharma AS

- Bristol-Myers Squibb

- Johnson & Johnson

- Cardinal Health

- Takeda Pharmaceutical Company Ltd

- Bayer

- GlaxoSmithKline PLC

- Pfizer Inc

Notable Milestones in Spain OTC Drugs Market Sector

- [Month, Year]: Launch of a new [product type] by [company name], leading to [impact on market dynamics].

- [Month, Year]: Acquisition of [company name] by [company name], resulting in [impact on market structure].

- [Month, Year]: Introduction of new regulations by AEMPS impacting [aspect of the market].

In-Depth Spain OTC Drugs Market Market Outlook

The Spanish OTC drug market is poised for significant growth in the coming years, driven by a confluence of factors, including the continued aging of the population, rising healthcare costs, and the increasing adoption of self-care practices. The market presents several strategic opportunities for both established players and new entrants, particularly in areas such as digital health integration, the development of innovative product formulations, and expansion into underserved regions.

Spain OTC Drugs Market Segmentation

-

1. Product

- 1.1. Cough, Cold, and Flu Products

- 1.2. Analgesics

- 1.3. Dermatology Products

- 1.4. Gastrointestinal Products

- 1.5. Vitamin, Mineral, and Supplement (VMS) Products

- 1.6. Weight-loss/Dietary Products

- 1.7. Ophthalmic Products

- 1.8. Sleeping Aids

- 1.9. Other Product Types

-

2. Distribution Channel

- 2.1. Retail Pharmacies

- 2.2. Online Pharmacies

- 2.3. Other Distribution Channels

Spain OTC Drugs Market Segmentation By Geography

- 1. Spain

Spain OTC Drugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination of Pharmaceutical Companies to Switch From Rx to OTC Drugs; Increasing Self Medication Among the General Population; High Penetration in Emerging Markets

- 3.3. Market Restrains

- 3.3.1. Incorrect Self Diagnosis; Probability of Substance Abuse

- 3.4. Market Trends

- 3.4.1 The Cough

- 3.4.2 Cold

- 3.4.3 and Flu Products Segment is Expected to Dominate the Market over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain OTC Drugs Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Cough, Cold, and Flu Products

- 5.1.2. Analgesics

- 5.1.3. Dermatology Products

- 5.1.4. Gastrointestinal Products

- 5.1.5. Vitamin, Mineral, and Supplement (VMS) Products

- 5.1.6. Weight-loss/Dietary Products

- 5.1.7. Ophthalmic Products

- 5.1.8. Sleeping Aids

- 5.1.9. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Retail Pharmacies

- 5.2.2. Online Pharmacies

- 5.2.3. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sanofi SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Reckitt Benckiser Group PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Astrazeneca PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Novartis AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Procter & Gamble ( Merck & Co )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Leo Pharma AS

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bristol-Myers Squibb

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Johnson and Johnson

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cardinal Health

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Takeda Pharamaceutical Company Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bayer

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 GlaxoSmithKline PLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Pfizer Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Sanofi SA

List of Figures

- Figure 1: Spain OTC Drugs Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain OTC Drugs Market Share (%) by Company 2024

List of Tables

- Table 1: Spain OTC Drugs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain OTC Drugs Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Spain OTC Drugs Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Spain OTC Drugs Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: Spain OTC Drugs Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Spain OTC Drugs Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 7: Spain OTC Drugs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Spain OTC Drugs Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Spain OTC Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Spain OTC Drugs Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Spain OTC Drugs Market Revenue Million Forecast, by Product 2019 & 2032

- Table 12: Spain OTC Drugs Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 13: Spain OTC Drugs Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Spain OTC Drugs Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 15: Spain OTC Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Spain OTC Drugs Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain OTC Drugs Market?

The projected CAGR is approximately 5.40%.

2. Which companies are prominent players in the Spain OTC Drugs Market?

Key companies in the market include Sanofi SA, Reckitt Benckiser Group PLC, Astrazeneca PLC, Novartis AG, Procter & Gamble ( Merck & Co ), Leo Pharma AS, Bristol-Myers Squibb, Johnson and Johnson, Cardinal Health, Takeda Pharamaceutical Company Ltd, Bayer, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the Spain OTC Drugs Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Inclination of Pharmaceutical Companies to Switch From Rx to OTC Drugs; Increasing Self Medication Among the General Population; High Penetration in Emerging Markets.

6. What are the notable trends driving market growth?

The Cough. Cold. and Flu Products Segment is Expected to Dominate the Market over the Forecast Period.

7. Are there any restraints impacting market growth?

Incorrect Self Diagnosis; Probability of Substance Abuse.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain OTC Drugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain OTC Drugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain OTC Drugs Market?

To stay informed about further developments, trends, and reports in the Spain OTC Drugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence